Inflation: India

(→Retail inflation) |

|||

| (39 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

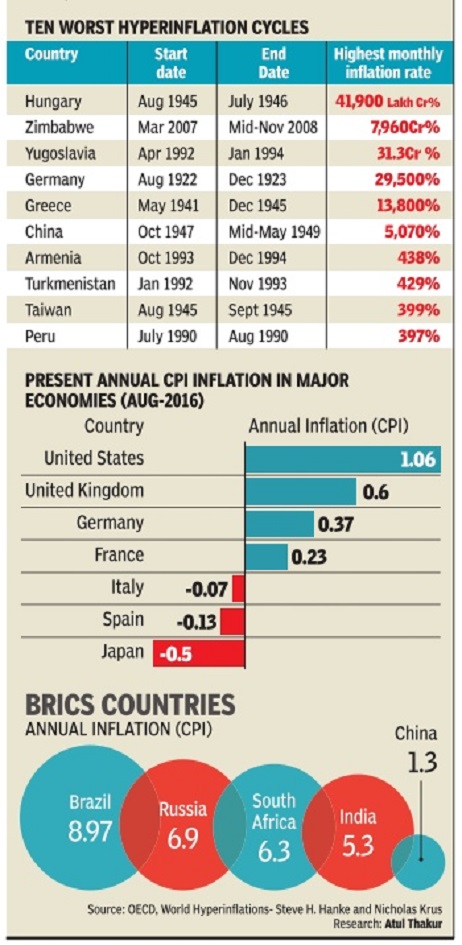

| + | [[File: The worst cases of hyperinflation in world history.jpg| i) Inflation in India, China and major economies in 2016l <br/> ii) The worst cases of hyperinflation in world history. <br/> [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-SOON-VENEZUELA-WILL-FACE-INFLATION-132-TIMES-17102016010023 ''The Times of India'']|frame|500px]] | ||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

| Line 9: | Line 10: | ||

[[Category: Economy-Industry-Resources |I]] | [[Category: Economy-Industry-Resources |I]] | ||

| − | =Price rise (Jan 2010-July 2014 | + | =Measuring inflation: Wholesale Price Index (WPI) and Consumer Price Index (CPI)= |

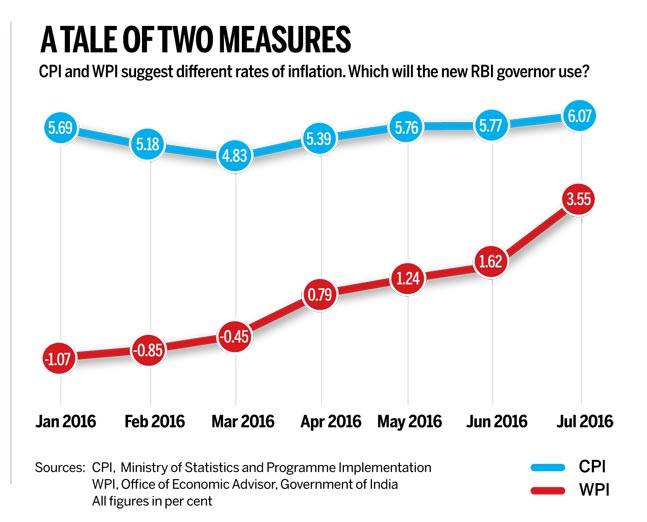

| + | [[File: Inflation , India Today , September 1,2016 .jpg| Inflation , India Today , September 1,2016 |frame|500px]] | ||

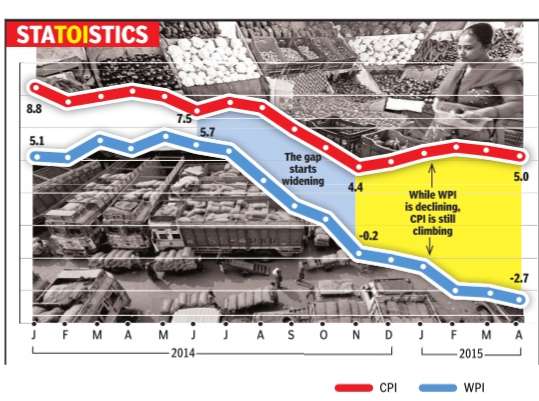

| + | [[File: Wholesale Price Index (WPI) and Consumer Price Index (CPI) 2014, 2015.jpg| Wholesale Price Index (WPI) and Consumer Price Index (CPI): 2014, 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=STATOISTICS--08062015008009 ''The Times of India''], Jun 08 2015 |frame|500px]] | ||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=STATOISTICS--08062015008009 ''The Times of India''], Jun 08 2015 | ||

| + | |||

| + | The Wholesale Price Index (WPI) and Consumer Price Index (CPI) are two ways of measuring inflation. Because of different constituents and weights for them, the inflation rates measured by both indices are often different. What is noticeable in recent months is that the two indices are showing divergent trends. The CPI indicates that there has been a rise in prices, while the WPI suggests that prices have fallen.One reason for this could be that food prices, which constitute a much larger part of the CPI, are up significantly over the last year.SOURCE: MOSPI, Office of the Economic Adviser; Research: Atul Thakur; Graphic: Asheeran Punjabi | ||

| + | |||

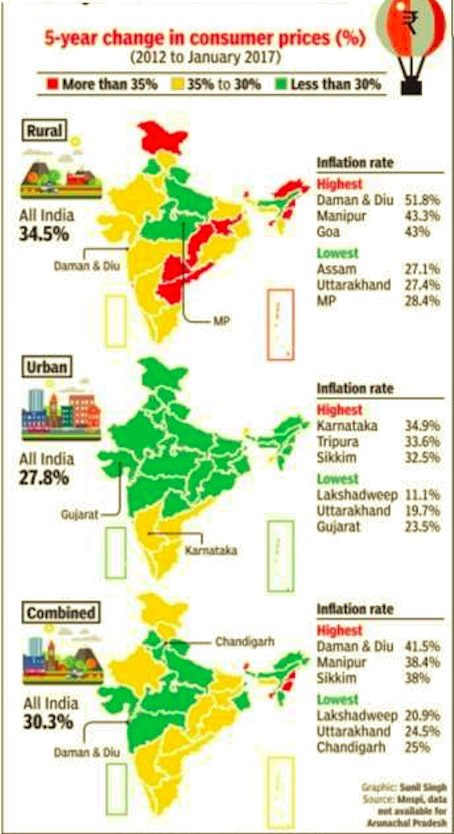

| + | ==Why all-India inflation is misleading== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-Why-all-India-inflation-is-misleading-to-16022017009038 The Times of India], Feb 16 2017 | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Change in consumer prices, 2012-17, rural-urban and state-wise'' | ||

| + | |||

| + | [[File: Change in consumer prices, 2012-17, rural-urban and state-wise.jpg|Change in consumer prices, 2012-17, rural-urban and state-wise; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-Why-all-India-inflation-is-misleading-to-16022017009038 The Times of India], Feb 16 2017|frame|500px]] | ||

| + | |||

| + | Every month the government releases national inflation data that is widely publicised and analysed. What goes unnoticed is the data on state-wise inflation, which is far closer to price rise (or fall) families have to live with. As the charts below show, some states have double the rate of inflation than others. Over the past five years, rural consumers had to live with a higher rate of inflation than urban Indians | ||

| + | |||

| + | =Food inflation= | ||

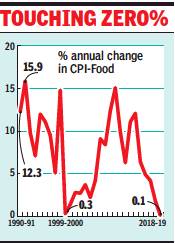

| + | ==1990-2019== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F04%2F14&entity=Ar00118&sk=A8BEDA7F&mode=text Surojit Gupta, Food inflation falls to lowest level since 1991, April 14, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Food inflation in India- 1990-2019.jpg|Food inflation in India: 1990-2019 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F04%2F14&entity=Ar00118&sk=A8BEDA7F&mode=text Surojit Gupta, Food inflation falls to lowest level since 1991, April 14, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | ''Excess Supply, Low Demand Key Factors: Experts'' | ||

| + | |||

| + | Average food prices in 2018-19 were almost the same as they were in 2017-18 — a phenomenon not seen for at least 27 years. An analysis by credit rating agency Crisil shows food inflation measured by the consumer price index rose only 0.1% in 2018-19. The last time annual food inflation had fallen below 1% was in 1999-2000. | ||

| + | |||

| + | Economists attribute low food prices to a string of factors, including bumper crop, low demand, low global prices, and muted impact of increased minimum support prices (MSP). Low and stable food prices are good for everybody except farmers, unless it is accompanied by increase in productivity. | ||

