Income Tax India: Statistics

(→See also) |

(→2017-18: Direct tax collection increases 19%) |

||

| Line 187: | Line 187: | ||

Similarly, the growth rate of net corporate tax collections increased from 10.8 per cent in Q2 to 17.4 per cent in Q3 and to 18.2 per cent as on January 15, 2018. | Similarly, the growth rate of net corporate tax collections increased from 10.8 per cent in Q2 to 17.4 per cent in Q3 and to 18.2 per cent as on January 15, 2018. | ||

| + | |||

| + | ==2017, April-Dec: Rs 26,500 crore paid by those who don’t pay full taxes== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F10&entity=Ar00502&sk=32657B01&mode=text Govt mops up ₹26,500 crore from those who didn’t file tax returns, February 10, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | The government’s drive, through a non-filer monitoring system, to target those who indulge in highvalue transactions but don’t pay enough taxes has forced the filing of at least 1.7 crore extra returns and helped the Centre mop up close to Rs 26,500 crore till December. | ||

| + | |||

| + | In a written reply, finance minister Arun Jaitley told Parliament on Friday that for the past few years, the tax department has been identifying non-filers by tracking in-house information and tallying it with data on high-value transactions received from external agencies along with TDS and tax collected at source (TCS). | ||

| + | |||

| + | “The mechanism for collection and verification of financial information has been broadened to include data in respect of various types of high-value transactions from banks and FIs and high-value expenditure from commercial establishments in the form of Statement of Financial Transaction (SFT),” the FM said, adding that the scope of TDS and TCS was also expanded. | ||

| + | |||

| + | He said quoting the Permanent Account Number was now mandatory for transactions of over Rs 2 lakh. This was yielding enormous data, which was being mined by I-T. | ||

| + | |||

| + | As a result, last year, 35 lakh non-filers were identified who the tax department believe had a tax liability. Though the number is down from 67 lakh a year ago, many who had large cash deposits may have filed returns. | ||

| + | |||

| + | |||

| + | ''' ‘Aim to get 1.25cr new return filers’ ''' | ||

| + | |||

| + | The move is part of an exercise aimed at deepening the income tax system with the FM saying this year, the target was to get 1.25 crore new return filers. | ||

| + | |||

| + | He said that after identifying the non-filers, the government was using rule-based algorithms to classify cases into various categories and monitoring them. Text messages and emails were sent to the targeted groups to file returns and a compliance management cell had been set up to track responses. This was followed by notices. The system is now proposed to be made more stringent through a new mechanism — Project Insight — to target people and seek voluntary compliance. | ||

=Complaints for prosecution= | =Complaints for prosecution= | ||

Revision as of 23:50, 10 February 2018

This is a collection of articles archived for the excellence of their content. |

Arrears

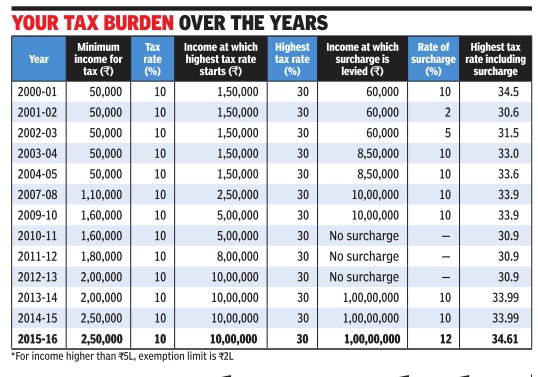

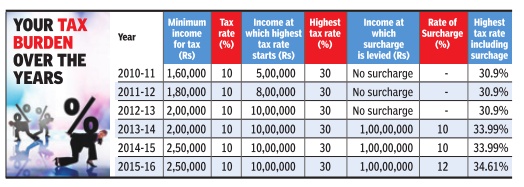

See graphic:

Income tax rates in India, 2000-2016

2015: 17 people owe Rs 2.14 lakh crore

The Times of India, Aug 01 2015

Just 17 people owe massive Rs 2.14 lakh cr in tax arrears

Just 17 individuals have a whopping Rs 2.14 lakh crore as outstanding tax arrears, with each of them owing more than Rs 1,000 crore. This is more than double the amount of total tax dues worth Rs 90,568 crore outstanding against 35 companies in this category (with outstanding tax arrears of over Rs 1,000 crore each), the Parliament has been informed.

Together, these individuals and companies account for more than one-third of the overall direct tax arrears (including the demand not fallen due), which stood at Rs 8,27,680 crore as on April 1, 2015.

At the same time, the number of taxpayers owing over Rs 10 crore to the government rose by about 69% to 4,692 in three years to March, 2015.

These details have been disclosed in written replies to the Rajya Sabha by minister of state for finance Jayant Sinha, who also said that a large proportion of the large-size outstanding tax arrears may not be collectible due to various reasons. Sinha said action for recovery is being taken.

Black Money Compliance Scheme

Valuer's report will not be questioned

The Times of India, Aug 19 2016

The valuation report from a registered valuer will not be questioned by the income tax department for disclosures made under the domestic black money compliance scheme, the CBDT clarified.

“The valuer is expected to furnish a true and correct valuation report in accordance with the accepted principles of valuation. In case of any misrepresentation, appropriate action as per law shall be taken against the registered valuer,“ said the fifth set of FAQs.

CBDT had received representations from stakeholders to provide an option to value the immovable property on the basis of the registered value.“After due consideration of the representations, the rules have been amended to provide that where acquisition of an immovable property is evidenced by a registered deed, an option shall be available with the declarant to declare the fair market value of such property by applying the cost inflation index to stamp duty value of property ,“ FAQs said.

