Remittances: South Asia

This is a collection of articles archived for the excellence of their content. |

BRIDGING THE GULF The Times of India Dec 01 2014

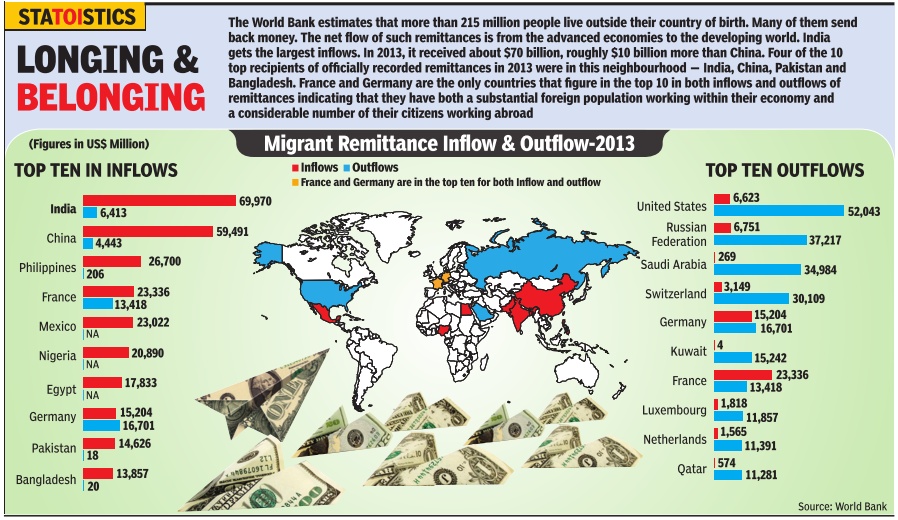

India gets the highest amount of remittances in the world at roughly $70 billion, almost three times the amount of FDI that comes into the country. Where does all this money come from? Data shows that the bulk of remittances come from three different categories of countries: Middle Eastern monarchies such as Qatar, Western developed nations such as the US or Australia, and next door neighbors such as Bangladesh and Nepal. By far the largest amount comes from the Gulf countries -Qatar, Bahrain, Oman, Saudi Arabia, and Kuwait -which sent a combined $32.7 billion, almost half of all remittances received.

Contents |

Migrant remittances: 2013

Outward remittance norms,2015:Overseas house purchases

Feb 05 2015

RBI's new remittance norm: No tax breaks may hit overseas home buys

Lubna Kably

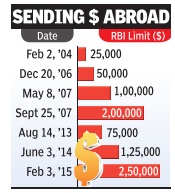

The Reserve Bank of India's (RBI's) recent move, which doubled overseas remittances for individuals up to $2,50,000 (Rs 1.5 crore) per individual per year, may tempt many to buy property overseas. Today , property prices in Dubai and some areas in the United States are attractive for Indian investors.A cursory glance at a few international property portals shows that a one-bedroom house in Dubai costs upwards of 9,50,000 UAE dirhams, or Rs 1.5 crore approximately . In Boston, USA, a similar-sized flat is available for $1,50,000 (upwards of Rs 90 lakh). These prices fall well within the now enhanced permissible remittance figures. However, tax professionals caution that buyers who wish to sell their house property or other assets in India (for instance, a shop or even jewellery) and reinvest the long-term capital gains in a residential property overseas should note that tax exemptions are no longer available for such reinvestments.

Sections 54 and 54F, which earlier permitted investors to claim a capital gains tax exemption even if the reinvestment was in a house property overseas, was amended by last year's Budget -effective from April 1, 2014.

Prior to this amendment, section 54 provided that, where capital gains arise from the transfer of a residential house (held for three years or more) and the tax payer reinvests the capital gains in a new residential house whether by way of purchase or construction within a certain period, the capital gains to the extent re-invested would be exempt.

Section 54F provided for similar exemptions for long term capital gains arising on sale of assets other than a residential property .

Thus, earlier, there was no explicit bar on capital gains being denied if the capital gains were re-invested in a residential house overseas. “Even tax tribunals had upheld the tax benefits in cases where re-investments were made in a house overseas. For instance, in the case of Vinay Mishra, a tax payer who had reinvested in a house property in Singapore, the Bangalore tax tribunal had held that the claim under section 54 could not be rejected. It had also added that the tax payer had not violated the law by purchasing the new house in Singapore utilizing the consideration on sale of his residential house in India. Subsequently, the Chennai tax tribunal also took a similar view. However, the amendment to the tax law by the Finance Act, 2014, has overturned these decisions,“ explains Sonu Iyer, tax partner at EY.