| + | |||

| + | “I would attribute it to two factors — above the trend growth in farm produce in the last 3-4 years, and favourable global food prices,” says D K Joshi, chief economist with Crisil. | ||

| + | |||

| + | |||

| + | ''' ‘Food inflation may move up, depending on status of monsoon’ ''' | ||

| + | |||

| + | According to Joshi, impact of increase in minimum support prices has been muted so far, mainly due to low market prices for most crops. “But going forward food inflation will move up and a lot will depend on the status of monsoon,” he said. | ||

| + | |||

| + | “The consistent downward surprise in food inflation has been a recurring feature in the last couple of years. It’s a combination of factors like better supply management, more production, low increase in procurement prices and shift in demand,” said Soumya Kanti Ghosh, group chief economic advisor at State Bank of India. “Demand shift could also be attributed to people spending less on food and more on services,” he said. | ||

| + | |||

| + | What does this mean for farmers who have been agitating all over the country for better return on their produce? Madan Sabnavis, chief economist at Care Ratings says the price levels are unsustainable and will rise in the months ahead. “It is a reflection of the fact that farmer has got lower income for their produce. There has been excess supplies in some segments like pulses, sugar and vegetables which have kept prices down,” he said. | ||

| + | |||

| + | Pronab Sen, former chief statistician of the country, doesn’t think that the low levels of food inflation could be linked to better inflation management and supplies. “It has nothing to do with surplus food supplies or better management. As I see it is likely that post-demonetisation the poor have no money and that is impacting demand which is showing up in the data. The way prices have collapsed cannot be from the supply side only,” said Sen. | ||

| + | |||

| + | To make the old and new data compatible, the Crisil study compared the food component of the consumer price index introduced since 2011-12 with the same component of consumer price index for industrial workers for the years before 2011-12. | ||

| + | |||

| + | To make the old and new data compatible, the Crisil study compared the food component of the consumer price index introduced since 2011-12 with the same component of consumer price index for industrial workers for years before 2011-12. | ||

| + | |||

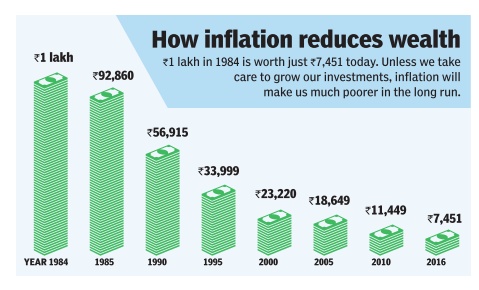

| + | =Impact of Inflation on wealth= | ||

| + | ==1984-2016== | ||

| + | [[File: How inflation eroded wealth in India, 1984- 2016.jpg|How inflation eroded wealth in India, 1984- 2016; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=13_03_2017_016_021_009&type=P&artUrl=MONEY-MYSTERIES-The-attack-of-the-inflation-monster-13032017016021&eid=31808 The Times of India], March 13, 2017|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''How inflation eroded wealth in India, 1984- 2016'' | ||

| + | |||

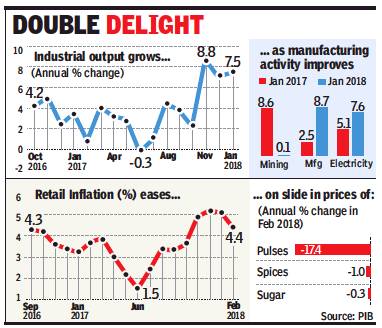

| + | =Retail inflation= | ||

| + | ==2016, Sep- 2018, Feb== | ||

| + | [[File: Industrial output, October 2016-June 2018; Manufacturing activity, January 2017-January 2018; Retail inflation, September 2016-February 2018; annual % change in prices of pulses, spices and sugar, as in February 2018.jpg|i) Industrial output, October 2016-June 2018; <br/> ii) Manufacturing activity, January 2017-January 2018; <br/> iii) Retail inflation, September 2016-February 2018; <br/> iv) annual % change in prices of pulses, spices and sugar, as in February 2018 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F03%2F13&entity=Ar02117&sk=D95700AF&mode=text March 13, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''i) Industrial output, October 2016-June 2018; <br/> ii) Manufacturing activity, January 2017-January 2018; <br/> iii) Retail inflation, September 2016-February 2018; <br/> iv) annual % change in prices of pulses, spices and sugar, as in February 2018'' | ||

| + | |||

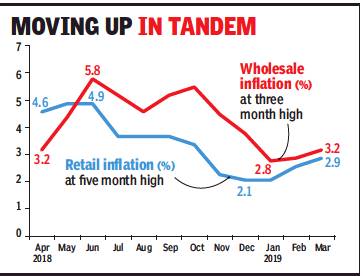

| + | ==2018-2019 Mar== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F04%2F16&entity=Ar01907&sk=E91FDE81&mode=text WPI inflation hits 3-month high in March on costlier food, fuel, April 16, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Retail and WPI inflation, 2018-2019 March.jpg|Retail and WPI inflation, 2018-2019 March <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F04%2F16&entity=Ar01907&sk=E91FDE81&mode=text WPI inflation hits 3-month high in March on costlier food, fuel, April 16, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | Annual wholesale price inflation (WPI) jumped in March to its highest level in three months on the back of a spurt in prices of food and fuel, posing a fresh challenge for policymakers to remain watchful on the price front. | ||

| + | |||

| + | Official data released on Monday showed inflation, as measured by the wholesale price index, rose an annual 3.2% in March, higher than previous month’s 2.9% and above 2.7% posted in the same month a year earlier . | ||

| + | |||

| + | “Like previous month, once again higher food inflation — in combination with fuel and power — provided impetus to the wholesale inflation. As a result, it inched up to 3.2% in March 2019 as compared to 2.9% previous month,” said Sunil Kumar Sinha, principal economist, India Ratings and Research. | ||

| + | |||

| + | “The bigger push, however, came from food articles where several items namely wheat, jowar, bajra, maize, barley have been witnessing double-digit or near double-digit inflation since November 2018. Pulses also recorded second consecutive month of double-digit inflation in March 2019. Within pulses, Arhar and moong have now witnessed four months of consecutive double-digit inflation,” said Sinha. | ||

| + | |||

| + | He said a fresh interest rate cut by the RBI would largely depend on how the monsoon pans out in the months ahead. The WPI data showed food prices rose an annual 5.7% in March, picking up pace from previous month’s 4.3% increase. | ||

| + | |||

| + | Prices of vegetables rose 28% compared to previous month’s 6.8%. Onion prices contracted 31.3% in March. | ||

| + | |||

| + | Fuel and power prices increased 5.4% in March, accelerating from previous month’s 2.2% rise. “We see headline CPI inflation averaging approximately 3.8% for FY20 (3.4% in FY19), but do reckon several uncertainties that cloud the outlook, namely monsoons, crude prices, global volatility, stillhigh core inflation and effective fiscal stance,” said Madhavi Arora, economist at Edelweiss Securities. “We are in consonance with the RBI on nearterm inflation dynamics and see another 25bps cut in first half of FY20, most possibly in June itself, especially amid current global goldilock situation. The bar for further cuts will be a much higher and will be data-dependent. We see upside risks to RBI’s inflation trajectory in latter part of FY20 and will closely watch out for the evolution of inflation amid various domestic and global idiosyncrasies and fiscal fragilities,” Arora added. | ||

| + | |||

| + | =Wholesale Price Index (WPI)= | ||

| + | ==1975-2015== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Wholesale-inflation-lowest-since-76-15082015031009 ''The Times of India''], Aug 15 2015 | ||

| + | |||

| + | ''' Wholesale inflation lowest since '76 ''' | ||

| + | |||

| + | '' Falls for 9th month in a row to -4.1%, longest negative stretch since '75 '' | ||

| + | |||

| + | Wholesale prices plunged for the ninth consecutive month in July on the back of a decline in food and fuel prices, raising prospects of a cut in interest rates to give a push to growth. This was the lowest level of the inflation based on wholesale price index (WPI) since 1976 and, according to economists, is the longest stretch of negative wholesale prices in the country since 1975.WPI inflation was in negative zone for 12 months between July 1975 and June 1976. | ||

| + | Data released by the commerce ministry showed the wholesale inflation fell 4.05% in July compared to a decline of 2.40% for the previous month and 5.41% during the corresponding month of the previous year. | ||

| + | |||

| + | The sharp dip in WPI comes close on the heels of the significant moderation in retail inflation in July and together the two data sets have fuelled expectations of a cut in interest rates. | ||

