Jan Dhan Yojana

(→Analysis) |

|||

| Line 94: | Line 94: | ||

Some adults declined to get an account as they were unable to afford the fees for maintaining and using an account, or think the fees are not worth it. Yet 40 % of adults cited lack of trust in financial institutions as reason for not opening an account. | Some adults declined to get an account as they were unable to afford the fees for maintaining and using an account, or think the fees are not worth it. Yet 40 % of adults cited lack of trust in financial institutions as reason for not opening an account. | ||

| + | |||

| + | ==2017: Women hold over 50% of Jan Dhan a/cs== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F15&entity=Ar01410&sk=97ED2581&mode=text February 15, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: Bank agents' services, 2015 and 2017.jpg|Bank agents' services, 2015 and 2017 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F15&entity=Ar01410&sk=97ED2581&mode=text February 15, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | In what marks a boost for financial inclusion, more than half of PM Jan Dhan Yojna account-holders are women and they are also carrying out transactions rather than merely opening accounts, a sample survey by a financial inclusion consulting firm has indicated. | ||

| + | |||

| + | The “State of the Agent Network 2017” report released by Microsave on Wednesday found that there has been a more than 200% increase in volumes of cashin, cash-out between 2015 and 2017. The Modi government’s drive to encourage opening of these accounts was to offer banking services to the poor for more reliable transfer of government benefits and to enable the less well off to avail credit or loans. | ||

| + | |||

| + | The transactions are increasing as the bank agents or business correspondents offer more products and services such as linking of Aadhaar to bank accounts, insurance registration and balance inquiry. Moreover, government-to-people payments such as direct transfer of cash, has led to increase in transactions. Aadhar linkage and mobile use are key elements in the inclusion scheme. | ||

| + | |||

| + | Banks appoint entities and individuals as agents for providing basic banking services in remote areas where they can’t practically start a branch. | ||

| + | |||

| + | Releasing the agent network report, chief economic advisor Arvind Subramanian said while India has made a lot of progress on the financial inclusion front, gaps remain. “You have gas cylinders but you need consistent gas offtake; you have bank accounts but you need to make genuine inclusion; your toilets are built, but are they used? I think that’s the next stage we need to work on....That is why, the banking correspondents story needs more work,” he said. | ||

| + | |||

| + | The report has recommended the need to take steps to increase the share of women agents from the present of only 2%, which could give a fillip to the financial inclusion of women. The report is based on a nationwide representative research that covered 3,048 businesses correspondents. | ||

Revision as of 12:11, 16 February 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

Performance

Aug. 2014- Nov. 2016

Authors' affiliation is as follows: Agarwal, Georgetown University; Alok, Indian School of Business; Pulak Ghosh, IIM Bangalore; Soumya Ghosh, State Bank of India; Piskorski, Columbia University; Seru, Stanford University

Is the NDA government's flagship initiative Jan Dhan Yojana bearing fruit on the ground?

There is a big debate about the activity role of financial markets and products in shaping consumer welfare and real economic . In developed economies, there is an increasing discussion that financial sector may have become inefficiently large and products offered to households may have become excessively complex. In contrast, in many developing countries, like India, there has been a significant push to increase the usage of financial products to “complete“ the market. While there is some empirical literature on the former, evidence on the latter is scant. To address this we conducted an extensive scientific study of the largest outreach programme in the world, the Pradhan Mantri Jan Dhan Yojana (JDY).JDY was launched in India on 28 August 2014, with the objective of providing banking services to a large proportion of the unbanked population in India.

Our study has two modest objectives.First, we document the initial uptake and subsequent usage of banking services that includes a savings account, overdraft facilities, and insurance benefits by the unbanked targeted by the programme.Second, we exploit the regional variation in pre-JDY financial access to explore how expanding access to financial services is related to broader outcomes such as lending, GDP growth, and consumer prices.

Several economic theories predict that financial inclusion programmes can directly benefit lower income households at the micro level through savings, spending, and reduction in transaction costs.What does the evidence say? We begin by documenting substantial outreach of the programme that led to 255 million formerly unbanked individuals getting access to formal banking services by November 2016. About 77% of the new accounts maintain a positive balance with the average monthly balance of Rs 482, which is about 60% of the rural poverty line in India.

Overall, our micro-evidence suggests that there was substantial uptake by households under JDY. Moreover, both savings and transactions go up over time for individuals banked under the programme. This evidence is consistent with learning by individuals that results in an increase in usage over time as they gain familiarity with banking services.The initial usage is also more frequent among married account holders.

