Currency: India

The Times of India

This is a collection of articles archived for the excellence of their content. |

History

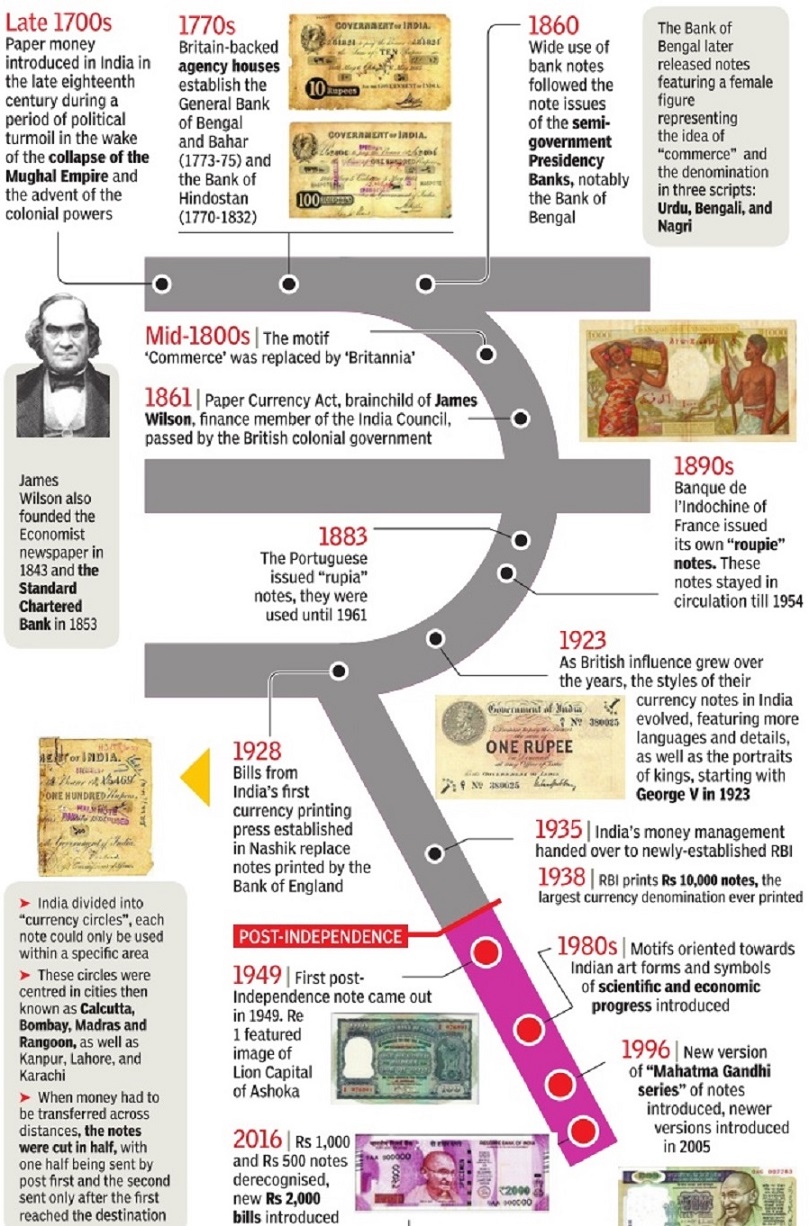

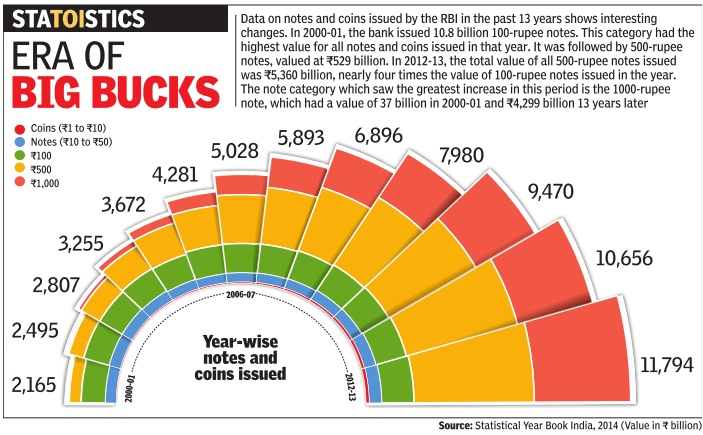

A history of paper currency in India, 1720-2016 (chart)

See the large The Times of India graphic on this page.

A history of paper currency in India (text)

Rezwan Razack/ Indian Bank Note

Rezwan Razack/ Indian Bank Note

Rezwan Razack/ Indian Bank Note

Rezwan Razack/ Indian Bank Note

Rezwan Razack/ Indian Bank Note

Some additional facts

i) Mainly from Rezwan Razack/ Indian Bank Note, author of The Revised Standard Reference Guide to Indian Paper Money.

ii) And also from The Hindu Businessline and

iii) India Today, May 4, 2016

Indian currency is as historic as the Indian civilization. Currency in the form of punch-marked coins existed even before Christ. Coinage can be traced back to as early as the 6th century BC, in the earliest of civilizations in India. This history of coins and notes is as interesting as it is long.

Currency has existed in the form of coinage in India since the 6th century BC. The Ancient, the medieval and the Mughal period all used currency in the form of coinage. The most notable was Sher Shah Suri's Rupiya, which became the precursor of the modern rupee.

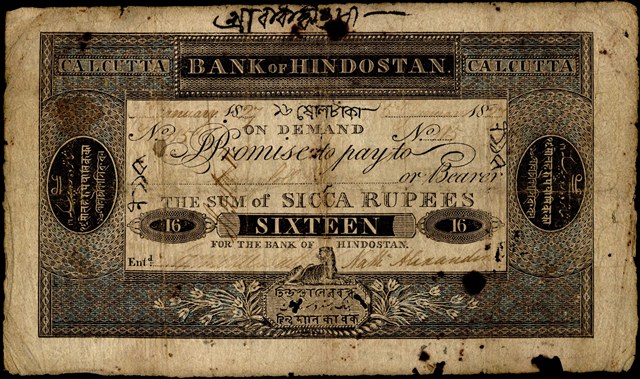

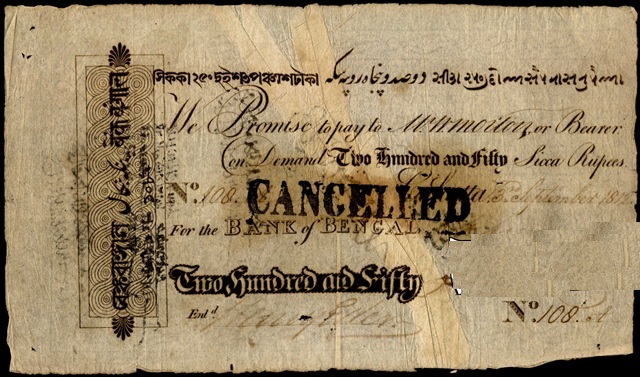

Paper money was first issued in the late eighteenth century. Bank of Hindostan, General Bank in Bengal and the Bengal Bank are the first banks to have issued paper currency.

The first Indian banknotes were issued by the Bank of Hindostan, a private bank, in 1770. The notes ranged from Rs.10 to Rs10,000. (See picture on this page.)

Denominations in those days included Rs.4, Rs,15, Rs.16 and Rs.250 sicca.

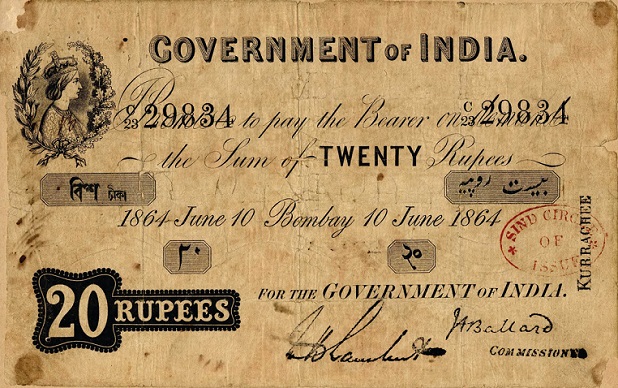

It was only in 1861 that the Government of India took over the issue of banknotes from private (eg Bank of Hindostan) and Presidency (e.g. the Madras Government Bank) banks. (See ‘uniface’ picture on this page.)

Government of India's first set of notes was the Victoria portrait series. For security reasons, the notes of this series were cut in half; one half was sent by post, and upon confirmation of receipt, the other half was sent. They were replaced by the Underprint series in 1867.

A Rs.2.50 (Two Rupees and Eight Annas) note was issued in 1918.

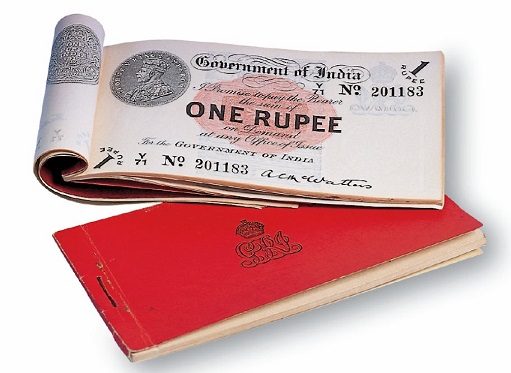

The first Re.1 notes were issued in 1917, with a portrait of King George V. Mr. Razack writes, ‘25% of these Rupee One notes were issued in a booklet of 25 notes.’ (See picture on this page.)

In 1935 The Reserve Bank of India was created. Ever since then it has been the only authority that can issue Government of India currency notes. The first note issued by the RBI was a five rupee note bearing King George VI's portrait.

The highest denomination note ever printed by the Reserve Bank of India was the Rs. 10,000 note in 1938 and again in 1954. But these notes were demonetised in January 1946. Rs. 1,000 and Rs. 10,000 bank notes were in circulation prior to January 1946. Higher denomination banknotes of Rs. 1,000, Rs. 5,000 and Rs. 10,000 were reintroduced in 1954 and all of them were demonetised in January 1978.

The one rupee note was the first banknote printed by independent India.

Immediately after the partition of India on 14 August 1947, Indian rupees were legal tender in Pakistan. In the later part of 1947, till some time in 1948, Pakistani rupees were essentially Indian rupees printed by the Reserve Bank of India, with the words ‘Government of Pakistan’ and ‘Hukumat e Pakistan’ printed in the window on the left. (See picture on this page.)

‘Notes of all denominations issued by the Reserve Bank of India after independence have the Ashoka Pillar and the Seal of Reserve Bank of India,’ Mr. Rezwan Razack informs us. Bank notes in Ashoka Pillar watermark series in Rs. 10 denomination were issued between 1967 and 1992, Rs. 20 in 1972 and 1975, Rs. 50 in 1975 and 1981 and Rs. 100 between 1967-1979. The banknotes issued during this period contained the symbols representing science and technology, progress and orientation to Indian art forms.

In the year 1980, the legend Satyameva Jayate - ‘truth alone shall prevail’ - was incorporated under the national emblem for the first time.

Re.100 notes were India’s highest denomination notes from 1978 to 1987.

Re.500 notes made a comeback on 23 October 1987, with a Braille feature on them, and later on most other notes.

Re.1,000 notes came back in November 2000. The move was then justified as attempt to contain the volume of banknotes in circulation due to inflation.

Nov 2016 was the first time that the Rs. 2,000 currency note was introduced.

Mr. Rezwan Razack also informs us that:

i) Star or Replacement notes were issued from 2006 onwards.

ii) The year of issue started being printed on the reverse of the notes from 2005 onwards.

iii) The only Governors of the Reserve Bank of India who did not sign a note were Mr. Osborne Smith and Mr. Ambegaonkar. However, Mr. Ambegaonkar signed the Re.1 note as the Secretary, Ministry of Finance, Government of India.

iv) There is only one instance of Republic of India notes being printed by the American Banknote Company, U.S.A., and that in 1997-98.

v) Notes of the ‘Government of India’ and ‘The Reserve Bank of India’ were issued for use in the Trucial and Gulf States of Kuwait, Bahrain, Qatar, Muscat and Oman from 1959-1966. They looked exactly like the notes used in India in those days but were printed in a different colour.

vi) A special batch of Re.10 and Re.100 notes was printed and issued in 1959 for Indian Haj Pilgrims for exchange with the local currency in Saudi Arabia. They had the word ‘HAJ’ printed discreetly in t Roman script on either side of the words ‘Reserve Bank.’ But otherwise they looked like normal Indian notes.

Mahatma Gandhi

In October 1987, Rs. 500 banknote was introduced with the portrait of Mahatma Gandhi and Ashoka Pillar watermark.

Mahatma Gandhi (MG) series banknotes — 1996 were issued in the denominations of Rs. 5, (introduced in November 2001), Rs. 10 (June 1996), Rs. 20 (August 2001), Rs. 50 (March 1997), Rs. 100 (June 1996), Rs. 500 (October 1997) and Rs. 1,000 (November 2000).

The Mahatma Gandhi Series - 2005 bank notes were issued in the denomination of Rs. 10, Rs. 20, Rs. 50, Rs. 100, Rs. 500 and Rs. 1,000 and contained some additional/new security features as compared to the 1996 MG series.

The Rs. 50 and Rs. 100 banknotes were issued in August 2005, followed by Rs. 500 and Rs. 1,000 denominations in October 2005 and Rs. 10 and Rs. 20 in April 2006 and August 2006, respectively

Coins

Denominations of 1 paise, 2 paise, 3 paise, 5 paise, 10 paise, 20 paise and 25 paise were in circulation till June 30, 2011 but were then withdrawn.

