Drugs and Pharmaceuticals: India

(→Govt bans Saridon, 327 other combination drugs) |

(→= SC stays drug ban, allows Saridon, Piriton, Dart) |

||

| Line 66: | Line 66: | ||

Meanwhile, many large drug companies have claimed that over the last couple of years they have either phased out such drugs or changed the combination. The FDCs in question are less than 2%, they claim. | Meanwhile, many large drug companies have claimed that over the last couple of years they have either phased out such drugs or changed the combination. The FDCs in question are less than 2%, they claim. | ||

| − | === SC stays drug ban, allows Saridon, Piriton, Dart== | + | === SC stays drug ban, allows Saridon, Piriton, Dart=== |

[https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F09%2F18&entity=Ar01416&sk=16D1445F&mode=text SC stays drug ban, allows manufacture, sale of 3 FDCs, September 18, 2018: ''The Times of India''] | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F09%2F18&entity=Ar01416&sk=16D1445F&mode=text SC stays drug ban, allows manufacture, sale of 3 FDCs, September 18, 2018: ''The Times of India''] | ||

Revision as of 08:37, 29 September 2018

Active pharmaceutical ingredients imported from China, 2016

The Times of India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

This is a collection of articles archived for the excellence of their content. |

Contents |

Banned drugs

Fixed-dose combinations/ proposed ban, 2018

Rupali Mukherjee, August 24, 2018: The Times of India

From: Rupali Mukherjee, August 24, 2018: The Times of India

The proposed government ban on over 340 combination medicines (fixed-dose combinations, or FDCs) will impact over 2% — nearly Rs 2,900 crore — of the organised retail market, with popular cough syrups, painkillers and flu medicines — like Phensedyl, Saridon, Sumocold, and Vicks Action 500 — facing action. A final decision on the ban is expected soon by health ministry, even as an expert panel — the Drug Technical Advisory Board, or DTAB — earlier recommended these “irrational and “harmful” medicines should be taken off the shelves.

An FDC contains two or more drugs combined in a fixed ratio, and made available in a single dosage form. They comprise around 50% of the Rs 1.25-lakh-crore market (moving annual total, or MAT, June 2018), with only certain combinations being marketed “irrational” and “harmful”.

Last year, the Supreme Court (SC) had asked the DTAB to review the matter and recommend which FDCs should be regulated or banned, following a protracted legal battle between the government and drug companies over the issue.

The banned combinations on the proposed list belong to several therapeutic areas like cough and cold syrups, gastrointestinal and anti-infective formulations, and dermatological medicines. The respiratory portfolio will bear the highest impact of 10%, followed by antidiabetic and anti-infective drugs, data culled from IQVIA, a leading technology-driven healthcare service provider said.

Gastro-intestinal medicine Panderm+ (Macleods Pharma) is the most impacted brand at 8% or Rs 233 crore in value terms in the banned category, followed by cough preparation Phensedyl Cough (Abbott).

IQVIA general manager South Asia Amit Mookim said, “The popularity of combination drugs has been due to the convenience of reduced pill burden at an affordable cost. After the ban implementation, the doctors may now have to change their Rx (prescription) habit and prescribe multiple plain drugs, instead of writing one FDC, which may have a huge cost impact on the patients. Further, retail pharmacists dispense medicines based on doctors’ prescriptions that mention the brand names. The banned FDCs are sold under multiple brand names, and looking into the combination of each such brand is an extremely complex process. Each pharmacy may have hundreds of brands with the same combination, and it will be difficult to identify the banned FDCs — which are given in pharmacological names — and eventually may pose a risk to the patients. Therefore, the industry will have to educate and create awareness among pharmacists for effective and safe implementation of the ban.”

Govt bans Saridon, 327 other combination drugs

September 13, 2018: The Times of India

From: September 13, 2018: The Times of India

Among the roughly 6,000 brands estimated to be affected by the ban are popular drugs like the painkiller Saridon, the skin cream Panderm, combination diabetes drug Gluconorm PG, antibiotic Lupidiclox and antibacterial Taxim AZ.

The government had banned 344 FDCs on March 10, 2016 and later added five more to this list. However, manufacturers of these drugs contested the ban in various high courts and the Supreme Court. The SC on December 15, 2017 asked for the matter to be examined by the Drugs Technical Advisory Board. DTAB concluded that there was no therapeutic justification for the ingredients in 328 FDCs and that these could be a risk to people. The board recommended banning them.

In the case of six other FDCs, the board recommended restricted manufacture and sale subject to certain conditions based on their therapeutic justification. The SC ruled that the government could not use the DTAB report to prohibit 15 of the 344 drugs in the original list as these have been manufactured in India since before 1988. This exception covered several popular cough syrups, painkillers and cold medication with sales amounting to over Rs 740 crore annually. However, the court told the ministry that it could still look into the safety of these 15 drugs by initiating a fresh investigation if it wanted to ban them.

