Demonetisation of high value currency- 2016: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Counterfeit currency

Fake notes with face value of Rs 400 crore in circulation

The Times of India, May 11 2016

Neeraj Chauhan 250 In Every 10 Lakh Bills Counterfeit: Indian Statistical Institute

Fake notes with face value of Rs 400 crore in circulation

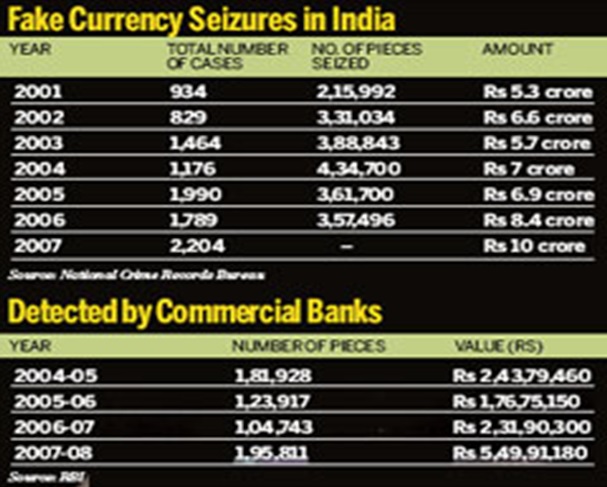

As many as 250 of every 10 lakh notes in circulation in India are fake, and banknotes with a face value of Rs 400 crore are in circulation in the country at any given point of time. The first ever study of counterfeit money has unearthed that fake Indian currency notes (FICN) with a face value of Rs 70 crore are infused into the Indian market every year, with agencies only able to intercept one third of them.

These shocking revelations are part of the study on “Estimation of the quantum of FICN in circulation“, conducted by the Indian Statistical Institute (ISI) Kolkata, which has asked the government to take “immediate steps“, since these figures are only indicative of the extent of the menace.

The findings have been accepted by the government and a series of strong measures to counter this `economic terrorism' is being planned in consultation with the primary FICN detection and probe agency, National Investigation Agency, besides other security and intelligence agencies including CBI, IB, DRI, R&AW and sta te police departments.

The study has further revealed that the detection rate of fake 100 and 500 rupee notes were found to be about the same and higher than the detection rate of 1000 rupee notes by about 10%. It added that fake 1,000 rupee notes constitute about 50% of the total value of FICN.

The ISI study was based on volumes of FICN detected and cash transaction in the banking sector. The study said that “the detection of FICN is carried out primarily by commercial banks. However, their reporting is irregular too and only three banks Axis, HDFC and ICICI report about 80% of the detection“. ISI, however, concluded that “the existing systems of seizure and detection are enough to flush out the quantum of FICN being infused“. The institute says that if detection can be improved, the value of FICN in circulation can be reduced by at least 20% annually .

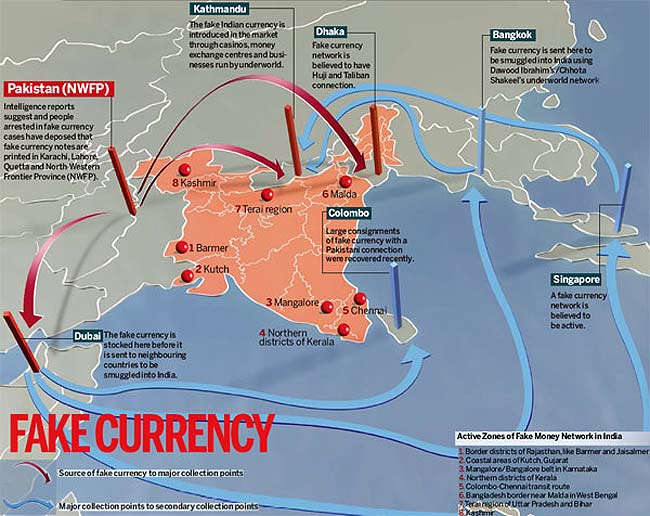

As per the NIA probe, which has a Terror Funding and Fake Currency Cell, Pakistan is the major supplier of FICN in India. “In 2015 alone, some 9-10 cases have come to the notice where FICN has come by sea or air from Pakistan,“ said NIA inspector general Alok Mittal.

