Inflation: India

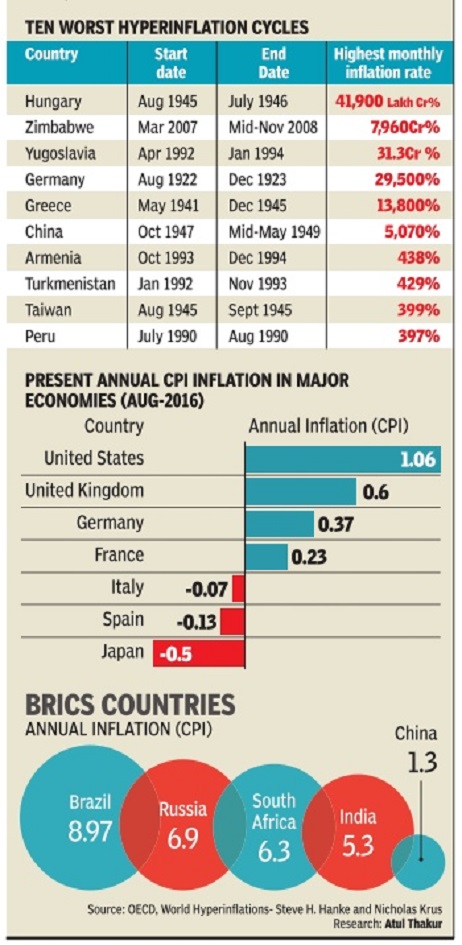

ii) The worst cases of hyperinflation in world history.

The Times of India

This is a collection of articles archived for the excellence of their content. |

Contents |

Measuring inflation: Wholesale Price Index (WPI) and Consumer Price Index (CPI)

The Times of India, Jun 08 2015

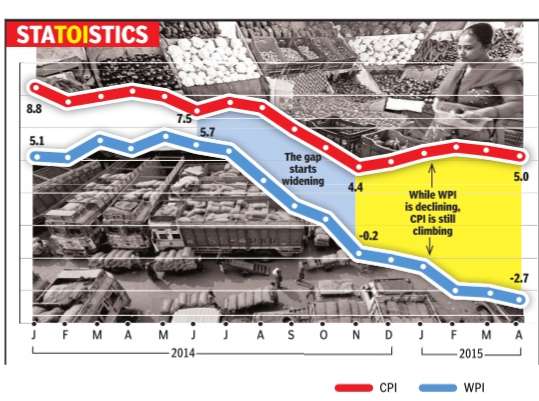

The Wholesale Price Index (WPI) and Consumer Price Index (CPI) are two ways of measuring inflation. Because of different constituents and weights for them, the inflation rates measured by both indices are often different. What is noticeable in recent months is that the two indices are showing divergent trends. The CPI indicates that there has been a rise in prices, while the WPI suggests that prices have fallen.One reason for this could be that food prices, which constitute a much larger part of the CPI, are up significantly over the last year.SOURCE: MOSPI, Office of the Economic Adviser; Research: Atul Thakur; Graphic: Asheeran Punjabi

Wholesale Price Index (WPI)