The All India Drug Action Network, one of the petitioners in the SC case, welcomed the ban and sought swift action on the 15 excluded FDCs.

‘Unsafe FDCs make up 25% of drug market’

The banned FDCs account for about Rs 2,500 crore and represent only the tip of the iceberg. In our estimate, the market for unsafe, problematic FDCs in India is at least onefourth of the total pharma market which is valued at Rs 1.3 trillion,” the All India Drug Action Network, a civil society group working on safety and access to medicines which was one of the petitioners in the Supreme Court case, said in a statement. It also sought a review of all FDCs in the market in the interest of patient safety as recommended by the Kokate Committee, constituted by the health ministry to examine FDCs.

Meanwhile, many large drug companies have claimed that over the last couple of years they have either phased out such drugs or changed the combination. The FDCs in question are less than 2%, they claim.

SC stays drug ban, allows Saridon, Piriton, Dart

SC stays drug ban, allows manufacture, sale of 3 FDCs, September 18, 2018: The Times of India

The Supreme Court allowed sale of Saridon, Piriton Expectorant and Dart — three fixed dose combination (FDCs) drugs — recently banned by the Centre along with 325 other drugs and permitted pharmaceutical companies to manufacture and sell the medicines.

A bench ofJustices R F Nariman and Indu Malhotra agreed to hear pleas from pharma majors challenging the Centre’s decision to ban the drugs.

The government took the decision on the recommendation of a panel constituted by the Centre on the SC’s direction to review safety, efficacy and therapeutic justification of FDCs. Hearing petitions challenging the Centre’s 2015 ban on some FDCs, the court in December referred the issue to the Drugs Technical Advisory Board (DTAB) for a fresh view before recommending action. FDCs are single dosage combinations of two or more drugs.

The review was ordered after the Centre challenged the Delhi high court order quashing its March 10, 2016, notification banning 344 FDC drugs citing health risks and lack of therapeutic justification. The ban on FDC drugs was enforced following a report by a six-member committee, which in January 2015 termed 963 FDCs as posing health threats. The court, however, said its Monday order will be applicable to FDCs given licence prior to 1988.

Challenging the Centre’s decision, manufacturing companies filed an application before the court saying contended the three FDCs were given licence before 1988 and the panel was not allowed to examine them.

Three drug manufacturers challenged the ban saying it was illegal and arbitrary, arguing their FDCs received licences before 1988 and the central panel was not allowed to examine them

Clinical trials

Rules eased/ 2016

The Times of India, Aug 04 2016

Sushmi Dey Clinical trials may rise as drug regulator eases rules The federal drug regulator has eased norms related to pharmaceutical research, a move that may boost the number of clinical trials but could also raise concerns on patient safety .

Drugs Controller General of India (DCGI) in a notification, said an investigator or researcher can undertake as many trials as approved by the ethics committee instead of the present cap of three. The regulator has also relaxed norms for hospitals or clinical sites undertaking such trials. Through a separate notification, the DCGI has revised the rule that prohibited any hospital with less than 50 beds to take up a trial.

Under the revised norms, the ethics committee has been empowered to decide whether asite is suitable for a trial irrespective of its bed capacity . It suggested the site should have “emergency rescue and care arrangements“.

The ethics committee is a panel of experts which examines the proposal of a pharmaceutical company or a researcher to conduct clinical trials or human experiments for new medicines.

Following random clinical trials and increasing number of deaths during such experiments, the government had earlier imposed a restriction of not more than three clinical trials to be conducted by an investigator.

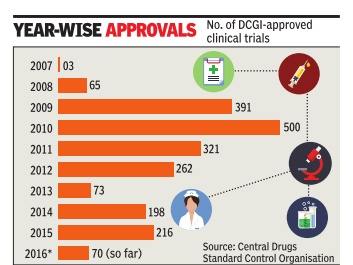

The number of clinical trials in India went up rapidly around 2008-09. According to data available from the Central Drugs Standard Control Organisation (CDSCO), aro und 65 trials were approved in 2008, whereas it jumped to 391 in 2009 and 500 in 2010. However, following the Supreme Court's intervention, the approvals dropped drastically from 2011onwards.

The changes have cheered the industry . “Ultimately what this translates into is qualitatively better clinical trials as decisions will be guided by which investigator or site is best suited for a particular trial,“ Indian Society of Clinical Research president Suneela Thatte said.

