Farm loans and their 'waivers': India

This is a collection of articles archived for the excellence of their content. |

Contents |

The extent of the problem

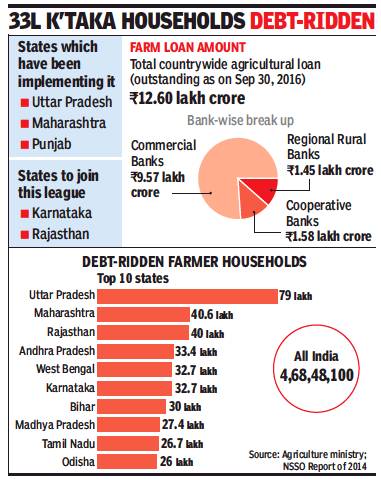

2014: Debt- ridden households

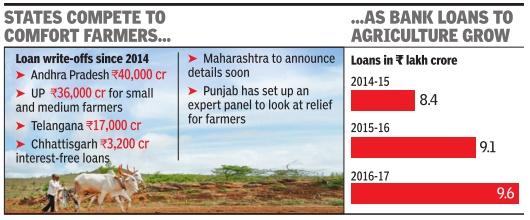

See graphic:

States which have been waiving farm loans;

Debt-ridden farmer households, 2014

ii) Debt-ridden farmer households in Karnataka.

From: Vishwa Mohan, K’taka set to be 5th state to grant farm loan waiver since last year, May 5, 2018: The Times of India

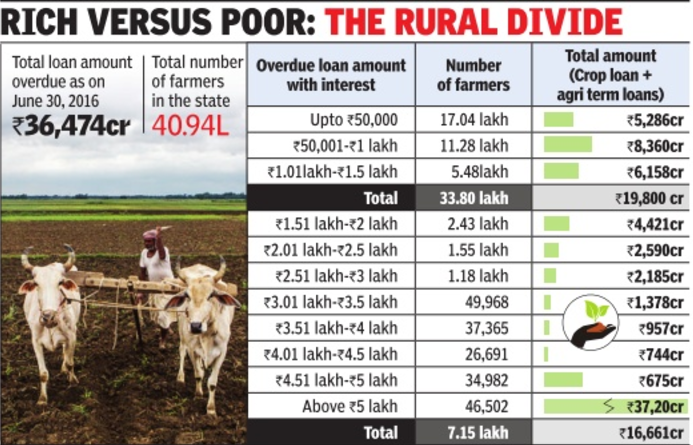

17% Maha farmers account for 46% of all loans due for waiver

7 Lakh Have Dues Of Over Rs 1.5L Each

The fear that rich farmers may corner a substantial portion of the largesse under the farm loan waiver scheme is not without basis.Statistics accessed by TOI from Maharashtra government's co-operation department shows that just 17% of all defaulting farmers account for 46% of total amount owed to banks in the rural sector. There are nearly 41 lakh farmers in the state who have bank debts that add up to an outstanding of Rs 36,474 crore as on June 30, 2016, the cut-off date set for the loan waiver. Of these, 7.15 lakh cultivators (17%) have loans that add up to Rs 16,669 crore. Each of them have an outstanding of more than Rs 1.5 lakh.

The rest have loans of less than Rs 1.5 lakh to repay . They are overwhelmingly in the ma jority (33.8 lakh) and are eligible for a full write-off. However, their cumulative debt at Rs 19,804 crore is just a shade over those who make up the 17% group.

Officials said a significant chunk of loans are from district central co-operative (DCC) banks and these are run by politicians. It is likely that bulk of loans which are being waived would have gone to those linked to their party or families. “We have come across cases where loans of more than Rs 5 lakh were given without even a piece of paper,“ said an official, underscoring the potential for misuse of the waiver scheme.

He also said that there are 13 DCC banks in the state that are financially weak and a large number of their defaulters are influential people. A crop loan of Rs 3 lakh can be availed of at 11% interest, of which a farmer has to pay only 4%, the rest being borne by the state and Centre. Hence, funds are often wrongly sourced as crop loans, said an official.

Farm loan waivers

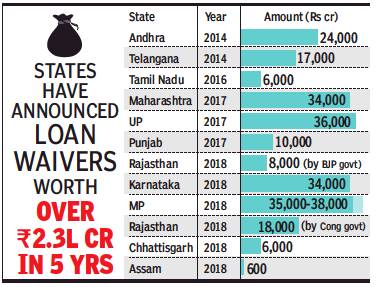

2014-18: states that have announced loan waivers

From: Sidhartha, Clear bank dues when loans are waived: Nabard to states, December 24, 2018: The Times of India

Amid a flurry of farm loan waivers, financial institution Nabard has written to states advising them to ensure that dues of banks that actually write off the loan are immediately cleared to ensure that the credit cycle is not broken.

The move follows the experience of several lenders in Andhra Pradesh and Tamil Nadu, where the dues have remained pending although they had written off the loans based on announcements from the state governments, banking sources said. In 2016, while announcing the Rs 6,000-crore loan waiver, Tamil Nadu, for instance, had decided to clear the dues of over Rs 3,200 crore to cooperative institutions over five years.

Some states, such as Uttar Pradesh, have cleared the dues, the sources added.

Nabard’s advisory will put pressure on states to ensure that they have funds in their budget as most governments that have announced a loan waiver ignored their financial position.

“The credit cycle stops if our dues are not cleared by the states,” said a banker.

With a large amount yet to be reimbursed, banks go slow on lending to farmers at a time when their non-performing assets soar due to farmers stopping their regular loan repayments.