We also note that financial inclusion programmes such as JDY can also have broader regional implications through at least two channels. First, such a programme could allow new capital to come into the formal banking system by means of new deposits, relaxing the capital constraints. This would allow banks to increase lending to their clients.

Second, information asymmetry between new customers and lenders or other costs in acquiring new customers may imply that a programme like JDY may allow banks to meet the unmet demand for credit for some households. To the extent that this increase in credit is large, one would see such programmes stimulating local economic growth through increased con sumption, investments, and employment.

To investigate such broader effects, we exploit spatial (regional) variation in implementation of this programme to explore how access to consumer savings accounts is related to broader economic outcomes such as lending and local GDP growth. To do this, we construct four pre-programme measures of JDY exposure that reflect the number of adults per branch in a region, the fraction of branches owned by the state-owned banks in a region, the percentage of unbanked households in a region, and a comprehen sive index capturing the degree of financial inclusion in a region.

In districts with high ex-ante exposure to JDY, using aggregate data provided by the central bank of India, we observe an increase in aggregate lending in areas with greater ex-ante JDY exposure. We verify these effects are present in our micro data and find an increase in both the number of new loans granted and the amount of loans granted in regions with greater JDY exposure relative to those with lower exposure. Our findings suggest that JDY may have allowed banks to meet the unmet demand for credit for some households that did not have prior access to formal banking products.

We also examine the impact of JDY on a number of other macroeconomic outcomes at the regional level. Here we do not observe an economically significant change in the GDP growth rate in more affected areas. However, given our nearterm focus due to the short time series of data, it is possible that the overall impact of the programme on GDP growth rate will manifest itself over the longer term.

We do find some evidence suggesting that the programme was associated with an increase in investments, though the data underlying this test is very limited.Importantly , we do not observe any significant relative change in the inflation rate in more exposed areas.This suggests that one of the common concerns that the programme may have led to substantially higher price level due to a higher circulation of money and creation of additional demand may be unwarranted, at least in the near term.

Overall, our research has shown that a financial inclusion programme like the JDY can have a very meaningful impact on the number of households using formal banking services. Our results also suggest that JDY has led banks to cater to the new demand for formal banking credit by previously unbanked borrowers, which could have a positive impact on the broader economy in the long run.

Impact…

…on society: People drinking less, saving more/ 2017

Surojit Gupta, How Jan Dhan a|cs keep villagers sober, October 16, 2017: The Times of India

Change In Habits As People Save More: Study

Village residents who opened bank accounts under the Prime Minister's Jan Dhan Yojana (PMJDY) may be saving more and cutting back on their consumption of alcohol and tobacco, a study by the economic research wing of the State Bank of India (SBI) suggests. This may have also slowed inflation in rural areas.

When the PMJDY pro gramme was launched there were fears that higher circulation of money would stoke inflation. The study using retail inflation data showed that states with more than 50% share of Jan Dhan accounts in villages had a “meaningful drop in inflation“.

Of the 30 crore-plus Jan Dhan accounts, many were opened after demonetisation last November. Just 10 states have 23 crore or 75% of the accounts, with Uttar Pradesh (4.7 crore) topping the list, followed by Bihar (3.2 crore) and West Bengal (2.9 crore).

The SBI study analysed state-wise impact of PMJDY accounts on rural and urban consumer price index (CPI).It is part of a research paper which is expected to be released later this year.

“The analysis confirms that besides formalisation of the economy, financial inclusion has had tangible benefits which is visible in the inflation data,“ the study said.

Besides inducing villagers to save, the Jan Dhan bank accounts also seem to have steered them away from intoxicants. “We observed that there is both statistically significant and economically meaningful drop in consumption of intoxicants such as alcohol and tobacco products in states where more PMJDY accounts were opened,“ the study conducted by Soumya Kanti Ghosh, group chief economic adviser at SBI, and his team showed. “This could be because of behavioural changes like less spending after demonetisation,“ the study said.

It also found an increase in household medical expenditure in states of Bihar, West Bengal, Maharashtra and Rajasthan since October 2016.

Experts said availability of banking channels can trigger change in behaviour. “It is well known that your spending behaviour changes when you have cash with you compared to money in the bank. It's the same when you have a credit card,“ said former chief statistician Pronab Sen.