50 paise coins were in circulation even in 2016. They are called small coins while the other denominations are known as rupee coins.

The value of the rupee: fall, fall and occasional rise

1927 to 1966

From 1927 to 1966, Rs. 13 rupees = £1 (pound). Till then the rupee was pegged to the British pound sterling.

In 1966, the rupee was devalued and pegged to the U.S. dollar at a rate of Rs.7.5 = $1.

The fallacy of 'dollar = rupee' in 1947 SAURABH CHANDRA | Mon, 19 Aug 2013, DNA India adds:

Indian rupee was pegged to the British Pound till [1966] when it was devalued and pegged to the US Dollar. A good account of the two devaluations of 1966 and 1991 is given in a paper by Johri and Miller. The peg to the pound was at INR 13.33 to a Pound which itself was pegged to $4.03. That means officially speaking the USD to INR rate would be closer to Rs 4 [in 1947]. In 1966, India changed the peg to dollar at INR 7.50. Surely, the exchange rates are not very meaningful when the currencies are fixed by governments and the unofficial rates would be usually even worse given the pressure British Pound was under post world war II.

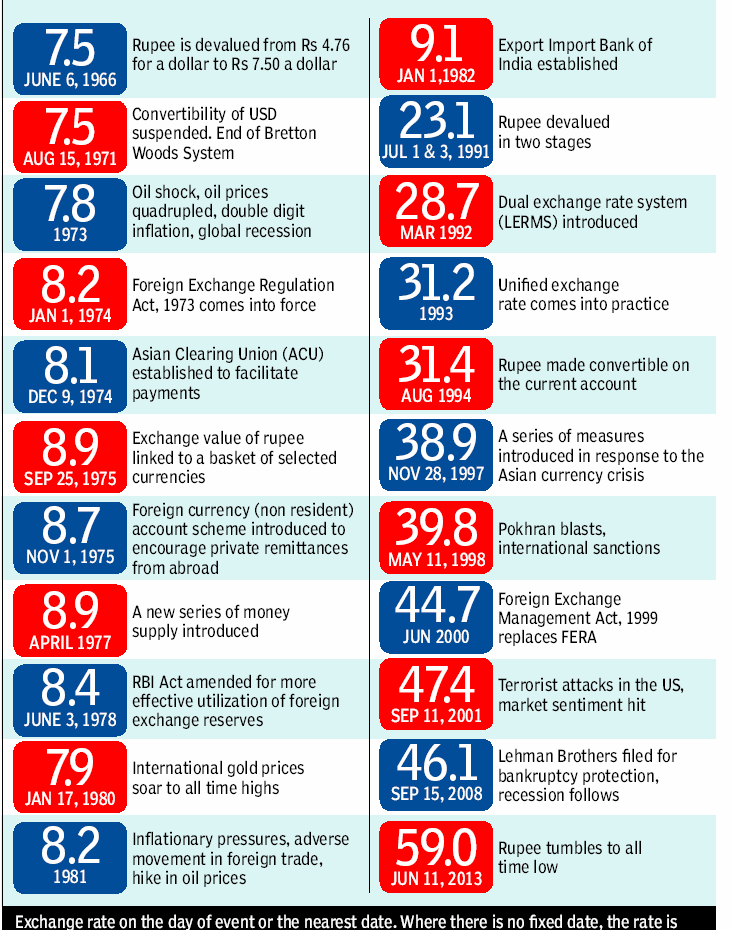

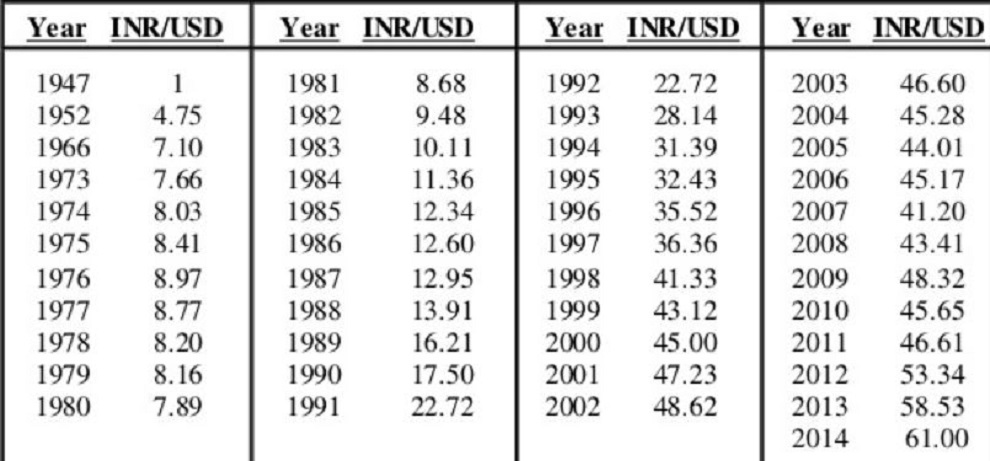

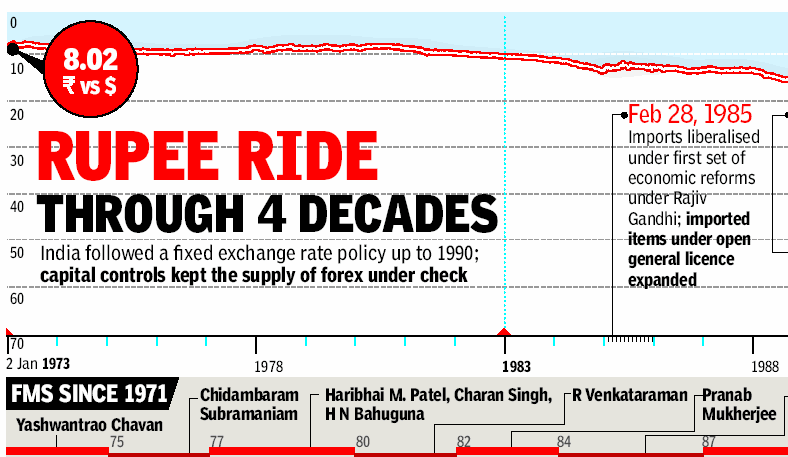

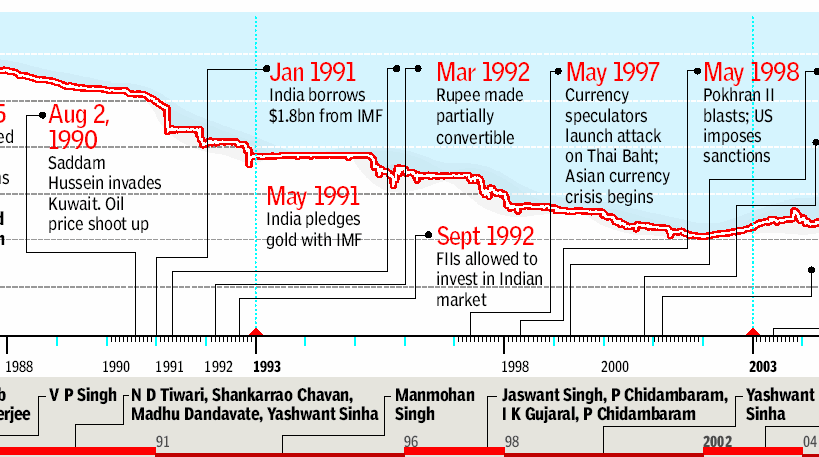

The steady depreciation of the rupee, 1966-2013

See the accompanying chart

The Times of India 15 June 2013

See Table 1

6/6/66: Devaluation of the rupee

The Times of India, June 7, 2016

June 6, 1966 - or 6/6/66 - turned out to be a defining day in independent India's economic history. It was the day on which Indira Gandhi devalued the rupee by 36.5%, increasing the dollar's value against it by 57.4%. The move sparked bitter, nationwide criticism. In both politics and economics, 1966 was India's annus horribilis. On January 11, Prime Minister Lal Bahadur Shastri - a popular, respected figure - died of a heart attack at Tashkent, and was replaced by Indira. Apparently, the Congress party old guard had conspired to install an inexperienced person, so they could call the shots.

Indira's inheritance in 1966 was onerous. Drought had ravaged foodgrain crops, forcing India to import rice and wheat for the first time. This was easier said than done, for India's foreign exchange reserves were sparse. In 1965, with imports of Rs 2,194 crore and exports of only Rs 1,264 crore, India's trade deficit of Rs 930 crore was the highest during the sixties.

With no money to import food, India sought aid from the US' ('friendly foreign government' - is this really necessary), whose 'Food for Peace' programme - authorized by Public Law 480 (PL-480) - allowed poor nations like India to pay the US in their own currency. President Lyndon B Johnson obliged by shipping 16 million tonnes of wheat, and 1 million tonnes of rice to India, and disbursing approximately $1 billion to alleviate her financial strain. Indira Gandhi's decision to accept this "ship-to-mouth" aid was unpopular.

1973-2013: The rupee under various finance ministers

See graphics:

The value of the Indian rupee under various finance ministers, 1973-88

The value of the Indian rupee under various finance ministers, 1988-2003

' The value of the Indian rupee under various finance ministers, 2004-2013

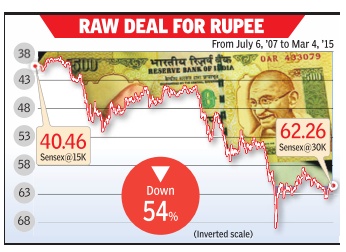

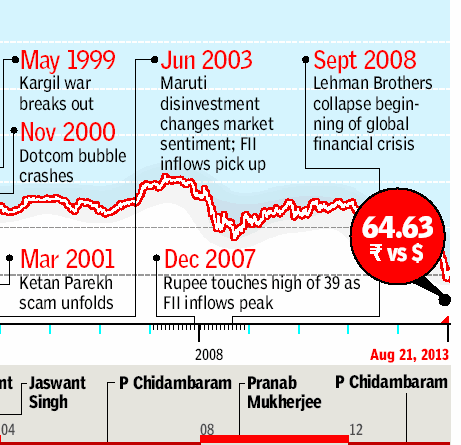

1993-2013: Movements of the rupee

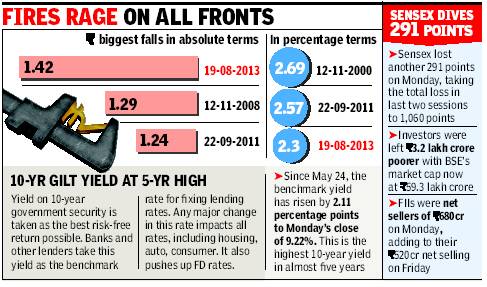

Inflation, trade imbalance sink Re

Mayur Shetty The Times of India Mar 05 2015

Growth Story Buoys Sensex Even As Currency Slips From Crisis To Crisis Historically the rupee has moved in tandem with the sensex. A surge in the equity index usually led to the domestic currency firming up against the dollar as foreign funds that drive up stocks also provide support to the rupee. Yet, despite foreign investment consistently rising, the rupee has sharply depreciated from its opening level of 32 against the dollar in 1993 -the year when it was allowed to float freely in terms of demand and supply . The answer to this behavior lies in India's higher inflation and trade deficit which has resulted in rupee finding a new floor every time there is a major global crisis.Here are some of them: Mexican crisis (August-December 1995): Triggered by risk averseness among global investors after Mexico's currency collapse, the rupee which was at 31.40 against the dollar in July `95 depreciated to 33.96 by end-September 1995 and further to 36.48 by end-January 1996. Although the fall was only five rupees it was sharp in percentage terms.Asian Currency Crisis (August '97-April '98): Much as Indian companies, banks and brokers tried to convince international investors that India was not a part of South East Asia, foreign institutional investors continued to stampede out of the country . The international sanctions after the nuclear tests known as Pokhran II did not help. Te rupee exchange rate which was 35.92 in August `'97 worsened to 42.76 against the dollar in August'98.Dotcom bust and 911 attacks (2000-2001): India saw a surge in technology stocks due to the increased business arising out of Y2K. While the dotcom bust weakened the rupee in 2000, the `risk-off' situation following the 911 attacks in New York sent the rupee into a free fall. It weakened from 43.64 per US dollar during April 2000 to 48.43 on September 17.Lehman Brothers collapse and Global Financial Crisis (2008): The rupee witnessed its longest steady spell in the run up to the global financial crisis and was trading around Rs 48 levels. After the crisis the currency breached the level of Rs.50 per dollar on October 27, 2008. The fall would have been sharper had the RBI not spent $18.7 billion worth dollars to support the rupee.US Sovereign downgrade (August 2011): In August 2011 S&P downgraded the US following a political deadlock which blocked funds to the government. But instead of the dollar weakening it was the rupee which lost as global investors sought refuge in US treasury bills.Grexit & Eurozone crises (2011-12): Portugal, Ireland, Greece and Spain formed the PIGS whose governments found it difficult to meet their debt obligations. Greece came close to defaulting and exiting the European Union. The resultant volatility saw the rupee weaken to 54.24 against the dollar during this period but regained its losses the next year.US Taper Tantrums: In May 2013 chief of US Fed Ben Bernanke said that he was considering tapering back the Fed's $70 billion a month liquidity infusion through buyback of bond and mortgage backed securities. When the US Fed sneezes, world markets catch a cold. The rupee fell the sharpest among emerging economies due to India's gigantic current account deficit. Between May 22, 2013 & August 30, 2013, the currency fell 15.5% against the US Dollar.