| + | |||

| + | Food inflation fell 1.16% year-on-year in July , while vegetable prices fell 24.52% during the month. The price of pulses continued to remain a worry as it rose 35.75% in July . | ||

| + | |||

| + | India Inc stepped up its call for a reduction in interest rates, citing sharp decline in both WPI and CPI inflation data.“The distinct downturn in both retail and headline inflation and soft inflationary scenario makes a strong case for RBI to resume its accommodative policy stance,“ CII said. | ||

| + | |||

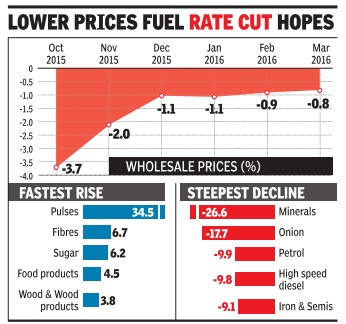

| + | ==Oct. 2015- Mar. 2016: steady decline== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Wholesale-prices-contract-for-17th-month-in-a-19042016020028 ''The Times of India''], Apr 19 2016 | ||

| + | [[File: Wholesale prices, fastest rate and steepest rate, item-wise, October 2015-March 2016.jpg|Wholesale prices, fastest rate and steepest rate, item-wise, October 2015-March 2016; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Wholesale-prices-contract-for-17th-month-in-a-19042016020028 ''The Times of India''], April 19, 2016|frame|500px]] | ||

| + | |||

| + | '''Wholesale prices contract for 17th month in a row''' | ||

| + | | ||

| + | Wholesale prices contracted for the 17th consecutive month in March on the back of sliding crude oil and manufactured product prices, adding to expectations of further interest rate cuts in the months ahead. | ||

| + | |||

| + | Data released by the commerce and industry ministry showed the annual rate of inflation, based on the wholesale price index, stood at -0.85% in March compared to -0.91% for the previous month and -2.33% during the corresponding month of the previous year. | ||

| + | |||

| + | Food inflation rose to 3.7% in March 2016 from 3.4% in February 2016 as prices for cereals, milk, eggs, meat & fish and vegetables firmed up. Price of pulses remained a concern, rising 34.4% in March 2016 but the pace of increase was slower than the previous month. Onion prices fell 17.7% in March compared to 13.2% in February . | ||

| + | |||

| + | “Since the prices of primary articles and manufac turing products are increasing, though marginally , it may pose a threat for WPI inflation in the upcoming months. In recent times, fuel prices have been easing, which may help to keep the inflation rates in the negative territory ,“ said Madan Sabnavis, chief economist at Care Ratings. | ||

| + | |||

| + | “The base effect may also wear off as the year progresses and we do expect WPI inflation to enter the positive zone in the next couple of month. However, this would not be a concern,“ Sabnavis added. | ||

| + | |||

| + | The widely watched reta il inflation slowed in March to a six-month low of 4.83% from a year earlier, stoking expectations of a reduction in interest rates. | ||

| + | |||

| + | RBI reduced interest rates by 25 basis points earlier this month and promised to ease rates in the months ahead if inflation remained within the central bank's comfort zone. Economists said they expect inflation to stay benign for now. | ||

| + | |||

| + | “After easing for several consecutive months, prices of pulses have hardened in the first half of April 2016.Moreover, prices of certain vegetables have risen in the last fortnight in line with seasonal trends during the summer months. However, the recent decline in prices of onions following the harvest is likely to offer some relief.While the trajectory of crude oil prices remains crucial, at present we expect WPI inflation to print in a narrow range of +0.5% in Q1 FY2017,“ said Aditi Nayar, senior economist at ratings agency ICRA. | ||

| + | |||

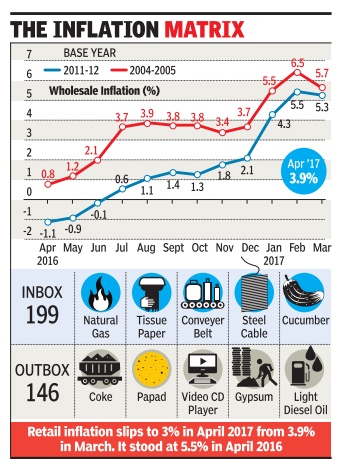

| + | ==Base year shifted to 2011-12; food index added== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=WPI-gets-revised-base-year-new-food-index-13052017025026 WPI gets revised base year, new food index, May 13, 2017: The Times of India] | ||

| + | |||

| + | [[File: Wholesale inflation, April 2016-March 2017, with base year 2011-12 and 2004-05.jpg|Wholesale inflation, April 2016-March 2017, with base year 2011-12 and 2004-05; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=WPI-gets-revised-base-year-new-food-index-13052017025026 WPI gets revised base year, new food index, May 13, 2017: The Times of India] |frame|500px]] | ||

| + | |||

| + | The government revised the wholesale price index (WPI) by shifting to a new base year of 2011-12 from 2004-05 and added a new WPI food index to capture the rate of inflation in food items. Revision of macroeconomic data is undertaken to reflect changes in the economy . The WPI series had undergone six revisions in the past. Apart from a new base year, the revision also includes change in the basket of commodities and assigning of new weights. | ||

| + | |||

| + | Under the revamped data series, the number of items have gone up to 697 from 676.The data now has 199 new items and 146 items have been deleted and has quotations from 8,331 sources compared with 5.482 in the old series. In the new WPI series, prices used for compilation do not include indirect taxes in order to remove the impact of fiscal policy. This is in line with international practices and moves the WPI closer to the producer price index. | ||

| + | |||

| + | Seasonality of fruits and vegetables has been updated to account for more months as these are now available for longer duration. The government has also set up a technical review committee, which will ensure that the product mix keeps pace with changing structure of the economy. | ||

| + | |||

| + | Under primary articles, new vegetables and fruits such as radish, carrot, cucumber, bitter gourd, mosambi, pomegranate, jack fruit, pear have been added. Around 173 new items have been added under the manufactured products category, while 135 items have been dropped. The new WPI food index will be compi led by combining food articles under primary articles and food products under manufactured products. Retail inflation slowed to its lowest level in five years in April, raising expectations of an interest rate cut by the RBI. Inflation as measured by CPI rose 3% in April, slower than previous month's 3.9%. | ||

| + | |||

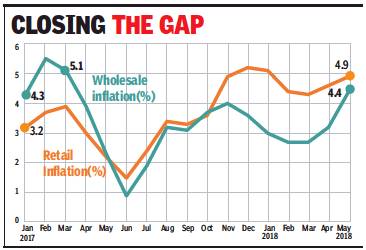

| + | ==2017-18== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F15&entity=Ar02202&sk=CFAE5F1A&mode=text June 15, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: Wholesale and retail inflation in India, 2017-18.jpg|Wholesale and retail inflation in India, 2017-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F15&entity=Ar02202&sk=CFAE5F1A&mode=text June 15, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Inflation based on wholesale prices shot up to a 14-month high of 4.4% in May on increasing prices of petrol and diesel, prompting industry to demand action from policymakers to keep fuel prices under check. | ||

| + | |||

| + | The Wholesale Price Index (WPI) based inflation stood at 3.2% in April and 2.3% in May last year. According to government data released on Thursday, inflation in food articles was at 1.6% in May 2018, as against 0.9% in the preceding month. | ||

| + | |||

| + | Inflation in ‘fuel and power’ basket rose sharply to 11.2% in May from 7.9% in April as prices of domestic fuel increased in line with rising global crude oil rates. Inflation in vegetables climbed to 2.5% in May, with potato inflation at a peak of 81.9%. Price rise in fruits was in double digits at 15.4%, while pulses saw a deflation of 21.1%. May inflation at 4.4% was a 14-month peak. The previous high was in March 2017, when WPI inflation stood at 5.1%. | ||

| + | |||

| + | Industry chamber Assocham called for government action to tame fuel price rise, saying increasing prices of petrol and diesel may significantly impact import bills, which may subsequently have an impact on exchange rates. “Besides, it might also negatively impact input prices for the industry which has already started feeling the pressure on its profitability,” Assocham secretary general D S Rawat said. | ||

| + | |||

| + | Icra principal economist Aditi Nayar said core WPI inflation rose sharply to 4.4% in May from 3.6% in the previous month, with a rise in 15 of the sub-indices. This reflects the pass through of higher input costs, and a weaker rupee. “The WPI inflation is expected to harden by up to 0.8% before easing somewhat in the July-September quarter. Key factors that would influence the inflation trajectory include the level at which global crude oil prices stabilise and the extent to which they are transmitted to domestic fuel prices, the trend in the monsoon dispersion and the extent of change in MSPs,” Nayar said. The WPI inflation for March has been revised upwards to 2.7% from the provisional estimate of 2.5%. | ||

| + | |||

| + | In its second monetary policy review for the fiscal, RBI hiked interest rate by 0.25% due to growing concerns about inflation stoked by rising global crude prices and domestic price hikes. | ||

| + | |||

| + | ==2018, Dec== | ||

| + | [https://timesofindia.indiatimes.com/business/wholesale-inflation-eases-to-3-8-courtesy-food-prices/articleshow/67619373.cms January 21, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: WPI inflation in December 2018.jpg|WPI inflation in December 2018 <br/> From: [https://timesofindia.indiatimes.com/business/wholesale-inflation-eases-to-3-8-courtesy-food-prices/articleshow/67619373.cms January 21, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