Drugs and pharmaceuticals made in India

Curbs by four EU nations

December 07 2014

Four European countries decided to suspend marketing authorization of 25 drugs, which had undergone tests at the GVK Biosciences facility European Medicines Agency (EMA) did say in a statement that it is reviewing the findings of non-compliance with good clinical practice at the GVK facility and determining its impact on medicines authorized on the basis of studies performed there. Germany , France, Luxembourg and Belgium have already decided to suspend marketing authorizations of these drugs. EMA's Committee for Medicinal Products for Human Use (CHMP) is now identifying, together with member states of the EU, the medicines covered by the inspection findings. French drug regulator ANSM has said on its website that Belgium, Germany , Luxembourg and France decided to suspend the marketing authorizations for the medicinal products concerned. “Although these documents are not essential to the demonstration of bioequivalence, the ANSM decided, as a precaution, to suspend the marketing authorization of 25 marketed generic drugs.

Drugs and pharmaceuticals sold in India

2008- 2014: Drug launches reduced by 80%

Dec 27 2014

New drug launches drop 80% in 6 yrs

Sushmi Dey

Launches of new medicines in India have come down by nearly 80% during 2008-2014 and drug manufacturers blame price regulations and policy uncertainty for making India an unattractive destination for both domestic as well as multinational pharmaceutical companies.

In 2008, 270 new drugs were approved for sale in India, whereas it dropped to 44 and 35 in 2012 and 2013, respectively. In 2014, only 56 new medicines were approved till November, government data shows.

“Most of the big pharmaceutical companies have knocked out India from their list of key markets. The reason is stricter policy measures cutting down on margins, making it less attractive as a business proposition for future growth,” a senior executive in a leading domestic pharmaceutical company said.

A stricter regulatory regime, which not only brings down drug MRPs but also continuously expands span of price control, is cited as the main reason why drug manufacturers are losing their India focus. Industry of ficials also blames looming uncertainty in policy as another reason for companies to delay product launches. Apart from pricing, the pharma industry has been facing hiccups in foreign investment, new drug approvals, as well as clinical trials.

Government and regulators, however, brush aside such concerns. According to a senior official in the National Pharmaceutical Pricing Authority (NPPA), the price regulations are as per the policy and MRPs are fixed based on average price of medicines in that segment. “There is no reason for a particular company to find it unviable when others are making the same drug at a lower price,“ the official said, adding that market surveys show a huge disparity in pric es of similar medicines sold under different brands.

The number of drug approvals peaked in 2008, when as many as 270 new drugs were granted approval, followed by 217 in 2009, 224 in 2010, and 140 in 2011, the data shows.

However, since 2012, when the government released the National Pharmaceutical Pricing Policy bringing in 348 medicine formulations un der price control, the new drug launches started reducing drastically. “The role of NPPA is to implement the policy in letter and spirit and not create confusion leading to instability in the drug industry,“ another senior industry official said.

Recently, many medicines were also found missing from the market following stringent regulatory measures.

Earnings, profits

2012-18; exports to USA in 2018

From: Rupali Mukherjee, US-focused pharma cos see 30% drop in FY18 earnings, June 15, 2018: The Times of India

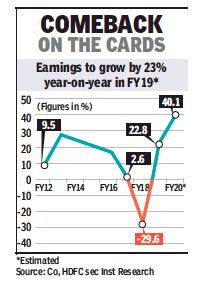

Regulatory clampdowns, increased competition and channel consolidation in the US have led to a drop of 30% — one of the worst — in earnings of USfocused Indian pharma companies in FY18. But the good news is there are signs of recovery with a strong doubledigit growth expected in FY19.

Analysts expect net profit of these companies to grow nearly 23% in fiscal 2019, fuelled by a rich and mature pipeline, a ramp-up in capacity, and a favourable base (GST and US tax impact).

Moreover, US revenues for the top 10 US-focused companies — Sun Pharma, Dr Reddy’s, Cipla, Lupin, Aurobindo, Glenmark, Cadila, Alkem, Torrent and Alembic — are expected to rebound, and grow in single digits in FY19, after the huge drop of nearly 12% witnessed in FY18.

Analysts believe fiscal 2019 may see a gradual comeback for large-cap pharma companies, driven by regulatory resolutions, and a moderating price erosion. Recently, beleaguered Sun Pharma resolved its regulatory issues at its Halol plant after a gap of over two years.

Most Indian pharma cos have scaled up US ops

Most companies were forced to go slow in US FDA (Food and Drug Administration) filings, as they were bogged down with their key plants being under the regulatory scanner. However, over last two years, companies have invested heavily to expand their capabilities — both in manufacturing and research and development.

Three years ago, a majority of US revenues of most Indian pharma majors was contributed by two plants. Since then, they have scaled up and diversified filings across multiple facilities. This has significantly reduced concentration risk with respect to future regulatory adversity, said an analyst from HDFC Securities in a note.

Glenmark Pharmaceuticals CMD Glenn Saldanha said, “We have had a good start to the new financial year with two good approvals, especially the approval of generic Welchol.

Though price erosion still remains a challenge in the US generic market, new product approvals will be key to growing the US business. We hope that we will be able to launch 10 to 15 new products in this year, which will augur well for our US generic business.”

