Right to Information (RTI): India

| Line 5: | Line 5: | ||

</div> | </div> | ||

|} | |} | ||

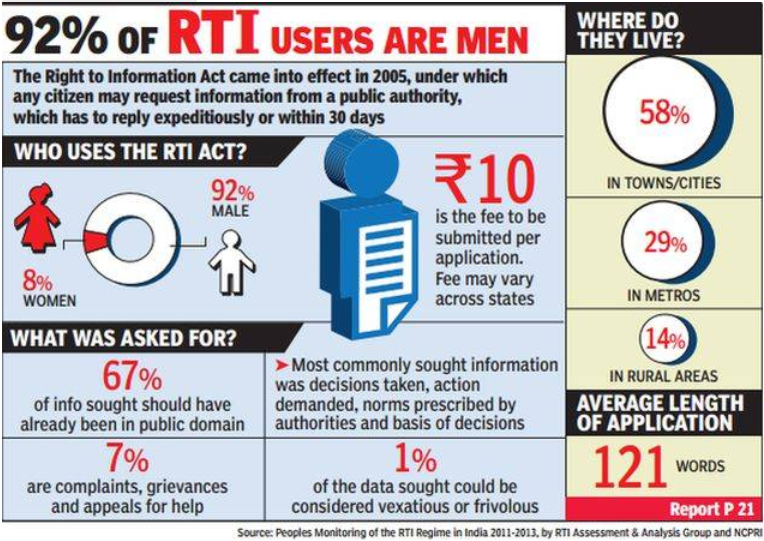

| − | [[File: rtiA.png| |frame|500px]] | + | [[File: rtiA.png|Chart: [http://timesofindia.indiatimes.com/india/One-RTI-Act-but-118-complications/articleshow/44787785.cms The Times of India Himanshi Dhawan,TNN | Oct 12, 2014] |frame|500px]] |

[[Category: India |R]] | [[Category: India |R]] | ||

[[Category: Law,Constitution,Judiciary |R]] | [[Category: Law,Constitution,Judiciary |R]] | ||

Revision as of 00:16, 12 October 2014

This is a collection of articles archived for the excellence of their content. |

Contents |

118 separate sets of rules

One RTI Act, but 118 complications

The Times of India Himanshi Dhawan,TNN | Oct 12, 2014

India has one Right to Information (RTI) Act but 118 separate sets of rules formulated independently by states, courts, information commissioners, Parliament and state assemblies that run a maze around the legislation.

The rules dictate varied fees, application format, number of words, type of identity proof required and mode of payment making the process of seeking information a complex one.

Just ahead of the RTI Act turning 10 on October 13, a report "Peoples Monitoring of the RTI regime in India-2011-2013" by Raag and NCPRI paints a bleak picture.

For instance 34 states and UTs have prescribed application fee of Rs 10. But cost of pursuing an RTI application could range between Rs 50 to Rs 100 excluding cost of information. Haryana charges Rs 50 for all RTI applications while Arunachal Pradesh charges Rs 50 for most applications but Rs 500 for information related to bids, tenders or business contracts.

Only Andhra Pradesh has cut down on the fees — Rs 10 for cities, free of cost for village level and Rs 5 for subdistrict level.

Sikkim charges Rs 100 for both first and second appeal, while filing a first appeal in Madhya Pradesh costs Rs 50 and a second appeal Rs 100. While the central government has mandated Rs 2 per photocopy, Chhatisgarh has limited the number to 50 pages while Arunachal charges Rs 10.

To complicate things further, inspection of documents is allowed free of cost by some states for the first hour and then charges of Rs 5 are levied in Tamil Nadu, Tripura, Sikkim and Uttarakhand. The cost of inspection of documents in Daman and Diu is Rs 100 a day for a maximum of 3 hours and if the information sought is older by a decade or more, the public authority can charge an additional Rs 25 an hour.

States have also placed odd restrictions on the format of the application. In Karnataka, Bihar, Chhattisgarh and Maharashtra the length of the RTI application cannot exceed more than 150 words while the Centre has mandated a 500 word limit.

There are similar inconsistencies in rules related to proof of identity required by public authorities. While the RTI act does not mandate any proof of identity section 3 does say that only Indian citizens can use the law. This has led to states like Goa, Gujarat, Odisha, Sikkim insisting on identity proof of the applicant.

Income tax details of judges

CIC: SC can’t give I-T details of judges

Dhananjay Mahapatra | TNN

From the archives of The Times of India 2007, 2009

New Delhi: In a rare instance, the Central Information Commission (CIC) has agreed with the Supreme Court and said that its registry could not be asked under the Right to Information (RTI) Act to provide details of the income tax returns filed by its judges.

In earlier instances — be it declaration of assets by the judges or revealing the details of the collegium meeting process for appointment of judges — the CIC’s ruling advocating transparency had been challenged by the apex court first before the Delhi high court and then before the Supreme Court.

But, on the income tax return details of the judges, the CIC saw reason to agree with the SC’s response to an RTI query and agreed with its counsel Devdatt Kamat that the registry did not have the details of the information sought by RTI applicant Dr Lal Bahadur.

