Insolvency, bankruptcy: India

This is a collection of articles archived for the excellence of their content. |

Insolvency and Bankruptcy Code 2016

2016: Parliament passes comprehensive bankruptcy code

The Times of India, May 12 2016

Insolvency code to ease closure of sick units gets House nod

Parliament passed a comprehensive bankruptcy code, a longpending grudge with international investors, which will help speed up closure of unviable companies and revival of viable entities.

The lack of a bankruptcy code is one of the key reasons for India ranking low on the ease of doing business rankings, since it takes several years to wind up a business. Currently , there are a dozen laws dealing with various aspects of sickness and closure, and the one related to insolvency is over a century old.

Through the new law, which was cleared by the Rajya Sabha on Wednesday evening, the government is trying to put in place a speedy process for early identifi cation of financial stress and resolve the strain if the business is found viable. It has stipulated a time-bound revival. The new law comes at a time when lenders are dealing with a record pile of bad debt, for which the government has also sought to amend existing laws to make recoveries smoother.

“The essential idea of the new law is that when a firm defaults on its debt, control shifts from the shareholderspromoters to a committee of creditors, who have 180 days in which to evaluate proposals from various players about resuscitating the company or taking it into liquidation. When decisions are taken in a time-bound manner, there is a greater chance that the firm can be saved as a going concern, and the productive resources of the economy (the labour and the capital) can be put to the best use. This is in complete departure with the experience under the SICA (Sick Industrial Companies Act) regime where there were delays leading to destruction of the value of the firm,“ the finance ministry said in a statement.

The new system provides for two processes for resolution of individual cases -fresh start and insolvency resolution.

It also puts the dues of the employees at the top of the pile with certain creditors getting preference over the government. In addition, it provides for powers to acquire overseas assets of a defaulter, for which the government has to sign global agreements.

FM seeks opposition support for GST

New Delhi: FM Arun Jaitley on again urged Congress to support the bill that seeks to amend the Constitution for the introduction of goods and services tax (GST) after the principal opposition party suggested it would offer support, provided its three key recommendations are accepted.

“For heaven's sake, I beseech you in the interest of Indian democracy not to go on this misadventure (judge-headed panel)...With the manner in which encroachment of legislative and executive authority by India's judiciary is taking place, probably fi nancial power and budget making is the last power that you have left. Taxation is the only power which states have,“ he said during the debate on the finance bill in the Rajya Sabha.

The minister said it was “wholly misconceived“ for any political party to hand over the taxation power to judiciary . Jaitley asked Congress to “reconsider“ its stance on GST, which is held up as Congress wants the government to specify the GST rate in the bill, provide for an independent dispute resolution mechanism, and drop the plan for an additional 1% levy by manufacturing states.

The extent of the problem

See graphic, 'Major defaulters on bank loans, 2017 '

Promoters of insolvent companies cannot bid for ailing entities

New ordinance to strike loan defaulters another body blow, November 23, 2017:The Times of India

From: New ordinance to strike loan defaulters another body blow, November 23, 2017:The Times of India

The government recommended an ordinance to significantly tighten the norms to bar promoters of companies facing.

insolvency proceedings from bidding for the ailing entities, a move that will shut out several business families from vying with competitors and overseas funds.

Apart from seeking to ban bidding by wilful defaulters, the Insolvency & Bankruptcy Code will be amended to disqualify a tainted promoter in control of an entity that has been a ‘non-performing asset’ for a “prescribed period”, which may be fixed at one year. A continuous loan default for 90 days forces banks to classify a borrower as an NPA.

The one-year clause will make promoters of some of the 12 large companies facing insolvency action — like the Ruias of Essar Steel and Singhals of Bhushan Steel — ineligible to submit bids for their companies next month. Bankers said both were classified as NPAs in 2015.

Insolvency board gets more powers to prescribe eligibility norms for bidders

The one-year clause may help reduce competition for companies such as JSW, Tata Steel, Arcelor Mittal and Nippon Steel and comes with the risk of bids being less aggressive.

The 12 companies, which account for nearly a quarter of the NPAs, were referred to the National Company Law Tribunal by banks led by State Bank of India and IDBI Bank after the Reserve Bank of India stepped in to clean up the unprecedented pile of bad debt that added up to nearly Rs 8.4 lakh crore on last count. The list includes Bhushan Power & Steel, Jaypee Infratech, Monnet Ispat, Amtek Auto and ABG Shipyard.

Finance minister Arun Jaitley told reporters that the cabinet had recommended amendments but did not comment on the provisions. Details of the ordinance are expected only after President Ram Nath Kovind approves it. With the winter session expected to be convened on December 15, the ordinance is likely to be promulgated over the next few days.

The government had enacted the Insolvency & Bankruptcy Code last year, which provides for a revival plan in a maximum of 270 days. During this period, the company is handled by an NCLT-appointed resolution professional. The government opted to amend the law in less than a

year as it feared that some promoters may end up acquiring the company at a steep discount, leaving banks to grapple with the pile of loans.

“A number of cases are likely to have long-pending default requiring deep haircut for the creditors. It is, therefore, necessary to ensure that promoters of the corporate debtor or the company, who are found to have contributed to the default, need to be prevented from regaining control through back door entry in the garb of a resolution applicant,” said a source.

The ordinance also gives more powers to the Insolvency and Bankruptcy Board of India to prescribe eligibility norms for prospective bidders or resolution applicants while keeping in mind the complexity and scale of operations of business of the ailing company.

Lenders as well as industry experts are closely watching how the government defines the “prescribed period” and its implications on the overall business environment. “A company gets into financial stress because of various reasons such as technological obsolescence or sudden change in policies, including court pronouncements such as cancellation of coal blocks or spectrum. By barring all promoters, you may be hitting the entrepreneurship environment,” said a top executive with a leading bank.

Industry experts also said that some of the norms proposed by the government opened the doors to further litigation. For instance, a promoter can be classified as a wilful defaulter and not allowed to bid but the court overturns the lender’s decision later.

“The disqualification on account of the debtor being a non performing account is harsh as there could be genuine reasons for default. Businesses succeed but also fail and a bonafide failure should not be punished. As a society we need to learn to forgive an unfortunate debtor and give him a second chance. Failure can also be as legitimate as success,” said Sumant Batra, managing partner at law firm Kesar Dass B & Associates, who is involved in several cases.

Apart from the 12 companies which are already in various stages of resolution, at least 40 other companies are being reviewed by banks after an RBI directive and the ordinance will also have an impact on them.

Lenders that abstain from voting process deemed to have voted against

Bankers plan to replicate the rigid timelines and forced decision-making that is ingrained in the Insolvency and Bankruptcy Code (IBC) in other forums where they meet to decide on resolution of bad loans outside bankruptcy proceedings.

A major highlight of the bankruptcy process is that lenders are not allowed to abstain from the meetings or voting process. If they do, they are deemed to have voted against the proposals. This has forced fence-sitters to be more active in the bankruptcy process. Besides the voting and compulsion to be present, a key feature of the IBC is the fixed timeline of six to nine months within which lenders have to agree on a resolution, failing which the business gets liquidated.

A senior banker with a large state-owned lender said that a decision has been taken in the Joint Lenders’ Forum (JLF) that banks will be forced to vote and a decision to abstain is treated as a vote against. The JLF as a forum was created by the Reserve Bank of India in 2014 to address cases of default where there are multiple lenders and the loan size is above Rs 100 crore. However, due to various shortcomings, the JLF was not able to successfully address the issue of nonperforming assets (NPAs).

Sapan Gupta, partner and head of banking and finance at Shardul Amarchand Mangaldas & Co, said, “The IBC is one of the methods for banks to pursue recovery and, in the current environment, IBC is the first option. At some point of time, banks will have to examine various other options including the JLF. So the learning from one framework can get transferred to others.”