For most companies, several product launches across generic and specialty categories are expected in the second half of FY19. With a rich pipeline, fiscal 2019 could be a breakthrough year in terms of niche product opportunities, the note says, including Sun Pharma’s (Tildra, Sceiera, Yonsa), Lupin (Solosec, Levothyroxine, generic Ranexa), and Dr Reddy’s (generic NuvaRing, generic Suboxone). Additionally, inhalers, bio-similars, trans-dermals and niche injectables are expected to be launched from FY20. A major reason for earnings having bottomed out is price erosion moderating in the US, experts say. Price erosion has been ever-present in the generics business. However, it has historically been in the range of 5-6%, while over 2016-18, there was a double-digit decline.

Most players have witnessed moderating price erosion during the fourth quarter FY18, and expect a stable singledigit price decline ahead.

Exports

2017: 300 USFDA generic approvals, a record

ii) The size of the US market for generics, 2012-17

From: Rupali Mukherjee , Indian pharma cos get record 300 USFDA generic drug nods, January 25, 2018: The Times of India

See graphic:

i) USFDA Final Approvals, 2015-17; and

ii) The size of the US market for generics, 2012-17

Domestic pharma companies received more than 300 approvals in 2017 to launch generic drugs in the US, which is an all-time high. The clearances came despite regulatory pressure from the US Food and Drug Administration (FDA), and unprecedented warning letters issued to the pharma companies’ facilities.

The final approvals for Indian players are up by nearly 43% from 211 in 2016, and corner about 40% of all global filings in the highly lucrative around $70-billion US market. This, even as all drug biggies — including Zydus, Sun Pharma, Dr Reddy’s and Cipla — faced regulatory ire, while some were pulled up for manufacturing lapses by the US regulator during last year.

In terms of each company, Zydus leads with 66 approvals in 2017, followed by Aurobindo (52), Glenmark (18), Lupin (17), Gland Pharma (16) and Cipla (10). Zydus cornered a majority of US filings as its Moraiya facility, which contributes about 60% of US sales, came out from under USFDA scanner in June last year. Sun Pharma remained static at 10 approvals, due to its Halol plant continuing under the regulatory glare.

The US generics market, a key driver of Indian pharma’s growth, has always been a dynamic market. But the pace of change has accelerated in the last few years. The increase in competition and consolidation of distribution channels have led to the US generics business getting commoditised. Price erosion has been at an all-time high and this has impacted operating margins significantly. Major domestic companies earn at least 40% of their overall sales from the US. To maximise margins, companies are now launching complex generics and speciality products.

Glenmark Pharma chairman & MD Glenn Saldanha says, “While the number of ANDA (abbreviated new drug application) approvals continue to remain strong for us, we, however, have begun the process of transitioning the US business to a specialty/innovation business. While the generics business in the US will still grow, the future for us will be in the specialty and innovation business. We plan to file our first specialty NDA in the next few months in the US.”

Fixed dose combination (FDC) medicines

Health ministry bans 344 FDC drugs, HC lifts ban/ 2016

Sushmi Dey, Dec 5, 2016: The Times of India

`344 FDC drugs limit therapy choices'

Public health groups have expressed concerns over the Delhi high court order lifting the ban on 344 fixed dose combination (FDC) medicines, imposed by the government.

“This is a huge setback to efforts aimed at bringing a semblance of order into the absolute anarchy that exists in India's pharmaceutical market,“ said a statement from Jan Swasthya Abhiyan.

The health ministry had banned 344 FDC drugs terming them as irrational and raising concerns over their misuse. These included some of the popular pharmaceutical brands such as Pfizer's Corex and Abbott's Phensedyl. However, recently the Delhi HC overturned the government's ban providing a major relief to the pharmaceutical companies.

Public health and advocacy groups have asked the government to appeal against the HC order as it has the potential to impact healthcare cost as well as quality of medicines. Health groups said lifting of the ban seems to be predicated on “perceived procedural issues“ which fundamentally abrogate the right to life and healthcare.

Jan Swasthya Abhiyan said use of FDCs increase cost of medication, exposes populations to a larger array of adverse effects and limits the choice of therapy as they may combine drugs with different dosage schedules. Further, some of the cough syrups in the ban order are primarily being used as addictive substances and not as therapeutic agents.

FDCs include two or more active pharmaceutical ingredients combined in a single dosage form.

“The Delhi High Court order does not appear to address the issues of rationality of the FDCs and the resultant adverse effect on public health,“ it said, asking the government to plug legal and regulatory loopholes so that the ban order can be restored.

“It is of utmost importance that the government, as a custodian of public health, act decisively to de fend it and strengthen regulatory mechanisms,“ JSA said.

The HC verdict has come as a major set back to the government which was planning to ban more FDCs to eliminate irrational combination drugs causing anti-microbial resistance. In some cases the toxicity is so high that it can even lead to failure of organs, officials say. There are also concerns many of these FDCs being available over-the-counter without doctors' prescription, which is leading to their misuse.

