Foreign Direct Investment (FDI): India

This is a collection of articles archived for the excellence of their content. |

Contents |

Foreign companies registered in India

Feb 09 2015

DESTINATION INDIA

As of December, 2014, there were over 4,000 foreign companies registered in the country. Of these, a little over 79% were active.Interestingly. the national capital had the highest number of such companies. It was followed by Maharashtra, Karnataka, Haryana and Tamil Nadu, usually perceived as some of the most industrialized states. The relatively large number of companies registered in Haryana seems to be linked to MNCs located in Gurgaon, one of the NCR's leading business hubs

FDI by G20 nations: 2000-15

The Times of India ,Sep 02 2015

Kounteya Sinha

UK leads G20 nations flow to India in FDIHOT The latest data to confirm Britain's increasing interest in investing in India will make PM Narendra Modi happy a couple of months before he embarks on his maiden visit to the United Kingdom. The UK has become the largest investor in India among all G20 countries with a combined revenue of more than $54 billion in India.

Between the year 2000 and 2015, UK's FDI into India amounts to $22 billion -9% of all FDI in the country .

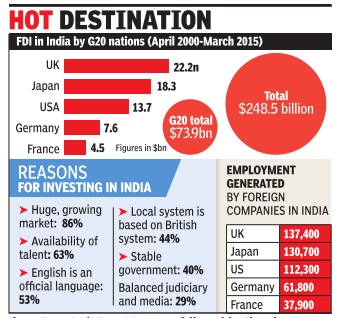

In total, G20 nations invested $ 73.9 billion in India between 2000-2015 with the UK being the single largest G20 investor into India followed by Japan ($ 18.3 bn), the US ($13.7bn), Germany ($ 7.6 bn) and France ($ 4.5 billion).

As India's largest employer, UK firms employ around 691,000 people across the country -5.5% of total organized private sector jobs in the country . Between 2000 and 2015, UK FDI generated around 138,000 direct jobs, 7% of the total 1.96 million jobs generated by FDI in India.

India's massive talent pool was the main reason for 63% of the British companies to believe in India's potential while India's recent growth story made 86% of them turn to interest towards the Asian giant. English being an official language has helped, too, with 53% of the companies relying on it while 40% said it was the country's stable government.

Confederation for British Industry's first Sterling Assets India report sponsored by PwC UK and brought out in association with the UK India Business Council says that Maharashtra and Delhi have attracted the bulk of Britain's FDI into India -26% and 20% respectively .

The chemicals sector attracts the lion's share of British investment in India, at $5.78 billion (26% of UK FDI), followed by the pharmaceutical sector at $3.76 billion (17% of UK FDI) and the food processing sector at $3.05 billion (14% of UK FDI).

Katja Hall, the confederation's deputy DG, said, “The economic relationship between India and the UK is in fine fettle. The UK has played a significant role in India's growth journey , investing more and creating more jobs than any other G20 nation.PM Modi's steps to improve the ease of doing business in India are a great boost and we look forward to the EU-India FTA talks resuming.“

2015: India no. 1 destination

The Times of India, Sep 30 2015

India pips US, China as No. 1 FDI destination

Rises 16 llaces in ranking of competitiveness

India has emerged on top of the foreign direct investment (FDI) league table, overtaking China and the US, according to fDi Markets, the FT data service. A ranking of the top destinations for greenfield investment (measured by estimated capital expenditure) in the first half of 2015 shows India at number one, having attracted roughly $3 billion more than China and $4 billion more than the US.

India has also moved up on the World Economic Forum's Global Competitiveness Index by 16 places to 55th position from 71st.

The two reports come as a shot in the arm for the Modi government, which has taken several steps to attract foreign investment and has helped revive the mood of investors since it came to office in May 2014.

“Satisying, our efforts are paying off,“ finance minister Arun Jaitley tweeted.

The government has unveiled several initiatives like `Make in India' and `Digital India' to lure investors.

It has moved to ensure that the country moves up on the World Bank's Ease of Doing Business and states have also started their clean-up act on this parameter.

