Indian money in foreign banks

This is a collection of articles archived for the excellence of their content. |

Amnesties, Indian, to bring back money stashed abroad

1997: Voluntary disclosure of income scheme

The Times of India, Sep 25 2015

Pradeep Thakur

Over 3.5 lakh entities came clean in 1997

The government's black money and foreign assets disclosure window is just six days away from closing but until Wednesday , only 29 declarations worth a little over Rs 2,000 crore have been made, tax officials said.

Officials blamed lack of clarity on some of the issues for the slow response to the compliance scheme that opened on July 1, prompting several high net worth individuals (HNIs) to wait till the last moment. The government expects declarations to gather pace in the last few days since non-disclosure will result in stiff penalties and possible jail term.

This was only 30% in 1997 for individuals and 35% for corporates.

Banks preferred by Indian depositors

Most Indian deposits are with UBS and Credit Suisse

Two big banks have 2/3rd of all Swiss money of Indians

PTI | Jun 20, 2014 The Times of India

It is just two big banks — UBS and Credit Suisse — which appear to be accounting for almost two-third of the total money held by Indians in Swiss banking system, known for their famed secrecy walls.

According to the latest official data disclosed by Switzerland's central banking authority Swiss National Bank (SNB), Indians' money in Swiss banks rose by 43 per cent last year to 2.03 billion Swiss francs (nearly Rs 14,000 crore), despite growing global pressure on Switzerland to share client details of their banks.

A further analysis of SNB data shows that the "big banks" account for 68.2 per cent or about 1.4 billion Swiss francs (close to Rs 10,000 crore) of the total money belonging to the Indian clients of Swiss banks.

There are a total of 283 banks in Switzerland, out of which only two — UBS and Credit Suisse — have been classified as 'big banks' by Zurich-based SNB. There are also 93 foreign-controlled banks operating in the country.

However, the amount held by Indian clients in "savings and deposit accounts" of Swiss banks is comparatively less at about 63 million Swiss francs (less than Rs 500 crore) and account for just about three per cent of the total exposure of Indians to the Swiss banking system.

Swiss banks classify a major portion of their clients' money as "other amounts due to customers" and such funds due to their Indian clients stand at nearly 1.6 billion Swiss francs (over Rs 11,000 crore).

The "other" avenues through which clients park their funds with Swiss banks include "trading portfolios, financial investments and participating interests". Besides, banks are also said to be promoting "precious metals" among their clients for parking their funds.

A small portion of clients' money is also held by Swiss banks through other banks in the foreign countries. For Indian clients, such funds stood at about 94 million Swiss francs (about Rs 650 crore) at the end of 2013.

The total Indian money held in Swiss banks include 1.95 billion Swiss francs held directly by Indian individuals and entities, and another 77.3 million Swiss francs through 'fiduciaries' or wealth managers at the end of 2013.

The funds, described by SNB as "liabilities" of Swiss banks or 'amounts due to' their their clients, are the official figures disclosed by the Swiss authorities and do not indicate towards the quantum of the much-debated alleged black money held by Indians in the safe havens of Switzerland.

Countries preferred by Indian depositors

Fewer deposits in Swiss banks vs. Singapore, Hong Kong

Indians have 'rather few' deposits: Swiss banks, June 19, 2017: The Times of India

Indians have “few deposits“ in Swiss banks compared to other financial hubs like Singapore and Hong Kong, says a grouping of private bankers in Switzerland amid stepped-up efforts to check the black money menace.

Money held by Indians in Swiss banks declined to a record low of 1.2 billion Swiss francs or CHF (approx. Rs 8,392 crore) at the end of 2015, as per the latest available official data. No official data is available for money in the other hubs. Committing itself to the global framework for automatic exchange of tax information, Switzerland last week ratified the decision to implement this regime with India and 40 other jurisdictions.

The framework for automatic exchange of information requires strict adherence to data confidentiality , but the Geneva-based Association of Swiss Private Banks said it has no particular concern over India, where the rule of law seems to be properly upheld.

“There are also rather few deposits of Indian residents in Switzerland, as opposed to Singapore or Hong Kong for instance,“ the association's manager Jan Langlo said.

