PVR (Priya Village Roadshow) group

This is a collection of articles archived for the excellence of their content. |

Contents |

Acquisitions

2018: PVR buys 72% in SPI Cinemas

D Govardan, PVR buys 72% in SPI Cinemas for ₹633cr, August 13, 2018: The Times of India

SPI cinemas,

screens and

annual footfalls

From: D Govardan, PVR buys 72% in SPI Cinemas for ₹633cr, August 13, 2018: The Times of India

PVR, the country’s largest multiplex chain said it was acquiring SPI Cinemas, owners of Sathyam Cinemas, one of the largest screen exhibitors in south India, in a cash-plus-stock deal that values the theatre chain at Rs 850 crore.

According to the terms of the acquisition, PVR would acquire a little over 2.22 lakh equity shares of the privately held SPI Cinemas, constituting 71.7% of the paid-up capital of SPI, from existing shareholders for a consideration of Rs 633 crore. It will also issue 1.6 million equity shares of PVR, accounting for 3.3% of the diluted paid-up equity share capital of the company, pursuant to a scheme of amalgamation between SPI and PVR.

SPI Cinemas redefined the theatre-going experience in Chennai over the past two decades, first by rebranding a single-location Sathyam Cinema, founded in 1974, and adding multiple brands under its chain — S2, Escape, Palazzo and The Cinema — to cater to different categories. It has a presence across south India and Mumbai.

With this acquisition, PVR’s total screen count will increase to 706 screens. It will also make PVR the seventh-largest cinema exhibitor in the world in terms of annual admissions at its theatres, which will be over 100 million per annum. SPI Cinemas logs in annual revenues of Rs 410-420 crore. Both Kiran Reddy and Swaroop Reddy, currently the major stakeholders at SPI Cinemas, will continue to be associated with the business and provide strategic guidance in integrating it with PVR.

EY India was the sole adviser to the transaction.

Rise of the Rs 1,350-crore PVR group

What keeps Ajay Bijli’s business ticking

By Binoy Prabhakar, ET Bureau | 17 Aug, 2014 The Economic Times

The Early Days

[India’s first 3-screen multiplex started in Madras—now Chennai—in the 1964. The 3-screen Blue Diamond, Sapphire, Emerald multiplex in Madras/ Chennai was without doubt India’s first multiplex. THE three southern metros--Chennai, Bangalore and Hyderabad—had hundreds of 2-screen theatres, e.g. Ramakrishna 70mm and Ramakrishna 35mm, in the same building by the late 1970s.]

A number of factors — external and internal — colluded to help PVR's ascent. When Bijli's Priya Exhibitors Private Ltd decided to launch multiplexes, they were unheard of in [north] India. He found a backer in Australian media company Village Roadshow (PVR retains its initials even after the company pulled out in 2003). When PVR completed its first multiplex project — the four-screen Anupam in Delhi's Saket — the government ended price control of movie tickets ((films were once watched for Rs 11 in the balcony, remember).

Finding an audience wasn't going to be a problem. The single screens were suffering from poor lighting and acoustics besides dreadful seats and toilets.

There was one wrinkle though. Multiplexes had to be ensconced in malls. As if on cue, malls began sprouting around the country. The first-mover, rather the only-mover, advantage helped PVR. So when a mall project was announced, Bijli simply had to travel to the locations diligently, scouting for ones where people constantly watched movies, had the capacity to pay and had a stable government. (It stays away from Jammu and Kashmir and the Northeast to this day due to insurgency).

Pramod Arora, group president of PVR, who spearheaded this effort, said once a location was picked, PVR started goading developers to build malls. It even started identifying parcels of land and helped with design. As a rule, PVR does not sign up with done-up malls. The reason is simple: costs typically spike once a mall gets underway; by partnering at inception, the company seals a sweet deal. The agreements are usually for 25 years and rentals are spiked by 15% every three years. There is a lock-in of seven years, which essentially means a developer can't evict PVR, but PVR can pull out after seven years if a malls loses its lustre. As PVR strives for a payback from from investments within three years, this part of the agreement too suits it fine.

Developers don't mind because multiplexes are the lynchpin of a mall. They are the people magnets. PVR was long the preferred, even sole, partner for malls because competitors emerged on the scene only by 2002. By then, it had a built a pipeline of 100-odd screens.

PVR did not blindly pursue expansion, keeping a watchful eye on returns on investment. A mall may have offered cheap rentals, but if it was located in a poorly connected area or if the property itself was wretched, PVR stayed away.

Bijli said he strongly believes that profitability must not be sacrificed for scale. This belief made PVR attractive for funding. ICICI Venture wouldn't have stepped in with Rs 40 crore when Village Roadshow xited or L Capital would not have invested `108 crore in 2012 to help acquire rival chain Cinemax if PVR wasn't making money.

4DX

In early June 2014, Ajay Bijli, chairman and managing director of PVR Ltd, India's largest multiplex chain, stepped into a cinema run by Major Cineplex Group in Bangkok. X-Men: Days of Future Past, the latest instalment in the superhero franchise that is popular with children, was playing and Bijli was not surprised to see he was one of the few adults present in the auditorium.

Bijli was unnerved by the experience, an unexpected turn for someone who "eats, breathes and dreams movies". It wasn't because of the movie or the audience.

The cinema houses the 4DX system, an immersive screening experience that multiplex chains believe will soon become the preferred way to watch movies. The 4DX technology features seats that rock and roll, moving in sync with the action on the screen, even offering scents and smoke as well as lightning, wind and fog effects. For me, it was too much," said Bijli, sitting in his plush office in Gurgaon. "But the kids... they loved it."

Bijli was in Bangkok to test how the audience took in the new system. The 4DX theatre experience had just passed with flying colours. The technology will be introduced in 2015 at PVR's 15-screen property in Noida, the biggest in the chain, as the cornerstone of its Superplex concept.

As Bijli returned from Bangkok, Kamal Gianchandani, president of PVR Pictures, the movie distribution division of the group, was preparing to travel to Bucharest in Romania. There, Gianchandani would meet executives of Grand Cinema Digiplex and Light Cinema.

The two enterprises have taken the lead in the field of Alternate Content, a concept wherein cinemas showcase live performances and broadcasted events across the genres of sports, comedy, theatre, music, opera and ballet — any form of content besides movies. Gianchandani wanted to see whether PVR could embrace these forms of entertainment.

Gianchandani returned satisfied. "It is another form of content being supplied to cinemas within the same properties," he said, shaking off the effects of jet lag, at the company's regional office in Mumbai's Andheri. PVR will introduce Alternate Content later this year.

Show Time

The 4DX technology and Alternate Content are the latest in a a series of multiplex formats such as Imax, a state-of-the art projection and sound system, ECX (enhanced movie experience), which boasts 100% surround sound and great picture clarity, and Director's Cut, plush auditoriums complete with reclining chairs, that PVR has introduced at its various properties. These formats complement different types of auditoriums, enabling PVR to offer a stuffed bouquet of products for the movie buff (see Now Showing...).

"Movie content is not in my hands. "Movie content is not in my hands. Consumers also have many options to watch cinema such as smartphones, portable devices and so on. So it is important for us to ensure that the customer who comes to our cinemas says this is a different experience, a great experience."

To keep customers hooked, PVR is in constant touch with providers of celluloid technology — what Dolby is doing in acoustics, what Christie is doing in projectors or what Imax is doing with its screens. The common thread running through PVR's offerings is that they have been spawned by visits to the properties of counterparts abroad. Every year, the management visits the best cinema chains in the world. Last year, the entire PVR management visited Regal Cinemas, the largest theatre chain in the US and AMC Entertainment Holdings, the No. 2 US theatre chain, to view their operations. The company then cherry-picks and absorbs the best practices of these operators into .. its operations.

"That's all we do. That's the advantage of doing only one thing," said Bijli. Bijli is a big fan of Howard Schultz of Starbucks, Jeff Bezos of Amazon and Rahul Bhatia of IndiGo, entrepreneurs "who do one thing but do it exceedingly well". He has adapted the same philosophy in his business. "There is always something better to do. That's the beauty of running one business."

The business mantra has clearly worked. Today, PVR is not . is not only the largest multiplex chain in India, it has also taken an almost unassailable lead in the number of screens compared with competitors. Its finances too are on an uptick, outperforming competitors' (see Sitting Pretty).

Eye on Profitability

Renuka Ramnath, who has invested twice in PVR (first in her capacity as head of ICICI Venture and as CEO of Multiples Alternate Asset Management, a private equity firm that owns 15.2% in PVR), said in her line of business, the proof of the pudding is whether investments are successful or not. "Financially, it has been a tremendously rewarding journey in both investments in PVR." Ramnath said the few cornerstones on which Bijli was building the were obvious. "He was putting a lot of attention on building a brand that transported consumers to a make-believe world."