Depreciation: 2000-13

See graphic:

Chart- Depreciation- 2000-13

2011, 2015: long winning streaks

Mar 25 2015

Re's longest run of gains since 2011

The rupee inched up on 24 March 2015 by 3 paise against the American currency to end at 62.25, extending its winning streak to the seventh straight session -the longest string of gains since June 2011. The rupee opened higher at 62.20 per dollar as against 23 March 2015 closing level of 62.28 per dollar at the Interbank Foreign Exchange (Forex) Market. It then firmed up further to 62.14 per dollar on initial selling of the greenback by banks and exporters in view of sustained capital inflows.

Expectations that the US Federal Reserve will not tighten its monetary policy until the second half of the year has helped emerging market currencies like rupee to gain.

In the Asian market, the euro fell against the dollar and the yen.

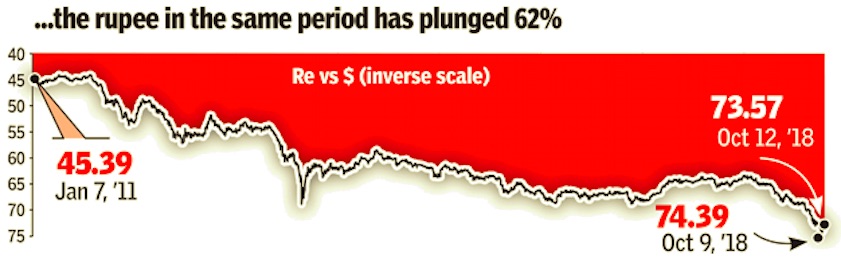

2011-2018, Oct: some losing streaks, too

October 23, 2018: The Times of India

From: October 23, 2018: The Times of India

RUPEE HAS DIVED 16% SINCE JAN

The rupee touched a record low of 74.39 on October 9, with a 16% plunge since Jan 1 this year, as rising oil prices fuelled concerns about a widening current account deficit & inflation amid a rout in emerging markets. On Monday, it closed at 73.56 against the dollar.

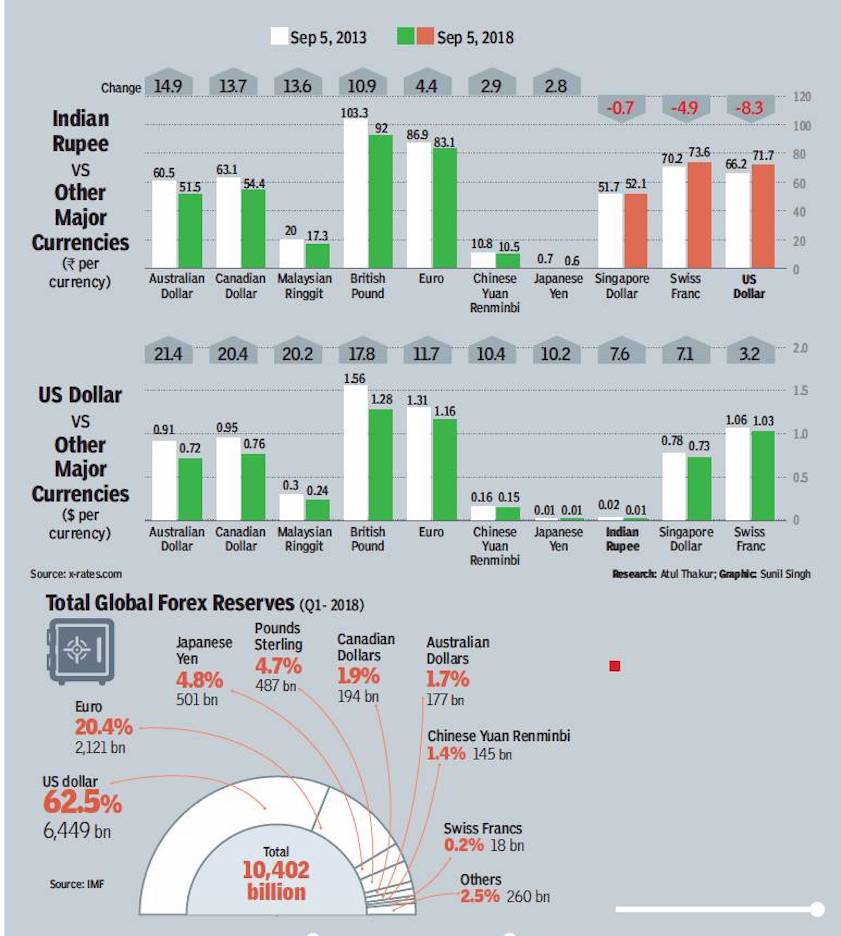

2013-18: ₹ worse than US$, S$, CHF; better than ¥, €, £…

Rupee Has Depreciated, And Appreciated Too, September 10, 2018: The Times of India

From: Rupee Has Depreciated, And Appreciated Too, September 10, 2018: The Times of India

The rupee has hit an all-time low against the US dollar after having fallen more than 12% this year — a slide the government blames on global factors, including a surge in oil prices. But over the years, the Indian currency has also gained against most other major currencies. A look...

Is rupee the world’s weakest currency at present?

Although the Indian rupee has fallen significantly against the American dollar, it is not the weakest currency. If one compares the exchange rate over a five-year period, it works out that the rupee has appreciated against most currencies. It is, however, to be noted that despite the appreciation against other currencies, a weak rupee against the dollar will have a significant impact on our trade as dollar is the currency in which majority of international transactions are done. The US dollar, on the other hand, has appreciated against most other major currencies.

Why is the dollar appreciating?

There are many reasons linked to the US’ internal matters that have increased the exchange rate of the dollar against other currencies. The American Federal Reserve (central bank) ended its expansive monetary policy after the American economy started recovering from the 2008 financial crisis. This meant that the rate at which the currency in supply was increasing was slowed down. Because of lower supply, the demand went up, increasing the value of the US dollar. Apart from this, the American central bank also increased the interest rate while the European Central Bank did the opposite. That means there will be a higher return on dollar deposits as compared to the euro, which again pushed up the demand for dollars and increased its value.

Who fixes the international exchange rate?

Mostly the market forces of demand and supply. Nearly all countries follow a floating exchange rate to determine the value of their currency against others. This basically means that a currency is worth the value that a buyer is willing to pay for it. The value is largely decided by market forces and depends on a range of factors like economic stability, inflation, foreign trade and so on.

Why is US dollar the currency most in demand?

The American dollar is among the most prominent global currencies, meaning it is among the most accepted currencies for international transactions. Because of its role in international trade, most countries maintain a foreign exchange reserve in US dollars, pushing up its exchange rate. According to the latest estimate by IMF, the American dollar constituted 62.5% of global forex reserves. It was followed by euro, yen and British pounds.

What are REER and NEER?

The simplest process of fixing the exchange rate would require a comparison of the purchasing powers of two currencies. Factors like inflation, however, can affect purchasing power. To understand the actual value of currencies, the central banks calculate two exchange rates. The Nominal Effective Exchange Rate, or NEER, is a weighted average of exchange rates of the currencies of all trading partners of a country. NEER determines how much foreign currency may be exchanged for a country’s currency. This, however, doesn’t reflect the actual purchasing power of the two currencies. For instance if India has a higher inflation as compared to US, then the rupee exchanged for dollars will buy fewer goods. To eliminate this, Real Effective Exchange rate – REER is calculated by adjusting NEER to inflation in both India and its trading partners.

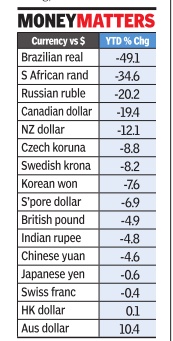

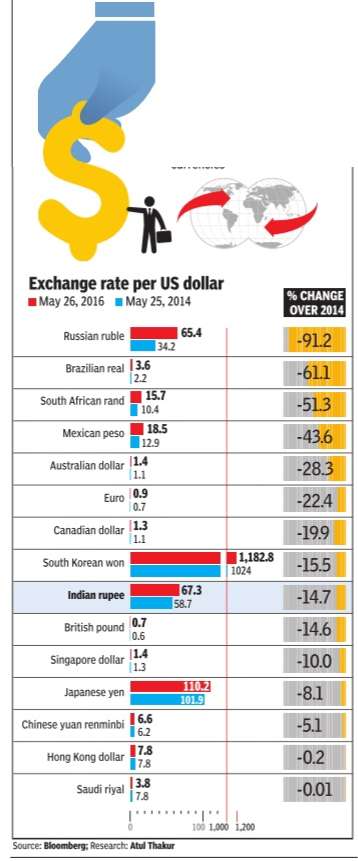

2015: One of best performing currencies

The Times of India Jan 01 2016

Mayur Shetty

The Indian rupee, despite weakening nearly 5% against the dollar, has emerged as one of the best performing currencies in 2015 as most others have fallen sharply against the dollar. However, early 2016 could end up being volatile for the domestic unit as the dollar surges ahead in the wake of the rate hike by the US Federal Reserve.

The rupee closed at 66.15 at the end of 2015 on Thursday -24 paise stronger than its previous close a day earlier. The dollar has gained Rs 2.79 during the calendar year. Against the greenback, the rupee swung nearly 10% from a high of 61.33 on January 28 to a low of 67.10 on December 14 -which was also a two-year low . But the currency has been strongest among emerging nations.

Among the BRICS nations, only China has been on a par with the rupee with the Chinese yuan weakening by 4.72%. Brazil, Russia and South Africa have depreciated by 49%, 31% and 33% respectively against the greenback. However, early 2016 could end up being volatile for the domestic unit as the dollar surges ahead in the wake of the rate hike by the US Federal Reserve.

'

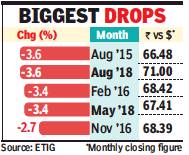

2015-18: the steepest monthly falls

Rupee hits 71, sees steepest monthly fall in 3 years, September 1, 2018: The Times of India

From: Rupee hits 71, sees steepest monthly fall in 3 years, September 1, 2018: The Times of India

The rupee breached the 71level and closed August at that level, recording the biggest monthly decline in three years. The local currency had weakened to 71.03 in intraday trade. Given that the Indian currency was trading at Rs 68.55 against the greenback on July 31, the drop this month is nearly 3.6%. The last time the rupee declined by over 3% in a month was in May this year.

The rupee came under pressure with emerging market currencies weakening. In Turkey, reports of the central bank deputy governor set to resign led to the lira falling sharply. The Indonesian rupiah fell to a 20-year low after fears that the currency crisis in Argentina and Turkey would spread to other emerging markets. What is adding to the pressure on the rupee is that the Reserve Bank of India (RBI) has been saving its reserves and not intervening in a big way. According to bankers, the RBI seems to be sending a message that it is not averse to a marginal depreciation.

2017: strengthens, 2018: weakens

From: April 24, 2018: The Times of India

See graphic:

The Indian rupee vis-à-vis other major currencies, 2017, and Jan-April 2018.

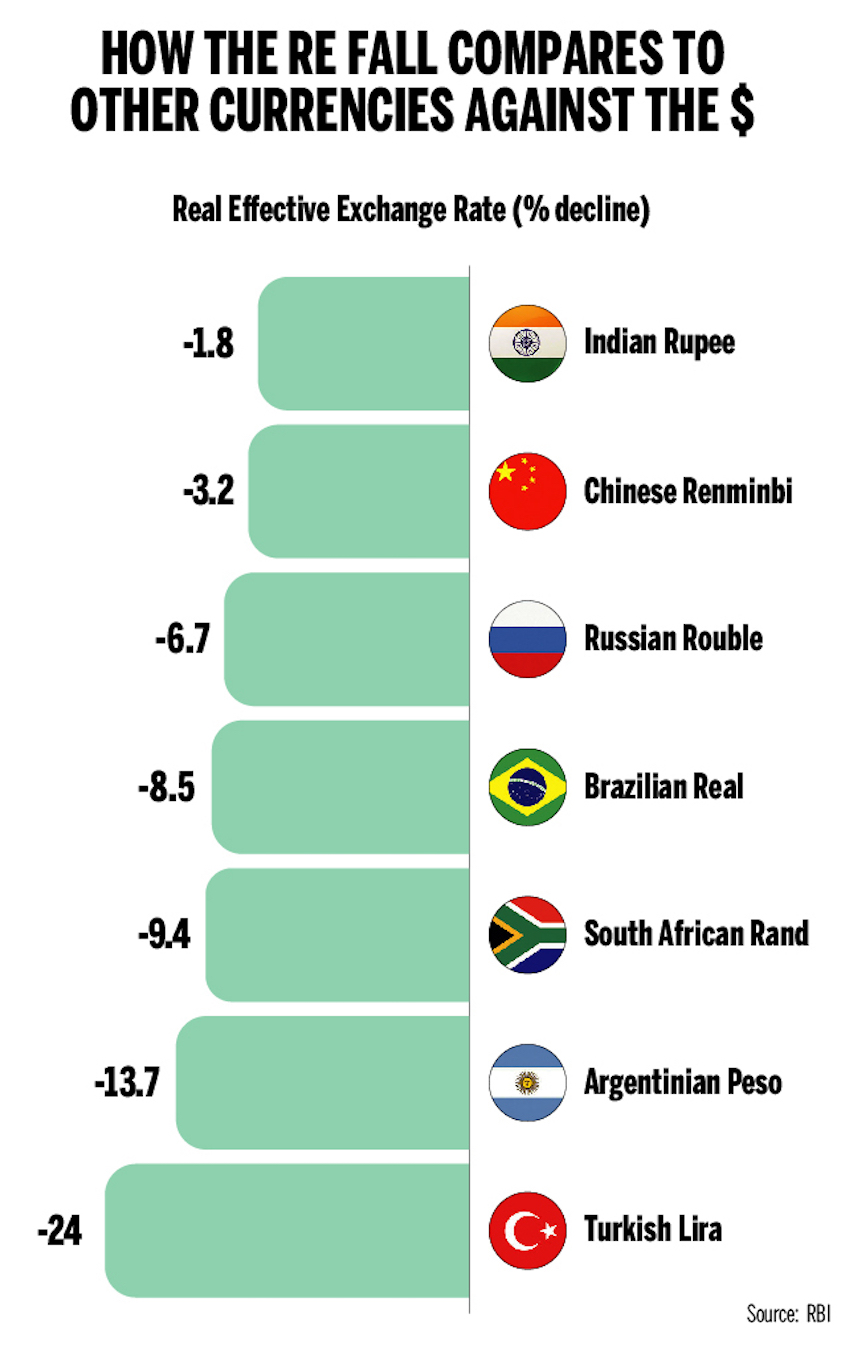

2018, Mar-Sept: ₹ loses, but less than BRICS, Turkish currencies

From: November 15, 2018: The Times of India

See graphic:

