Government finances (the states): India

This is a collection of articles archived for the excellence of their content. |

Contents |

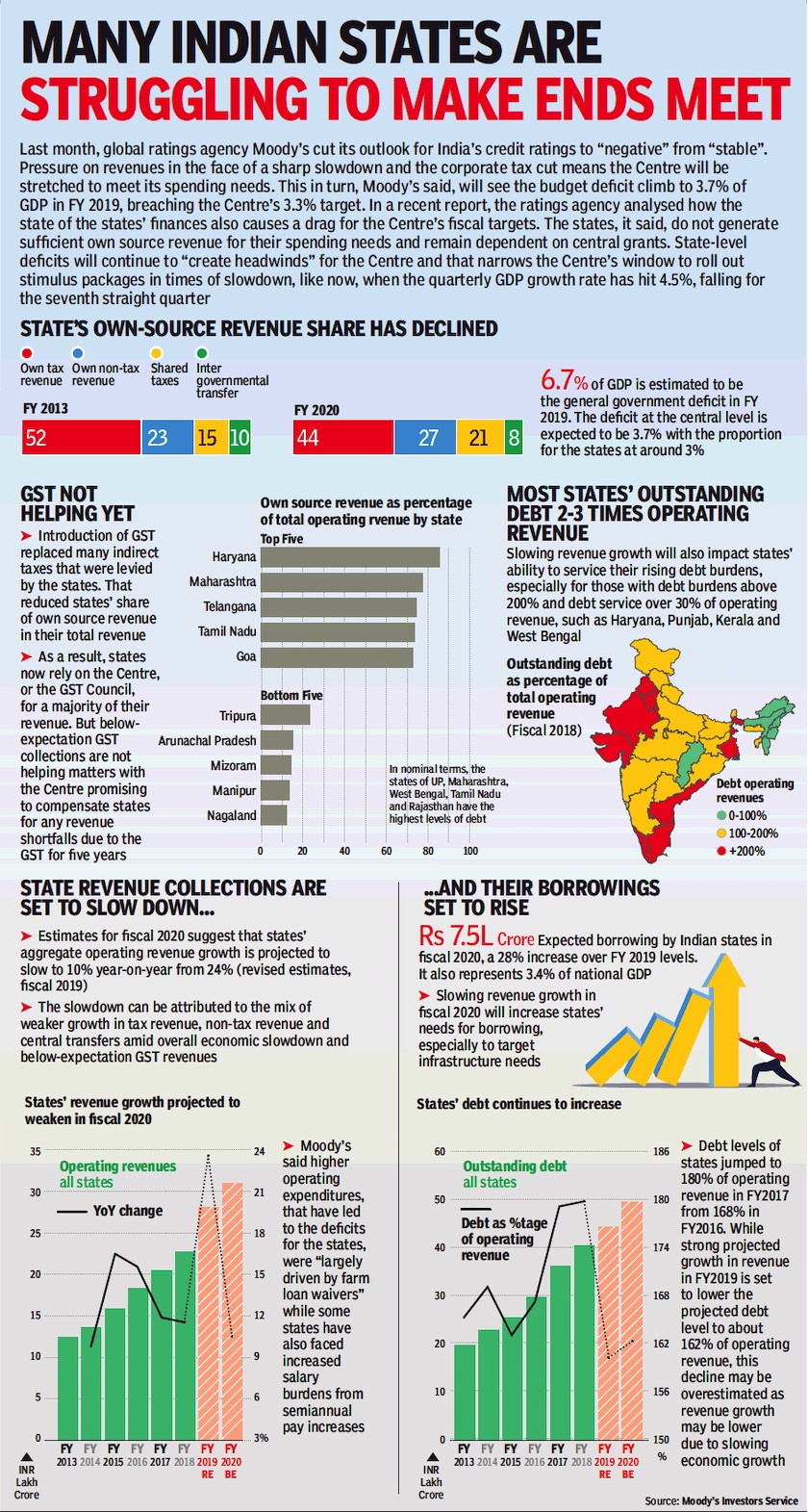

Revenues and borrowings

2013-18

From: Dec 3, 2019: The Times of India

See graphic:

2013-18: the revenues and borrowings of India’s state governments.

2021

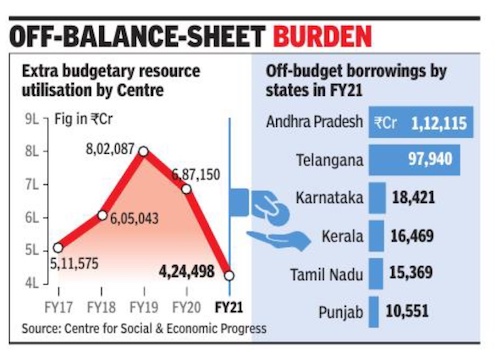

From: Sidhartha, Sep 4, 2023: The Times of India

See graphic:

Off budget borrowings by Indian states in 2021

Off budget borrowings by Indian states

A 2021 study

Sidhartha, Sep 4, 2023: The Times of India

New Delhi : Just two states, Andhra Pradesh and Telangana, had off-balance-sheet borrowings of around Rs 2.1 lakh crore in 2020-21, nearly half the extra budgetary resources utilised by the Centre, an analysis by a think tank has shown amid concerns that the states may be hiding the true extent of their borrowings by raising money through their public sector companies to meet subsidies and other liabilities.

A report on off-budget borrowings by the Centre for Social and Economic Progress has pointed to violations of the mandated debt level under the fiscal responsibility law. For instance, Andhra Pradesh maintained total liabilities at 35% of the gross state domestic product (GSDP) — but without factoring in the off-budget borrowings. Once that was added, in 2020-21, total liabilities added up to 44% of GSDP, the paper by Shurti Gupta and Jevin James estimated.

In the case of Telangana, the gap was nearly 10 percentage points — which meant that after factoring in the off-budget borrowings, the total liabilities shot up to 38.1%. In the case of Kerala, the gap was around three percentage points — 42.8% (including off-budget borrowings) against 39.9% — while it was a percentage point for Karnataka (22.4% versus 21.4%). The report indicated that the gap had widened since 2019-20, although the Centre has sought to crack down on it.

The paper estimated that 11 states between them had combined off-budget borrowings of over Rs 2.5 lakh crore, with data for Gujarat, Madhya Pradesh and Uttarakhand unavailable. The five southern states accounted for 93% of the off-budget borrowings with Telangana’s ratio at 10% of its GSDP.

It has suggested that the Centre’s extra budgetary resources (EBR) utilisation has dropped from over Rs 8 lakh crore at the end of 2019 (see graphic), but cautioned that the borrowings have been decreasing as the numbers may be incomplete. This is despite the Union finance ministry maintaining that the dues to the Food Corporation of India are now routed through the budget instead of the National Small Savings Fund or the NHAI programme being funded directly by the Centre instead of by issuing bonds, which did not reflect in the Union government’s Budget. So, what are states borrowing for? It is for a variety of reasons. In the case of Andhra, 35% was used by the state civil supplies corporation that manages the foodstuff value chain, much like FCI at the national level.

Tamil Nadu used 96% of the borrowings to meet the requirements of the state power transmission and generation company, with a similar trend seen for Punjab. Nearly 37% of Telangana’s off-budget borrowings were used up by Kalleshwaram Irrigation Projection Corporation.