Consumer protection: India

This is a collection of articles archived for the excellence of their content. |

Consumer Forums

Non-lawyer can appear for others

Swati Deshpande TNN

The Times of India, Sep 1, 2011

Non-lawyers can appear for others under CPA: SC

Mumbai: The Supreme Court has ruled that non-lawyers can represent, appear and argue cases filed under the Consumer Protection Act before consumer district forums and commissions.

The SC passed the directive while dismissing an eightyear-old appeal filed by the Bar Council of India against a 2002 Bombay high court judgment that permitted agents to represent consumers. The SC bench of Justice Dalveer Bhandari, Justice R Mukundakam Sharma and Justice Anil Dave on Monday, however, said guidelines were needed and accordingly, it directed the National Consumer Commission to “frame comprehensive rules within three months” to regulate the eligibility, ethics and conduct of non-legal representatives. Agents can be friends or relatives but they cannot accept any remuneration and must display competency.

Before concluding that the HC judgment required no interference, the apex court considered American, English and Australian laws that permitted similar non-legal representation in certain areas before quasi-judicial bodies or subordinate courts.

In India, rules framed in 1986 under the Consumer Protection Act permit authorized agents to represent parties. The SC noted that the National Commission has rightly placed “reasonable restrictions” on such rights to rule out misuse of liberty by any person or organization for “ulterior motive” or “to make a profession out of it”.

But with even lawyers against it, the issue over “authorized agents” has not been decided for over a decade. In 2000, in a complaint against two tour operators in Mumbai for alleged deficiency in service at the South Mumbai District Consumer Forum, the operators demanded that non-advocates should not be allowed to represent consumers. The forum agreed and held that the authorized representative had no right to plead as he was not enrolled as an advocate.

But in an earlier complaint in 1997, the consumer forum held that authorized agents did have a right to act, appear and argue complaints filed by consumers. The matter thus went to the state consumer commission that stayed the hearing of matters in which authorized agents appeared before the Consumer Forum.

The commission’s order was challenged before the Bombay HC that held that litigants before consumer forums “cannot be compelled to engage advocates” as they were quasi-judicial bodies. The consumer law is meant to be a swift and inexpensive remedy for consumers at the receiving end of poor service, unfair trade practice or faulty goods.

Justice Arijit Pasayat committee’s findings

SC Panel: Forums Hurt By Lack of Punctuality & Infrastructure

Thirty years after Parliament enacted Consumer Protection Act to make `consumer the king', its implementation lies in tatters with abysmally low consumer rights awareness and dysfunctional consumer forums, says a Supreme Court appointed committee.

“Consumer sovereignty is the primary and stated objective of government policy . But looking at the actual state of affairs of the consumer fora, which are in dire straits, consumers have bleak prospects in near future. The consumer fora in almost all states, with a few exceptions, have not been provided even with minimum level of facilities required for their effective functioning,“ said the committee headed by former Supreme Court judge, Justice Arijit Pasayat.

Among the deficiencies that hurt speedy redressal of consumers' complaints are -inadequate infrastructure at consumer forum, appointment of nonjudicial members through political and bureaucratic influence, serious lack of punctuality by members of consumer forums so much so that many sit only for two hours once or twice a week, files kept in open either getting lost or eaten by termites, and nonjudicial members ganging up against judicial members.

The committee found very few approaching consumer forums because of abysmally low level of awareness. “The level of awareness of consumer rights is very poor in rural, tribal and far-flung areas due to economic inequality, low level of literacy and ignorance of law,“ it said.

“The awareness campaigns run by the central government like `Jago Grahak Ja go' through the electronic and print media appear to have a limited impact. It is imperative that an all-out effort is made to spread awareness of consumer rights and grievance redressal mechanism under the act,“ it recommended.

Looking into grievances against consumer forums as highlighted by a PIL pending for 14 years, a bench headed by Chief Justice T S Thakur had taken views of additional solicitor general Maninder Singh before appointing the committee. The panel, which also comprises former Delhi high court judge Rekha Sharma and member P V Rama Sastri, was asked to visit states and give a factual ground report on the state of consumer forums in the country .

The report shocked the CJI-headed bench which said it would soon pass appropriate orders. TOI has a copy of the report. In a disturbing disclosure, the committee said: “The consumer forums were not found maintaining punctuality anywhere. Most start working around 11.30am or 12 noon and finish work by 1.30pm or 2pm. Either one or more nonjudicial members were found missing from the dais. Nonjudicial members are not at all competent but have somehow managed to get selected.“

“Remuneration paid to nonjudicial members of the consumer fora varies from state to state and in some states, it is too meagre to attract any qualified competent person. The members hardly display any interest in discharging their functions.“

“Most of the nonjudicial members are not capable of writing or dictating even small orders. At some places, such nonjudicial members act in unison against president (of the consumer forum) and pass orders contrary to law, thereby bringing bad name to the president,“ it said.

“This has also caused fear in the minds of presidents and they allow them (the nonjudicial members) to abstain from sitting in the court. Nonjudicial members make one or two appearances in a week and come late. As a result, the consumer forums are not able to keep the disposal up to the desired level as per the norms fixed by National Consumer Disputes Redressal Commission,“ the committee said.

District consumer forums: Selection Process Lacks Transparency

`Selection Process Lacks Transparency'

District consumer forums in many states have become the backyard for politicians and bureaucrats to fill the posts of nonjudicial members with their men, a Supreme Court-appointed committee has said.

“Such nonjudicial members manage to get selected and then misuse their position as members as they call themselves `judges',“ the committee said.

A bench headed by Chief Justice T S Thakur had set up a committee under former SC judge, Justice Arijit Pasayat, to know the state of consumer forums in the country . The committee's report gave startling facts about Uttar Pradesh and Haryana.

In its 15-page report submitted to the apex court after visiting district forums in different states, the committee said: “There has been considerable bureaucratic and political influence or interfe rence in the `selection process' and functioning of the consumer forums.“

“Just to cite a few instances, the committee found that relatives of politicians, bureaucrats and judicial fraternity have been selected,“ the report said.

Giving examples in UP and Haryana, it said: “These instances make it crystal clear that there is definite political influence and interference and in such a scenario, the work of district consumer forum is affected as it results in lowering the morale of the president of the forum.“

The committee gave a few examples: “A nonjudicial member Jamal Akhtar post ed at Meerut District consumer forum has been absenting without permission since May 11, 2015. The state government has failed to take any action against him. Pleas of president (of the forum) and state commission have gone unheeded. His post has not been declared vacant, yet another non-judicial member posted elsewhere has been attached in his place.“

“One nonjudicial member, who had her first term at Lucknow, has now been enjoying her second term being appointed to Barabanki district consumer forum. She has been attached to Greater Noida consumer forum and as per reports attends work in Greater Noida once or twice a week.“

“Another woman nonjudicial member who happens to be wife of a bureaucrat was appointed for district forum Baghpat but was posted at Greater Noida, “ the Justice Pasayat committee said.

“In Haryana, a non-judicial woman member does not attend the district forum regularly , as she has to travel around 160km everyday . The president of one district forum who happens to be former president of the Bar association has been serving the second term as president of the forum,“ it added.

The committee said the selection process of nonjudicial members in district forums lacks transparency .

“The candidates applying for various posts should be required to undergo written tests, particularly in respect of consumer protection-related aspects. Desirability of posting selected candidates at places other than their own district needs to be given serious consideration,“ it said.

“But to attract best talent, the remuneration and emoluments have to be reasonable,“ the committee said and promised to give furtherreport on this issue to the Supreme Court.

Delhi, 2016: 20% of cases on insurance

Dipak Dash, 20% of consumer court cases on insurance, Jan 29 2017: The Times of India

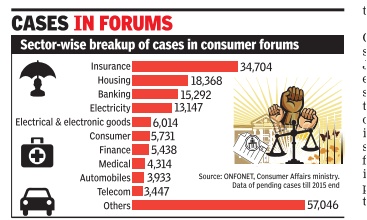

One in almost every five cases in consumer forums is related to the insurance sector, followed by complaints relating to the housing and banking sectors, according to a sample analysis done by the consumer affairs ministry .

The latest data shared by the ministry with the state governments recently show that at present about 4.15 lakh cases are pending before different consumer forums, nearly three-fourth of them at the district level.

The analysis of data of pending cases till 2015, available on internet-based case monitoring system Confonet, show that there were 34,704 pending cases relating to the insurance sector out of the total 1.67 lakh cases.