“There could be behavioural changes happening.But the most important thing is that Jan Dhan accounts are promoting a culture of saving and helping to curb spending on alcohol and other such items,“ said N R Bhanumurthy , professor at the National Institute of Public Finance and Policy (NIPFP).

However, Ashok Gulati, Infosys chair professor of agriculture at the thinktank Indian Council for Research on International Economic Relations (ICRIER) said further analysis is needed to prove the correlation between Jan Dhan accounts and behavioural changes.

“We need more robust analysis before we can say for sure that because people now have bank accounts they are spending less on intoxicants,“ he said.

The professor added that other factors, such as developed infrastructure and links with markets in some states may have had a far greater impact on the price situation.

Analysis

Jan 2018: 10% gender gap in opening accounts

Nagesh Prabhu, 10% gender gap in Jan Dhan accounts: study, January 6, 2018: The Hindu

Difference is 21% in Madhya Pradesh

A World Bank paper has noted a 10% gender gap in opening accounts under the country’s flagship financial inclusion programme — Jan Dhan Yojana — with 73 % men applying for accounts against 63 % women. Madhya Pradesh recorded the largest gender gap of 21%. The World Bank’s policy research working paper ‘Making It Easier to Apply for a Bank Account: A Study of the Indian Market’ (2017) by Asli Demirguc-Kunt, Leora Klapper, Saniya Ansar and Aditya Jagati also noted an income gap — 64% being poorer adults and 71 % richer adults — in applying for an account.

The share of wage earners (72%) was higher than the share of adults who are out of the workforce and applied for an account (64%). Among adults with primary school education, 62% applied as compared with 70% of adults who had completed secondary school education (and 84 % of adults with a graduate degree).

The survey was carried out between January and March of 2016 in 12 States — Andhra Pradesh (including Telangana), Bihar, Chhattisgarh, Himachal Pradesh, Jharkhand, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Rajasthan, Uttar Pradesh — which make up about 70% of the country’s population.

The paper explored the costs of opening an account, the efficiency of the account application process, and demographic differences between those who choose to apply and those who do not.

The research said despite initial successes, people who wished to apply for an account continued to incur a range of costs, including the cost of travelling to bank branches, the cost of collecting documentation and various other monetary costs. The confluence of these factors makes account opening a tedious task, researchers said.

Some adults declined to get an account as they were unable to afford the fees for maintaining and using an account, or think the fees are not worth it. Yet 40 % of adults cited lack of trust in financial institutions as reason for not opening an account.

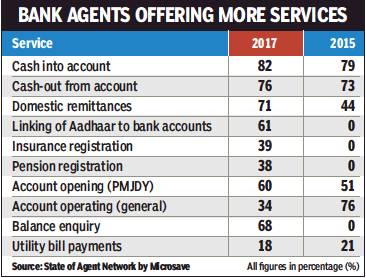

2017: Women hold over 50% of Jan Dhan a/cs

February 15, 2018: The Times of India

From: February 15, 2018: The Times of India

In what marks a boost for financial inclusion, more than half of PM Jan Dhan Yojna account-holders are women and they are also carrying out transactions rather than merely opening accounts, a sample survey by a financial inclusion consulting firm has indicated.

The “State of the Agent Network 2017” report released by Microsave on Wednesday found that there has been a more than 200% increase in volumes of cashin, cash-out between 2015 and 2017. The Modi government’s drive to encourage opening of these accounts was to offer banking services to the poor for more reliable transfer of government benefits and to enable the less well off to avail credit or loans.

The transactions are increasing as the bank agents or business correspondents offer more products and services such as linking of Aadhaar to bank accounts, insurance registration and balance inquiry. Moreover, government-to-people payments such as direct transfer of cash, has led to increase in transactions. Aadhar linkage and mobile use are key elements in the inclusion scheme.

Banks appoint entities and individuals as agents for providing basic banking services in remote areas where they can’t practically start a branch.

Releasing the agent network report, chief economic advisor Arvind Subramanian said while India has made a lot of progress on the financial inclusion front, gaps remain. “You have gas cylinders but you need consistent gas offtake; you have bank accounts but you need to make genuine inclusion; your toilets are built, but are they used? I think that’s the next stage we need to work on....That is why, the banking correspondents story needs more work,” he said.

The report has recommended the need to take steps to increase the share of women agents from the present of only 2%, which could give a fillip to the financial inclusion of women. The report is based on a nationwide representative research that covered 3,048 businesses correspondents.