Collection of tax

About Taxmen

See graphic

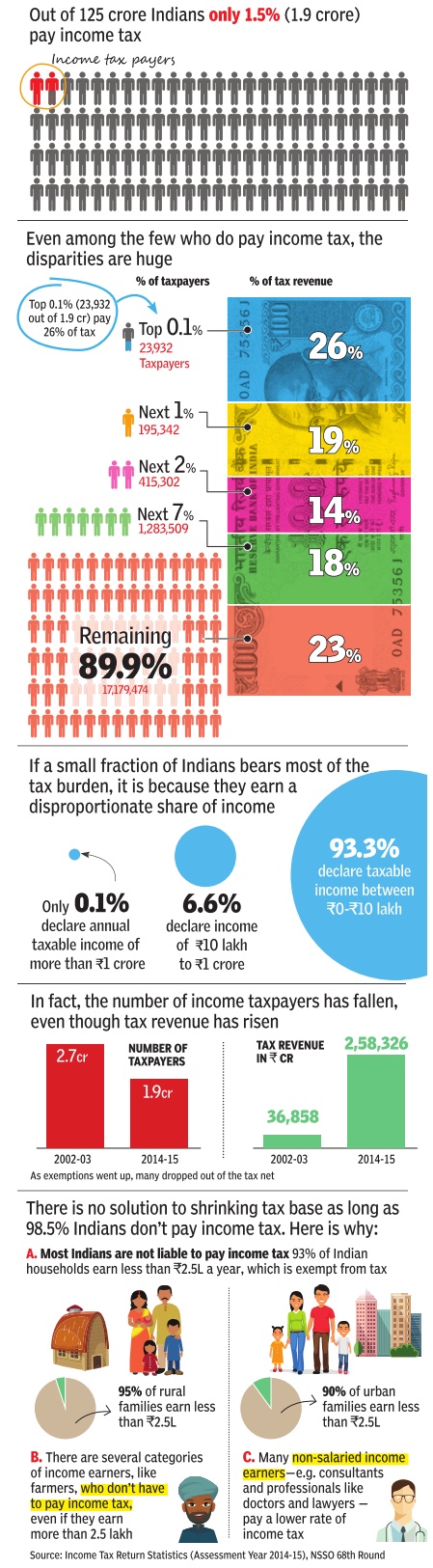

India Today.in , Why it’s tough taxing with love “India Today” 23/6/2016

2011: 2.77% Indians pay I Tax

Only 2.77% Indians pay income tax

The Times of India, Sep 1, 2011

Just 2.77% of India’s 1.21 billion people pay personal income tax, official data has revealed. “The number of effective tax payers as on March 31, 2011 was 3,35,79,831 (33.57 million),” minister of state for finance S S Palanimanickam said in a reply to a question in the Rajya Sabha on Tuesday.

This is just 2.77 % of over 121 crore or 1.21 billion population of the country. The amount of direct tax collection rose to Rs 446,070 crore in 2010-11 from Rs 378,063 crore the previous year, the minister said. IANS

2011-12, individuals in tax bracket

The Times of India, Aug 20 2016

1.3L disclosed zero income in 2011-12

Over 35,600 individuals filed returns showing annual income of over Rs 1 crore with at least 1.3 lakh disclosing zero income during financial year 2011-12, data released by the government showed. Those reporting zero income in their returns were those who accounted for tax breaks against investments such as provident fund and public provident fund as well as home loans, which helped reduce the total income to under Rs 1.8 lakh, which was threshold for the levy of tax in the lowest bracket.

Another 36 lakh tax payers, or 12.5% of the 2.89 crore individuals who filed returns disclosed income of up to Rs 1.5 lakh, while over 37% were in the Rs 1.5-2 lakh range.

But the number which is under watch is those in the higher brackets as only 14 lakh or less than 5% of the entire taxpayer base was in the top bracket of 30%. But this segment paid nearly 75% of the total income tax. The government has initiated a number of steps to track those failing to disclose income.

2012-13, individuals in Income Tax bracket

The Times of India, Aug 19 2016

Only 14L fell in 30% tax bracket in 2012-13

Only 14 lakh individuals out of 2.89 crore assessees declared an annual income of over Rs 10 lakh, attracting the highest tax bracket of 30%, in assessment year 2012-13. As per the Income Tax Return Statistics for Assessment Year 2012-13, 14 lakh people or just 4.6% of the total assessees paid taxes in the highest 30% tax bracket. These 14 lakh people accounted for 75% of the total personal income tax collection. “The data reveals very clearly that there is a need for widening and deepening of the tax net now,“ revenue secretary Hasmukh Adhia said.

The analysis revealed that of 2.89 crore taxpayers who filed returns, 1.63 crore (56.4%) did not pay taxes and 0.84 crore assessees (29.3%) were in the 10% tax bracket. These two segments constitute more than 85.5% of the individual tax base.