When asked about trends in terms of deposits from Indian residents, Langlo said it has not noticed any particular trend. “It is simply more practical for them to open an account in an Asian financial centre than in Switzerland,“ Langlo noted.

According to data from the Swiss National Bank, the funds held by Indians fell by CHF 596.42 million to CHF 1,217.6 million at the end of 2015.

2017: Hong Kong, Macau, Singapore, Bahrain, Malaysia

Hong Kong & Singapore are the new tax havens, Sep 14 2017: The Times of India

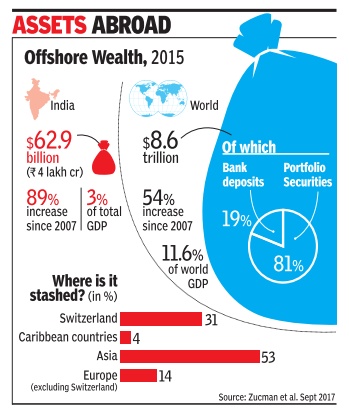

Offshore wealth held by Indians in tax havens has surged 90% since 2007 to $62.9 billion (about Rs 4 lakh crore) in 2015. That's about 3.1% of India's GDP in 2015, the latest year for which data is available.

Also, contrary to popular belief, Switzerland is no longer the preferred destination. Over 53% of this Indian wealth is now held closer home in Asian tax havens like Hong Kong, Macau, Singapore, Bahrain and Malaysia. Swiss banks hold 31% of Indian wealth abroad, down from 58% in 2007.

This trend has emerged from analysis of data released for the first time by the Basel-based Bank of International Settlements on bilateral foreign holdings. Till last year, BIS, which is the nodal data clearing house for all inter national financial transactions, did not disclose the country of origin of the data.

These new estimates for India show that the muchpublicised struggle against hoarding of black money in foreign banks is not making much headway . Analysing the new data for an NBER (National Bureau of Economic Research) paper, economist Gabriel Zucman of UCLA and his colleagues Annette Alstadsæter of the Norwegian University of Life Sciences and Niels Johannesen of the University of Copenhagen calculated that total offshore wealth in the world was $8.6 trillion, which is about 11.6% of world GDP.

It is up 54% since 2007.Non-financial assets like art or real estate are not included in these figures.

While Switzerland has become slightly more transparent, and leaks like the Panama Papers have exposed other tax havens, the outward flow has shifted to new pastures like Hong Kong and Singapore.

There is wide disparity among the countries in terms of what share of their GDPs is secreted away in offshore tax havens.

From just a few per cent of their GDP in Scandinavian countries, the wealth rises to 15% in Continental Europe, and to as much as 60% in Russia, Gulf states, and a number of Latin American countries. China has about $287 billion offshore wealth, which is 2.4% of their 2015 GDP.

Analysts say the reason these variations exist cannot be easily explained by tax rates or any institutional factors.

“Among countries with a large stock of offshore assets, one finds autocracies (Saudi Arabia and Russia), countries with a recent history of autocratic rule (Argentina and Greece), alongside old democracies (UK and France). Among those with the lowest stock of offshore assets, one finds relatively low-tax countries (Korea and Japan) alongside the world's highest tax countries (Denmark, Norway),“ Zucman and his colleagues write.

One important contribution of this analysis is that the wealth of the wealthiest section, the top 0.1% of the global population, needs to be recalculated by adding this offshore wealth to their existing wealth figures.This will likely further increase the inequality in their countries.

The extent of Indian money stashed abroad

2012: sharp decline in Indian deposits

At 9,000cr, Indian money in Swiss a/cs at record low

Zurich/New Delhi: Indians’ money in Swiss banks has fallen to a record low level of about Rs 9,000 crore (1.42 billion Swiss francs), as a global clampdown against the famed wall of secrecy of the Switzerland banking system made it unattractive for their international clients.

The total funds held by Indian individuals and entities included 1.34 billion Swiss francs held directly by Indian individuals and entities and another 77 million Swiss francs through ‘fiduciaries’ or wealth managers at the end of 2012, as per the latest figures released by the Swiss National Bank (SNB) in Zurich.