According to Gupta, the biggest contribution of IBC is that it makes it compulsory for everyone to attend and if they do not attend it is a ‘no’ vote. “Voting has to happen either immediately when 100% of the committee of creditors (CoC) is present or within 72 hours of the CoC meeting through electronic vote. Those timelines are not there in JLF which leads to indecisiveness,” said Gupta. “Also, the voting is related to loan exposure as against JLF which goes by number of votes. JLF also needs to take into account different types of lenders including non-institutional.”

Another issue that currently comes in the way of resolution is that different lenders choose different forums to pursue recovery. “Bankers can take a stand that, when a bad loan is being pursued under JLF, the lenders will not seek any other remedy so that the borrower can focus and provide a solution,” said Gupta.

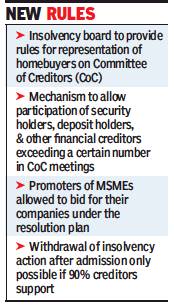

2018: Home buyers get more say in insolvency

June 7, 2018: The Times of India

From: June 7, 2018: The Times of India

IBC Ordinance Lifts Ban On Bidding By MSME Promoters

The government promulgated an ordinance to amend the Insolvency and Bankruptcy Code (IBC) and treat home buyers in ailing real estate companies on a par with banks in the resolution process. The tag of financial creditors will allow buyers of apartments in Jaypee Infratech and Amrapali projects to have a say in ensuring that their interests are not compromised during the resolution process.

Corporate affairs secretary Injeti Srinivas told reporters that the ordinance empowers even a single home buyer to approach the National Company Law Tribunal to initiate insolvency proceedings. But it is not sufficient to offer them the same rights as the lenders in case the company goes into liquidation as the home buyers will have to prove that they are secured creditors. “It will depend on the agreement that the home buyers have signed. But the ordinance recognises the special status that home buyers should get,” said Srinivas, adding that rules regarding their representation on the committee of creditors (CoC) will be notified soon. In some states, there are two agreements — one for the land and the other for the house, which allows home buyers to be treated as secured creditors.

“The ordinance provides significant relief to home buyers by recognising their status as financial creditors. This would give them due representation in the CoC and make them an integral part of the decision-making process,” an official statement said.

The other major change concerns micro, small and medium enterprises (MSMEs), where the earlier ban on promoters from bidding has been lifted. Further, finance companies that had picked up shares of the ailing companies are also eligible to bid now. “While the idea is to keep those who are not desirable out of the process, we also need to ensure enough competition,” Srinivas said. The statement said that the ordinance also empowers the central government to allow further exemptions or modifications related to MSMEs. The government has, however, stuck to the current legal definition of MSMEs — which mandates investment of up to Rs 10 crore in plant and machinery — ignoring suggestions of the Rs 250 crore turnover limit.

2018: Homebuyers, depositors in stressed companies can nominate representative

Homebuyers can name rep to decide stressed co’s fate, July 5, 2018: The Times of India

2018 empower homebuyers, depositors

From: Homebuyers can name rep to decide stressed co’s fate, July 5, 2018: The Times of India

Rules Detail Process, Timeline To Decide Successful Bidder

Homebuyers and depositors in companies facing insolvency action will get to nominate their representative from a panel of three insolvency professionals to represent them on the committee of creditors (CoC) — the decision-making body that decides the fate of stressed companies.

The move follows an amendment to the Insolvency and Bankruptcy Code (IBC) in the wake of action against realtors such as Jaypee Infratech and Amrapali, with homebuyers now given a representation in the committee of creditors to have a say in deciding the fate of the stressed company. Earlier, the fear was that lenders who were the sole representatives will put together a deal that does not factor in the interests of other stakeholders.

The rules notified by the regulator Insolvency and Bankruptcy Board of India (IBBI) stipulate that every category of creditor — including depositor, security holder and homebuyer in case of a housing company — which has at least 10 entities or individuals will get to nominate its representative in CoC. “The insolvency professional, who is the choice of the highest number of creditors in the class, shall be appointed as the authorised representative of the creditors of the respective class,” it said in a statement.

IBBI has also given detailed norms for the resolution professional to decide the evaluation matrix, given that there have been accusations of favouritism in some of the cases that are currently being decided. “The request for resolution plans (RFRP) shall detail each step in the process, and the manner and purposes of interaction between the resolution professional and the prospective resolution applicant, along with corresponding timelines,” it said.

The resolution plan prepared by bidders will have to show how the reason for default is being addressed, whether it’s feasible and viable, provisions for its effective implementation and capability of the applicant to implement it, among other things.

As reported by TOI, the guidelines are seen to have come in the wake of the initial cases, especially the high-profile ones getting delayed, prompting the government to suggest that detailed norms should be issued, much like the Companies Act. It is also aimed at ensuring transparency in the process and protection to members of CoC. The rules have also provided a detailed timeline for each action to ensure that the whole process is completed within the 180-day deadline provided in the law.

2019/ SC rejects challenges to insolvency code

Dhananjay Mahapatra, January 26, 2019: The Times of India

From: Dhananjay Mahapatra, January 26, 2019: The Times of India

Says Experiment Is Proving To Be Largely Successful, Defaulters’ Paradise Ended

The Supreme Court upheld the validity of the Insolvency and Bankruptcy Code (IBC) in its entirety and showered wholesome praise on the NDA government for enacting the code in 2016, saying it ended a “defaulters’ paradise” and allowed the economy to regain its rightful position.

After an analysis of benefits accruing from the code in dealing with bankrupt companies, a bench of Justices R F Nariman and Navin Sinha said, “Figures show that the experiment conducted by enacting the IBC is proving to be largely successful.” Upholding the validity of IBC’s Section 29 which debarred defaulters, their business partners and relatives from participating in the resolution plan of a bankrupt company, the bench in its 150-page judgment dealt with every conceivable challenge to IBC, rejected them all and returned a finding that the code “passed constitutional muster”. Section 29 has dealt a body blow to the Ruias, who have been trying back-door methods to bid and gain control of debt-ridden Essar Steel.

Writing the judgment for the bench, Justice Nariman said while IBC was a legitimate experiment, such exercises had earlier failed, being fraught with errors. “The experiment contained in IBC, judged by the generality of its provisions and not by so-called crudities and inequalities that have been pointed out by the petitioners, passes constitutional muster. To stay experimentation in things economic is a grave responsibility, and denial of the right to experiment is fraught with serious consequences to the nation,” he said.

Stating that IBC was a process that involved all stakeholders, the bench noted with happiness the positives of IBC working and said, “Flow of financial resources to the commercial sector in India has increased exponentially as a result of financial debts being repaid.” This observation counters the argument of the opposition that IBC has failed to take off and provide the relief intended to stakeholders and creditors of bankrupt companies.

The bench clarified that the complete ban on relatives of erstwhile promoters, responsible for bankruptcy of a company, from participating in the resolution process would debar only those relatives who had business links with the promoters.

2019/ Finance cos brought under ambit of code

Nov 16, 2019: The Times of India

The government said the Insolvency and Bankruptcy Code (IBC) will be applicable to systemically important financial service providers (FSPs), other than banks.

The rules shall apply to FSPs or categories of FSPs, to be notified by the central government under section 227 from time-to-time in consultation with appropriate regulators, for purpose of their insolvency and liquidation proceedings. The move to include FSPs comes against the backdrop of the crisis confronting the non-banking finance companies (NBFCs) sector. FM Nirmala Sitharaman, who also heads the corporate affairs ministry, said code was applicable to companies but did not provide for insolvency resolution of financial firms.

“In an environment where it may be necessary to invoke something akin to IBC and in absence of IBC like provision for the financial services sector we have brought out this notification under 227 within IBC which can be used. Post this, it is up to the RBI to take a call on this,” FM said.

“Whether we will have something equivalent to IBC for financial sector we will address that in future. We want to bring something equivalent to IBC for the financial sector. Till such time this will take care of financial institutions,” Sitharaman said.