Experts said consumer forums receive more insurance-related cases for two reasons. First, consumers prefer approaching these forums to civil courts where one has to pay court fee. Second, consumers, who largely buy insurance products in good faith without even going through the contract conditions properly, are confronted with tricky conditions to deny compensation by insurance companies.

“Usually, insurance products are marketed and sold by agents whom consumers know for years. They sign documents in good faith even without going through the terms and conditions. Agents even take the responsibility to collect the premium from the consumers,“ said Suresh Misra, professor of consumer affairs in Indian Institute of Public Affairs.

He said the consumers come to know about the terms and conditions only when they apply for compensation.

President of National Consumer Disputes Redressal Commission Justice D K Jain had last month observed: “Insurance companies should have a heart. I feel they lack it.“ He had pointed out how surveyors often look into clauses written in the smallest fonts with a magnifying glass to prove that the insured person had failed to provide the most minute details while buying a policy.

Former member of NCDRC Justice J M Malik said while consumer forums at three levels --district, state and Centre-were set up for speedy justice, the large number of pending cases points to the need to fix the system.“Governments are not not filling vacant posts of presidents and members in district and state forums. The number of judges deployed does not match with the number of cases.“ he said.

Unregistered bodies cannot file cases

Dipak Dash, Unregistered bodies can't file cases: Consumer court, May 7, 2017: The Times of India

The country's apex consumer forum, NCDRC, has ruled that trusts, unregistered consumer organisations, residents' welfare associations (RWAs), cooperative societies or associations of flat or plot buyers cannot file a case for one or more consumers or on behalf of a group.

The order passed ends ambiguity on who can approach the consumer forum under the category of “Voluntary Consumer Association (VCA)“.

“A trust cannot be said to be a VCA within the meaning of section 12 of the Consumer Protection Act,“ the order by a three-member bench said while hearing more than a dozen cases filed by different or ganisations, RWAs in Delhi Noida, Gurgaon, Kolkata and Chennai.

There have been several cases in the past when trusts and unregistered entities had filed cases in the National Consumer Diputes Redressal Commission (NCDRC) see king relief for consumers.Section 12 of the Consumer Protection Act mentions that besides individual consumers only “recognised consumer organisation“ can file a case in the consumer forums.It further explains recognised consumer association as those VCAs that are registered under any law.

Both the NCDRC and the Supreme Court have already ruled that a group of consumers with the same interest can come together without forming any association to file a case in NCDRC and qualify under the threshold of Rs 1 crore or more claim. The apex consumer forum can take up cases directly where the claim is Rs 1crore or more. If the claim is less, then consumers need to file cases in the district forum or state commission.

Welcoming the order, national convenor of Fight for Real Estate Regulation Act (RERA) Abhay Upadhyay said, “It has cleared the ambiguity and will not only help the ongoing cases by recognised VCAs but will also encourage other suffering home buyers to seek justice through collective effort against the builders by forming such associationsMore and more suffering consumers can take this route, which is not only more cost effective but also more forceful.“

Consumer Forums’ performance

2017: adjournments, cases pending, types of cases

In Most States, Average Adjournment Period Is A Month

If the trends of adjournments and their duration are any indication to go by, consumers are in for a long haul while fighting cases in state consumer commissions.

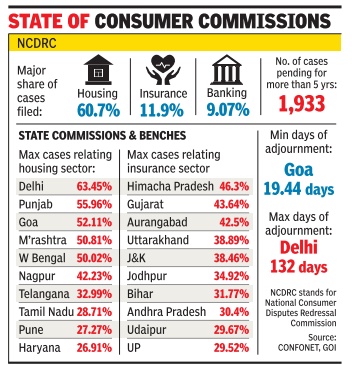

According to details accessed from the government's computer networking of consumer foras (CONFONET), the period of adjournment in Delhi is the maximum at an average of more than four months. Barring a few states UTs including Goa, Puducherry and Chandigarh, the average adjournment period in almost all other state consumer commissions is more than a month. Even the average adjournment period in the country's apex consumer commissionNational Consumer Disputes Redressal Commission (NCDRC)-it is over three months.

