Infosys

| Line 17: | Line 17: | ||

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=THE-OLD-ORDER-CHANGES-13062014019005# The Times of India] Jun 13 2014 | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=THE-OLD-ORDER-CHANGES-13062014019005# The Times of India] Jun 13 2014 | ||

| + | iii) ''' Balakrishnan's exit raises concern over Infosys's ability to retain core talent: Analysts ''' Shilpa Phadnis,TNN | Dec 23, 2013 [http://timesofindia.indiatimes.com/tech/tech-news/Balakrishnans-exit-raises-concern-over-Infosyss-ability-to-retain-core-talent-Analysts/articleshow/27801326.cms The Times of India] | ||

| + | =The Infosys story= | ||

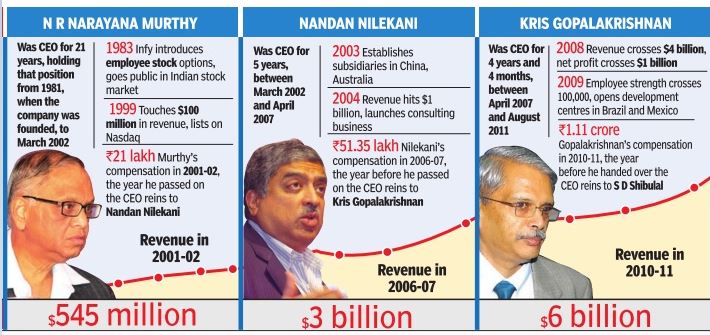

It's a story that's been told often. Thirty-three years ago, seven men scrounged together $250 to build a dream. | It's a story that's been told often. Thirty-three years ago, seven men scrounged together $250 to build a dream. | ||

After seeing the company grow from strength to strength, the founders finally are letting go | After seeing the company grow from strength to strength, the founders finally are letting go | ||

| Line 79: | Line 81: | ||

==June 2013: attrition begins== | ==June 2013: attrition begins== | ||

Six top executives at Infosys resigned within four months after Murthy came back in June 2013 as executive chairman. And in terms of financials, the Murthy-led team was able to bump up growth in the quarter ended September 30, 2013, over the previous quarter. | Six top executives at Infosys resigned within four months after Murthy came back in June 2013 as executive chairman. And in terms of financials, the Murthy-led team was able to bump up growth in the quarter ended September 30, 2013, over the previous quarter. | ||

| + | == Dec 2013: Balakrishnan resigns == | ||

| + | Infosys board member V Balakrishnan's exit, marking the eight between June and Dec 2013, raised concerns over the company's ability to retain core members. Balakrishnan's departure left a vacuum in the leadership team especially after he was seen as a strong contender for the CEO's role. | ||

| + | |||

| + | The resignation of V Balakrishnan was surprising given that he was only a few weeks before given additional responsibilities as the head of Switzerland-based consultancy firm Lodestone that was acquired in a $350mn deal in 2012. In 2013, he was given the given additional responsibility of managing utilities and resources for the North American region. | ||

Revision as of 19:07, 14 June 2014

This is a collection of articles archived for the excellence of their

content. You can update or correct this page, and/ or send photographs to the Facebook page, Indpaedia.com. All information used will be duly acknowledged. |

Contents |

The authors of this article include

i) Shibulal's role unclear as Murthy calls shots Suman Layak,ET Bureau | Oct 20, 2013

ii) THE OLD ORDER CHANGES The Times of India Jun 13 2014

iii) Balakrishnan's exit raises concern over Infosys's ability to retain core talent: Analysts Shilpa Phadnis,TNN | Dec 23, 2013 The Times of India

The Infosys story

It's a story that's been told often. Thirty-three years ago, seven men scrounged together $250 to build a dream. After seeing the company grow from strength to strength, the founders finally are letting go

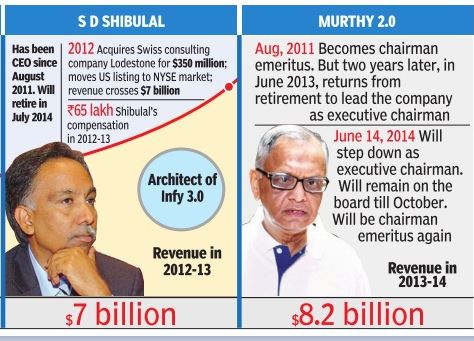

Shibulal

1980

In 1980 NR Narayana Murthy had unwittingly locked up his junior colleague SD Shibulal in his office - asking him not to go home before finishing a complex piece of software - he seems to have done it again.

