File:India and the world, the top 20 megacities that face water risk, drought as per a WWF assessment, presumably as in 2018.jpg, Subsidies (government subsidies): India

m (Jyoti moved page Subsidies: India to Subsidies (government subsidies): India without leaving a redirect) |

|||

| Line 1: | Line 1: | ||

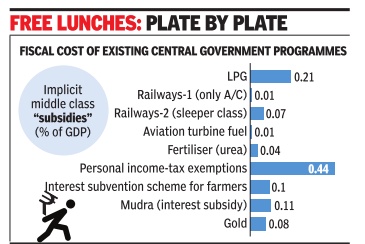

| + | [[File: Fiscal cost of existing central government programmes, as on February 1, 2017.jpg|Fiscal cost of existing central government programmes, as on February 1, 2017; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=01_02_2017_016_028_011&type=P&artUrl=Cash-For-All-Worth-A-Debate-Survey-01022017016028&eid=31808 The Times of India], Feb 1, 2017|frame|500px]] | ||

| + | {| Class="wikitable" | ||

| + | |- | ||

| + | |colspan="0"|<div style="font-size:100%"> | ||

| + | This is a collection of articles archived for the excellence of their content.<br/> | ||

| + | </div> | ||

| + | |} | ||

| + | |||

| + | [[Category:India |S ]] | ||

| + | [[Category:Government |S ]] | ||

| + | [[Category:Development |S ]] | ||

| + | [[Category:Economy-Industry-Resources |S ]] | ||

| + | |||

| + | =Impact on deficit= | ||

| + | ==2017> ’18: Subsidies reduced but not deficit== | ||

| + | [https://timesofindia.indiatimes.com/business/why-subsidy-cuts-may-not-help-fiscal-deficit-goals/articleshow/65303038.cms August 7, 2018: ''The Times of India''] | ||

| + | |||

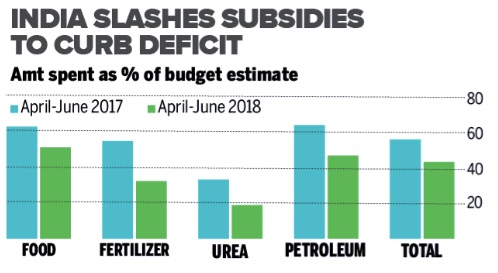

| + | [[File: Amount spent as % of budget estimates, April-June 2017-2018.jpg|Amount spent as % of budget estimates, April-June 2017-2018 <br/> From: [https://timesofindia.indiatimes.com/business/why-subsidy-cuts-may-not-help-fiscal-deficit-goals/articleshow/65303038.cms August 7, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | India is spending less on subsidies to narrow its budget gap. In three months of FY2018, it spent Rs 11.7 lakh crore ($17 billion) on major subsidies, less than Rs 13.5 lakh crore ($19.6 billion) doled out a year ago. | ||

| + | India recorded a fiscal deficit of $62.57 billion for April-June, or 68.7 per cent of the budgeted target for the current fiscal year. It was 80.8 per cent a year ago. For 2018-19, the government has set a fiscal deficit target of 3.3 per cent of GDP against a revised estimate of 3.5 per cent in 2017-18. This is surely a sign of fiscal consolidation, but at a slower pace than that recommended under the Fiscal Responsibility and Budget Management (FRBM) framework. | ||

| + | |||

| + | =State-wise, statistics= | ||

| + | =Assam= | ||

| + | ==2016== | ||

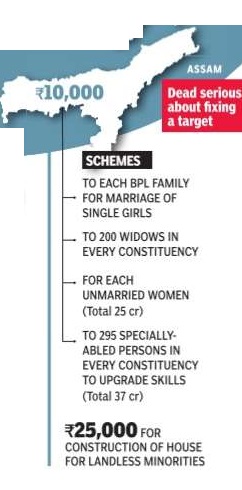

| + | [[File: Subsidies, Assam.jpg|Subsidies, Assam; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31804&articlexml=Amma-spoils-all-with-dosa-rice-and-curd-10032016016017 ''The Times of India''], Mar 10 2016|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Subsidies, Assam'' | ||

