Fast/ quick service food: India

(→Food industry in India) |

|||

| Line 88: | Line 88: | ||

=Food industry in India= | =Food industry in India= | ||

| + | ==2019== | ||

[[File: Food industry in India, 2019.jpg|Food industry in India, 2019 <br/> From: [https://epaper.timesgroup.com/olive/apa/timesofindia/SharedView.Article.aspx?href=TOIDEL%2F2019%2F05%2F22&id=Ar02507&sk=1C286EA3&viewMode=image May 22, 2019: ''The Times of India'']|frame|500px]] | [[File: Food industry in India, 2019.jpg|Food industry in India, 2019 <br/> From: [https://epaper.timesgroup.com/olive/apa/timesofindia/SharedView.Article.aspx?href=TOIDEL%2F2019%2F05%2F22&id=Ar02507&sk=1C286EA3&viewMode=image May 22, 2019: ''The Times of India'']|frame|500px]] | ||

| Line 95: | Line 96: | ||

'' Food industry in India, 2019 '' | '' Food industry in India, 2019 '' | ||

| − | [[Category:Cuisine|F FAST/ QUICK SERVICE FOOD: INDIA | + | [[Category:Cuisine|F FAST/ QUICK SERVICE FOOD: INDIAFAST/ QUICK SERVICE FOOD: INDIA |

FAST/ QUICK SERVICE FOOD: INDIA]] | FAST/ QUICK SERVICE FOOD: INDIA]] | ||

| − | [[Category:Economy-Industry-Resources|F FAST/ QUICK SERVICE FOOD: INDIA | + | [[Category:Economy-Industry-Resources|F FAST/ QUICK SERVICE FOOD: INDIAFAST/ QUICK SERVICE FOOD: INDIA |

FAST/ QUICK SERVICE FOOD: INDIA]] | FAST/ QUICK SERVICE FOOD: INDIA]] | ||

| − | [[Category:India|F FAST/ QUICK SERVICE FOOD: INDIA | + | [[Category:India|F FAST/ QUICK SERVICE FOOD: INDIAFAST/ QUICK SERVICE FOOD: INDIA |

FAST/ QUICK SERVICE FOOD: INDIA]] | FAST/ QUICK SERVICE FOOD: INDIA]] | ||

Latest revision as of 09:22, 22 November 2020

This is a collection of articles archived for the excellence of their content. |

Contents |

[edit] Fast-food restaurants

[edit] 2017: Domino’s is ahead of McDonald’s

McDonald's has a legal problem in pizza-loving India, March 28, 2018: The Times of India

HIGHLIGHTS

McDonald’s terminated its agreement with Connaught Plaza Restaurants Ltd., the joint venture company that manages outlets in northern and eastern India in August

Data shows Domino’s and Subway have gained share since then, eroding McDonald’s hold

McDonald’s Corp. has a problem in India and its rivals are loving it.

Even as the world’s largest restaurant chain tries to woo Indian stomachs with such menu items as the McAloo Tikki (a potato and pea patty on a bun), a legal dispute with a key franchisee partner has hampered its expansion. Shares of India’s Domino’s Pizza operator Jubilant Foodworks Ltd. have more than doubled in the past year as the country’s biggest quick-service outlet benefits from a surge in online orders for home pizza delivery.

A pickup in the economy and growing demand from the planet’s largest youth population are boosting fast-food sales in India. Researcher Euromonitor International predicts the market will expand 5.8 per cent to $21.2 billion this year -- a 50 per cent jump since 2008. Domino’s and Subway have gained share, eroding McDonald’s hold, Euromonitor data show.

“Our growth has completely petered off,” said Vikram Bakshi, managing director of Connaught Plaza Restaurants Ltd., the joint venture company that manages McDonald’s outlets in northern and eastern India, encompassing such cities as New Delhi and Kolkata.

McDonald’s terminated its agreement with Connaught in August, though the Indian venture has kept running its 169 outlets while the dispute is adjudicated in the courts. Bakshi has been fighting Oak Brook, Illinois-based McDonald’s since 2013, the same year Domino’s overtook McDonald’s as India’s largest fast-food brand.

A McDonald’s spokesman declined to comment on the matter because it’s under judicial consideration and prohibited from being discussed outside of the courts. The Indian unit of the U.S. company hasn’t been able to verify if Connaught-run restaurants are complying with McDonald’s standards, he said.

