Non-resident Indians (NRIs)

(→2009-18: 3,500 plaints of desertion by NRI men) |

|||

| Line 6: | Line 6: | ||

|} | |} | ||

| − | [ | + | |

| − | [[ | + | |

| − | + | ||

| + | =Definition= | ||

| + | ==2020: definition changed to stop tax avoidance== | ||

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F02&entity=Ar00313&sk=5CF3FE57&mode=text February 2, 2020: ''The Times of India''] | ||

| + | [[File: 2020- definition changed to stop tax avoidance- Status and tax incidence in India.jpg|2020- definition changed to stop tax avoidance- Status and tax incidence in India <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F02&entity=Ar00313&sk=5CF3FE57&mode=text February 2, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | The Budget has tightened the screws on those seeking to escape tax by exploiting their non-resident status. While earlier it was possible to be classified as non-resident by staying out of the country for 183 days or about six months in a year, this has now been, in effect, enhanced to 245 days. | ||

| + | |||

| + | The change has been made because some taxpayers divided their time between India and overseas to avoid being categorised as tax residents in India. Once a tax resident is further classified as ordinarily resident (OR), he pays tax in India on his global income, which would include say interest income on overseas bank accounts. | ||

| + | |||

| + | As Parizad Sirwalla, partner and head, global mobility services (tax) at KPMG India points out, “Indian citizens and persons of Indian origin who were on visit to India had an extended period of 182 days of stay in India (as opposed to 60 days) before they could be regarded as a resident from an income tax perspective. This period is proposed to be reduced to 120 days now.” | ||

| + | |||

| + | As things stand, an individual is a resident in India for a particular financial year if he has been here for an overall period of 365 days or more within the four years preceding and an overall period of 60 days in that particular year. The 182-day relaxation was made available to Indian citizens and persons of Indian origin. | ||

| + | |||

| + | |||

| + | ''' ‘Only The Stateless Will Be Deemed Indian And Taxed’ ''' | ||

| + | |||

| + | The Budget memorandum pointed out that this relaxed duration of 182 days was misused by individuals who had significant economic activity in India (say a business), managed their period of stay, so as to remain a non-resident in perpetuity. With such individuals now being required to stay out of the country for 245 days in a year, the misuse becomes more difficult for those having business interests in India. | ||

| + | |||

| + | Gautam Nayak, tax partner at CNK & Associates cautions, “NRIs or Overseas Citizens of India, visiting relatives in India need to now be more careful and limit their stays to less than 120 days in a year, or else they may face tax on their worldwide income.” | ||

| + | |||

| + | After having determined an individual as a tax resident, there is a secondary test to determine whether the individual qualifies as a not ordinarily resident (NOR) or ordinarily resident (OR). | ||

| + | Currently there are complex rules to determine when a person is NOR. This has been simplified to say that a person is NOR for a particular financial year if he has been a non-resident in seven out of the ten preceding years. This determination is critical as while an ‘NOR’ is only taxed on India income, an individual who is an ‘OR’ is taxable on his worldwide income. | ||

| + | |||

| + | Another change made is that an Indian citizen not ‘liable to tax’ in any other country or territory shall be deemed to be resident in India. At first glance, it appeared that India’s diaspora which works in Gulf countries (where there is no tax on individual income) would be badly hit. | ||

| + | |||

| + | However, the Finance Bill added that this would be the case if the individual is not liable to tax in any other country by reason of his domicile, or residence or any other criteria of similar nature. Nayak adds, “The SC in the case of Azadi Bachao Andolan has held that the term ‘liable to tax’ is not the same as ‘is actually taxed’. The OECD Model Tax Convention also provides that a person does not have to be actually paying tax to be “liable to tax”. If the host country chooses not to tax such income, it does not mean that they are not “liable to tax” in that country. They may still not be regarded as residents of India. However, the issue needs to be clarified to avoid litigation. This provision would therefore perhaps only impact those Indian citizens who are not residents of any country at all.” | ||

| + | |||

| + | ANI quoted the revenue secretary, Ajay Bhusan Pandey, as saying that only if an Indian citizen is not a resident of any country in the world, he will be deemed to be a resident of India and his worldwide income will be taxed. | ||

| + | |||

| + | Amarpal S Chadha, partner and India mobility leader at EY-India says, “The intent behind this amendment is to tax the Indian citizens who are stateless and enjoy the privilege of not paying taxes in any country or jurisdiction, based on their tax planning. However, a formal clarification on this will be helpful to avoid litigation.” | ||

| + | |||

| + | |||

=Legal status, rules= | =Legal status, rules= | ||

| Line 79: | Line 111: | ||

[[Non-resident Indians (NRIs): Gujarat]] | [[Non-resident Indians (NRIs): Gujarat]] | ||

