Infosys

This is a collection of articles archived for the excellence of their

content. You can update or correct this page, and/ or send photographs to the Facebook page, Indpaedia.com. All information used will be duly acknowledged. |

This is only the first draft of an article that you can help expand considerably

The authors of this article include

i) Shibulal's role unclear as Murthy calls shots Suman Layak,ET Bureau | Oct 20, 2013

ii) THE OLD ORDER CHANGES The Times of India Jun 13 2014

iii) Balakrishnan's exit raises concern over Infosys's ability to retain core talent: Analysts Shilpa Phadnis,TNN | Dec 23, 2013 The Times of India

iv) Why Infosys is losing momentum in every vertical Shilpa Phadnis,TNN | Jul 6, 2013 The Times of India

v) Infosys whistleblower could get $5-8m PTI | Oct 31, 2013

vi) Infosys wins contract from Chinese company FESCO PTI | Dec 17, 2013

vii) Infosys reduces staff strength of R&D arm The Times of India Shilpa Phadnis,TNN | Oct 9, 2013

Vii a) Infosys: Revenue from North America up 4.9% ET Bureau | Jul 12, 2013

ix) Leaving the dream: Infosys battles worker exodus Reuters | May 11, 2014

x) Infosys settles sexual harassment lawsuit out of court for $3m Rediff, PTI, NDTV, Reuters [1] May 11, 2003 Indian Express

The Infosys story

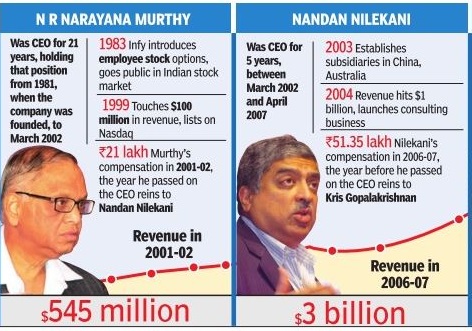

Rise It's a story that's been told often. Infosys was founded in 1981 when seven engineers, including NR Narayana Murthy, pooled $250 — mostly borrowed from their wives. The company's rapid growth kick-started the outsourcing movement in India and coined the term 'to be Bangalore-d'.

After seeing the company grow from strength to strength, the founders finally are letting go

The best training

New company hires are put on a 23-week training programme regarded as among the best in the industry, and work in a Silicon Valley-style headquarters campus on sprawling grounds, with multi-cuisine food courts and state-of-the-art gymnasiums. Employee stock options helped make some of India's first salaried millionaires.

Fall

Around 2012 Infosys was criticized for not changing with the times, for being too conservative in chasing new business and, at times, for depending too much on Murthy, which some investors and analysts say has hobbled the development of new leadership.

A revamp, dubbed "Infosys 3.0", aimed to move the company up the value chain but fell short of expectations, prompting the return of Murthy from retirement in June 2013 to try to revive its fortunes. But his return, with his son Rohan as his executive assistant, saw at least nine senior executives depart [June 2013 to Apr 2014] amid a reshuffle of teams and titles. Some Infosys insiders say Murthy's return was aimed at grooming Rohan for the top job, prompting confusion and damaging morale.

"When senior management leaves in bunches, we begin to wonder if it's a sinking ship," said one Bangalore-based software consultant who had worked at Infosys for six years .

"For the last two years [2012-2014], there have been no significant wage hikes, there's saturation in career growth, the company's results have been below market expectations and there's internal strife, with senior guys leaving," she said. "Regular workers are feeling there's not much chance of growth in the company."

Addressing shareholders for the last time (in June 2014) NR Narayana Murthy said the nation's second largest IT services firm Infosys had "diluted focus on meritocracy and accountability" in the past decade [roughly 2004-14], forcing him to take "hard and tough decisions [in 2013]" However, former finance and HR head of Infosys Mohandas Pai attributed the exits [of 2013-14] to lack of empowered senior managers. "Lack of empowerment of senior managers is the reason the company failed in the last [2011-14]. The people who left, they are doing extraordinarily well, wherever they are."

Resurrection?

Murthy has said it would take a few years before Infosys gains significant ground in SMAC [social media, applications (apps) and cloud computing (SMAC)]

Will Vishal Sikka, CEO, w.e.f October 2014 be able to resurrect Infosys?

Early struggles with the licensing regime

When Narayana Murthy took 3 years and 50 trips to Delhi to import one computer The Times of India By NR Narayana Murthy Jul 21, 2016

Infosys was a 10-year-old company with just one international office in Boston. NR Narayana Murthy was just another struggling entrepreneur, running from pillar to post, trying to get licences for importing computers.