Injeti Srinivas, secretary, corporate affairs, said the special framework for financial service providers was essentially aimed at serving as an interim mechanism to deal with any exigency pending introduction of a full-fledged enactment to deal with financial resolution of banks and other systemically important financial service providers.

Companies under IBC: their irregularities

2016-2018 Dec

Sidhartha, April 22, 2019: The Times of India

From: Sidhartha, April 22, 2019: The Times of India

Forensic audit of over 200 companies facing corporate insolvency resolution action under the Insolvency and Bankruptcy Code (IBC) has revealed irregularities of more than Rs 1 lakh crore, including possible diversion of funds.

The ministry of corporate affairs, which is responsible for implementation of IBC, is expected to initiate action against the promoters, directors and even auditors in some cases, although it is stretched for manpower and resources, sources told TOI.

Apart from siphoning of funds, instances of transactions with related parties and several other irregularities have been found, including involvement of banks. Forensic audit refers to an independent evaluation of an entity’s accounts and transactions to detect data and evidence of fraud and financial irregularities.

In cases such as Jaypee Infratech, the forensic audit had revealed how the parent Jaiprakash Associates used the land bank available with the former to secure loans from banks, with representatives of the lenders playing ball. Irregularities have also been found in case of Amtek Auto and Bhushan Steel.

In a majority of the dozen high-profile cases referred for action by the Reserve Bank of India, irregularities have been noticed, which also being probed separately by agencies such as the Serious Frauds Investigation Office. In most of the cases taken up under IBC, forensic audit was initiated by the resolution professional appointed by the National Company Law Tribunal although the coverage is limited to the preceding few years. In several cases, including some of the high profile ones, the lenders had conducted a forensic audit even before the company was referred to NCLT under the insolvency process.

IBC empowers the resolution professional to seek an audit to detect if fraudulent transactions were undertaken, with the creditors also empowered to seek action in case the NCLT-appointed custodian fails to act. In fact, a ruing by NCLT’s Hyderabad bench has made it simpler for creditors, including banks, to get a forensic audit. The bench had ruled that creditors could seek forensic audit if 51% of them voted in favour of the move.

Lawyers, however, pointed out that there are limitations in the law. For instance, IBC only provides for probe of related party transaction for two years prior to the initiation of insolvency action. For others, it can only go back up to a year.

Between December 2016, when the provision of corporate insolvency resolution came into force and last December, 1,484 cases have been referred for action under the IBC, of which close to 900 were still to be resolved. Nearly half the cases were initiated by operational creditors such as vendors.

Laws, rules, court judgements

Guarantors

Corporate guarantor can face insolvency action/ SC

Dhananjay Mahapatra, March 27, 2021: The Times of India

The Supreme Court ruled that a bank can initiate proceedings under the Insolvency and Bankruptcy Code (IBC) against a corporate guarantor if the principal borrower defaults on repayment of loans and the debt is declared nonperforming asset (NPA).

A bench of Justices A M Khanwilkar, B R Gavai and Krishna Murari rejected the argument that as the principal borrower was not a corporate person, the financial creditor could not have invoked remedy of insolvency resolution proceedings under Section 7 of the IBC against the corporate person, who had merely offered guarantee for such loan account.

“That action can still proceed against the guarantor being a corporate debtor, consequent to the default committed by the principal borrower. There is no reason to limit the width of Section 7 of the IBC, despite law permitting initiation of corporate insolvency resolution process (CIRP) against the corporate debtor, if and when default is committed by the principal borrower. For, the liability and obligation of the guarantor to pay the outstanding dues would get triggered co-extensively,” the bench said.

Writing the judgment for the bench, Justice Khanwilkar said Section 7 of the IBC enabled the financial creditor to initiate CIRP against the principal borrower if it was a corporate person, including against the corporate person being a guarantor in respect of loans obtained by an entity not being a corporate person.

Explaining the mandate of the provision, the bench said, “Section 7 is an enabling provision which permits the financial creditor to initiate CIRP against a corporate debtor. The corporate debtor can be the principal borrower. It can also be a corporate person assuming the status of corporate debtor having offered guarantee, if and when the principal borrower/debtor (be it a corporate person or otherwise) commits default in payment of its debt.”

The SC said undoubtedly, a right or cause of action would be available to the lender (financial creditor) to proceed against the principal borrower, as well as the guarantor, in equal measure in case they commit default in repayment of the amount of debt acting jointly and severally.

Personal guarantee cases, 2018- 23

Sidhartha, February 20, 2024: The Times of India

From: Sidhartha, February 20, 2024: The Times of India

New Delhi: Insolvency & Bankruptcy Board of India (IBBI) on Monday said a recent Supreme Court ruling will help improve the recovery of creditors from personal guarantors (PGs) and cautioned them against prolonging cases, as it will only “amplify their liabilities”.

The comment by IBBI chairman Ravi Mittal in the latest newsletter comes months after a Supreme Court ruling. “The judgment has cleared roadblocks for the insolvencies involving PGs, providing relief for lenders whose petitions for insolvency proceedings against PGs were getting stuck in various legal forums due to challenge of various provisions. This facilitates a more holistic resolution of the corporate debtor (company) and its PGs aligning with the IBC’s mandate for value maximisation,” he said.

List of PGs facing proceedings includes several wellknown names — from Anil Ambani to Venugopal Dhoot, Ruias of Essar Group and Bhushans of Bhushan Steel. At the height of the loan boom, when valuations had soared, personal guarantees were the norm.

At the end of Dec, there were nearly 2,500 such insolvency applications, involving debt of over Rs 1.7 lakh crore Of these, 87 applications have been withdrawn or rejected before the appointment of a resolution professional (RP), while RPs have been appointed in 1,096 cases. After appointment of a RP, 296 cases have been admitted in NCLT. So far, only 21 cases have resulted in approval of a repayment plan, with the amount realised adding up to just Rs 91 crore — or 5.2% of the claims. IBBI data showed creditors have been able to recover around 32% of claims admitted by NCLT. Cases have dragged for 724 days, 2.7 ti- mes of deadline of 270 days.

Mittal pointed to “excessing litigation” delaying cases, which results in value erosion of the company and in turn increases the burden on the guarantors. Citing IBC, he argued that process for PGs prioritises debt restructuring over outright bankruptcy, which is the last resort in case the repayment plan falters. “By cooperating in the process and submitting a repayment plan for approval by creditors, debtors can effectively discharge their debt liabilities instead of initiation of their bankruptcy process,” Mittal wrote in a message to PGs

Personal guarantors can face insolvency proceedings 2023

Nov 10, 2023: The Times of India

New Delhi: The Supreme Court on Thursday upheld the constitutional validity of various provisions of Insolvency and Bankruptcy Code (IBC), including Section 95, which allows creditors to initiate insolvency proceedings against personal guarantors.

A bench of Chief Justice D Y Chandrachud and Justices J B Pardiwala and Manoj Mishra rejected a plea against the provisions of the IBC and dismissed more than 200 petitions filed against the provision alleging violation of principles of natural justice in the process followed under the code.

The Supreme Court of India has upheld the constitutional validity of various provisions of the Insolvency and Bankruptcy Code (IBC), including the section that allows creditors to initiate insolvency proceedings against personal guarantors. The decision will enable creditors to take action against ousted promoters of companies that have undergone insolvency resolution. So far, only a small percentage of cases against personal guarantors have been admitted and resulted in creditors receiving payments. The court also ruled that resolution professionals cannot have adjudicatory powers and can only make recommendations.

The Supreme Court Collegium has recommended the names of three new judges for appointment to the apex court. The recommended judges are Chief Justice Satish Chandra Sharma of the Delhi High Court, Chief Justice Augustine George Masih of the Rajasthan High Court, and Chief Justice Sandeep Mehta of the Gauhati High Court. The Collegium stated that the Supreme Court has a large backlog of cases, and the workload of judges has increased significantly. The court currently has 31 judges and a sanctioned strength of 34 judges.