How Rupee fall compares to other currencies against the $, 2018, Mar-Sept

The value of the rupee: shoring it up

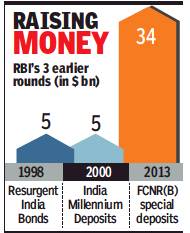

1998, 2000, 2013

RBI likely to issue $35bn NRI bonds to support ₹, June 12, 2018: The Times of India

From: RBI likely to issue $35bn NRI bonds to support ₹, June 12, 2018: The Times of India

The Reserve Bank of India (RBI) is likely to mop up foreign exchange of $30-35 billion by floating bonds to non-resident Indians (NRIs), according to a report by Bank of America Merrill Lynch. The main trigger for the dollar mop-up is the rise in crude oil prices, which in turn has put pressure on the rupee.

If the RBI does go ahead and sells bonds to NRIs, this will be the fourth such offering. The government had first raised money through NRIs by floating $5 billion of Resurgent India Bonds in 1998 in the wake of sanctions placed on the country following the second round of nuclear tests in Pokhran. The second offering was the $5-billion India Millennium Deposits just two years later. The last such issuance was a $34-billion FCNR (B) special deposit in September 2013, after the rupee hit 68.84 following the ‘taper tantrums’ — the term used by markets to describe the volatility after the US Fed announced that it would taper off its bond repurchase programme.

In a research report, DSP Merrill Lynch’s India Economist Indranil Sen Gupta said, “Every NRI bond issuance has been effective in curbing rupee volatility.”

HIGHER GAINS FOR NRIs

$27bn foreign bonds will mature in ’19

Gupta added, “We think that there is a rising case for issuing NRI bonds, with our oil analysts now seeing $72 per barrel in 2018 and $75 in 2019.”

Although all bond issues have been by banks, the lenders have largely been fronts with the RBI buying the dollars from them and agreeing to sell at a fixed price. The bonds have been highly successful as — for NRIs — they are a sure bet with returns higher than what they would get in overseas banks and no exchange rate risk. There is also an arbitrage opportunity for NRIs as many offshore banks are willing to lend them money at a lower rate than what is offered on the bonds.

Another reason for the government to issue bonds is that $27 billion of forex loans and bonds are set to mature by March 2019, putting further pressure on rupee. The classic textbook defence for the rupee has been interest rate hikes.

2013: Stabilising the Re through FCNR

The Times of India, Aug 13 2016

Rajan found scheme that rescued Re in 2013 `idiotic'

Outgoing RBI governor Raghuram Rajan said on Friday that he found the $34-billion foreign currency deposit scheme, which staved off a collapse of the rupee in September 2013, to be “completely idiotic“ and “worst of the ideas on the table“ when it was first proposed, but it worked. The RBI's success in taming the runaway rupee in September in 2013 was seen as Rajan's big achievement in his initial months. A special foreign currency non-resident (FCNR-B) deposit scheme, which garnered $34 billion, was seen to have played a crucial role in stabilizing the currency . The scheme was among the first announcements made by Rajan after taking charge.

Speaking during a discussion on former governor D Subbarao's book, `Who Moved My Interest Rate', Rajan said: “I get credit for that idea which I neither invented nor believed in.“

He said that upon joining as an understudy in August, he went around seeking suggestions on what new and interesting measures the RBI could take to change the narrative on the rupee. “There was one proposal which came from bankers that I found completely idiotic. I thought this was a terrible, terrible thing to do. The proposal was: `Give us a 3.5% subsidy and we will bring in money from outside and that will be fantastic',“ said Rajan. According to the governor, he was outraged with a 3.5% subsidy proposal.

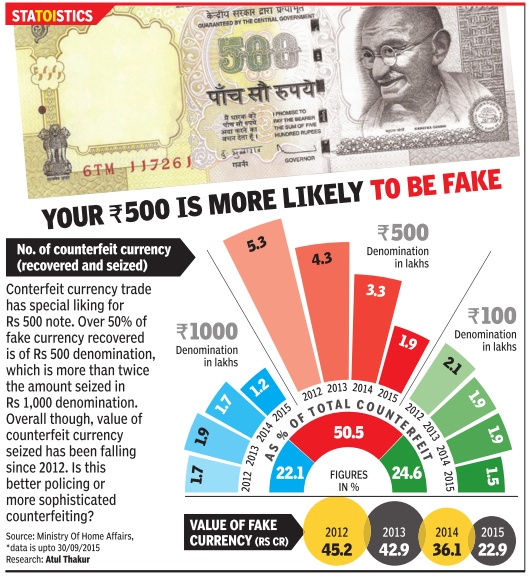

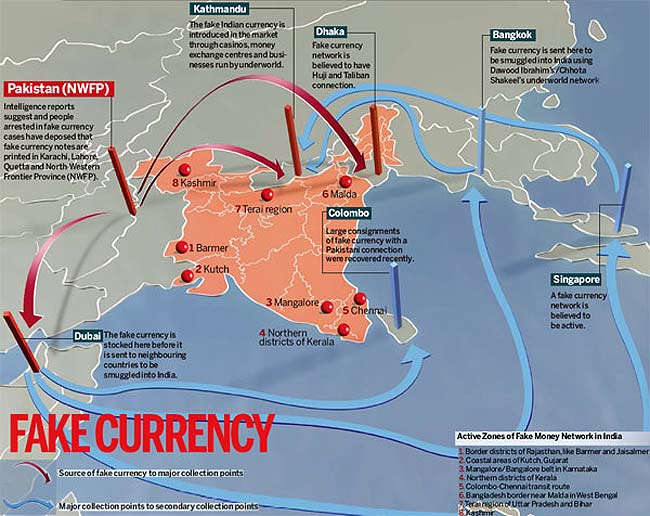

Counterfeiting currency

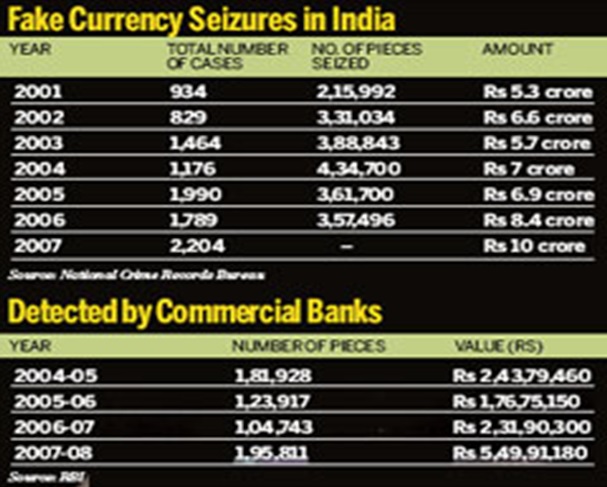

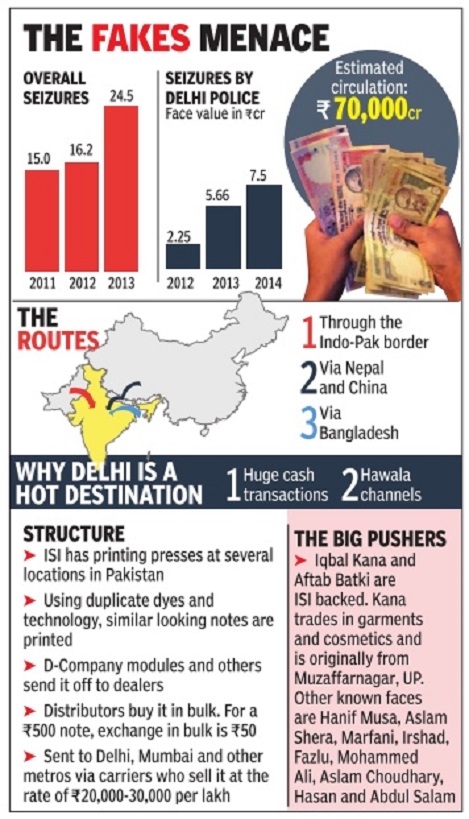

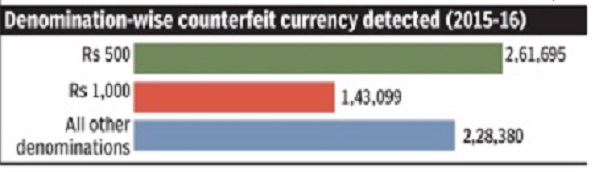

2012-15: Counterfeit currency

i) Seizures, and extent of counterfeit notes in circulation,

ii) The big pushers,

The Times of India

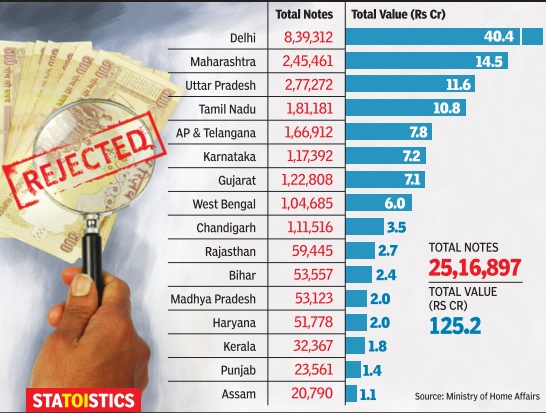

Mar 23 2015

In the past three years, fake currency worth Rs 125 crore has been seized and recovered by the government. According to the answer to a recent Rajya Sabha question, high-quality Indian currency notes printed in Pakistan are being smuggled into the country to create a self-sustaining terror network in south and southeast Asia. In Delhi alone, such currency worth Rs 40.4 crore (the highest in the country) was seized and recovered in the past three years. The national capital was followed by Maharashtra, Uttar Pradesh and Tamil Nadu, each registering recoveries of over Rs 10 crore.

The Times of India

2014: 3rd most counterfeited currency in Switzerland

In Switzerland: Most counterfeited currency after US Dollar and Euro

Rupee third on fake foreign currency list in Switzerland

The number of fake Indian rupee notes found in Switzerland during 2013 stood at 403 — the third highest for any foreign currency.

PTI | Jul 20, 2014

NEW DELHI/BERNE: As a debate continues on alleged black money of Indians in Swiss banks, the authorities in Switzerland have come across a significant quantum of fake Indian rupee notes in their country — the third highest for any foreign currency after Euro and the US dollar.

According to the latest counterfeit currency statistics released by Switzerland's Federal Office of Police (Fedpol), the number of fake Euro notes seized in the year 2013 stood at 2,394, while there were 1,101 fake US dollar bills.

The number of fake Indian rupee notes found in Switzerland during 2013 stood at 403 — the third highest for any foreign currency. This included 380 fake Rs 500 notes and another 23 counterfeit Rs 1,000 notes.

However, the numbers have declined considerably since 2012 when Fedpol found as many as 2,624 fake rupee notes — the second highest among foreign currencies after 5,284 counterfeit US dollar notes at that time. The number of fake Euro notes was third highest during that year at 2,084.

The number of fake Swiss franc notes stood at 4,309 during 2012, but was higher than any foreign currency in 2013 at 3,729, as per details compiled by the Fedpol's Counterfeit Currency Unit.

Among other counterfeit foreign currencies found during 2013, there were 99 fake British pound notes, 71 South African rand notes, 34 Deutsche Mark notes (German currency officially in circulation from 1948 till 2002 when Euro was introduced), 23 Chinese yuan notes and ten Canadian dollar.

The number of any other fake foreign currency notes was in single-digits.

Unaccounted for rupees in circulation

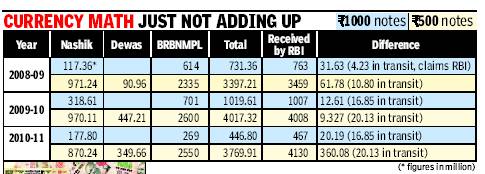

Millions of notes not printed in mints land in RBI vaults

Bank, Press Records Don’t Tally

Hemali Chhapia TNN

The Times of India 2013/08/04

Mumbai: Millions of currency notes worth hundreds of crores of rupees that have apparently never been printed at our nation’s mints have mysteriously made it to the vaults of the Reserve Bank of India over the years.

A series of RTI applications reveal that while the mismatch between currency bills printed and those transported to the RBI is seen across denominations, it is more pronounced in the case of higher value notes — those of Rs 1,000 and Rs 500.