The official data, which forms part of SNB’s annual report on Swiss banks, further showed that the Indians’ money there fell by about 35% or Rs 4,900 crore in 2012. This was much steeper than a 9.1% fall in the funds held by entities from across the world in Swiss banks, which also hit an all-time low of 1.4 trillion Swiss francs ($1.5 trillion) at the end of 2012. PTI

2013: Rise in Indian deposits

Indian money in Swiss banks rises to over Rs 14,000 crore

PTI | Jun 19, 2014

ZURICH/NEW DELH: Indians' money in Swiss banks has risen to over two billion Swiss francs (nearly Rs 14,000 crore), despite a global clampdown against the famed secrecy wall of Switzerland banking system.

The funds held by Indians with banks in Switzerland rose by over 40% during 2013, from about 1.42 billion Swiss francs at the end of previous year, as per the latest data released today by the country's central banking authority Swiss National Bank (SNB).

In contrast, the money held in Swiss banks by their foreign clients from across the world continued to decline and stood at a record low of 1.32 trillion Swiss francs (about $1.56 trillion or over Rs 90 lakh crore) at the end of 2013.

During 2012, the Indians' money in Swiss banks had fallen by over one-third to a record low level.

The total Indian money held in Swiss banks included 1.95 billion Swiss francs held directly by Indian individuals and entities, and another 77.3 million Swiss francs through 'fiduciaries' or wealth managers at the end of 2013.

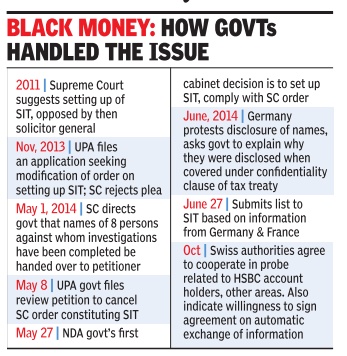

India has constituted a Special Investigation Team (SIT) to probe cases of alleged black money of Indians, including funds stashed abroad in places like Switzerland.

The funds, described by SNB as 'liabilities' of Swiss banks or 'amounts due to' their clients, are the official figures disclosed by the Swiss authorities and do not indicate towards the quantum of the much-debated alleged black money held by Indians in the safe havens of Switzerland.

SNB's official figures also do not include the money that Indians or others might have in Swiss banks in the names of entities from different countries.

There are a total of 283 banks in Switzerland, down from nearly 300 at the beginning of 2013. This include two banks (UBS and Credit Suisse) classified as big banks, while there are 93 foreign-controlled banks operating in the country. A total of close to 1.25 lakh staff work at these banks.

With regard to the money held by Indians in Swiss banks, it rose during 2013 after a sharp decline in 2012. Prior to that, Indian money in Swiss banks had risen during 2011 also.

The quantum of Indian funds in Swiss banks stood at a record high level of 6.5 billion Swiss francs at the end of 2006, but it declined by more than 4 billion Swiss francs after four straight years of fall till 2010.

2015: Dips 33% to Rs 8,392 crore

The Times of India, Jul 01 2016

Indian money in Swiss banks dips 33% to Rs 8,392cr

Money held by Indians in Swiss banks has fallen by nearly one-third to a record low of 1.2 billion franc (Rs 8,392 crore), although this could simply mean that black money is moving to other hideaways. The funds held by Indians with banks in Switzerland fell by CHF 596.42 million to CHF 1,217.6 million at the end of 2015, as per the latest data released on Thursday by Swiss National Bank.

2016: Rs 13,000 crore, mainly from HSBC

The Times of India, Jun 27 2016

Pradeep Thakur

The government's crackdown on those stashing undeclared income in overseas bank accounts has started yielding results with the Income Tax authorities having unearthed more than Rs 13,000 crore from just two sets of information received in 2011 and 2013. In at least 400 cases of Indians with deposits in HSBC, Geneva, the details of which were received from the French government in 2011, the Income Tax (I-T) authorities have unearthed undisclosed income of Rs 8,186 crore, the highest disclosure ever from offshore bank accounts, and raised a tax demand of about Rs 5,377 crore against such account-holders till March 31, 2016, according to an I-T assessment report.

