Indian money in foreign banks

This is a collection of newspaper articles selected for the excellence of their |

Contents |

2012: sharp decline

At 9,000cr, Indian money in Swiss a/cs at record low

Zurich/New Delhi: Indians’ money in Swiss banks has fallen to a record low level of about Rs 9,000 crore (1.42 billion Swiss francs), as a global clampdown against the famed wall of secrecy of the Switzerland banking system made it unattractive for their international clients.

The total funds held by Indian individuals and entities included 1.34 billion Swiss francs held directly by Indian individuals and entities and another 77 million Swiss francs through ‘fiduciaries’ or wealth managers at the end of 2012, as per the latest figures released by the Swiss National Bank (SNB) in Zurich.

The official data, which forms part of SNB’s annual report on Swiss banks, further showed that the Indians’ money there fell by about 35% or Rs 4,900 crore in 2012. This was much steeper than a 9.1% fall in the funds held by entities from across the world in Swiss banks, which also hit an all-time low of 1.4 trillion Swiss francs ($1.5 trillion) at the end of 2012. PTI

2012: The relative ranks of China, India and Pakistan

Swiss money: India slips to 70th position; UK on top Sri Lanka Swiss banks PTI | Jun 23, 2013,

The latest official data released by Switzerland's central bank shows that the money they owed to Indian clients at the end of 2012 was 1.42 billion Swiss francs (about Rs 9,000 crore).

ZURICH/ NEW DELHI: India has slipped to 70th position in terms of foreign money lying with the Swiss banks and accounts for a meagre 0.10 per cent of total global wealth held in the Switzerland banking system.

While the UK continues to account for the largest chunk of such funds, India has now slipped lower to 70th position -- the lowest rank among all major economies of the world, shows an analysis of annual data released by Swiss National Bank (SNB) on all the banks present in the European country. India was ranked 55th for such funds a year ago with a total amount of 2.18 billion Swiss francs belonging to the Indian individuals. Among the top-ten jurisdictions in terms of source of money with Swiss banks, the UK is now followed by the US, West Indies, Jersey, Guernsey, Germany, France, Bahamas, Cayman Islands and Hong Kong.

The major countries ranked among the top-25 include include Singapore, Japan, Italy, Australia, Russia, Netherlands, Saudi Arabia and Cyprus. Besides, China was ranked 26th, Canada 28th, Brazil at 39th and South Africa at 50th. India's neighbouring country Pakistan was also ranked one place higher at 69th, although countries like Mauritius, and Sri Lanka are positioned below India.

2013: Rise in Indian deposits

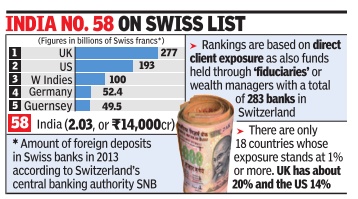

Indian money in Swiss banks rises to over Rs 14,000 crore

PTI | Jun 19, 2014

ZURICH/NEW DELH: Indians' money in Swiss banks has risen to over two billion Swiss francs (nearly Rs 14,000 crore), despite a global clampdown against the famed secrecy wall of Switzerland banking system.

The funds held by Indians with banks in Switzerland rose by over 40% during 2013, from about 1.42 billion Swiss francs at the end of previous year, as per the latest data released today by the country's central banking authority Swiss National Bank (SNB).

In contrast, the money held in Swiss banks by their foreign clients from across the world continued to decline and stood at a record low of 1.32 trillion Swiss francs (about $1.56 trillion or over Rs 90 lakh crore) at the end of 2013.

During 2012, the Indians' money in Swiss banks had fallen by over one-third to a record low level.

The total Indian money held in Swiss banks included 1.95 billion Swiss francs held directly by Indian individuals and entities, and another 77.3 million Swiss francs through 'fiduciaries' or wealth managers at the end of 2013.

India has constituted a Special Investigation Team (SIT) to probe cases of alleged black money of Indians, including funds stashed abroad in places like Switzerland.

The funds, described by SNB as 'liabilities' of Swiss banks or 'amounts due to' their clients, are the official figures disclosed by the Swiss authorities and do not indicate towards the quantum of the much-debated alleged black money held by Indians in the safe havens of Switzerland.

SNB's official figures also do not include the money that Indians or others might have in Swiss banks in the names of entities from different countries.

There are a total of 283 banks in Switzerland, down from nearly 300 at the beginning of 2013. This include two banks (UBS and Credit Suisse) classified as big banks, while there are 93 foreign-controlled banks operating in the country. A total of close to 1.25 lakh staff work at these banks.

With regard to the money held by Indians in Swiss banks, it rose during 2013 after a sharp decline in 2012. Prior to that, Indian money in Swiss banks had risen during 2011 also.

The quantum of Indian funds in Swiss banks stood at a record high level of 6.5 billion Swiss francs at the end of 2006, but it declined by more than 4 billion Swiss francs after four straight years of fall till 2010.

Most Indian deposits are with UBS and Credit Suisse

Two big banks have 2/3rd of all Swiss money of Indians

PTI | Jun 20, 2014 The Times of India

It is just two big banks — UBS and Credit Suisse — which appear to be accounting for almost two-third of the total money held by Indians in Swiss banking system, known for their famed secrecy walls.

According to the latest official data disclosed by Switzerland's central banking authority Swiss National Bank (SNB), Indians' money in Swiss banks rose by 43 per cent last year to 2.03 billion Swiss francs (nearly Rs 14,000 crore), despite growing global pressure on Switzerland to share client details of their banks.

A further analysis of SNB data shows that the "big banks" account for 68.2 per cent or about 1.4 billion Swiss francs (close to Rs 10,000 crore) of the total money belonging to the Indian clients of Swiss banks.

There are a total of 283 banks in Switzerland, out of which only two — UBS and Credit Suisse — have been classified as 'big banks' by Zurich-based SNB. There are also 93 foreign-controlled banks operating in the country.

However, the amount held by Indian clients in "savings and deposit accounts" of Swiss banks is comparatively less at about 63 million Swiss francs (less than Rs 500 crore) and account for just about three per cent of the total exposure of Indians to the Swiss banking system.

Swiss banks classify a major portion of their clients' money as "other amounts due to customers" and such funds due to their Indian clients stand at nearly 1.6 billion Swiss francs (over Rs 11,000 crore).

The "other" avenues through which clients park their funds with Swiss banks include "trading portfolios, financial investments and participating interests". Besides, banks are also said to be promoting "precious metals" among their clients for parking their funds.

A small portion of clients' money is also held by Swiss banks through other banks in the foreign countries. For Indian clients, such funds stood at about 94 million Swiss francs (about Rs 650 crore) at the end of 2013.

The total Indian money held in Swiss banks include 1.95 billion Swiss francs held directly by Indian individuals and entities, and another 77.3 million Swiss francs through 'fiduciaries' or wealth managers at the end of 2013.

The funds, described by SNB as "liabilities" of Swiss banks or 'amounts due to' their their clients, are the official figures disclosed by the Swiss authorities and do not indicate towards the quantum of the much-debated alleged black money held by Indians in the safe havens of Switzerland.

See also

Indian money in Swiss banks Indian money in Liechtenstein banks Sri Lankan money in Swiss banks