The Finance Bill, 2014 (providing for tax provisions applicable for the financial year April 1, 2014 to March 31, 2015) was tabled in the Parliament on July 10, 2014. As of this date, RBI's liberalized remittance scheme prohibited individuals from remitting money overseas for purchase of property .Thus, the amendment in the Income Tax Act of prohibiting capital gains exemption on reinvestment in a house property overseas had little or no adverse impact.

“With the RBI now doubling the remittance figure, and overseas property proving to be attractive, investors are hoping for a tax break. The forthcoming Budget should consider this issue and re-introduce tax breaks on reinvestment in a house property overseas,“ says Naushad Panjwani, senior executive director, Knight Frank India.

Outward remittances

The remittance limit: 2015

Buying a house overseas easier now

Mumbai TIMES NEWS NETWORK The Times of India Feb 04 2015

RBI Increases Forex Remittance Limit To $250,000Year As Reserves Swell

Buying a house overseas, which used to be the preserve of the super rich, has now become a lot easier for wealthy Indians with the Reserve Bank of India doubling the foreign exchange remittance limit to $250,000 per individual per year. In other words, a family of four can remit $1 million (equivalent of Rs 6.2 crore) every year to purchase assets overseas. With this move, the rupee has become almost fully convertible for most Indians. The funds remitted overseas can be used for almost any activity barring a few such as speculation in exchanges, funding terror groups or for remittances to Bhutan, Nepal, Mauritius and Pakistan.

According to Bank of India chairperson V R Iyer, the increase in the liberalized remittance scheme to $2.5 lakh reflects the confidence of the regulator in consistency in foreign inflows.

RBI governor Raghuram Rajan said on Tuesday the foreign currency remittance limit was relaxed following a review of the external sector outlook and as a further exer cise in macro prudential management. The central bank also said that it will ask the government to subsume under this limit various remit tances that an individual is allowed under the Foreign Exchange Management Act, which include donations, gift remittances and exchange facilities for those seeking employment overseas and for maintenance of close relatives abroad. Until now, this facility was in addition to remittance limits already available for private travel, business travel, studies, medical treatment, etc as described in Schedule III of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

An improvement in the country’s foreign exchange re serves has emboldened the RBI to increase the limit. Announcing his policy , Rajan said the following the drop in oil prices the current account deficit has been comfortably financed by net capital inflows, mainly in the form of buoyant portfolio flows and supported by foreign direct investment inflows and external commercial borrowings.

“Accordingly, there was accretion to India’s foreign exchange reserves to the tune of $6.8 billion in Q3,” said Rajan. The sensex fell 122 points on Tuesday to close at 29,000 because of RBI’s decision to maintain status quo on rates and a sell-off in PSu banks due to worsening asset quality. FII selling added to the slide, dealers said.

The day’s session started on a better note with the index opening about 100 points higher. After the RBI said that it was keeping the key policy rates unchanged due to lack of data since its last rate cut, the index started giving up gains and at one point was down over 200 points.

In volatile trades, finally the index closed 0.4% lower with banking and financial services sector stocks among the top laggards.

While FIIs were net sellers in the stock market, in the debt segment they got more freedom to invest in the government securities market. In its policy, RBI allowed foreign investors to plough back their interest earnings from gilts into the same instrument, in effect increasing their exposure limit in government securities.

With the current FII gilt limit at $30 billion, at the current gilt yield, foreign investors can invest an additional $2.5 billion in gilts next year, bond dealers pointed out. This will also help in government’s debt auction by channelizing more funds into the gilt market, they said.

NRI bank deposits in Gujarat

The Times of India, Jun 17, 2015

Premal Balan & Kalpesh Damor

Thanks to NRIs, 3 small Gujarat villages each have Rs 2,000cr bank deposits

Eight full-fledged branches of nationalized banks cater to just 1,292 households in the tiny hamlet Baladia, some 15km from Bhuj. The NRI-rich village boasts of bank deposits worth Rs 2,000 crore. Baladia is one of over a dozen wealthy Patel villages around Bhuj. With 7,630 households, bank deposits in Madhapar stand at Rs 5,000 crore. Kera village, home to 1,863 families, too has deposits of Rs 2,000 crore. Almost half of this is NRI money.

READ ALSO: NRI deposits dip by Rs 9,890 crore in Gujarat

No wonder bank hoardings flashing interest rates for NRI deposits (up to 10%) is a common sight in these villages. "Some villages in Kutch like Madhapar and Baladia have very high NRI deposits. To the best of our knowledge, this is the highest in the country," said K C Chippa, former convener of the State Level Banker's Committee (SLBC) Gujarat. Between them, Madhapar, Baladia and Kera have 30 bank branches and 24 ATMs.