In the HSBC case, the government had received information about 628 bank accounts. Of these, at least 213 we re found “not actionable“ as they either had no money in them or they belonged to nonresident Indians. Also, in some cases, the entities remained untraceable. “Out of the actionable cases, assessments have been completed in 398 cases, including those settled by the I-T Settlement Commission as well as cases where assessment proceedings have been dropped,“ according to the I-T report. A HSBC spoke sperson declined to comment.

Based on another set of information disclosed in 2013 on the website of the International Consortium of Investigative Journalists (ICIJ), a Washington-based organisation, I-T officials have detected undisclosed income of Rs 5,000 crore in foreign bank accounts allegedly linked to 700 Indians.

So far, the I-T department has filed 55 prosecution complaints before criminal courts in the ICIJ cases on charges of wilful attempt to evade tax.The basis has been false statements made by these entities during the verification process. In the HSBC Geneva case, tax authorities have launched prosecution proceedings in 75 cases, a majority for wilful attempt to evade tax.The criminal courts have taken cognisance in most of these prosecution complaint cases, paving the way for the Enforcement Directorate to initiate actions under the stringent Prevention of Money Laundering Act (PMLA).The recently enacted Black Money Undisclosed Foreign Income and Assets Act has made the “wilful attempt to evade tax“as a predicate offence under the PMLA, giving the ED powers to attach and confiscate properties of an accused equivalent to the amount stashed abroad.

The I-T report said many Indians whose names appeared in the ICIJ cases had filed declarations under the black money declaration window scheme, which the government had launched for a limited period during 2015. However, those individuals against whom the department had already launched probe were not eligible for any relief.

Laws, Indian

Switzerland: India's data security, confidentiality laws “adequate"

HIGHLIGHTS

Switzerland found India's data security and confidentiality laws "adequate" for entering into an automatic exchange of information pact.

The Swiss Federal Council in June ratified automatic exchange of financial account information with India and 40 other jurisdictions.

NEW DELHI/BERNE: Switzerland found India's data security and confidentiality laws "adequate" for entering into an automatic exchange of information pact, which will open a continuous access to details about alleged black money+ hoarders in once-all-secret Swiss banks.

In a detailed notification and fact sheet published in its official gazette for introduction of "automatic exchange of information relating to financial accounts with India", the Swiss government has also cited decisions by other financial centres like Liechtenstein and Bahamas to enter into similar pacts. Besides, Switzerland also took note of the US tax authority, the Internal Revenue Service (IRS), recognising India among the countries that provide an "adequate degree" of data protection for mutual exchange of tax information.

The fact sheet and the notification, published in German, also talks about Switzerland looking to explore greater access to Indian market, including the reinsurance sector and other financial services.

The Swiss Federal Council, the top governing body of the European nation, in June ratified automatic exchange of financial account information with India and 40 other jurisdictions to facilitate immediate sharing of details about suspected black money even as it sought strict adherence to confidentiality and data security.

Taking the decision forward, the Swiss government has now notified the decision and the notification authorises the Council to notify India about the exact date when such automatic exchange must take place.

The implementation is currently planned for 2018 and the first set of data should be exchanged in 2019. The decision is not subject to any referendum - which means there should be no further procedural delay in its implementation.

The issue of black money has been a matter of big debate in India, and Switzerland has been long perceived as one of the safest havens for the illicit wealth allegedly stashed abroad by Indians.

The notification follows hectic parleys between India and Switzerland for introduction of the AEOI (Automatic Exchange of Information) on tax matters under the guidance of G20, OECD and other global organisations.

In the fact sheet about India, which forms part of the notification about all 41 jurisdictions selected for AEOI by Switzerland, the Swiss government noted India showed its commitment for implementing the international pact with effect from 2016 itself and "adaptations of the internal laws necessary for the implementation were made in good time". Listing various changes to the tax laws and introduction of new laws for fighting black money stashed abroad as well as within the country, the Swiss government said, "The legal, administrative and technical framework for confidentiality and data security in India was deemed satisfactory by the Global Forum's panel of experts."

The Swiss Federal Department of Finance assessed this evaluation and found them to be "adequate", the notification said. It further said that India negotiated with the US a model intergovernmental agreement on FATCA for reciprocal exchange of information, which has entered into force after the IRS assessed the level of confidentiality and data security in India and found it "appropriate". "All agreements concerning the exchange of tax information concluded by India contain a confidentiality clause which corresponds to that of the model OECD agreement," it noted, while adding that the country's Income Tax Act contain other confidentiality provisions as well.