PVR has decked the path to that world with top-of-theline technology, plush interiors, great ambience, comfortable chairs and good service. At least 50 properties of the chain are located in prime locations, where the company has invested in interiors that resemble a five-star hotel as well as cutting- edge formats such as ECX and Imax.

Each cinema is designed different. Typically, PVR revamps a property after five years, driven by a 10-member team that hires a mix of Indian and foreign architects.

But wouldn't these investments be lost on an audience that loves to watch Humshakals rather than Edge of Tomorrow? Sanjeev Kumar, joint MD of PVR, said it's a given that multiplexes have to offer excellent customer experience. "No chain can be agnostic to that. If the AC is not working, seats are dirty, sound system is compromised, a customer will not go back. That's what keeps us on our toes."

That calls for running a round-the-clock operation. Multiplex as a business doesn't sleep, according to Arpan Dutta, chief customer officer, PVR. When the last customer exits — usually at 1 am — a housekeeping team starts cleaning. When their work is over, an operations team — which works in shifts — takes over. Preparations to sell tickets and food and beverages (F&B) begin an hour before a show starts.

Once the first ticket is sold, the cinema manager's key task — how to maximise revenue — begins. The bywords are strike rate and 'upselling'. The first relates to selling food and drinks to all the people queuing up before stalls and the second to selling extra goodies — a person who comes to buy salted popcorn, is coaxed to also part with a soft drink.

Box office collections are still the mainstay of PVR's operations, but in recent years, the F&B business has become a money-spinner. "In F&B, there was a perception, probably rightly so, that cinema food was not good. We have worked to change that," said Bijli.

The man driving that change is Gautam Dutta, chief operating officer of PVR Cinemas. He hired a corporate chef to prepare food and a five-star hotel veteran to oversee services. The PVR menu today would give a restaurant a run for its money. The results are showing. The spend per head — a measure of F&B revenues — long tapered around 20-25%, or Rs 45, of the average ticket price (ATP) of Rs 175. It has since risen to 35%, or Rs 62, according to Dutta.

Dutta is a marketing veteran, but selling movies is primarily the prerogative of producers and distributors. (PVR's marketing budget is less than Rs 20 crore, peanuts for a Rs 1,350-crore group). That has allowed him to devote time to other aspects of the business. Besides the F&B drive, another brainchild of Dutta has been the Super Saver. On Wednesday in the west and Thursday in the north, PVR sells tickets at a discount of Rs 75-125, to woo fans who find prices daunting or are not keen to catch a particular movie.

The surge in footfalls on a Super Saver day makes up for the rest of the days, even the weekends. It is still a cautious pricing strategy — a multiplex wouldn't want to wean away its affluent weekend customers with steep discounts.

PVR executives said they are acutely aware that customers reject high prices. Still, ticket prices have been growing at 4-5% a year. Many squirm at the steep ticket and food prices.

Nitin Sood, chief financial officer, PVR, doesn't quite agree. " We test prices to check what customers are willing to pay (based on a cinema manager's advice)." Sood argued that the bulk of the cinemas — PVR Cinemas with 340 screens — is targeted at the masses. And multiplexes cannot charge lesser than single screen cinemas.

Reducing prices is nevertheless the last resort, according to Arpan Dutta. People will not watch for free a bad movie. The alternative is to reduce the shows of a dud, inject fresh movies and rework the schedules

This is the task of the programming team, which is also overseen by Gautam Dutta. The team receives a forecast of movies from producers. It also helps that multiplexes offer customers the flexibility to offer different movie timings — a gap of usually five minutes between shows and up to five shows a day at one auditorium — but exhibitors must understand consumer behaviour. The right time slots can draw crowds, the wrong ones will push them to a competitor.

If PVR appears to be running a well-oiled machine, it boils down to Bijli's mantra of running one business efficiently. He is clearly not a big fan of diversification. He said he would rather absorb something really intrinsic to his business.

PVR Pictures, which distributes Hindi and English movies, and PVR Rare, which offers a platform for Indian indie flicks, bear the stamp of this motif. The first unit is the largest distributor of English movies in India. The second makes five times its budget. Shiladitya Bora, head, PVR Rare, said he releases these movies and documentaries not only in PVR screens but also on other platforms such as Netflix and iTunes.

