Gold in the Indian economy

This graphic links to the graphic below.

The Times of India

This graphic links to the graphic above.

The Times of India

The Times of India

The Times of India

The Times of India

The Times of India

The Times of India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

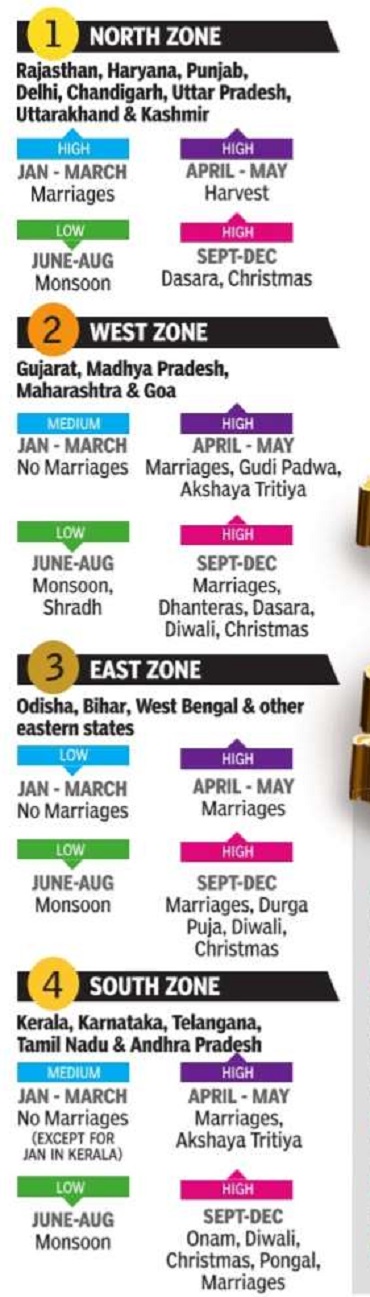

Demand for gold

Demand is season-based

Shenoy Karun, THE POWER OF GOLD Oct 17 2016 : The Times of India

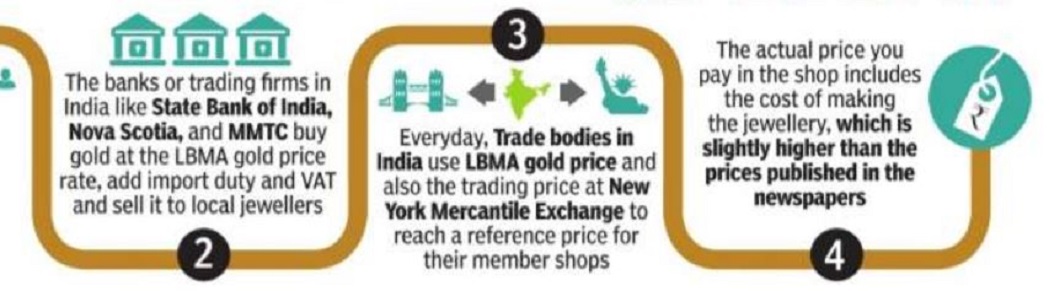

Every year, after a short lull during monsoon, gold sales in the country pick up again with festivals. It is Onam that kick-starts this string of festivals across India. Shenoy Karun writes how gold consumption pattern differs from season to season across the country and presents the bigger picture of the world's total production and its major producers

See seven graphics.

2007-17

See graphic: Demand for gold in India, 2007-2017

From: Aparna Desikan, Gold demand hits 7-year low in Q3, November 10, 2017: The Times of India

2012

Gold demand in the country was 864 tonnes according to data given in WGC 'Gold Demand Trends 2013' report.

2013: rises by 13%

India's gold demand up 13% at 975 tonnes in 2013: Report

PTI | Feb 18, 2014

India's gold demand remained buoyant and rose by 13% to 975 tonnes compared to 2012, despite government putting in several restrictions to curb imports, according to a World Gold Council report.

"Demand in the second half was lower due to the effect of the supply curbs introduced in that period, but, equally, it was due to households having met a large part of their annual gold requirements in the first half, using the price drop in April as a buying opportunity," WGC Managing Director India Somasundaram P R told PTI.

The total jewellery demand in the country in 2013 was up by 11% at 612.7 tonne valued at Rs 1,61,750.6 crore compared to 552 tonne valued at Rs 1,58,359.1 crore in 2012.

The total investment demand for 2013, was up by 16% at 362.1 tonnes from 312.2 tonnes in 2012.

In value terms, gold investment demand rose by six% at Rs 95,460.8 crore against Rs 90,184.6 crore in 2012.

Recycled gold, however, declined by 10.79% to 100.8 tonnes in 2013, compared to 113 tonnes in 2012.

The latter half of 2013, Somasundaram said, has seen intense grey market activity.

But India drops to no.2: 2013

The Times of India Oct 25 2014

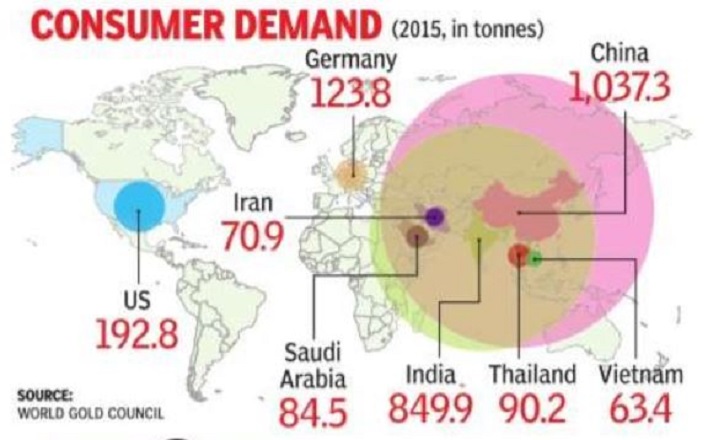

2013: India is no more the world's largest market for consumer gold demand-gold jewellery, bars and coins acquired directly by individuals. Data collated by the World Gold Council shows that in 2013 China trounced India in consumer gold demand. China's 2013 individual gold purchases of 1,066 metric tonnes were 32% higher than its 2012 demand, while India's demand increased by 13% to become 975 tonnes. On a per capita basis, annual consumer gold demand of 8.5 gm in UAE, 8.1 gm in Switzerland, 5.4 gm in Hong Kong, Saudi Arabia's 2.4 gm and Turkey's 2.3 gm were among the highest in the world. India's annual per capita gold demand of roughly 0.8 gm is the 9th highest in the world.