The notification also referred to the personal data protection measures provided in other laws of the country, incoming the Informational Technology Act and the Right to Information Act.

The Swiss government will prepare a situation report before the first exchange of data for which confidentiality and data protection requirements are to be strictly followed. On access to Indian market, the Swiss government said the Indian market is not one of the strategic markets targeted by Switzerland-based financial services providers for their cross-border activities, as "bureaucratic and prudential obstacles were generally more difficult to overcome".

Nonetheless, they are interested in taking advantage of improved governance conditions and greater legal certainty in the financial services sector, particularly in the reinsurance sector.

Switzerland said the two countries have committed to improve the framework conditions for cross-border business activities to give a boost to international investment and financial services segments.

The names of some Indian account holders

2014

Govt starts disclosing foreign ac holders with 3 names

Dhananjay Mahapatra The Times of India Oct 28 2014

No Politicians In First List

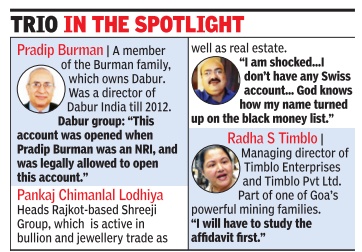

After hinting at the involvement of top politicians in the black money case, the Centre on Monday revealed three business names –

Dabur's Pradip Burman,

bullion trader Pankaj Chimanlal Lodhiya and

Goa's Timblo Pvt Ltd.

It was the French authorities who informed India about Burman's alleged tax evasion and stashing of money abroad. Information about the other two -Lodhiya and Timblo Pvt Ltd -came from the German authorities. Timblo Pvt Ltd faces prosecution along with its directors Rad ha S Timblo, Chetan S Timblo, Rohan S Timblo, Anna C Timblo and Mallika R Timblo. The names of alleged black money account holders were revealed by the Centre before the Supreme Court in an affidavit filed 24 hours before the scheduled hearing in the case. It said: “Several more cases are under process and the names of persons prosecuted will become public in due course.“

But the Centre's commitment to reveal names came with a caveat.

“Government is committed to disclose names of persons holding illegal money abroad. However, every account held by an Indian in a foreign country may not be illegal and the fundamental right of citizens to privacy under Article 21 of the Constitution cannot be ignored,“ said the affidavit mentioned by attorney general Mukul Rohatgi before a bench headed by Chief Justice H L Dattu.

The Centre said double taxation avoidance agreements (DTAAs) and similar treaties with other countries are vital sources of information on Indians stashing ill-gotten money in foreign banks and that the agreements and treaties mandate that information provided under these could be revealed only after court proceedings were initiated against them on completion of a proper investigation about the financial illegality committed by the person.

It told the SC, “Names of persons found to have stashed illegal money abroad, as also information and documents received from foreign countries relating to off-shore tax evasion and avoidance will be dis closed after following the procedure prescribed in the legal instruments through which the information has been received.“ The German authorities had provided names of 12 trustsentities involving 26 Indians who had accounts with LGT Bank in Liechtenstein. The government after completion of investigation concluded that 18 cases merited investigation. The names of the 18 were revealed to the court and petitioner Ram Jethmalani.

But, it contested the SC's May 1 order directing the Centre to reveal the names of the other eight where no illegality was found. Revealing their names would not only breach bilateral agreements but also send a wrong signal to other countries with which India was on the verge of signing DTAAs, which it termed as an important means to get information on black money deposited in foreign banks.

The Centre said: “India is on the verge of entering into bilateral and multilateral agreements for automatic exchange of information that will greatly help in our fight against black money stashed in financial accounts and assets maintained overseas by Indian tax payers.“

Efforts to obtain information about undisclosed money held by Indians abroad also include entering into new treaties and agreements as per the new global standards on automatic exchange of information.

2015: ICIJ/ Indian Express' list of HSBC a/c's

See Indian money in HSBC, Switzerland

Neo Corp International Ltd, Indore

The Times of India, Sep 09 2015

Black money: Swiss govt reveals name of MP firm

In a fresh disclosure on black money cases being probed by Indian tax authorities , Switzerland said it has received a request for information on Indore-based textiles firm Neo Corp International Ltd. Neo Corp, which began as a small woven sack maker in 1985, had faced income tax searches on its various premises in February .