Take the Rs 1,000 notes. The redesigned bill was introduced in October 2000. Ever since, the two authorized mints — Bharatiya Reserve Bank Note Mudran Private Limited, Bangalore, and Currency Note Press, Nashik — have printed a total of 4,452.3 million bills. But RBI records show that it has received 4,462 million notes, an excess of 9.7 million notes. That means the RBI has received Rs 970 crore more than what was actually printed.

WHAT THE RBI SPOKESPERSON SAYS

You have collected the data of printing from the press and the supply received from RBI. You cannot do that because there are a lot of logistics involved. Numbers must be compared from the one source; either you take RBI numbers or the printing presses’ numbers. You cannot mix and match.

An aggregate discrepancy of Rs 4,608 crore

In 2006-07 the number of 1000-rupee notes received by the RBI was 589 million. (The number of such notes printed that year was 591m.)

While this closes the difference between what was printed and what was received to a considerable extent, there still remains a discrepancy of about Rs 72 crore for the period in question, which the bank has attributed to “rounding off”.

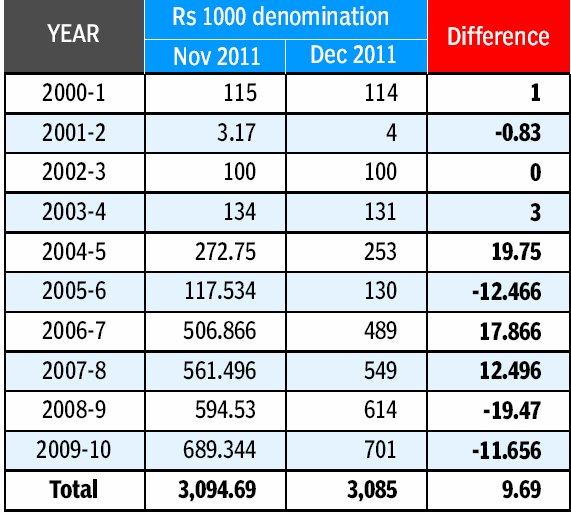

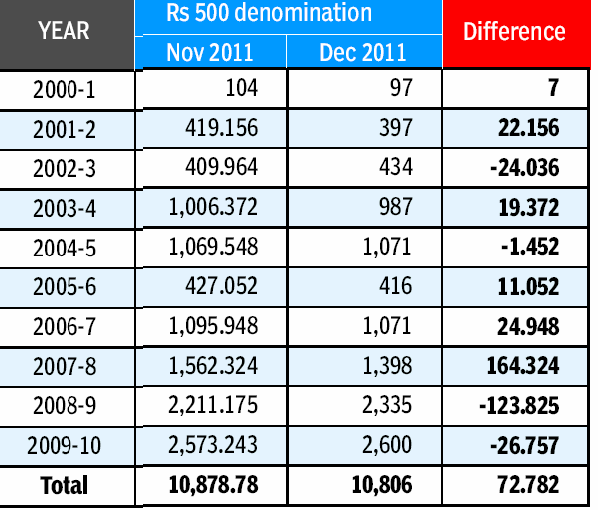

However, there is a large discrepancy between the numbers provided by the Bharatiya Reserve Bank Note Mudran, RBI’s wholly owned subsidiary, in its response to two similar queries just a month and a half apart under the Right to Information Act. A response dated November 10, 2011 to a query indicates the total count of Rs 500 notes printed between 2000-01 and 2009-10 as 10,878m while another response dated December 24, 2011 shows 10,806 m notes were printed—a difference of 72.782m notes valued at over Rs 3,639 crore (see Tables 3a-c).

Similarly, there is a difference in the case of currency notes of Rs 1000 denomination. The November response indicates the total number of Rs 1000 notes printed between 2000-01 and 2009-2010 as 3094.69m while the December response places it at 3,085m—a difference of 9.69m notes valued at Rs 969 crore (see Tables 3a-c).

The aggregate discrepancy—Rs 500 and Rs 1,000 notes—between the two RTI responses is a significant Rs 4,608 crore.

2016: Fake notes with face value of Rs 400 crore in circulation

The Times of India, May 11 2016

Neeraj Chauhan 250 In Every 10 Lakh Bills Counterfeit: Indian Statistical Institute

Fake notes with face value of Rs 400 crore in circulation

As many as 250 of every 10 lakh notes in circulation in India are fake, and banknotes with a face value of Rs 400 crore are in circulation in the country at any given point of time. The first ever study of counterfeit money has unearthed that fake Indian currency notes (FICN) with a face value of Rs 70 crore are infused into the Indian market every year, with agencies only able to intercept one third of them.

These shocking revelations are part of the study on “Estimation of the quantum of FICN in circulation“, conducted by the Indian Statistical Institute (ISI) Kolkata, which has asked the government to take “immediate steps“, since these figures are only indicative of the extent of the menace.

The findings have been accepted by the government and a series of strong measures to counter this `economic terrorism' is being planned in consultation with the primary FICN detection and probe agency, National Investigation Agency, besides other security and intelligence agencies including CBI, IB, DRI, R&AW and sta te police departments.

The study has further revealed that the detection rate of fake 100 and 500 rupee notes were found to be about the same and higher than the detection rate of 1000 rupee notes by about 10%. It added that fake 1,000 rupee notes constitute about 50% of the total value of FICN.

The ISI study was based on volumes of FICN detected and cash transaction in the banking sector. The study said that “the detection of FICN is carried out primarily by commercial banks. However, their reporting is irregular too and only three banks Axis, HDFC and ICICI report about 80% of the detection“. ISI, however, concluded that “the existing systems of seizure and detection are enough to flush out the quantum of FICN being infused“. The institute says that if detection can be improved, the value of FICN in circulation can be reduced by at least 20% annually .

As per the NIA probe, which has a Terror Funding and Fake Currency Cell, Pakistan is the major supplier of FICN in India. “In 2015 alone, some 9-10 cases have come to the notice where FICN has come by sea or air from Pakistan,“ said NIA inspector general Alok Mittal. Link title

ATMs, banks dispensed 19L fake notes in less than 4 yrs

Arun Dev, ATMs, banks dispensed 19L fake notes in less than 4 yrs, Nov 28 2016 : The Times of India

Bengaluru:

Over the last three and a half years, 19 lakh counterfeit notes of different denominations worth Rs 14.97 crore were dispensed by ATMs and banks across the country, reveals an RBI report on `detection of fake Indian currency through bank channel'. The RBI doesn't attribute any real value to the notes, which continue to exchange hands, as they are not legal tender, and calls it notional.

A denomination-wise analysis shows that 5.42 lakh fake Rs 100 notes worth Rs 39.56 crore, 8.56 lakh Rs 500 notes worth Rs 42.8 crore and 4.7 lakh Rs 1,000 notes worth Rs 47 crore were dispensed through banking channels.

RBI guidelines mandate that banks should have currency checking machines to establish genuineness of notes. Before accepting deposits or loading cash into ATM machines, the currency must be checked using these machines.

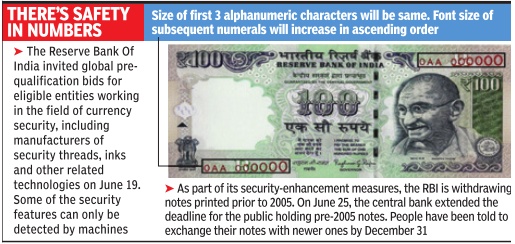

2015: Safety measures

The Times of India, Jul 02 2015

Partha Sinha

New feature on notes to give forgers run for money

To make Indian currency less prone to counterfeiting, the Reserve Bank Of India (RBI) has started printing Rs 100 notes on which the last six numerals of the nine-digit currency note number will be in ascending print size from left to right.

For example, if a Rs 100 note has the serial number 9AA 123456, the `9AA' part will have uniform print size.However, in the six-digit number portion, the print size for `2' will be larger than `1', print size for `3' will be larger than `2' and so on with `6' being in the largest font size. All other security features for this new series of Rs 100 notes will remain the same. The central bank will issue all currency notes, from Rs 10 to Rs 1,000 denomination, on which the num bering will be in this new ascending print size pattern, also called `exploding font'.“Printing the numerals in ascending size is a visible security feature in the banknotes so that the general public can easily distinguish a counterfeit note from a genuine one,“ a release from the central bank said. This new security fea ture is part of RBI's contin uing endeavour to improve security features of currency notes to make them more robust. Going forward, the currency notes will have moving images or variation in colour, micro-perfora tions etc. on security threads on each currency note.

RBI to mint 1.2cr coins for Kumbh devotees

The RBI is set to mint 1.2 crore coins of various denominations especially for the occasion. Bank officials estimate the total valuation of the coins at Rs 3 to Rs 3.5 crore.Anticipating a coin shortage, the State Bank of India (SBI) and the Bank of Maharashtra (BoM) have jointly ordered 1.2 crore coins of Rs 1, Rs 2 and Rs 5 denominations so that pilgrims can perform rituals as well as make offerings at Ramkund. “It is an age-old practice among Hindus to offer coins to sacred rivers such as the Godavari,“ said assistant general manager of SBI Sanjay Shrivastava. “Apart from offerings, pilgrims also give coins to beggars, which is considered auspicious,“ Shrivastava added.

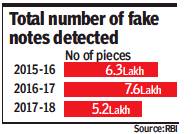

2015>18: RBI, banks detect fewer fake notes

August 30, 2018: The Times of India

From: August 30, 2018: The Times of India

Reserve Bank of India said that the number of counterfeit notes detected dropped by 31.4% as compared to the previous year. The total number of fake notes detected fell to 5.2 lakh as against 7.6 lakh in the previous year, it said in its annual report.

Economic affairs secretary SC Garg attributed the drop in counterfeit notes to the high level security features in the new notes, starting with Rs 2,000, introduced post-demonetisation. “In the last one year and ten months, we have not seen any high-quality fake notes. The counterfeit notes that have been seized are of low quality and can be detected by a normal person,” he said.

According to the RBI annual report, of the 5.2 lakh fake notes detected 2.3 lakh were of the hundred rupee denomination while another 1.27 lakh notes were among the old Rs 500 notes that were demonetised and handed over to RBI by banks. In the Mahatma Gandhi (New) Series of banknotes in the denominations of Rs 500 and Rs 2000, counterfeit notes detected during 2017-18 were 9,892 and 17,929 as against 199 and 638, respectively during the previous year.

With currency in circulation returning to pre-demonetisation level, RBI has gone slow on printing of notes. As a result, its currency printing cost 2017-18 dropped to Rs 4,912 crore from Rs 7,965 crore in the previous year. The Rs 2000 denomination accounts for 37.3% of total banknotes in circulation down from 50.2% last year. However, the share of Rs 500 note has nearly doubled to 43% from 22.5%.

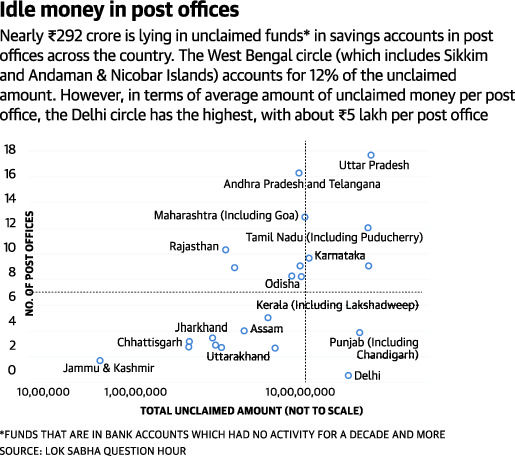

2016: Seizure of FICN

From: Neeraj Chauhan, December 1, 2017: The Times of India

See graphic:

Highest seizures of Fake Indian Currency Notes (FICN)

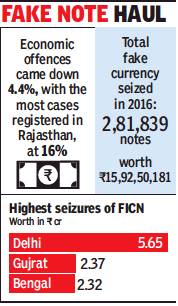

2017: states where most counterfeit notes have been seized

The Times of India, Oct 13 2017

See graphic:

Number and value of fake Rs 2000 notes seized after demonetisation, state-wise, as on October 13, 2017

From: The Times of India, Oct 13 2017

One of the objectives of demonetisation was to suck counterfeit currency notes out of the system. Data released recently shows, however, that even the new currency notes continue to be faked and are in circulation. Parliament learnt recently that Gujarat and West Bengal are among states where most counterfeit notes have been seized.

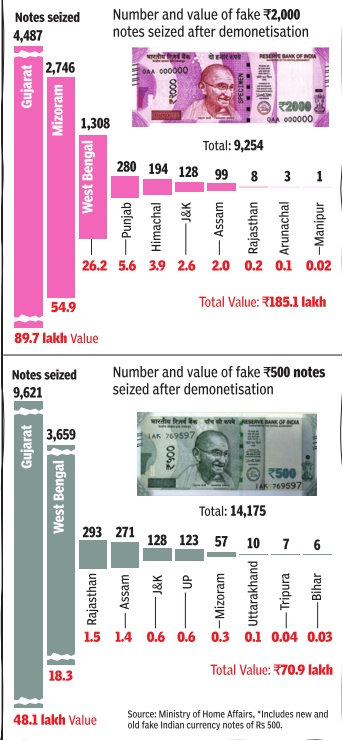

Currency with the post offices

Unclaimed money in post offices

From: July 26, 2018: The Hindu

See graphic:

Total unclaimed amount in the post offices in India, presumably in 2018

Currency with the public

2016, April and December

The Times of India, Apr 2, 2016

Mayur Shetty

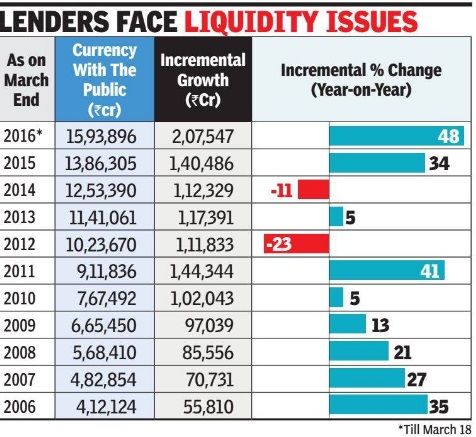

A steep surge in the amount of currency in circulation has baffled bankers and economists as this preference for cash among the public is slowing down deposit growth and hurting banks. According to data released by the Reserve Bank of India, cash with the public grew by 48% in the last fiscal till March 18, adding over Rs 2 lakh crore to the currency in circulation.