2014 (forecast)

"In 2014, market estimation of gold demand is between 900-1,000 tonnes," he added.

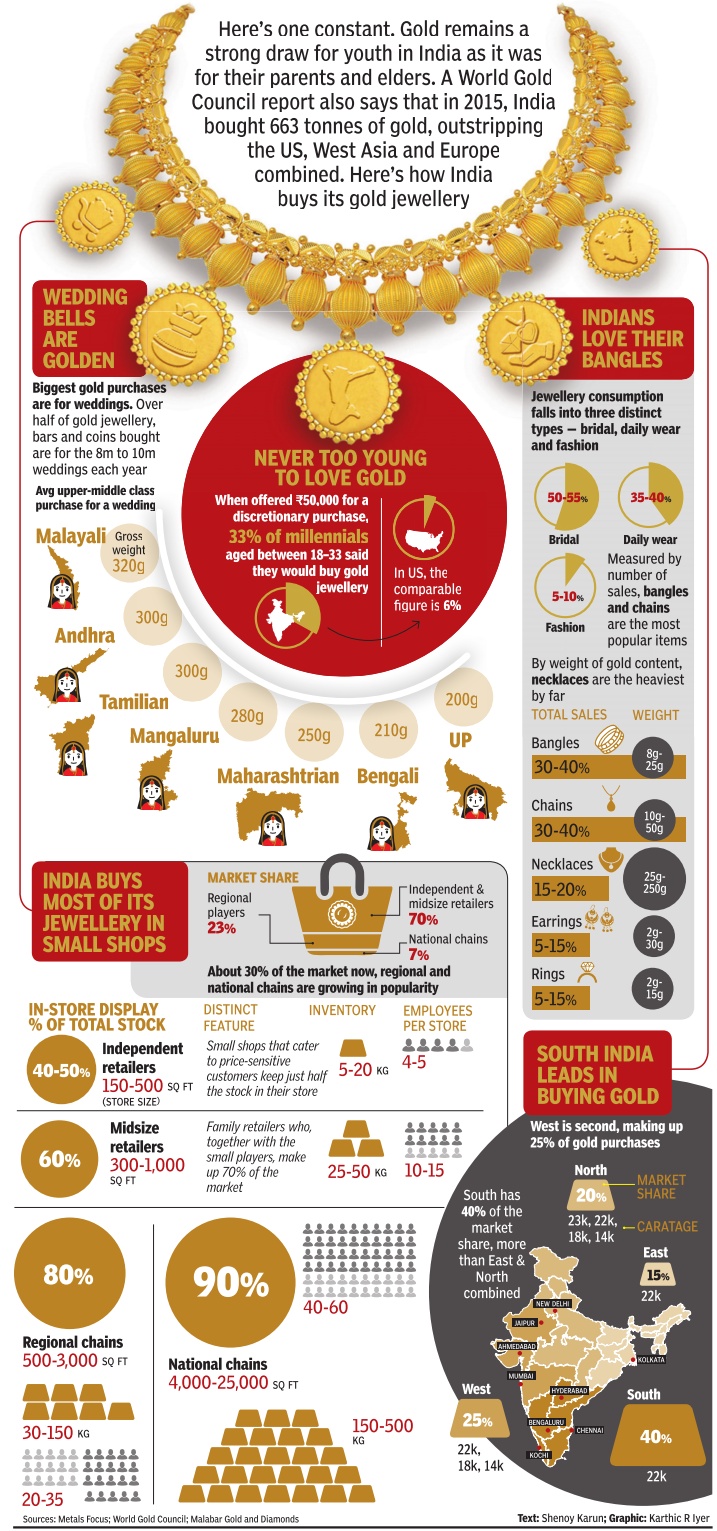

2015: How India purchased its gold jewellery

HOW INDIA BUYS ITS GOLD JEWELLERY|Jul 18 2017 : The Times of India

Here's one constant. Gold remains a strong draw for youth in India as it was for their parents and elders. A World Gold Council report also says that in 2015, India bought 663 tonnes of gold, outstripping the US, West Asia and Europe combined. Here's how India buys its gold jewellery.

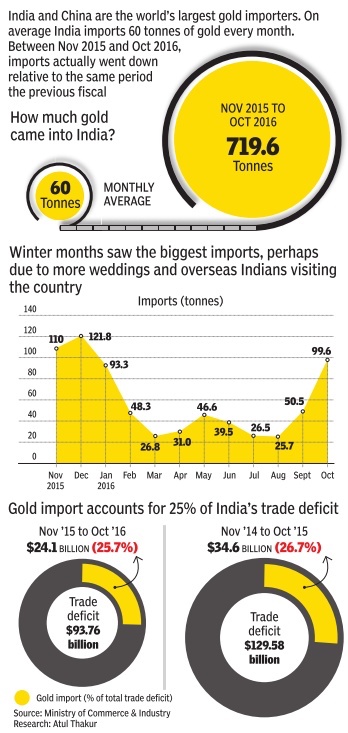

November 2015-October 2016, gold imports

See graphic:

Gold imports in India, Nov 2015-Oct 2016 and share of gold import in India's trade deficit, Nov 2014-16

2016/ 21% decrease in demand

Aparna Desikan, Gold demand in India 21% lower, says WGC, Feb 04 2017: The Times of India

The Times of India, Feb 3, 2017

India's gold demand fell sharply by 21% to 676 ton in 2016

HIGHLIGHTS

The fall in demand was mainly due to jewellers strike, PAN card requirement and demonetisation move

The gold demand for 2015 stood at 857.2 tonne, while it was 675.5 tonne in 2016, the WGC data revealed.

Jewellery demand in India also witnessed a sharp decline of 22.4 per cent in 2016

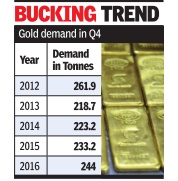

Demand for gold in India has weakend in 2016, but October-December quarter has bucked the trend. In Q4, the demand for gold has risen by 3% at 244 tonnes compared to 194.8 tonnes in the same period of 2015, World Gold Council (WGC) figures showed. Demand in Q4 is the highest since 2012 (261.9 tonnes).