| + | |||

| + | [[Category:Diaspora|N | ||

| + | NON-RESIDENT INDIANS (NRIS)]] | ||

| + | [[Category:India|N | ||

| + | NON-RESIDENT INDIANS (NRIS)]] | ||

| + | [[Category:Law,Constitution,Judiciary|N | ||

| + | NON-RESIDENT INDIANS (NRIS)]] | ||

Revision as of 22:40, 16 October 2020

This is a collection of articles archived for the excellence of their content. |

Contents |

Definition

2020: definition changed to stop tax avoidance

February 2, 2020: The Times of India

From: February 2, 2020: The Times of India

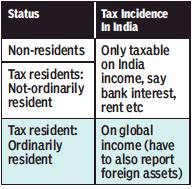

The Budget has tightened the screws on those seeking to escape tax by exploiting their non-resident status. While earlier it was possible to be classified as non-resident by staying out of the country for 183 days or about six months in a year, this has now been, in effect, enhanced to 245 days.

The change has been made because some taxpayers divided their time between India and overseas to avoid being categorised as tax residents in India. Once a tax resident is further classified as ordinarily resident (OR), he pays tax in India on his global income, which would include say interest income on overseas bank accounts.

As Parizad Sirwalla, partner and head, global mobility services (tax) at KPMG India points out, “Indian citizens and persons of Indian origin who were on visit to India had an extended period of 182 days of stay in India (as opposed to 60 days) before they could be regarded as a resident from an income tax perspective. This period is proposed to be reduced to 120 days now.”

As things stand, an individual is a resident in India for a particular financial year if he has been here for an overall period of 365 days or more within the four years preceding and an overall period of 60 days in that particular year. The 182-day relaxation was made available to Indian citizens and persons of Indian origin.

‘Only The Stateless Will Be Deemed Indian And Taxed’

The Budget memorandum pointed out that this relaxed duration of 182 days was misused by individuals who had significant economic activity in India (say a business), managed their period of stay, so as to remain a non-resident in perpetuity. With such individuals now being required to stay out of the country for 245 days in a year, the misuse becomes more difficult for those having business interests in India.

Gautam Nayak, tax partner at CNK & Associates cautions, “NRIs or Overseas Citizens of India, visiting relatives in India need to now be more careful and limit their stays to less than 120 days in a year, or else they may face tax on their worldwide income.”

After having determined an individual as a tax resident, there is a secondary test to determine whether the individual qualifies as a not ordinarily resident (NOR) or ordinarily resident (OR). Currently there are complex rules to determine when a person is NOR. This has been simplified to say that a person is NOR for a particular financial year if he has been a non-resident in seven out of the ten preceding years. This determination is critical as while an ‘NOR’ is only taxed on India income, an individual who is an ‘OR’ is taxable on his worldwide income.

Another change made is that an Indian citizen not ‘liable to tax’ in any other country or territory shall be deemed to be resident in India. At first glance, it appeared that India’s diaspora which works in Gulf countries (where there is no tax on individual income) would be badly hit.

However, the Finance Bill added that this would be the case if the individual is not liable to tax in any other country by reason of his domicile, or residence or any other criteria of similar nature. Nayak adds, “The SC in the case of Azadi Bachao Andolan has held that the term ‘liable to tax’ is not the same as ‘is actually taxed’. The OECD Model Tax Convention also provides that a person does not have to be actually paying tax to be “liable to tax”. If the host country chooses not to tax such income, it does not mean that they are not “liable to tax” in that country. They may still not be regarded as residents of India. However, the issue needs to be clarified to avoid litigation. This provision would therefore perhaps only impact those Indian citizens who are not residents of any country at all.”

ANI quoted the revenue secretary, Ajay Bhusan Pandey, as saying that only if an Indian citizen is not a resident of any country in the world, he will be deemed to be a resident of India and his worldwide income will be taxed.

Amarpal S Chadha, partner and India mobility leader at EY-India says, “The intent behind this amendment is to tax the Indian citizens who are stateless and enjoy the privilege of not paying taxes in any country or jurisdiction, based on their tax planning. However, a formal clarification on this will be helpful to avoid litigation.”

Legal status, rules

PPF a|c to be closed, NSCs encashed if holder turns NRI

PPF a|c to be closed, NSCs encashed if holder turns NRI, Oct 30 2017: The Times of India

Amending rules on post office savings schemes like the National Savings Certificates (NSC) and Public Provident Fund (PPF), the government has notified that such accounts would be closed prior to maturity in case of holders changing their personal status to become nonresident Indians (NRIs).

The amended rules were notified in the official gazette in October 2017.

The amendment to the PPF Scheme, 1968, says: “If a resident who opened an account under this scheme, subsequently becomes a non-resident during the currency of the maturity period, the account shall be deemed to be closed with effect from the day he becomes non-resident“.

The interest payable would be up to the date of the account closure, it said.

A separate notification on NSCs said in case of a sim ilar change of status of the certificate holder before the maturity period, “the certificate will be encashed, or deemed to be encashed on the day he becomes non-resident“ and interest will be paid accordingly.

NRIs are not allowed in instruments like the National Savings Certificates, Public Provident Fund, Monthly Income Schemes and other time deposits offered by the post office.