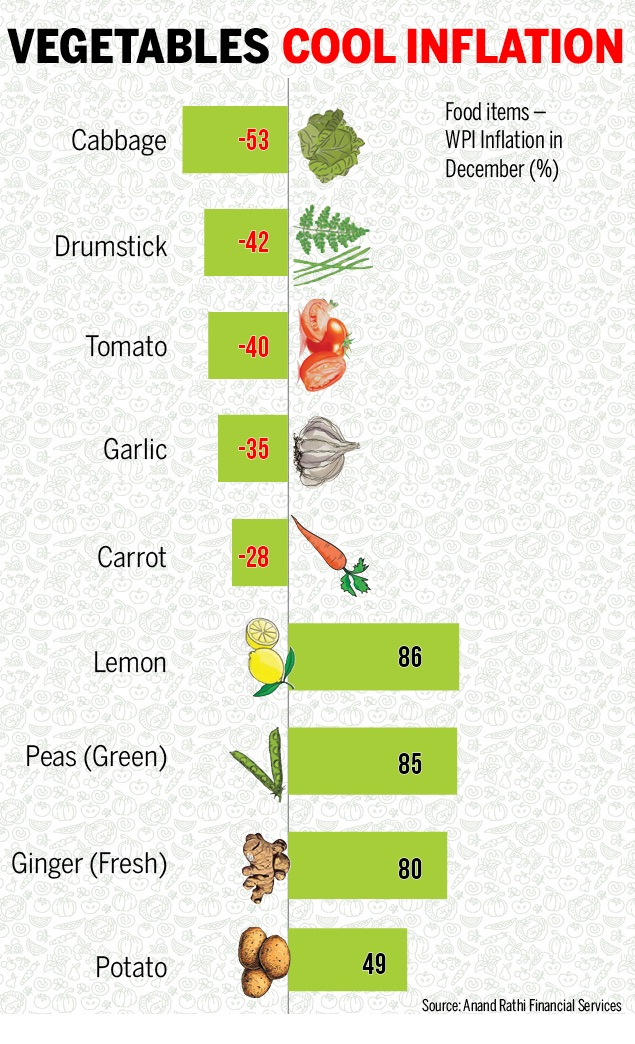

| + | '''See graphic''': | ||

| + | |||

| + | ''WPI inflation in December 2018'' | ||

| + | |||

| + | Wholesale price index inflation fell faster than consumer price index inflation in December 2018, edging down to 3.8 per cent on the back of dip in food prices. Within food, vegetable prices registered the lowest inflation. Eight of the top 10 that registered price deflation were in the food category. While cabbage price inflation saw the steepest fall, lemon price recorded the highest increase in inflation. | ||

| + | |||

| + | =Price rise: Jan 2010-July 2014= | ||

''' Pricey Places ''' | ''' Pricey Places ''' | ||

| Line 17: | Line 182: | ||

Between Jan 2010-July 2014, India has seen retail prices rise 35.6% on average, equivalent to an annual rate of about 7%. But different states have witnessed varying levels of price rise. | Between Jan 2010-July 2014, India has seen retail prices rise 35.6% on average, equivalent to an annual rate of about 7%. But different states have witnessed varying levels of price rise. | ||

| − | |||

| − | |||

| − | |||

| − | + | =Consumer Price Index (CPI)= | |

| + | ==Measuring price rise: CPI’s consumption basket== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Low-weightage-to-pulses-in-CPI-helped-check-14092015010034 ''The Times of India''], Sep 14 2015 | ||

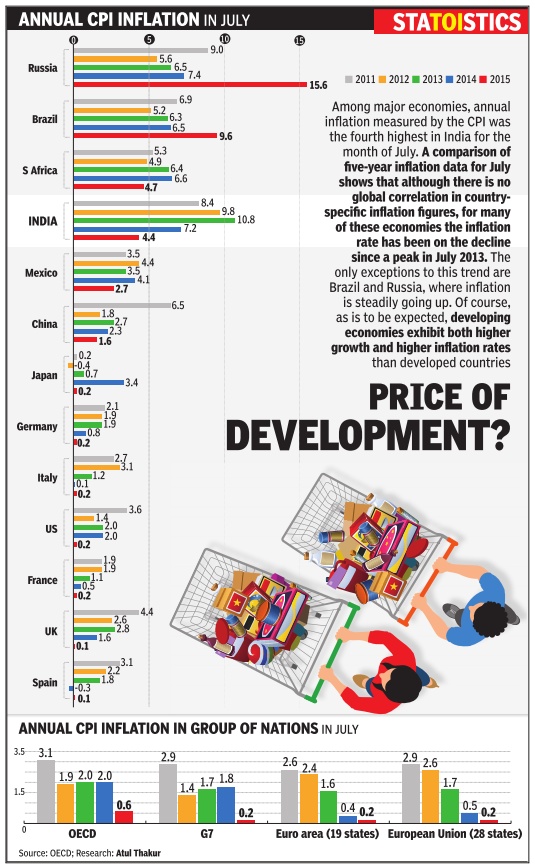

| + | [[File: Annual CPI inflation, July 2015, India and the world.jpg|India and the world: Inflation in July 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=23_09_2015_013_014_002&type=P&artUrl=STATOISTICS-PRICE-OF-DEVELOPMENT-23092015013014&eid=31808 ''The Times of India'']|frame|500px]] | ||

| + | ''' ''Low weightage to pulses in CPI helped check price rise'' ''' | ||

| + | | ||

| + | '''How is price rise measured?''' | ||

| + | |||

| + | There are two widely accepted ways of measuring price rise or inflation: the wholesale price index (WPI) and the consumer price index (CPI). The WPI is designed to measure trends of wholesale prices of goods. In short, it tracks the farm and factory gate price of commodities before they reach the retail market. Services are not included in the WPI. The CPI, on the other hand, measures the general level of retail prices of goods and services consumed by households. From a consumer's point of view, it is the CPI that is more meaningful. | ||

| + | |||

| + | '''What commodities are included in the WPI and what is the base year?''' | ||

| + | |||

| + | The price index is measured with respect to a particular year called the base year. The base year chosen should be one in which prices were normal and not affected by some unusual natural calamity or international crisis. For the measurement of the current WPI in India, 2004-05 is the base year while for the CPI, 2012 is the base year. The WPI aims to capture all commodity trans actions carried out in the domestic market and hence it includes most of them. Weights are assigned to different commodities on the basis of the proportion of that commodity's transactions to all wholesale transactions in the economy . | ||

| + | |||

| + | '''How is the CPI's consumption basket made?''' | ||

| + | |||

| + | The consumption basket of the CPI is meant to represent all households in the country. For instance, the new CPI index includes all items which more than 75% of the country's households have reportedly consumed.Weights are assigned to various CPI commodities on the basis of average monthly consumption expenditure on these items discovered as part of a survey. | ||

| + | |||

| + | '''Why do the CPI and WPI show divergent inflation trends?''' | ||

| + | |||

| + | According to the latest data, inflation measured at the wholesale level was -4.05% for July 2015 when compared to July 2014. For the same period, the combined inflation rate for rural and urban consumers was 7.39%. This anomaly is attributed to several reasons. The most important is the weight of various commodities. For instance, the highest weight in CPI is given to food items, which comprise about 54.2%.In the WPI, the corresponding weight is just 14.3% and hence the high food price inflation that is troubling the country affects this index much less. Apart from this there is a tendency to counter the increase in the cost of raw materials by giving below normal wage increases to workers. In that case, the WPI will be low, but not the CPI. | ||