MUMBAI: Gold demand in India witnessed a significant decline of 21 per cent in 2016 at 675.5 tonne, mainly due to challenges like jewellers' strike+ , PAN card requirement and demonetisation+ move, says World Gold Council.

The gold demand for 2015 stood at 857.2 tonne, the WGC data revealed.

Jewellery demand in the country also witnessed a sharp decline of 22.4 per cent in 2016, at 514 tonne compared to 662.3 tonnes in 2015.

In value terms, jewellery demand saw a drop of 12.3 per cent in 2016 at Rs 1,38,837.8 crore, from Rs 1,58,310.4 crore in 2015, the report revealed.

Wedding and festival season purchases, pent-up demand fuelled buying in Q4, while an improved monsoon also helped, said P R Somasundaram, MD, World Gold Council, India. “Prices softened in October, coinciding with the demand during Di waliDhanteras, which partially contributed to the increase in purchase. There was a spurt in buying until a week post-demonetisation, after which the cash crunch led to a reduction in purchases,“ he added.

"India's gold demand for 2016 fell sharply, though the fourth quarter demand grew by 3 per cent to 244 tonne, due to softened gold prices that coincided with Diwali and wedding season. Demand was affected as the industry faced challenges, including PAN card requirement, Excise duty on jewellery, demonetisation and the publicity around income disclosure schemes," WGC Managing Director, India, Somasundaram PR said. This was not unique to gold but trade practices and embedded buying behaviour created short-term headwinds, he said.

Looking ahead, these policies aim to deliver stronger economy and a more transparent gold industry, both of which should deliver significant benefits to gold buyers as well as accelerating transformation of the industry in becoming more organised, he said.

Also, the rural community was the hardest hit by cash crunch, but the effect is likely to be temporary as healthy income and good monsoon will support gold demand going forward, he explained.

Somasundaram said, "We anticipate that 2017 will see a demand range of 650-750 tonne due to the introduction of the Goods and Services Tax+ (GST) coupled with gradual adaptation to the previous year's policy changes."

Meanwhile, total investment demand for 2016 was down by 17.1 per cent at 161.5 tonne against 194.9 tonne in 2015, the WGC report said. In value terms, gold investment demand was at Rs 43,647.5 crore, a fall of 6.3 per cent, from Rs 46,597.3 crore in the previous year.

Jewellers said that increase in Q4 demand was main ly due to the Dhanteras season and buying was muted until December. “The October-December quarter, which traditionally sees demand during Diwali, wedding seasons and NRI purchases in December (margazhi), saw business as usual only in October. Overall, there was a 15% reduction,“ said N Ananthapadmanabhan, MD, NAC Jewellers.

The quarter ended December was probably the only quarter which saw an increase in demand for gold.The full year demand, however, fell 21.4% to 675.5 tonnes compared to 857.2 tonnes in 2015. For jewellery alone, the market ended 22% down, compared to the previous year.

Andhra Pradesh, Telangana , 2017

Syed Akbar, 'Golden era' back in Andhra Pradesh, Jan 21, 2017, The Times of India

HIGHLIGHTS

Andhra Pradesh and Telangana consume about one-fourth of gold imported by India

Andhra Pradesh has a history of gold mining dating back to the Vijayanagar empire

The latest gold prospecting studies will cover about 900 acres of forest land

The search for gold is set to resume in Andhra Pradesh with one of the private firms, which got licence for prospecting studies, submitting its proposals to the Union ministry of environment, forests and climate change seeking forest clearance.

The prospecting studies will be conducted in the forest areas of Sadukonda and Tamballapalle in Chittoor district. Apart from gold, the firm will also look for iron, tungsten, copper, lead, zinc and silver among others. The proposal came up for hearing before the forest clearance panel on January 5. However, the panel kept the proposal pen ding seeking more information on prospecting studies. Once the panel gives its nod, prospecting studies will be taken up covering about 900 hectares of forest area.

The new search for gold is likely to give fillip to the AP government's plans to set up a gold refinery in Krishna district.

The Indian Bureau of Mines (IBM) has estimated that Andhra Pradesh has a potential gold ore of 1.22 crore tonnes.Earlier estimates had put the reserves at about 68 lakh tonnes of gold ore. Prospecting studies have been held up in Andhra Pra desh for about a decade for various reasons. The latest proposal by Geomysore Services (India) Private Limited has revived the hope of gold prospecting and excavation in AP , which incidentally has about three per cent of India's gold ore.

Earlier, drilling along Ramagiri Gold Fields covering about half a dozen villages including Bhadrampalle and Ramagiri in Chittoor district yielded good gold prospects. IBM studies reveal "feeble to moderate" values of gold in Tellakonda village in neighbouring Kadapa district. Jonnegiri in Anantapur district is estimated to produce about 70 tonnes of gold a year. Banaganapalle, Pagadarai and Yerragudi in Kurnool and Jaggaiahpet in Krishna district also showed encouraging signs of gold, according to official data. An IBM annual report for AP traces gold reserves in small quantities along rivers and streams in the state.

According to state government data on minerals, there are a number of gold-bearing green stone schist belts in Chittoor, Anantapur, Kurnool, Guntur, Prakasam, Kadapa and Nellore districts. Officials have already identified about three dozen gold-bearing belts, which extend from 16 km to 185 km in length. The average assay of three to five grams of gold per tonne of ore is present in such belts. About 62,000 kg of gold can be obtained from these three dozen identified sites.

Besides, officials have also estimated about presence of 22,000 kg of gold in the old gold mines in the greenstone belt near Venkatampalle in Chittoor district. A report of the sub group II on metals and minerals, go vernment of In dia, has also listed several areas in AP that "could be developed into mines by 2025-30".

They are Bhad rampalle, Rama pura, Venkatampalle, Chinnabhavi and Jibutil. Of these, Chinnabhavi alone has 634.31 tonnes of gold ore.