Murthy went on to become a doyen of the Indian IT services business. Infosys became an icon of wealth creation in the country, spawning over 200 dollar millionaires and about 20,000 rupee millionaires through its employee stock option plans. Infosys revenue grew from $1.5 million in 1992 to $9.5 billion in 2016.

First, we did not have current account convertibility, so even if I had to travel abroad for one day, I had to apply to the Reserve Bank of India. That appears stupid today. I had to wait for 10-12 days. They might or might not get back. So, opening an office abroad, hiring consultants from abroad, having sales people abroad — they were possible before 1991.

Second, we had an official called the Controller of Capital Issues, who incidentally did not understand capital markets at all. He was a civil servant sitting in Delhi. Nobody ever asked a question about why he was sitting in Delhi and not in Bombay, where the capital markets are. He rarely gave any premium on par value. When we went to the Controller of Capital Issues in 1990, for a Rs 10 par value share, he said that he would allow me Rs 11. We went to Rs 95 in 1993 when this was abolished by Manmohan Singh.

There was also such a strict licensing regime to import a computer that it took me three years and I went about 50 times to Delhi. Those days I couldn't afford a flight, so I took a train. I had to stay in some seedy place near Old Delhi Railway Station. Even that cost money for a fledgling company.

For new companies, there was such a heavy tariff because even before you got a licence, 50 visits meant — even if it was $500 a trip (at that time, it was Rs 6 per dollar) — $25,000 spent on a $100,000 computer before you bought it or got a licence.

The officers did not know anything about computers. They would quibble about small things. Why do you need 64MB of memory? Go with only 48MB, they would say. Let's say, if one got a licence after two years of running around, one would discover that the models one got the licence for had become old in the US.

India was always three generations behind. Once licensing was abolished, it allowed companies to make decisions in their boardrooms rather than in the corridors of North Block.

Shibulal

1980

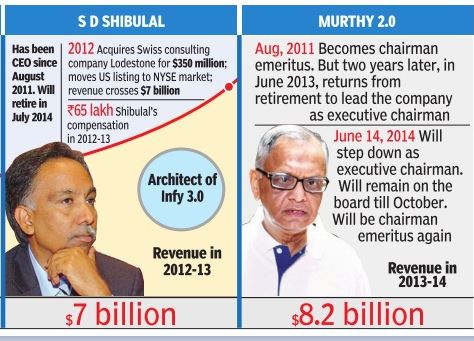

In 1980 NR Narayana Murthy had unwittingly locked up his junior colleague SD Shibulal in his office - asking him not to go home before finishing a complex piece of software - he seems to have done it again.

Back in 1980 the two worked at Patni Computer Services, before co-founding Infosys Technologies with five others a year later. Murthy himself had rescued Shibulal when he found him 48 hours later, labouring away in his lungi, over the weekend.

2011-13

In 2011, Shibulal, the brilliant backroom boy, got his turn as CEO at Infosys. Two years later, he was still CEO, but only just, with Murthy who came back as executive chairman in June 2013 making subtle shifts in strategy and changing the way it is executed - and in the process reversing many of Shibulal's decisions.

In a less genteel environment, Shibulal would have gone They treated him well and with respect because he was a co-founder.

Shibulal (born 1955) stuck on for a while- even as he saw his own well-crafted strategy being improvised on by his mentor. He is slated to retire in March 2015 and ever since he took over in 2011, there was speculation about his successor.

2012: Infosys lost momentum in every vertical

Infosys's overall revenues dropped below that of Cognizant in 2012. But what worried the IT company more was its loss of momentum in almost every vertical. And in both its flagship verticals - BFSI (banking , financial services & insurance ) and manufacturing - its rank has dropped.

In BFSI, Infosys's revenue in the March quarter of fiscal 2011 was $571.9 million and this grew modestly to $657 million in March 2013. But Cognizant's revenue grew from $570 million to $855 million in the same period , pushing Infosys to No. 3 in that space. In fact, Cognizant surpassed Infosys in this vertical in the June quarter of fiscal 2012.

In manufacturing, Infosys used to be No. 1, but in the September quarter of fiscal 2013, TCS's revenue ($402 million) crossed that of Infosys ($397 million) and has remained ahead since then. In retail, Infosys and TCS's revenues were similar in the March quarter of 2011, but by March 2013, TCS had grown its revenues to $407 million, while Infosys's rose to just $298 million.