The Supreme Court collegium, headed by Chief Justice of India D Y Chandrachud, has recommended the appointment of Justices Satish Chandra Sharma, Augustine George Masih, and Sandeep Mehta as judges of the apex court. The decision was made to address the backlog of cases and ensure a full working judge-strength. The Supreme Court currently has 31 judges out of a sanctioned strength of 34. Justice Sharma, Justice Masih, and Justice Mehta are currently serving as chief justices of the high courts of Delhi, Rajasthan, and Gauhati respectively.

Personal assets of guarantors cannot be liquidated in companies facing insolvency

Allirajan M, Guarantors’ own assets get shield, March 8, 2018: The Times of India

Creditors Cannot Liquidate Personal Property Under IBC, Says NCLAT

In a landmark judgment, the National Company Law Appellate Tribunal (NCLAT) has ruled that personal assets of guarantors, who in most cases are promoters, cannot be liquidated in companies facing corporate insolvency resolution process under IBC. The moratorium on sale of assets applies not just to corporate debtors but also personal guarantors under the Insolvency and Bankruptcy Code (IBC), the tribunal said.

NCLAT’s latest ruling has huge ramifications as it offers relief for the personal assets of promoters. This also effectively overturns another important ruling where the National Company Law Board’s (NCLT’s) Mumbai bench held that the promoter cannot escape the liquidation of personal assets by simply filing for bankruptcy. NCLT-Mumbai had ordered lenders to go after the personal properties of Schweitzer Systemtek India in July 2017, though the company brought voluntary bankruptcy proceedings.

The NCLAT said, “From the IBC provisions, it is clear that resolution plan, if approved by the committee of creditors and if the same meets the requirements as referred to in sub-section (2) of Section 30 and once approved by the adjudicating authority, is not only binding on the corporate debtor, but also on its employees, members, creditors, guarantors and other stakeholders involved in the resolution plan, including the personal guarantor.” “In view of the provisions, we hold that the ‘moratorium’ (on sale of assets) will not only be applicable to the property of the corporate debtor but also on the personal guarantor,” the NCLAT ruled in an appeal filed by SBI against V Ramakrishnan, a director in the Tiruchibased Veesons Energy Systems and who is the personal guarantor for the company.

K S Ravichandran of KSR & Co Company Secretaries said, “The NCLAT has removed inconsistencies in decisions of benches of NCLT. This also removes language deficiency in Section 14 of IBC.” Section 14 of the IBC empowers the adjudicating authority to declare a moratorium on the transfer, alienation or disposal of assets of the corporate debtor.

SBI invoked its right under SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002 against the personal guarantor in August 2015 for recovery of Rs 61.1 crore.

The notice was challenged by the corporate debtor (Veesons Energy) in the Madras high court, which was dismissed with costs in November 2016. Following this, SBI issued a possession notice and took symbolic possession of the secured assets. The personal guarantor filed an application in NCLT-Chennai for stay of proceedings under the SARFAESI Act, 2002, including the auction notice dated July 12, 2017. The tribunal restrained SBI from proceeding against the personal guarantor till the moratorium period is over.

SC: Guarantors liable under IBC proceedings

Dhananjay Mahapatra, May 22, 2021: The Times of India

In a blow to promoters of several companies facing insolvency action, the Supreme Court ruled that personal assets of chairpersons and directors, who stood guarantee for corporate loans from banks that turned into bad debts, would face liability in the resolution process under IBC.

The court upheld the validity of the November 15, 2019 notification issued by the Centre, fastening liability of bad debts on corporate guarantors for loans obtained by their companies, which later failed to pay up and went into resolution proceedings under the Insolvency & Bankruptcy Code. The ruling will help banks go after those who have offered guarantees to recover dues in case the resolution amount is short of the claims filed by them in the National Company Law Tribunal.

TOUGH RULES

‘Will help creditors frame realistic plans for dues’

The ruling will disappoint high-profile petitioners such as Sanjay Singhal and Aarti Singhal of Bhushan Power and Steel, Reliance group’s Anil Ambani, Punj Lloyd’s Atul Punj, infrastructure firm IVRCL’s E Sudhir Reddy and Sabbineni Surendra, the promoter of Hyderabad-based Coastal Projects, who had challenged the validity of the central notification. They had argued that once a resolution plan for the distressed company is approved by NCLT, the personal guarantors stood absolved of their liability. Companies promoted by them have been part of the insolvency drive initiated by lenders due to a massive pileup of bad debt. Over the years, many companies have repeatedly defaulted in loan repayment and got banks to restructure the debt, often citing systemic issues. But as part of the clean-up initiated five years ago, the IBC was enacted and banks were told to go after those who were not paying their dues The State Bank of India, through advocate Sanjay Kapur, had informed the court that the bank or a consortium led by SBI had initiated proceedings against Singhals (Rs 12,276 crore), Punj (Rs 3,400 crore), Surendra (Rs 2,130 crore), Ambani (Rs 1,900 crore) and Reddy (Rs 1,250 crore).

He had informed the SC that cumulatively, SBI had invoked personal guarantees of corporate guarantors in 16 cases for recovery of nearly Rs 20,000 crore.

A bench of Justices L N Rao and S R Bhat said NCLT will be able to consider the whole picture, as it were, about the nature of the assets available, either during the corporate debtor’s insolvency process, or even later. “This would facilitate the CoC in framing realistic plans, keeping in mind the prospect of realising some part of the creditors’ dues from personal guarantors,” it said.

Bankruptcy will not void guarantees: SC

May 22, 2021: The Times of India

Even After Losing Cos To Insolvency Process, Promoters Have To Honour Personal Pledges

TIMES NEWS NETWORK

Delhi/Mumbai:

Banks can look forward to improved recovery prospects from promoters of defaulting companies who have provided personal guarantees for corporate loans. The Supreme Court upheld the government notification of November 2019, which allowed banks to enforce the personal guarantee of the promoter if lenders are not able to fully recover their dues after the insolvency resolution process.

Among the defaulting corporate houses that are referred for insolvency proceedings, there are a host of promoters ranging from Sanjay Singhal of Bhushan Power & Steel to Anil Ambani, Venugopal Dhoot, Atul Punj and the Ruias of Essar, who have provided a personal guarantee to their loans. For these promoters. who have already lost control over their companies due to the initiation of corporate insolvency resolution, the notification was the last thing they expected. This prompted several of them — including Singhal, Ambani and Punj — to challenge the legality of the circular. But like most issues related to the Insolvency & Bankruptcy Code (IBC), the Supreme Court held that even this notification was legally valid.

“What it does is that it allows the creditors to recover based on these guarantees in case the corporate insolvency process does not generate enough funds to cover the claims filed by them,” explained an officer at the Insolvency & Bankruptcy Board of India. So, if a lender has a claim of, say, Rs 100 crore, and can recover only Rs 70 crore through the insolvency process, they can initiate action either in the NCLT, if the case is still going on, or move the DRT to recover the rest by invoking the personal guarantees of the promoter.

“This judgment will pave the way for banks to initiate proceedings against the corporate debtor and personal guarantors of corporate debtors under IBC and to recover the amount from personal guarantees despite the debt of the corporate debtor being resolved in accordance with resolution plans. Thus, even if the loan to the corporate debtor is restructured or settled or written off, the liability against the personal guarantor will continue,” said L Viswanathan, partner at Cyril Amarchand Mangaldas.

While SBI told the SC that it had invoked guarantees in 16 cases to recover close to Rs 20,000 crore, the bank’s chairman Dinesh Khara was guarded in his response, saying the lender would examine the nuances of the order before taking a course of action. “This will help settle the jurisprudence finally on simultaneous initiation and proceeding with insolvency resolution process against principal borrower and guarantors or co-guarantors/co-obligors as well,” said Misha, partner at Shardul Amarchand Mangaldas.