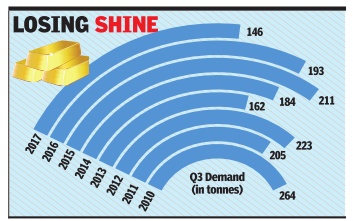

2017, July- September: demand down by 24% than 2016

Aparna Desikan, Gold demand hits 7-year low in Q3, November 10, 2017: The Times of India

Gold demand plummeted to a seven-year low in the July-September quarter, 2017 at 146 tonnes, down by 24% in comparison to the same period in 2016.Data from the World Gold Council (WGC) shows that this latest fall in demand comes after three consecutive quarters of growth. Also, the 146-tonne figure is the lowest for the period in this decade.

Jewellers attribute the fall to the introduction of the Prevention of Money Laundering Act (PMLA) that impacted consumer sentiment. “It was on for almost 50 days and it hit sentiments, leading to a 35% drop in purchases. Even as the Act is not in effect now, sentiments have not improved. This can be attributed to the GST impacting businesses. Buying jewellery becomes the last resort and the sale has been down since, barring the few days surrounding Diwali,“ said NAC Jewellers MD N Anantha Padmanabhan.

The drop in demand comes in the wake of Korean imports being banned as well, say industry sources.

The WGC makes a conservative estimate of the total annual demand, placing them at 650-750 tonnes, leaning towards the lower end. WGC India MD P R Somasundaram said, “While initially we had estimated the annual demand to hit 750 tonnes, lower than the average of 845 tonnes, we are further revising the estimate to be 650 tonnes.“

Gems and Jewellery Federation (GJF) adds that frequent changes in policy , demonetisation and GST have dampened sentiments. GJF chairman Nitin Khandelwal said, “There have been changes in the policy in the last 15 months -starting with the mandatory declaration of PAN, demonetisation, PMLA and GST.Besides, there is a softness in the income owing to poor yield of staple crops such as soyabean and cotton.“

June 2017- July 2018: demand down by more than 25%

July 5, 2018: The Times of India

Imports slumped more than 25 per cent to 54 metric tons in June from a year earlier, a person familiar with the information said, asking not to be identified as the figures aren’t public. Overseas purchases plunged 40 per cent to 343 tons in the first half from a year ago, according to data from Finance Ministry officials compiled by Bloomberg.

Buying has been poor as the rupee extended its slump to a record low last month, making prices of overseas goods more expensive. Rural demand has suffered as farmers typically go slow on gold purchases from June to August because they are busy taking advantage of seasonal rains to plant crops. Finance Ministry spokesman D S Malik declined to comment on the June numbers.

Another reason for the decline in demand has been the waning interest from millennials, who are more attracted by high-end consumer goods. The precious metal has dropped to third position among India’s imports as the relentless rise in purchases of smartphones, TVs and other goods has made electronics the second-largest item, with oil the first.

Prices in India are holding above the psychological level of Rs 30,000 per 10 grams, discouraging fresh buying, said Gnanasekar Thiagarajan, a director at Commtrendz Risk Management Services Pvt. Ltd. “The great performance of equities in India has dented the appetite for safe-haven gold.”

Gold reserves

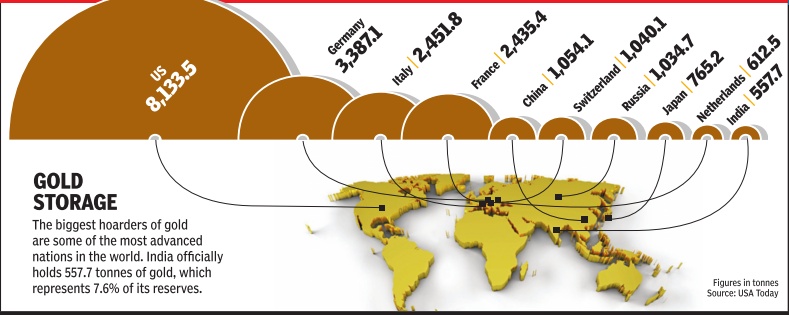

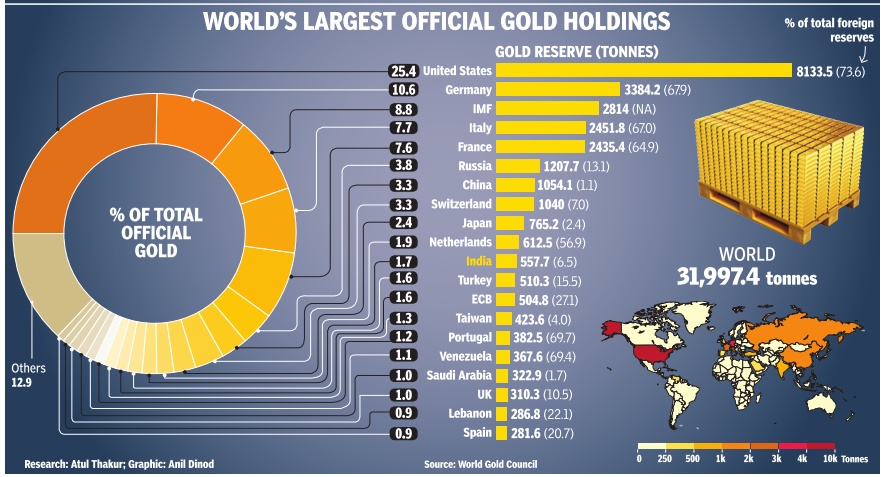

India’ official gold holdings No.10 in world: 2014

Apr 20 2015

Historically, a nation's gold reserves were considered key to its key wealth. It is interesting to note that even today many central banks hold huge quantities of gold totaling about 32,000 tonnes in 2014. The central banks of the US along with old colonial powers like Italy, France, the Netherlands hold the largest quantity of gold. In terms of official gold holdings, India ranks tenth in the world. The Indian official reserve, which constitutes 1.7% of the global total, was far lower than the US, which holds nearly one-fourth of the world's total official gold holdings

Tirumala’s gold reserves

The Times of India, Aug 08 2015

Tirumala has 4.5t of gold in bank, more on way

Tirumala Tirupati Devasthanams (TTD) officials indicated that 4.5 tonnes of gold have been deposited in banks and the temple administration is in the process of depositing one more tonne in State Bank of India soon. Calculated at today's rates, the total cost of the 5,500 kg `disclosed' gold with the TTD stands at Rs 1,320 crore.

