Pensions and retirement: India

This is a collection of articles archived for the excellence of their content. |

Contents |

National Pension System (NPS)

Transfer from provident, superannuation funds

`Fund transferred from PF to NPS not taxable', March 8, 2017: The Times of India

PFRDA Now Unveils Rules On Transfers

The pension regulator unveiled rules for transfer from recognised provident and superannuation funds to the National Pension System (NPS).

In the 2016-17 budget, the government had announced that subscribers from provident and superannuation funds would be able to transfer their corpus from these funds to NPS without any tax complications.

The Pension Fund and Regulatory Development Authority said any subscriber interested in such a transfer should have an active NPS Tier I account which can be opened either through the employer (where NPS is implemented) or through the points-of-presence (POPs) or online through eNPS on the NPS Trust website.

The regulator also made it clear that as per the provisions of the Income Tax Act, 1961, the amount transferred from recognised provident or superannuation fund to NPS was not treated as income for the current year and hence not taxable.

“Further, the transferred recognised provident fund superannuation fund will not be treated as contribution of the current year by employeeemployer and accordingly the subscriber would not make income tax claim of contribution for this transferred amount,“ the regulator said in a statement.

The subscriber presently under government, private sector employment should approach the recognised provident or superannuation fund trust through the current employer requesting transfer to the NPS account.

“The recognised provident fundsuperannuation fund trust may initiate transfer of the fund as per the provisions of the trust deed read with the provisions of the Income Tax Act,“ the pension regulator said.

In case of a government or private sector employee, the employee should request the recognised provident or superannuation fund to issue a letter to his present employer mentioning that the amount was being transferred from the recognised fund to the NPS Tier I account of the employee. This should be recorded by the present employer or POP as the case may be, while uploading the amount.

The return on NPS for central government employees for one year works out to 15.9% while for five years it stands at 11%.

2017: Age limit relaxed

Age limit relaxed for National Pension System, Nov 1, 2017: The Times of India

HIGHLIGHTS

Subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years

The choice of pension fund and investment option to remain same for subscribers

At a time when bank fixed deposits rates are falling, the government on Wednesday increased the age limit for joining the National Pension System (NPS). This small savings scheme is open for Indian citizens as well as for the non-resident Indians (NRIs).

The maximum age of joining the savings scheme under NPS-Private Sector (All Citizen and Corporate Model) is now increased to 65 years from the existing 60, a release from the Ministry of Finance stated. Any subscriber "between the age of 60-65 years can also join NPS and continue up to the age of 70 years," it added.

"With this increase of joining age, subscribers who are willing to join NPS at later stage of life will be able to avail the benefits of the scheme," it further said.

The choice of pension fund and investment option to remain same for subscribers joining after or before the age of 60 years.

To opt out from the scheme, the subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years. In this case, they are required to utilise at least 40 per cent of the corpus for purchase of annuity and the remaining amount can be withdrawn in lump-sum.

Pension fund regulator PFRDA said that the subscribers of NPS increased by 27 per cent to 1.78 crore at September-end.

25% withdrawal from after 3 years

Allirajan M, Pension plan withdrawal norms eased, January 17, 2018: The Times of India

Coimbatore: The Pension Fund Regulatory Development Authority (PFRDA) has relaxed the norms for partial withdrawal under the National Pension Scheme (NPS). NPS subscribers who have contributed for three years can now withdraw up to 25% of the corpus subject to conditions. Earlier, NPS subscribers were allowed to make a withdrawal from the corpus only after 10 years.

“A subscriber, on the date of submission of the withdrawal form, shall be permitted to withdraw not exceeding 25% of the contributions made by such subscriber to his/her individual pension account,” PFRDA said in its latest circular.

Such withdrawals, however, will be allowed only for “higher education of his/ her child including legally adopted child, marriage of his/her child including a legally adopted child”. Withdrawals can also be made for the purchase or construction of a residential house or flat in his or her own name or in a joint name with his or her legally wedded spouse.

“In case, the subscriber already owns either individually or in the joint name a residential house or flat, other than ancestral property, no withdrawal under these regulations shall be permitted,” PFRDA stated.

NPS subscribers can withdraw money for treatment of specified illnesses for himself, legally wedded spouse, including a legally adopted child and dependent parents. Subscribers can withdraw money for hospitalisation and treatment for cancer, end stage renal failure, primary pulmonary arterial hypertension, multiple sclerosis, major organ transplant, coronary artery bypass graft, aorta graft surgery, heart valve surgery, stroke, myocardial infraction, coma, total blindness, paralysis, accident of serious/life threatening nature and any other illness of a life threatening nature stipulated in the circulars, guidelines or notifications issued by PFRDA from time to time.

Subscribers are allowed to withdraw only a maximum of three times during the entire tenure of subscription under NPS.