No clarity on modalities of reimbursement: Banks

At a recent state-level bankers’ committee meeting in Karnataka, which announced a loan waiver earlier this year, it was pointed out that there was a Rs 5,353 crore fall in the outstanding agricultural loans between March and June, 2018. With farmers complaining of pressure on their income, Nabard is keen to ensure that loan flow is not choked in any manner, the sources said.

At least three Congressruled states – Madhya Pradesh, Rajasthan and Chattisgarh — have joined the list of states announcing farm loan waivers. Between them, they plan to provide loan amnesty of around Rs 60,000 crore, taking the total to Rs 2.3 lakh crore spread across 12 states. Between them, the outstanding crop loan was estimated to be close to Rs 1.5 lakh crore at the end of March.

Bankers said there is no clarity on the modalities of reimbursement from these states and farmers stop repayments the moment they get a whiff of a scheme being in the works. As reported by TOI on Friday, the expectation of a loan waiver in the run-up to the just-concluded assembly elections in MP has resulted in a spike in defaults with non-performing assets of banks in the farm sector rising 24% in the year-to-year to June 2018.

Economists and the RBI have repeatedly warned political parties to refrain from announcing loan waivers as it spoils the credit culture, impacts credit flow and derails state finances.

2017: UP, Maharashtra, Punjab waive farm loans

Punjab 3rd state to waive farm loans, to take Rs 24k cr hit, The Times of India, Jun 20 2017

The farm loan waiver fever is spreading across the country , threatening to place a huge additional burden on the already creaking finances of state governments. On Monday , Punjab became the third state this year -after UP and Maharashtra -to announce a total waiver of all crop loans up to Rs 2 lakh for small and marginal farmers (up to 5 acres) and a flat Rs 2 lakh relief for all other marginal farmers, irrespective of their loan amount.

Punjab chief minister Amarinder Singh announced the waiver, one of his key poll promises, in the assembly . He said the move would benefit 10.25 lakh farmers. Some 8.75 lakh farmers have farms of up to five acres. The waiver will cost the debt-ridden state Rs 24,000 crore, according to one estimate. Singh said his government had not decided on whether to take a fresh loan or generate more revenue for the purpose. The CM refused to say how much the state would need to raise to meet the waiver requirements. “These are all figures which will be given in the state budget,“ he told reporters after announcing the waiver. The state budget is to be tabled on Tuesday .

Punjab had got just 0.8% of the Rs 52,520 crore loan waiv er that the UPA-I government had announced in 2008. Effectively, this is the first major debt waiver for the state.

The Punjab CM had been under pressure to announce a loan waiver after UP CM Yogi Aditya Nath had waived loans of up to Rs 1 lakh on April 4. Capt Singh, however, insisted his waiver would provide double the relief announced by UP and Maharashtra. The decision is based on the interim report of the expert group headed by wellknown economist T Haque.Capt Singh added his government had decided to take over the outstanding crop loans (from institutional sources) of all families of farmers who committed suicide in the state.

The government has also decided to raise the ex gratia for suicide-affected families to Rs 5 lakh from the existing Rs 3 lakh. He proposed that the Speaker constitute a fivemember committee of the assembly to visit families of suicide victims, ascertain the reasons for suicide and suggest steps to check the problem. He informed the House his government had already decided to repeal Section 67 A of the Punjab Cooperative Societies Act, 1961, which provides for auction of the lands of farmers who can't pay back their loans.

Capt Singh claimed the previous government, headed by Parkash Singh Badal, had accepted a loan of Rs 31,000 crore to cover the shortfall in the cash credit limit for procurement of food grains, for which his government has to pay Rs 270 crore every month and Rs 3,240 crore annually. Had this not been done, his government would have utilised the additional Rs 31,000 crore to benefit farmers, he added.

The Punjab CM said there are about 18.5 lakh farming families in the state, and about 65% of them are small and marginal; of these, about 70% have access to institutional finance.

He said a state agriculture policy focusing on increase in farmers' incomes on a sustainable basis would be formulated soon.

2017, ’18: States that granted farm loan waivers

After Cong, BJP Too Promises Relief In Its Manifesto

With three states — UP, Maharashtra and Punjab — having already implemented a waiver for small and marginal farmers.

UP had announced a waiver for crop loans of up to Rs 1 lakh for nearly 87 lakh small and marginal farmers while Punjab had promised waiver for farm loans of up to Rs 2 lakh for farmers with less than 5 acres of land. It had also promised to waive off loans of bigger farmers. The scheme is being implemented in the state in a phased manner, depending on the size of landholdings and loan amount.

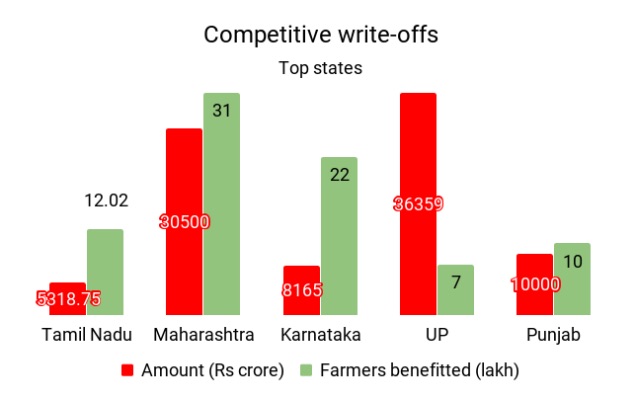

According to recent report, UP has already waived off over Rs 36,000 crore farm loans after BJP took office last year. On the other hand, Maharashtra had announced to waive loans of up to Rs 1.5 lakh for about 87 lakh farmers. In Karnataka, this could benefit more than 22 lakh farmers.