| + | |||

| + | =Kerala= | ||

| + | ==2016== | ||

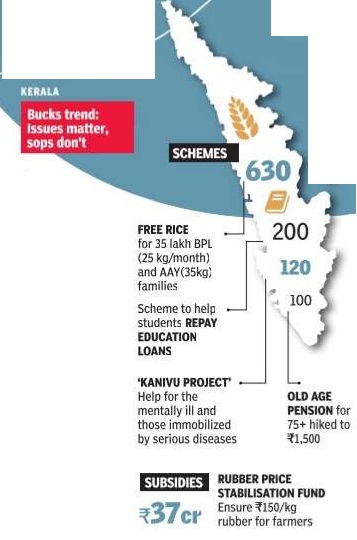

| + | [[File: Subsidies, Kerala.jpg|Subsidies: Kerala; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31804&articlexml=Amma-spoils-all-with-dosa-rice-and-curd-10032016016017 ''The Times of India''], Mar 10 2016|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Subsidies: Kerala'' | ||

| + | |||

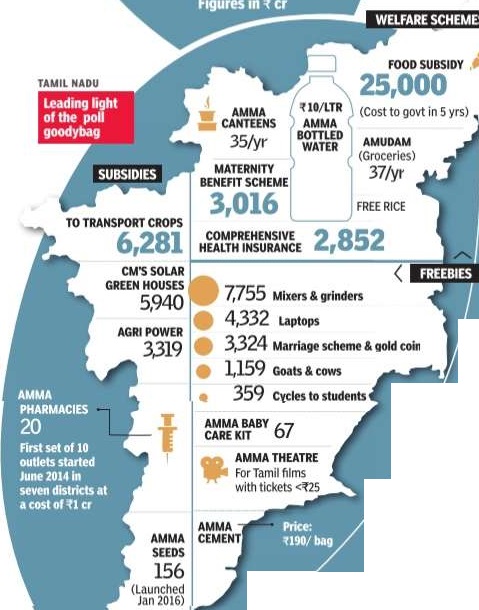

| + | =Tamil Nadu= | ||

| + | ==2016== | ||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31804&articlexml=Amma-spoils-all-with-dosa-rice-and-curd-10032016016017 ''The Times of India''], Mar 10 2016 | ||

| + | |||

| + | [[File: Subsidies, Tamil Nadu.jpg| Subsidies: Tamil Nadu; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31804&articlexml=Amma-spoils-all-with-dosa-rice-and-curd-10032016016017 ''The Times of India''], Mar 10 2016|frame|500px]] | ||

| + | |||

| + | Sivakumar B | ||

| + | |||

| + | ''' Amma spoils all with dosa, rice and curd ''' | ||

| + | |||

| + | AIADMK, which traditionally restricted welfare to basic necessities, changed tack in 2011, promising everything from goats to grinders even though the 2G scam had already built up anti-incumbency against DMK. | ||

| + | |||

| + | After winning the election, the Amma canteens, pharmacies, cement and bottled water followed -the cost of the welfare schemes for the past 5 years has crossed the Rs 43000-crore mark. | ||

| + | |||

| + | The state-run canteens, especially the ones that cater to urban poor and migrant workers, have been widely appreciated. | ||

| + | |||

| + | The concept is now being adopted by other states also. | ||

| + | |||

| + | The AIADMK government has spent several thousand crores on various welfare schemes with food subsidy alone costing Rs 25,000 crore. But there are outliers too. Anbumani Ramadoss' PMK, for instance, has promised to do away with the freebie model of governance. | ||

| + | |||

| + | DMK has criticised Jayalalithaa's Amma-branded schemes but remains silent on its own freebies such as television sets. | ||

| + | |||

| + | Analysts say schemes such as subsidised canteens and pharmacies will continue. Their names might change if there's a change in the ruling dispensation just as AIADMK changed the name of the free medical insurance scheme when it assumed office five years ago. | ||

| + | |||

| + | But Ramadoss is certain freebies will not have an impact on the voters' decisions. “In 2006 alone, there was an impact the DMK's `1 kg rice for Re 1' scheme made a difference But in the last election, even after offering so many freebies, DMK came third,“ he said.“PMK will offer free services such as quality health care, education, transport instead.“ | ||