| + | |||

| + | '''Why are soaring pulse prices not reflected in the CPI?''' | ||

| + | |||

| + | The CPI is based on the actual consumption pattern of households and its composition is revised from time to time, with weights of various commodities changing according to their consumption. If prices of pulses continue to rise rapidly , their weight in the index will also go up unless the price increase is offset by a decline in their consumption. The present CPI food basket, however, gives a higher weight to milk and milk products, vegetables, prepared meals, meat and fish, sugar and spices than to pulses. The low weight for pulses explains why their price increase has only a minor impact on the CPI as a whole. | ||

| + | |||

| + | ===November 2016: CPI data=== | ||

| + | [http://www.thehindubusinessline.com/todays-paper/retail-inflation-at-2year-low/article9425419.ece ''The Hindu’’], December 14, 2016 | ||

| + | |||

| + | '''Retail inflation at 2-year low''' | ||

| + | |||

| + | Retail inflation, measured by consumer price index (CPI), fell to a two-year low in November 2016 at 3.63 per cent, as depressed consumer demand following demonetisation disrupted daily life. | ||

| + | |||

| + | The CPI print, November 2016 — well below the RBI’s five per cent inflation target for March 2017 — has raised hopes of central bank going in for a repo rate cut at its next monetary policy review meeting. | ||

| + | |||

| + | '''Note ban effect''' | ||

| + | |||

| + | The note ban had a telling effect on food articles inflation — 47 per cent weight in CPI —which declined to 2.11 per cent in November from October’s 3.32 per cent. | ||

| + | |||

| + | Food articles inflation in November last year stood at 6.07 per cent. | ||

| + | |||

| + | Overall CPI inflation stood at 5.41 per cent in November in 2015, and at 4.20 per cent in October 2016 | ||

| + | |||

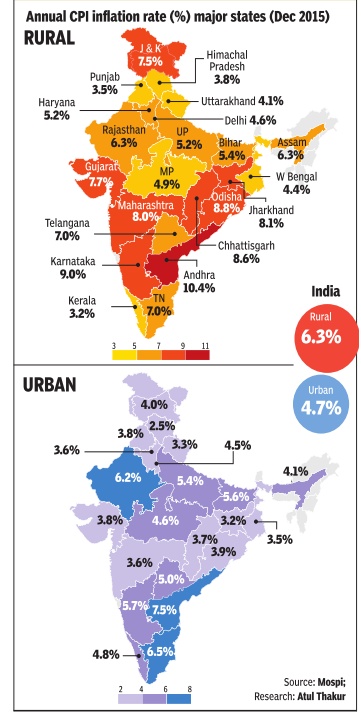

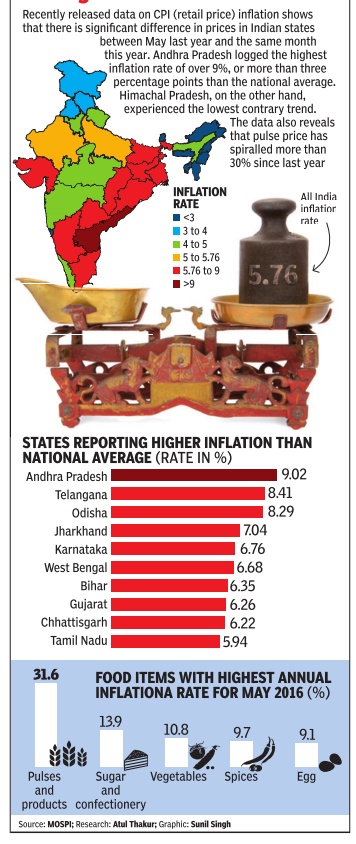

| + | =State-wise data on inflation= | ||

| + | ==Dec. 2015: Wide variations across states== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-THE-LIE-CALLED-ALL-INDIA-INFLATION-02022016012020 ''The Times of India''] Feb 02 2016 | ||

| + | [[File: infla.jpg|Annual CPI Inflation rate (%) major states (Dec 2015), Rural and Urban|frame|500px]] | ||

| + | |||

| + | Inflation in December was 4.7% for urban India and 6.3% for rural India. But this all-India average figure is of little use to the common man. We don't really live in India, we live in one of its states.And inflation rate varies hugely across states. As hugely as 7.5% in urban Andhra Pradesh and only 2.5% in urban Himachal Pradesh--that's a gap of 5 percentage point. Difference between highest and lowest rural inflation was even greater: 6.6% | ||

| + | |||

| + | |||

| + | ==State-wise inflation: 2015-16== | ||

| + | [[File: Food inflation. Rise in the price of potatoes, 2015-16, and tomatoes, 2014-16.jpg| Food inflation. Rise in the price of potatoes, 2015-16, and tomatoes, 2014-16; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-In-uneven-price-rise-among-states-Andhra-17062016009026 ''The Times of India''], June 17, 2016|frame|500px]] | ||

| + | |||

| + | [[File: State-wise inflation, 2015-16.jpg| State-wise inflation, 2015-16; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-In-uneven-price-rise-among-states-Andhra-17062016009026 ''The Times of India''], June 17, 2016|frame|500px]] | ||

| + | |||

| + | '''See graphics''' | ||

| + | |||

| + | Food inflation. Rise in the price of potatoes, 2015-16, and tomatoes, 2014-16 | ||

| + | |||

| + | State-wise inflation, 2015-16 | ||

| + | |||

| + | ==2018, Aug: Bengal, Assam, J&K 4 times higher than Rajasthan== | ||

| + | [[File: Most and least expensive states in India, August 2018.jpg|Most and least expensive states in India, August 2018 <br/> From: [https://timesofindia.indiatimes.com/business/inflation-states-with-the-highest-and-lowest-prices/articleshow/65819126.cms September 15, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: High and low inflation states in 2018, August.jpg|High and low inflation states in 2018, August <br/> From: [https://timesofindia.indiatimes.com/business/inflation-states-with-the-highest-and-lowest-prices/articleshow/65819126.cms September 15, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | ''Most and least expensive states in India, August 2018'' | ||

| + | |||

| + | ''High and low inflation states in 2018, August'' | ||

| + | |||

| + | ==2018== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/six-unseen-faces-of-inflation/articleshow/67805488.cms February 2, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: 2018- State-wise data on inflation- Overall inflation and vegetables.jpg|2018- State-wise data on inflation- Overall inflation and vegetables <br/> From: [https://timesofindia.indiatimes.com/business/india-business/six-unseen-faces-of-inflation/articleshow/67805488.cms February 2, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: 2018- State-wise data on inflation- Recreation and pulses.jpg|2018- State-wise data on inflation- Recreation and pulses <br/> From: [https://timesofindia.indiatimes.com/business/india-business/six-unseen-faces-of-inflation/articleshow/67805488.cms February 2, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

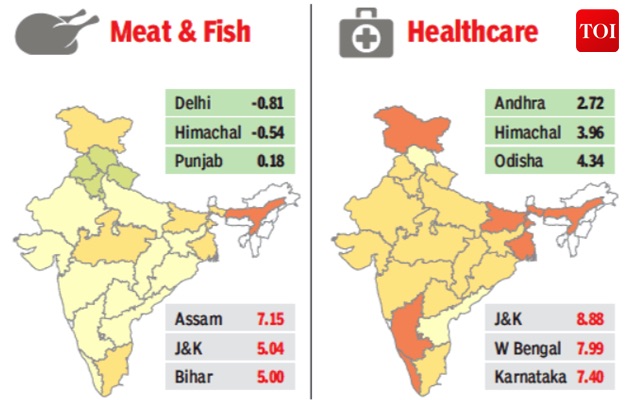

| + | [[File: 2018- State-wise data on inflation- Meat and fish and healthcare.jpg|2018- State-wise data on inflation- Meat and fish and healthcare <br/> From: [https://timesofindia.indiatimes.com/business/india-business/six-unseen-faces-of-inflation/articleshow/67805488.cms February 2, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | ''2018- State-wise data on inflation- Overall inflation and vegetables'' | ||

| + | |||

| + | ''2018- State-wise data on inflation- Recreation and pulses'' | ||

| + | |||

| + | ''2018- State-wise data on inflation- Meat and fish and healthcare'' | ||

| + | |||

| + | |||

| + | The rate of inflation you read about every month is how the average of thousands of prices moves in that month versus the previous month or past year. But like any average, all-India, all-product inflation hides more than it reveals. This is how widely inflation rates of five product groups of common consumption varied across states in 2018 over 2017 | ||

| + | |||

| + | =See also= | ||

| + | [[Demonetisation of high value currency- 1946, 1978: India]] | ||

| + | |||

| + | [[Demonetisation of high value currency- 2016: India]] | ||

Revision as of 21:07, 16 April 2019

ii) The worst cases of hyperinflation in world history.