The unusual rise in cash with the public has prompted State Bank of India chairman Arundhati Bhattacharya to call upon the central bank to examine the reasons for the increase. Bhattacharya raised the issue amid banks facing issues of systemic liquidity due to high currencyholdings( bothintheform of cash and jewellery) as well as the rise in government cash balances with the RBI. According to SBI chief economist Soumya Kanti Ghosh, if people are withdrawing money to spend, it should reflect in higher economic activity, but numbers do not reflect this. "The manufacturing sector credit growth has completely collapsed to a little over 5%. The only sectors seeing growth are power and iron & steel, which is extremely distressing," he said.

High-value denomination notes have been going out of currency chests of banks to the hinterland, but not returning. This is despite a surge in card payments as well as a jump in bank accounts due to the Jan-Dhan Yojana. The last time when cash with the public grew at over 40% was in 2011. But that was in the midst of a fiscal stimulus and inflation was raging at 11%, prompting people to spend more.

According to Madan Sabnavis, chief economist, Care, gold demand has risen because of low interest rates, and since a large part of the transactions in the yellow metal takes place in cash, there has been an increase in currency with public. "Although inflation has come down, inflation expectation among public has not come down even as returns on deposits have declined. The reduction in small savings rate has made it easier for banks to bring down deposit rates. If you look at monetary policy as well as the recent action on small savings, they appear to be geared toward enhancing credit rather than encouraging savings," he said.

Another reason for the surge in cash as on March 18 could be a string of bank holidays that followed, according to Sujan Hajra, co-head, research at Anand Rathi Securities. But even if one were to look at currency growth as on February, the increase was as high as 38%. "With inflation low and with low return on most assets, the opportunity cost for holding cash and loss of opportunity due to moving to cash is low. The know-your-customer norms for investments in real estate has increased, which could be reducing the opportunity there. Most jewellers have also been on strike for long and they are one of the major sources for cash deposits into the banking system and this could also be a reason," said Hajra.

Bank deposits continue to grow at a sluggish pace. As on March 18, 2016, the yearon-year growth in deposits stood at 9.9%.

2018, Feb: exceeds Oct 2016 levels

Growing cash in economy may be due to polls: SBI, March 10, 2018: The Times of India

From: Growing cash in economy may be due to polls: SBI, March 10, 2018: The Times of India

SBI has said that the spike in currency in circulation to near pre-demonetisation levels is possibly driven by political parties hoarding cash ahead of polls. Historically, cash usage picks up ahead of elections across governments. The surge in currency is slowing down deposit growth and pushing up interest rates in money markets.

The issue of cash with the public going up due to elections was first officially acknowledged by former Reserve Bank of India governor Raghuram Rajan in April 2016. “Around election time, cash with the public does normally increase... You can guess as to reasons why, we can also guess,” Rajan had said. He said that the central bank had witnessed that currency demand goes up not just in the states going for elections, but in the adjoining areas as well.

SBI chief economist Soumya Kanti Ghosh said, the currency in circulation has increased rapidly in the past two months. On a monthly basis, growth has been 0.45 lakh crore and 0.51 lakh crore in January and February respectively, compared to an average of 0.1 lakh crore and 0.2 lakh crore respectively in these two months in previous years. “Given that many state elections are scheduled for 2018, growth in currency in circulation is likely to remain robust. This would put pressure on bank deposits to expand as it represents a leakage from the banking system,” said Ghosh.

For banks, the negative fallout of the increase in currency is that deposit growth has been slowing down following an initial spike after demonetisation.

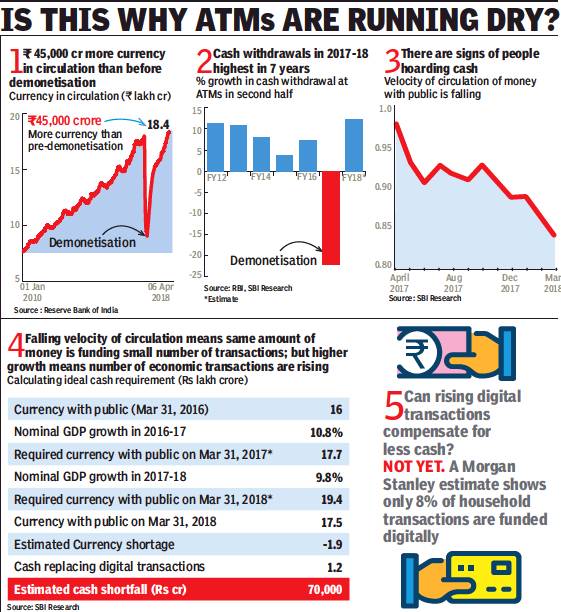

2018, April: ₹70,000cr shortfall of currency

₹70,000cr shortfall of currency: SBI, April 19, 2018: The Times of India

i) The currency in circulation, 2010> 2018;

ii) Cash withdrawals, 2012-2018;

iii) and iv) Velocity of circulation of currency, 2017-18; and

v) Percentage of household transactions that are funded digitally in 2018.

From: April 19, 2018: The Times of India

A report by State Bank of India has estimated the shortfall of currency in circulation at around Rs 70,000 crore.

SBI’s chief operating officer Neeraj Vyas on Wednesday said that cash availability in the bank’s ATMs improved in the last 24 hours. “Efforts are being made to improve the cash availability further in a few geographies. Overall issue of less cash should come to normalcy within the soonest possible time,” he said.

While currency with public (excluding currency with RBI) stands at Rs 17.5 lakh crore, an SBI research report has estimated the requirement is at Rs 19.4 lakh crore based on nominal growth in GDP at 10.8% in FY17 and 9.8% in FY18.

“Currently currency with public shows a gap of Rs 1.9 lakh crore. The increase in digital modes of payment compensates some part of the existing gap. The shift to digital modes could be at least Rs 1.2 lakh crore. The apparent shortfall thus could be around Rs 70,000 crore or even less,” said Soumya Kanti Ghosh, chief economic advisor, SBI.

According to Ghosh, the reason for the higher demand for banknotes could be on account of the slowdown in income velocity (the number of times banknotes change hands). “Income velocity of currency with public has been on a declining trend in FY18, particularly in the second half. This indicates possibly currency of the higher denomination Rs 2,000 is not getting adequately circulated in the economy,” said Ghosh.

SBI’s internal estimates suggest that in states like Bihar, Gujarat and southern states, the income velocity is far less than the national average.

Ghosh said that fear of note scarcity could have been accentuated because of the shift to lower denomination notes in ATMs. This would result in ATMs drying up faster. “As ATMs have to be replenished more frequently, it can lead to the conjecture that cash is not available,” said Ghosh. In the report, Ghosh said that heightened economic activity beginning Q4 of FY18 has meant that the demand for working capital cycle has changed for the better, resulting in more usage of cash for transactional purposes.

2018, June: doubles from Rs 8.9L crore (post-demonetisation) to Rs 19.3L crore

June 10, 2018: The Times of India

HIGHLIGHTS

The total currency put in circulation by the RBI has also more than doubled to over Rs 19.3L crore — from a low of about Rs 8.9L crore post-demonetisation.

The high level of currency available with the public is in sharp contrast to the reported cash crunch in various parts of the country a few months ago.

Currency with the public has reached a record high level of over Rs 18.5 lakh crore, more than double from a low of about Rs 7.8 lakh crore it had hit post-demonetisation decision in late 2016, as per RBI data.

At the same time, the total currency put in circulation by the Reserve Bank has also more than doubled to over Rs 19.3 lakh crore -- from a low of about Rs 8.9 lakh crore post- demonetisation.

Currency with the public is arrived at after deducting cash with banks from total currency in circulation.

This high level of currency available with the public is in sharp contrast to the reported cash crunch in various parts of the country a few months ago. There has been a fear that hoarding or accumulation of large amounts of cash for various reasons could have triggered an artificial currency crunch.

The figures for both 'currency with the public' and 'currency in circulation' have also exceeded the levels seen before the government's demonetisation decision on November 8, 2016, that saw nearly 86 per cent of the currency in circulation at that time being invalidated overnight by scrapping the then Rs 500/1,000 banknotes.

The public was given time to deposit the invalidated notes in banks, which saw nearly 99 per cent of banned notes coming back into the system.

As per the RBI's latest disclosure in this regard, people had returned Rs 15.28 lakh crore as on June 30, 2017, of the Rs 15.44 lakh crore banned currency, or 98.96 per cent, of the scrapped notes to the banking system.

Since then, the RBI has introduced new denominations of Rs 2,000 and Rs 200, among others, besides a new Rs 500 note. After the recent cash crunch, the government had announced that printing of Rs 500 notes would be stepped up.

While the RBI is yet to announce its final word on processing and verification of all the returned notes, the latest 'money supply' data from the central bank puts the "currency with the public" at over Rs 18.5 lakh crore as on May 25, 2018 -- up more than 31 per cent from year-ago level.

This is an over two-fold jump from Rs 7.8 lakh crore as on December 9, 2016 -- the lowest level it had seen after the announcement of the demonetisation decision as people rushed to deposit the scrapped notes with banks and the RBI.

Prior to demonetisation, the currency with the public stood at about Rs 17 lakh crore.

In terms of 'currency in circulation', the RBI puts the latest figure at over Rs 19.3 lakh crore as on June 1, 2018 -- again a jump of about 30 per cent from the year-ago level, according to the 'reserve money' data released by the central bank.

This also marks an over two-fold rise from a low of Rs 8.9 lakh crore as on January 6, 2017 -- the lowest level it saw post-demonetisation. The current level of currency in circulation is also above the pre-demonetisation figure of Rs 17.9 lakh crore as on November 5, 2016.

The RBI publishes the figures for currency in circulation on a weekly basis, while the currency with the public comes out every fortnight.

An analysis of historic data shows that the currency with the public stood at about Rs 13 lakh crore before the Modi government took charge in May 2014.

It rose to over Rs 14.5 lakh crore in a year and then further to close to Rs 16.7 lakh crore by May 2016. The figure crossed Rs 17 lakh crore level by October that year, before starting to decline due to demonetisation.

The figure again came back above Rs 10 lakh crore by February 2017 and crossed Rs 15 lakh crore mark in September last year.

A similar trend was seen in the currency in circulation figure, which dropped sharply from November 2016 till early January 2017 due to demonetisation, before starting to go up.

The total money supply, described as M3 by the RBI, now stands at over Rs 140 lakh crore -- nearly 11 per cent higher than the year-ago level. It stood at about Rs 120 lakh crore during the demonetisation period and was below Rs 100 lakh crore level before the Modi government came to power.

The M3 includes currency with the public, deposit money of the public (demand deposits with the banking system plus 'other' deposits with the RBI) and the time deposits with the banking system.

This figure is equivalent to the net bank credit to the government, plus the bank credit to the commercial sector, plus net foreign exchange assets of the banking sector, plus government's currency liabilities to the public, minus the net non-monetary liabilities of the banking sector.

The government's currency liabilities to the public comprise rupee coins and small coins.

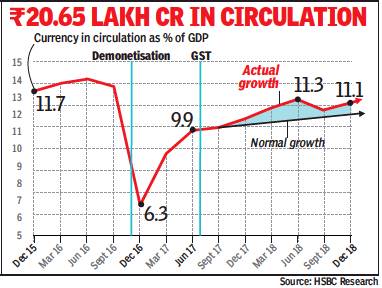

2019, Jan: Rs 20.65 lakh crore

Mayur Shetty, Cash in system surges: Informal sector’s back?, February 12, 2019: The Times of India

From: Mayur Shetty, Cash in system surges: Informal sector’s back?, February 12, 2019: The Times of India

Govt Eases Up On GST Compliance: Research Report

Currency in circulation touched a new high of Rs 20.65 lakh crore on January 18, 2019, way above the pre-demonetisation high of Rs 17.97 lakh crore. The increase in currency usage points to a recovery in ‘informality’ in the economy as the government goes easy on goods and services tax compliance and businesses continue using cash, according to Pranjul Bhandari, chief economist, India, HSBC.

The acceleration of CIC since late-2017 has resulted in leakage of liquidity from the banking system, said Bhandari, who has previously served at the IMF, finance ministry and Planning Commission. The introduction of GST was expected to improve tax compliance but is taking time, she said in a research report.

She said the informal sector, which had weakened significantly following demonetisation has, with the progress of remonetisation, inched up.

However, Soumya Kanti Ghosh, chief economist, SBI group, told TOI, “It is a matter of debate whether currency in circulation implies more cash usage. This is because there has been a decline in velocity of money implying that fewer cash transactions are being made.” In the past, economists have noted how CIC goes up ahead of major elections. Former governor Raghuram Rajan, too, had attributed the surge in currency in April 2016 to state elections. “Around election time, cash with the public does normally increase.... You can guess as to reasons why, we can also guess,” he had said.