According to bankers, other villages with bank deposits in the range of Rs 100 to Rs 500 crore include Nanpura, Sukhpar, Samatra, Kodaki, Bharasar, Rampar-Vekara and Mankuva to name a few.

The top three villages draw majority of deposits from a large number of non-resident Gujaratis (NRGs). While Kutchi Patels dominate Baladia and Madhapar, Kera has a vast number of Khoja community NRGs.

"NRGs form over 60% of Baladia village population. They put all their money in bank deposits," said Jadavji Garasia, a local businessman from Baladia.

According to a Dena Bank official, the district has NRI deposits of around Rs 9,181 crore, the second highest in the state after Ahmedabad. Bank deposits in Kutch total around Rs 24,353 crore.

Residents of these villages are settled mostly in countries like Kenya, Uganda, Mozambique, Tanzania, South Africa, the UK and Australia.

"The high number of deposits is because they feel indebted to their hometowns," said Haribhai Halasia, former president of the Kutch Levua Patel Samaj in the UK. "People like me who are living in the UK come to Kutch every 3-4 years and try to pay back our native place," said Halasia, who frequents his native village Madhapar, 20km from Bhuj. Halasia says there are about 2,500-3,000 people from Madhapar in Britain. Kutch Madhapar Karyalay, a body registered in the UK, has over 1,000 registered families from Madhapar.

Interestingly, those with high amount deposits also negotiate with banks for higher interest on their deposits. In many cases, banks also agree to pay them 0.25% or 0.5% more depending on the amount of deposits.

NRI deposits in Kerala: 2014-15

The Times of India, Jun 7, 2015

Viju B

Remittances by NRIs to Kerala cross Rs 1 lakh crore

Everyone knows about the large-scale migration of Malayalis to the Gulf region and the significant role their remittances have played in Kerala's economy. But here's a really big piece of news: NRI deposits in Kerala have now crossed the magic mark of Rs 1 lakh crore, soaring by more than 17% from Rs 93,884 crore to Rs 1.1 crore (at the end of 2014-15) in the space of just one year, according to data collected by the state level bankers committee (SLBC). This includes money from all parts of the world.

What's noteworthy is that the growth has come in spite of an uncertain job scenario in West Asia, especially in Saudi Arabia, which has been trying to replace foreign workers with its own.

Reserve Bank of India (RBI) data shows that there was a little over $115 billion in NRI accounts in India, which is about Rs 7 lakh crore. Kerala, thus accounts for roughly a sixth of all the money deposited in NRI accounts.

India is the largest recipient of remittance flows in the world receiving about $70 billion (roughly Rs 4.2 lakh crore) from this source in 2014, according to World Bank data.

A Kerala government survey showed that remittances sent by the diaspora support at least 50 lakh people in the state, which has a population of 3.15 crore.

The Muslim-dominated Malappuram district has the highest number of people living off remittances, around 2.9 lakh. Around 58,500 women from Kerala today work as nurses and Kottayam district has the maximum number of women working abroad.

State government data shows that of the 16.3 lakh non-resident Keralites (the Centre for Development Studies puts the figure at a much higher 24 lakh), 88% live in West Asia. The maximum number of Keralites, around 5.73 lakh, reside in the UAE and around 4.50 lakh in Saudi Arabia. Many have been migrating to the US and Europe in the last decade thanks to the boom in infotech and fast-growing opportunities in healthcare.

The same government data shows that in the US, there are over 78,000 Keralites, while in Europe there are nearly 53,000. Canada has close to 10,000 Keralites. Families have also migrated to the Africa with nearly 7,000 Keralites residing in different parts of the continent.

Kerala's NRIs seem to prefer public sector banks to private sector banks when depositing their money. NRI deposits in public sector banks total Rs 64,700 crore, compared to Rs 44, 900 crore in the private sector banks.

The exodus began in the early seventies with the Gulf boom when unemployment rates touched an all-time high with youngsters, though highly literate, having to migrate in search of semi-skilled jobs. Since then there has been no looking back.

Remittances from the Gulf region are still a key growth engine for the state, which has seen agriculture in decline till recently and negligible growth in manufacturing while neighbouring states like Tamil Nadu and Karnataka have surged ahead.

Experts say these huge NRI deposits should be used for productive activities like infrastructure development. "The government should float NRI bonds with attractive interest rates so that money does not flow into the hands of private financial groups, which are making huge profits while infrastructure projects in the state are in limbo due to lack of funds, Dr Mary George, a former member of the public review expenditure committee, said.