Hair colours (dyes): India

This is a collection of articles archived for the excellence of their content. |

Sales

2015> 2018

Namrata Singh, November 7, 2018: The Times of India

From: Namrata Singh, November 7, 2018: The Times of India

The hair colour market, which has traditionally been driven by ‘powders’, including henna, has seen significant shifts in consumers upgrading to using crème colours following a strategy change by leading players.

When global player L’Oréal entered the market with their premium range of crème hair colours two decades ago, a large majority of Indian consumers were spending a maximum of Rs 50. The process of natural upgradation of consumers to use premium products would have been a lengthy one. L‘Oreal adopted what the shampoo industry has successfully pioneered — offer small-ticket packs at convenient prices to bring consumers to use crème colours.

Other players followed suit and the strategy clicked. Branded crème colour companies started playing in the Rs 30-37 price range, which prompted users of henna and powders (priced at Rs 17-20) to spend only an additional Rs 10 to upgrade to crème hair colours.

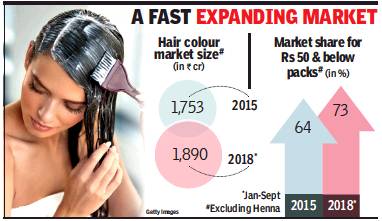

Today, 60% of the crème hair colour market is below Rs 50, up from 44% in November 2014, according to industry estimates. On the other hand, the size of the hair colour market increased from around Rs 1,700 crore in 2015 to about Rs 1,900 crore this year. Some of the brands operating in crème hair colour are Garnier, Godrej Expert Rich Crème, Streax and Indica.

Aseem Kaushik, director (consumer products division) at L’Oréal, said, “When we started the crème colour revolution in 1996, the prices were always high for branded products. In the last four years, what you see is that suddenly the price point below Rs 50 has been activated through sachets of crème colour. This was never a price point for crème colours before. A lot of people who were buying sachets of powder hair colour are upgrading to crème now.” Kaushik said the prices with box packs have sustained, riding on affluent Indian consumers in SEC A in metro, mini metro and tier-1 towns.

Vivek Gambhir, MD of Godrej Consumer Products (GCPL), said, “Given the lower penetration in hair colour, our focus has been on democratising the category and making beauty more affordable and accessible.” GCPL does this by offering products with distinctive design at affordable prices.