1975-2015

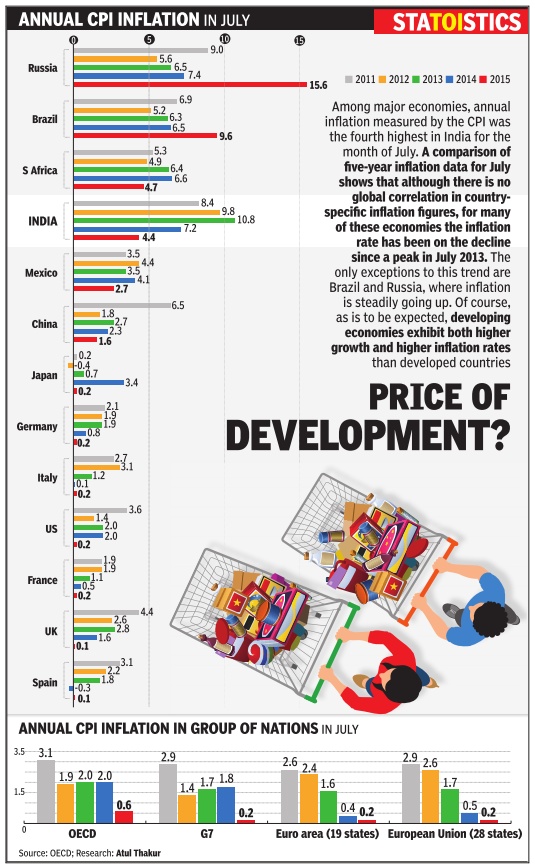

The Times of India, Aug 15 2015

Wholesale inflation lowest since '76

Falls for 9th month in a row to -4.1%, longest negative stretch since '75

Wholesale prices plunged for the ninth consecutive month in July on the back of a decline in food and fuel prices, raising prospects of a cut in interest rates to give a push to growth. This was the lowest level of the inflation based on wholesale price index (WPI) since 1976 and, according to economists, is the longest stretch of negative wholesale prices in the country since 1975.WPI inflation was in negative zone for 12 months between July 1975 and June 1976. Data released by the commerce ministry showed the wholesale inflation fell 4.05% in July compared to a decline of 2.40% for the previous month and 5.41% during the corresponding month of the previous year.

The sharp dip in WPI comes close on the heels of the significant moderation in retail inflation in July and together the two data sets have fuelled expectations of a cut in interest rates.

Food inflation fell 1.16% year-on-year in July , while vegetable prices fell 24.52% during the month. The price of pulses continued to remain a worry as it rose 35.75% in July .

India Inc stepped up its call for a reduction in interest rates, citing sharp decline in both WPI and CPI inflation data.“The distinct downturn in both retail and headline inflation and soft inflationary scenario makes a strong case for RBI to resume its accommodative policy stance,“ CII said.

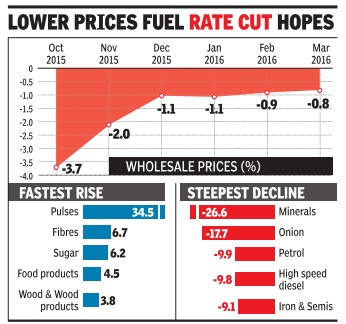

Oct. 2015- Mar. 2016: steady decline

The Times of India, Apr 19 2016

Wholesale prices contract for 17th month in a row Wholesale prices contracted for the 17th consecutive month in March on the back of sliding crude oil and manufactured product prices, adding to expectations of further interest rate cuts in the months ahead.

Data released by the commerce and industry ministry showed the annual rate of inflation, based on the wholesale price index, stood at -0.85% in March compared to -0.91% for the previous month and -2.33% during the corresponding month of the previous year.

Food inflation rose to 3.7% in March 2016 from 3.4% in February 2016 as prices for cereals, milk, eggs, meat & fish and vegetables firmed up. Price of pulses remained a concern, rising 34.4% in March 2016 but the pace of increase was slower than the previous month. Onion prices fell 17.7% in March compared to 13.2% in February .

“Since the prices of primary articles and manufac turing products are increasing, though marginally , it may pose a threat for WPI inflation in the upcoming months. In recent times, fuel prices have been easing, which may help to keep the inflation rates in the negative territory ,“ said Madan Sabnavis, chief economist at Care Ratings.

“The base effect may also wear off as the year progresses and we do expect WPI inflation to enter the positive zone in the next couple of month. However, this would not be a concern,“ Sabnavis added.

The widely watched reta il inflation slowed in March to a six-month low of 4.83% from a year earlier, stoking expectations of a reduction in interest rates.

RBI reduced interest rates by 25 basis points earlier this month and promised to ease rates in the months ahead if inflation remained within the central bank's comfort zone. Economists said they expect inflation to stay benign for now.

“After easing for several consecutive months, prices of pulses have hardened in the first half of April 2016.Moreover, prices of certain vegetables have risen in the last fortnight in line with seasonal trends during the summer months. However, the recent decline in prices of onions following the harvest is likely to offer some relief.While the trajectory of crude oil prices remains crucial, at present we expect WPI inflation to print in a narrow range of +0.5% in Q1 FY2017,“ said Aditi Nayar, senior economist at ratings agency ICRA.

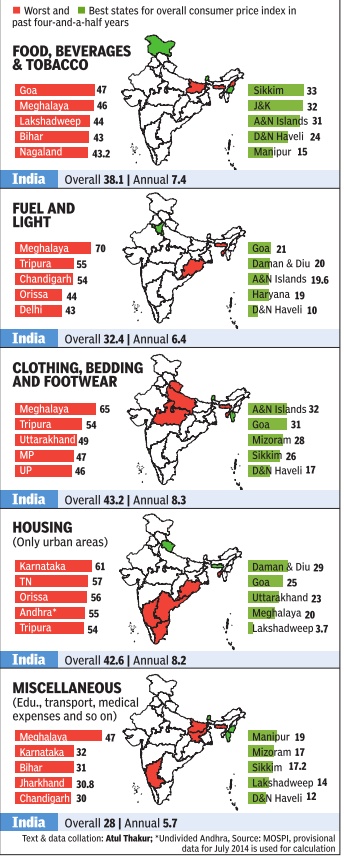

Price rise: Jan 2010-July 2014

Pricey Places

The Times of India Aug 30 2014

Between Jan 2010-July 2014, India has seen retail prices rise 35.6% on average, equivalent to an annual rate of about 7%. But different states have witnessed varying levels of price rise.