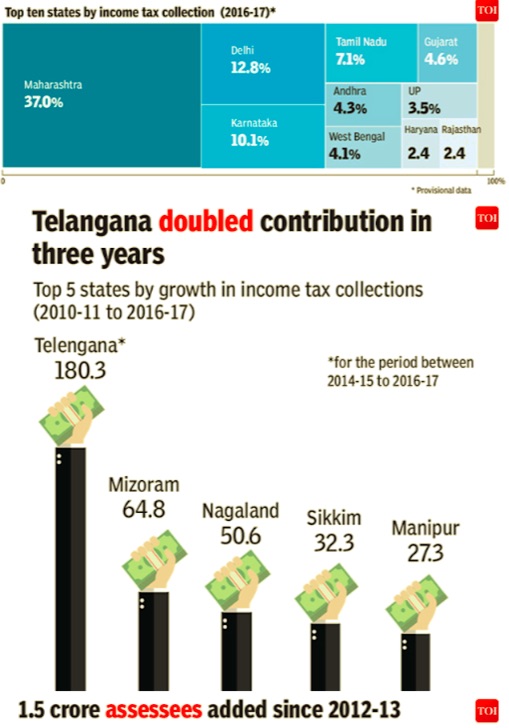

2012-17, Income Tax in the states; persons in the tax bracket

December 21, 2017: The Times of India

See graphics:

Top ten states by Income tax collection, 2016-17; Top 5 states by growth in Income tax collections (2010-11 to 2016-17)

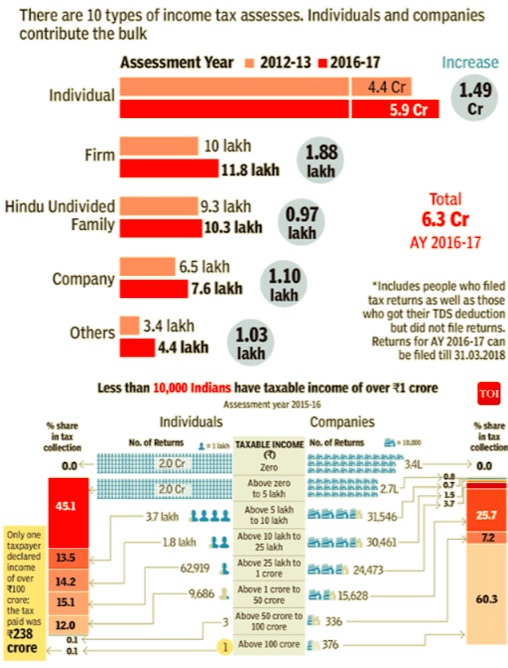

Ten types of Income tax assesses, individuals and companies, 2012-13 to 2016-17; Persons in the tax bracket, 2015-16

From: December 21, 2017: The Times of India

From: December 21, 2017: The Times of India

HIGHLIGHTS

Only 3% Indians (4.1 crore) filed income tax returns in 2014-15.

Only 1.6% actually paid income tax.

Nearly 50% of tax assessees who filed a return declared zero taxable income.

Reports released by the income tax department show 4.1 crore Indians filed income tax returns in 2014-15. But two crore tax filers declared zero taxable income. Another two crore Indians paid average annual income tax of Rs 42,456. Only one crore taxpayers paid income tax of more than Rs 1 lakh.

2015-16: 1.7% Indians paid income tax

December 25, 2017: The Times of India

HIGHLIGHTS

In the previous AY 2014-15, 1.91 crores, out of 3.65 crores who filed returns, had paid income tax.

The data, released last week, indicates just over 3 per cent of the 120 crore population filed returns.

Of the 4.07 crore tax returns field in AY 2015-16, close to 82 lakh showed zero or income less than Rs 2.5 lakh.

Just over 2 crore Indians, or 1.7 per cent of the total population, paid income tax in the assessment year (AY) 2015-16, according to data released by the I-T department.

The number of income-tax return filers increased to 4.07 crore in the assessment year 2015-16 (FY 2014-2015) from 3.65 crores in the previous year but only 2.06 crore actually paid tax as the others claimed income below taxable limits.

In the previous AY 2014-15, 1.91 crores, out of 3.65 crores who filed returns, had paid income tax. But the total income tax paid by individuals declined to Rs 1.88 lakh crore in AY 2015-16 from Rs 1.91 lakh crore in AY 2014-15.

The data, released last week, indicates just over 3 per cent of the 120 crore population filed returns. Of these, 2.01 crore paid nil income tax, 9,690 paid tax of over Rs 1 crore. Only one individual paid over Rs 100 crore in taxes (Rs 238 crore to be precise).

Maximum among of 19,931 crore was collected from 2.80 crore tax filers who paid between Rs 5.5 lakh to Rs 9.5 lakh in taxes. As many as 1.84 crore returns were filed for payment of income tax of less than Rs 1.5 lakh or an average of Rs 24,000. Of the 4.07 crore tax returns field in AY 2015-16, close to 82 lakh showed zero or income less than Rs 2.5 lakh.

Currently, no income tax is for income up to Rs 2.5 lakh.

In AY 2014-15, 3.65 crore filed tax returns with 1.37 crore showing zero or less than Rs 2.5 lakh income. The combined income of all individual tax filers rose to Rs 21.27 lakh crore in AY 2015-16 from Rs 18.41 lakh crore in the previous year.

A maximum number of 1.33 crore individuals were in Rs 2.5 lakh to Rs 3.5 lakh income group in AY 2015-16. In all, 4.35 crore income tax returns, including those by individuals, were filed in AY 2015-16. Total income declared was Rs 33.62 lakh crore.

In the previous year, 3.91 crore returns were filed with Rs 26.93 crore declared income. Companies filed 7.19 lakh returns with gross income of Rs 10.71 lakh crore.