Debtor’s assets

Sale of corporate debtor’s assets as going concern

Allirajan M, Insolvency resolutions get a boost, March 31, 2018: The Times of India

IBBI Amendments Allow Sale Of Corporate Debtor’s Assets As Going Concern

The Insolvency and Bankruptcy Board of India has amended the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2018 to fix a time frame for identifying resolution applicants. As the amended regulation makes it mandatory to identify the applicants by the 105th day, experts say the resolution process can be completed in a timely manner within the stipulated 180 days.

There is no deadline for identifying resolution applicants. Generally, the identification process and criteria keep changing till the fag end of the resolution period, which leads to delays in completion of the entire process. K S Ravichandran of KSR & Co Company Secretaries said, “It (the amendment) means bids must be invited under section 25 much before the 105th day.”

Monish Panda, founder of legal firm Monish Panda & Associates, said, “Hopefully, the new amendment will ensure timely completion of the resolution process.”

However, the lack of a fixed time frame for identifying resolution professionals (RPs) was only one of the several factors behind the stretched bankruptcy resolution processes. Recent weeks have seen legal challenges dragging the outcome in some of the prominent cases.

The IBBI (Liquidation Process) (Amendment) Regulations, 2018 also come into play after the insolvency resolution process is not successful. Earlier, regulation 32 of the principal regulations provided four modes for liquidation of corporate debtor — sale on a stand-alone basis, slump sale, sell the assets in parcel, and sell the assets collectively. After the latest amendment, the IBBI has added a fifth method of selling assets of the corporate debtor — ‘as a going concern’.

Panda said, “A going concern indicates that the company has not completely dissolved yet, even though its valuation may be considerably lower. This inclusion is in line with the spirit of the code.” He added, “The objective of the code is to ensure continuity of the corporate debtor as a going concern to realise maximum value for creditors and ensure welfare of employees of the corporate debtor.”

The amendment contemplates a scenario where, despite failure of the resolution process, the corporate debtor continues as a going concern. The liquidator then has the option to sell it as such, rather than in parcels if he/she feels that selling the company as a going concern will fetch a better value than in bits and pieces.

Ravichandran said, “This amendment brings to the fore the need to preserve, if possible, the status of the undertaking as a going concern, which will bring more value rather than selling assets of a closed undertaking. This method of sale will protect contracts and arrangements that are under way and employees and stakeholders will benefit from the continued operations of the undertaking.”

Impact of 2016 law

From: Dhananjay Mahapatra, SC: NCLT should reduce interference, September 14, 2018: The Times of India

See graphic:

What are national Company Law Tribunal and National Company Law Appellate Tribunal?

Impact of law

Impact: banks get tough with defaulting promoters/ 2017

Till now, the business phrase “exit policy“ meant the exit of workers, to allow owners to survive and flourish. Now, for the first time, India has an exit policy for owners that allows workers to survive and flourish. If it succeeds, it may go down as Narendra Modi's finest achievement.

India is famous for having many sick industries but no sick industrialists, whose political clout (and legal delays) precluded seizure of their assets by lenders. That has changed dramatically with the enforcement of the Insolvency and Bankruptcy Code 2016. The RBI is using this to force banks to get tough with defaulting promoters, forcing them to sell assets to repay debts and make their companies solvent. If this does not work, the banks will eject the promoters, and appoint a professional manager to run the company till it is auctioned to new buyers.

This is a revolutionary change. In June, the RBI identified 12 major companies for insolvency proceedings, each owing over Rs 5,000 crores. Bhushan Steel, Electosteel Steel and Lanco Infratech headed the dirty dozen, owing a whopping Rs 1,75,000 crore (almost a quarter of all bad bank loans).

Reports say the RBI has prepared a second list of 40 companies, including giants like Videocon and Jindal Steel and Power Ltd. The top 500 defaulters face similar action. The finance ministry backs a “zero tolerance“ policy for bad loans.

Many questions remain. Will new buyers be available? Will these ask for such high loan forgiveness in the takeover package that banks will refuse, leading to stalemates? Will old owners regain control at bargain prices via benami companies in tax havens? Time will tell. Yet let's hope for a new era where industrial might is no protec tion against the rule of law, and the exit of celebrated but defaulting industrialists is not only possible but happening. True capitalism requires exit for capitalists no less than workers.

Once, Vijay Mallya was politically so powerful that banks kept ever-greening loans to his sinking Kingfisher Airlines. He hoped to survive a debt of Rs 9,000 crore, as industrialists always had.But when the BJP government moved to arrest him, he fled abroad in 2016. His assets in India -including holdings in United Breweries and United Spirits -have been seized. The Enforcement Directorate claims these assets will cover his bank dues of Rs 9,000 crore, and awaits court clearance for an auction.

The Essar Group ran up huge debts to expand its empire, among allegations of inflated capital costs. Lenders have forced it to sell Essar Oil, which includes India's second biggest oil refinery, its captive port at Vadinar, a power station of 1,010MW capacity, and 3,500 filling stations. The $12.9 billion sale to Rosneft will enable the group to halve its debts, and probably hang on to indebted Essar Steel. However, the group's debts remain huge at Rs 70,000 crore.

The Jaiprakash Group (Jaypee) had a spectacular rise in the 2000s as it borrowed hugely to fund enormous infrastructure projects and real estate. That bubble then burst. The initial reaction of banks was to keep extending their loans to Jaypee despite defaults: this was business as usual. But in today's new era, they have leaned on Jaypee to sell its cement plants to the Birlas for a reported Rs 16,000 crore. As part of its debt recasting plan, the banks are reported to have taken over Jaypee's land assets worth over Rs 13,000 crore. Never before have owners ever been obliged to part with such massive, profitable assets to repay old debts.

Ousting promoters is not an end in itself.Many promoters were unlucky, including those hit by land acquisition delays, and those who built power plants but could not get fuel from Coal India. “Resolution“ in banking terminology means a deal where the lenders and owners (and sometimes trade unions) all agree to take a hit so that the enterprise becomes viable again.Resolution is the simplest and most preferred outcome. But it is feasible only when company assets are still substantial and the business is fundamentally viable. Resolution will not work for run-down companies with worthless assets.

In the old days, banks kept lending till a company became worthless, and closed without paying workers. The new approach is to seize a defaulting company while it still has good assets, revive it through resolution, or else go for a forced sale to a new buyer. The owner will exit but most workers will remain employed. It remains to be seen if this works. If it does, how marvellous!

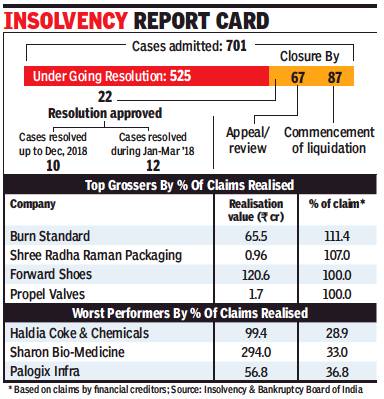

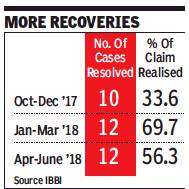

2018: Realisation from bankrupt cos. Increases

From: Sidhartha, Banks see jump in realisation from cos hit by bankruptcy, June 11, 2018: The Times of India

Businesses Eyeing Expansion Find Value In Distressed Assets

Lenders to companies facing bankruptcy proceedings saw their entire claims settled in a third of the cases resolved during the March quarter, while average realisation from the dozen companies was close to 70% — more than twice the level seen up to December.

Latest data released by regulator Insolvency and Bankruptcy Board of India (IBBI), showed that against the admitted claims of Rs 4,405 crore by the financial creditors, Rs 3,070 crore were realised — which was more than twice the liquidation value.

In contrast, in the first 10 cases resolved up to the December quarter, the Economic Survey had said that of the Rs 5,530-crore claims made by financial creditors, in nine out of the 10 cases, they could recover Rs 1,853 crore or 33% of the claims.