Consumer Price Index (CPI)

Measuring price rise: CPI’s consumption basket

The Times of India, Sep 14 2015

Low weightage to pulses in CPI helped check price rise How is price rise measured?

There are two widely accepted ways of measuring price rise or inflation: the wholesale price index (WPI) and the consumer price index (CPI). The WPI is designed to measure trends of wholesale prices of goods. In short, it tracks the farm and factory gate price of commodities before they reach the retail market. Services are not included in the WPI. The CPI, on the other hand, measures the general level of retail prices of goods and services consumed by households. From a consumer's point of view, it is the CPI that is more meaningful.

What commodities are included in the WPI and what is the base year?

The price index is measured with respect to a particular year called the base year. The base year chosen should be one in which prices were normal and not affected by some unusual natural calamity or international crisis. For the measurement of the current WPI in India, 2004-05 is the base year while for the CPI, 2012 is the base year. The WPI aims to capture all commodity trans actions carried out in the domestic market and hence it includes most of them. Weights are assigned to different commodities on the basis of the proportion of that commodity's transactions to all wholesale transactions in the economy .

How is the CPI's consumption basket made?

The consumption basket of the CPI is meant to represent all households in the country. For instance, the new CPI index includes all items which more than 75% of the country's households have reportedly consumed.Weights are assigned to various CPI commodities on the basis of average monthly consumption expenditure on these items discovered as part of a survey.

Why do the CPI and WPI show divergent inflation trends?

According to the latest data, inflation measured at the wholesale level was -4.05% for July 2015 when compared to July 2014. For the same period, the combined inflation rate for rural and urban consumers was 7.39%. This anomaly is attributed to several reasons. The most important is the weight of various commodities. For instance, the highest weight in CPI is given to food items, which comprise about 54.2%.In the WPI, the corresponding weight is just 14.3% and hence the high food price inflation that is troubling the country affects this index much less. Apart from this there is a tendency to counter the increase in the cost of raw materials by giving below normal wage increases to workers. In that case, the WPI will be low, but not the CPI.

Why are soaring pulse prices not reflected in the CPI?

The CPI is based on the actual consumption pattern of households and its composition is revised from time to time, with weights of various commodities changing according to their consumption. If prices of pulses continue to rise rapidly , their weight in the index will also go up unless the price increase is offset by a decline in their consumption. The present CPI food basket, however, gives a higher weight to milk and milk products, vegetables, prepared meals, meat and fish, sugar and spices than to pulses. The low weight for pulses explains why their price increase has only a minor impact on the CPI as a whole.

2015

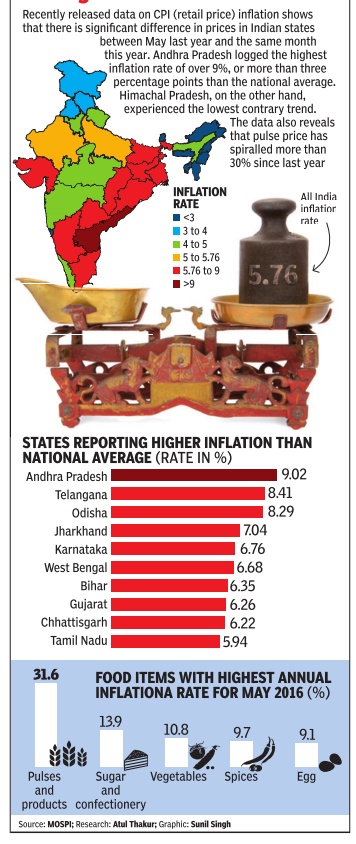

Dec. 2015: Wide variations across states

The Times of India Feb 02 2016

Inflation in December was 4.7% for urban India and 6.3% for rural India. But this all-India average figure is of little use to the common man. We don't really live in India, we live in one of its states.And inflation rate varies hugely across states. As hugely as 7.5% in urban Andhra Pradesh and only 2.5% in urban Himachal Pradesh--that's a gap of 5 percentage point. Difference between highest and lowest rural inflation was even greater: 6.6%

2015-16