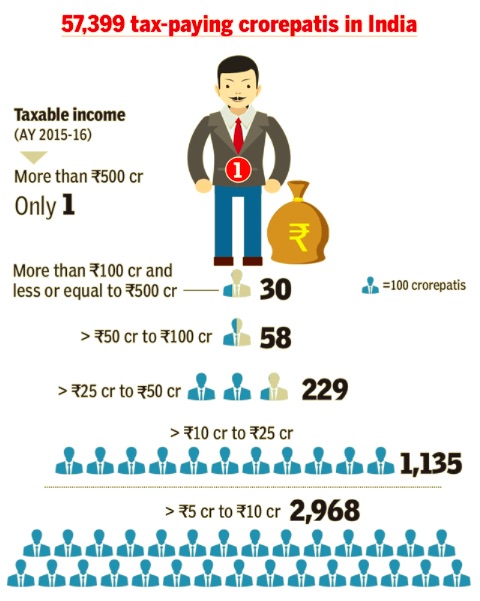

2012-16: crorepatis (₹10m.) increase by 54%

India sees a 54% rise in tax-paying crorepatis, January 2, 2018: The Times of India

From: India sees a 54% rise in tax-paying crorepatis, January 2, 2018: The Times of India

How is the super-rich population growing in India? A look at the individual income tax returns reveals that there has been a steady increase in the number of individuals whose taxable income show earnings over Rs 1 crore. In the assessment year 2012-13, there were 37,248 such individuals.This went up to 57,399 in 2015-16.

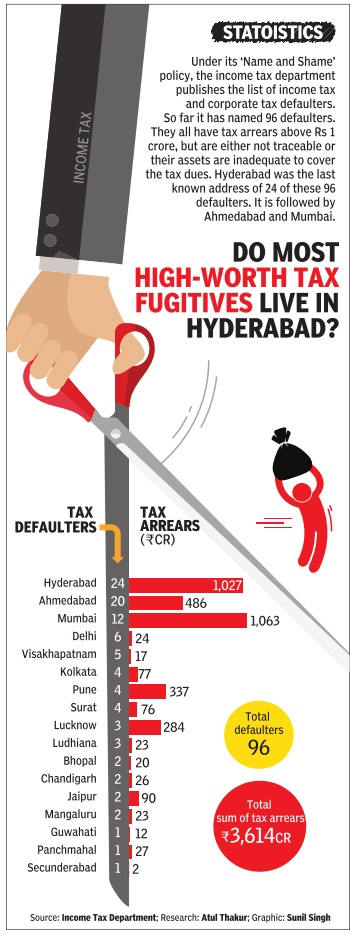

2016-17: cities where evaders live

See graphics:

The cities in which high- worth tax evaders lived in India in 2016-17

Why income tax payers in India are a small and shrinking section, some facts, 2017

From The Times of India, October 12, 2017

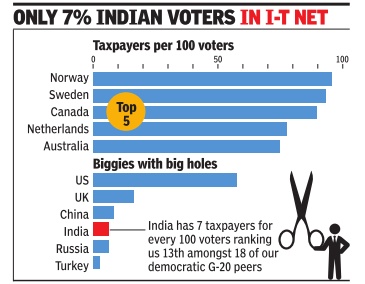

Voters amongst Income Tax payers, 2017

See graphic

Number of taxpayers per 100 voters, India and the world, February 2017

2017-18: Direct tax collection increases 19%

January 17, 2018: The Times of India

Direct tax collection jumps 19% to Rs 6.89 lakh crore this fiscal

Direct tax collections during the first nine-and-a-half months of the current fiscal have risen by 18.7 per cent to Rs 6.89 lakh crore, the tax department said. The collections till January 15, 2018 represent over 70 per cent of the Rs 9.8 lakh crore revenue target from direct taxes, the Central Board of Direct Taxes (CBDT) said in a statement.

"The provisional figures of direct tax collections up to January 15, 2018, show that net collections are at Rs 6.89 lakh crore which is 18.7 per cent higher than the net collections for the corresponding period last year," it said.

Gross collections (before adjusting for refunds) have increased by 13.5 per cent to Rs 8.11 lakh crore during April, 2017 to January 15, 2018.

Refunds amounting to Rs 1.22 lakh crore have been issued during this period.

Stating that there has been "consistent and significant" improvement in the position of direct tax collections during the current fiscal, the CBDT said the growth rate of total gross collections has improved from 10 per cent in Q1, to 10.3 per cent in Q2, to 12.6 per cent in Q3 and to 13.5 per cent as on January 15, 2018.

Similarly, the growth rate of total net direct tax collections has climbed up from 14.8 per cent in Q1, to 15.8 per cent in Q2, to 18.2 per cent in Q3 and to 18.7 per cent as on January 15, 2018.

The growth in corporate tax collections has risen from 4.8 per cent in first quarter of current fiscal to 10.1 per cent in Q3 and 11.4 per cent as on January 15, 2018.

Similarly, the growth rate of net corporate tax collections increased from 10.8 per cent in Q2 to 17.4 per cent in Q3 and to 18.2 per cent as on January 15, 2018.

2017, April-Dec: Rs 26,500 crore paid by those who don’t pay full taxes

The government’s drive, through a non-filer monitoring system, to target those who indulge in highvalue transactions but don’t pay enough taxes has forced the filing of at least 1.7 crore extra returns and helped the Centre mop up close to Rs 26,500 crore till December.

In a written reply, finance minister Arun Jaitley told Parliament on Friday that for the past few years, the tax department has been identifying non-filers by tracking in-house information and tallying it with data on high-value transactions received from external agencies along with TDS and tax collected at source (TCS).

“The mechanism for collection and verification of financial information has been broadened to include data in respect of various types of high-value transactions from banks and FIs and high-value expenditure from commercial establishments in the form of Statement of Financial Transaction (SFT),” the FM said, adding that the scope of TDS and TCS was also expanded.