“In certain cases, the next date of hearing is put after six months. There are at least 5-6 hearings for each case and go ing by this trend of long adjournments, you can imagine how the process of justice is getting delayed,“ said Gaurav Prakash, a consumer activist, who has started an online petition to push for quicker processing of cases and urgent filling of vacancies in these commissions. Delay due to long adjo urnments defeats the whole purpose of consumer fora, which were created specially under the Consumer Protection Act, said Anil Sood, another consumer activist.

“These have become like normal courts. The procedures are complicated and lengthy, processes are cumber some. These commissions have become parking place for retired persons. Most of the members don't want to work and the condition of these commissions is worse while posts of members are lying vacant for months,“ Sood alleged.

Even a former member of a state commission admitted that many of the members are “simply spending time while occupying posts“.NCDRC has three vacant posts of members for more than a year.

Former NCDRC member Justice J M Malik said the governments need to give members a tenure of 10 years.

National Consumer Disputes Redressal Commission (administrative issues

2014-17: declining disposal rate

From: Dipak Dash, Consumer plaint disposal drops as case flow surges, December 27, 2017: The Times of India

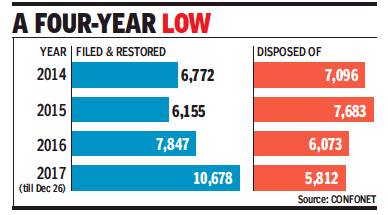

The disposal of cases filed in the National Consumer Disputes Redressal Commission (NCDRC), the country’s apex consumer commission, is at its lowest in four years while the number of cases has hit an all-time high.

According to details available on the central online database of consumer forums (CONFONET), the number of cases disposed of by the NCDRC was 5,812 till Tuesday, against 10,678 cases filed and restored during the year. The share of restored cases, the ones not inititally pursued by complainants but which they later sought to resolve, is low, at nearly 300.

Raising concerns over the dwindling number of cases disposed of in comparison to the number of complaints filed, NCDRC president Justice D K Jain had recently said he was disheartened that people were not getting the relief they expected when approaching the commission. “The increase in cases filed indicates that the consumers have become more aware... But we are not meeting their expectation. This disheartens me,” Justice Jain said on national consumer day.

Ideally, every case filed in the forums must be disposed of in three to six months. But in 2017 the average period between two hearings in the NCDRC has been more than three months. “The consumer forums were created for quicker redressal of consumer disputes. But these have become like normal courts and the purpose gets defeated if people have to wait for years to get relief,” said consumer rights activist Bejon Mishra.

One of the reasons for the drastic fall in disposal of cases has been the four vacancies for members that the government is struggling to fill. Considering this serious situation, the Supreme Court recently extended the retirement of members and its chairman by three months to give more time for the government to find replacements.

The biggest impact of low disposal has been on flat buyers. According to CONFONET data, 60% of the cases filed are from the housing sector, followed by insurance, banking and medical sectors. “People moved the NCDRC hoping to get quick justice. But long adjournments have dashed our hopes,” said Gaurav Prakash, who is involved in an online campaign to strengthen the apex consumer commission.

National Consumer Disputes Redressal Commission (decisions)

Flat owners can jointly exceed Rs 1 crore value

The Supreme Court has ruled that flat owners can join hands to directly approach the National Consumer Disputes Redressal Commission (NCDRC) against builders.

As per the Consumer Protection Act, a plea can be filed in NCDRC directly only if the cost involved is more than Rs 1 crore. Amrapali Sapphire Developers had cited this rule to plead that 43 flat buyers, who had together moved the apex consumer forum against it for delay in handing over possession, were disqualified from filing a joint plea.

On August 30, 2016, NCDRC member Justice V K Jain had ruled in favour of the flat owners, saying they could form an association to achieve the pecuniary limit of Rs 1 crore for approaching the NCDRC directly . The builder told the apex court bench of Justices Dipak Misra, A M Khanwilkar and M M Shantanagoudar that the cost of each flat was way below Rs 1 crore, thus the owners were individually ineligible to approach NCDRC directly . “By joining hands, they have shown that the cost of their flats was above Rs 1 crore to maintain their plea in NCDRC, which was against the rule,“ the builder's counsel said.

The SC's rejection of Am rapali Sapphire Developers' plea will come as a boon to middle-class flat owners.