This loss of momentum and ranking put the company at risk of losing mindshare among customers in the long run.

2013: Infosys blatantly flouted immigration laws: USA

Federal prosecutors have alleged that IT major Infosys indulged in blatant violation of immigration laws by not only bringing its employee inside the country on a visa which does not permit work, but also issuing specific directions to its workers to mislead the immigration officials on their point of entry on their nature of work.

NEW YORK: A former American employee of Infosys, who had brought a whistleblower lawsuit against the IT giant, could receive between $5 to 8 million of the total $34 million that the Indian company will pay to settle visa fraud allegations.

In one of the largest settlements in an immigration fraud case, Bangalore-based Infosys has agreed to pay the amount to resolve claims made by federal prosecutors in Texas.

The payment by Infosys includes $5 million to Homeland Security Investigations for civil or administrative forfeiture, a similar amount to the Department of State and $24 million to the US Attorney's Office for the Eastern District of Texas.

Jack Palmer, who had worked at Infosys, brought the whistle-blower lawsuit in Alabama in February 2011, saying that he had been punished and sidelined by company executives after he reported witnessing widespread visa fraud. His lawsuit was dismissed in 2012 by a federal judge but it spurred the federal investigation into Infosys' visa procedures.

Palmer said he had turned down an early settlement offer from Infosys, because it would not have allowed him to continue cooperating with federal investigators. "They wanted to buy my silence, and I wouldn?t do it," he said. "I never did it for the money. I did it because they were violating the law."

June 2013: Murthy returns

Shibu, as he is known popularly, was sidelined from the decision-making process, even though he continued to be the public face of the company. "He would often say 'go ask Murthy'," it was said

The percentage game

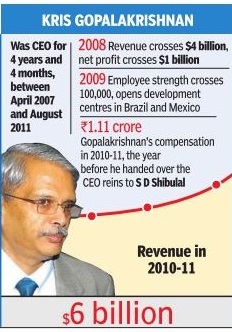

At an investor conference organised by Motilal Oswal on September 3, 2013, Murthy pointed out to an audience of analysts how the growth and margins at Infosys started falling after Gopalakrishnan handed over the CEO's baton to Shibulal.

Infosys grew at 26% during fiscal year 2011 over a year ago, operating margins were at 29.5% and post-tax profit margin was just under 25% when Gopalakrishnan laid down office. A year later the growth rate slipped to 16%, although operating margins and post-tax profit margins were maintained. But as Murthy pointed out at the conference: "The year 2012-13 was what was of great concern...because our growth went down to 5.8%, our net income margin went down to 23.3%."

He added that the net margin stayed at that level because of Infosys' non-operating income (primarily interest income from a cash pile in excess of Rs 25,000 crore). "These are the things that cause tremendous concern because first of all [Infosys was] losing its growth rate by as much as 80%; second, losing the operating margin, particularly in the context of the devaluation of the rupee, is something that is not good news..." explained Murthy.

Phil Fersht, founder and CEO of HFS Research, says: "The lower margins are primarily a consequence of increased onshore labour to execute engagements; during this period Infosys has increased its on-site costs (36% of Infosys' cost base was on-site in fiscal year 2012 compared with 46% in fiscal year 2013). In addition, increasing labour costs in its offshore locations have also driven down margins, with a competitive labour market and currency fluctuations driving up costs of Indian delivery."

Murthy explains: he decided to focus on three areas as chairman. One is to reduce costs by reducing locations to improve margins; second is to focus on winning large deals to bring back growth; and the third is to better incentivise performers both in sales and delivery. Murthy also said the company had somehow taken its eye off the ball - the large outsourcing projects that can add to revenues.

There are early tentative signs of a revival. After Murthy returned on June 1, 2013, the company showed a 7.78% growth in net sales for April-June over the January-March quarter. And in the July-September quarter, sales growth jumped to 15% over April-June. However, profit growth over the previous quarter has stagnated at less than 2% for four quarters now.

The Infosys board restructured the hierarchy with executive co-chairman Kris Gopalakrishnan - who Shibulal had succeeded as CEO - transitioning to executive vice-chairman. And for good measure Murthy also brought along his son Rohan Murty to assist him.

Murthy basically decentralised decision-making, bringing executive authority closer to the chairman's office. The executive council that ran Infosys saw powers moving to the chairman's office, manned by MD Ranganath, Deepak Padaki and Rohan. So regional satraps, who had a lot of freedom to operate, suddenly found their decision-making executive powers taken away.