Farm loan waiver has always been a major demand of farmers across the country. A large number of farmers’ outfits have been pitching in with many of them even getting opposition parties to bring a private members’ bill — Farmers’ Freedom from Indebtedness Bill — in Parliament to deal with the issue.

Before the UP government’s move, a mega loan waiver scheme in the country was implemented in 2008 when the then UPA government had initially announced a waiver of Rs 60,000-crore loan for small and marginal farmers. It was later extended to the large farmers as well.

Impact of waivers on farmers

Does debt waiver improve living conditions of poor farmers?

Does debt waiver improve living conditions of poor farmers? Data for the 2008 scheme paints a very bleak picture

(Mrinal Mishra is with Swiss Finance Institute, Venkatesh Upamanyu and Prasanna Tantri are with Indian School of Business and Nagaraju Thota is with BITS Pilani, Hyderabad Campus) We seem to be headed for a season of competitive debt waivers. Voices demanding debt relief to farmers are gaining strength across the country , especially in states such as Madhya Pradesh. But a debt waiver does not improve loan performance. On the contrary it curtails the flow of formal bank credit in the post waiver period.

In a recent research paper, we investigate the impact of debt waiver on the consumption and savings of beneficiary farmers. Using detailed household level National Sample Survey Office (NSSO) data, we show that the 2008 national level debt waiver announced by the UPA-1 government did not lead to any material increase in the overall consumption level of farming households. We detect a significant decrease in spending on critical items such as health and education. Anticipating difficult times ahead, households increase investment in precautionary savings.

NSSO conducts regular national level consumption surveys. We use data from the 64th, 66th and 68th round of NSSO surveys. Incidentally , 64th round was conducted just before the waiver, 66th round was conducted within 12-24 months after the waiver and 68th round was conducted within 36-48 months after the waiver.

In these surveys, randomly selected households are asked about the amount of money spent on items of day to day consumption as well as on one time purchases such as jewellery .Also recorded is data regarding landholding of the household as well as the principal occupation of its members.

As per the 2008 waiver scheme, defaulting agricultural borrowers having landholding of less than or equal to two hectares were eligible for full waiver.Other defaulting borrowers were eligible only for a partial waiver of 25% of the outstanding loan. We used this feature to divide our sample into `control' and `treatment' groups.

Our treated group consists of farmers having landholding just below two hectares and the control group consists of farmers having landholding just above two hectares. We make a reasonable assumption that, in a large sample, those who are to the immediate right and left of this arbitrary barrier of two hectares are likely to be similar on average.

Crucially however, as noted before, they differ with respect to the way they are treated by the waiver scheme: those to the left of two hectares got full waiver and those to the right received only 25%. We examine the difference in outcomes between these two groups immediately after the waiver.

We are unable to reject the hypothesis that the regular monthly expenditure on con sumption in the post waiver period is no different on both sides of the discontinuity . In other words, despite getting their loans fully waived off, the waiver beneficiaries do not experience any improvement in their living conditions.

We then look at the disaggregated consumption data. Here we find that expenditure of the full waiver beneficiaries on education and health is lower by 34%; on clothing, bedding and footwear is lower by 10.2%; and on transportation is lower by 34%. Expenditure on most other items of consumption remains unchanged.

Interestingly, investment on jewellery , which is also used by the poor as precautionary savings, increases by 21%.Note that our sample period precedes the Pradhan Mantri Jan Dhan Yojna. Most of the poor did not even have a bank account and hence faced savings constraints. The poor, in such a situation, were forced to save for rainy days using real assets rather than financial assets.

Why would the poor anticipate difficult times after a waiver and resort to precautionary savings? The answer lies in the expected tightening of bank credit after the waiver. In fact, using loan level data that we obtained from a bank, we show that the supply of credit to waiver beneficiaries fell by almost 50% in the post waiver period. Faced with the expected credit shock, it appears that waiver beneficiaries cut down on consumption and increase precautionary savings.

It is unreasonable to believe that the waivers granted now will lead to any different consequences. It is quite possible that the protesters will be back on street in a couple of years demanding another waiver.Waivers do no good to farmers even in the medium term.

Farmers wilfully default in hope of waiver

Bankers Flag Rising Trend At FinMin Meeting

Expectation of loan waiver has prompted farmers across states to stop repayment of money owed to financial institutions. This adds pressure on banks that are already grappling with a record pile of bad corporate debt.

Several bankers confirmed that there was a rising trend of farmers refusing to clear dues, an issue that was also flagged at a meeting on Monday convened by the fi nance ministry . The total farm loans are estimated at a little under Rs 10 lakh crore.

While it is early to quantify the extent of loan delinquency by farmers, bankers say that in some states, the default rate has increased by up to 50% in recent months. “Farmers are emptying their bank accounts so that we cannot deduct the payment due from them,“ the head of a large bank told TOI.The chief of a public sector bank headquartered in the south said that in some places loan defaulters have come together to demand relief. “If I expect someone to write me a cheque of Rs 1 lakh to take over my loan, I am going to stop repaying.

This is exactly what is happening in many states,“ said a Mumbai-headquartered bank's CEO. Andhra, Telangana, UP and Maharashtra have announced farm loan waivers. Other states, especially where polls are due, are under pressure to follow suit.At least two bank chairmen said they were finding it tough to get dues from Andhra, which had waived loans of over Rs 40,000 crore after N Chandrababu Naidu won the assembly polls in 2014. Loan waivers or relief from governments help clear our books as far as defaults are concerned but it impacts the overall payment culture badly in the long run,“ said a bank head. SBI chairman Arundhati Bhattacharya, too, had recently warned: “Support to farmers is necessary but not at the cost of credit discipline.“

2008 waiver by UPA-1: RBI to study its effectiveness

New Delhi: The government has initiated a study to ascertain how effectively the farm loan waiver, announced by UPA-1 in 2008, was implemented and whether the ‘aam admi’ actually benefited from the Rs 70,000 crore scheme.