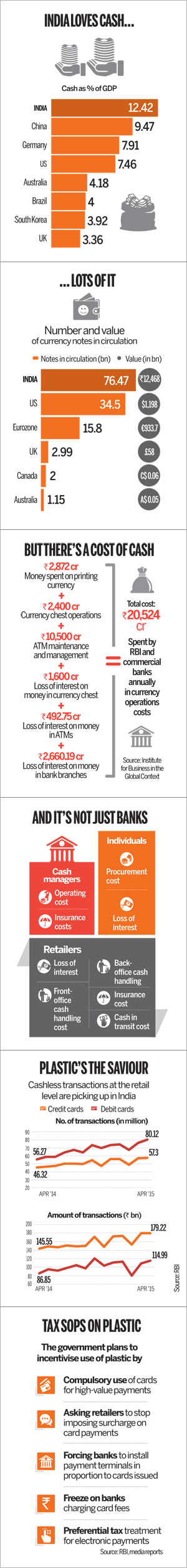

2012-13: Cash to GDP ratio

Jan 19 2015

India's love for cash costs $3.5bn a yr Cash-to-GDP ratio higher than peers, but e-payments double in 5 yrs: Study

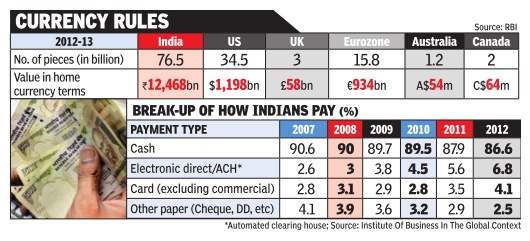

The Reserve Bank of India and commercial banks annually spend around Rs 21,000 crore ($3.5 billion) in currency operations costs while citizens of Delhi alone spend Rs 9.1 crore and 60 lakh hours in collecting cash. The scale of this burden is unique to India considering that it is among the most cash-intensive economies in the world with a cash-to-GDP ratio of 12%, almost four times as much as other markets such as Brazil (3.93%), Mexico (5.3%) and South Africa (3.73%). There are many reasons why India has to pay such a high price for its payments.One is the need to frequently reissue notes due to poor handling -low-value notes have to be replaced in less than a year. The other reason is the need to frequently upgrade security features and replace old notes. There is a huge cost in pulling old notes out of circulation and replacing them. India also has unique issues in logistics and in some places the cur rency notes have to be transported by helicopter.

A report on `Cost of Cash in India' commissioned by MasterCard and brought out by the Institute For Business In The Global Context has highlighted how much of a drag the overdependence on currency for payment is turning out to be. One reason for the increased dependence on cash is the lack of access to banking with a third of the population over 15 years not having used a bank account.

The report also highlights that although mobile banking has picked up, it is not yet being used for payments. There has been a jump in electronic payments since 2007 with its share increasing from 2.6% to 6.8%.This is largely due to the development of non-cash payment systems such as the Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT) and National Electronic Clearing System (NECS). But the report says that growth in these segments has typically benefited the commercial sector more than retail clients. The value of transactions through ATMs has grown sixfold from Rs 3 lakh crore in 2007 to about Rs 18 lakh crore in 2012, according to the report. However, when the ATM transactions are weighted for population, India continues to fare poorly even when compared to lesser developed markets such as Kenya, Niger or Egypt. According to RBI data, in 2013, 15,400 crore banknotes were issued globally, of which the maximum banknotes, 5,400 crore, were issued by China and almost 2,000 crore by India. The glob al projections for the next three years have been worked out at 16,000 crore, 16,600 crore and 17,300 crore banknotes, for the world, China and India, respectively .

“The steps taken by RBI over the years strive to make the idea of financial inclusion a reality . Innovations in the electronic payments space not only deliver greater transparency but more importantly , they simplify transactions, enhance security , increase efficiency and have the potential to dramatically reduce costs,“ said Vikas Varma, area head, south Asia, MasterCard.

The report also busts the conventional wisdom which assumes that cash is free. Citing the example of Delhi, the report says that residents spend 60 lakh hours and Rs 9.1 crore ($1.5 million) to obtain cash. Compared to this, Hyderabad, which is smaller, spends 17 lakh hours and Rs 3.2 crore ($0.5 million) to do the same, which corresponds to fees and transport costs about twice as high as Delhi on a per capita basis.