However, not everyone was sure that Murthy was on the right track. Says R Wang, principal analyst and CEO of San Francisco-based Constellation Research: "The strategy for higher margins and to expand in existing accounts still makes sense. However, there are broader shifts happening in this market and it's important that Infosys also builds IP, expands partnerships, and leads in specific verticals."

Bendor-Samuel of Everest says he has not been a fan of Infy's strategy or execution and feels they moved too fast and confused the customer base. He says Murthy's moves are smart ones for the short run but are unlikely to succeed in the long run and he will have to manage the tension between growth and higher margins. " Wipro, Cognizant and TCS are all decentralising, moving decision making closer to the customer. Infy is moving completely differently from the rest," Bendor-Samuel adds.

The family

The other factor that did not please many, including Bendor-Samuel, was the growing importance of Murthy's son Rohan in the company. Appointed executive assistant to Murthy in June, the company has since neither denied nor confirmed reports that he would be elevated to vice-presidentship soon.

CEO Shibulal added nothing to the story when he said in Oct 2013 that Murthy had clearly articulated his son's role in the company.

At the investor conference, Murthy said that he had "invited Dr Rohan Murty to come and join my office" as he "wanted somebody with an open mind, somebody who brought the finest ideas in computer science, somebody who has distinguished himself as a stellar academician to come and help me in improving our software delivery effectiveness". Rohan is junior fellow in the society of fellows at Harvard University.

John A Davis, professor at Harvard Business School and founder of the Cambridge Institute of Family Enterprise, Massachusetts, feels founders are often considered to have mythical abilities to turn around companies. "Employees and customers react well to a founder-entrepreneur and they see them as someone with a magic touch. So do the markets," Davis says.

And he says nothing is wrong with bringing in a family member, even as a CEO (not that Infosys has indicated any plan to have Rohan as CEO). "The CEO always needs to have confidence of the largest shareholders. For a family member CEO, it works out well," he says.

Bendor-Samuel disagrees. "Anytime you have a hint of nepotism in the way an organisation is run you have issues." He points out that Wipro too has a similar situation where promoter Azim Premji's son Rishad holds a senior management position, but the shareholding patterns of the two IT services giants make it a very different game altogether. While Murthy owns around 4.5% in Infosys and all the founders together around 16%, in Wipro promoter Azim Premji controls roughly 73.5% of the shares.

Bendor-Samuel says he finds both Rishad Premji and Rohan extremely talented and capable professionals but "it is discouraging for other people".

Those other people could well include Shibulal; those clued into the company in Bangalore suggest he is waiting for his daughter Shruti Shibulal's nuptials in November before he calls it a day. V Balakrishnan is the top internal contender for the CEO's mantle after the exit of Ashok Vemuri.

When asked by an analyst what are the leadership traits he would be looking for in Infosys' next CEO, Murthy articulated several, from the leader's ability to raise aspirations to being able to connect; he also said he was looking for the attribute of "courage to take tough decisions", the attribute of generosity - to "share credit" - and the ability to take quick decisions. Does Balakrishnan fit the bill?

Revenues for Apr-June 2013

Infosys said its revenues from North America—which contributes nearly two-thirds to the company's topline—grew 4.9% on a quarter-on-quarter basis.

The Bangalore-based company's revenues from Europe, however, declined 3% due to reduced client spending and macro-economic uncertainties. Europe has been a concern for most Indian software exporters, with revenues and profits declining 2011 to 2013. Clients in Europe contributed 23% of Infosys' revenues during the first quarter.

Infosys, India's second-largest software firm, posted a 3.7% year-on-year increase in its first-quarter net profit. The company said its revenues from India, where it provides information technology services to India Post and Ministry of Corporate Affairs, grew 10% during this quarter. India contributed 2.4% of Infosys' revenues.

Revenues from rest of the world, which contributes 12% to Infosys' overall revenues, grew 2.4%.

Attrition after June 2013

June 2013: attrition begins at the top

Six top executives at Infosys resigned within four months after Murthy came back in June 2013 as executive chairman. And in terms of financials, the Murthy-led team was able to bump up growth in the quarter ended September 30, 2013, over the previous quarter.

Dec 2013: Balakrishnan resigns

Infosys board member V Balakrishnan's exit, marking the eight between June and Dec 2013, raised concerns over the company's ability to retain core members. Balakrishnan's departure left a vacuum in the leadership team especially after he was seen as a strong contender for the CEO's role.