But experts say there are several areas where the government needs to step up reforms. The areas where investors want more reforms include tax policy, labour laws, cutting red tape and issues linked to land acquisition.

Investors have started taking interest in India and the recent visit of PM Modi to Silicon Valley triggered enormous interest from software and technology czars. India's growth is expected to be the fastest among large economies. Several multilateral agencies have also pointed out that India is a beacon of hope at a time when emerging economies are taking a hit and the Chinese stock market is witnessing volatility. Experts say India is expected to benefit from the slowdown in China and the overall sluggishness in global commodity prices including crude oil is expected to provide a cushion to the growth fortunes of Asia's third largest economy . The government is confident of achieving close to 8% growth in the current fiscal year. India has also moved up on Global Competitiveness Index by 16 places to 55th position.

The FT said that for the past several years, China and the US have vied for FDI supremacy and fought each other nearly to a draw last year, with the US ranking as the number one greenfield destination by number of projects and China coming in first by capital expenditure.

It said India ranked fifth last year for capital investment, after China, the US, the UK and Mexico. In a year when many other major FDI destinations posted declines, India experienced one of 2014's best FDI growth rates, increasing its number of projects by 47%, the article said.

“India is tracking well ahead of where it was at this time last year: it has more than doubled its midyear investment levels, attracting $30 billion by the end of June 2015 compared with $12 billion in the first half of last year,“ the newspaper said.

“Research from fDi Markets found 97 of 154 countries typically classed as emerging markets experiencing declines in capital expenditure on greenfield investment projects in the first six months of this year compared with the same time period last year,“ it said.

Confusion over Financial Times figures

The Times of India, Oct 01 2015

Subodh Varma

RBI pegs fund flow at $20.6Bn in first half of 2015 against FT estimate of $31Bn

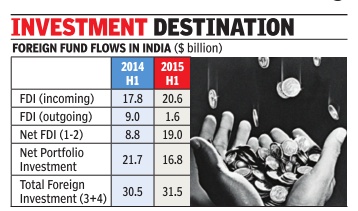

A recent report by a data consultancy owned by the FT of London created a stir by estimating that India is now the most favourite destination for foreign direct investment, beating China and the USA. The fine print indicates that they are talking about “estimated capital expenditures“ in greenfield, that is, new ventures. By this estimate, India attracted $31 billion compared to China's $28 billion in the first half of 2015. Reserve Bank of India (RBI) data for foreign investment flows does not appear to reflect this, causing much puzzlement in India. The total foreign direct investment that flowed into India between January and June 2015 is pegged at $20.6 billion. If you deduct the outflow from India in the form of outgoing FDI from India, this gets pared down to $19 billion.

Besides this inflow, there is also foreign portfolio investment mainly by institutional investors in the stock market. This was about $17 billion in the first half of 2015.

When put together, these two components of investment direct and portfolio yields about $31.5 billion for the same period. But this could hardly be what the FT report is talking about since much of this is neither greenfield nor capital investment.

The other puzzling aspect of the FT report is the com parison with China.

According to the National Statistical Bureau of China, foreign direct investment into China in the first half of 2015 was a whopping $68.4 billion, more than three times that of India's $20.6 billion, between January and June 2015.

A comparison of RBI data between the first halves of 2014 and 2015 shows that incoming FDI has increased by about 16% in 2015 but outgoing FDI has drastically declined, probably due to weakening economies around the world. Hence net FDI inflow to India has jumped up from $8.8 billion to $19 billion.

Analysis of this data by India's Department of Industrial Policy and Promotion (DIPP) indicates that most of the foreign direct investment has come into the IT sector followed by automobiles, trade and the financial sector. Major sources of FDI in India remain Singapore and Mauritius followed by the Netherlands, US and Germany .

Net portfolio investment has, however, sharply declined by about 23% from $21.7 billion in the first half of 2014 to $16.8 billion in the comparable period of 2015.

As a result of these opposing trends, the net foreign flows into India have shown only a marginal increase from $30.5 billion to $31.5 billion between the first halves of 2014 and 2015.