Temple insiders say this could just be a partial estimate of the total wealth of what is regarded as the richest temple in the country . In July 2014, another contender had emerged in the form of the Padmanabha Swami Temple in Thiruvananthapuram, where an inventory revealed that its total wealth stood at Rs 1 lakh crore. But those championing the cause of the Tirumala temple contend the total wealth with Lord Balaji has not been made public, and, therefore, could be more than that of the Kerala temple.

Addressing the media in Tirumala about offering Arjitha Sevas online, TTD executive officer D Sambasiva Rao said one tonne gold will be deposited with banks soon under the gold scheme. Rao later told TOI “To date, 4.5 tonnes of gold have been deposited in banks including SBI, Indian Over seas Bank and Corporation Bank.“ This gold includes the offering made by devo tees in the hundi as well as big individual donations.

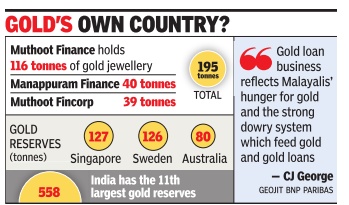

Muthoot and Manappuram’s gold reserves

Gold reserves of Muthoot and Manappuram

Shenoy Karun, December 14, 2014

Three gold loan companies in Kerala have more precious metal in their vaults than the gold reserves of some of the richest nations. Muthoot Finance, Manappuram Finance and Muthoot Fincorp jointly hold nearly 200 tonnes of gold jewellery, which is higher than the gold reserves of Singapore, Sweden or Australia.

India accounts for approximately 30% of the global demand for gold, a true and-tested source of insurance for millions of families that have little access to other forms of social security .What is true for India is even more so for Kerala, where two lakh people are employed in the gold industry . The metal's fungibility makes it an ideal collateral for over the-counter loans.

Muthoot Finance holds 116 tonnes of gold as security for its loans, Manappuram Finance has 40 tonnes and Muthoot Fincorp, 39 tonnes.The trio's combined holdings total 195 tonnes. To put things in global per spective, Singapore's gold reserves are 127 tonnes, Sweden's 126 tonnes, South Africa's 125 tonnes and Mexico's 123 tonnes. Muthoot Finance, the largest of Kerala's gold loan companies, holds more gold in its vaults than the reserves of Greece (112.4 tonnes), Australia (79.9 tonnes), Kuwait (79 tonnes), Denmark (66.5 tonnes) and Finland (49.1 tonnes).

India, according to the World Gold Council, has the 11th largest gold reserves, with 558 tonnes.The US heads the pack with 8,134 tonnes, while Germany and IMF come next (3,384 and 2,814 tonnes, respectively). “Malayalis have excelled in financial services as an ethnic group. The size of these companies reflects their innovative skills. Gold loan business also reflects Malayalis' hunger for gold and the strong dowry system which feeds gold and gold loans,“ said C J George, founder and MD of stock broking firm Geojit BNP Paribas.

It was even better a couple of years ago. Muthoot Fincorp, which has a gold loan portfolio of Rs 8,550 crore, then had 41 tonnes of gold in its vaults.“Then, two things happened -gold prices declined and banks became aggressive in gold loans.As gold prices declined, our business also came down slightly, reflecting on our gold holdings,“ said Thomas John Muthoot, chairman and managing director of Muthoot Fincorp.

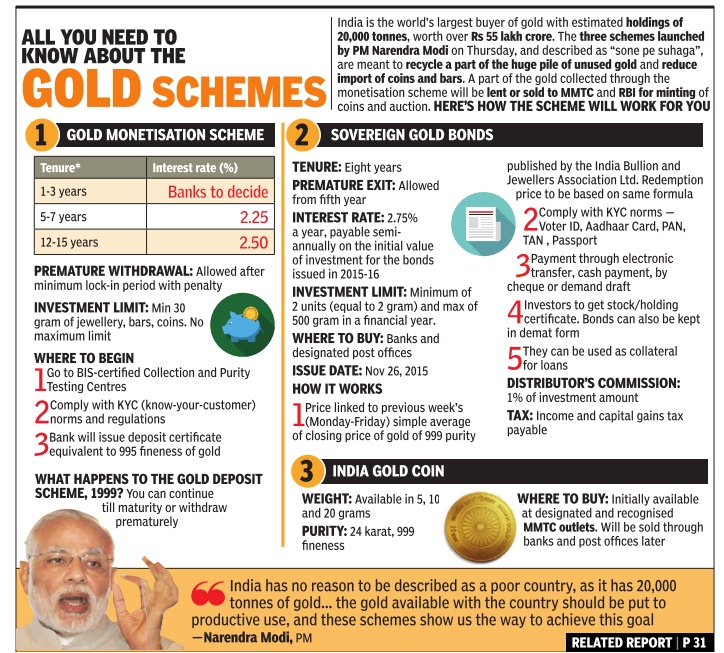

Government’s plans to monetise the gold reserves/ 2015

Amarnath K. Menon

April 30, 2015

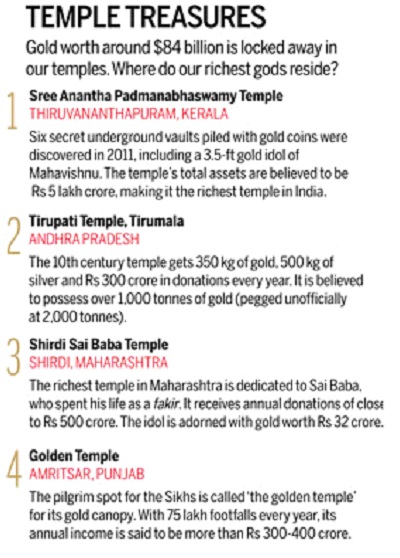

The Modi government wants gold idling in temple vaults to be part of the India growth story. The trusts aren't enthusiastic.

