Rich list, India: 2016

(→See also) |

(→See also…) |

||

| Line 105: | Line 105: | ||

=See also…= | =See also…= | ||

| − | [[Rich List: India]] <> [[Rich List: India, 2014: Forbes]] <>[[Rich List: India, 2014: Hurun]] <>[[Rich List: India, 2015: Forbes]] <> [[Rich List: India, 2015: Hurun]] <>[[Rich list, India: 2016]] <> [[Rich List: India, 2016: Forbes]] <> <> [[Rich List: India, 2017]] | + | [[Rich List: India]] <> [[Rich List: India, 2014: Forbes]] <>[[Rich List: India, 2014: Hurun]] <>[[Rich List: India, 2015: Forbes]] <> [[Rich List: India, 2015: Hurun]] <>[[Rich list, India: 2016]] <> [[Rich List: India, 2016: Forbes]] <> [[Rich List: India, 2017]] <> [[Rich List: India, 2017: Hurun]]<> [[Rich list, India: 2018]] |

| + | |||

| + | [[Rich list of film artistes: India]] | ||

==…and also== | ==…and also== | ||

[[Rich List: Nepal]]<> [[Celebrity List: India]]<> [[Indian money in HSBC, Switzerland]] <> [[Private lives of famous Indians]] | [[Rich List: Nepal]]<> [[Celebrity List: India]]<> [[Indian money in HSBC, Switzerland]] <> [[Private lives of famous Indians]] | ||

==…and also== | ==…and also== | ||

[[Public Companies, South Asia's Biggest]] | [[Public Companies, South Asia's Biggest]] | ||

Latest revision as of 14:48, 22 October 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

[edit] New World Wealth report, 2016

The Times of India, Aug 24 2016

India ranks 7th on wealthiest list: Report

India has figured among the top 10 wealthiest countries in the world with a total individual wealth of $5,600 billion, while the US topped the chart. According to a report by New World Wealth, India was ranked 7th ahead of Canada ($4,700 billion), Australia ($4,500 billion) and Italy (USD 4,400 billion), which came in at 8th, 9th and 10th slots, respectively .

The US is the wealthiest in the world in terms of total individual wealth held ($48,900 billion), while China stood second and Japan third, with total individual wealth of $17,400 billion and $15,100 billion, respectively .

[edit] The spread of wealth in India in 2016

24L earn over Rs 10L, 25L cars bought every yr, Dec 28, 2016: The Times of India

India has just 24.4 lakh tax payers who declared an annual income of over Rs 10 lakh yet 25 lakh new cars, including 35,000 luxury cars, are being bought every year for last five years, a top official said.

A nation of over 125 crore people had only 3.65 crore individuals filing their tax returns in the assessment year 2014-15, the official said, alluding to a huge number of individuals being outside the tax net. “Of the 3.65 crore individuals, there were only 5.5 lakh people who paid income tax of more than Rs 5 lakh and accounted for 57% of the total tax kitty . This essentially means that only 1.5% of those filing tax returns are contributing to 57% of tax kitty ,“ the official said.

The tax returns when compared with car sales throw astonishing numbers, he said. “Car sales on an average in last five years has been about 25 lakh per year. In the last three years the car sales were 25 lakh, 26 lakh and 27 lakh,“ he said, adding that the statistics points to a large number of people having income to buy cars are outside the tax bracket.

A car normally has a life of seven years and a second car is purchased not before five years by a common man, the official said. The income tax data collated shows only 48,417 persons reporting income of more than Rs 1 crore in a year. Yet luxury brands like BMW, Jaguar, Audi, Merce des, Porsche and Maserati sell almost 35,000 cars every year. Of the individuals filing returns, 5.32 lakh were with income of less than Rs 2 lakh per annum and not within the tax bracket. There were 1.47 lakh tax payers who had an income of over Rs 50 lakh in a year. Also during the 2014-15 assessment year, there were 1.61 crore people whose tax was deducted at source but they did not file income tax return (ITR), he said. India's tax revenue as a percentage of GDP was 16.7% in 2016, compared to 25.4% in the US and 30.3% in Japan.

The official said the numbers point to a significant number of people who are liable to pay tax aren't doing so.The government, he said, is shoring up its efforts to check evasion.