He said quoting the Permanent Account Number was now mandatory for transactions of over Rs 2 lakh. This was yielding enormous data, which was being mined by I-T.

As a result, last year, 35 lakh non-filers were identified who the tax department believe had a tax liability. Though the number is down from 67 lakh a year ago, many who had large cash deposits may have filed returns.

‘Aim to get 1.25cr new return filers’

The move is part of an exercise aimed at deepening the income tax system with the FM saying this year, the target was to get 1.25 crore new return filers.

He said that after identifying the non-filers, the government was using rule-based algorithms to classify cases into various categories and monitoring them. Text messages and emails were sent to the targeted groups to file returns and a compliance management cell had been set up to track responses. This was followed by notices. The system is now proposed to be made more stringent through a new mechanism — Project Insight — to target people and seek voluntary compliance.

Complaints for prosecution

2017: Income Tax prosecution cases treble in 2017+ conviction up four times

HIGHLIGHTS

Prosecution complaints filed by the I-T department shot up nearly three times to 2,225 during April-November 2017

48 people were convicted of various offences during the first eight months of the financial year, a four-fold jump from last year

NEW DELHI: Prosecution complaints filed by the income tax department shot up nearly three times to 2,225 during April-November 2017, compared to 784 cases a year ago, the government said on Friday.

The tax authorities decided to push for the prosecution of offenders as they did not want to be seen as being soft on violations of the Income Tax (I-T) Act, given the Modi government's focus on reducing black money. In addition, there has been an 83 per cent rise in cases where compounding has taken place, with the number reaching 1,052. Compounding of offences is done when the defaulter admits to their offence and pays the compounding fee as per stipulated conditions.

In a statement, the finance ministry said 48 people were convicted of various offences during the first eight months of the financial year, compared to 13 during April-November 2016, a jump of nearly four times. The numbers come a day after the government said it had stepped up its crackdown on benami property and are seen as a response to criticism that demonetisation and other black money actions failed to produce the desired results.

"Prosecutions have been initiated for various offences, including wilful attempt to evade tax or payment of any tax; wilful failure in filing returns of income; and false statement in verification and failure to deposit the tax deducted/collected at source, or inordinate delay in doing so," the finance ministry said.

Among the cases where the judiciary has ruled in favour of the I-T department include one where a Dehradun court convicted a defaulter for holding an undisclosed account in a foreign bank and sentenced him to two years of imprisonment for wilful attempt to evade tax and two years for false statement in verification, along with a monetary penalty for each default.

In Bengaluru, the managing director of an infrastructure company was found guilty of not depositing tax deductions of over Rs 60 lakh and sentenced to rigorous imprisonment of three months along with a fine. Similarly, a Mohali resident was held guilty of non-deposit of TDS within the prescribed time and sentenced to a year's jail along with fine.

"The income tax department is committed to carry forward the drive against tax evasion and action against tax evaders will continue in all earnest in the remaining part of the current financial year," the ministry said.

Exchange of tax information

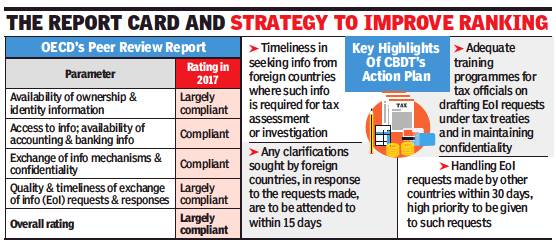

2013-16: India’s compliance rating slips

India slips in OECD ratings on exchange of tax info, November 22, 2017: The Times of India

From: India slips in OECD ratings on exchange of tax info, November 22, 2017: The Times of India

Peer Review Seeks More Clarity In Requests For Data

India has slipped from a rating of ‘compliant’ to an overall rating of ‘largely compliant’ as regards its meeting international standards for exchange of tax information, according to a peer review. A set of peer review reports covering six countries, including India, were released recently by the Organisation for Economic Co-operation and Development (OECD).

A pertinent suggestion for India, is to “ensure the quality of the exchange of information (EoI) requests sent to tax authorities of other countries and an efficient communication with its EoI partners, in all cases”. A peer review of a country is periodically conducted by officials representing other countries to check the implementation of the OECD-stipulated standards of transparency and exchange of information, which helps combat offshore tax evasion.

EoI requests made by India’s tax authorities to its counterparts worldwide have resulted in India detecting over Rs 1,900 crore in undisclosed bank accounts and 171 prosecutions in 123 cases. This covers cases where details of hundreds of offshore accounts were disclosed by the International Consortium of Investigative Journalists (ICIJ) in April 2013, and details of alleged unaccounted HSBC bank accounts in Switzerland which were uncovered via another leak in February 2015, cites the peer review report.

The current peer review covers the period July 1, 2013 to June 30, 2016. The report notes that the earlier review (report released in 2013) did not take into account the quality of information exchange requests sent by India to other countries or its communication with foreign tax authorities. The earlier report also did not factor the availability of information in India relating to beneficial ownership. Both these new parameters, on which India was judged as ‘largely compliant’, also pulled down its overall rating.

While India has legal and regulatory norms in place for disclosure of beneficial ownership in e-tax returns and under anti-money laundering regulations, the peer review group has suggested that India’s tax authorities monitor the quality of information collected via income tax (I-T) returns. As regards EoI requests, the report calls for greater clarity of such requests made by India’s tax authorities. They should also demonstrate the relevance of their requests and improve communications with the tax authorities in other countries, notably where bulk requests or complex requests are concerned, adds the report.