While many of these products are sold at the chemists level, officials and health experts say often adverse events are not reported because patients do not come back to doctors unless these drugs are used repetitively , leading to severe problems.

Estimates show around FDCs comprise over 40% of the total Rs 1 lakh crore annual Indian pharmaceutical market. However, only around 16 FDCs are part of the National List of Essential Medicines.

Import of ingredients

2017: 26% dip in import from China

Chethan Kumar, 26% dip in drug ingredient import from China, January 22, 2018: The Times of India

From: Chethan Kumar, 26% dip in drug ingredient import from China, January 22, 2018: The Times of India

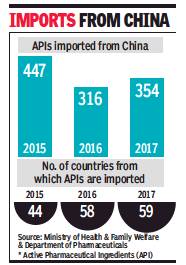

See graphic:

APIs imported from China to India, 2015-17

In 2017, India imported 354 Active Pharmaceutical Ingredients (APIs) from China, a 26% dip compared to 447 in 2015, largely achieved because the number of countries India imported such material from increased from 44 in 2015 to 58 in 2016 and 59 in 2017.

The number of APIs imported from China has grown slightly compared to 2016 (316) though. Also, import from China is still the highest in this category, accounting for 66% of all imports in 2017 — Rs 12,254.97 crore of the Rs 18,372.54 crore. The trend has remained similar in all the three years.

Many of these APIs go into 12 essential drugs listed by India — paracetamol, metformin, ranitidine, amoxicillin, ciprofloxacin, cefixime, acetylsalicylic acid, ascorbic acid, ofloxacin, ibuprofen, metronidazole and ampicillin — and 8 of which are also on WHO’s Model List of Essential Medicines.

Officials from the Department of Pharmaceuticals (DoP) and industry experts point out that the import of APIs is because of economic considerations, but experts also pointed out the issue of quality that comes with such over-dependence.

Earlier this month, India banned import of APIs from six Chinese firms claiming they did not meet the required quality standards.

Drugs Controller General of India Dr GN Singh said: “Our mandate is limited. We are concerned about the quality of imports and are always keeping a track of it. The ban on those firms is routine and should not been seen as targeting the Chinese companies.”

He said that India is also manufacturing APIs and there are more than 500 products, but most of them are being exported. Indian Pharmaceutical Association president Dr Rao VSV Valdlamudi said drug prices in the domestic market are controlled and while the APIs being exported command the price their quality demands, they do not fetch the same price domestically.

“The problem of over-dependence, however, is a much larger issue. If China stops importing from India, will India be able to turn all its exports to the domestic market? Over-dependence has to reduce. At present the government doesn’t take into consideration many variables and overheads in production and subsidies, as some argue, is not a longterm solution,” Rao said.

India has been putting in place some systems, but chemicals and fertilisers minister HN Ananth Kumar, while blaming legacy, concedes the Centre is not fully happy with the progress.

“Historically, there has been too much dependence on China and previous governments have done nothing about it. We took a twopronged approach.

First, from 0% customs duty on import of APIs from China, we made it 7.5% which is very good for domestic API makers. As per the Dr Katoch Committee report, we initiated having bulk drug parks and the first will come up near Hyderabad,” he said.

He said the Centre will provide up to Rs 500 crore for common facilities like power, water, effluent treatment, testing and trading facilities at such parks, which will reduce production cost by 30% making it globally competent, even compared to China.

Influencing academies, research

Pharma industry influences Academy of Paediatrics

Rema Nagarajan, How pharma firms influence paediatricians' body, Mar 27, 2017: The Times of India

A Parliament question “regarding the influence of vaccine-makers on the immunisation plan“ has raised the issue of funding of the Indian Academy of Paediatrics (IAP), the body representing over 23,000 paediatricians in India. A look at its finances shows just how dependent the IAP is on funding from the pharma industry , especially vaccine manufacturers.

Most of the industry funding comes as sponsorship for IAP's annual conference, Pedicon, and funding for the association's activities under the Presidential Action Plan.

In 2016, IAP earned Rs 5.5 crore, of which almost 30% was combined income from Pedicon (55 lakh) and the Action Plan (Rs 1.1 crore). Pedicon's share is usually much larger, touching Rs 93 lakh and Rs 94 lakh in 2013 and 2014 respectively , including the bidding charge of Rs 15 lakh that the organising branch has to pay the central IAP (CIAP).