The Reserve Bank of India (RBI) has been asked to provide all related banking data to the government’s auditor, the Comptroller and Auditor General (CAG), which will scan the disbursements made by public sector banks across the country with sample field visits. The opposition parties had alleged that only large farmers and those with perennial credit default history had benefited from the waiver, while the marginal farmers were kept away from any credit facility. “We are examining how effectively the agricultural debt waiver scheme was implemented,” CAG Vinod Rai told reporters in Shimla.

“We do not audit banks as it is done by the RBI and chartered accountants. But we decided to do this audit. So, now, we will look into the books of the banks also,” he added.

The debt waiver scheme was announced in the Union budget 2008-09 and covered all agricultural loans disbursed by commercial banks, regional rural banks and cooperative credit institutions to farmers. According to finance ministry, at least 3.69 crore farmers benefited from the scheme till November 2009. The government has claimed that all eligible farmers were covered.

Andhra Pradesh topped the chart of 35 states and Union Territories (UTs) for having extended the maximum waiver of Rs 11,353 crore with about 77.55 lakh farmers benefiting from the scheme. Till December 2009, various public sector banks had written off Rs 65,318 crore across the country.

Among other states, UP was second in the list of largest disbursements, while Maharashtra came at the third position for having waived more than Rs 8,900 crore to 42 lakh farmers. For bringing more farmers under the credit facility, the government had increased farm credit from Rs 87,000 crore in 2003-04 to Rs 3.25 lakh crore in 2009-10 and also lowered the rate of interest on such loans.

Waivers will not help marginal farmers

Subodh Varma, Few Avail Of Bank Loans Due To Hassles Involved, April 11, 2017: The Times of India

“In this whole terai belt you will find very few small farmers who have got bank loans. There is too much headache, too many procedures and then, people take cuts.If we need money we have to go to the money lender,“ laments the elderly farmer. About 86 lakh small and marginal farmers will have their bank debts up to Rs.1 lakh waived, as per the UP government's claims. This is not a small number and has cheered up a large number of small farmers suffering from financial crunch brought on by droughts and dwindling incomes.

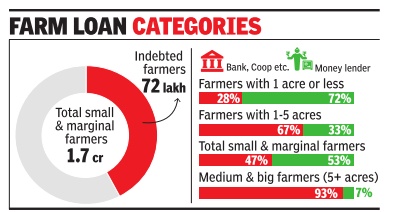

But NSSO data shows that less than half of the small and margi nal farmers in the vast state owe money to banks. Majority of such indebted farmers have taken loans from informal or non-institutional sources like local money lenders, traders, friends and relatives or bigger farmers.

The smaller the farmer in terms of land holding, the less likely that he or she will get a bank loan, the data shows. Among farmers with less than one acre of land, just 28% have outstanding bank loans with the remaining 72% owing money to non-formal creditors, mainly money lenders.Among farmers holding one to five acres, the share of those with bank loans rises to 67%.

So, while Yogi Aditya Nath will probably derive political mileage for fulfilling an election promise, on the ground this policy may not provide the much needed relief to the poorest sections of farmers.

Experience with previous debt waivers has been similar. The biggest such scheme was announced by the UPA in 2008, with Rs 52,520 cr waived off across the country . According to a study done by R Ramkumar of the Tata Institute of Social Sciences (TISS), in most of the states the benefits were cornered by farmers with bigger land holdings. In UP , there is a clear possibility that this is what will happen given the nature of loan disbursals.Another issue troubling farmers is that this is a one-off scheme. What happens afterwards?

“With rising costs, we don't get enough returns on the harvested produce. While this scheme will give some relief, the future is still murky ,“ says Sohan Lal, a farmer in Gonda, smirking at the prospect of Rs.45,000 loan getting waived.

UP farmers unhappy despite Rs 36,000cr waived of loans

Loans of Rs 36,000cr waived, but UP farmers still unhappy, June 18, 2017: The Times of India

Sukhram Singh, a mar ginal farmer from Man davali village in Bijnor, repaid a Rs 70,000 loan taken in 2015 as quickly as he could, to avail a 3% subsidy . This was before the UP government's announcement of a farm loan waiver, and now he is resentful about not having been able to avail of it.

Across the state, it is becoming more apparent that the growing discontent among farmers is driven by who qualifies for the waiver, and why . Marginal farmers do not constitute a large section of those eligible. In the agricultural heartland of Bijnor district, of 4 lakh farmers, only 95,000 small and marginal farmers are eligible. “(Loan) repayment delays lead to hefty penalties. Marginal farmers wouldn't dare to delay or default,“ Sukhram said.

Sethpal Singh of Saharanpur, who owns just 6 bighas (0.96 hectares) said, “I re paid my Rs 65,000 loan just two months before the waiver. The 3% subsidy makes a lot of difference to farmers like me. But today I feel deceived by the government.“

The fine print of the waiver announced by the Yogi Aditya Nath government says loans of up to Rs 1lakh, taken up to March 31, 2016, are eligible. Small farmers said the defaulters, and therefore the beneficiaries, were not farmers like them. “Big farmers use IDs of family members, or labourers, to take multiple small loans and then default on them. They are the ones who benefit,“ said Sukhram.