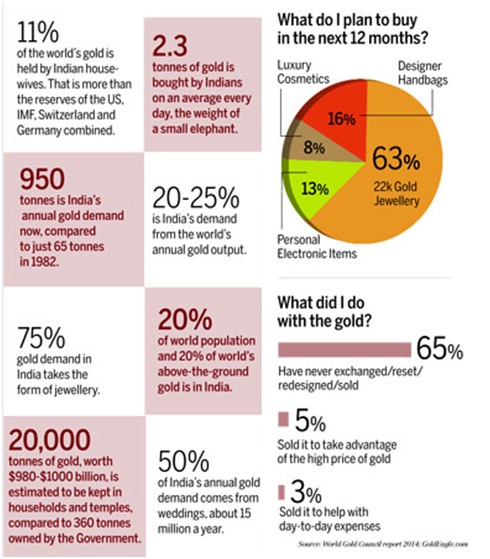

On April 21, India celebrated Akshaya Tritiya, a day considered auspicious by Hindus for buying gold. But it's not the only such day of the year. Buying the yellow metal is believed to be propitious on Dhanteras, Diwali and ahead of most other festivals too. Little wonder then that Indians are the world's largest consumer of gold. The country imported about 850 tonnes of it in 2014-15, and officials estimate another 175 tonnes were smuggled in. The import figure for March 2015 alone was 121 tonnes, up from 48.5 tonnes in March 2014.

Despite the mammoth numbers, officially India holds a meagre 557.7 tonnes, globally 11th in official gold reserve in a list topped by the United States with 8,133.5 tonnes, according to the World Gold Council.

So where do all those hundreds of tonnes imported go? Largely into private lockers: about 22,000 tonnes of gold and gold jewellery are held by individuals, families, temples and other trusts-perhaps the largest gold reserve anywhere in the world. A significant share-estimated at more than 3,000 tonnes-of that is with temple trusts, in the form of jewellery for the idols, coins and gold bars, though no temple management is ready to put a figure on the value of the bullion. And yet, most of this is what economists call "idle" gold, which adds nothing to the economy. In fact, they are a drain. As a non-essential import item, gold accounted for 28 per cent of India's current account deficit-or the import-export imbalance-in 2012-13.

It is here that the Narendra Modi administration wants to cash in and turn them into operational assets. Starting May, the government plans to monetise the reserves by making them an investment option: depositing in banks to earn interest like a cash deposit would, opting for gold bonds that can be sold later, among others. Once with the government, these otherwise idle assets will help trim the gold import bill. And thereby help cut the deficit.

There are few takers for the scheme, however.

Temple trustees contend that gold piles in their vaults have come as offerings from devotees over centuries. Take the subterranean vaults of Sree Padmanabhaswamy Temple, Thiruvananthapuram, for instance. Its reserves are believed to be a treasure trove-of much greater value than what is reckoned as the richest Hindu shrine: the Sri Venkateswara Temple in Tirumala, Andhra Pradesh. The Sree Krishna Temple in Guruvayoor and Lord Ayyappa Temple in Sabarimala-both in Kerala-are said to have gold reserves worth thousands of crores.

But the Travancore, Cochin and Malabar Devaswom Boards that oversee 3,890 temples in Kerala are opposed to the idea. They fear the banks will convert them into gold bars, and that they would lose value. In fact, a source in Travancore Devaswom Board says gold ornaments donated by them during the India-China war were returned as bars that could not be remade as ornaments for want of skilled artisans. Some others are opposed to temples earning interest on gold offered to the deity.

Kerala Chief Minister Oommen Chandy, himself a Christian, has also opposed the gold monetisation proposal. "We will not allow the central government to touch the invaluable jewels of Sree Padmanabhaswamy Temple or any other places of worship without the consent of the devotees and temples," he has said.

One exception of sorts is the Tirumala Tirupati Devasthanams (TTD), which manages the famous Sri Venkateswara Temple in Andhra Pradesh and is said to be the world's largest holder of gold outside of the central banks. In recent years, TTD has started sending gold ornaments to the mint in Mumbai to be melted down into 22-carat coins. The coins are then sold to devotees worldwide.

A devotee offers a pair of gold feet worth Rs. 50 lakh at Sri Venkateswara Temple, Tirumala; (Below) Tirumala Tirupati Devasthanams former executive officer M.G. Gopal hands over 1,800 kg of gold deposits to SBI Chairperson Arundhati Bhattacharya. The TTD has also turned over gold offered by devotees to banks, which is melted, purified to 0.995 grade at the mint and lent as gold bars to jewellers in lieu of interest. They are returned as gold, and not cash, when the deposit tenure expires.

The Anandji Kalyanji Trust, which manages 1,300 Jain temples in Gujarat's Bhavnagar district, has also deposited its gold reserves with banks for nominal interest, while others such as the Shri Arasuri Ambaji Mata Devasthan Trust, which manages the popular Ambaji Temple, and Shree Dwarkadhish Mandir Devasthan Samiti in Jamnagar, have evinced interest in the Gold Deposit Scheme.

Managers at Mumbai's Siddhivinayak Temple, meanwhile, welcome the idea with a caveat. "We will deposit our gold in nationalised banks if the policy is beneficial, safe and earns good interest," says Narendra Murari Rane, the temple trust's chairman. In fact, interest rates may be the key to unlocking a significant portion of this idle gold. "Banks will have to offer much more than the nominal 1 per cent interest," says Rajendra Jadhav, executive officer, Shri Sai Baba Sansthan, Shirdi.

But devotees are circumspect. "Temples earning interest on gold offered to gods is a sin," says a Mumbai gold trader whose family has donated 200 kg gold to temples over the years.

For the 29 government-controlled temples, managed by trusts under the Himachal Pradesh Hindu Public Religious Institutions and Charitable Endowments Act, 1984, there is a mechanism through which 10 per cent of the donated gold can be used for temple development activities and 20 per cent invested in State Bank of India's Gold Deposit Scheme. The temples can reserve a further 20 per cent and the remaining half will be purified with the help of the Metals and Minerals Trading Corporation and minted for souvenirs such as coins and mementos.

The government's scheme offers immense opportunity for India to monetise gold, valued at more than $1 trillion and held in private hands, to fund the nation's growth, says P.R. Somasundaram, managing director, India, World Gold Council, the global gold miners' lobby. Financial analysts say all gold received in donation should be melted, converted into bricks, bars or coins and put on online auction every month. The money received, they say, should go to the bank account of the religious trust concerned.

But what this transition in gold economy calls for, literally, is a leap of faith.

2014-September 2016: Gold with Kerala firms

The gold holdings of the three largest gold loan companies in Kerala have grown from 195 tonnes in 2014 to nearly 263 tonnes towards the end of September 2016. Between them, they have more precious metal in their vaults than the gold reserves of some of the richest nations.