The growing dependence on industry was raised by IAP treasurer Pravin J Mehta in the 2013 annual report when he said: “Our expenditure per year is approximately 2.77 crores. Our fixed income... is approximately 1.77 crores.That means every year we are dependent on variable income of rupees one crore...Major chunk of this variable income is from Pedicon. This means that in unforeseen circumstances of Pedicon not doing well financially , it will be difficult to match income with rising expenditure.“

The “lead sponsor“ of Pedicon 2017 held in Bengaluru in January this year was Bharat Biotech, a leading vaccine company . According to the brochure, platinum sponsorship was Rs 5 crore. So was Bharat Biotech the platinum sponsor? Dr Govindaraj M, the chief organising chair man, claims he does not know.Other vaccine companies like Wyeth and Sanofi too got prominent mention at the venue, which could mean that they were diamond (Rs 4 crore), gold (Rs 3 crore) or silver (Rs 2 crore) sponsors. Judging by the sponsorship brochure, this conference could have raked in over Rs 15 crore.

Pedicon is supposed to be an academic conference, but the discussions regarding it seem to revolve primarily around the revenue it generates and sharing of the profits between the central IAP and the organising branch in a 30:70 ratio. The profits generated by some Pedicons have been over Rs 3 crore.

IAP's 2015 annual report talks about the escalating costs of the annual conference with per delegate costs rising from Rs 10,000 for four days to over Rs 20,000 in the past three years. Total expenses had more than doubled from about Rs 4.5 crore in 2010 to over Rs 9 crore by 2014.

The report noted that IAP had no mechanism for oversight of expenses and though the income from the conference has continued to rise, profits had remained almost static. There was a suggestion that the IAP should take complete charge of Pedicon finances. But that is being resisted.

In a critical note in the annual report, Dhananjay Shah, founder convenor of the first finance committee, wrote: “Pedicon organisers have been kindly making luxurious arrangements for the 50 odd group of newly elected EB members who are provided a five-star accommodation at a luxurious hotel for full five days during their Pedicon as an expense item of the Pedicon. The EB meeting is actually a CIAP (central IAP) function and has nothing to do with the Pedicon event.“

He also warned that the money available in IAP cof fers could be an “attractive bait for those with evil designs“ and that candidates were already spending sums of even Rs 50 lakh “to win the presidential crown“. IAP's academic role “will take a severe beating and thrashing“, he apprehended.

Gala cultural evenings and bar nights push up the cost of these so-called academic conferences. However these are not unique to IAP.Almost all doctors' associations organise these lavish sponsored conferences ostensibly to educate doctors. From the annual conference of national associations of specific specialties, to those organised by state or city branches, all are funded by pharma companies that shell out crores to oblige the doctors.

In 2014, the IAP alone had 27 state branches and 314 city district branches. The Cardiology Society of India has 26 state branches, not including the sub-specialty councils. Doctors insist they are never influenced by the generosity of these companies, but that begs the question of why for-profit companies would spend crores without expecting returns in the form of `prescription support' from the doctors.

Prices of Drugs and pharmaceuticals

Nodal agency: National Pharmaceutical Pricing Authority

The Hindu Business Line, November 26, 2016

S. Srinivasan

NPPA (National Pharmaceutical Pricing Authority), formed in 1997 implements the DPCO (Drug Price Control Order) 2013.

In considering dismantling of the institution, the thought is that price control should be “delinked” from the 370-plus essential drugs. And thereafter price control must be confined to what the government thinks fit. Tell this to the poor people standing in the queue to exchange their demonetised notes. They understand the devastating impact of such a move on their lives.

The argument being given for dismantling price control is that:

a) it inhibits growth of pharma industry and

b) inhibits new investment.

This is a wrong argument and not evidence based. Price control affects only 12 per cent (maximum of Rs. 12,000 crore) of the total domestic market of more than Rs. 1 lakh crore. Out of which less than 50 per cent of the “affected” market, that is only Rs. 6,000 crores, had to actually reduce their prices to the ceiling price fixed by the DPCO. About 88 per cent of the market is out of price control. During the period DPCO 2013 has been in operation, the domestic sales of medicines have increased from Rs. 70,000 crore in 2013 to more than Rs. 100,000 crore as of date. Exports are another Rs. 100,000 crore. So, does the DPCO really inhibit growth?

There is in fact a need to expand the span of price control to cover a range of essential and life-saving drugs as directed by the Supreme Court in its order dated March 10, 2003 in Union of India vs KS Gopinath and Ors. The Supreme Court has clearly held that the government has a Constitutional obligation to ensure the affordability of essential medicines. The AIDAN (All-India Drug Action Network) and Others had impleaded themselves in the matter in 2003 and the case is still before the Supreme Court (Writ Petition (Civil) 423/2003). The current DPCO 2013 is itself an outcome of the above PIL. It is, hence, curious that the Government should discuss the dismantling of the DPCO 2013 when:

a) the matter is sub judice, and

b) when it is against the spirit of Supreme Court directives on the issue.

AIDAN has served a legal notice, citing the case, to those involved with the discussion of dismantling the NPPA (the CEO of the Niti Aayog and the Secretaries of Health, Department of Pharmaceuticals and the Department of Industrial Policy and Promotion).