The resignation of V Balakrishnan was surprising given that he was only a few weeks before given additional responsibilities as the head of Switzerland-based consultancy firm Lodestone that was acquired in a $350mn deal in 2012. In 2013, he was given the given additional responsibility of managing utilities and resources for the North American region.

The nine key exits between June 2013-June 2014 were CFO V Balakrishnan, Americas head Ashok Vemuri, president BG Srinivas, global sales head Basab Pradhan, Infosys consulting head Stephen Pratt, BPO sales head Australia Kartik Jayaraman and BPO head Latin America Humberto Andrade.

2013-14: Record rate of attrition

Annual revenue in the year to end-March 2014 rose 24.2 per cent, lagging growth of 29.9 per cent at TCS.

The annualized rate of attrition at Infosys — effectively the number of staff leaving or retiring — was a record 18.7 per cent at end-March, 2.4 percentage points higher than a year earlier. That's close to a fifth of the company's workforce of more than 160,000. The attrition rate at market leader TCS was 11.3 per cent.

Infosys announced an average 6-7 per cent pay rise in April 2014 for India-based staff, below the average 10 per cent raise at TCS. Third-ranked Wipro Ltd said it plans raises of 6-8 per cent from June.

Infosys president Pravin Rao acknowledged that attrition is higher than the 12-13 per cent rate the company is comfortable with Unfazed by the exodus of top executives, Infosys co-founder and executive chairman Murthy said he wished luck to those who quit the company.

Changes after 2013

Oct 2013: R&D arm reduced

In yet another indication that Infosys was putting the focus back on its traditional services, the company cut the strength of its R&D arm, called Infosys Labs, and moved these employees to billable projects on the IT services side. This was in keeping with chairman N R Narayana Murthy's idea of taking a step back into the traditional space of application development and maintenance (ADM) and infrastructure services in the short term..

The Labs division was a technology and domain-focused team of 600, developing proprietary technologies . Infosys moved to reduce the strength by at least 30% over time .

Infosys Labs, established in 1999, worked to find ways to produce cheaper, faster and better services, and shared synergies in particular with the PPS (products, platforms and solutions) business.

ADM and infrastructure services have been the spaces that have driven revenues for the industry's growth leaders - TCS, Cognizant and HCL - in recent years. Infosys's assessment is that it took its eyes off those spaces in its effort to build the non-linear business

The talk in Infosys was that the Labs development followed soon after Murthy's son and executive assistant Rohan Murty had a meeting with business unit heads, including Labs head Subrahmanyam Goparaju, and reviewed the performance of each unit.

Infosys Labs was formerly called Software Engineering and Technology Labs (SetLabs). It collaborates with various universities -- University of Cambridge, University of Illinois at Urbana Champaign , Indian Institute of Technology Bombay, Monash Research Academy, Purdue University and Queens University Belfast.

It worked on immersive technologies like augmented reality, touch and gesture interfaces and data visualization.

International business

2013: FESCO, China contract

In Dec 2013 IT services major Infosys bagged a contract from Chinese firm FESCO to develop a human resource (HR) services platform.

FESCO is the first Chinese firm to provide professional HR services to foreign enterprises, financial institutions and economic organisations in China. FESCO provides services to more than 10,000 global users located in over 100 countries.

Incorporated in 2003, Infosys China -- which in 2013 employed about 3,300 people -- has a sales office in Hong Kong, a global education centre in Jiaxing and development centres in Shanghai, Hangzhou, Beijing and Dalian. The company is developing a new campus at Zizhu Science and Technology Park in Shanghai.

Volvo

Infosys inked a multi-year pact with Volvo Cars to provide application development services for its global operations.

Lansforsakringar

Infosys signed a five-year deal with Lansforsakringar to provide application development and management support.

Sydney

Infosys has opened a new Sydney branch office to keep pace with business growth.

2002-03: Sexual harassment lawsuit against Phaneesh Murthy

Infosys Technologies Ltd, the Bangalore-based global IT major, on Sunday announced that it had reached an out-of-court settlement in the sexual harassment lawsuit against the company's former board member Phaneesh Murthy, who was based in the United States.

The lawsuit was filed by Phaneesh's executive secretary Reka Maximovitch, a Bulgarian American national, complaining of sexual harassment and wrongful termination of her employment.

Under the terms of the settlement, the company retained all rights to proceed with legal action against Phaneesh Murthy.

Giving details of the settlement, Infosys chairman and chief mentor N R Narayana Murthy told mediapersons in Bangalore that the company would be paying $3million to the plaintiff.