Muthoot Finance, Manappuram Finance and Muthoot Fincorp jointly hold nearly 263 tonnes of gold jewellery, which is higher than the gold reserves of Belgium, Singapore, Sweden or Australia.

India accounts for approximately 30% of the global demand for gold, a true and tested source of insurance for millions of families that have little access to other forms of social security. What is true for India is even more so for Kerala, where two lakh people are employed in the gold industry. The metal's fungibility makes it ideal collateral for over-the-counter loans.

Over 2014-16, the gold holdings of Muthoot Finance, the largest of Kerala's gold loan companies, grew from 116 tonnes to 150 tonnes. It now holds more yellow metal in its vaults than the reserves of Singapore (127.4 tonnes), Sweden (125.7 tonnes), Australia (79.9 tonnes), Kuwait (79 tonnes), Denmark (66.5 tonnes) and Finland (49.1 tonnes). There are other two big players — Manappuram Finance with 65.9 tonnes and Muthoot Fincorp with 46.88 tonnes. The combined holdings of the three are 262.78 tonnes.

India, according to World Gold Council, has the 11th largest gold reserves at 558 tonnes. The US heads the pack with 8,134 tonnes, while Germany and IMF come next (3,378 and 2,814 tonnes, respectively).

According to GFMS Gold Survey, India tops the list of countries consuming gold jewellery, with a consumption of 107.6 tonnes during Q3 of calendar year 2016. Compared to this, Europe and North America together consumed only 67.1 tonnes in the same period. China, the second-largest gold jewellery buyer in the world, consumed 98.1 tonnes over the same period.

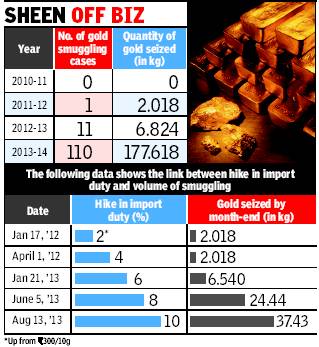

Gold smuggling

Gold smuggling 2013-14

26-fold jump in gold smuggling at IGI

Data Reveals 85 Kilos Seized This Year Alone

Suhas Munshi TNN

Estimates of the extent of gold smuggling in India vary widely, market analysts have suggested it could have added between 20-30 tonnes per month, the report pointed out.

"However, our estimation, based on our own analysis of the market, is that these unofficial flows may be considerably higher. We have previously been on record with our estimate of between 150-200 for 2013, and we feel that the total for 2013, was closer to the top-end of this range," he said.

Gold smuggling at Delhi's IGI airport alone in 2013-4 is up 26 times from previous years with 177.6kg of the yellow metal being intercepted at the airport this financial year, according to information obtained via an RTI plea and official data.

Nearly 85kg gold was seized by the customs department between April 2013 and Feb 2014. In all of 2012-13, only 6.8kg of gold was seized .

The official said gold seizures have skyrocketed in Jan-Feb 2014. Officials have been linking the rise in gold smuggling to hike in import duties over the past two years. In 2010-11, import duty on gold was Rs 300 per 10gm. No case of smuggling was detected. In 2011-12, when import duty was hiked by 2%, 2kg gold was seized. In 2012-13 the duty was hiked twice and 6.82kg gold was intercepted while in 2013-14 duty was hiked twice and recoveries jumped almost 26-fold.

In December 2013, finance ministry admitted gold smuggling has risen due to hike in import duty and fluctuation in global prices. “Increase in smuggling may be partly attributed to fluctuation in gold prices and duty rates,” minister of state for finance JD Seelam said.

Officials say the scenario has changed fast. While people of only a particular gender and ethnicity earlier used to smuggle gold, profiles of smugglers and modes of smuggling have altered. “They change faces and modus operandi to fool the customs and security,” says a senior department official.

Gold smuggled: 2014-15

May 27 2015

Gold smuggling at all-time high, seizures total Rs 1,000cr

Deeptiman Tiwary

Flow from Nepal dries up as kingpin dies in earthquake

For the first time in the history of gold smuggling in India, the seizure in illicit trade has crossed Rs 1,000 crores in one financial year with customs, police and revenue agencies seizing more than 3,500 kg of gold in 2014-15. In 2012-13, the same figure stood at merely Rs 100 crore with just about 350 kg gold seized. In two years -since government increased duty on gold to 10% to rein in a yawning current account deficit -gold smuggling has grown by 900%. That as an accepted principle seizures could be less than 10% of actual smuggling, the figures look even more ominous.

Sources say gold has also begun to be smuggled in ever unique ways and from rather unexpected corners.

There is a silver lining to the grim story though. There is an unexpected drop in Nepal, which had seen a massive spurt in gold smuggling in the past couple of years. The reason: the kingpin of illicit yellow metal trade in the Himlayan nation died under the rubble of his house in Kathmandu during the recent quake.Nepal, which normally sees seizures of around 80-100kg a year, saw figures more than double in 2013-14 due to rise in duty of gold import in India.The rise was explained by agencies as smugglers push ing in gold from Dubai, Thailand and China into Nepal to be brought to India as traditional channels were being more vigorously monitored.

“It's the one positive fallout of a massive tragedy . The deceased was the main conduit who coordinated illicit trade from various countries and helped push them into India.Just before the quake, 40kg gold was seized in Silliguri in Bengal. It came from Nepal. Since then, seizures have been almost negligible,“ said an of icial from the Directorate of Revenue Intelligence. The official, however, acknowledged hat as long as duties remained so high in India, someone else would replace him.

Sources said smugglers are now exploiting all possible routes to push in gold which has now begun coming rom the Morey border in Manipur, Kandla port in Gujarat, Bangladesh border in Bengal and the old tested routes of Sri Lanka to ports in Chennai and various airports from Dubai and Thailand.

Increasingly, smugglers are using courier parcels to send in gold. “This is, however, camouflaged.The courier s of a torch where the batteries are made of gold. Of a mixer which has golden blades.Of a transistor which has a capacitor in gold,“ said a DRI official detailing how only recently agencies caught 60 kg gold at Delhi airport brought n through courier this way.

High customs duty and smuggling

The Times of India, Aug 26 2015

High customs duty on gold fuels smuggling

The high rate of customs duty on gold may have acted as a deterrent for imports but it has resulted in large-scale smuggling. It was highlighted during discussions at the annual meeting of the chief commissioners and directors general of customs and central excise here on Monday .