Pharma industry lobbies are reeling from two recent court orders: one, the refusal by the Bombay High Court to question the legitimacy of the NPPA’s action, under Para 19 of the DPCO 2013, that brought more essential drugs, like antidiabetics and cardiovasculars, under price control. The other order, by the Supreme Court, will result in industry having to pay more than Rs. 4,500 crore for overcharging essential medicines under the previous DPCO. It is no wonder that the very foundation of price control is now being brought to question.

But in the interest of bringing in greater “ease of doing business”, the Government needs to ensure that Parliament and the regulatory requirements are not bypassed, stakeholders are not kept in the dark, and patient interest is not sacrificed.

Trends

Limited rural reach inspite price control measures

The Times of India, Jul 15 2015

Sushmi Dey

Pharma price control has stunted innovation: Study

Lower cost but rural reach poorer

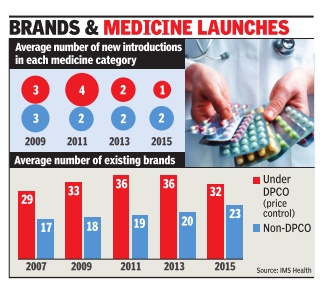

Consumers may be happy about a cut in medicine bills but the government's price control measures have forced many brands out of the “unviable“ pharmaceutical market, resulting in a drastic slowdown in launches over the last five years. From an average of four new drugs being launched in any specific category in 2011, it was down to a mere one in 2014-15, implying a 75% decline in launches, according to estimates by IMS Health -a leading healthcare market research agency .

Not just that, data collected since 2013, when the new pharmaceutical pricing policy came into place, show a sharp decline in consumption of price-controlled medicines. That's because of a growing push for alternative options outside price control.

With lower margins in price-controlled medicines, there is also less incentive to reach out to rural markets. “For low-income households that are reliant on the government system for healthcare, DPCO (Drugs Price Control Order) will not improve the patient's ability to purchase drugs. This is supported by the fact that no significant penetration of price-controlled molecules in rural markets is visi ble...,“ says a new report, Assessing the Impact of ` Price Control Measures on Access to Medicines in India' by IMS Health.

According to the report, consumption of price-controlled medicines in rural areas dropped by 7% in the past two years, whereas sales of other medicines increased by 5%. It says even in Tier-II and III cities, such medicines have witnessed a muted growth.

The industry argues that the move has failed to achieve the intended objectives of increased affordability and availability because policy measures have impacted tail-end brands more than the leading players.But public health experts brush aside such concerns saying companies manufacture one medicine under several brands with different compositions, and regulations are aimed at bringing them on a par in terms of pricing.

Life-saving medicines: limited competition keeps rates high

Rupali Mukherjee, Critical illness drugs remain unaffordable, Nov 03 2016 : The Times of India

Steps To Cap Prices Of Life-Saving Meds Prove Futile, Limited Competition Keeps Rates High

Market dynamics and limited competition in biosimilars (approved versions of complex biologic drugs) and other life-saving drugs have resulted in little reduction in prices, making them unaffordable for many . Surprisingly , government measures to bring down their prices (through the Drug Price Control Orders, or DPCOs) too have been futile, making them out of reach for patients as treatments often run into lakhs of rupees. Biosimilars are used in cancer therapy , rheumatoid arthritis and other critical illnesses.

Even in the case of medicines for hepatitis B and C like sofosbuvir, tenofovir and entecavir, which were brought under price control, there has been little change in the access scenario. Take the example of two biosimilars -rituximab and trastuzumab -where there is not much change in MRP , even after government brought these drugs under price control in April and May respectively .The National Pharmaceutical Pricing Authority (NPPA) ceiling price for breast cancer drug trastuzumab is Rs 55,812 (440 mg), marginally lower than that charged by companies at around Rs 58,000, while the ceiling price of another cancer drug rituximab (500 mg) is Rs 36,947, close to the MRP of Ristova (innovator Roche's brand) at Rs 37,500.

Ceiling prices are fixed by NPPA based on a simple average of price to retailer (MRP) of products of companies with over 1% market share. “Given this methodology , wherever the innovator has had an almost monopoly position, the price reduction before and after price control has not been significant. Therefore, given the same methodology being in force, a ceiling price revision after two years can be expected to bring about a further reduction consequent to more players participating in the market and offering products at competitive prices,“ K V Subramaniam, president and CEO, Reliance Life Sciences, said.