Connaught has engaged a new logistics partner, ColdEX Logistics Pvt Ltd., which provides distribution services for other multinational food-service brands, and Connaught is compliant with India’s food industry regulations, Bakshi said.

OPENING OUTLETS

Westlife Development Ltd., the other McDonald’s franchise partner, runs 271 stores in the southern and western parts of India. According to a company spokeswoman, it plans to expand to as many as 500 outlets by 2022 -- growth prospects that have helped propel the shares 53 per cent in the past 12 months.

Meantime, Jubilant Foodworks is forging ahead and has said the company is on course to have added at least 30 Domino’s stores this financial year to its 1,127-strong network across 265 cities. “There is significant potential for the pizza business in the country, and we are committed to leveraging that potential,” Chief Financial Officer Pratik Pota told analysts and investors on a conference call in January, according to a transcript.

Jubilant’s profit more than tripled to Rs 66 crore in the quarter ended December 31 from a year earlier, helped by the Indian government’s introduction of a goods and services tax for restaurants in July, which Co-Chairman Hari Shanker Bhartia said would boost India’s organized restaurant industry at the expense of “unorganized” vendors. Hawkers and small operators combined make up the bulk of India’s fast-food market.

The shares have climbed 33 per cent in Mumbai trading this year, making Jubilant the best-performer among stocks on the S&P BSE 200 Index. “Jubilant has clearly gained from the ongoing fracas” involving McDonald’s, said Santosh Kanekar, an adviser at BeLive Corp. in Mumbai. Chains such as Burger King and KFC will also be trying to gain market share, he said.

Domino’s became the first food-services company in India to begin taking online orders nationwide, Jubilant said in 2011. Since then, online ordering has become “a significant engine of growth,” Pota said on the January 19 earnings call. “As technology gets embraced across the pop strata, as smartphone penetration increases, I’d expect this growth to continue.”

As for McDonald’s, resolution with Connaught will take time, the spokesman said. Meantime, India remains an important market and its local unit is looking for a new partner, he said.

[edit] Home delivery

[edit] 2015-18

John Sarkar, April 24, 2019: The Times of India

From: John Sarkar, April 24, 2019: The Times of India

Little has changed in two years at the only burger joint in a bustling Gurgaon office complex. The tables still remain empty during lunch hour, but now there’s a horde of smartphonetoting delivery boys in the orange and scarlet colours of Swiggy and Zomato.

Quick service restaurant (QSR, or fast-food) chains in India didn’t have that option before. If consumers didn’t walk in, they were sitting ducks in a highly price-sensitive market. With only 5% of their overall sales coming from deliveries ordered through call centres, several had to shut hundreds of outlets in 2016-17 when same-store sales growth (SSG) plunged to record lows.

Two years later, deliveries contribute 20-25% to the overall sales of most QSR chains. Call centres have all but faded into oblivion. Pick-up kiosks catering to online delivery platforms, including Zomato, Foodpanda and Swiggy, have sprung up in their place.

“There was talk of the outlet being shut down as we weren’t getting enough walk-in customers. We were scared of losing our jobs,” the burger outlet’s manager told TOI. “Then online delivery orders from Zomato and Swiggy started picking up. These companies have come as a boon for us. Currently, more than 50% of sales of this outlet comes from deliveries as there are several offices in the area.”

Companies, too, are reporting healthy numbers. India’s largest pizza chain, Dominos, which showed a negative SSG of 7.5% in January-March 2017, reported an SSG of 13.5% in 2018. KFC, which reported a 2% system sales growth in Jan-March 2017, showed a growth of 25% in July-September, 2018.

“There has been exponential growth in deliveries since the time online aggregators came into the market. Our incremental sales through deliveries have jumped five times compared to what we were doing three years ago. And only one-fifth of that comes from our call centres at present. The rest is through online orders,” said Akshay Jatia, GM, brand extensions, at Hardcastle Restaurants, master franchisee of US burger chain McDonald’s in West and South India. Senior executives at Domino’s echoed similar sentiments. “Ordering-in is the new eating-out,” the company said in its latest annual report. Two years ago, 46% of deliveries were booked online. Today, it has increased to 58%. Also, around 74% of online orders are now placed on smartphones, compared to 57% in 2016-17.