The bottom line is profitability. PVR has opened two restaurants to complement its multiplexes. Likewise, customers exiting a PVR cinema cannot miss outlets of PVR bluO, a bowling alley venture with Major Cineplex.

Bijli is loath to diversification, but he said in every entrepreneur's journey, there tends to be a distraction. The distraction in his case happened to be film production. It remains the only blot in an otherwise spotless journey.

PVR Pictures actually had a great start in production. The first two films — Taare Zameen Par and Jaane Tu Ya Jaane Na — were big hits. But a series of bombs followed, the biggest being Khelenge Hum Jee Jaan Se. PVR exited on a high, though. Its last film Shanghai was a moderate hit and received critical acclaim.

What Next?

Wouldn't — shouldn't — a movie exhibitor excel in making movies? Gianchandani said great footballers don't always make great managers. "That business needs complete focus from the management."

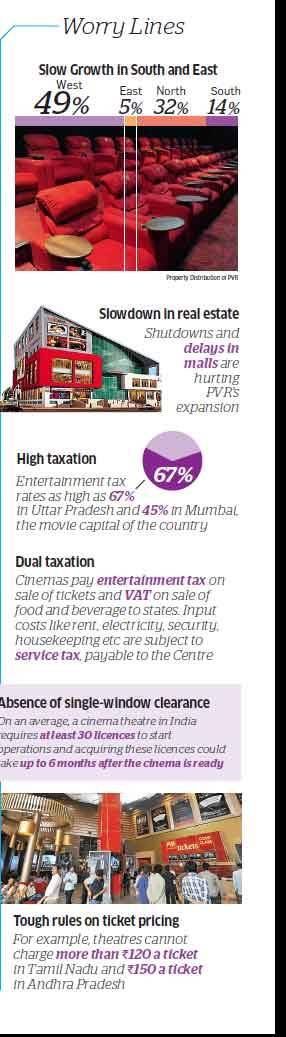

To PVR's credit, its didn't stick around production too long. The same mindset has helped PVR weather storms such as competition from the Indian Premier League, a stock market crash and depressed earnings. Even so, PVR faces many obstacles, many beyond its reach (see Worry Lines). It faces curbs on pricing. Dual taxes are a bugbear — for a Rs 100 ticket, multiplexes are left with Rs 20 after paying entertainment tax, service tax and sharing the with distributors.

But the most worrying obstacle has to be the slowing real estate market in India. Until the 2010 fiscal, PVR was a mere Rs 340-crore business. Revenues shot up to Rs 800 crore in 2013 fiscal and Rs 1,350 crore last year thanks to a massive expansion in footprint — Cinemax's 135 screens were the main catalyst besides its own addition of screens.

To keep revenues ticking, footfalls have to increase. For footfalls to increase, PVR badly needs to expand. But regretfully, real estate is scare in India (Director's Cut is confined to Delhi, for instance). In this context, PVR's ambition to become a 1,000-screen company by 2018 appears to be audacious.

Bijli remains unfazed, however. India remains underscreened — it has 8 screens for every million people compared with USA's 117 — and PVR has room to take underperforming single screens of other operators into its fold. That will swing the current 80: 20 ratio of single screens to multiplexes — there were 7,700 single screens compared with 1,700 multiplex screens in 2013, according to a KPMG Ficci study — in its favour.

2015

Oneindia | 29th Nov, 2015

Mumbai

PVR to add 23 screens, take total to 500 this fiscal

PVR currently operates 477 screens across 44 cities in the country. It has four brands across different price points - PVR Talkies, PVR Cinemas, PVR Premium and newly launched PVR Icon. Dutta said the new screens will largely be in PVR Cinemas and PVR Premium. The company has a capex of Rs 200 crore in 2015-16, which includes Rs 135-140 crore for new projects and the remaining for renovation and the cost of each new screen is around Rs 2-2.5 crore. It recently launched the PVR Icon brand, which is an ultra-premium category, at one of its multiplexes at a suburban mall here with an investment of Rs 25 crore. PVR enjoys an occupancy rate of 35-37 per cent, with a reported footfall of 66 million. Online sales contribute around 35-36 per cent of the total ticket earnings. Food and beverages contribute 25 per cent of the revenues, while advertising accounts for 12 per cent of the income.

See also

Delhi: Cinema halls/ theatres / Madras/ Chennai theatres/ cinemas / PVR (Priya Village Roadshow) group / Sapphire, Emerald, Blue Diamond: Chennai/ Madras /