Of this, Infosys would contribute $1.5 million while insurers would cough up the remaining $1.5million under the company's directors and officers liability insurance cover.

Under California law, the company was also liable for the conduct of Phaneesh because he was an officer and a member of the board.

Murthy said "Phaneesh did not disclose to the company management, as an important functionary, that he had a relationship with Maximovitch and also of the fact that she had filed in the court for a restraining order against him".

The company paid $570,000 to Phaneesh Murthy as part of the final settlement of his dues when he resigned in July 2003 as head of Infosys' worldwide sales and marketing and from the company's board of directors.

After leaving Infosys, Murthy founded a company that was bought by iGate in mid-2003. In 2011, he teamed up with buyout firm Apax Partners to conduct iGate's $1.2 billion purchase of much-bigger Indian rival Patni Computer Systems.

iGate shares, and revenues, more than quadrupled since Mr Murthy joined the company, but the scandal threatened to cut short Mr Murthy's long and illustrious career.

Eleven years after he was forced to quit Infosys Ltd following sexual harassment charges, Phaneesh Murthy was in 2013 sacked by US-based outsourcing firm iGATE Corporation for not disclosing his "relationship with a subordinate".

2014: Vishal Sikka appointed Infosys CEO

Thirty-three after its inception, the Indian IT behemoth appointed its first non-founder CEO in Sikka, who was roped in from outside. In June 2014, executive chairman, Murthy, announced that he along with his son Rohan had decided to step down full four years ahead of their term, said his "work was done" and hoped that the new CEO Vishal Sikka would chart a new course without any interference from founders

Murthy, who founded Infosys along with six engineers in 1981, bid adieu to the over USD 8 billion entity for the second time. He was called back from retirement in June 2013. After Sikka assumes charge, Murthy will be designated as chairman emeritus.

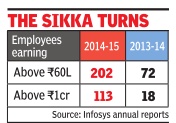

2014-15: increase in the number of high-paid executives

May 24 2015

Crorepati count at Infy up from 18 to 113 in a yr

Sujit John & Shilpa Phadnis

There's been a dramatic increase in the number of crorepatis and high-paid executives in Infosys in the past year, a move that analysts ascribe to CEO Vishal Sikka's effort to align salaries with the market and stem the spate of top-level exits in the run-up to his ap pointment in August last year. As many as 113 executives drew over Rs 1 crore in total compensation in 2014-15, up from a mere 18 in the year before. And as many as 202 drew over Rs 60 lakh, compared to just 72 in 2013-14. There was a quantum jump in the compensation of many executives. Several long-serving executives who did not figure in the 2013-14 list of those earning over Rs 60 lakh, drew more than Rs 1 crore last year. Al most all executive VPs earned between Rs 3 crore and Rs 4 crore, up from an average of Rs 1.5 crore in the year before.

All the figures have been compiled from Infosys's annual reports, and a note in the latest report indicates that significant bonuses were paid to several executives in 2014-15. The Companies Act obliges firms to disclose the compensation details of every employee based in India drawing over Rs 60 lakh.Considering that several of the major new appointments that Infosys CEO Vishal Sikka has made included positions based overseas, especially in Palo Alto, US, where he himself is located, the actual number of crorepatis in the company now would be higher than that mentioned in the latest annual report.

These executives include Michael Reh, head of Finacle and Edegverve, Kaustav Mitra, VP of innovation ecosystems, Abdul Razack, head of platforms, big data and analytics, Ritika Suri, head of corporate development, Sanjay Rajagopalan, head of design and research, and Navin Budhiraja, head of architecture and technology .

Rival Wipro's annual report for the last fiscal year is yet to come out. In 2013-14, the company had 36 executives drawing over Rs 1 crore, and 114 drawing more than Rs 60 lakh. The numbers in that year were significantly higher than for Infosys, but it's likely that in the last year, Infosys has pulled way ahead of Wipro. The two companies are also comparable because they have similar overall employee strengths -Infosys has 1.76 lakh, and Wipro 1.58 lakh.

Mervyn Raphael, managing director of global human resource management consulting firm People Business, said Infosys was setting the stage for a “certain equalization.“

“They are following the 80:20 rule -about 20% of high-potential leaders who drive the organization's strategy laid out by the new CEO are paid salaries above market. It's a well thought out strategy as the company is shifting gears in an evolving IT landscape. It's a small blip in the overall cost of operations, but the returns would be much higher,“ said Raphael.

See also

Infosys<> TCS (Tata Consultancy Services)