“Online deliveries are compensating for the lack of hyper-growth in the QSR space. What’s interesting is that volume growth in dine-in is stable at 5-8% across the industry, which means online sales are not cannibalising walk-in numbers,” said Rakesh Ranjan, VP of food delivery at Zomato, which has witnessed orders from QSRs on its platform grow eight times in two years.

Not only are more people ordering pizza, kulfi and even tea online, QSR chains are getting more repeat orders too, thanks to restaurant aggregators that are burning cash to drive higher gross merchandise value (GMV). Zomato, for instance, currently loses Rs 25 per delivery compared to Rs 44 last year.

“We are seeing a repeat rate of around 58% in 60 days compared to a repeat rate of 30% a year ago, which means 58% of our customers order again within a period of two months,” said Kabir Jeet Singh, founder and CEO of homegrown burger chain Burger Singh, which is set to open 100 new outlets by 2022. Interestingly, online orders contribute 75% to Burger Singh’s overall revenues at present, up from 50% a year ago.

The online lure has prompted several large QSR chains, including KFC, to venture into cloud kitchens that help operators prepare, pack and deliver food without any dine-in facility. Compared to 1,500 square feet for a full-blown outlet, a cloud kitchen can be housed in a space of 250-300 square feet. “The order penetration of cloud kitchens on our platform was less than 1% two years ago. Currently, it has grown to 8-10% with new brands taking away share from the established players,” said Zomato’s Ranjan.

A Swiggy delivery boy in South Delhi told TOI that he has been getting queries from several small restaurant owners about cloud kitchens. “These restaurants hardly get any walk-ins and have only a couple of chairs and tables. But they are doing brisk business through Swiggy and Zomato. And they are very curious to know how the cloud kitchen model works because they are thinking of expanding to other cities as well,” he said.

The cloud kitchen model not only helps bring down rent-to-sales ratio for a company as the cost of rentals and manpower decreases, it also reduces the price for the consumer. Sequoiabacked Rebel Foods, which operates more than 160 cloud kitchens with brands such as Faasos and Behrouz Biryani, delivered same kitchen sales growth of more than 75% in FY18 compared to the industry average of 10-15% SSG.

And this is just the beginning. Online orders worth around $1.7 billion were placed in India, in 2018 — more than twice as many as a year ago. By 2020, the market is set to double again to $3 billion a year, according to Red-Seer Consulting.

“Packaging has been a major investment for us because we had to figure out how to deliver piping hot tea in a smart manner. That’s how seriously we take deliveries which contribute around 22% to our topline. With the aggregators getting better at their game, the onus to up the ante now lies with us,” said Nitin Saluja, founder of tea café chain Chaayos that currently operates 58 outlets in India.

[edit] Food industry in India

[edit] 2019

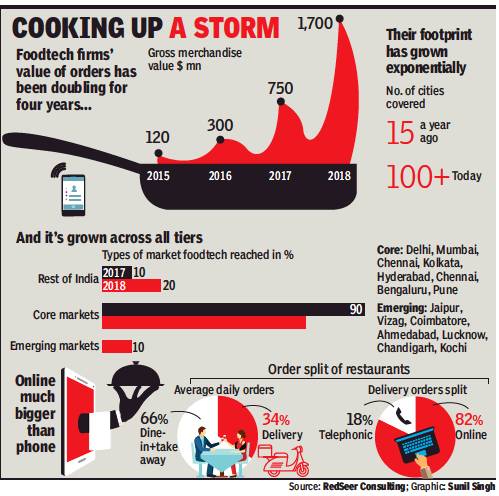

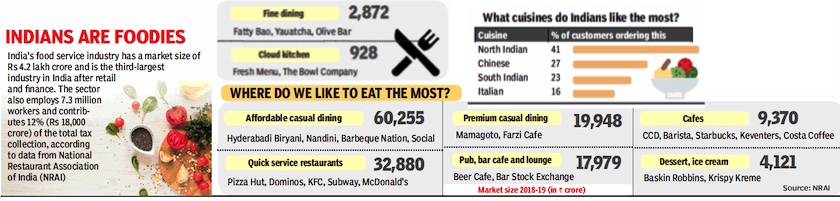

From: May 22, 2019: The Times of India

See graphic:

Food industry in India, 2019