“There are several loopholes in the agricultural loan policy which has not only kept small farmers in distress, but allowed big farmers to avail of small loans.Marginal farmers are therefore left feeling that such a waiver does not benefit them at all. Given its short-term impact, a waiver is just first aid for the deep wounds in the agricultural sector,“ said R P Juyal, associate professor of economics at Nanakchand Anglo Sanskrit PG College in Meerut.

The waiver is meant to benefit 78 lakh of UP's 2.15 crore farmers, of which 1.8 crore are small and marginal.The scheme will see loans to the tune of Rs 36,000 crore waived. However, several types of farmers will not actually benefit from the waiver.

According to the National Sample Survey Organisation, 27% of UP's rural households are of landless agricultural labourers. They have to take personal loans from banks or local moneylenders for expenses like weddings or medical treatment. None of these loans is eligible for the waiver. Some of the anger is also over the slow pace in which the waiver is being implemented. An Agra bank manager, Pankaj Saxena said, “Till now banks have not received any written directives from the government, although banks have been asked to share data regarding such loans. We expect instructions after budgetary allocation in July.“

Impact of waivers on the economy, the government

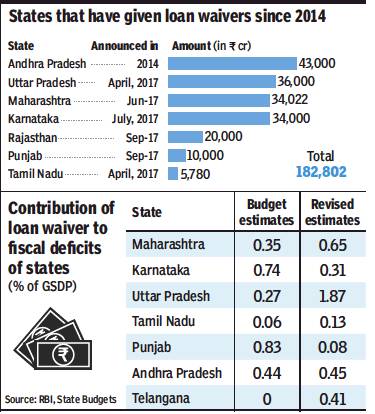

History, 1990-2018; impact, 2014-17

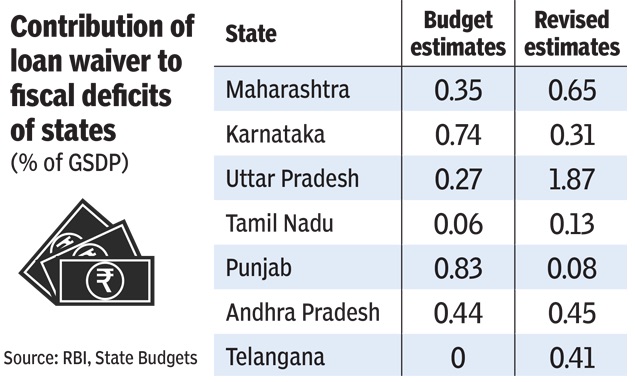

States that have given loan waivers since 2014

Contribution of loan waiver to fiscal deficits of states

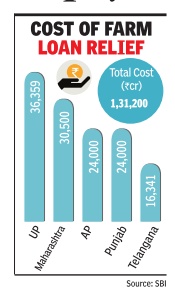

From: Surojit Gupta, Why income support, not farm loan waiver, may be better for all, December 14, 2018: The Times of India

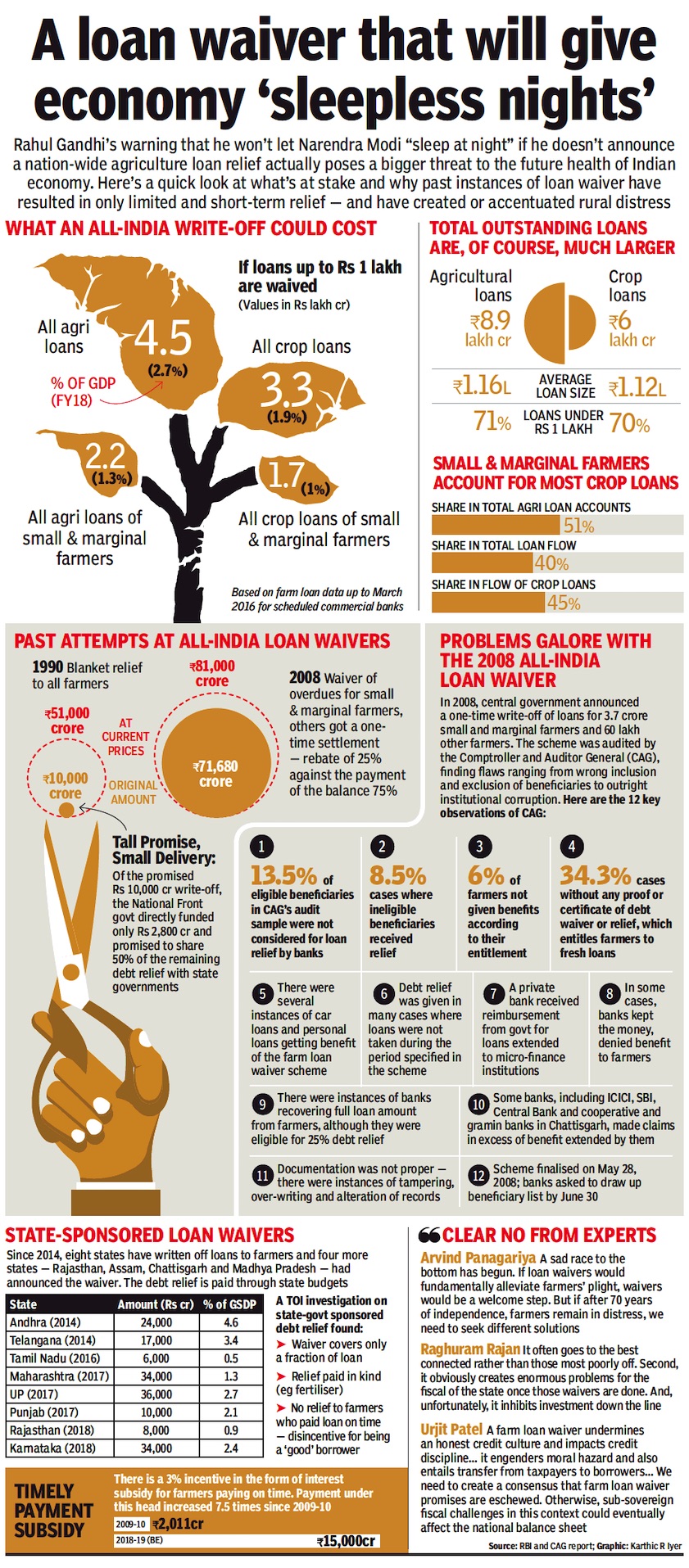

What an all-India write-off could cost;