Responding to the SC ruling, Confederation of Real Estate Developers' Associations of India (Credai) president Getamber Anand, who is also CMD of ATS Infrastructure, said, “Such broad directives can be misused also. This will adversely affect the sector, which is already facing a tough time.“

NCDRC member Justice Jain had said, “Once it is accepted that a consumer complaint on behalf of more than one consumer can be filed by a recognised consumer association, it can hardly be disputed that it is the aggregate value of the services which has to be taken for the purpose of determining the pecuniary jurisdiction of the consumer forum before which the complaint is filed.“ Referring to the 43 flat owners' joint plea through an association, the NCDRC had said that if the aggregate value of services in respect of the flat buyers, on whose behalf this complaint was filed, was taken, then it exceeded Rs 1 crore and hence NCDRC has jurisdiction to entertain their plea.

Haj pilgrims are not consumers

Setting a precedent, the National Consumer Disputes Redressal Commission has held that Haj pilgrims are not consumers as the Haj Committee of India is operating without any motive of profit. The ruling came on a complaint of a father-and-son duo and the Haj Committee of India where the duo claimed that they had been overcharged and provided with an accommodation facility inferior than what they desired for in Saudi Arabia.

Hotels are liable for car thefts

Dipak Dash, At owner’s risk? Hotel liable for car theft: Panel, February 6, 2018: The Times of India

The mere mention of ‘at owner’s risk’ on the parking tag does not absolve a hotel of liability if a vehicles goes missing from its parking space and it will be construed as ‘negligence’, the country’s apex consumer commission ordered.

The order was passed by single-member bench of M Shreesha while hearing the case of a Maruti Zen being stolen from the parking lot of Taj Mansingh Hotel in Delhi in August 1998 after the car owner left it at the valet parking. Holding the hotel responsible, the National Consumer Disputes Redressal Commission (NCDRC) ordered it to pay Rs 2.8 lakh to United India Insurance Company, which had insured the car, and pay interest at 9% from January 28, 1999.

One Sapan Dhawan had gone to the hotel on August 1, 1998 to have dinner at 11 pm and had given the keys to the parking man. He had received a parking slip. When he retuned after dinner two hours later and asked for the key, he was informed that his car was driven away by some unknown person.

The hotel had denied any negligence on its part when Dhawan sought Rs 5.3 lakh as compensation. He approached the Delhi state commission, which ordered Rs 2.8 lakh compensation to the insurance company and Rs 1 lakh to Dhawan. Though the hotel paid Dhawan, it challenged the order in NCDRC.

The hotel argued there was no negligence on its part and the parking slip clearly mentioned the vehicle was being parked at the request of the guest at his own risk.

But the NCDRC observed that as per the doctrine of ‘infra hospitium’, the hotel’s ‘duty of care’ towards guests’ vehicle does not stop with mere parking of the vehicles.

“...When the parking tag is issued in the name of the hotel, it can be reasonably inferred by the ‘car owner’ that the car would be in the ‘duty of care’ and custody of the hotel, which in this case, it failed to exercise and is held liable to pay damages,” NCDRC member Shreesha said.

Patients treated free can sue for negligence

Patients treated free of charge at government hospitals fall under the definition of ‘consumers’ and cases can be filed in consumer forums against hospitals for negligence, country’s apex consumer forum NCDRC has said.

Holding the district medical officer and in-charge of Government Bangar Hospital in Rajasthan’s Pali district guilty of negligence, resulting in the death of a road accident victim in 2001, the National Consumer Disputes Redressal Commission (NCDRC) ordered Rs 10 lakh penalty on the hospital. The order was passed by a bench comprising president Justice D K Jain and member M Shreesha on Tuesday.

Ramesh Chand Vyas, a former commissioner of Pali municipal council had succumbed to injuries four days after he was admitted to the hospital in June 2001.

The counsel of the respondents had argued that the complaint does not fall within the definition of consumer under the Consumer Protection Act as the patient was in a government hospital and he was treated free of cost. The NCDRC bench referred to a 1995 judgment of the Supreme Court which had observed that “free service would also be ‘service’ and the recipient a ‘consumer’ under the Act.”

The petitioner had alleged that Vyas was admitted in the trauma ward of hospital. It was pleaded that despite repeated requests from the relatives and attendants, ultra sonography and other necessary pre-investigative tests were not performed and the diagnosis was not even explained to the patient.