In September 2017, the government had retained the interest rate on Public Provident Fund for October-December unchanged at 7.8%, in line with the rates for small savings schemes.

Social issues

Matrimonial tensions

Chethan Kumar, 1 NRI wife calls home for help every 8 hours, February 5, 2018: The Times of India

Many Indian parents look for a foreign match for their daughters but here’s a reason to be wary. On average, at least one woman married to an NRI calls home every eight hours seeking help to return after being deserted by her husband or because of reasons like ill-treatment and physical torture.

Complaints received by the ministry of external affairs (MEA) show that in the 1,064 days between January 1, 2015 and November 30, 2017, the MEA received 3,328 such complaints — an average of more than three calls a day or one every eight hours.

Most of the women are originally from Punjab and Andhra-Telangana followed by Gujarat, say lawyers, activists and people working in Indian missions abroad. The National Institute of Public Cooperation and Child Development, in its study on deserted women some years ago, also confirms this fact.

‘Most dowry complaints from Andhra, Telangana’

Aarthi Rao worked with the Indian embassy in Washington DC for 16 years, six of which were as a community development officer dealing with such cases. “Most women,” she said “were from Andhra Pradesh (including Telangana), where the dowry system is still strong. The boys went to India to please their parents and married someone, but had no intentions of living withthem once they returned.”

Aarthi, who later served as adviser totheMEA, saidshe received a lot of complaints from West Asian countries during her Delhi stint. In one complaint that the MEA received, Shazia (name changed) said shewas stuck in Bahrain as her husband had destroyed her visa document and was preventing her from making calls.

The erstwhile Overseas Indian Affairs Ministry, now merged with MEA, had introduced a scheme for such women in 2007. The MEA now addresses the issue through its grievance redressal portal, MADAD. Besides, all missions also receive complaints from women and help them both financially and legally.

Not all complaints go to the ministry. Chennai-based lawyer Sudha Ramalingam says the majority are from West Asian countries, the US and Canada. “Just six weeks ago, there was a man working with Qatar Airlines harassing his wife. She reached out to me after great difficulty and we’ve just managed to get her separated from her husband,” she said. While Ramalingam said there was “no one solution” to the problem, sociologist Samata Deshmane attributedittoIndian parents’ “obsession” with acertain status associatedwith NRI grooms.

2009-18: 3,500 plaints of desertion by NRI men

3,500 plaints of desertation by NRI men in last 9 years: NCW, July 31, 2018: The Times of India

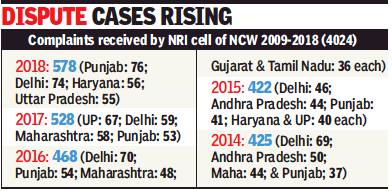

The National Commission for Women has received 3,569 complaints since 2009 from women who were deserted by their NRI husbands. A total of 355 complaints were received from Punjab alone during this period.

NCW chief Rekha Sharma said that the commission will push for stringent punitive measures against NRI husbands who desert their Indian wives. “An analysis of data reveals harassment and ill treatment in many ways, including abandonment, loss of communication with spouse upon leaving India, brief holidaymarriages and cheating,” Sharma said at the National Seminar on ‘NRI Marriage Related Issues in Punjab’ held in Jalandhar.

“Matrimonial advertisements by parents often highlight their daughters’ qualifications and background when seeking NRI grooms. They don’t conduct detailed verification or cross-check background for grooms,” she said.

Over 20 women deserted by their NRI husbands participated in the seminarand presented recommendations to stakeholders. Officials from Punjab NRI commission, police, district and state administration, local body representatives and civil society organisations were part of the seminar. Among various measures being planned to crack down on absconding NRI husbands, the government is also working on detterence.

2014-18: complaints received by NCW

To hasten process, Maneka moves Rajnath, November 14, 2018: The Times of India

From: To hasten process, Maneka moves Rajnath, November 14, 2018: The Times of India

The home minister has agreed to call the meeting of the informal group of ministers. This informal group of four ministers led by Singh was set up in June to discuss concerns and look for solutions to concerns arising out of recommendations made by the inter-ministerial panel on the matter and agreed upon in principle in June. Led by Sushma Swaraj the inter-ministerial panel was set up in 2017.

When this group of ministers met in June this year, Singh chaired the deliberations where it was felt that there is a strong need to find solutions, even innovative ones, to tighten the law and and bring non-resident Indian offenders to book. The meeting was to be followed by preparation of a Cabinet proposal after legal scrutiny. The meeting which had considered the legal tenability of measures is understood to be in agreement of the changes in the law that will be required. However, the finalisation of the proposal is still under process as fresh concerns have been cited.

To build pressure on absconding NRI husbands who have failed to respond to court summons, the Centre has been exploring changes in law to enable confiscation of joint family property and alienation of land to stop any sale of commonly owned property. It was also proposed to bring changes in laws for putting up unanswered summons on the website of the ministry of external affairs and these will be considered served.