Gold in the Indian economy

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Demand for gold

India's gold demand up 13% at 975 tonnes in 2013: Report

PTI | Feb 18, 2014

2012

Gold demand in the country was 864 tonnes according to data given in WGC 'Gold Demand Trends 2013' report.

2013

India's gold demand remained buoyant and rose by 13% to 975 tonnes compared to 2012, despite government putting in several restrictions to curb imports, according to a World Gold Council report.

"Demand in the second half was lower due to the effect of the supply curbs introduced in that period, but, equally, it was due to households having met a large part of their annual gold requirements in the first half, using the price drop in April as a buying opportunity," WGC Managing Director India Somasundaram P R told PTI.

The total jewellery demand in the country in 2013 was up by 11% at 612.7 tonne valued at Rs 1,61,750.6 crore compared to 552 tonne valued at Rs 1,58,359.1 crore in 2012.

The total investment demand for 2013, was up by 16% at 362.1 tonnes from 312.2 tonnes in 2012.

In value terms, gold investment demand rose by six% at Rs 95,460.8 crore against Rs 90,184.6 crore in 2012.

Recycled gold, however, declined by 10.79% to 100.8 tonnes in 2013, compared to 113 tonnes in 2012.

The latter half of 2013, Somasundaram said, has seen intense grey market activity.

2014 (forecast)

"In 2014, market estimation of gold demand is between 900-1,000 tonnes," he added.

Gold smuggling

26-fold jump in gold smuggling at IGI

Data Reveals 85 Kilos Seized This Year Alone

Suhas Munshi TNN

Estimates of the extent of gold smuggling in India vary widely, market analysts have suggested it could have added between 20-30 tonnes per month, the report pointed out.

"However, our estimation, based on our own analysis of the market, is that these unofficial flows may be considerably higher. We have previously been on record with our estimate of between 150-200 for 2013, and we feel that the total for 2013, was closer to the top-end of this range," he said.

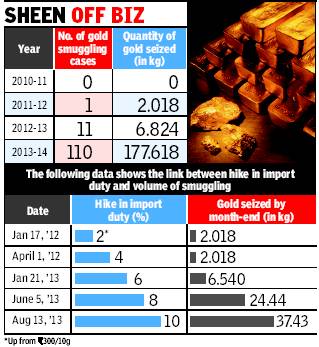

Gold smuggling at Delhi's IGI airport alone in 2013-4 is up 26 times from previous years with 177.6kg of the yellow metal being intercepted at the airport this financial year, according to information obtained via an RTI plea and official data.

Nearly 85kg gold was seized by the customs department between April 2013 and Feb 2014. In all of 2012-13, only 6.8kg of gold was seized .

The official said gold seizures have skyrocketed in Jan-Feb 2014. Officials have been linking the rise in gold smuggling to hike in import duties over the past two years. In 2010-11, import duty on gold was Rs 300 per 10gm. No case of smuggling was detected. In 2011-12, when import duty was hiked by 2%, 2kg gold was seized. In 2012-13 the duty was hiked twice and 6.82kg gold was intercepted while in 2013-14 duty was hiked twice and recoveries jumped almost 26-fold.

In December 2013, finance ministry admitted gold smuggling has risen due to hike in import duty and fluctuation in global prices. “Increase in smuggling may be partly attributed to fluctuation in gold prices and duty rates,” minister of state for finance JD Seelam said.

Officials say the scenario has changed fast. While people of only a particular gender and ethnicity earlier used to smuggle gold, profiles of smugglers and modes of smuggling have altered. “They change faces and modus operandi to fool the customs and security,” says a senior department official.

2013: India drops to no.2

The Times of India Oct 25 2014

2013: India is no more the world's largest market for consumer gold demand-gold jewellery, bars and coins acquired directly by individuals. Data collated by the World Gold Council shows that in 2013 China trounced India in consumer gold demand. China's 2013 individual gold purchases of 1,066 metric tonnes were 32% higher than its 2012 demand, while India's demand increased by 13% to become 975 tonnes. On a per capita basis, annual consumer gold demand of 8.5 gm in UAE, 8.1 gm in Switzerland, 5.4 gm in Hong Kong, Saudi Arabia's 2.4 gm and Turkey's 2.3 gm were among the highest in the world. India's annual per capita gold demand of roughly 0.8 gm is the 9th highest in the world.

Gold reserves of Muthoot and Manappuram

Shenoy Karun, December 14, 2014

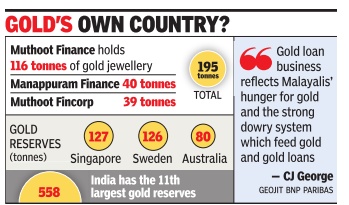

Three gold loan companies in Kerala have more precious metal in their vaults than the gold reserves of some of the richest nations. Muthoot Finance, Manappuram Finance and Muthoot Fincorp jointly hold nearly 200 tonnes of gold jewellery, which is higher than the gold reserves of Singapore, Sweden or Australia. India accounts for approximately 30% of the global demand for gold, a true and-tested source of insurance for millions of families that have little access to other forms of social security .What is true for India is even more so for Kerala, where two lakh people are employed in the gold industry . The metal's fungibility makes it an ideal collateral for over the-counter loans.

Muthoot Finance holds 116 tonnes of gold as security for its loans, Manappuram Finance has 40 tonnes and Muthoot Fincorp, 39 tonnes.The trio's combined holdings total 195 tonnes. To put things in global per spective, Singapore's gold reserves are 127 tonnes, Sweden's 126 tonnes, South Africa's 125 tonnes and Mexico's 123 tonnes. Muthoot Finance, the largest of Kerala's gold loan companies, holds more gold in its vaults than the reserves of Greece (112.4 tonnes), Australia (79.9 tonnes), Kuwait (79 tonnes), Denmark (66.5 tonnes) and Finland (49.1 tonnes).

India, according to the World Gold Council, has the 11th largest gold reserves, with 558 tonnes.The US heads the pack with 8,134 tonnes, while Germany and IMF come next (3,384 and 2,814 tonnes, respectively). “Malayalis have excelled in financial services as an ethnic group. The size of these companies reflects their innovative skills. Gold loan business also reflects Malayalis' hunger for gold and the strong dowry system which feeds gold and gold loans,“ said C J George, founder and MD of stock broking firm Geojit BNP Paribas.

It was even better a couple of years ago. Muthoot Fincorp, which has a gold loan portfolio of Rs 8,550 crore, then had 41 tonnes of gold in its vaults.“Then, two things happened -gold prices declined and banks became aggressive in gold loans.As gold prices declined, our business also came down slightly, reflecting on our gold holdings,“ said Thomas John Muthoot, chairman and managing director of Muthoot Fincorp.