The Times of India

This is a collection of articles archived for the excellence of their content. |

Contents |

Measuring inflation: Wholesale Price Index (WPI) and Consumer Price Index (CPI)

The Times of India, Jun 08 2015

The Wholesale Price Index (WPI) and Consumer Price Index (CPI) are two ways of measuring inflation. Because of different constituents and weights for them, the inflation rates measured by both indices are often different. What is noticeable in recent months is that the two indices are showing divergent trends. The CPI indicates that there has been a rise in prices, while the WPI suggests that prices have fallen.One reason for this could be that food prices, which constitute a much larger part of the CPI, are up significantly over the last year.SOURCE: MOSPI, Office of the Economic Adviser; Research: Atul Thakur; Graphic: Asheeran Punjabi

Why all-India inflation is misleading

The Times of India, Feb 16 2017

See graphic:

Change in consumer prices, 2012-17, rural-urban and state-wise

Every month the government releases national inflation data that is widely publicised and analysed. What goes unnoticed is the data on state-wise inflation, which is far closer to price rise (or fall) families have to live with. As the charts below show, some states have double the rate of inflation than others. Over the past five years, rural consumers had to live with a higher rate of inflation than urban Indians

Food inflation

1990-2019

Surojit Gupta, Food inflation falls to lowest level since 1991, April 14, 2019: The Times of India

From: Surojit Gupta, Food inflation falls to lowest level since 1991, April 14, 2019: The Times of India

Excess Supply, Low Demand Key Factors: Experts

Average food prices in 2018-19 were almost the same as they were in 2017-18 — a phenomenon not seen for at least 27 years. An analysis by credit rating agency Crisil shows food inflation measured by the consumer price index rose only 0.1% in 2018-19. The last time annual food inflation had fallen below 1% was in 1999-2000.

Economists attribute low food prices to a string of factors, including bumper crop, low demand, low global prices, and muted impact of increased minimum support prices (MSP). Low and stable food prices are good for everybody except farmers, unless it is accompanied by increase in productivity.

“I would attribute it to two factors — above the trend growth in farm produce in the last 3-4 years, and favourable global food prices,” says D K Joshi, chief economist with Crisil.

‘Food inflation may move up, depending on status of monsoon’

According to Joshi, impact of increase in minimum support prices has been muted so far, mainly due to low market prices for most crops. “But going forward food inflation will move up and a lot will depend on the status of monsoon,” he said.

“The consistent downward surprise in food inflation has been a recurring feature in the last couple of years. It’s a combination of factors like better supply management, more production, low increase in procurement prices and shift in demand,” said Soumya Kanti Ghosh, group chief economic advisor at State Bank of India. “Demand shift could also be attributed to people spending less on food and more on services,” he said.

What does this mean for farmers who have been agitating all over the country for better return on their produce? Madan Sabnavis, chief economist at Care Ratings says the price levels are unsustainable and will rise in the months ahead. “It is a reflection of the fact that farmer has got lower income for their produce. There has been excess supplies in some segments like pulses, sugar and vegetables which have kept prices down,” he said.

Pronab Sen, former chief statistician of the country, doesn’t think that the low levels of food inflation could be linked to better inflation management and supplies. “It has nothing to do with surplus food supplies or better management. As I see it is likely that post-demonetisation the poor have no money and that is impacting demand which is showing up in the data. The way prices have collapsed cannot be from the supply side only,” said Sen.

To make the old and new data compatible, the Crisil study compared the food component of the consumer price index introduced since 2011-12 with the same component of consumer price index for industrial workers for the years before 2011-12.

To make the old and new data compatible, the Crisil study compared the food component of the consumer price index introduced since 2011-12 with the same component of consumer price index for industrial workers for years before 2011-12.

Impact of Inflation on wealth

1984-2016

See graphic:

How inflation eroded wealth in India, 1984- 2016

Retail inflation

2016, Sep- 2018, Feb

ii) Manufacturing activity, January 2017-January 2018;

iii) Retail inflation, September 2016-February 2018;

iv) annual % change in prices of pulses, spices and sugar, as in February 2018

From: March 13, 2018: The Times of India

See graphic:

i) Industrial output, October 2016-June 2018;

ii) Manufacturing activity, January 2017-January 2018;

iii) Retail inflation, September 2016-February 2018;

iv) annual % change in prices of pulses, spices and sugar, as in February 2018

2018-2019 Mar

WPI inflation hits 3-month high in March on costlier food, fuel, April 16, 2019: The Times of India

From: WPI inflation hits 3-month high in March on costlier food, fuel, April 16, 2019: The Times of India

Annual wholesale price inflation (WPI) jumped in March to its highest level in three months on the back of a spurt in prices of food and fuel, posing a fresh challenge for policymakers to remain watchful on the price front.

Official data released on Monday showed inflation, as measured by the wholesale price index, rose an annual 3.2% in March, higher than previous month’s 2.9% and above 2.7% posted in the same month a year earlier .

“Like previous month, once again higher food inflation — in combination with fuel and power — provided impetus to the wholesale inflation. As a result, it inched up to 3.2% in March 2019 as compared to 2.9% previous month,” said Sunil Kumar Sinha, principal economist, India Ratings and Research.

“The bigger push, however, came from food articles where several items namely wheat, jowar, bajra, maize, barley have been witnessing double-digit or near double-digit inflation since November 2018. Pulses also recorded second consecutive month of double-digit inflation in March 2019. Within pulses, Arhar and moong have now witnessed four months of consecutive double-digit inflation,” said Sinha.

He said a fresh interest rate cut by the RBI would largely depend on how the monsoon pans out in the months ahead. The WPI data showed food prices rose an annual 5.7% in March, picking up pace from previous month’s 4.3% increase.

Prices of vegetables rose 28% compared to previous month’s 6.8%. Onion prices contracted 31.3% in March.

Fuel and power prices increased 5.4% in March, accelerating from previous month’s 2.2% rise. “We see headline CPI inflation averaging approximately 3.8% for FY20 (3.4% in FY19), but do reckon several uncertainties that cloud the outlook, namely monsoons, crude prices, global volatility, stillhigh core inflation and effective fiscal stance,” said Madhavi Arora, economist at Edelweiss Securities. “We are in consonance with the RBI on nearterm inflation dynamics and see another 25bps cut in first half of FY20, most possibly in June itself, especially amid current global goldilock situation. The bar for further cuts will be a much higher and will be data-dependent. We see upside risks to RBI’s inflation trajectory in latter part of FY20 and will closely watch out for the evolution of inflation amid various domestic and global idiosyncrasies and fiscal fragilities,” Arora added.

Wholesale Price Index (WPI)

1975-2015

The Times of India, Aug 15 2015

Wholesale inflation lowest since '76

Falls for 9th month in a row to -4.1%, longest negative stretch since '75

Wholesale prices plunged for the ninth consecutive month in July on the back of a decline in food and fuel prices, raising prospects of a cut in interest rates to give a push to growth. This was the lowest level of the inflation based on wholesale price index (WPI) since 1976 and, according to economists, is the longest stretch of negative wholesale prices in the country since 1975.WPI inflation was in negative zone for 12 months between July 1975 and June 1976. Data released by the commerce ministry showed the wholesale inflation fell 4.05% in July compared to a decline of 2.40% for the previous month and 5.41% during the corresponding month of the previous year.

The sharp dip in WPI comes close on the heels of the significant moderation in retail inflation in July and together the two data sets have fuelled expectations of a cut in interest rates.

Food inflation fell 1.16% year-on-year in July , while vegetable prices fell 24.52% during the month. The price of pulses continued to remain a worry as it rose 35.75% in July .

India Inc stepped up its call for a reduction in interest rates, citing sharp decline in both WPI and CPI inflation data.“The distinct downturn in both retail and headline inflation and soft inflationary scenario makes a strong case for RBI to resume its accommodative policy stance,“ CII said.

Oct. 2015- Mar. 2016: steady decline

The Times of India, Apr 19 2016

Wholesale prices contract for 17th month in a row Wholesale prices contracted for the 17th consecutive month in March on the back of sliding crude oil and manufactured product prices, adding to expectations of further interest rate cuts in the months ahead.

Data released by the commerce and industry ministry showed the annual rate of inflation, based on the wholesale price index, stood at -0.85% in March compared to -0.91% for the previous month and -2.33% during the corresponding month of the previous year.

Food inflation rose to 3.7% in March 2016 from 3.4% in February 2016 as prices for cereals, milk, eggs, meat & fish and vegetables firmed up. Price of pulses remained a concern, rising 34.4% in March 2016 but the pace of increase was slower than the previous month. Onion prices fell 17.7% in March compared to 13.2% in February .