The customs officers provided gold seizure details which has almost doubled to more than Rs 1,100 crore in 2014-15 as compared to Rs 692 crore in the previous year. It was Rs 99 crore two years ago.

The rise in smuggling and seizures was primarily on account of the government raising customs duty on gold from 8% to 10% in 2013 to discourage high imports.

India is the second largest importer of gold after China.The high rate of duty has also opened smuggling channels because the resultant difference in gold prices in India makes smuggling more remunerative, said an assessment report of the customs.

The customs report explains various modi operandi adopted to illicitly bring in gold, which include “body concealment, in toilets of planes, under aircraft seats, in the form of mobile phone batteries, spring coils of bar seats, buckles of belts, inside trolley bag handles, gold dust in henna powder, sketch pen refills, packets of dates, chocolate wrappers, LED televisions, laptops, emergency lights, staple pins, sealing machines, air compressors, etc“.

Interestingly , the value of gold seizures in 2014-15 was almost 90% of the total value of duty recovered by the government on commercial and other frauds that year. In the last fiscal, the duty recovered was Rs 1,237 crore.

Earlier, while inaugurating the two-day conference, finance minister Arun Jaitley appreciated the efforts of Central Board of Excise and Customs to improve the tax payer services by reaching out to the taxpayers. The CBEC has recently created three new directorates, of Tax Payers Services, of Performance Management and one for Goods and Services Tax which is awaiting passage in Parliament.

India's own standard bar of Gold

Bharatiya Nirdeshak Dravya: BND 4102

India now has its own standard bar of gold that is 99.99% pure and can be used to verify the purity of gold sold in shops. Despite India being one of the largest markets for gold, goldsmiths so far depended on imported reference gold bars to check the purity of their biscuits, coins and jewellery.

Called the Bharatiya Nirdeshak Dravya (BND 4201), the bar, weighing 20gm and with the dimensions of a ‘Parle-G’ biscuit (in the words of a scientists associated with its development), will mean that Indian jewellers will no longer need to import gold bars to check the purity of ornaments. Last November, the India Government Mint (IGM), a unit of Security Printing and Minting Corp of India Ltd, signed an agreement with the Bhabha Atomic Research Centre (BARC) and CSIR-National Physical Laboratory (NPL) to develop the first gold standard. The NPL is the repository of standard units — such as the kilogram, the second, the centimetre — in India and provides calibration services. So far, 200 gold bars — each 35mm long, 15 mm wide and 1.5mm thick — have been made, Director of CSIR-NPL, Dinesh Aswal, told The Hindu. He added that these could be a major source of a major source of revenue in future.

“The gold bar would be 25% cheaper than the imported version and as a business (reference gold bars being bought by dealers for tests) could be worth nearly ₹1000 crore per annum,” he added. While the bars will be made by the IGM, technical aspects such as measurement would be done by the BARC and certifying the purity of the bars would be the responsibility of the NPL.

Mr. Aswal added that most of the gold references that India imported was sourced from Canada and Switzerland. The new bars being developed were 99.99% pure with impurities of only 100 parts-per-million.

“Development of this reference material indigenously will add to the Make in India campaign and will save foreign exchange as well as minimise dependency on foreign countries,” the IGM said in a statement.

The Department produces Standard Gold Bars of standard fineness and purity of 10g, 50g, 100g, 500g & 1000g denominations. According to the World Gold Council, demand in India jumped 19% to $3.62 billion (approx. ₹19,000 crore) this quarter, with volumes up 16% to 92.3 tonnes.

Price of gold

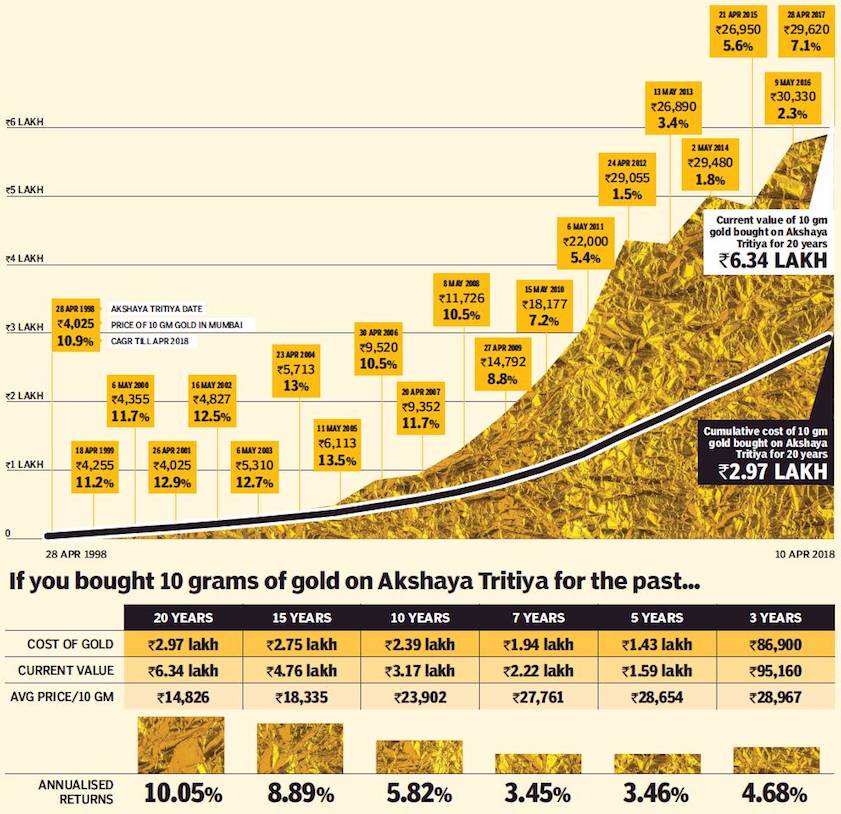

1998-2018

Annualised returns on investment in gold, 1998-2018

The rise in the value of gold purchased between three and twenty years ago (2018 figures)

From: April 16, 2018: The Times of India

See graphic:

The price of gold in India, 1998-2018

Annualised returns on investment in gold, 1998-2018

The rise in the value of gold purchased between three and twenty years ago (2018 figures)

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India <> Gold in the Indian economy