Bhandari says this is not the case now. “We tested for some other drivers of cash as well, for instance, poll-related increase in cash use, and found it to be insignificant.” Bankers say money not coming back into the banking system is one of the reasons why they are unable to meet deposit growth targets.

Deposit growth has not kept pace with credit surge

Deposit growth during FY19 (up to January 18, 2019) at 4.9% has not been keeping pace with credit surge, which has grown 8.2% during the same period, making it difficult for banks to cut interest rates.

“Traditionally, currency in circulation has been positively correlated with rural demand. However, that relationship may have broken down in FY19. Nearly 70% of rural India, whose main source of income is wages, was not doing too well. And yet, CIC accelerated. We attribute this to the recovery in the informal sector,” said Bhandari. When currency in circulation surpassed predemonetisation levels, government officials said the increase was below trend growth and as a ratio of GDP, it was still lower. The CIC-to-GDP ratio was 11.9% on the eve of demonetisation.

After touching a low of 8.8% in March 2017, it jumped to 10.9% in March 2018, and a likely 11.4% by March 2019. “We expect the CIC-to-GDP ratio to inch up further to 11.6% by March 2020, implying some increase but not an acceleration in currency leakage,” said Bhandari.

Incidentally, high CIC-to-GDP ratio was one of the reasons cited by the government for demonetisation. Bhandari attributes the rise of ‘informal’ economy to teething issues with the GST regime. She says this is expected to get addressed next year, arresting the increase in informality and blunting the acceleration in the CICto-GDP ratio. “However, if rural demand rises over the year, that could lead to a rise in CIC,” she adds.

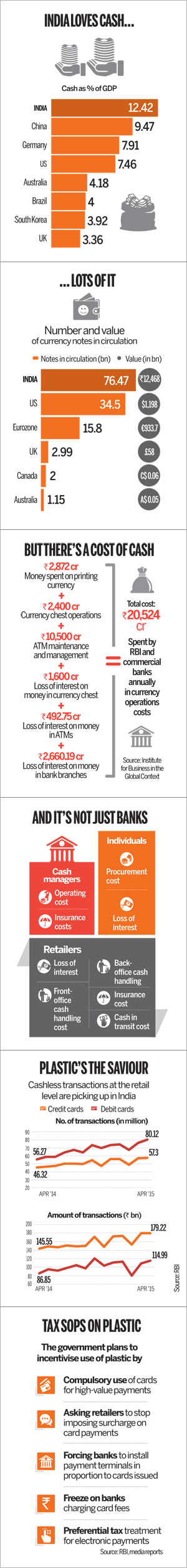

Cash-to-GDP ratio

2012-13: 12%

Jan 19 2015

India's love for cash costs $3.5bn a yr

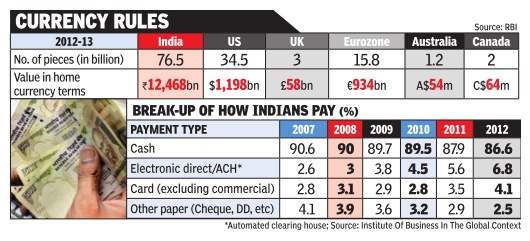

Cash-to-GDP ratio higher than peers, but e-payments double in 5 yrs: Study

The Reserve Bank of India and commercial banks annually spend around Rs 21,000 crore ($3.5 billion) in currency operations costs while citizens of Delhi alone spend Rs 9.1 crore and 60 lakh hours in collecting cash. The scale of this burden is unique to India considering that it is among the most cash-intensive economies in the world with a cash-to-GDP ratio of 12%, almost four times as much as other markets such as Brazil (3.93%), Mexico (5.3%) and South Africa (3.73%).

There are many reasons why India has to pay such a high price for its payments.One is the need to frequently reissue notes due to poor handling -low-value notes have to be replaced in less than a year. The other reason is the need to frequently upgrade security features and replace old notes. There is a huge cost in pulling old notes out of circulation and replacing them. India also has unique issues in logistics and in some places the cur rency notes have to be transported by helicopter.

A report on `Cost of Cash in India' commissioned by MasterCard and brought out by the Institute For Business In The Global Context has highlighted how much of a drag the overdependence on currency for payment is turning out to be. One reason for the increased dependence on cash is the lack of access to banking with a third of the population over 15 years not having used a bank account.

The report also highlights that although mobile banking has picked up, it is not yet being used for payments. There has been a jump in electronic payments since 2007 with its share increasing from 2.6% to 6.8%.This is largely due to the development of non-cash payment systems such as the Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT) and National Electronic Clearing System (NECS). But the report says that growth in these segments has typically benefited the commercial sector more than retail clients. The value of transactions through ATMs has grown sixfold from Rs 3 lakh crore in 2007 to about Rs 18 lakh crore in 2012, according to the report. However, when the ATM transactions are weighted for population, India continues to fare poorly even when compared to lesser developed markets such as Kenya, Niger or Egypt. According to RBI data, in 2013, 15,400 crore banknotes were issued globally, of which the maximum banknotes, 5,400 crore, were issued by China and almost 2,000 crore by India. The glob al projections for the next three years have been worked out at 16,000 crore, 16,600 crore and 17,300 crore banknotes, for the world, China and India, respectively .

“The steps taken by RBI over the years strive to make the idea of financial inclusion a reality . Innovations in the electronic payments space not only deliver greater transparency but more importantly , they simplify transactions, enhance security , increase efficiency and have the potential to dramatically reduce costs,“ said Vikas Varma, area head, south Asia, MasterCard.

The report also busts the conventional wisdom which assumes that cash is free. Citing the example of Delhi, the report says that residents spend 60 lakh hours and Rs 9.1 crore ($1.5 million) to obtain cash. Compared to this, Hyderabad, which is smaller, spends 17 lakh hours and Rs 3.2 crore ($0.5 million) to do the same, which corresponds to fees and transport costs about twice as high as Delhi on a per capita basis.

Demonetisation of high value currency- 1946, 1978: India

See the detailed page Demonetisation of high value currency- 1946, 1978: India

Demonetisation of high value currency- 2016: India

See the detailed page Demonetisation of high value currency- 2016: India

Design, colour, size of Indian currency notes

2014-19

March 9, 2019: The Times of India

Ever since demonetisation, the government has been busy introducing new currency either in the form of issuing new denomination notes or redesigning some of the existing denominations or simply introducing new series of coins.

'Sole right' under the Coinage Act

The Coinage Act, 1996 gives the sole right to mint coins to the government of India. While, section 22 of the Reserve Bank of India Act, 1934 gives the central bank the sole authority to issue notes (of up to Rs 10,000).

The 'new series' of coins

A new series of 'visually impaired friendly circulation' coins were introduced by Prime Minister Narendra Modi (right in picture) on March 7. The coins are in the denomination of Re 1, Rs 2, Rs 5, Rs 10 and Rs 20. The exact date of issuance of these coins is yet to be announced.

New Rs 20 'dodecagon' coin

For the first time, the government of India has announced a new Rs 20 coin which will be shaped like a 12-edged polygon (dodecagon). The face of the coin will bear the Lion Capital of Ashoka Pillar with the legend "Satyamev Jayate" inscribed below, flanked on the left periphery with the word "Bharat" in Hindi and on the right periphery with the word "INDIA" in English.

Dimension of the new Rs 20 coin

The new Rs 20 coin will weigh 8.54 gram and its outside diameter will be 27 mm with the outer ring made of nickel silver and the centre piece of nickel brass.The reverse side of the coin is flanked with the design of grains depicting the agricultural dominance of the country.

The new Rs 10

The RBI issued the first Rs 10 coin nearly 10 years ago in March 2009. Since then there have been 13 iterations of the coin which lead to confusion that the coins could be fake. However, the central bank later issued a clarification last year saying all 14 kinds of coin continue to be legal tender. A new Rs 10 coin was announced on March 7 this year. Also, a new chocolate brown colour note was also issued on January 5, 2018, featuring the Konark Sun temple on the reverse.

The fluorescent Rs 50

A new Rs 50 note was designed and announced, post demonetisation, on August 19, 2017. The fluorescent blue note had the Hampi Chariot on the reverse side. However, the old Rs 50 note also continues to be a legal tender.

The commemorative Rs 75 coin

The government announced a commemorative Rs 75 coin on the occasion of the 75th anniversary of Netaji Subhash Chandra Bose hoisting the tricolour for the first time at Port Blair.

New Rs 100

The new Rs 100 note was redesigned and issued on July 19, 2018 with 'Rani Ki Van in Gujarat' on its back. The note is lavender in colour. PM Modi also released a commemorative Rs 100 coin in memory of former PM Atal Bihari Vajpayee on Christmas eve in 2018. However, the old Rs 100 note also continues to be valid legal tender.

New yellow coloured Rs 200 note

A bright yellow coloured Rs 200 note was launched on August 25, 2017, featuring the 'Sanchi Stupa' on the reverse.

Rs 500 note introduced after demonetisation

The government banned the Rs 500 currency in circulation on November 8, 2016 overnight as part of its demonetisation drive. A new stone grey coloured note on November 10, 2016, featuring the Red Fort on the reverse, was issued.

The highest denomination currency note in circulation: Rs 2,000

In another firsts, a magenta colour Rs 2,000 note was issued by the government, along with the new Rs 500 note post the note ban drive. The back side of the new note features 'Mangalyaan', India's first interplanetary space mission. The sizes of the currencies introduced post demonetisation are smaller than their previous one, for instance Rs 50, Rs 500 and Rs 500.

Denominations in circulation

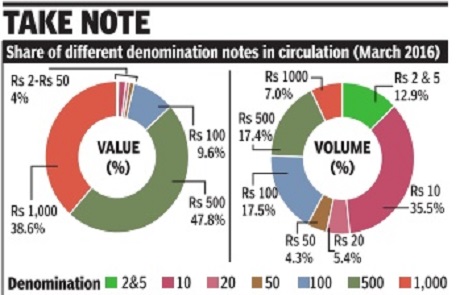

The Times of India

See graphic:

Share of notes of different denominations in circulation in March 2016

In March 2016

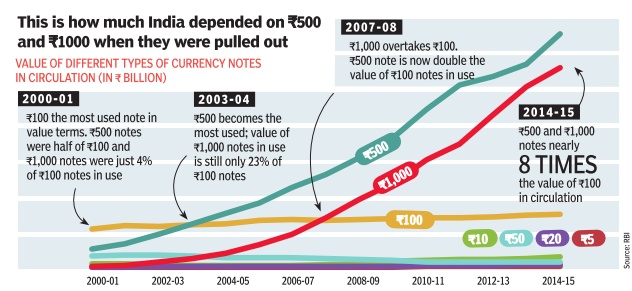

The decision to phase out Rs 500 and Rs 1,000 notes is linked to concerns over the increasing proportion of high-denomination currency in use.

Economic affairs secretary Shaktikanta Das said on Tuesday that, between 2011 and 2016, the circulation of all notes grew by 40%, but that of Rs 500 and Rs 1,000 notes grew by 76% and 109%, respectively . Between 2011 and 2016 the economy expanded by 30%, he added to emphasise the spurt in the Rs 500, Rs 1,000 bills' circulation.

In value terms, Rs 500 and Rs 1,000 notes accounted for 86.4% of the total value of bank notes in circulation, as of March 2016. Despite the emphasis and shift towards non-cash modes of transaction, the Indian economy remains flush with high value notes. In terms of volume, Rs 500 notes now account for 17.4%, and Rs 1,000 notes for 7% of the total notes in circulation.

July 2016: Exchange of pre-2005 notes stopped

The Times of India, Jul 01 2016

Banks will no longer exchange notes introduced prior to 2005. If anyone has such notes he would need to approach one of the 20 offices of the Reserve Bank of India directly to get such notes exchanged. However, there's a way out: If one has such notes, the person can deposit those notes in his bank account and the bank will send those notes to RBI.

Since January 2014, the RBI, through banks, has been withdrawing currency notes circulated prior to 2005. The central bank on Thursday said a large percentage of these notes have since been withdrawn, with only a small percentage still remaining in circulation. “On a review thereof, it has since been decided that July 1 onwards, the facility for members of public to exchange the pre-2005 notes will be available only at the following offices of RBI: Ahmedabad, Bengaluru, Belapur, Bhopal, Bhubaneswar, Chandigarh, Chennai, Guwahati, Hyderabad, Jaipur, Jammu, Kanpur, Kolkata, Lucknow, Mumbai, Nagpur, New Delhi, Patna, Thiruvananthapuram and Kochi,“ a release from the RBI said.

The RBI has also clarified that these pre-2005 banknotes will continue to remain legal tender, meaning people can use these notes just like other notes which were printed and circulated since 2005.

RBI sought Rs 5,000, Rs 10,000 notes

Under Rajan, RBI had sought Rs 5k, Rs 10k notes for `eroded' Rs 1k, Jan 21, 2017: The Times of India

The Reserve Bank of India (RBI), under former governor Raghuram Rajan, had suggested the introduction of Rs 5,000 and Rs 10,000 notes in view of the value of the Rs 1,000 note being eroded by inflation.

Information provided by the RBI to the Public Accounts Committee revealed that the central bank had made the recommendation in October 2014, some months after the Modi government took charge.

Some 18 months later, the government informed the RBI, in May 2016, about its “in principle“ decision to introduce a new series of Rs 2,000 notes, and the printing presses were finally given instructions in June last year.