“Since the prices of primary articles and manufac turing products are increasing, though marginally , it may pose a threat for WPI inflation in the upcoming months. In recent times, fuel prices have been easing, which may help to keep the inflation rates in the negative territory ,“ said Madan Sabnavis, chief economist at Care Ratings.

“The base effect may also wear off as the year progresses and we do expect WPI inflation to enter the positive zone in the next couple of month. However, this would not be a concern,“ Sabnavis added.

The widely watched reta il inflation slowed in March to a six-month low of 4.83% from a year earlier, stoking expectations of a reduction in interest rates.

RBI reduced interest rates by 25 basis points earlier this month and promised to ease rates in the months ahead if inflation remained within the central bank's comfort zone. Economists said they expect inflation to stay benign for now.

“After easing for several consecutive months, prices of pulses have hardened in the first half of April 2016.Moreover, prices of certain vegetables have risen in the last fortnight in line with seasonal trends during the summer months. However, the recent decline in prices of onions following the harvest is likely to offer some relief.While the trajectory of crude oil prices remains crucial, at present we expect WPI inflation to print in a narrow range of +0.5% in Q1 FY2017,“ said Aditi Nayar, senior economist at ratings agency ICRA.

Base year shifted to 2011-12; food index added

WPI gets revised base year, new food index, May 13, 2017: The Times of India

The government revised the wholesale price index (WPI) by shifting to a new base year of 2011-12 from 2004-05 and added a new WPI food index to capture the rate of inflation in food items. Revision of macroeconomic data is undertaken to reflect changes in the economy . The WPI series had undergone six revisions in the past. Apart from a new base year, the revision also includes change in the basket of commodities and assigning of new weights.

Under the revamped data series, the number of items have gone up to 697 from 676.The data now has 199 new items and 146 items have been deleted and has quotations from 8,331 sources compared with 5.482 in the old series. In the new WPI series, prices used for compilation do not include indirect taxes in order to remove the impact of fiscal policy. This is in line with international practices and moves the WPI closer to the producer price index.

Seasonality of fruits and vegetables has been updated to account for more months as these are now available for longer duration. The government has also set up a technical review committee, which will ensure that the product mix keeps pace with changing structure of the economy.

Under primary articles, new vegetables and fruits such as radish, carrot, cucumber, bitter gourd, mosambi, pomegranate, jack fruit, pear have been added. Around 173 new items have been added under the manufactured products category, while 135 items have been dropped. The new WPI food index will be compi led by combining food articles under primary articles and food products under manufactured products. Retail inflation slowed to its lowest level in five years in April, raising expectations of an interest rate cut by the RBI. Inflation as measured by CPI rose 3% in April, slower than previous month's 3.9%.

2017-18

June 15, 2018: The Times of India

From: June 15, 2018: The Times of India

Inflation based on wholesale prices shot up to a 14-month high of 4.4% in May on increasing prices of petrol and diesel, prompting industry to demand action from policymakers to keep fuel prices under check.

The Wholesale Price Index (WPI) based inflation stood at 3.2% in April and 2.3% in May last year. According to government data released on Thursday, inflation in food articles was at 1.6% in May 2018, as against 0.9% in the preceding month.

Inflation in ‘fuel and power’ basket rose sharply to 11.2% in May from 7.9% in April as prices of domestic fuel increased in line with rising global crude oil rates. Inflation in vegetables climbed to 2.5% in May, with potato inflation at a peak of 81.9%. Price rise in fruits was in double digits at 15.4%, while pulses saw a deflation of 21.1%. May inflation at 4.4% was a 14-month peak. The previous high was in March 2017, when WPI inflation stood at 5.1%.

Industry chamber Assocham called for government action to tame fuel price rise, saying increasing prices of petrol and diesel may significantly impact import bills, which may subsequently have an impact on exchange rates. “Besides, it might also negatively impact input prices for the industry which has already started feeling the pressure on its profitability,” Assocham secretary general D S Rawat said.

Icra principal economist Aditi Nayar said core WPI inflation rose sharply to 4.4% in May from 3.6% in the previous month, with a rise in 15 of the sub-indices. This reflects the pass through of higher input costs, and a weaker rupee. “The WPI inflation is expected to harden by up to 0.8% before easing somewhat in the July-September quarter. Key factors that would influence the inflation trajectory include the level at which global crude oil prices stabilise and the extent to which they are transmitted to domestic fuel prices, the trend in the monsoon dispersion and the extent of change in MSPs,” Nayar said. The WPI inflation for March has been revised upwards to 2.7% from the provisional estimate of 2.5%.

In its second monetary policy review for the fiscal, RBI hiked interest rate by 0.25% due to growing concerns about inflation stoked by rising global crude prices and domestic price hikes.

2018, Dec

January 21, 2019: The Times of India

From: January 21, 2019: The Times of India

See graphic:

WPI inflation in December 2018

Wholesale price index inflation fell faster than consumer price index inflation in December 2018, edging down to 3.8 per cent on the back of dip in food prices. Within food, vegetable prices registered the lowest inflation. Eight of the top 10 that registered price deflation were in the food category. While cabbage price inflation saw the steepest fall, lemon price recorded the highest increase in inflation.

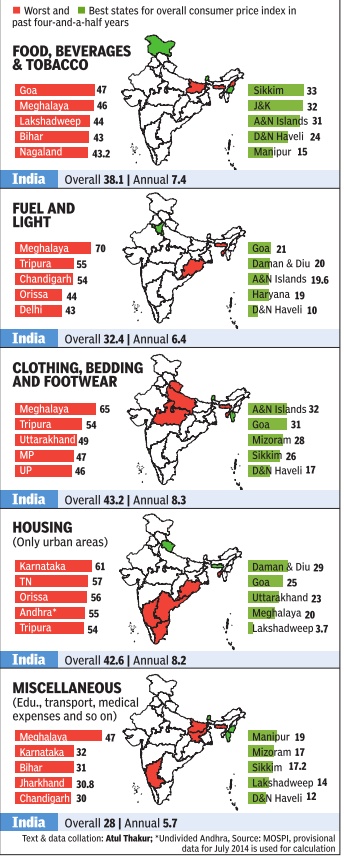

Price rise: Jan 2010-July 2014

Pricey Places

The Times of India Aug 30 2014

Between Jan 2010-July 2014, India has seen retail prices rise 35.6% on average, equivalent to an annual rate of about 7%. But different states have witnessed varying levels of price rise.

Consumer Price Index (CPI)

Measuring price rise: CPI’s consumption basket

The Times of India, Sep 14 2015

Low weightage to pulses in CPI helped check price rise How is price rise measured?

There are two widely accepted ways of measuring price rise or inflation: the wholesale price index (WPI) and the consumer price index (CPI). The WPI is designed to measure trends of wholesale prices of goods. In short, it tracks the farm and factory gate price of commodities before they reach the retail market. Services are not included in the WPI. The CPI, on the other hand, measures the general level of retail prices of goods and services consumed by households. From a consumer's point of view, it is the CPI that is more meaningful.

What commodities are included in the WPI and what is the base year?

The price index is measured with respect to a particular year called the base year. The base year chosen should be one in which prices were normal and not affected by some unusual natural calamity or international crisis. For the measurement of the current WPI in India, 2004-05 is the base year while for the CPI, 2012 is the base year. The WPI aims to capture all commodity trans actions carried out in the domestic market and hence it includes most of them. Weights are assigned to different commodities on the basis of the proportion of that commodity's transactions to all wholesale transactions in the economy .

How is the CPI's consumption basket made?

The consumption basket of the CPI is meant to represent all households in the country. For instance, the new CPI index includes all items which more than 75% of the country's households have reportedly consumed.Weights are assigned to various CPI commodities on the basis of average monthly consumption expenditure on these items discovered as part of a survey.

Why do the CPI and WPI show divergent inflation trends?

According to the latest data, inflation measured at the wholesale level was -4.05% for July 2015 when compared to July 2014. For the same period, the combined inflation rate for rural and urban consumers was 7.39%. This anomaly is attributed to several reasons. The most important is the weight of various commodities. For instance, the highest weight in CPI is given to food items, which comprise about 54.2%.In the WPI, the corresponding weight is just 14.3% and hence the high food price inflation that is troubling the country affects this index much less. Apart from this there is a tendency to counter the increase in the cost of raw materials by giving below normal wage increases to workers. In that case, the WPI will be low, but not the CPI.

Why are soaring pulse prices not reflected in the CPI?