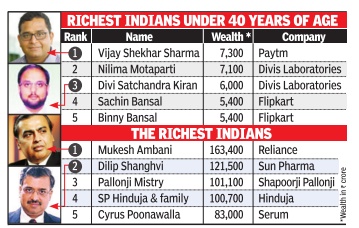

[edit] Richest entrepreneurs under 40

The Times of India, Sep 08 2016

Avik Das

Paytm founder Vijay Shekhar Sharma's wealth surged by 162% in 2015-16, making him the richest entrepreneur under 40 in Hurun's India rich list for 2016.

Sharma is worth about Rs 7,300 crore, up from Rs 2,824 crore in 2015. The rise in wealth can be attributed to Chinese e-commerce behemoth Alibaba's investment in the company and subsequent funding rounds that have raised Paytm's valuation. Sharma holds about 21% stake in the company.

After Sharma, Indigo co-founder Rakesh Gangawal has seen the biggest increase in we alth of more than 150%. His wealth stood at Rs 15,900 crore, thanks to the share price performance of the airline post its IPO last year. Anas Rahman Junaid, MDIndia of Hurun Report, a monthly magazine that focusses on high net-worth individuals in China and India, said sub dued investor interest in e-commerce and online businesses had reduced valuations of ecommerce unicorns in 2016. Several mutual funds with holdings in Flipkart have lowered the valuations of those stakes in the past few months.

Bhavish Aggarwal of Ola, the youngest in the list at 30, is worth Rs 3,000 crore, up from Rs 2,385 crore in last year's list. His co-founder Ankit Bhati is no longer in the list, which looks at those with wealth of Rs 1,600 crore and more. Last year, Bhati's wealth was exactly the same as Aggarwal's. Hurun's Junaid said Bhati does not have as much stake as Aggarwal does at present.

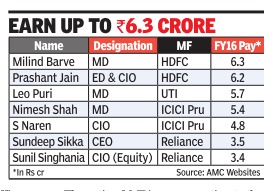

[edit] Executive remunerations

The Times of India, May 10 2016

Top HDFC MF execs remain highest paid in industry

Allirajan M

HDFC Mutual Fund (MF) executives continue to remain the highest paid in the industry , earning in excess of Rs 6 crore for 2015-16 -15-30% more than what their peers at ICICI Prudential earned during 2015-16. This, despite Prudential ICICI toppling HDFC MF from the top slot.

Milind Barve, MD of HDFC MF , was the highest paid executive in the MF in dustry earning Rs 6.25 crore in 201516. UTI MF's MD Leo Puri came second with a remuneration of around Rs 5.74 crore while ICICI Prudential MF's MD and CEO Nimesh Shah, who earned Rs 5.4 crore during the year, stood third.

HDFC's Prashant Jain remains the highest paid fund manager in the country . He was paid Rs 6.17 crore in 2015-16, which was almost 30% higher than his peer Sankaran Naren of ICICI Prudential MF . Jain's pay was 83.6% higher than Sunil Singhania, chief investment officer (CIO), equity investments, Reliance MF , the third largest fund house.

Naren, who is the CIO of ICICI Prudential MF , received Rs 4.75 crore as remuneration for 2015-16. Jain, who is also the executive director and CIO of HDFC MF , got Rs 16.3 crore by exercising his employee stock options (ESOPs). Barve's ESOPs netted him nearly Rs 20 crore. Incidentally, HDFC and Reliance were the only fund houses that published information on ESOPs.

Sundeep Sikka, the CEO of Reliance MF , the third largest fund house by assets, received Rs 10.25 crore through one-time payments and by exercising his stock options while its CIO, equity investments, Sunil Singhania, got Rs 4.65 crore through such payments and ESOPs.

The CEO of Birla Sun Life MF , the fourth largest fund house, A Balasubramanian, took home Rs 3.93 crore as pay in 2014-15. The fund house has not yet disclosed remuneration details of its top executives for 2015-16. The ratio of MD's remuneration to the median salary of employees was1:86 for ICICI Prudential or about 1.16% and was followed by HDFC at 1:68 or 1.47%, UTI at 1:43 or 2.33% and Reliance at 1:39 or 2.58%.

“With the objective of promoting transparency in remuneration policies so that executive remuneration is aligned with the interest of investors, MFsAMCs (asset management companies) should disclose information on their pay under a separate head in their respective websites,“ market regulator Sebi had said in its circular in March.

AMCs were not disclosing the remune ration paid to its star fund managers.They started to disclose compensation paid to key managerial personnel (KMP), which includes the MD.

