Finance Commissions: India

| Line 8: | Line 8: | ||

[[Category:India |F ]] | [[Category:India |F ]] | ||

[[Category:Government |F ]] | [[Category:Government |F ]] | ||

| − | |||

| − | |||

=A backgrounder= | =A backgrounder= | ||

| Line 49: | Line 47: | ||

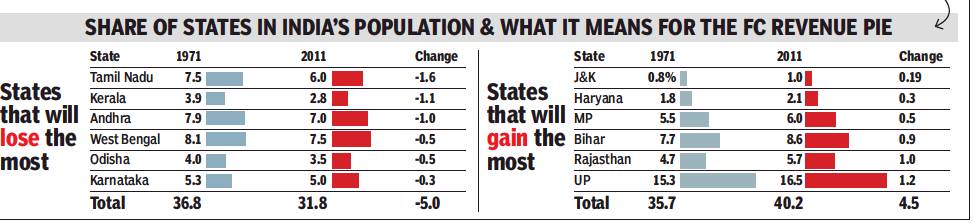

• The biggest controversy is linked to the change in the population base year. Its terms of reference state that the 15th FC is supposed to calculate the population weight entirely according to Census 2011. This, it is feared, will mean that the shares of states more successful in controlling their population will decrease, while those who couldn’t control their population will get a larger share. As a result, southern states could lose the most, while some in the north would gain. | • The biggest controversy is linked to the change in the population base year. Its terms of reference state that the 15th FC is supposed to calculate the population weight entirely according to Census 2011. This, it is feared, will mean that the shares of states more successful in controlling their population will decrease, while those who couldn’t control their population will get a larger share. As a result, southern states could lose the most, while some in the north would gain. | ||

| + | |||

| + | ==13th FC vs. 14th FC: Funds for Congress-ruled states== | ||

| + | [[File: 13th FC (2010-15) vs. 14th FC (2015-20).jpg|The devolution of central revenues to Congress ruled states by the 13th FC (2010-15) vs. 14th FC (2015-20); Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=05_07_2015_021_053_010&type=P&artUrl=CENTRES-VIEW-States-are-now-free-to-decide-05072015021053&eid=31808 July 5, 2015: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''The devolution of central revenues to Congress ruled states by the 13th FC (2010-15) vs. 14th FC (2015-20)'' | ||

Revision as of 21:27, 18 April 2018

This is a collection of articles archived for the excellence of their content. |

A backgrounder

…and the 2011 census controversy

April 16, 2018: The Times of India

From: April 16, 2018: The Times of India

The states that will gain and lose the most according to the 14th Finance Commission’s decision to use the 2011 census, which penalises states that have controlled their population growth and rewards those whose population continues to grow above the national average

From: April 16, 2018: The Times of India

What does the Finance Commission do?

• In India’s federal structure, taxation powers and obligations for various services — like law and order, health, education — are unequally shared between the Centre and the states. Hence, the Constitution mandates the setting up of a Finance Commission (FC) every five years to recommend how revenues from central taxes should be shared between the Centre and the states. A fair distribution of tax revenues is necessary also so that public services are equally available to all people whether they live in the poorer or richer states.

In recent years, the Centre has gone beyond the FC mandate and has been transferring money equivalent to about half of its tax revenues to states.

These transfers can be through FC-mandated sharing, or through grants or by way of centrally sponsored schemes. Also, there are other types of financial support extended by the Centre to the states not covered by the FC. The FC deals only with revenue collected through taxes by the Centre (that is, corporation and income tax, customs and excise duties and, now, GST). These make up about two-thirds of central receipts.

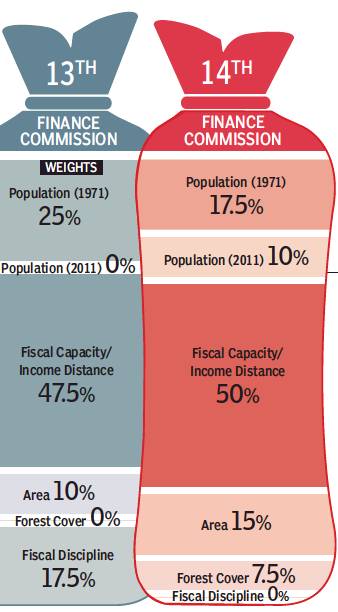

What was the formula given by the 14th FC to divide resources between states?

• The broad principle of various FCs has been to take the different needs and capacities of states into account. The precise formula varies from one FC to the next.

The formula used by the 14th FC took into consideration population, demographic changes, area, a state’s per capita income, and its share of forest cover. These factors were assigned different weights and each state’s share was computed on that basis.

Although the base year for population was taken as 1971 (more population meaning higher share), the FC also gave some weight to population changes in the ensuing four decades. A larger area and higher forest cover also implied a higher share. The highest weight, however, was given to ‘income distance’ — a measure of how far the state’s per capita GSDP is from the top states. It implied that states with more poor people will get a higher than proportionate share of central taxes.

Apart from the states’ share, the FC also determined how much of central funds will be shared with panchayats and urban local bodies. The FC also mandated grants for certain states based on the level of fiscal stress they faced.

What is the legal status of the Finance Commission?

• The FC is appointed by the President under Article 280 of the Constitution. It has five members, including a chairperson. Its recommendations are implemented for a period of five years. India has had 14 such commissions, the first one in 1951. Recommendations on distribution of Union taxes and duties and grants-in-aid are implemented by a Presidential order; others like sharing of petroleum profit, debt relief are implemented by executive orders.

Is the FC unique to India?

• No, some other federal systems such as Australia and Canada also resolve the vertical (between federal & provincial governments) and horizontal (between states) imbalances through similar mechanisms.

What is the controversy with the 15th FC?

• The biggest controversy is linked to the change in the population base year. Its terms of reference state that the 15th FC is supposed to calculate the population weight entirely according to Census 2011. This, it is feared, will mean that the shares of states more successful in controlling their population will decrease, while those who couldn’t control their population will get a larger share. As a result, southern states could lose the most, while some in the north would gain.

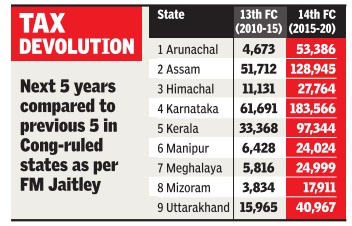

13th FC vs. 14th FC: Funds for Congress-ruled states

See graphic:

The devolution of central revenues to Congress ruled states by the 13th FC (2010-15) vs. 14th FC (2015-20)