Although no immediate reason was available, market players said that for companies looking to expand their businesses, the distressed companies with a good asset base offered an attractive option. Officials said the data suggested that fears of a sharp drop in valuations — after the government decided to keep out the promoters — were unfounded.

“The system is stabilising and there is greater awareness, resulting in more competition for companies. If the trend continues, banks can hope to see even better realisation,” said an official.

IBBI said that early initiation of the resolution process helps creditors realise a better value. “Many of the corporates ending up in liquidation had long-pending dues and hence were left with little organisational capital. Therefore, in most cases, the resolution value offered was either below the liquidation value, the resolution plan came from ineligible parties or there was no resolution plan at all,” it said.

Till the end of March, 701 cases had been admitted by the National Company Law Tribunal (NCLT), with 525 companies undergoing the resolution process, IBBI data showed. So far, 176 cases have seen closure in various benches of the NCLT, but almost half (87) went into liquidation, while 22 have been resolved — including the dozen in the March quarter.

While there were four cases where financial creditors managed to realise 100% or more of the claims admitted, on cases of Trinity Components, the realisation was 99.98%, the data showed, with almost the entire Rs 17.38 crore of the claims realised.

The data also revealed that of the 701 cases, 310 (44%) were moved by operational creditors, such as vendors and suppliers, while 262 (37%) came from financial creditors, and the remaining 129 were filed by companies.

Officials said that the numbers suggested that smaller suppliers were often using the IBC to get their dues back from companies especially as 2,100 cases involving Rs 83,000 crore of claims were settled as soon as they were filed and had not been admitted by the NCLT.

SC asks NCLT to reduce interference/ 2018

Dhananjay Mahapatra, SC: NCLT should reduce interference, September 14, 2018: The Times of India

Litigants taking recourse to moving the National Company Law Tribunal (NCLT) to stall proceedings before finalisation of a resolution plan must stop and and tribunal should not be allowed to intervene till the committee of creditors took a final view, the Supreme Court said.

The SC’s comments came after it expressed disgust on NCLT acting as a “super supervisor” at each stage of proceedings against debt-ridden companies under the Insolvency and Bankruptcy Code, virtually defeating the IBC’s objective of speedy resolution or liquidation of loan defaults running into lakhs of crores of rupees.

When a bench of Justices R F Nariman and Indu Malhotra sought suggestions to improve the bleak situation which resembled the snailpaced BIFR proceedings, senior advocate Harish Salve said the SC must give a purposive interpretation to the IBC provisions. He said the court should debar NCLT from interfering till the committee of creditors (CoC) completed its deliberations on the resolution plan submitted by the resolution professional (RP) after examining bids.

The bench said, “That is absolutely correct. That should be made mandatory. That is the single most important point. Otherwise, it becomes a meaninglessly endless exercise despite IBC stipulation for finalisation of resolution plan within 270 days of NCLT admitting insolvency petition by banks and financial institutions against a corporate loan defaulter. The mechanism adopted by litigants to attempt stalling of proceedings at every stage before the finalisation of resolution plan by moving NCLT every now and then must stop.”

When Salve said NCLT was not a super supervising authority for the RP or CoC, Justice Nariman agreed and said, “absolutely”. Salve said the SC must interpret provisions to say NCLT would not come into the picture till the RP finalised proposals and the CoC took a final view on that. Justice Nariman said “100% correct” and added, “Top to bottom, what is going on at present — the manner in which NCLT going into every issue dealt by RP or CoC is completely wrong.” Salve reiterated that the SC must do a “purposive interpretation”.

Justices Nariman and Malhotra stressed the sanctity of the 270-day period for finalising a resolution plan and said some time limit must be fixed for NCLT and the appellate tribunal (NCLAT) to decide disputes after finalisation of a resolution plan. Salve said NCLT was saddled with too many responsibilities — company law disputes to insolvency, merger and de-merger to acquisition.

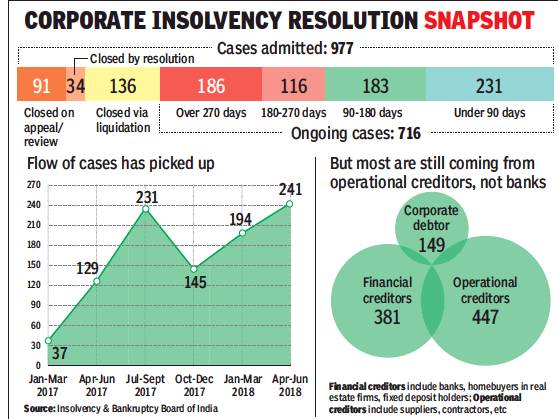

2017, 2018: Debtors pay up ₹1 lakh crore for fear of action

From: Sidhartha, Debtors pay up ₹1 lakh crore for fear of insolvency action, October 1, 2018: The Times of India

From: Sidhartha, Debtors pay up ₹1 lakh crore for fear of insolvency action, October 1, 2018: The Times of India

Two years ago, when the Insolvency and Bankruptcy Board of India (IBBI) was set up, the regulator wanted to meet bank chiefs but bankers were unwilling, prompting it to seek the Reserve Bank of India’s intervention. But seven bank MDs did not turn up even when RBI convened a meeting with the IBBI brass.

Today, banks are seen to be the biggest beneficiaries of the Insolvency and Bankruptcy Code (IBC), enacted to bring rogue borrowers to book. Fear of insolvency action has helped creditors, led by banks, recover Rs 1.1 lakh crore from loan defaulters who were earlier unwilling to clear dues, with promoters of errant companies paying up to avoid losing control, sources told TOI.

So far, 977 cases have been admitted by the National Company Law Tribunal where either the lenders or the operational creditors, such as suppliers, have sought to initiate action. The number of cases filed is almost four times higher, sources said, but many are withdrawn before they are admitted as the borrower agrees to settle dues. “It would be wrong to say all cases are withdrawn because the debtor pays up, but we are seeing many instances of dues being cleared once a case is filed,” an official said.

Last week, the government had said public sector banks were aiming to recover around Rs 1.8 lakh crore from loan defaulters this fiscal year, around two-and-a-half times the amount recovered in 2017-18. Finance minister Arun Jaitley had attributed this to the IBC, which has barred promoters of companies whose loans have been classified as non-performing assets from bidding.

While the new law has helped push loan recoveries, in over 42% of cases the 180-day deadline to complete the insolvency resolution process has been missed. While the law allows another 90-day extension, in over a quarter of the ongoing 716 cases the process has not been completed within the stipulated period.

“Probably, India is the only country where the process has to be completed in a timebound manner. In the coming months, the situation will improve,” IBBI chairman M S Sahoo told TOI.

Officials said the government was in the process of appointing more members to the National Company Law Tribunal benches, which deal with insolvency cases.

Data for the June quarter, released a few days ago, also showed that in three of the 12 cases where resolution took place, lenders managed to realise their entire claims. In the MBL Infrastructure case, recovery was almost Rs 1,600 crore against claims of Rs 1,428 crore.

At the other extreme was Orissa Manganese and Minerals, where financial creditors managed to get Rs 310 crore of the total claims of Rs 5,388 crore — around 5.75% of the amount due. This makes Orissa Manganese one of the worst deals for financial creditors, almost on a par with Synergies Dooray Automotive where only 5.6% of the claims were realised.

That case had prompted the government to promulgate an ordinance to bar promoters of companies with loans that have turned into a nonperforming asset from bidding.

2016-19: a success

SIDHARTHA, May 17, 2019: The Times of India

From: SIDHARTHA, May 17, 2019: The Times of India

Govt talking to 25 large cos in bid to resolve issues, spur investment

Hopes To Speed Up Clearances, Declog Fund Flow

New Delhi:

The government has begun consultations with the country’s top 25 corporate houses and lenders, including the Tatas, Reliance, Birla, Mahindra, Adanis, Infosys and Wipro, to assess their investment plan and also try and resolve issues that they may be facing in their bid to expand operations.

