Foreign Portfolio Investments (FPI): India

This is a collection of articles archived for the excellence of their content. |

2015-17

Indian mkts get $30bn foreign inflows in 2017, December 18, 2017: The Times of India

From: Indian mkts get $30bn foreign inflows in 2017, December 18, 2017: The Times of India

Foreign investors are flocking to the Indian capital markets in a big way with a net inflow of over $30 billion (nearly Rs 2 lakh crore) of so-called ‘hot money’ in 2017, with equities alone getting over $8 billion (over Rs 50,000 crore) — an amount bigger than the cumulative investment of the previous two years.

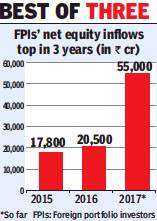

The Indian stock market seems to have regained its status as one of the most favoured destinations for foreign portfolio investors (FPIs), as they have taken their net investment position in equities so far in 2017 to Rs 55,000 crore — the highest in three years after Rs 20,500 crore in 2016 and Rs 17,800 crore in 2015.

But this remains a far cry from the heady levels seen earlier — Rs 97,000 crore in 2014, Rs 1.13lakh crore in 2013 and Rs 1.28 lakh crore in 2012. However, a sharper turnaround was seen in 2017 in terms of FPI inflows into debt markets where the net investments soared to a staggering Rs 1.5 lakh crore ($23 billion) after a net outflow of about Rs 43,600 crore in 2016.

Although marketmen believe that this kind of FPI flows may not continue in 2018 as the withdrawal of liquidity and rate hikes in developed economies pick up. Also, the inflation cycle is likely to turn following increase in commodity prices and recovery in consumption demand. The capital poured in by FPIs is often called ‘hot money’ because of its unpredictability, but these overseas entities have still been among the most important drivers of Indian stock markets. In terms of sectors, banking, housing finance and auto have seen consistent FPI inflows.

2018: 5 stocks favoured by FIs

From: July 27, 2018: The Times of India

See graphic :

2018: 5 Indian stocks favoured by Foreign investors