This throws further light on the sequence of events and discussions between the RBI and the government ahead of the decision to demonetise the old Rs 500 and Rs 1,000 banknotes that was announced on November 8 last year.

Finance minister Arun Jaitley has said that the government did not accept the recommendation for Rs 5,000 and Rs 10,000 notes as it wanted replacement currency available immediately , and so went for Rs 2,000 notes. As it turned out, in the initial days following demonetisation, the acceptance of Rs 2,000 notes was low due to a lack of “change“, and higher denomination notes would have made the task even more problematic.

2017: Estimates and apprehensions in SBI Ecoflash report

SBI report: RBI may be holding back ₹2k notes, December 21, 2017: The Times of India

The RBI may either be holding back Rs 2,000 notes or could have stopped printing high-denomination currency, says an SBI Research report.

Juxtaposing the data presented in the Lok Sabha recently with the one provided by the RBI in its annual report earlier, the SBI Ecoflash report said on Wednesday, “we observe” that the value of small denomination currency in circulation up to March 2017 was Rs 3,50,100 crore.

This implies that the value of high denomination notes was equivalent to Rs 13,32,400 crore as on December 8, after netting out the small denomination notes from the currency in circulation on that day, it said.

The report further said that according to the ministry of finance report in the Lok Sabha recently, the RBI has printed 1,69,570 lakh pieces of Rs 500 notes and 36,540 lakh pieces of Rs 2,000 notes as on December 8. The total value of such notes translates into Rs 15,78,700 crore.

“This means that the residual amount of high currency notes of Rs 2,46,300 crore may have been printed by the RBI but not supplied in the market,” said the report authored Soumya Kanti Ghosh, group chief economic adviser, SBI.

The report added, “it is safe to assume” that Rs 2,46,300 crore may be on the lower side as the RBI must have printed notes of small denomination in the interregnum (Rs 50 and Rs 200).

“As a logical corollary, as 2,000-denomination currency led to challenges in transactions, it thus seems that the RBI may have either consciously stopped printing the 2,000-denomination notes or is printing in smaller numbers after initially it was printed in ample amount to normalise the liquidity situation,” said Ecoflash.

Digital payments, transactions

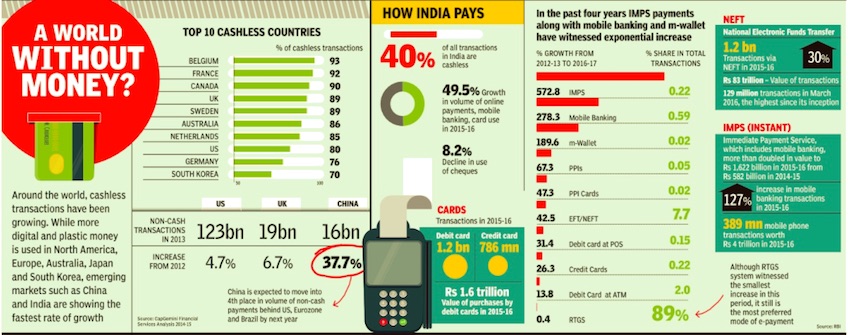

Towards a cashless future

See graphic: Top cashless countries, IMPS payments-% growth from 2012-17, year-wise and % share in total transactions, 2012-17, year-wise

November 13, 2016: The Times of India

2017: 11% growth

Digital payments grow 11% in Dec YoY, January 18, 2018: The Times of India

Digital transactions for the month of December 2017 are 11% higher than the figure for December 2016, when transactions had shot up due to a withdrawal of cash from the system due to demonetisation.

According to data released by the NPCI, total electronic payment transactions crossed 1 billion in December 2017 to 1.06 billion compared to 957 million a year earlier. In value terms, the total transactions amounted to Rs 125.53 lakh crore, 20% higher than Rs 104 lakh crore last year.

Transactions in most segments were higher than the earlier year, except card payments. Payments using debit and credit cards fell to 263 million in December 2017 as compared to 311

million in December 2016. In value terms, however, card payments amounted to Rs 52,800 crore compared to Rs 52,200 crore in the previous year. The bump up in the number of digital transactions came from payments made using the Unified Payments Interface (UPI). Transactions using this account-to-account transfer platform rose 2 million to 145 million.

According to bankers, transactions on the UPI platform has got a big boost due to the entry of Google Tez and Paytm, which were running promotion campaigns to get users to switch to their platform.

The bump up in e-transactions came from payments made using UPI

Germs and Indian currency notes

Herd immunity protects against germs on old notes

CULTURE TEST SHOWS SCANT BACTERIAL GROWTH ON SOILED BILLS

Worried about handling soiled currency notes? You need not any more. Following recent surveys pointing to currency notes getting contaminated by bacteria due to constant exposure and change of hands, TOI got two dirty notes and a new Rs 500 note tested at the Central Lab, a city-based laboratory at Richmond Circle.

Culture and sensitivity test on a Rs 100 note (from 2010) and a Rs 10 note (from 2014) showed they had gram positive cocci (a group of bacteria) in singles and pairs, which, doctors say, is no major cause of worry. Further, no microbial colonies were found on a new Rs 500 note freshly withdrawn from an ATM.

The report issued after 48 hours of testing showed scant growth of bacteria on Rs 10 and Rs 100 notes.

“The notes tested carried scanty bacterial growth. Clinically, it’s insignificant. Dirt need not necessarily carry ger ms and not all ger ms are infectious,” said Dr Babli Dhaliwal, director, technical head, Central Lab.

“There is herd immunity among us towards germs commonly found on notes,” said Dr Ambanna Gowda, general physician, Fortis Hospital. “Not just currency notes, bacteria can be seen on many objects of daily use, especially mobile phone screens. Just that it’s not affecting everyone of us because of herd immunity,” he said.

However, doctors and microbiologists say paper currencies could be contaminated with microbes, which transmit harmful organisms.

According to Sandhya VK, microbiologist, Virus Diagnostic Lab of the health and family welfare department in Shivamogga, paper currencies are exchanged constantly and thus are potential carrier of infections, though the tested samples were found to be safe.

“Though the report shows scanty growth, at times, a single organism can become infective in immunosuppressed persons. It is important to educate people about the effects of not maintaining hygiene while handling notes,” she said.

Government guarantee of banknotes

The Times of India, Dec 23, 2016

Actually , it is both [the Govt of India and the RBI]. The direct liability is on the RBI. The RBI Act, 1934, says the following: “The liabilities of the Issue Department (of RBI) shall be an amount equal to the total of the amount of the currency notes of the Government of India and bank notes for the time being in circulation.“ However, the same law also makes it clear that “every bank note shall be legal tender at any place in India... and shall be guaranteed by the Central Government.“ This is why banknotes are issued by the RBI and carry both a promise by its governor and the term “guaranteed by the central government“. The only exception is the one-rupee note which is issued by the government itself. In essence, the RBI acts as the government's currency manager.

Printing, destroying, replacing Indian currency

How Indian banknotes are destroyed

ii) Number and value of Indian banknotes in circulation in 2016

iii) Cost of production of currency to the RBI

The Times of India

See graphic:

i) How Indian banknotes are destroyed

ii) Number and value of Indian banknotes in circulation in 2016

iii) Cost of production of currency to the RBI

Cost of printing: 2016

Sivakumar B, At 78p per print, Rs 1 note now profitable, Nov 06 2016 : The Times of India

Two different mints charge the Reserve Bank of India different amounts to print the same currency denominations. This was revealed in replies to an RTI plea filed by RTI activist Subhash Agarwal.

While Bharatiya Reserve Bank Note Mudran Pvt Ltd, an RBI-owned company , prints Rs 10 and Rs 20 notes at a cost of 70 and 95 paise, respectively , the same notes printed by the governmentowned Security Printing and Minting Corporation of India (SPMCIL) cost Rs 1.22 and Rs 1.216, respectively.

The cost of printing Re 1 notes at the SPMCIL has come down from Rs 1.14 per unit to 78.5 paise due to better use of technology . The printing of one-ru pee notes, which was discontinued in 1994 because of high printing cost, is now costing less, the RBI has revealed. The currency is printed by the SPMCIL.

The cost of printing Re 1 notes in 1994-95 was Rs 1.48 a note and when reintroduced, the cost came down to Rs 1.14 and now it has reduced below its nomination value to 78.5 paise.

2017-18: Nashik slows down

Tushar Pawar, Currency note production down 44% at Nashik press, April 18, 2018: The Times of India

The printing of currency notes in the denomination of Rs 500, Rs 200, Rs 100 and Rs 20 has decreased by about 44% at the Nashik-based Currency Note Press (CNP).

While printing of Rs 500 notes was stopped in November last year, printing of Rs 200, Rs 100 and Rs 20 notes was stopped on April 1 this year. The printing of Rs 500 notes was stopped because CNP-Nashik had completed the target of printing 1,800 million pieces set by RBI for 2017-18. Similarly, it had to stop printing of currency notes of Rs 20 and Rs 100 on April 1 as new designs had been planned for these notes.

As far as printing of Rs 200 note is concerned, RBI had placed orders to CNP-Devas in Madhya Pradesh, following which Nashik stopped production. CNP-Nashik is currently printing notes in the denomination of Rs 10 and Rs 50 only.

“Daily production has come down from 18 million pieces to 10 million pieces,” said a CNPNashik functionary.

“Since April 16, CNP-Nashik has re-started printing of Rs 500 notes, but in a very low quantity,” sources in Nashik said.

2018: India’s first note made of domestic materials

July 20, 2018: The Times of India

The Reserve Bank of India has released a new Rs 100 denomination banknote in the Mahatma Gandhi series with a Swachh Bharat logo in lavender colour. This is the first note made of entirely domestic materials.

“This note is designed in India, printed on currency paper made in India. The ink is made in India and even the security features have been made by Indian companies. This is a dream come true,” said Kaza Sudhakar, who recently retired as managing director of Bharatiya Reserve Bank Note Mudran (BRBNM), which prints banknotes. The new Rs 100 note was designed in the BRBNM Design Studio in Mysore, Sudhakar added.

The new note will have a different dimension from the existing Rs 100 note, which means that it will not be available in ATMs until the machines are recalibrated.

The new banknote, bearing the signature of RBI governor Urjit R Patel, has a motif of Gujarat’s ‘Rani Ki Vav’ on the reverse, depicting the country’s cultural heritage. The base colour of the note is lavender and it contains other designs and geometric patterns, aligning with the overall colour scheme, both on the obverse and reverse.

According to Sudhakar, this is a routine introduction of a new currency note and the old design notes will be phased out over a period of time.

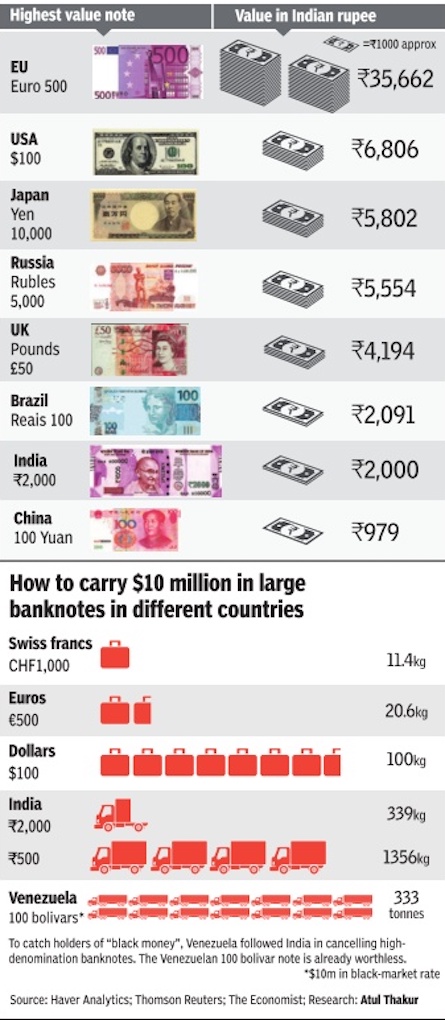

Highest denominations of currency, India and the world

2017

See graphic

Rupee symbol

Rupee becomes only 5th currency to get a symbol Design By IIT Grad Cleared By Cabinet

New Delhi: In keeping with India’s growing economic might and its status as a major investment destination, the hitherto humble rupee is all set to get a distinct identity in the form of a new symbol. The Union Cabinet on Thursday gave its approval to the symbol which combines the Roman letter ‘R’ with the Devnagri ‘Ra’.

The symbol will catapult the rupee into the company of four ‘elite’ currencies which have similarly distinct identities — the US dollar, euro, yen and British pound.

The symbol has been designed by D Udaya Kumar, an IIT Bombay post-graduate, who has just joined as a teacher at IIT Guwahati. Kumar will receive a prize money of Rs 2.5 lakh for his efforts. The symbol will standardize the expression for the Indian rupee in different languages, both within and outside the country.

‘‘It’s a big statement on the Indian currency. It would distinguish the rupee from those countries whose currencies are also designated as rupee or rupiah, such as Pakistan, Nepal, Sri Lanka and Indonesia,’’ I&B minister Ambika Soni said after the Cabinet meeting. The symbol, she added, would reflect the strength and robustness of the Indian economy.

Till now, the Indian currency was simply denoted by Rs or INR. Kumar’s symbol was chosen after a public competition was held among resident Indian citizens inviting entries for a symbol which ‘‘reflects and captures the Indian ethos and culture’’.

Over 3,000 entries were received. These were evaluated by a jury headed by the RBI deputy governor, which included experts from reputed art and design institutes.