Maximum retail price (MRP)

Applies to multiplex, airport shops, too

Dipak Dash, Dec 1, 2016: The Times of India

`Multiplex, airport shops must follow normal MRP'

There cannot be two maximum retail prices (MRPs) for the same packaged item within a state, the consumer affairs department has said in its advisory to state governments. This means that not just bottled water, but all packaged items, including beverages, cannot be sold at two different MRPs in shops, multiplexes or airports.

“There is no dual MRP provision in the packaged commodity rules and hence state governments must ensure that no one sells packaged items at different prices within a region. In case of different MRPs, the lowest one will be treated as the actual price,“ a senior department official said. He said while there were orders from the National Consumer Disputes Redressal Commission (NCDRC) that no one could sell bottled water at different MRPs, including at malls, cinema halls and airports, it actually applied to all packaged items.

The department is also writing to state governments to carry out verification of net content of bread at manufacturing units. The step is being taken after the department received complaints of how the actual weight of bread was less in many cases against what the manufacturers declared.

“As per our norms, the net weight difference can be 4.5 grams. But there were complaints that bread makers were not complying with the norms. The states are empowered to inspect, verify and take action. We expect the manufacturers to comply with the specified rules and ensure consumers get products of the right weight for which they are paying,“ the official said.

SC: restaurants can charge more for packaged water

The government will file a review petition before the Supreme Court after its order allowed hotels and restaurants to charge more than the maximum retail price (MRP) for mineral and packaged water bottles.

The consumer affairs department will cite the latest change in rules, done specifically to bring such ‘institutional consumers’ under the ambit of the law. The law had specified that items procured in bulk for their own use could

not be sold as retail items. The modified rule was notified on June 23 and will come into effect from January 1.

In its order, the SC had said that provisions of legal metrology rules for retail sale of packaged commodities would not apply to institutional consumers such as hotels. It had ruled that neither the Standards of Weights and Measures Act or the Legal Metrology Act would apply so as to prohibit the sale of mineral water in hotels and restaurants at prices which were above the MRP.

The court had observed that a client would order nothing beyond a bottle of water or a beverage, but his direct purpose in doing so would clearly travel to enjoying the ambience available therein and incidentally to the ordering of any article for consumption.

Relief under consumer law

It is in addition to court cases: SC

The Supreme Court has said nursing homes without an intensive care unit facility cannot carry out surgeries because ab sence of an ICU poses danger to the patient's life.

A bench of Justices Adarsh Kumar Goel and U U Lalit gave the ruling on a petition filed by Bijoy Kumar Sinha, who lost his wife due to the alleged medical negli gence of Dr Biswanath Das who conducted a hysterectomy surgery at Ashutosh Nursing Home in Kolkata.The nursing home did not have an ICU facility. The Supreme Court's ruling in a case, based on a plea filed by a man who lost his wife due to alleged medical negligence of a doctor who had conducted a surgery on her at a Kolkata nursing home which didn't have an ICU, has implications for beleaguered homebuyers of Jaypee Infratech projects.

The petitioner, Bijoy Kumar Sinha, died while fighting a lengthy 23-year-long litigation over his wife's death, in consumer forums before his son Soumik pursued the case to get justice for his mother in the Supreme Court.

The SC said that the Consumer Protection Act was an additional remedy , thereby indicating that proceedings against a realtor under the Insolvency and Bankruptcy Code 2016 wouldn't bar recourse to parallel action in consumer forums. This will boost hopes of all homebuyers facing harassment at the hands of truant realtors.

A bench of Justices Adarsh Kumar Goel and U U Lalit said, “Provisions of the Consumer Protection Act, 1986, are in addition to and not in derogation of any other law. Thus, the Act provides for additional remedies. The authorities under the Act exercise quasi-judicial powers.The award of damages (in the case filed by Sinha) is aimed at bringing about qualitative change in the attitude of service providers.“

While absolving Dr Biswanath Das of medical negligence for deciding to perform surgery on Sinha's wife, the court awarded a compensation of Rs 5 lakh to Soumik.

This ruling means that even if a realtor has been proceeded against under the Insolvency and Bankruptcy Code, people won't be barred from taking recourse to consumer forums to claim relief for deficient services.