India vis-a-vis other countries

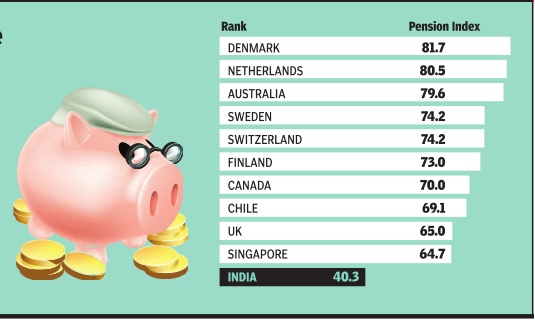

Global Pension Index 2015

The Times of India, Dec 13 2015

No country to retire

The Indian retirement system was ranked last worldwide, while Denmark topped the list of countries in the Melbourne Mercer Global Pension Index 2015. The MMGPI's seventh edition measured 25 retirement income systems against more than 40 indicators, under the sub-indices of adequacy, sustainability and integrity. In the process, it covered nearly 60% of the global population

The Aegon Retirement Readiness Index 2017: Indians best

Indians best at retirement plans: Survey, January 22, 2018: The Times of India

See graphic:

The Aegon Retirement Readiness Index, 2017

From: Indians best at retirement plans: Survey, January 22, 2018: The Times of India

43% Expect Own Savings To Generate Most Income

Indian workers are more confident of managing retirement in 2017 as compared to three years earlier. However, they are much more worried about health in retirement compared to their global peers.

According to Aegon Retirement Readiness Survey 2017, Indians continue to be the best placed in superannuation preparedness among respondents from 15 countries. The Aegon Retirement Readiness Index (ARRI) measures the preparedness and aspirations for retirement based on six parameters — personal responsibility, awareness, financial understanding, superannuation planning, financial preparedness and income replacement.

Aegon has said that the survey is not indicative of the general population and is conducted among middle and high income-earning organised workers in cities.

India, with an ARRI score of 7.6, ranks higher than all 15 major economies. India is followed by the US (6.9), Brazil (6.4), China (6.3) and the UK (6.2). Spain and Japan rank the lowest with index scores of 4.7 and 5.1respectively.

According to the survey report, in 2014, 37% of Indian workers were confident that they would achieve a comfortable retirement. This has risen by over half to 57% in 2017.

Interestingly, Indians have considerably different expectations to the global average as to how their retirement will be funded. Around 43% of those surveyed expect the greatest portion of their retirement income to be funded by their own savings and investments. Globally, only 30% of retirees expect to self-fund their retirement and expect contributions from their employers and government to keep them going.

While 60% of Indian workers are habitual savers, around 25% keep aside some money for retirement from their occasional surpluses. Only 16% of Indian workers said that they do not save at all. This is a much smaller ratio compared to 37% of workers not saving globally.

The median age at which Indian workers expect to retire is 60 years. Those in fair or good health expect to spend a further 15 years living in retirement, while those in excellent health have considerably higher expectations of living 20 years.

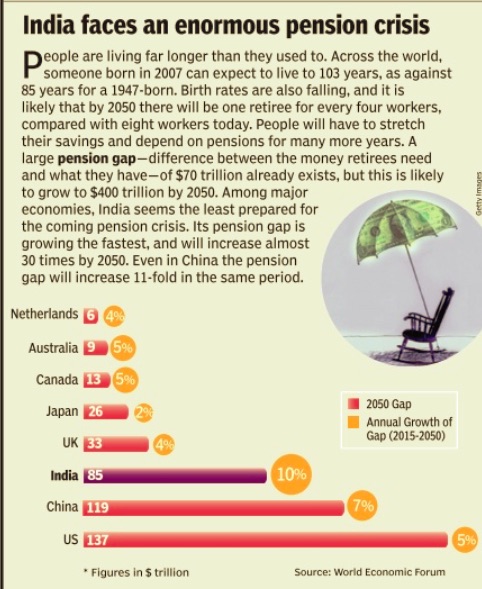

Pension gap

2015: India and the world

See graphic:

Pension gap, India and the world

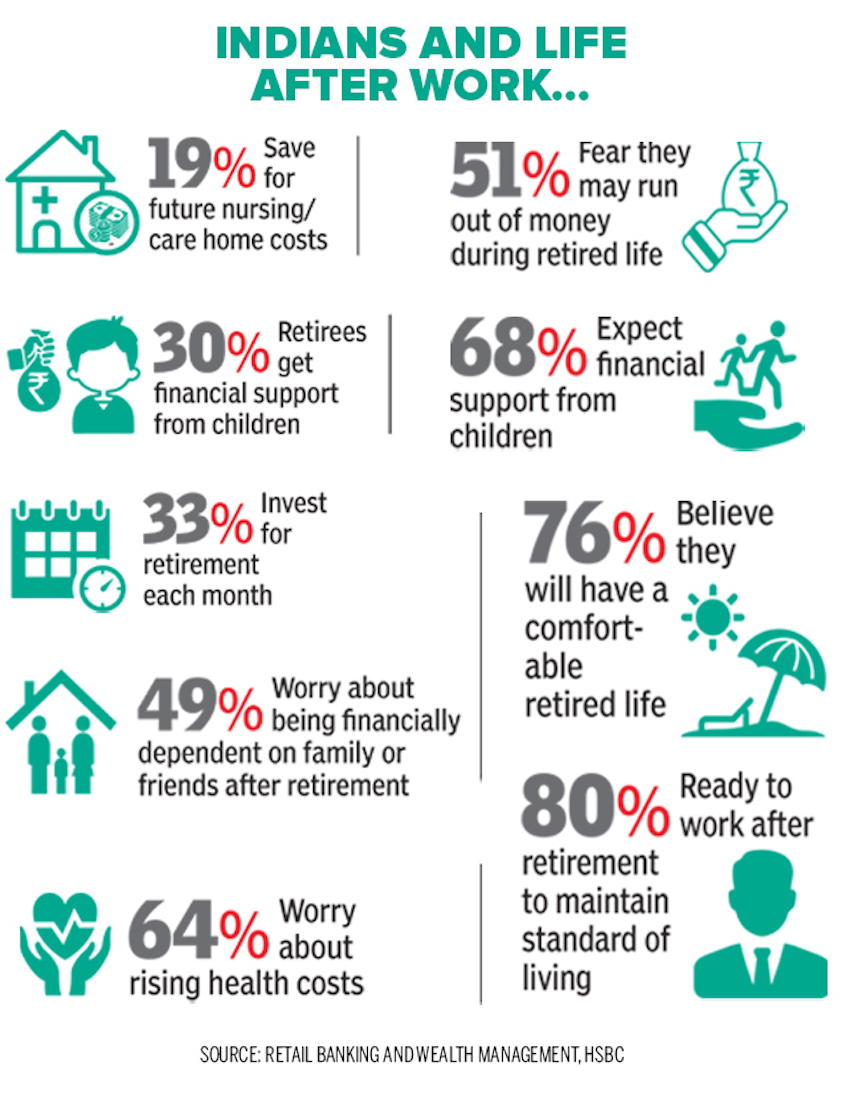

2018: Indians who plan for retirement

From: Only a third of Indians put money into retirement account every month, November 26, 2018: The Times of India

See graphic:

2018: Indians who plan for their retirement, and those who don’t

Planning for life after work is crucial, but many are not making adequate monthly investments. Only a third (33%) of those surveyed among a working age group are contributing to a retirement kitty. Not surprisingly, one out of every two worries about running out of money during retired life.

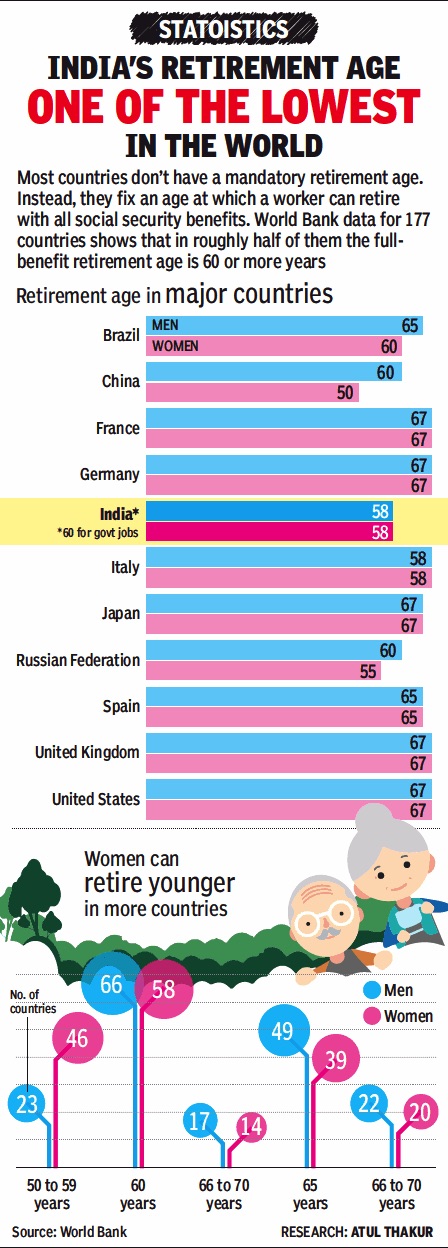

Retirement age

This graphic is factually incorrect insofar as the age of retirement for employees of the Government India, male as well as female, has been 60 since 1998. Several state governments adopted this age, though after 1998.

In this graphic only Brazil and China are somewhat comparable to India. OECD countries (which include Japan) have falling birth rates (which India does not) and rising life expectancy, which forced them to raise the age of retirement.

From: April 25, 2018: The Times of India

See graphic:

The age of retirement in Brazil, China, India and some western countries, presumably as in 2017 .

This graphic is factually incorrect insofar as the age of retirement for employees of the Government India, male as well as female, has been 60 since 1998. Several state governments adopted this age, though after 1998.

In this graphic only Brazil and China are somewhat comparable to India. OECD countries (which include Japan) have falling birth rates (which India does not) and rising life expectancy, which forced them to raise the age of retirement.