In Indore, I-T commissioner, Prashant Jha told TOI, “We conducted raids at Neo Corp in February and after that a request was sent to Switzerland government to get details on financial transaction of the company .“ “We recovered some Global Deposit Receipt (GDR) of the company in which they claimed to raise funds for investing in the company . All details of financial transaction were mentioned on their balance sheet and they shared this information with RBI as well,“ said Jha.

Chairman and managing director of Neo Corp, Sunil Trivedi said, “ An official account of our company was opened in Investec Bank of Switzer land in 2011-12 to raise capital. But incidentally this account was not used and another account in a bank in Singapore was used for raising funds. No transaction was done through bank account in Switzer land, which was closed in 2015.“

“It is part of standard procedure in which requests are sent to get details verified from respective countries. We raised Rs 104 crore from the international market for investing in the company and we informed RBI about it,“ he said.

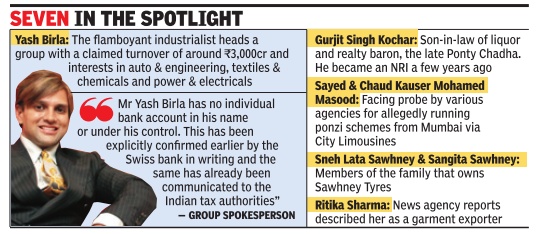

Yash Birla, Gurjit Singh Kochar, Sayed and Chand Kauser Mohamed Masood, Sneh Lata Sawhney and Sangita Sawhney and Ritika Sharma

The Times of India, May 27 2015

Pradeep Thakur

Yash Birla in fresh list of Indian bank account holders disclosed by Swiss

Swiss tax authorities have disclosed more names of Indians having accounts in their jurisdiction, marking a success for the government's efforts to persuade them to share information on at least those against whom the income tax department has collected credible evidence of non-reporting. A day after two names -Sneh Lata Sawhney and Sangita Sawhney , linked to the own ers of Sawhney Tyres -were disclosed, more identities of Swiss account holders from India became public. These included industrialist Yash Birla, Sayed Mohamed Masood and Chand Kauser Mohamed Masood, Gurjit Singh Kochar and Ritika Sharma. The Mumbai-based Masoods are facing various investigations for their alleged involvement in what is known as the City Limousine scam. Kochar, an NRI, is the son-in-law of the late Ponty Chadha, a real estate, sugar and liquor tycoon. Swiss tax authorities told TOI that the names were disclosed because the individuals concerned had not provided valid addresses. They did not rule out putting out more Indian names. A spokesperson of the Swiss Federal Tax Authority emphasized that account details of those whose names have been disclosed would be shared with the India if the individuals did not respond or appeal within 10 days.

The spokesperson said in an email to TOI, “The names published in the Swiss Federal Gazette about Indians are exceptional cases where we don't have valid addresses and these people could not be informed... It is an opportunity to respond before information is shared with India.They are not necessarily cases of tax evasion... (it is) difficult to say how many names will be published in the gazette.“

Indian authorities celebrated the development, seen as a breakthrough after sustained efforts to persuade the Swiss to breach what finance minister Arun Jaitley said was their “banking secrecy“.Politically, the disclosures could not have been timed better, coming on the first anniversary of the Modi government, which was under pressure for not redeeming its pledge to recover black money . Jaitley told reporters that the cooperation fructifying around the NDA 's anniversary made him even happier.

Sources said while the Sawhneys were among those on the list of account holders in HSBC's Geneva branch, the Swiss had stonewalled India's requests for information on them. They had argued that the HSBC list was based on “stolen“ data and Swiss law barred them from making it public. It was after three rounds of discussions -including two at the level of the Indian finance minister -that they agreed to act in cases where the government submitted evidence against individuals. Sources said the disclosure about the Sawhneys followed submission of evi dence gathered during I-T searches on their premises.

Considering that the I-T department has launched prosecution in 121 cases linked to the HSBC list, more disclosures are likely . The cases of the Masoods and Kochar show that Swiss help has stretched beyond the HSBC list. Data on them was provided on the basis of I-T probe.