Share of different sections in total outstanding loans;

Past attempts at all-India loan waivers, 1990, 2008;

Problems which emerged with loan waiver, 2008;

State sponsored loan waivers, 2014- 18;

Expert opinion on loan waiver;

From: December 20, 2018: The Times of India

The election results in which BJP lost three key states have once again pointed to the agrarian crisis and triggered demands for loan waivers. Pressure on the Centre has intensified ahead of the 2019 polls and comes against the backdrop of a tight fiscal situation.

The government has committed itself to meet the fiscal deficit target of 3.3% of GDP. In the aftermath of several states unveiling waiver schemes, finance minister Arun Jaitley had made it clear last year that the Centre won’t be part of any such plan and states will have to bear the cost from their resources.

Since 2014 seven states have unveiled loan waivers totalling nearly Rs 182,802 crore. Agriculture economist Ashok Gulati reckons that the total farm loan waiver may touch Rs 4 lakh crore in the run-up to the general elections in 2019 as other states join the fray.

Congress, which has won the Chhattisgarh state assembly polls, has vowed to waive farm loans as soon as it is sworn in. A similar promise has been made in neighbouring Madhya Pradesh.

The first countrywide debt waiver scheme was implemented in 1990 under the VP Singh government and the total cost was around Rs 10,000 crore. The UPA government in its 2008-09 budget had announced a one-time bank loan waiver of nearly Rs 71,000 crore to cover an estimated 40 million far mers.

While credit to the farm sector has been growing, many experts feel farm loan waivers are a quick fix to resolve the wider problems hobbling the country’s agrarian sector.

The RBI in a report had said that debt waivers can deflect the state from its fiscal consolidation path. “If the waivers are not targeted efficiently… the potential for these waivers contributing to inflationary pressures via higher fiscal deficits remains a key concern,” RBI said in a report on state finances. Some economists say loan waiver is the “worst solution” to alleviate rural distress and instead back an income support scheme for farmers.

“Bold steps now have to be taken to allay the apprehensions of the farming community. An Income Support Scheme for small and marginal farmers might turn out be a viable solution,” said Soumya Kanti Ghosh, group chief economic advisor, SBI. “The cost of such a scheme will be around only Rs 50,000 crore a year -- or 0.3% of GDP. This is lower than the incremental debt waiver,” he added.

Loan waivers spike states’ deficit: RBI, 2018

July 13, 2018: The Times of India

From: July 13, 2018: The Times of India

The RBI has once again come out strongly against farm loan waivers, stating that it bloats fiscal deficits and increases inflation. In its report on state finances released on Thursday, the RBI has raised concerns that states due for elections might spend more on loan waivers.

In its report, the RBI warned that states are overspending and slipping on their fiscal deficit targets even as their tax revenues under GST turn out lower. The RBI has been particularly critical of farm loan waivers in its report. It stated that farm productivity improvements through debt waivers are unproven. It pointed out that since these waivers are coming on the back of schemes like Uday, which aim to provide debt relief to power distributors, it can deflect states from their fiscal consolidation targets.

This is the second time that the RBI is flagging farm loan waivers. In April 2017, after the Maharashtra government’s loan waiver announcement, RBI governor Urjit Patel had said, “Waivers undermine an honest credit culture... It leads to crowding out of private borrowers as high government borrowing tends to impose an increasing cost of borrowing for others.” The governor had called for a consensus against loan waiver promises to avoid “sub-sovereign fiscal challenges affecting national balance sheet”.

Studies suggest that debt waivers have led to a shift to informal sources of finance, the RBI said. Starting with Andhra Pradesh and Telangana in 2014, a slew of states including Tamil Nadu, Maharashtra, Uttar Pradesh, Punjab and now Karnataka have announced the sop.

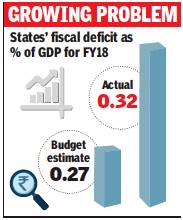

In FY18, farm loan waivers touched 0.32% of the GDP as against budget estimates of 0.27%, the RBI said, adding that more such moves are pending for the fiscals ahead. The central bank has warned that if states go in for populist measures, particularly those facing an election, their borrowing costs could shoot up. “States have budgeted for a revenue surplus in 2018-19 and a lower fiscal deficit. Going forward, fiscal risk may emanate for many states going for election during the year, continuing announcements and rollouts of farm loan waivers as well as the implementation of the pay commission awards by some states,” the RBI said.