The initiative undertaken by commerce and industry minister Piyush Goyal as part of the Project Management Cell (PMC) has already seen consultations with companies such as Maruti Suzuki and Hindustan Unilever, which have flagged areas of concern for their operations and expansion, which are now being shared with other ministries as well as state governments, sources told TOI.

HUL, for instance, has pointed to misuse of intellectual property rights and the regulatory regime for using plastics that varies across states, creating problems. Similarly, the Maruti Suzuki brass has pointed to issues related to financing of vehicles.

The consultations began a few weeks ago and come at a time when the government is trying to boost investment and spur economic activity. While capacity constraints are often cited as the reason for companies holding back investments, officials said, in a number of cases investments already announced have not taken off due to delays in clearances. Just declogging some of the investments could result in a significant flow of funds.

The government is hoping that decision to lower the corporation tax will encourage many companies to invest, especially as new manufacturing entities have been permitted to pay just 15% tax in case they begin operations in a little over three years from now.

“We are trying to ascertain the issues that are being faced at various levels that could be anything related to the regulatory environment, licences, or simple funding-related aspects and trying to connect them with the right authorities,” said an officer.

Cos asked to share 5-yr plan for investments

A part from this, business houses are being asked to share their investment plan for five years along with short-term expansion plans.

In the coming weeks, Goyal is slated to meet Vedanta Group’s Anil Agarwal, Bharti Group’s Sunil Mittal, JSW’s Sajjan Jindal, Sun Pharma’s Dilip Sanghvi, HDFC chairman Deepak Parekh, ICICI Bank’s Sandeep Bakshi, banker Uday Kotak, Bajaj group representatives, the Shapoorji Pallonji group and L&T’s S N Subrahmanyan.

Further, some interactions with industry groups such as retail, aviation, textiles, roads and railways are also planned. Separate consultations with the country’s top lawyers to get a feedback on issues faced by their clients is also planned.

Real estate sector, impact on

As in 2021

Sidhartha, June 24, 2021: The Times of India

Jaypee may be the most high-profile case where the hunt for a resolution application continues but there are several other real estate projects across the country where home buyers continue to face uncertainty.

Five years after the Insolvency & Bankruptcy Code (IBC) was notified, only six resolution plans for real estate sector have been approved although some 197 cases had been admitted until December 2020, the latest period for which detailed data is available with the Insolvency & Bankruptcy Board of India (the latest numbers do not provide sectoral break up).

That translates into a success rate of just 3%, making it the worst performing sector, barring computer and related activity.

This is despite the stakes being much higher. Unlike other sectors where it is banks and operational creditors such as suppliers, who drag companies to the National Company Law Tribunal (NCLT), here there is the additional challenge of protecting the interests of home buyers, who invest their life-time savings. No wonder, this is the only area where even the government made an exception in bumping up home buyers from the category of operational creditors to financial creditors – given them an equal say in deciding the new resolution applicant.

“Unlike in other sectors, there are more complexities in real estate. It’s not just IBC, which usually has institutional creditors and suppliers. Real Estate (Regulation and Development) Act which means protecting buyers who may have a bank loan, is another case in point. Moreover, the rules keep evolving, which makes it more difficult to comply with the newer guidelines when a developer looks to take over a project. Basically, these regulations and guidelines are still work in progress and need to evolve further. That said, they are still major upgrades over the previous lack of regulation and redressal mechanisms,” said Shobhit Agarwal, MD & CEO at ANAROCK Capital.

For banks, the primary focus of the resolution exercise is to minimise the hit that they have to take on their loans and maximise the gains. In contrast, homebuyers want a more stable company to take over the company even if it means that lenders have to take a haircut.

What has complicated matters is a fall in real estate prices, making the project unviable for resolution applicants. “Projects normally won’t be commercially viable if the cost of construction is more than receivables and financial creditors consist of financial institutions and home buyers. In many cases, funds have been diverted and the corporate debtor (company) doesn’t have sufficient money to construct the units. In such cases, projects are in a limbo. Besides, the market doesn’t have adequate liquidity to support real estate cases,” says Chandra Prakash, a resolution professional dealing with three real estate projects.

There are other complications when land is owned by more than one entity and it needs to be combined. “In such cases project insolvency laws should be applicable whereas in IBC we don’t have project or group insolvency (provisions),” Prakash added.

The problems with resolution have resulted in suggestions for a review of provisions. Former Oriental Bank of Commerce CMD Mukesh Kumar Jain suggests a hybrid model for real estate. “Given the complexities, the priority should be to first complete construction. One can explore a process where an asset reconstruction company kind of a model is there which nurtures the asset before selling it.”

Procedures

The government said insolvency resolution plans, such as sale and transfer of assets, do not require approval from shareholders or the company as the law provides a detailed process from the receipt of the resolution plan to approval by the adjudicating authority.

The clarification by the ministry of corporate affairs is expected to speed up the process of resolving cases facing insolvency action in various benches of the National Company Law Tribunal (NCLT), which range from large steel companies such as Essar Steel and Bhushan Steel to real estate players such as Jaypee Infratech and some of the companies of the Amrapali Group. A number of these cases are now nearing the deadline for working out a resolution plan, which is fixed at 180 days, with a 90-day extension possible.

It will also help push through resolution in insolvency cases where the original promoters of the company seek to block a plan by insisting on a vote in line with the provi sions of the Companies Act or Sebi norms.

The government is of the view that Insolvency and Bankruptcy Code (IBC) provides that the resolution plan will be binding on a company , its shareholders, lenders, employees, guarantors and other stakeholders if approved by NCLT. But it has suggested that the onus of ensuring that the plan is in line with norms is with the committee of lenders and the insolvency resolution professional. “It is understood that the requirements... of the Code (IBC) ensure that resolution plan(s) considered and approved by the committee of creditors and the adjudicating authority is compliant with the provisions of the applicable laws and therefore is legally implementable,“ the ministry said. It pointed out that a resolution plan should not allow for 100% foreign investment when the FDI ceiling for the sector is 75%.“The purpose is to prevent approval to resolution plans, which are not legally implementable,“ it said.

Sources said that there was confusion due to different legal opinion given by insolvency lawyers, some of whom believed that any resolution plan needed to be endorsed by shareholders. There was an opposite views as well, which were heard by the ministry and the Insolvency and Bankruptcy Board of India, the agency responsible for the new law, which decided to issue the circular to ensure clarity.

2019: more teeth added to bankruptcy process

From: February 8, 2019: The Times of India

See graphic:

In 2019 more teeth were added to the bankruptcy process

B

Cases that revealed lacunae in the IBC, 2016

Jet Airways’ cross-border insolvency

Satvik Varma, Sep 11, 2019: The Times of India

(The writer is a litigation counsel and corporate attorney based in Delhi. A graduate of Harvard Law School, he’s licensed to practice both in India and New York)

The insolvency proceedings against Jet Airways in India and the Netherlands bring to fore the lacunae in the Insolvency and Bankruptcy Code (IBC), 2016 to deal with cross-border insolvencies.

Cross-border insolvency involves the handling of distressed debtors who have assets and/or creditors in several countries, and become subject to insolvency proceedings in multiple jurisdictions. If these companies were to flounder, and insolvency proceedings get initiated, it is imperative that these diversely located assets be protected and the claims of creditors from the various jurisdictions be collated and resolved.

In the Netherlands, an administrator was appointed by a Dutch court to take charge of the assets of Jet Airways which confiscated a Boeing 777, which the administrator had undertaken before the National Company Law Tribunal not to dispose of.

Owing to non-cooperation of the Indian Resolution Professional and the Committee of Creditors, the administrator sought to withdraw its undertaking and proceed independently of the Indian proceedings. One reason for this withdrawal was payment of fees to the Dutch administrator by the Indian RP. The administrator has now filed an appeal before the National Company Law Appellate Tribunal. At a time when India is a preferred foreign investment destination, it is startling that the IBC, enacted just a few years ago, chose to give a miss to the UN Commission on International Trade Law, Model Law on Cross-Border Insolvency (Model Law) which many jurisdictions like the US, UK, Singapore and Japan adopted into their domestic legislations.