The CPI is based on the actual consumption pattern of households and its composition is revised from time to time, with weights of various commodities changing according to their consumption. If prices of pulses continue to rise rapidly , their weight in the index will also go up unless the price increase is offset by a decline in their consumption. The present CPI food basket, however, gives a higher weight to milk and milk products, vegetables, prepared meals, meat and fish, sugar and spices than to pulses. The low weight for pulses explains why their price increase has only a minor impact on the CPI as a whole.

November 2016: CPI data

The Hindu’’, December 14, 2016

Retail inflation at 2-year low

Retail inflation, measured by consumer price index (CPI), fell to a two-year low in November 2016 at 3.63 per cent, as depressed consumer demand following demonetisation disrupted daily life.

The CPI print, November 2016 — well below the RBI’s five per cent inflation target for March 2017 — has raised hopes of central bank going in for a repo rate cut at its next monetary policy review meeting.

Note ban effect

The note ban had a telling effect on food articles inflation — 47 per cent weight in CPI —which declined to 2.11 per cent in November from October’s 3.32 per cent.

Food articles inflation in November last year stood at 6.07 per cent.

Overall CPI inflation stood at 5.41 per cent in November in 2015, and at 4.20 per cent in October 2016

State-wise data on inflation

Dec. 2015: Wide variations across states

The Times of India Feb 02 2016

Inflation in December was 4.7% for urban India and 6.3% for rural India. But this all-India average figure is of little use to the common man. We don't really live in India, we live in one of its states.And inflation rate varies hugely across states. As hugely as 7.5% in urban Andhra Pradesh and only 2.5% in urban Himachal Pradesh--that's a gap of 5 percentage point. Difference between highest and lowest rural inflation was even greater: 6.6%

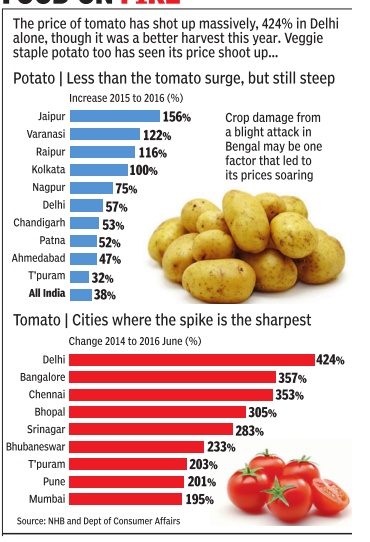

State-wise inflation: 2015-16

See graphics

Food inflation. Rise in the price of potatoes, 2015-16, and tomatoes, 2014-16

State-wise inflation, 2015-16

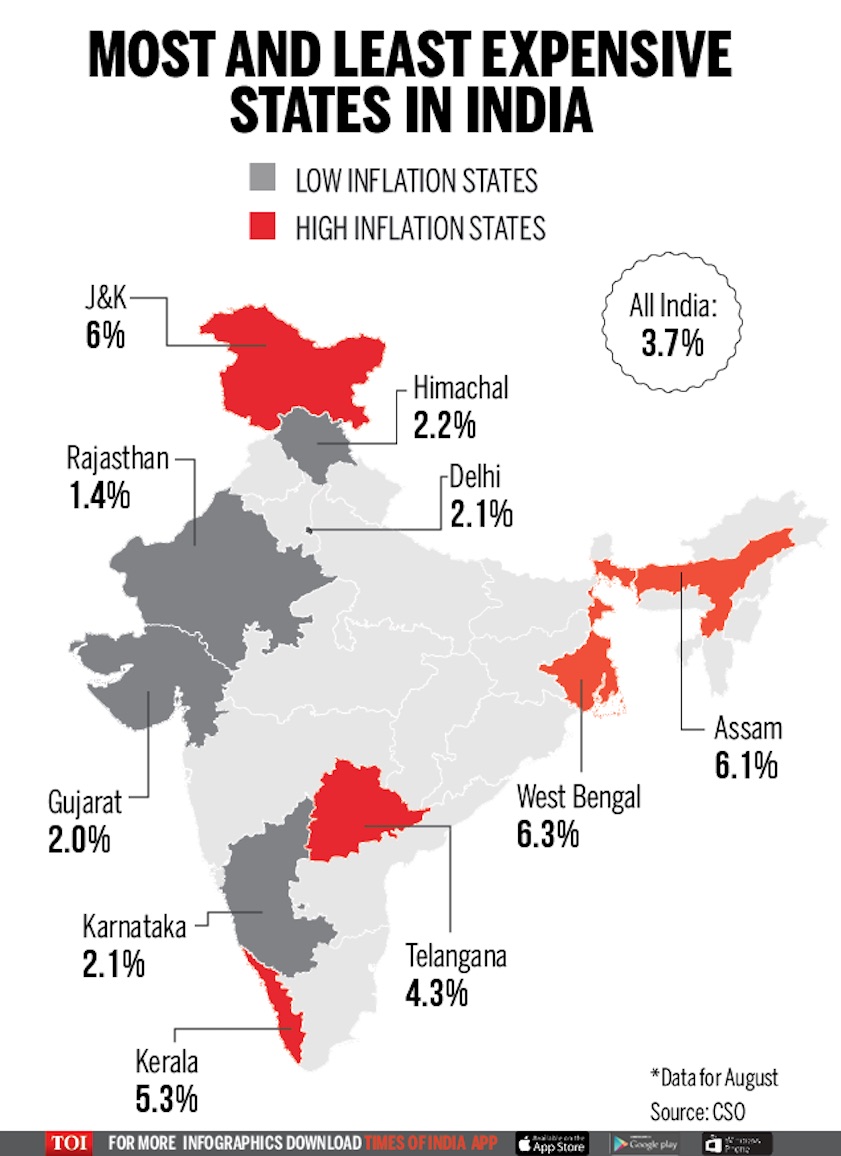

2018, Aug: Bengal, Assam, J&K 4 times higher than Rajasthan

From: September 15, 2018: The Times of India

From: September 15, 2018: The Times of India

See graphics:

Most and least expensive states in India, August 2018

High and low inflation states in 2018, August

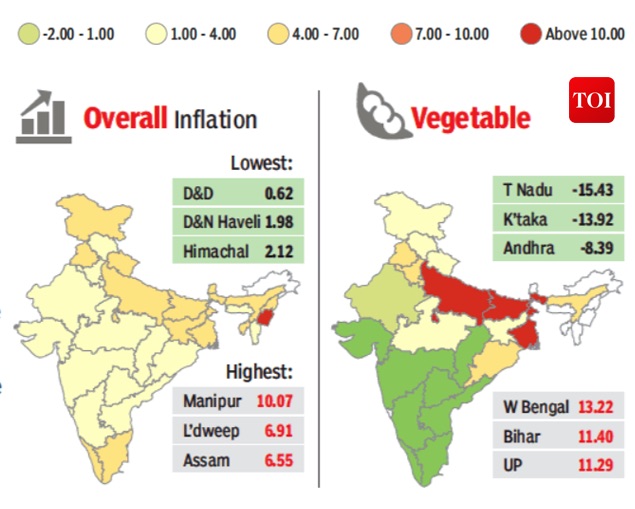

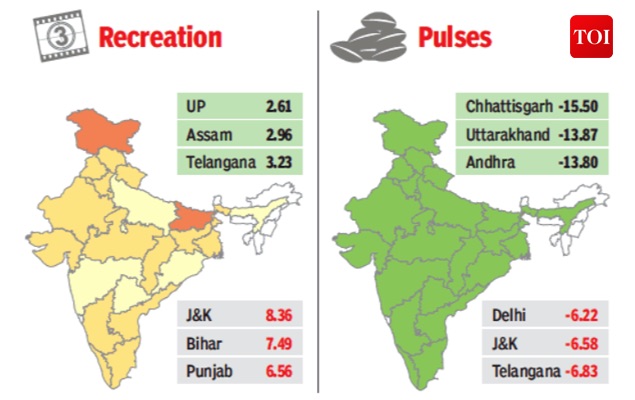

2018

February 2, 2019: The Times of India

From: February 2, 2019: The Times of India

From: February 2, 2019: The Times of India

From: February 2, 2019: The Times of India

See graphics:

2018- State-wise data on inflation- Overall inflation and vegetables

2018- State-wise data on inflation- Recreation and pulses

2018- State-wise data on inflation- Meat and fish and healthcare

The rate of inflation you read about every month is how the average of thousands of prices moves in that month versus the previous month or past year. But like any average, all-India, all-product inflation hides more than it reveals. This is how widely inflation rates of five product groups of common consumption varied across states in 2018 over 2017