2012-15: Counterfeit currency

Mar 23 2015

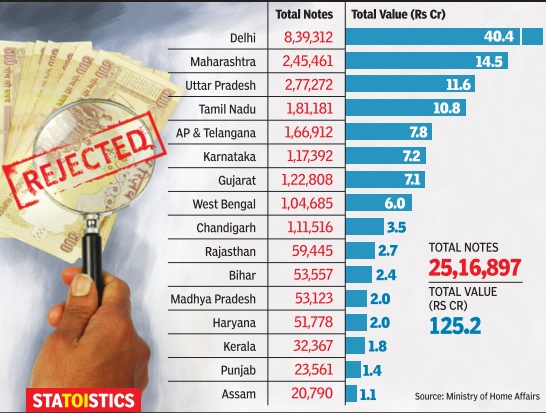

In the past three years, fake currency worth Rs 125 crore has been seized and recovered by the government. According to the answer to a recent Rajya Sabha question, high-quality Indian currency notes printed in Pakistan are being smuggled into the country to create a self-sustaining terror network in south and southeast Asia. In Delhi alone, such currency worth Rs 40.4 crore (the highest in the country) was seized and recovered in the past three years. The national capital was followed by Maharashtra, Uttar Pradesh and Tamil Nadu, each registering recoveries of over Rs 10 crore.

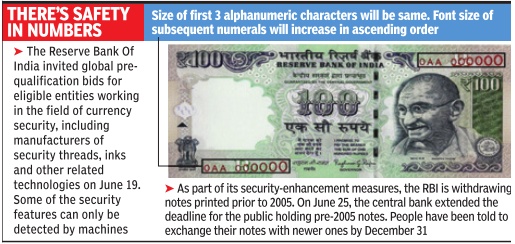

2015: Safety measures

The Times of India, Jul 02 2015

Partha Sinha

New feature on notes to give forgers run for money

To make Indian currency less prone to counterfeiting, the Reserve Bank Of India (RBI) has started printing Rs 100 notes on which the last six numerals of the nine-digit currency note number will be in ascending print size from left to right.

For example, if a Rs 100 note has the serial number 9AA 123456, the `9AA' part will have uniform print size.However, in the six-digit number portion, the print size for `2' will be larger than `1', print size for `3' will be larger than `2' and so on with `6' being in the largest font size. All other security features for this new series of Rs 100 notes will remain the same. The central bank will issue all currency notes, from Rs 10 to Rs 1,000 denomination, on which the num bering will be in this new ascending print size pattern, also called `exploding font'.“Printing the numerals in ascending size is a visible security feature in the banknotes so that the general public can easily distinguish a counterfeit note from a genuine one,“ a release from the central bank said. This new security fea ture is part of RBI's contin uing endeavour to improve security features of currency notes to make them more robust. Going forward, the currency notes will have moving images or variation in colour, micro-perfora tions etc. on security threads on each currency note.

RBI to mint 1.2cr coins for Kumbh devotees

The RBI is set to mint 1.2 crore coins of various denominations especially for the occasion. Bank officials estimate the total valuation of the coins at Rs 3 to Rs 3.5 crore.Anticipating a coin shortage, the State Bank of India (SBI) and the Bank of Maharashtra (BoM) have jointly ordered 1.2 crore coins of Rs 1, Rs 2 and Rs 5 denominations so that pilgrims can perform rituals as well as make offerings at Ramkund. “It is an age-old practice among Hindus to offer coins to sacred rivers such as the Godavari,“ said assistant general manager of SBI Sanjay Shrivastava. “Apart from offerings, pilgrims also give coins to beggars, which is considered auspicious,“ Shrivastava added.

2016: Exchange of pre-2005 notes stopped

The Times of India, Jul 01 2016 Banks will no longer exchange notes introduced prior to 2005. If anyone has such notes he would need to approach one of the 20 offices of the Reserve Bank of India directly to get such notes exchanged. However, there's a way out: If one has such notes, the person can deposit those notes in his bank account and the bank will send those notes to RBI. Since January 2014, the RBI, through banks, has been withdrawing currency notes circulated prior to 2005. The central bank on Thursday said a large percentage of these notes have since been withdrawn, with only a small percentage still remaining in circulation. “On a review thereof, it has since been decided that July 1 onwards, the facility for members of public to exchange the pre-2005 notes will be available only at the following offices of RBI: Ahmedabad, Bengaluru, Belapur, Bhopal, Bhubaneswar, Chandigarh, Chennai, Guwahati, Hyderabad, Jaipur, Jammu, Kanpur, Kolkata, Lucknow, Mumbai, Nagpur, New Delhi, Patna, Thiruvananthapuram and Kochi,“ a release from the RBI said.

The RBI has also clarified that these pre-2005 banknotes will continue to remain legal tender, meaning people can use these notes just like other notes which were printed and circulated since 2005.