Impact on economy: as in 2018

December 19, 2018: The Times of India

Top states- Tamil Nadu,

Maharashtra,

Karnataka,

UP,

Punjab- 2018

From: December 19, 2018: The Times of India

From: December 19, 2018: The Times of India

HIGHLIGHTS

The RBI had cautioned against the propensity of waiving off loans as they were increasing the fiscal deficits of the states

There has been an increase of 0.05% in the fiscal deficit as a percentage of GDP, from 0.27% to 0.32% in the last financial year

Like a flu: Following the decision in Madhya Pradesh and Chhattisgarh by their respective chief ministers Kamal Nath and Bhupesh Baghel to waive farm loans, of up to Rs 2 lakh in MP and Rs 6,100 crore for 16 lakh farmers in Chhattisgarh, Assam has also clambered onto the waive-wagon, announcing its decision to write off Rs 600 crore of farmers' loans, which will benefit 8 lakh farmers. Today, Rajasthan became the fourth state this week to write off farm loans.

Damn the economy: The RBI, in a report on state finances in July, had cautioned against the propensity of waiving loans as they were increasing the fiscal deficits of the states, which were facing a double whammy of lower GST revenues — there has been an increase of 0.05% in the fiscal deficit as a percentage of GDP, from 0.27% to 0.32% in the last financial year. This was, in fact, the second time the RBI red-flagged farm loan waivers — it had also earlier done so in 2017. Given the proximity to the 2019 Lok Sabha polls, there are valid fears that the waiver mania may result in fiscal deficit touching 2% of the GDP.

Self-inflicted wound: Farm loan waivers have also resulted in a spike in banks' NPAs, in the agricultural sector as well as pushing the farmers into borrowing from money lenders at an exorbitant interest rate — that's because banks become wary of lending to farmers fearing loan write-offs by the government, which reduces sources of credit for the farmers who are then forced into borrowings from informal sources of finance.

2018/ Waivers cause drop in crop insurance

Vishwa Mohan, August 6, 2018: The Times of India

From: Vishwa Mohan, August 6, 2018: The Times of India

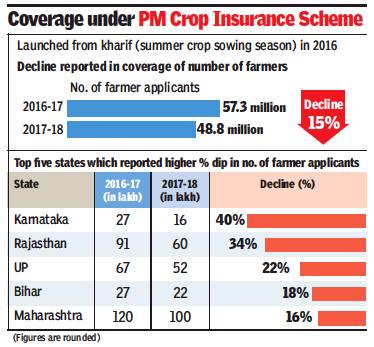

The Centre’s flagship crop insurance scheme, launched in the 2016-17 kharif season, has reported a 15% decline in coverage of farmers in its second year (2017-18) and one of the key reasons for this dip is the loan waiver announced by several states in 2017-18.

Data on the crop insurance scheme, shared in Parliament, showed that farmers’ enrolment declined from 57.3 million in 2016-17 to 48.8 million in 2017-18 with Karnataka, Rajasthan, UP, Bihar and Maharashtra reporting substantial decline. Incidentally, four of these five states — Karnataka, Rajasthan, UP and Maharashtra — announced loan waiver schemes last year, affecting the footprint of Pradhan Mantri Fasal Bima Yojana in 2017-18.

Premium, claims under farm insurance plan grew in 2017-18

Giving reasons for the dip, the agriculture ministry said in its written response to a question in Rajya Sabha, “This is mainly due to factors like announcement of debt waiver scheme in Maharashtra and Uttar Pradesh, farmers’ perception of mitigated risk in 2017-18 which was a good monsoon year, de-duplication due to Aadhaar being made mandatory for coverage etc.”

Records showed that UP, Maharashtra and Karnataka announced their loan waiver schemes before the cut-off date for farmers to enrol for insurance for kharif crops under PMFBY in 2017. The fall in coverage in Bihar, however, can be explained by the state’s resistance to PMFBY.

Figures shared by the ministry in Parliament showed that overall premium and claims under PMFBY increased in 2017-18 compared to 2016-17 despite decline in enrolment.

Gross premium (shares of farmers, central government and state governments) increased from Rs 165 billion in kharif 2016 to Rs 195 billion in kharif 2017 while approved claims increased from Rs 104 billion to Rs 137 billion during the period.

The Beneficiaries of farm loans

Maharashtra: cities get more farm loans

Apr 08 2015

`Maha cities corner more farm loans than villages'

Priyanka Kakodkar

At the RBI's 80th anniversary recently , Prime Minister Narendra Modi had invoked farmers' suicides to urge banks to lend more to cultivators. “When a farmer dies, does it shake the conscience of the banking sector? He faces death because he has taken loans from a moneylender,“ Mr Modi said. Credit to the farm sector has in fact risen across the country over the last decade.Yet, in Maharashtra, which reports the highest farmer's suicides in the country , the bulk of farm loans ironically do not go to farmers, says a new study based on RBI data.

Although the majority of farmers live in rural areas, a larger portion of agricultural loans are supplied by urban and metropolitan branches of scheduled commercial banks, the study says.

Urban and metropolitan branches of these banks ac branches of these banks accounted for nearly 44% of agricultural credit, the study said. By contrast, rural branches supplied almost 30%. The study by economists R Ramakumar and Pallavi Chavan is based on data from the RBI's report “Basic Statistical Returns of Sched uled Commercial Banks in India“ for 2013.

So loans to farmers are not driving the rise in agricultural credit. Instead the major beneficiaries in the revival of farm credit in this decade are agri-businesses and corporates involved in agriculture, the authors say .

This is because the definition of agricultural credit has expanded to include these businesses. “The definition includes loans to corporate and agri-business institutions as well as storage equipment in cities. It includes loans for commercial and export-oriented agriculture,“ says Ramakumar, an economist with the Tata Institute of Social Sciences, Mumbai.

The growth in agricultural credit has also been fuelled by a rise in indirect loans, the study says.Direct loans are given to farmers while indirect loans are given to institutions indirectly involved in agricultural production. The share of credit to small and marginal farmers has dropped dramatically across the country , the study shows. Instead, loans of Rs 1 crore and above are driving the revival of agricultural credit, the study says.