India extensively relies on the EoI mechanism. During the peer review period, it received 298 requests largely from tax officials in Belgium, Norway, US, Singapore and Indonesia. On the other hand, 3,787 requests were sent by India’s tax authorities to officials, mainly in British Virgin Islands (BVI), France, Singapore, Mauritius and UAE.

A retired government official said, “In the initial period covered by the review, Indian tax authorities lacked adequate expertise and experience in framing EoI requests. It was only in May 2015 that the CBDT issued a revised comprehensive manual on exchange of information, as ‘fishing expeditions’ — cases where information was sought without any concrete basis — had given India a bad name.” The peer review report concedes that since 2015, India has shown improvements in the quality of its requests and is also implementing an action plan.

Exemptions claimed

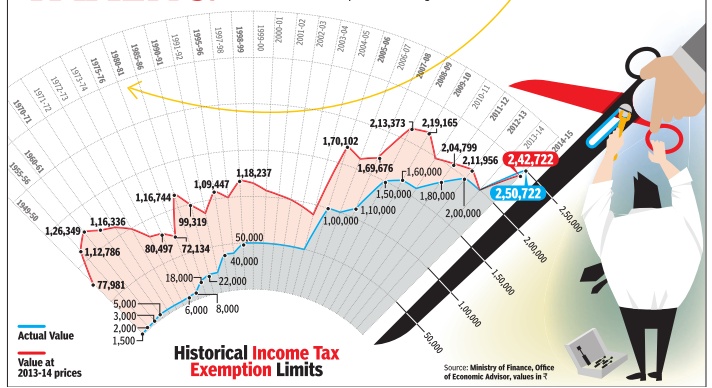

Tax exemption limits over the years/ 1949, 2015

See graphic:

Income tax exemption limits:1949-2015

Tax exemption limits over the years/ 1949, 2017

See graphics:

Payment of income tax, 1949-2017, some salient changes

Tax-free income levels in 1949 and 2017

From: January 15, 2018: The Times of India

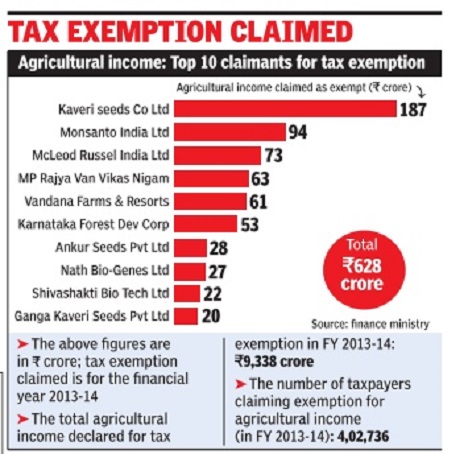

Exemptions on agricultural income: 2013-14

In 2013-14, ten top bodies claimed Rs 628cr tax breaks Oct 03 2016 : The Times of India

The Times of India

The comptroller and auditor general has initiated an audit of entities claiming tax exemption on agricultural income amid suggestions from some political parties and income tax authorities that a blanket exemp tion be done away with and tax be levied after a threshold.

The auditor has written to the finance ministry seeking details of entities which have declared agricultural income and the amount of tax exemption granted to them. Recently, tax authorities had raised concerns about possible misuse of the exemption availab le to agricultural income, although the government has clearly said that there was no move to impose tax.

Finance ministry data showed that nearly four lakh people declaring farm income had been granted exemption during 2013-14. Total agricultural in come exempted from tax in 2013-14 was Rs 9,338 crore.

The details were as per the list of those who had filed their returns till November 2014.

During 2013-14, the top 10 entities had claimed tax exemption of Rs 628 crore on their agricultural income and the list included multinational seed distribution companies. In fact, those declaring over Rs 1 crore agricultural income had come under the lens recently .

Film actors

Promotion of film: actor not expected to incur expenditure

Money spent by Hrithik to promote film `taxable', Nov 30, 2016: The Times of India

It is not an actor's responsibility or obligation to incur expenditure on promotion of his film, the Mumbai bench of the Income Tax Appellate Tribunal (ITAT) ruled recently . It disallowed an expenditure of Rs 5.6 lakh, incurred for promotion of `Gujarish', which was claimed by the lead actor, Hrithik Roshan, as deduction from his income in 2010-11.

While verifying Hrithik's income-tax (I-T) returns, the officer noticed that Hrithik had shown an expenditure of Rs 7 lakh for promotion of his film.The actor said it was paid to seven contestants of `Saregama', a TV show, for promotion his brand image, as he was the lead actor in the film. `Guzaarish' was a 2010 release, composed and directed by Sanjay Leela Bhansali, which also had Aishwarya Rai in the lead role. The officer held that expenditure relating to the film's making, its promotion et all was the producer's responsibility . He disallowed the expenditure claimed by the actor in his I-T computation as a business deduction.

Online returns

2016: 2.2 crore filed

The Times of India, Aug 09 2016

The income tax (I-T) department has issued refunds to 55 lakh assessees for Rs 14,300 crore till last week, in the first four months of the current financial year. This includes refunds of around Rs 3,000 crore for assessment year 201617, the last date of filing of returns for which was August 5. This is the first time that the government has refunded such a large tax surplus even before the date for filing returns had expired. A new benchmark has also been set with 2.27 crore people filing online returns this year, compared to 71 lakh in 2015-16. The total returns filed were a little more than two crore till the extended date of September 7 last year. A finance ministry statement said the growth in e-returns this year has been over 9.8%. Faster refunds have been possible as a large number of taxpayers have used the everification facility this time. The e-verification of re turns has been used by over 75 lakh taxpayers till August 5 as compared to 33 lakh last year till September 7.