The IBC has only two provisions, Section 234, which relates to agreements with foreign countries, and Section 235, pertaining to letter of request to a country outside India, that envisage cross-border insolvency cases. In November 2017, an Insolvency Law Committee was appointed to suggest amendments to the IBC, which submitted its reports in 2018 and opined that the “existing provisions in the Code do not provide a comprehensive framework for cross-border insolvency matters”. The committee attempted a comprehensive framework based on the Model Law and contemplated inserting a separate chapter in the IBC. The committee also noted that the cross-border insolvency network needed immediate attention and suggested the IBC be harmonised with the Model Law.

The committee identified four principles on which the Model Law is based that need to be incorporated into our domestic framework, i.e. (i) Access, to allow foreign insolvency professionals and foreign creditors direct access to domestic courts and enable them to participate in and commence domestic insolvency proceedings; (ii) Recognition, of foreign proceedings and provision of remedies by domestic courts based on such recognition. Further, granting relief on the basis of whether the foreign proceeding is a main or a non-main proceeding on the basis of the concept of ‘centre of main interests’; (iii) Cooperation, between domestic and foreign courts, and; (iv) Coordination, when multiple proceedings have been initiated in several jurisdictions. These would have allowed a greater degree of streamlining and efficacy in complex cross-border insolvencies like in the case of Jet Airways.

Regrettably, nothing came out of these reports. Independently, the Supreme Court ruled in 2017 that foreign creditors shall stand on equal footing as domestic creditors to initiate corporate resolution insolvency process.

The IBC provides for a moratorium which operates upon admission of a corporate insolvency and restricts fresh cases or continuation of existing suits against the debtor. It also prohibits the debtor’s assets from being encumbered or transferred. However, the moratorium operates only in India and is only applicable to assets of the debtor in India. Indian creditors do not have access to the debtor’s foreign assets. Owing to this, the NCLAT observed in its latest hearing that the CoC can only advise the RP on offshore claims and otherwise has no role to play.

The appeal before NCLAT by the Dutch administrator highlights how immediate attention is required to decide on the priority of claims of foreign creditors and foreign insolvency proceedings. This harmonisation will have to be done in a manner that it protects alienation of assets belonging to the domestic entity, located in a foreign jurisdiction, to the detriment of domestic creditors, whilst also balancing the claims of foreign creditors and administrators. Jet Airways may be a test case, but many others could follow. After all, it’s only fair that if one is eating in a group with others, the bill is split by going Dutch!

Lenders’ decisions questioned

Mayur Shetty, August 14, 2021: The Times of India

From: Mayur Shetty, August 14, 2021: The Times of India

A series of judgments in the Supreme Court has established the unbridled power of the committee of creditors (CoC) in insolvency cases. However, the CoC wisdom has come under question in the Videocon and Siva Industries case, which has strengthened calls for a code of conduct proposed by the Parliamentary standing committee on finance last week.

In the early years of the Insolvency and Bankruptcy Code (IBC), the SC upheld the unquestionable nature of the commercial wisdom of the CoC in the Essar judgment. The apex court had also affirmed that tribunals do not have any right to question CoC’s wisdom, including on dissenting creditors in another case. Besides, there are several other orders giving financial creditors the upper hand.

Lenders have also been accepting bids after deadlines, citing value maximisation, they have also accepted bids close to liquidation value, leading the Parliamentary panel to question their actions.

The National Company Law Tribunal (NCLT) has also questioned the behaviour of the CoC in two cases. In the Videocon case, the NCLT raised doubts on the confidentiality clause being in real-time use after it turned out that the bid put in by Vedanta’s Twin Star was close to the confidential liquidation value assigned by lenders.

“Commercial wisdom of Coc is like the basic structure of the IBC process. Any deviation there may have wider dysfunctional implications. However, to address growing concerns about indiscretion in decision making of CoC, there is now a felt need to have a professional code of conduct for CoC as suggested by standing committee on finance, and penal provisions for acts of misconduct, if any,” said Hari Hara Mishra, director, UV ARC.

More recently this week, the NCLT Chennai bench shot down a proposal put forward by the CoC to withdraw insolvency proceedings against Sivasankaran’s Siva Industries in order to do a one-time settlement. “The NCLT observed that without receiving even a single penny from the promoter of the corporate debtor, the CoC has voted in favour of withdrawal of insolvency proceedings and this is what gave an impression that it is not a settlement but a business restructuring plan,” said Nirav Shah, partner, DSK Legal.

Cases filed

2017-19

From: April 29, 2019: The Times of India

See graphic:

2017-19: Cases filed under the Insolvency and Bankruptcy Code 2016

2019-23

From: April 5, 2023: The Times of India

See graphic:

Corporate insolvency resolution processes submitted each qtr over 4 years, Q3FY19-Q3FY23

2020

From: Sidhartha, June 24, 2021: The Times of India

See graphic:

Corporate insolvency process- Data on cases admitted and approved, at the end of December 2020

Realisation

2016- 23

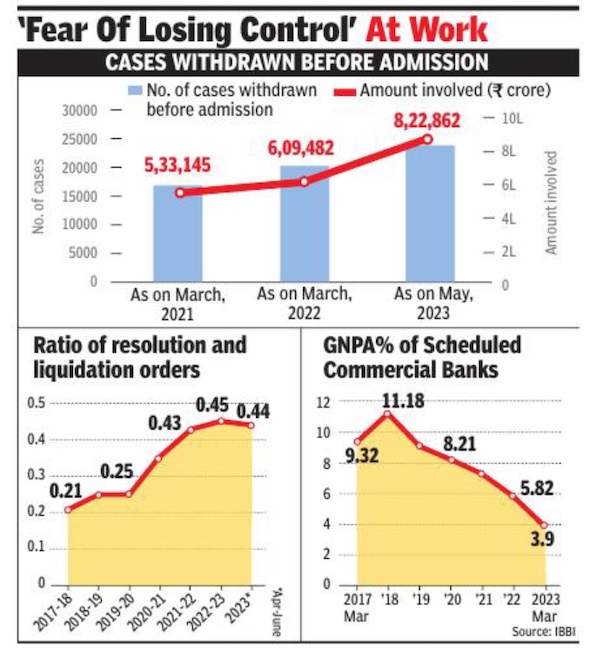

May 13, 2023: The Times of India

From: May 13, 2023: The Times of India

New Delhi : Creditors, including banks, have seen realisation in bankruptcy resolution cases rise to 36% of the admitted claims during 2022-23, compared to 23% in the previous year, despite a sharp rise in the number of cases filed for insolvency resolution.

Latest data released by the Insolvency and Bankruptcy Board of India showed that 1,255 corporate insolvency actions were initiated last year, a 41% increase over the 887 cases filed in NCLT in the previous year.

With 650 cases filed by financial creditors, it was the first time that action initiated by this segment crossed the 50% mark since insolvency action began in 2016-17. Ever since the law was implemented over half the cases in every fiscal were filed by operational creditors, including vendorsand statutory agencies.

While 80% of the cases filed by financial creditors had defaults of over Rs 10 crore, almost the same proportion of operational creditors, mainly vendors, trigger action in case of defaults of under Rs 1 crore. Amajority of the cases filed by operational creditors — 53% or 3,265 of the 6,567 actions initiated — were closed due to appeal, review or withdrawal, indicating that they were “settled”.

Separate data put together by the regulator showed that 38% of the 847 cases were withdrawn as the company, which faced insolvency action opted for full settlement with the applicant. Over a quarter of these cases were withdrawn citing “other settlements” with the creditors.

Resolution

2017 – 23

From: Sidhartha, August 24, 2023: The Times of India

See graphic:

The resolution and liquidation of insolvency cases in India, 2017 – 23

See also

Insolvency, bankruptcy: India