| + | |||

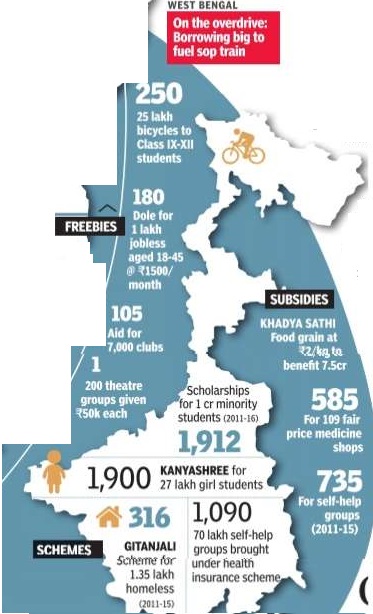

| + | =West Bengal= | ||

| + | ==2016== | ||

| + | [[File: Subsidies, West Bengal.jpg|Subsidies: West Bengal; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31804&articlexml=Amma-spoils-all-with-dosa-rice-and-curd-10032016016017 ''The Times of India''], Mar 10 2016|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Subsidies, West Bengal'' | ||

Revision as of 10:35, 16 December 2020

This is a collection of articles archived for the excellence of their content. |

Contents |

Impact on deficit

2017> ’18: Subsidies reduced but not deficit

August 7, 2018: The Times of India

From: August 7, 2018: The Times of India

India is spending less on subsidies to narrow its budget gap. In three months of FY2018, it spent Rs 11.7 lakh crore ($17 billion) on major subsidies, less than Rs 13.5 lakh crore ($19.6 billion) doled out a year ago. India recorded a fiscal deficit of $62.57 billion for April-June, or 68.7 per cent of the budgeted target for the current fiscal year. It was 80.8 per cent a year ago. For 2018-19, the government has set a fiscal deficit target of 3.3 per cent of GDP against a revised estimate of 3.5 per cent in 2017-18. This is surely a sign of fiscal consolidation, but at a slower pace than that recommended under the Fiscal Responsibility and Budget Management (FRBM) framework.

State-wise, statistics

Assam

2016

See graphic:

Subsidies, Assam

Kerala

2016

See graphic:

Subsidies: Kerala

Tamil Nadu

2016

The Times of India, Mar 10 2016

Sivakumar B

Amma spoils all with dosa, rice and curd

AIADMK, which traditionally restricted welfare to basic necessities, changed tack in 2011, promising everything from goats to grinders even though the 2G scam had already built up anti-incumbency against DMK.

After winning the election, the Amma canteens, pharmacies, cement and bottled water followed -the cost of the welfare schemes for the past 5 years has crossed the Rs 43000-crore mark.

The state-run canteens, especially the ones that cater to urban poor and migrant workers, have been widely appreciated.

The concept is now being adopted by other states also.

The AIADMK government has spent several thousand crores on various welfare schemes with food subsidy alone costing Rs 25,000 crore. But there are outliers too. Anbumani Ramadoss' PMK, for instance, has promised to do away with the freebie model of governance.

DMK has criticised Jayalalithaa's Amma-branded schemes but remains silent on its own freebies such as television sets.

Analysts say schemes such as subsidised canteens and pharmacies will continue. Their names might change if there's a change in the ruling dispensation just as AIADMK changed the name of the free medical insurance scheme when it assumed office five years ago.

But Ramadoss is certain freebies will not have an impact on the voters' decisions. “In 2006 alone, there was an impact the DMK's `1 kg rice for Re 1' scheme made a difference But in the last election, even after offering so many freebies, DMK came third,“ he said.“PMK will offer free services such as quality health care, education, transport instead.“

West Bengal

2016

See graphic:

Subsidies, West Bengal

File history

Click on a date/time to view the file as it appeared at that time.

| Date/Time | Thumbnail | Dimensions | User | Comment | |

|---|---|---|---|---|---|

| current | 19:07, 8 December 2020 | Error creating thumbnail: /var/www/html/ind/bin/ulimit4.sh: line 4: /usr/bin/convert: No such file or directory | 560 × 780 (95 KB) | Jyoti Sharma (Jyoti) (Talk | contribs) |

- Edit this file using an external application (See the setup instructions for more information)

File usage

The following page links to this file: