Cryptocurrency: India

This is a collection of articles archived for the excellence of their content. |

Contents |

What is bitcoin

May 17, 2017: The Economic Times

HOW BITCOIN CAME TO BE?

It's a mystery. Bitcoin was launched in 2009 by a person or group of people operating under the name Satoshi Nakamoto. Bitcoin was then adopted by a small clutch of enthusiasts. Nakamoto dropped off the map as bitcoin began to attract widespread attention. But proponents say that doesn't matter: The currency obeys its own internal logic.

An Australian entrepreneur in 2016 stepped forward and claimed to be the founder of bitcoin, only to say days later that he did not 'have the courage' to publish proof that he is.

Bitcoins are created as a reward for a process known as mining.

Without a central repository or single administrator, Bitcoin was invented by an unknown person or a group of people under the name 'Satoshi Nakamoto' and released as open source software in 2009. The system is peer-to-peer, and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a blockhain. Bitcoins are created as a reward for a process known as bitcoin mining.

HOW BITCOINS WORK?

Bitcoin is not tied to a bank or government and allows users to spend money anonymously. The coins are created by users who 'mine' them by lending computing power to verify other users' transactions.

They receive bitcoins in exchange. The coins also can be bought and sold on exchanges with US dollars and other currencies.

Can one buy bitcoins in India?

Yes, one can buy the bitcoins via bitcoin wallets. There are wallet firms in India such as Unocoin (Bangalore-based), Zebpay (Mumbai, Ahmedabad-based) and Coinsecure (New Delhi-based). You can buy bitcoins in the Indian National Rupee (INR) by transferring money through NEFT/RTGS. And when you sell bitcoins, the money (in the Indian currency, of course) is transferred to the bank.

WHY ARE BITCOINS POPULAR?

Bitcoins are basically lines of computer code that are digitally signed each time they travel from one owner to the next. Transactions can be made anonymously, making the currency popular with libertarians as well as tech enthusiasts, speculators and criminals.

IS IT REALLY ANONYMOUS?

Yes, to a point. Transactions and accounts can be traced, but the account owners aren't necessarily known. However, investigators might be able to track down the owners when bitcoins are converted to regular currency.

For now, the three accounts tied to the ransomware attack appear untouched -- and it'll be difficult for perpetrators to cash in anytime soon without getting traced.

WHO IS USING BITCOIN?

Some businesses have jumped on the bitcoin bandwagon amid a flurry of media coverage. Overstock.com accepts payments in bitcoin, for example. The currency has become popular enough that more than 300,000 daily transactions have been occurring recently, according to bitcoin wallet site blockchain.info. A year ago, activity was closer to 230,000 transactions per day.

HOW ARE BITCOINS KEPT SECURE?

The bitcoin network works by harnessing individuals' greed for the collective good. A network of tech-savvy users called miners keep the system honest by pouring their computing power into a blockchain, a global running tally of every bitcoin transaction.

The blockchain prevents rogues from spending the same bitcoin twice, and the miners are rewarded for their efforts by being gifted with the occasional bitcoin. As long as miners keep the blockchain secure, counterfeiting shouldn't be an issue.

Change in value

2012-17

From: Aarati Krishnan, What’s behind the bitcoin boom?, December 3, 2017: The Hindu

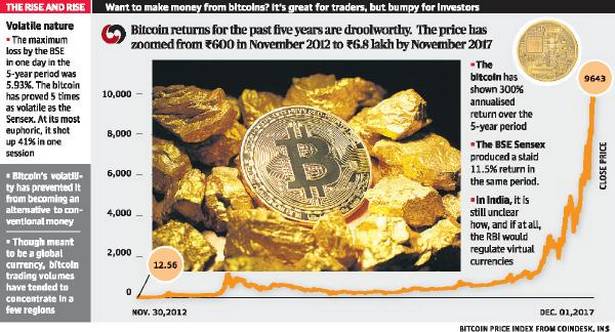

See graphic:

Bitcoin, change in value/ November 30, 2012-December 1, 2017

Investment by Indians in Bitcoin

May 17, 2017: The Economic Times

Despite the Reserve Bank's call for caution to people against the use of virtual currencies, a domestic Bitcoin exchange today said it is adding over 2,500 users a day and has reached five lakh downloads.

Zebpay, an app-absed Bitcoin exchange, said it has had five lakh downloads on the Android operating system and is adding more than 2,500 users every day.

The company, launched in 2015, said, the increasing downloads highlight the "growing acceptance of Bitcoins as one of the most popular emerging asset class."

Reason behind the boom

Aarati Krishnan, What’s behind the bitcoin boom?, December 3, 2017: The Hindu

While it has delivered stellar returns over the years, the volatile nature of the trade is not for the feeble-hearted

As the price of the bitcoin leapt past $10,000 in December 2017, marking a tenfold gain in 2017, many investors seemed to nurse a ‘missed-out’ feeling. The financial press ran ‘how-to-invest-in-bitcoin’ tutorials right alongside unflattering comparisons of the bitcoin boom to the Tulip mania. If you are among the Indian investors who are rueing their decision to skip bitcoins in favour of the stock market, here are some bitcoin facts that may make you feel better.

Scarcity premium

In the financial markets, asset bubbles are spotted by comparing the traded price of an asset to its fair value. For stocks, the valuation metric may be the price-to-earnings or book value multiple. For oil or gold, there’s the cost of producing each barrel or ounce. The rupee is assessed on real effective exchange rate. But it’s hard to say if there’s a bubble brewing in bitcoins because it has no such valuation measure. Its price is therefore decided mainly by demand-supply dynamics.

No one knows yet, if Bitcoin’s pseudonymous inventor Satoshi Nakamoto was a computer engineer, academic or Silicon Valley geek. But one subject that Nakamoto certainly understood was economics. He knew that when unlimited demand chases finite supply, the result is sky-rocketing prices.

So, while creating the original algorithm to ‘mine’ blocks of bitcoins (new bitcoins are created when you use computers to solve complex mathematical problems set by the system), he set a finite limit on the bitcoins that could be mined for all time to come. He also ensured that the algorithm got more complex over time and that the bitcoin yield shrank in geometric proportion with each new block.

This has effectively set a hard limit of 21 million on total bitcoin supply, of which an estimated 16.7 million (80 per cent) has already been mined. Mining new blocks now entails gigawatts of electricity and computing power.

To make things interesting, there’s uncertainty about the existing bitcoin supply as well. About a million bitcoins are said to have been spirited away by Nakamoto himself, a few million have gone missing due to lost hard disks and forgotten passwords, and a good number are out of circulation because they’re stockpiled by investors.

This scarcity factor and the lack of a fair value measure makes the bitcoin a great playground for speculators, but a very uncomfortable one for long-term investors.

High on volatility

Looking back today, bitcoin returns for the last five years are drool-worthy. The rupee-equivalent price of a bitcoin has zoomed from under ₹600 in November 2012 to more than ₹6.8 lakh by November 2017, a cool 300% annualised return. In the same period, the BSE Sensex has produced a staid 11.5% despite a bull market.

If this is making you regret choosing stocks over bitcoins, do note that you would have needed nerves of steel to stay invested in bitcoins. While delivering stellar returns, the bitcoin has subjected its investors to an extremely rocky ride.

Over the last five years, the maximum loss made by the BSE Sensex on any given day was 5.93%. Its biggest single-day gain was 3.8%. The rupee, with which the bitcoin competes as a virtual currency, saw a biggest single-day depreciation (against the dollar) of 3.6% and gained 3.4% on its best day.

But the bitcoin, on its bad days, has proved five times as volatile as the Sensex. On its worst day in the last five years, its price tanked by 28% in dollar terms. At its most euphoric, it shot up by 41% in a single session. Also, 10% single-day losses were not unusual for the bitcoin, with 36 such occasions in the last five years.

The short history of the bitcoin has been punctuated by quite a few stomach-roiling events too. In 2014, thousands of bitcoins were stolen from the leading exchange Mt Gox which had to be shuttered. The event saw a two-year lull in the bitcoin bull market. In August, a breakaway faction Bitcoin Cash, ‘forked’ off from the main bitcoin blockchain. This week, global bitcoin exchanges reported outages and flash crashes unable to handle the sharp surge in traffic.Due to such volatility, though it has proved a blockbuster investment, the bitcoin hasn’t really made headway as a global alternative to conventional money.

Regulatory approval

When originally introduced, virtual currencies, backed by the ultra-democratic blockchain technology, were expected to offer a border-less alternative to fiat currencies, which were being systematically debased by governments in the developed world. There was clamour for a globally-accepted medium of exchange that was free of political hegemony.

But trading volumes in cryptocurrencies have tended to become quite concentrated in a few regions lately. They’ve also proved quite sensitive to governmental actions. After galloping fivefold between January and September 2017, bitcoins suffered a 30% blip this September after the Chinese government, wary of capital flight, ordered the shut-down of leading bitcoin exchanges. In April, markets cheered Japan’s decision to officially recognise bitcoins as legal tender and license 11 exchanges.

Trading volumes have also flown from one region to another depending on how favourably disposed regulators have been towards bitcoins. Chinese exchanges dominated bitcoin trading a couple of years ago with a more than 80% volume share. But after the clampdown, Japanese and U.S. exchanges now control over two-thirds of volumes.

In India, the RBI is still undecided on the issue of how and if at all it will regulate virtual currencies. Meanwhile, it has issued disclaimers that it hasn’t authorised bitcoins as a medium of exchange, warning investors of potential ‘financial, operational, legal, customer protection and security-related risks’ if they dabble in them.

Why are the prices rising so sharply?

Bitcoin prices have risen sharply in the past year-and-a-half. In September 2016, bitcoins were priced around $600-700 in the international market and in December 2017, the prices are hovering around $10,000-$11,000. Bitcoin prices are rising chiefly because of a proliferation of interest in it and an ever-growing speculation that the currency, being based on the technology of blockchain, will continue to grow by leaps and bounds.

According to research produced by Cambridge University in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoins. Besides this, new bitcoins are created in a regular and limited numbers which are halved from time to time. The next halving will happen in the mid-2020.

Views

Government of India/ FM Arun Jaitley

Government doesn’t recognise bitcoin as legal: FM Arun Jaitley, December 1, 2017: The Economic Times

With virtual currency gaining traction among investors, Finance Minister Arun Jaitley today said India does not recognise cryptocurrency as legal tender.

“Recommendations are being worked at. The government’s position is clear, we don’t recognise this as legal currency as of now,” Jaitley said when asked whether the government has taken any decision on the cryptocurrency.

He had informed the Parliament IN aUGUST 2017 that taking cognisance of concerns raised at various fora from time to time on increasing use of virtual currencies (VCs) and the regulatory challenges, the Department of Economic Affairs (DEA) constituted a committee with representations from DEA, Department of Financial Services (DFS), Ministry of Home Affairs (MHA), RBI, Niti Aayog and SBI.

Reserve Bank of India

May 17, 2017: The Economic Times

RBI WARNING OVER BITCOIN:

RBI has been repeatedly flagging concerns on virtual currencies like Bitcoins, stating that they pose potential financial, legal, customer protection and security-related risks.

In cyber attacks, "ransomware hackers held victims hostage by encrypting their data and demanding them to send payments in bitcoins to regain access to their computers.

Bitcoin is a digital currency that allows people to buy goods and services and exchange money without involving banks, credit card issuers or other third parties.