The relative rank of India

2012: vis-à-vis China, India and Pakistan

Swiss money: India slips to 70th position; UK on top Sri Lanka Swiss banks PTI | Jun 23, 2013,

The latest official data released by Switzerland's central bank shows that the money they owed to Indian clients at the end of 2012 was 1.42 billion Swiss francs (about Rs 9,000 crore).

ZURICH/ NEW DELHI: India has slipped to 70th position in terms of foreign money lying with the Swiss banks and accounts for a meagre 0.10 per cent of total global wealth held in the Switzerland banking system.

While the UK continues to account for the largest chunk of such funds, India has now slipped lower to 70th position -- the lowest rank among all major economies of the world, shows an analysis of annual data released by Swiss National Bank (SNB) on all the banks present in the European country. India was ranked 55th for such funds a year ago with a total amount of 2.18 billion Swiss francs belonging to the Indian individuals. Among the top-ten jurisdictions in terms of source of money with Swiss banks, the UK is now followed by the US, West Indies, Jersey, Guernsey, Germany, France, Bahamas, Cayman Islands and Hong Kong.

The major countries ranked among the top-25 include include Singapore, Japan, Italy, Australia, Russia, Netherlands, Saudi Arabia and Cyprus. Besides, China was ranked 26th, Canada 28th, Brazil at 39th and South Africa at 50th. India's neighbouring country Pakistan was also ranked one place higher at 69th, although countries like Mauritius, and Sri Lanka are positioned below India.

2013

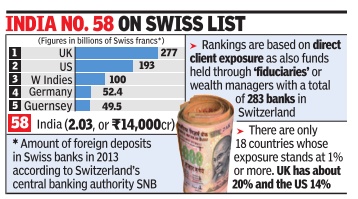

See graphic, ' India'was no.58 at the end of 2013… '

2017: Indians 88th in terms of deposits

Stash by desis drops to 0.04% of foreign funds in Swiss banks

ZurichNew Delhi

PTI

India has slipped to 88th place in terms of money parked by its citizens with Swiss banks, while the UK remains on the top. Also, the money officially held by Indians with banks in Switzerland now accounts for a meagre 0.04% of the total funds kept by all foreign clients in the Swiss banking system, as per an analysis of the latest figures compiled by the SNB (Swiss National Bank) as on 2016-end.

India was placed at 75th position in 2015 and at 61st in the year before that, though it used to be among top-50 countries in terms of holdings in Swiss banks till 2007. The country was ranked highest at 37th place in the year 2004.

The latest data from Zurich-based SNB comes ahead of a new framework for automatic exchange of information between Switzerland and India to check the black money menace. SNBs official figures do not include the money that Indians, NRIs or others might have in Swiss banks in the names of entities from different countries.

There is a view that the Indians alleged to have parked their illicit money in Swiss banks in the past may have shifted the funds to other locations after a global clampdown began on the mighty banking secrecy practices in Switzerland.

Swiss banks have also said Indians have “few deposits“ in them compared to other global financial hubs like Singapore and Hong Kong amid stepped-up efforts to check the black money menace.

The UK accounted for the largest chunk at about CHF 359 (over 25%) of the total foreign money with Swiss banks. The US came second with nearly CHF 177 billion or about 14%. Indians' share not even one-hundredth of the total money . India is now ranked 88th with 676 million Swiss francs (about Rs 4,500 crore).

Tax treaties (multilateral, Swiss, US) and confidentiality

Black money: Switzerland reminds India of terms for sharing bank information

TNN & Agencies | Oct 31, 2014 The Times of India

Swiss double taxation agreement with India

Swiss authorities are worried about sharing information and made comments to this effect at a time when a Supreme Court-monitored SIT is probing alleged stashing of black money by Indians aboard.

In Oct 2014 Switzerland said that information exchanged with India under its tax treaty can't be disclosed "in principle" to a court or any other body outside the proceedings of a "specific and relevant" case.

Explaining the treaty provisions about disclosure of such 'secret' information, a Swiss finance ministry spokesperson told PTI from Berne that authorities from the two countries have "regular contacts on bilateral tax matters" but refused to comment on particular cases.