Back in 1980 the two worked at Patni Computer Services, before co-founding Infosys Technologies with five others a year later. Murthy himself had rescued Shibulal when he found him 48 hours later, labouring away in his lungi, over the weekend.

2011-13

In 2011, Shibulal, the brilliant backroom boy, got his turn as CEO at Infosys. Two years later, he was still CEO, but only just, with Murthy who came back as executive chairman in June 2013 making subtle shifts in strategy and changing the way it is executed - and in the process reversing many of Shibulal's decisions.

In a less genteel environment, Shibulal would have gone They treated him well and with respect because he was a co-founder.

Shibulal (born 1955) stuck on for a while- even as he saw his own well-crafted strategy being improvised on by his mentor. He is slated to retire in March 2015 and ever since he took over in 2011, there was speculation about his successor.

2013: Murthy returns

Shibu, as he is known popularly, was sidelined from the decision-making process, even though he continued to be the public face of the company. "He would often say 'go ask Murthy'," it was said

The percentage game

At an investor conference organised by Motilal Oswal on September 3, 2013, Murthy pointed out to an audience of analysts how the growth and margins at Infosys started falling after Gopalakrishnan handed over the CEO's baton to Shibulal.

Infosys grew at 26% during fiscal year 2011 over a year ago, operating margins were at 29.5% and post-tax profit margin was just under 25% when Gopalakrishnan laid down office. A year later the growth rate slipped to 16%, although operating margins and post-tax profit margins were maintained. But as Murthy pointed out at the conference: "The year 2012-13 was what was of great concern...because our growth went down to 5.8%, our net income margin went down to 23.3%."

He added that the net margin stayed at that level because of Infosys' non-operating income (primarily interest income from a cash pile in excess of Rs 25,000 crore). "These are the things that cause tremendous concern because first of all [Infosys was] losing its growth rate by as much as 80%; second, losing the operating margin, particularly in the context of the devaluation of the rupee, is something that is not good news..." explained Murthy.

Phil Fersht, founder and CEO of HFS Research, says: "The lower margins are primarily a consequence of increased onshore labour to execute engagements; during this period Infosys has increased its on-site costs (36% of Infosys' cost base was on-site in fiscal year 2012 compared with 46% in fiscal year 2013). In addition, increasing labour costs in its offshore locations have also driven down margins, with a competitive labour market and currency fluctuations driving up costs of Indian delivery."

Murthy explains: he decided to focus on three areas as chairman. One is to reduce costs by reducing locations to improve margins; second is to focus on winning large deals to bring back growth; and the third is to better incentivise performers both in sales and delivery. Murthy also said the company had somehow taken its eye off the ball - the large outsourcing projects that can add to revenues.

There are early tentative signs of a revival. After Murthy returned on June 1, 2013, the company showed a 7.78% growth in net sales for April-June over the January-March quarter. And in the July-September quarter, sales growth jumped to 15% over April-June. However, profit growth over the previous quarter has stagnated at less than 2% for four quarters now.

The Infosys board restructured the hierarchy with executive co-chairman Kris Gopalakrishnan - who Shibulal had succeeded as CEO - transitioning to executive vice-chairman. And for good measure Murthy also brought along his son Rohan Murty to assist him.

Murthy basically decentralised decision-making, bringing executive authority closer to the chairman's office. The executive council that ran Infosys saw powers moving to the chairman's office, manned by MD Ranganath, Deepak Padaki and Rohan. So regional satraps, who had a lot of freedom to operate, suddenly found their decision-making executive powers taken away.