This time, Aadhaar-based everification was used by 17.68 lakh taxpayers during the current year as against 10.41 lakh during the same period in 201516. At least 3.32 lakh digitally signed their returns. “Over 35% of taxpayers have already completed the entire process of return submission electronically,“ the ministry said.

The department has been encouraging taxpayers to use e-verification process as an easy alternative to sending their return forms to the I-T's central processing centre in Bengaluru for verification.

Purchase of property

Buyers won't lose I-T exemptions by adding kin name

Lubna Kably, Flat buyers won't lose I-T sop by adding kin name, May 1, 2017: The Times of India

Purchaser Should Get Full Tax Benefits: Tribunal

The Income Tax Appellate Tribunal (Mumbai bench) has, in a recent order, held that if the entire investment for purchase of a new residential house, along with stamp duty and registration charges, has been made by an individual, he should get the full benefit of the relevant income tax (I-T) exemptions.

Merely because the name of a close relative has been added to the newly purchased property (or in other words the new property is jointly held), it should not result in dilution of the I-T exemption in the hands of the individual who has paid for it.

The I-T Act, under various sections, offers tax benefits where sale proceeds (such as sale of residential house) are reinvested in certain assets (such as another residential house or eligible investments).

For instance, under section 54, if on sale of a residential house, the sale proceeds are reinvested in another house in India, within the stipulated period of time, to the extent of such reinvestment an exemption is available in computing capital gains. The taxable component of capital gains is reduced to the extent of the reinvestment, which results in a lower capital gains tax outgo.

If you look up the name plates in your housing society, you may find that several flats are jointly held.

The flat may be in the joint name of a couple, or owned with a parent or a sibling. The co-owner may or may not have contributed towards this purchase and the name of such a relative may have been added for the sake of convenience, such as to prevent family disputes arising in the future.

“The ITAT has upheld the well-established criteria that ownership for I-T purposes is determinant upon who has made the payment and to what extent. Very often, the name of a non-earning spouse, or parent or even sibling is added when a new property is purchased to offer a security net to them.

In those cases, where they have not contributed towards the purchase, the I-T benefit, such as on re-invest ment should flow entirely to the buyer who had made the purchase. This aspect has been reiterated by the ITAT,“ explains Gautam Nayak, tax partner, CNK & Associates.

In this case, decided by the ITAT on April 27, the taxpayer, Jitendra V Faria, had on sale of a residential house incurred capital gains of Rs.43.01 lakh. He reinvested Rs 42.66 lakh in a new residential house and claimed this amount as exempt under section 54 of the I-T Act. On the deficit balance, of Rs 35,000 odd, he paid capital gains tax amounting to Rs 7,376.

However, in the course of assessment, the I-T official noted that the new house that had been purchased was held in the name of two persons -Jitendra Faria with his brother Kunal Faria.Thus, the I-T official held that the exemption claimed by Jitendra Faria should be restricted to Rs 21.33 lakh (which is 50% of the amount claimed as exempt by him under section 54).

When the matter reached the ITAT, the tribunal noted that the name of brother was included only for the sake of convenience. It observed that even the I-T official had confirmed that the entire cost of the new house was borne only by Jitendra Faria. Thus, the ITAT set aside the decision of the I-T authorities and decided in favour of the taxpayer.

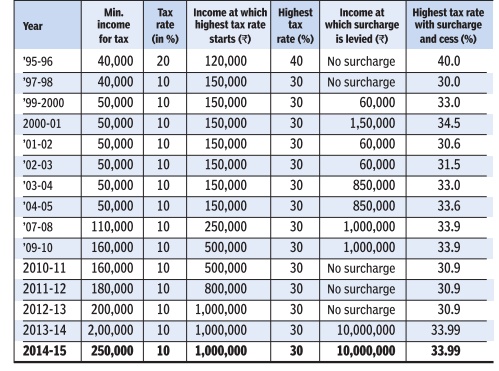

Rates of income tax in India

1995-2015

See the chart on this page

See graphic:

Income tax rates in India: 1995-2015

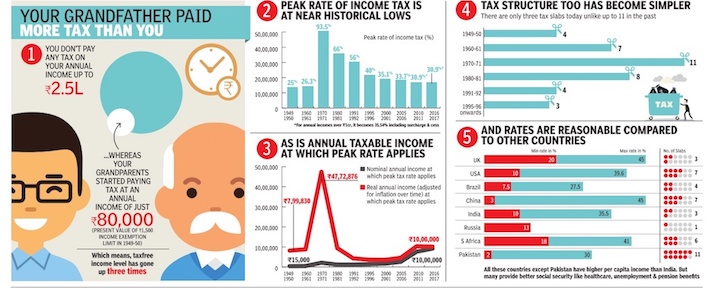

1949-2017: peak rate of Income Tax

January 15, 2018: The Times of India

From: January 15, 2018: The Times of India

See graphic:

1949-2017: peak rate of Income Tax

Highlights

We know you absolutely hate a part of your annual income going into to the government's kitty in the form of taxes. After all, you worked hard the whole year and wish the exemption limit would be set higher. Whether that would be done or not will be known till Budget 2018 is presented, but you should take heart from the fact that you pay much less tax than what your grandfather did during his time.