Leena Menghaney , treatment activist and lawyer, said, “The system devised by NPPA of fixing prices encourages companies to artificially keep prices high, and hence, works against patients and consumer interests. The government has allowed both multinational and generic countries to profiteer out of the disease of people, driving millions of patients to death.“

The cost of production should be taken into consideration, where medicines included in the National List of Essential Medicines (NLEM) are linked to price control. This is because there is evidence that cost of producing certain offpatent registered drugs is cheap, based on cost of active pharmaceutical ingredient (raw material). “The market is not 100% perfect and, at times, anomalies creep in. In certain cases, there are limitations in making drugs affordable,“ an NPPA official said. In the case of hepatitis medicines, pharmacologist Andrew Hill from Liverpool University has calculated the treatment costs for a patient.“The drug entecavir is very cheap, and could be made for only $36 per year, or 10 cents per day . Sofosbuvir can be made for $1 per day , including a profit margin. So the ceiling price fixed by the government seems high,“ Dr Hill told TOI.

“The cost of biosimilars needs to be viewed in the con text of global prices of these expensive biologics which are being provided in India at a fraction of their original cost. The cost of developing a biosimilar ranges between $50-150 million in comparison to a generic which costs around $3-5 million. The scale-up of manufacturing is extremely difficult and expensive,“ Kiran Mazumdar Shaw, CMD, Biocon, said.

However, there is a section which feels that price control alone cannot improve access. “Competitive pricing, local production and compulsory licensing will drive down prices“, says Indian Pharmaceutical Alliance secretary general D G Shah.

’Retail margin on generic drugs as high as 1,000%'

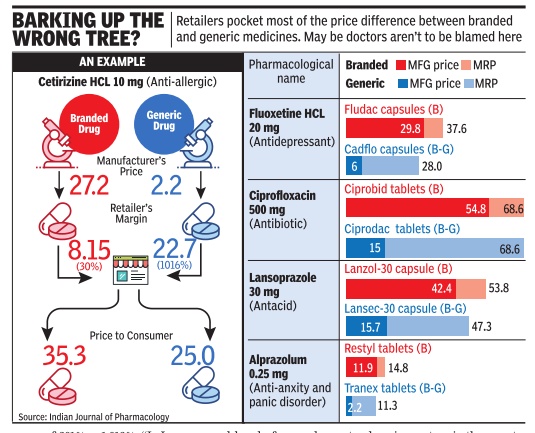

If you think doctors prefer to prescribe expensive drugs when cheaper options are available, you are only partly right. A study in Indian Journal of Pharmacology found that while generic versions were less expensive than the branded ones, the retail margin on generic variants was way higher -sometimes more than 1,000% of the manufacturer's price.

This implies that retailers have a strong financial incentive to push generic drugs, even if doctors prescribe branded. PM Narendra Modi had on Monday said that government is contemplating a legislation that will make it mandatory for the doctors to prescribe generic drugs. Authored by pharmacologists from Delhi University's VP Chest Institute and MD University, the 2010 study compares retailers' profit margin on five common drugs -cetirizine, fluoxetine, ciprofloxacin, lansoprazole and alprazolam.

Dr Anita Kotwani, professor of pharmacology at Delhi University's V P Chest Institute, told TOI fleecing of patients in this manner continues. “It will not stop until government comes up with regulation to ensure manufacturers drop trade names and sell drugs by their pharmacological name as in the US and other developed countries,“ she said.

Dr Kotwani was the lead author of the IJP study . She said retailer margin for five branded medicines they studied was in the range of 25%-30%, but for their branded-generics version manufactured by the same company it was in the range of 201% -1,016%. “In India, there are very few innovator or patented products. Generic drugsare available in two forms: the branded product which companies advertise and push through doctors and branded-generic which they expect retailers to push in the market,“ she said.

In the IJP study , quality of both branded and branded-generic drug was found to be equally good. But doctors say all generic drugs sold under different name do not have similar quality. “We have observed that epilepsy goes out of control in epilepsy patients when they changed the brand which is indicative of variation in quality of drugs manufactured by different companies,“ said Dr Kameshwar Prasad, profes sor and head of neurology at AIIMS. He added there should be strict control on quality and pricing of generic drugs.

“Doctors are often blamed for coming under the influence of big firms, who lure them with different benefits, and batting for brands. This is partially true. The fact that quality of generic drugs sold under various trade names for same molecule is not uniform, hence lack of trust on the less popular ones,“ said another doctor.

Ironically , India is one of the world's largest exporters of generic drugs. It exports to over 200 countries, including the highly regulated markets of US, Europe, Japan and Australia. But the experts say quality control is much better abroad. “There are only 1800 drug inspectors in the country .This number is grossly inadequate,“ Dr K K Aggarwal, president of Indian Medical Association, said. He added that less than 0.01% of the drugs produced in the country are tested for quality. “For doctors to prescribe generic drugs, it is crucial that the laws regarding drug testing and quality assurance are strengthened,“ the IMA president clarified.

Prime Minister Modi, while speaking at a function to inaugurate a charitable hospital in Gujarat on Monday , said the government will bring in a legal framework by which if a doctor writes a prescription, he has to write in it that it will be enough for patients to buy generic medicines and he need not buy any other medicines.