National Stock Exchange

(Created page with "{| class="wikitable" |- |colspan="0"|<div style="font-size:100%"> This is a collection of articles archived for the excellence of their content.<br/> Additional information ma...") |

|||

| Line 7: | Line 7: | ||

|} | |} | ||

| − | [[ | + | |

| − | [ | + | |

| − | + | ||

| + | |||

| + | = NIFTY 50= | ||

| + | ==1996-2021== | ||

| + | [[File: National Stock Exchange’s NIFTY 50, 1996-2021.jpg|National Stock Exchange’s NIFTY 50, 1996-2021 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F04%2F24&entity=Ar01512&sk=78962F6E&mode=image April 24, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' National Stock Exchange’s NIFTY 50, 1996-2021 '' | ||

=Wrongdoings= | =Wrongdoings= | ||

| Line 45: | Line 53: | ||

Sebi also penalised current and former NSE officials Ravi Varanasi, Suprabhat Lala, Subramanian Anand, Nagendra Kumar SRVS, Deviprasad Singh, and officials at the three broking houses. | Sebi also penalised current and former NSE officials Ravi Varanasi, Suprabhat Lala, Subramanian Anand, Nagendra Kumar SRVS, Deviprasad Singh, and officials at the three broking houses. | ||

| + | |||

| + | [[Category:Crime|N | ||

| + | NATIONAL STOCK EXCHANGE]] | ||

| + | [[Category:Economy-Industry-Resources|N | ||

| + | NATIONAL STOCK EXCHANGE]] | ||

| + | [[Category:India|N | ||

| + | NATIONAL STOCK EXCHANGE]] | ||

| + | [[Category:Pages with broken file links|NATIONAL STOCK EXCHANGE]] | ||

Revision as of 05:18, 17 May 2021

This is a collection of articles archived for the excellence of their content. |

Contents |

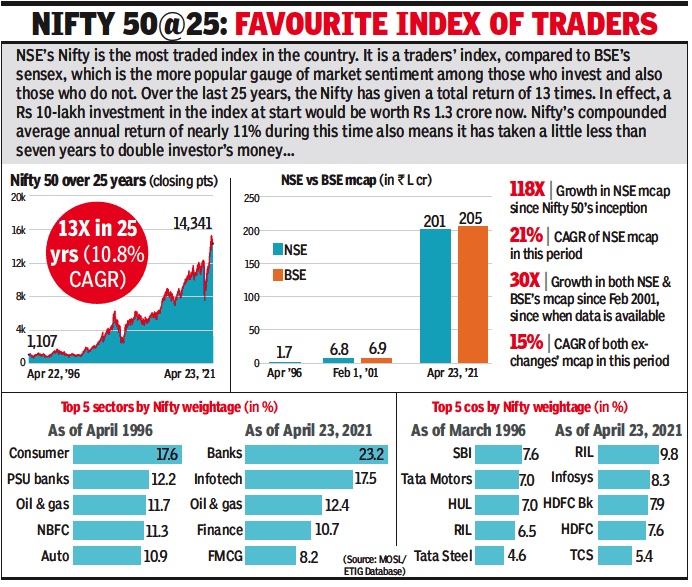

NIFTY 50

1996-2021

From: April 24, 2021: The Times of India

See graphic:

National Stock Exchange’s NIFTY 50, 1996-2021

Wrongdoings

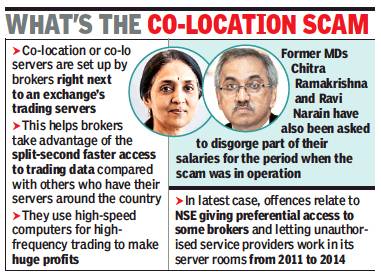

The Co-location scam

Partha Sinha, May 1, 2019: The Times of India

From: Partha Sinha, May 1, 2019: The Times of India

Sebi fines NSE ₹1,100cr, bans 2 ex-MDs in brokers’ scam

3 Brokers, Former FinMin Official Also Barred

Mumbai:

Market regulator Sebi asked the National Stock Exchange, the largest bourse in India, to pay about Rs 1,100 crore for favouring a few brokers to make illegal gains by using unauthorised trading software, networks and servers in the same room where the exchange’s main trading servers were located. Sebi also banned Ravi Narain and Chitra Ramkrishna, both former MDs of the exchange, from the market for five years each and also asked them to disgorge part of their salaries for the years when NSE had demonstrated favouritism to three brokers — OPG Securities, GKN Securities and Way2Wealth Securities — over all other brokers.

The regulator also asked NSE not to introduce any new derivatives contracts for the next six months. Sebi, through five different orders, also banned the three brokers from the market for up to five years and asked them to disgorge illegal gains and interest on the same, aggregating about Rs 51 crore.

Sebi also banned Ajay Shah, a former finance ministry official and a professor of economics, from associating with any listed company for two years. Shah had used confidential trading data from NSE for personal benefits. Several other people and software vendors who played crucial roles in facilitating the brokers to make illegal gains have also been either banned or fined by Sebi. While Narain had resigned as MD of NSE in May 2013 and took over as its vice-chairman, Ramkrishna took over as MD.

NSE’s preferential treatment to the three brokers for access to its trading servers, called co-location of servers scam or co-lo scam, continued between 2011 and 2014.

‘Orders won’t impact trading’

The illegal operation also involved putting up optical fibre networks within NSE’s premises by unauthorised vendors which were used to access the exchange’s servers.

For its role in the scam, Sebi also banned NSE from the stock market for six months, meaning the exchange cannot go for its IPO, which has been stalled for years on regulatory directions. An NSE spokesperson said that the exchange was in the process of examining Sebi’s order and will take appropriate steps as may be legally advised. Narain and Ramkrishna did not reply to TOI’s calls and messages for their comments.

According to NSE MD Vikram Limaye, the orders will not impact regular trading on NSE and “the trust on NSE and the Indian markets for all investors is rock solid”.

In the order, Sebi’s whole time member G Mahalingam noted that it was established beyond doubt that NSE had not exercised the requisite due diligence while putting in place the TBT architecture (a specialised trading software process). According to Mahalingam, “NSE being a market infrastructure institution cannot be treated at par with other market intermediaries or participants as it derives its power to act as a stock exchange from the recognition granted to it.”

In its order, Sebi asked NSE to pay Rs 625 crore and 12% interest from April 1, 2014 for its role in the co-location scam. It also directed NSE to pay Rs 62.6 crore and 12% interest from September 11, 2015. The fine has to be paid within 45 days from the date of the order. It also asked OPG Securities to pay Rs 15.6 crore, Way2Wealth Rs 15.34 crore and GKN Securities Rs 4.9 crore penalty. These three brokers will also pay 12% interest for four to five years on the amount of penalty.

Sebi also penalised current and former NSE officials Ravi Varanasi, Suprabhat Lala, Subramanian Anand, Nagendra Kumar SRVS, Deviprasad Singh, and officials at the three broking houses.