While exemption limit today stands at Rs 2.5 lakh annually, it was Rs 1,500 way back in 1949-50. Though this may seem a meagre amount to you, a back of the envelope calculation shows this works out to be Rs 80,000 in today's terms. So your grandfather started paying tax at annual income of Rs 80,000, while you enjoy tax-free income that is nearly three times more than it.

Tax rates are another reason for you to cheer about. The peak tax rate today stands at 30.9%. But during 1970-71 it was a staggering 93.5%, a massive increase from the 25% Indians paid in 1949-50.

You may find three tax slabs cumbersome for tax calculation, but thank your stars, your parents or grandparents had to deal with as many as 11 tax slabs.

1949, and since 1995: The number of tax slabs

From January 15, 2018: The Times of India

See graphic:

The number of tax slabs in 1949, and since 1995

Refunds

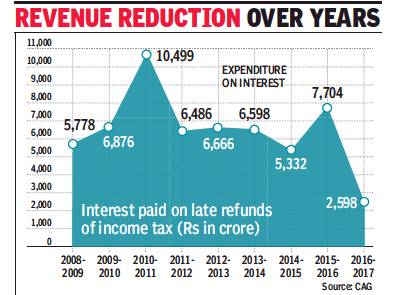

2008-17: Interest on delayed refunds cost ₹58,000 cr

From: Interest on delayed I-T refunds cost CBDT ₹58,000 cr in 9 years, December 20, 2017: The Times of India

See graphic:

Interest paid on late refunds of income tax, 2008-17

The Central Board of Direct Tax has incurred an expenditure of over Rs 58,500 crore in the last nine years only on interest paid to individuals and corporates for delayed refunds of excess income tax paid to the department.

The comptroller and auditor general, in its report tabled in Parliament on Tuesday, has criticised the CBDT and the revenue department in the finance ministry for not making budgetary provisions for the interest to be paid on delayed refunds and incurring such expenditure without the approval of Parliament.

“As in the past, no budget provision for interest on refunds was made in the budget estimates for the financial year 2016-17 and expenditure on interest on refunds amounting to Rs 2,598 crore was incurred by the department in contravention of provisions of the Constitution and in disregard of the recommendations of the public accounts committee,” CAG observed.

It said an expenditure of Rs 58,537 crore on interest payments had been incurred over a period of last nine years without obtaining approval of the Parliament through necessary appropriation.

The CBDT, however, informed the CAG that on the basis of opinion of the attorney general “holding the current practice of treating interest on refund as reduction of revenue and with the approval of the ministry of finance, recommendations of the PAC were not accepted”.

The CBDT classifies interest on refunds of excess tax as reduction in revenue. However, successive CAG’s audit reports have commented on this incorrect practice and observed that the department has failed to take any corrective action.

The CAG pointed out: “Article 114(3) of the Constitution stipulates that no money shall be withdrawn from the Consolidated Fund of India except under appropriation made by law. Payment of interest on refunds of excess tax is a charge on the Consolidated Fund and is, therefore, payable only after having been authorised under due appropriation made by law.”

Women’s income

Urban women

The Times of India, July 26, 2011

Samidha Sharma & Namrata Singh

Urban women’s average income doubles in 10yrs

Mumbai: Reinforcing the growing financial independence of women in India, a survey says the income level of urban Indian women has doubled in the last decade. This increase has also led to the average urban household income doubling, according to a study by market research firm IMRB. The urban Indian woman, who earned Rs 4,492 per month in 2001, took home Rs 9,457 as of 2010. The rise in income is directly reflected in the average monthly household income of urban India going up from Rs 8,242 to Rs 16,509 in 2010, says the survey. While this seems impressive, urban incomes seem to have gone up significantly less than those of the average Indian. According to official data, India’s per capita income rose from Rs 16,688 in 2000-01 to Rs 54,835 in 2010-11, a rise of 228%. The IMRB figures suggest urban incomes in the same period rose by 100% and incomes of urban women by 111%.

“We have aligned our strategy, communication and products to women. And with the growing aspirations and financial independence of women not only in urban India but in tier II and tier III cities, women are at the core of our business. The woman today is buying for herself and for her family,” said Kishore Biyani, founder, Future Group.

2001-10

Urban women’s avg income rose from 4,492/month in 2001 to 9,457 in 2010

Avg monthly household income of urban India rose from 8,242 to 16,509

No. of women doing household work dropped from 91% to 71%, says survey Women sourcing household work

As the income level of urban Indian women is rising fast, retail giant Future Group, which runs stores like Pantaloon and Big Bazaar, has seen the contribution of womenswear to overall sales more than double from 22% when it started operations to 55% at present.

What is significant in the survey is that with the woman’s personal income doubling, she is increasingly outsourcing household work. From 91% women saying they did household work themselves, the number has dropped to 71% in 2010, according to the survey. “With the average income of women and of urban households increasing over the years the propensity to spend has also gone up significantly. Although, there is a strong sense of deriving value for money out of all purchases made, the thought of putting all of the household income into savings is slowly diminishing,” said Ashish Karnad, group business director, IMRB International.

Brand experts say the changes over the last decade where more of the buying power is moving into the hands of woman has led to her influence in purchases even in categories predominantly of male consumption. “There remain very few areas of consumption in which the female does not increasingly participate today. Most household purchase decisions are either joint or exclusively female,” Tanya Dubash, ED, Godrej Industries.

See also

Income Tax India: Expert advice

Income Tax, India: Statistics: this page includes historical details of income tax rates and tax exemption limits over the years; how many Indians pay I Tax; how the income of women has risen over the years; the extent of tax arrears...