Demonetisation of high value currency- 2016: India

(→2012-13: Cash to GDP ratio) |

(→2015: Safety measures) |

||

| Line 15: | Line 15: | ||

=Counterfeit currency= | =Counterfeit currency= | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

=2016= | =2016= | ||

==2016: Exchange of pre-2005 notes stopped== | ==2016: Exchange of pre-2005 notes stopped== | ||

Revision as of 13:14, 11 November 2016

This is a collection of articles archived for the excellence of their content. |

Contents |

Counterfeit currency

2016

2016: Exchange of pre-2005 notes stopped

The Times of India, Jul 01 2016

Banks will no longer exchange notes introduced prior to 2005. If anyone has such notes he would need to approach one of the 20 offices of the Reserve Bank of India directly to get such notes exchanged. However, there's a way out: If one has such notes, the person can deposit those notes in his bank account and the bank will send those notes to RBI.

Since January 2014, the RBI, through banks, has been withdrawing currency notes circulated prior to 2005. The central bank on Thursday said a large percentage of these notes have since been withdrawn, with only a small percentage still remaining in circulation. “On a review thereof, it has since been decided that July 1 onwards, the facility for members of public to exchange the pre-2005 notes will be available only at the following offices of RBI: Ahmedabad, Bengaluru, Belapur, Bhopal, Bhubaneswar, Chandigarh, Chennai, Guwahati, Hyderabad, Jaipur, Jammu, Kanpur, Kolkata, Lucknow, Mumbai, Nagpur, New Delhi, Patna, Thiruvananthapuram and Kochi,“ a release from the RBI said.

The RBI has also clarified that these pre-2005 banknotes will continue to remain legal tender, meaning people can use these notes just like other notes which were printed and circulated since 2005.

2016: Demonetisation of Rs. 500 and Rs 1000 notes

A background

The Hindu, November 9, 2016

RBI board had approved production of Rs. 2,000 denomination notes long ago, say officials

The government’s move to scrap nearly 23.2 billion high-value currency notes of Rs. 500 and Rs. 1,000, was in the pipeline for several months but was kept tightly under wraps, with just a handful of officials in the know.

The Reserve Bank of India’s central board had approved the production of the Rs. 2,000 notes several months ago and even began production of the new Rs. 500 and Rs. 2,000 notes, which are to be issued from November 10 a few months ago.

System ready

“The timing [of the announcement by the Prime Minister] was appropriately chosen as we should be ready with adequate number of notes to replace the existing ones. We had ramped up production in the past few months of the new notes, and hence, it was decided to do it now as we can provide more of them in the weeks and days to come,” said RBI governor Urjit Patel at a briefing.

Security concerns

The case for introducing new notes followed prolonged deliberations within the top echelons of government, based on inputs from security agencies and the central bank.

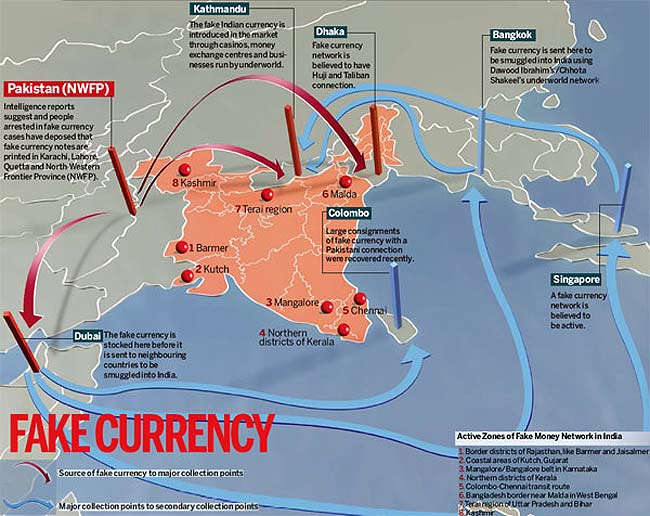

“There’s been no breach of security features of our notes. But for ordinary citizens, it is often difficult to tell a genuine note from a fake. There’s now a confluence of thought between the government and the Reserve Bank of India. Multiple objectives can be met so this led us to withdraw the legal tender character of Rs. 500 and Rs. 1,000 notes,” Mr Patel pointed out.

Mr. Das said the bold and decisive step to fight black money and the use of fake currency notes to finance terrorism was backed by analysis of India’s currency trends.

‘Disproportionate rise’

“Statistics show that high denomination currency in circulation has risen sharply between 2011 and 2015. When all currency notes grew 40 per cent, Rs. 500 notes in circulation rose by 76 per cent and Rs. 1000 notes went up by 109 per cent. But during this period, the economy expanded by 30 per cent so the circulation of such notes had gone up disproportionately,” he said.

“The long shadow of the ghost economy has to go for the real economy to grow. This will add to our economy’s strength,” Mr. Das stressed.

Terms and conditions for denomination

The Hindu, November 8, 2016

Demonetisation of Rs. 500 and Rs. 1000 notes: RBI explains

From midnight of November 8, 2016, Rs. 500 and Rs.1000 will cease to be legal tender.

Taking the nation by surprise, Prime Minister Narendra Modi announced demonetisation of Rs. 1000 and Rs. 500 notes with effect from November 9, 2016 making these notes invalid in a major assault on black money, fake currency and corruption.

In his first televised address to the nation, Mr. Modi said people holding notes of Rs. 500 and Rs. 1000 can deposit the same in their bank and post office accounts from November 10 till December 30.

Cost to RBI

The Hindu, November 9, 2016

New notes to cost RBI more than Rs. 12,000 crore

Sharad Raghavan

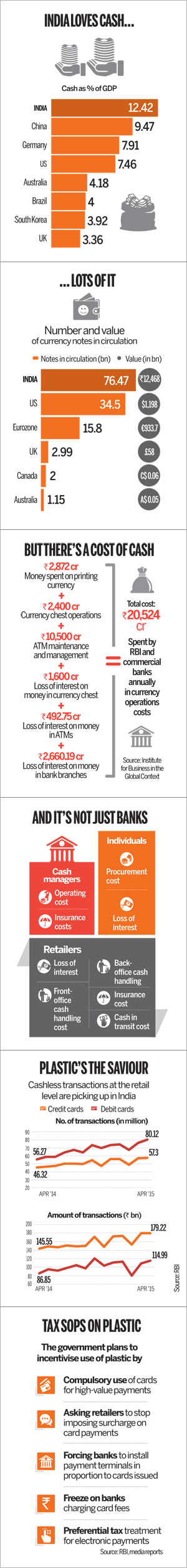

By removing the Rs. 1,000 note, the government is doing away with the cheapest note to print in relation to the face value of the note.

Replacing all the Rs. 500 and Rs. 1,000 denomination notes with other denominations, as ordered by the government, could cost the Reserve Bank of India at least Rs. 12,000 crore, based on the number of notes in circulation and the cost incurred in printing them.

Data from a Right to Information answer by the RBI in 2012 shows that it costs Rs. 2.50 to print each Rs. 500 denomination note, and Rs. 3.17 to print a Rs. 1,000 note.

That means that it cost the central bank Rs. 3,917 crore to print the 1,567 crore Rs. 500 notes in circulation, and Rs. 2,000 crore to print the 632 crore Rs. 1,000 notes in circulation currently.

Assuming that the new Rs. 500 notes cost the same to print, then that is an additional Rs. 3,917 crore spent in simply maintaining the same number of notes in circulation.

The new Rs. 2,000 notes are likely to cost about the same or a little more than the Rs. 1,000 notes, which means an additional cost of Rs. 2,000 crore to print them.

In total, removing the old notes and replacing them with the new Rs. 500 and Rs. 2,000 notes will cost the central bank a total of at least Rs. 12,000 crore. This figure is likely to go up since additional security measures, which the new notes are set to have, will only add to the cost of printing.

By removing the Rs. 1,000 note, the government is doing away with the cheapest note to print in relation to the face value of the note.

Highest cost

The Rs. 3.17 it costs to print a Rs. 1,000 note is the highest in absolute terms across denominations, but it is the lowest when compared to the face value of the note.

For example, a Rs. 10 note costs only Rs. 0.48 to print, but that works out to 9.6 per cent of the face value of the note. Printing a Rs. 10 note costs 10 per cent of what that note is worth. This, for a Rs. 1,000 note, is 0.3 per cent.