[edit] The highest paid actors/ 2016

Rich list of film artistes: India

[edit] Million-dollar professionals outnumber promoters/ 2016

The Times of India, Dec 19 2016

NamrataSingh

India Inc's million-dollar salary club just got beefier with professionals outnumbering promoters in financial year 2015-16. The compensation study of executives commissioned by TOI to global executive search firm EMA Partners reveals that in 2015-16, 61 professional CEOs took home a pay package of Rs 6.5 crore or roughly a million dollars, compared with 58 promoters who form part of this elite club.

This is the first time professional CXOs have outnumbered promoter CXOs, reflec ting the coming of age of Indian enterprises where pay-forperformance defines the work culture and professionals get rewarded handsomely for the impact they create. In the previous year's survey (2014-15), out of 100 executives who made it to the million-dollar salary list, 52 were promoters and 48 were professionals. In the year preceding that, the gap between promoters and professionals was wider -58 promoters against only 36 professionals.In 2009, out of a total of 49 in the million-dollar club, only nine were professionals.

K Sudarshan, managing partner, EMA Partners India, said: “We believe this trend is set to continue and we will see more professional CEOs join the ranks of India's highest paid executives. This is also a reflection of the scale of Indian businesses, which are now truly global.“

Sudarshan said this was “just the tip of the iceberg“ as a number of highly paid professionals, who are part of unlisted entities serving Indian and multinational companies across sectors like financial services, private equity and large business conglomerates, don't feature in this list.

“Further, if we are to consider the value of stock options then we will probably see another 125-150 people added to this list,“ he said. Keeping up with tradi tion, the Marans (Kala nithi Maran and Kavery Kalanithi) continue to keep the top two slots in the list of India's highest-paid CEOsCXOs for the fourth consecutive year.

Among those who saw 100% or more increase in compensation from the previous year are A M Naik of Larsen & Toubro, K Venkataramanan (now retired from L&T), Vishal Sikka of Infosys and Ameet Desai, executive director and Group CFO at Adani Enterprises, and Vijay Aggarwal, MD of Prism Cement. Only two women are part of the million-dollar club -Kavery Kalanithi Maran (Sun TV) and Renu Sud Karnad, MD, HDFC.

Said Karnad: “It is a positive trend that we are seeing of more professional executives in the `million-dollar club'. This emphasises their growing demand in organisations as business complexities and importance of talent at top level increases. Professional executives' vast industry experience and independent and unbiased views, and the increasing global reach of business makes them an ideal choice to work along with promoters and in the best interests of stakeholders. This also highlights an important fact that promoters are giving more importance to talent at top level. This is in line with the trend in developed countries of having professional executives at the helm of the organisation.“

Indian compensation at the top is reaching a point where the numbers are quite comparable to what one sees in the West. “As Indian family owned businesses build scale and complexity, their reliance on professionals is only increasing all the time as many of them are now board managed and professionally run with exemplary governance standards comparable to the best in the world,“ said Sudarshan. The study reveals an over all positive trend in the remuneration package of senior executives in the country, with over 75% taking home increased compensation and only four taking a cut of over 20% compared with last year. It ranks executives as per their compensation package including bo nus (excluding stock optionsshares) in the top 200 companies for the financial year 2014-15. It has based its million dollar cutoff at Rs 65 per US dollar, which comes to a salary of Rs 6.5 crore per annum. For comparison purposes, the previous year's salaries have also been mapped at the same exchange rate.

Most promoter chiefs earn from dividends from their companies and equity appreciation rather than remuneration. During 2015-16, Mukesh Ambani, with compensation at Rs 15 crore, was ranked 43rd as per the EMA Partners' study. Anand Mahindra, with about Rs 7 crore compensation, was ranked 117th, while Adi Godrej (about Rs 19 crore compensation) was at no. 34 and Kumar Mangalam Birla (Rs 43 crore) at no. 11.

Compared with 2014-15, there has not been much change in sectorwise comparison. Industrialmanufacturing which comprises steel, chemicals and construction continues to pay high compensation to the executives and have the largest pie. However, in 2016, some professionals have either retired or resigned, which means the needle could tilt back towards promoters unless more professionals break into the million-dollar salary bracket.

[edit] See also…

Rich List: India <> Rich List: India, 2014: Forbes <>Rich List: India, 2014: Hurun <>Rich List: India, 2015: Forbes <> Rich List: India, 2015: Hurun <>Rich list, India: 2016 <> Rich List: India, 2016: Forbes <> Rich List: India, 2017 <> Rich List: India, 2017: Hurun<> Rich list, India: 2018

Rich list of film artistes: India

[edit] …and also

Rich List: Nepal<> Celebrity List: India<> Indian money in HSBC, Switzerland <> Private lives of famous Indians