Chief information commissioner Wajahat Habibullah, in a five-page decision, said: “It should be clear that it is not the Supreme Court that would hold information on the income tax returns of the high court judges even at the time of their elevation as Supreme Court judges, coming as they are, from different states in the country.”

“Application will then have to be made to the department of revenue, ministry of finance, that administers income tax for all,” Habibullah said.

The original RTI application was filed by Dr Bahadur before the Supreme Court, which routed it to the ministry of law and justice. The ministry returned it to the apex court and tersely said: “Perhaps the Supreme Court of India could be in a better position to furnish the information, as sought by the RTI application.”

RTI Act does not apply to judgments

SC: RTI Act doesn’t apply to judgments

Dhananjay Mahapatra | TNN

From the archives of The Times of India 2007, 2009

New Delhi: Can a judge be asked under the Right to Information (RTI) Act as to why and how he came to a particular conclusion in a judgment?

No, says the Supreme Court. The apex court saw the mischief potential of queries under the RTI Act in relation to a judge and his judgments and a Bench comprising Chief Justice K G Balakrishnan and Justice B S Chauhan firmly said that a judge speaks through his judgments and he could not be made to answer questions relating to his verdict in a case.

“A judge speaks through his judgments and he is not answerable to anyone as to why he wrote a judgment in a particular manner,” the Bench said dismissing an appeal filed by one Khanapuram Gandaiah, who had not even challenged the verdict in his case before an appellate forum.

What he asked using an RTI query was why the judge concerned did not consider parts of his submissions, parts of the voluminous documents while additionally putting questions about other aspects of the judgment against him.

Terming all these grievances as valid grounds for filing an appeal, which Gandaiah did not, the Bench minced no words in criticising the appellant for resorting to the RTI Act rather than seeking remedy before higher courts. Gandaiah had made an appliaction under Section 6 of RTI Act, which provides that any information possessed by a public authority under the Act has to be given to an applicant on such a request made either electronically or in writing. The District Judge had rejected his RTI plea.

The Bench agreed with the rejection of his plea seeking information about the judgment under the RTI Act and said: “A judge can only speak through his judgments and he cannot be made to go on explaining why he took a particular view in a judgment.”

“Moreover, as the judge has given his views in the judgment, he cannot give any other reason for his judgment, RTI Act query or otherwise. No party has a right to ask the judge concerned through RTI about the judgment,” the Bench said dismissing Gandaiah’s appeal.

RTI and govt aided NGOs

From the archives of The Times of India 2010

NGOs getting govt aid in RTI ambit: HC

TIMES NEWS NETWORK

New Delhi: The Delhi high court has held that non-governmental organizations (NGOs) which get government funds should come under the purview of RTI Act making it mandatory for them to disclose information pertaining to their functioning.

‘‘The term public authority has been given a broad meaning not only to include bodies which are owned, controlled or substantially financed directly or indirectly by the government but even NGOs, which are financed directly or indirectly by the government,’’ justice Sanjeev Khanna said while declaring the stock exchanges as public authorities in a recent order.

The court said it is not necessary that the government should have pervasive and deep control over an organization to bring it under the purview of the Transparency Act. ‘‘Even private organizations, which are enjoying benefit of substantial funding directly or indirectly from the governments, fall within the definition of public authorities under the Act,’’ the court said.

The court made these observations while passing an order on a petition filed by the National Stock Exchange (NSE) challenging a Central Information Commission order which had directed it to disclose information under the Act. The court dismissed the NSE plea that it cannot be forced to reveal information to public under RTI.

Uttar Pradesh: poor performance under RTI

UP government's RTI record miserable: Study

Ashish Tripathi,TNN | Feb 26, 2014

Section 4 of the RTI Act says that every public authority shall maintain all its records duly catalogued and indexed and ensure that they get computerized so that all important details related to these public authorities get published within 120 days of enactment of this Act. However, a study conducted by RTI activists Amitabh Thakur and Nutan Thakur.reveals that ground realities of Uttar Pradesh government are contrary to the mandate.

The couple studied the status of RTI in 81 Departments of the UP Government mentioned at the Home page of the website (http://upgov.nic.in/allsites.asp), particularly related to the mandatory information that needs to be provided under section 4(1)(b). The study found that almost none have provided the rules, regulations, instructions, manuals and records, required for discharging functions in the electronic form.

It was also found that in many cases information provided was old. In fact, some of websites of departments are still carrying names of ministers in previous BSP rule - Nasimuddin Siddique in cane development, Narayan Singh in horticulture, Lalji Verma in parliamentary affairs and JN Rai in handloom department. These ministers left office in March 2012. Similarly, the names of retired officers like RK Sharma in the horticulture, Sri Krishna in handloom and SC Gupta in the IT department can also be found in respective websites.

Names of the public information officers and Appellate Authority of many departments are also old. In many cases only names have been provided with no other necessary detail. Further, while many departments have not provided details of annual budget, some departments have uploaded budgets but they are of financial years 2008-09 or 2009-10.

Departments like basic education, coordination, culture, finance, fisheries, infrastructure development etc have provided almost negligible information. Samagra gram vikas, small scale industries and export promotion departments do not even mention about the RTI Act while revenue and vidhai departments have links to the RTI section but these links are not operational. The governor office has information only in English while the chief minister office has limited information provided under RTI Act.