However, not everyone was sure that Murthy was on the right track. Says R Wang, principal analyst and CEO of San Francisco-based Constellation Research: "The strategy for higher margins and to expand in existing accounts still makes sense. However, there are broader shifts happening in this market and it's important that Infosys also builds IP, expands partnerships, and leads in specific verticals."

Bendor-Samuel of Everest says he has not been a fan of Infy's strategy or execution and feels they moved too fast and confused the customer base. He says Murthy's moves are smart ones for the short run but are unlikely to succeed in the long run and he will have to manage the tension between growth and higher margins. " Wipro, Cognizant and TCS are all decentralising, moving decision making closer to the customer. Infy is moving completely differently from the rest," Bendor-Samuel adds.

The family

The other factor that did not please many, including Bendor-Samuel, was the growing importance of Murthy's son Rohan in the company. Appointed executive assistant to Murthy in June, the company has since neither denied nor confirmed reports that he would be elevated to vice-presidentship soon.

CEO Shibulal added nothing to the story when he said in Oct 2013 that Murthy had clearly articulated his son's role in the company.

At the investor conference, Murthy said that he had "invited Dr Rohan Murty to come and join my office" as he "wanted somebody with an open mind, somebody who brought the finest ideas in computer science, somebody who has distinguished himself as a stellar academician to come and help me in improving our software delivery effectiveness". Rohan is junior fellow in the society of fellows at Harvard University.

John A Davis, professor at Harvard Business School and founder of the Cambridge Institute of Family Enterprise, Massachusetts, feels founders are often considered to have mythical abilities to turn around companies. "Employees and customers react well to a founder-entrepreneur and they see them as someone with a magic touch. So do the markets," Davis says.

And he says nothing is wrong with bringing in a family member, even as a CEO (not that Infosys has indicated any plan to have Rohan as CEO). "The CEO always needs to have confidence of the largest shareholders. For a family member CEO, it works out well," he says.

Bendor-Samuel disagrees. "Anytime you have a hint of nepotism in the way an organisation is run you have issues." He points out that Wipro too has a similar situation where promoter Azim Premji's son Rishad holds a senior management position, but the shareholding patterns of the two IT services giants make it a very different game altogether. While Murthy owns around 4.5% in Infosys and all the founders together around 16%, in Wipro promoter Azim Premji controls roughly 73.5% of the shares.

Bendor-Samuel says he finds both Rishad Premji and Rohan extremely talented and capable professionals but "it is discouraging for other people".

Those other people could well include Shibulal; those clued into the company in Bangalore suggest he is waiting for his daughter Shruti Shibulal's nuptials in November before he calls it a day. V Balakrishnan is the top internal contender for the CEO's mantle after the exit of Ashok Vemuri.

When asked by an analyst what are the leadership traits he would be looking for in Infosys' next CEO, Murthy articulated several, from the leader's ability to raise aspirations to being able to connect; he also said he was looking for the attribute of "courage to take tough decisions", the attribute of generosity - to "share credit" - and the ability to take quick decisions. Does Balakrishnan fit the bill?

June 2013: attrition begins

Six top executives at Infosys resigned within four months after Murthy came back in June 2013 as executive chairman. And in terms of financials, the Murthy-led team was able to bump up growth in the quarter ended September 30, 2013, over the previous quarter.

Dec 2013: Balakrishnan resigns

Infosys board member V Balakrishnan's exit, marking the eight between June and Dec 2013, raised concerns over the company's ability to retain core members. Balakrishnan's departure left a vacuum in the leadership team especially after he was seen as a strong contender for the CEO's role.

The resignation of V Balakrishnan was surprising given that he was only a few weeks before given additional responsibilities as the head of Switzerland-based consultancy firm Lodestone that was acquired in a $350mn deal in 2012. In 2013, he was given the given additional responsibility of managing utilities and resources for the North American region.