Money Laundering: South Asia

This is a collection of articles archived for the excellence of their content. |

Contents |

Basel Anti-Money Laundering (AML) Index

About the Basel AML Index

The 2017 Basel AML Index edition covered 146 countries and assigns each country a score on a scale from 0 (low risk) to 10 (high risk). High-risk scores in the Basel AML Index generally indicate weak AML/CTF standards, low institutional capacities and a lack of transparency in the financial and public sector. The Basel AML Index does not assess the amount of illicit financial money or transactions but is designed to assess the risk of money laundering, i.e. to indicate the vulnerability of a country to money laundering and terrorism financing based on publicly available indicators. The Basel AML Index is a composite index, meaning the overall score is a weighted average of 14 indicators from various publicly available sources such as the Financial Action Task Force (FATF), Transparency International, the World Bank and the World Economic Forum.

2017

The South Asian list

Basel AML Index Scores and World Rankings (from highest to lowest risk)

1 Iran 8.60 (highest risk)

2 Afghanistan 8.38

13 Myanmar 7.58

14 Nepal 7.57

25 Sri Lanka 7.15

46 Pakistan 6.64

51 China 6.53

82 Bangladesh 5.79

88 India 5.58 (lowest risk in the South Asia-China region)

145 Lithuania 3.67

146 Finland 3. (lowest risk)

Bhutan and the Maldives were not ranked

Basel Institute’s explanatory notes

The Basel Institute on Governance’s 2017 edition of the Basel Anti-Money Laundering

(AML) Index, is an annual ranking assessing 146 countries regarding money laundering/terrorism

financing risks. It was the sixth annual release of the Basel AML Index, which remains to date the only

research-based risk rating of countries in this field issued by an independent non-profit institution.

Since its first release in 2012 the Index has not seen significant changes in terms of countries occupying the top ten risk positions; yet, in the 2017 Basel AML Index we observe that the average country risk level has been deteriorating at least during the last three years. While the global average risk scores were 5.82 in 2015 and 5.85 in 2016, the average risk score this year is equal to 6.15 (on a scale of 0=low risk to 10=high risk).

Main results and findings in 2017

• The 10 countries with the highest AML risk are Iran, Afghanistan, Guinea-Bissau, Tajikistan, Laos, Mozambique, Mali, Uganda, Cambodia and Tanzania.

• The three lowest risk countries are the same as last year: Finland, followed by Lithuania and Estonia.

• The greatest improvements since 2016 have been made by Sudan, Taiwan (China), Israel and Bangladesh.

Although a majority of countries legally comply with current AML/countering terrorism financing (CTF) standards, most continue to fall (sometimes severely short) in terms of effective implementation and enforcement of these laws. By including data from the FATF, which for the past few years has used an assessment methodology that looks not only at technical compliance but also at enforcement capacity, the Basel AML Index is increasingly able to capture this significant difference.

Regional findings and highlights

East Asia and Pacific

In East Asia and the Pacific, Laos, Cambodia, Myanmar, Vietnam, Marshall Islands are the top risk countries in the region. Taiwan (China) has recorded the largest improvements, whereas Laos’ ranking deteriorated the most.

South Asia

Among the six South Asian countries, Afghanistan, Nepal and Sri Lanka stand out with particular highrisk scores in the Basel AML Index.

2017: The top Money laundering entities

Pradeep Thakur, November 23, 2017: The Times of India

From: Pradeep Thakur, November 23, 2017: The Times of India

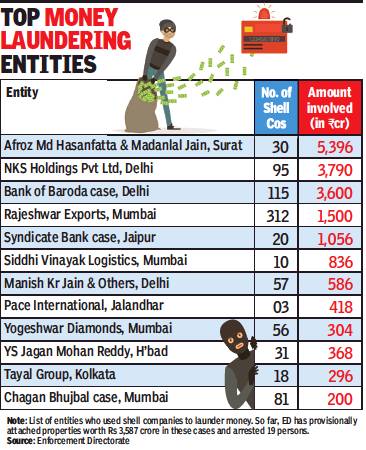

The Enforcement Directorate has drawn up a list of top money launderers and the shell companies used by them to transact unaccounted money. The list includes some top politicians of the country.

Topping the list is one Afroz Mohammed Hasanfatta and Madanlal Jain of Surat who remitted money to Dubai and Hong Kong through forged bills of entry. Together the duo allegedly laundered Rs 5,400 crore through 30 shell companies.

NKS Holdings Pvt Ltd of Delhi is second on the list and allegedly laundered Rs 3,790 crore using 95 shell companies, followed by the accused in the Bank of Baroda case in Delhi where 115 shell companies were used to launder Rs 3,600 crore and remittances sent abroad. The operators of NKS Holdings accepted black money of “clients” and converted them into share premium through shell companies to make them look like legitimate business transactions.

The politicians in the list include Jagan Mohan Reddy of YSR Congress who is accused by the agency of laundering at least Rs 368 crore through 31 shell companies linked to him and his associates. The other prominent politician is Chhagan Bhujbal, NCP leader and former deputy CM of Maharashtra, who is being investigated for allegedly laundering Rs 200 crore using 81shell companies.

Rajeshwar Exports of Mumbai had the highest number of 312 shell companies which laundered Rs 1,500 crore. Jaipur, Jalandhar, Raipur, Hyderabad, Chennai and Panaji were among the cities where entities engaged in laundering in a big way. The ED tracked about 1,000 shell companies recently involved in such activities, some of which were linked to terror funding.

“These shell companies were used to conceal the nature, origin and destination of misappropriated funds by concealing the beneficiary and the proceeds of crime generated out of corruption,” a senior ED official said.

Shell companies are those which have no real business activity and are merely registered to launder unaccounted and illegal money earned by businessmen, corrupt bureaucrats and politicians. Some of this laundered money is allegedly proceeds of crime through illegal activity like bullion smuggling, narcotics trade or terror activity.

An IAS officer, Babulal Agarwal, also figured on the list. Agarwal, former Chhattisgarh principal secretary, is accused of laundering Rs 60 crore through at least 13 shell companies.