The apex court said though an alternative dispute redressal mechanism for settlement of disputes outside courts was applicable only to civil cases, “there is no reason to exclude its applicability to consumer fora“.

“It will be open to the national commission and the state commissions to coordinate with the national legal services authority and state legal services authorities for settlement of disputes by resorting to alternative dispute redressal mechanism,“ the Supreme Court said.

RTI: Information under, sought by applicants

Jan 12 2015

Applicant seeking info under RTI Act is not a consumer

Jehangir B Gai

There were conflicting judge ments of the National Commission as to whether an applicant seeking information under the RTI Act would be a consumer or not. Certain two member benches had held that an RTI applicant who pays fees for the information would be a consumer, while other benches held a consumer complaint would not be maintainable since the RTI Act provides its own channel of appeals. Hence, a three member bench was constituted to settle the law.

The National Commission addressed itself two issues. Firstly , whether a person seeking information under RTI Act can be addressed as a consumer. If it is held that he is a consumer, can a complaint be filed under the Consumer Protection Act, or would this remedy be barred by the provisions of the RTI Act.

The Commission observed that an applicant under the RTI Act is required to pay fees along with the application seeking information. Thereafter, at the time of being provided the information, the applicant is charged further fees towards the cost of providing the information.Hence the information is provided on payment of consideration.

However, the legislative intent is equally important. Citizens have a right to know every public act, everything that is done in a public way by their public functionaries, which right is derived from the concept of freedom of speech. The RTI Act has been passed with this objective, so that citizens can access public information. The RTI Act is a complete code in itself, which provides an adequate and effective remedy to the person aggrieved by any decision, inaction, act, omission or misconduct of a Public Information Officer. Not only does the RTI Act provide for two ap peals, but it also provides for a complaint to the Central or State Information Commission, as applicable, in case the information sought is not furnished within the prescribed time. The Central or State Information Commissioner can impose penalty upon the errant Information Officer, and also recommend disciplinary action against him. He can also award suitable compensation to the applicant. If a person is still aggrieved, he can approach the concerned high court by way of a writ petition. In fact, several writ petitions are pending in the high courts against the orders passed by the Information Commissions.

The National Commission observed that it is a settled legal proposition that when a right is created by a statute which also provides for an adequate and satisfactory remedy to enforce that right, a person must avail of the mechanism available under the relevant Act. The Public Information Officer is actually discharging a statutory function and not rendering any services. Besides, section 23 of the RTI Act bars the jurisdiction of courts.

By its order of 8.1.2015, the National Commission concluded that it is not permissible to have two parallel machineries for enforcement of the same rights created by the RTI Act which a special statute. If a consumer complaint is permitted, it would defeat the purpose of providing a special mechanism under the RTI Act.

An RTI applicant is not entitled to file a consumer complaint for deficiency in service. He must follow the appeal procedure prescribed under the RTI Act.

'Sales’ at discounted prices

VAT/ other duties on the discounted price

No VAT on items sold at a discount: Consumer body, Feb 3, 2017: The Times of India

The National Consumer Disputes Redressal Commission has held that shops selling goods at 40% discount cannot charge VAT or any other duty on the discounted price. It said that the rebate was on the MRP, which includes all taxes and cess as per Section 2(d) of Consumer Goods Act.

The NCDRC order came last month after state forums had rejected the plea of Woodland franchises in Chandigarh and Delhi that had refused to refund VAT charged to customers on jackets sold at `flat 40% discount'. The amount in dispute was Rs 119.85, which was the VAT charged on a jacket bought at 40% discount on an MRP of Rs 3,995.

Justice D K Jain, NCDRC president, held that “the advertisement in the above form is nothing but an allurement to gullible consumers to buy the advertised merchandise at a cheaper bargain price, which itself was not intended to be the re al bargaining price and, therefore, tantamount to unfair trade practice“. “The defence of the petitioners that they had charged VAT as per law is of no avail as the issue, viz misleading advertisement resulting in unfair trade practice, is concerned,“ the order said. The bench upheld verdicts of district and state forums that any discount falling short of “flat 40%“ on the MRP would amount to unfair trade practice.

The district forum had directed the shop owners to refund the extra amount to complainants, besides paying compensation, ranging between Rs 2,000 and Rs 5,000, and litigation cost, between Rs 1,000 and Rs 2,500.