The exchange of information on tax matters between India and Switzerland is based on the double taxation agreement (DTA) and the protocol that was signed in 2010 between the two countries. It has been in force since October 2011. "This agreement is in line with the international standards and provides for exchange of information on request," the spokesperson said.

"Accordingly, the information exchanged under the terms of the DTA can be provided to a court in situations where it is dealing with a specific case related to tax matters for which this information is relevant. Conversely, information cannot be disclosed in principle to a court or another body outside of such proceedings," the official added. The spokesperson, however, declined to comment on "particular cases", citing the confidentiality provisions of the Swiss-Indian DTA.

There has been a heated debate on whether the disclosure of names, without prosecution, could violate tax treaties under which these names and other details are shared by foreign countries.

Replying to queries in this regard, the Swiss Federal department of finance spokesperson said the protocol to Swiss-Indian Double Taxation Agreement states that any information received "by a contracting state shall be treated as 'secret' in the same manner as information obtained under the domestic laws of that state..."

The treaty further provides that any such information "shall be disclosed only to persons or authorities (including courts and administrative bodies) concerned with the assessment or collection of (information), the enforcement or prosecution in respect of, or the determination of appeals in relation to the taxes ... or the oversight of the above."

The Swiss finance ministry spokesperson further said the treaty states that "such persons or authorities shall use the information 'only' for such purposes. They may disclose the information in public court proceedings or in judicial decisions".

Multilateral Competent Authority Agreement

This Swiss clarification came a day after the government was ordered by the Supreme Court to hand over all the 627 names of Indian account holders in HSBC Bank, Geneva, forcing the government to opt out from the signing of an international treaty on exchange of financial information.

Officials in India said that all countries which have legally shared information with India have done so under treaties, which contain a confidentiality clause. "That's the way business is done internationally. We have to follow the same practice," an official said.

India's last minute withdrawal from the Multilateral Competent Authority Agreement — which provides for automatic information exchange, starting 2017 — is bound to choke the flow of vital data to tax authorities and hinder attempts to act against unaccounted funds parked in overseas accounts. India can still sign the pact. Currently, it is awaiting clarity from the court.

Inter-Governmental Agreement with the US

The source pointed out that India also has to sign the Inter-Governmental Agreement with the US for automatic exchange of information, which also comes with a confidentiality clause. Officials said that in case of a delay beyond December 31, 2014 all remittances from the US will face a 30% withholding tax.

"For signing the agreement, the government has to give a commitment that it will follow international standards for the information received. But we could not give an assurance due to Supreme Court's interpretation of confidentiality, which is critical for all governments to exchange information," said a government official.

Switzerland or Swiss banks

Indians 88th in terms of deposits/ 2017

India has slipped to 88th place in terms of money parked by its citizens with Swiss banks, while the UK remains on the top. Also, the money officially held by Indians with banks in Switzerland now accounts for a meagre 0.04% of the total funds kept by all foreign clients in the Swiss banking system, as per an analysis of the latest figures compiled by the SNB (Swiss National Bank) as on 2016-end.

India was placed at 75th position in 2015 and at 61st in the year before that, though it used to be among top-50 countries in terms of holdings in Swiss banks till 2007. The country was ranked highest at 37th place in the year 2004.

The latest data from Zurich-based SNB comes ahead of a new framework for automatic exchange of information between Switzerland and India to check the black money menace. SNBs official figures do not include the money that Indians, NRIs or others might have in Swiss banks in the names of entities from different countries.

There is a view that the Indians alleged to have parked their illicit money in Swiss banks in the past may have shifted the funds to other locations after a global clampdown began on the mighty banking secrecy practices in Switzerland.

Swiss banks have also said Indians have “few deposits“ in them compared to other global financial hubs like Singapore and Hong Kong amid stepped-up efforts to check the black money menace.

The UK accounted for the largest chunk at about CHF 359 (over 25%) of the total foreign money with Swiss banks. The US came second with nearly CHF 177 billion or about 14%. Indians' share not even one-hundredth of the total money . India is now ranked 88th with 676 million Swiss francs (about Rs 4,500 crore).

See also

Indian money in foreign banks

Indian money in offshore entities: The ‘Paradise Papers’

Indian money in HSBC, Switzerland