State protection of moneylenders

SarangdharsinghShivdassinghChavan case/ 2010

The Supreme Court held a Congress chief minister of Maharashtra, parts of which had then be come infamous as farmers' graveyard, responsible for protecting money lenders who squeezed farmers into inescapable debt traps.

On December 14, 2010, the SC in “SarangdharsinghShivdassinghChavan“ case held VilasraoDeshmukh responsible for preventing the police from taking action against moneylenders accused of harassing farmers.

“This court is extremely anguished to see that such an instruction could come from the chief minister of a state which is governed under a Constitution which resolves to constitute India into a socialist, secular, democratic republic. Chief minister's instructions are so incongruous and anachronistic, being in defiance of all logic and reason, that our conscience is deeply disturbed. We condemn the same in no uncertain terms,“ it had said.

When the judgment came, Deshmukh was a minister in Manmohan Singh's cabinet.

Farmers, Dalits and Mus lims died or were killed in equal numbers in the past as today . The BJP-led NDA government and the parties ruling states are rightly being criticised for lethargy in tackling the motley criminal gangs spreading hatred in the name of religion and cow.

Even after accounting for crimes committed today by the despicable breed of cow vigilante groups, is the ground situation any different from the past? Statistics say no. Then, why did we keep silent when farmers, Dalits and Muslims were dying or getting murdered in the past? Was it because `secular' parties held the reins at the Centre and states? Maybe, we should not be asking this as it could discredit `secular' parties which are today rightly protesting loudly against similar murders.

Before we go to statistics, a disclaimer: Even after 70 years of independence, the plight of farmers, Dalits and Muslims have not seen the transformation envisioned by leaders of the freedom struggle.

Last week, it was heartening to see people from all walks of life -actors, writers, authors, journalists, social activists and many more -who kept silent for years over trampling of rights and lives of farmers, Dalits and Muslims, venting their dissent against vigilantism-driven murders, making optimum use of their constitutional right to free speech and saying `Not In My Name'.

In the last decade, when farmers were committing suicide in droves, Dalits were getting murdered across the country and Muslims were targeted, one wonders what prevented the present protesters from exercising free speech in “their name“ to criticise the governments concerned. But a good beginning, though belated, is always a welcome step.

Right to free speech and expression guaranteed under Article 19 of the Constitution is a conscience driven exercise. One reacts to an incident when deep within shehe feels it does not conform to the ethos, culture and human values of society that keeps alive our hard earned democratic values.

Today , it would be futile to ask why their conscience was not pricked and why secular political parties did not rally farmers to protest against a Congress chief minister of Maharashtra, parts of which had then be come infamous as farmers' graveyard, when the Supreme Court held him responsible for protecting money lenders who squeezed farmers into inescapable debt traps.

On December 14, 2010, the SC in “Sarangdharsingh Shivdassingh Chavan“ case held Vilasrao Deshmukh responsible for preventing the police from taking action against moneylenders accused of harassing farmers.

“This court is extremely anguished to see that such an instruction could come from the chief minister of a state which is governed under a Constitution which resolves to constitute India into a socialist, secular, democratic republic. Chief minister's instructions are so incongruous and anachronistic, being in defiance of all logic and reason, that our conscience is deeply disturbed. We condemn the same in no uncertain terms,“ it had said.

When the judgment came, Deshmukh was a minister in Manmohan Singh's cabinet.None among the intelligentsia, social activists or farmers' leaders echoed the SC's anguish and protested to seek Deshmukh's resignation.Probably , it is not a fad to protest when `secular' parties hold the reins of power.

Last week, Congress leader, economist, author and former MP Bhalchandra Mungekar wrote a column in a daily newspaper quoting statistics from the National Crime Records Bureau to highlight atrocities faced by Dalits between 2009 and 2013, when his party was in power at the Centre.

Mungekar wrote, “During 2009-13, there were 3,194 incidents of Dalit murders; 7,849 Dalit women were raped. During this period, the seven states of Andhra Pradesh, Odisha, Bihar, Karnataka, Madhya Pradesh, Rajasthan and Uttar Pradesh accounted for 80% of total crimes and atrocities, with UP alone accounting for about 25%.“ This means, every day more than two Dalits were murdered and more than five Dalit women were sexually assaulted during this period.

During 2009-2013, UP was ruled by a `secular' party , so were Andhra Pradesh, Rajasthan, Odisha and Bihar. But Dalit atrocities seldom figured as a debating or a rallying point for expression of anguish against `secular' governments during that period.

Discrimination and atrocities against Dalits have been continuing, and we must protest continuously irrespective of the party in power. It is every citizen's fundamental duty to protect dignity of the voiceless and protest against injustice.

In 2008, the UPA government had sent to the states `Guidelines on Communal Harmony' to prevent and avoid communal disturbancesriots and the follow up action required. Despite this, 2013 Muzaffarnagar riots (UP , 62 killed), 2012 Assam riots (Kokrajhar, 77 killed), 2011 Bharatpur riots (Rajasthan, 8 killed) and 2010 Deganga riots in West Bengal happened.

The grim reality is that `secular' parties at the Centre and states fared no better in protecting the minority community . When Kashmiri Pandits faced ethnic cleansing, not many protested against the dance of raw communal hatred.

A commoner wants harmony and peace. He will always lend his name to protests against vigilante groups, communal forces, corruption and injustice.But the `secular' intelligentsia must remain neutral to the colour of the ruling party while leading protests.

See also

Farmers, cultivators and their issues including Farm loans

Farm loans and their 'waivers': India