Consumer protection: India

This is a collection of articles archived for the excellence of their content. |

Who are "Consumers"?

Construction labourers are ‘consumers’

In a landmark judgment, the Supreme Court has categorised over 2.8 crore registered construction workers as ‘consumers’ enabling them to move consumer forums if any government denied them statutory benefits promised under welfare schemes implemented with the funds collected as ‘cess’ from builders.

Under the Building and Other Construction Workers Welfare Cess Act, 1996, each state was mandated to set up Welfare Boards which are to provide registered construction workers and their dependants immediate assistance under various heads — in case of accident, pension to over 60 year-olds, loans and advances for construction of house, premium for group insurance scheme for workers, financial assistance for education of their children, medical expenses for treatment of major ailments, maternity benefit to female workers, and provision and improvement of other welfare measures and facilities as prescribed.

A bench of Justices D Y Chandrachud and Ajay Rastogi said, “the registered workers are clearly beneficiaries of the service provided by the welfare board in a statutory capacity.” As of today, the states and Union government have collected nearly Rs 40,000 crore as cess from builders but have spent meagre percentage on welfare of registered construction workers. Writing the judgment for the bench, Justice Chandrachud said,“As a matter of interpretation, the provisions contained in the Consumer Protection Act, 1986 must be construed in a purposive manner. Parliament has provided a salutary remedy to consumers of both goods and services. Public authorities, such as the appellants who have been constituted under an enactment of Parliament, are entrusted with a solemn duty of providing welfare services to registered workers.”

“The workers who are registered with the Board make contributions on the basis of which they are entitled to avail of the services provided in terms of the schemes notified by the Board. Public accountability is a significant consideration which underlies the provisions of the Consumer Protection Act 1986. The evolution of jurisprudence in relation to the enactment reflects the need to ensure a sense of public accountability by allowing consumers a redressal in the context of the discharge of non-sovereign functions which are not rendered free of charge. This test is duly met in the present case.,” the bench said.

Consumer Forums

Non-lawyer can appear for others

Swati Deshpande TNN

The Times of India, Sep 1, 2011

Non-lawyers can appear for others under CPA: SC

Mumbai: The Supreme Court has ruled that non-lawyers can represent, appear and argue cases filed under the Consumer Protection Act before consumer district forums and commissions.

The SC passed the directive while dismissing an eightyear-old appeal filed by the Bar Council of India against a 2002 Bombay high court judgment that permitted agents to represent consumers. The SC bench of Justice Dalveer Bhandari, Justice R Mukundakam Sharma and Justice Anil Dave on Monday, however, said guidelines were needed and accordingly, it directed the National Consumer Commission to “frame comprehensive rules within three months” to regulate the eligibility, ethics and conduct of non-legal representatives. Agents can be friends or relatives but they cannot accept any remuneration and must display competency.

Before concluding that the HC judgment required no interference, the apex court considered American, English and Australian laws that permitted similar non-legal representation in certain areas before quasi-judicial bodies or subordinate courts.

In India, rules framed in 1986 under the Consumer Protection Act permit authorized agents to represent parties. The SC noted that the National Commission has rightly placed “reasonable restrictions” on such rights to rule out misuse of liberty by any person or organization for “ulterior motive” or “to make a profession out of it”.

But with even lawyers against it, the issue over “authorized agents” has not been decided for over a decade. In 2000, in a complaint against two tour operators in Mumbai for alleged deficiency in service at the South Mumbai District Consumer Forum, the operators demanded that non-advocates should not be allowed to represent consumers. The forum agreed and held that the authorized representative had no right to plead as he was not enrolled as an advocate.

But in an earlier complaint in 1997, the consumer forum held that authorized agents did have a right to act, appear and argue complaints filed by consumers. The matter thus went to the state consumer commission that stayed the hearing of matters in which authorized agents appeared before the Consumer Forum.

The commission’s order was challenged before the Bombay HC that held that litigants before consumer forums “cannot be compelled to engage advocates” as they were quasi-judicial bodies. The consumer law is meant to be a swift and inexpensive remedy for consumers at the receiving end of poor service, unfair trade practice or faulty goods.

Justice Arijit Pasayat committee’s findings

SC Panel: Forums Hurt By Lack of Punctuality & Infrastructure

Thirty years after Parliament enacted Consumer Protection Act to make `consumer the king', its implementation lies in tatters with abysmally low consumer rights awareness and dysfunctional consumer forums, says a Supreme Court appointed committee.

“Consumer sovereignty is the primary and stated objective of government policy . But looking at the actual state of affairs of the consumer fora, which are in dire straits, consumers have bleak prospects in near future. The consumer fora in almost all states, with a few exceptions, have not been provided even with minimum level of facilities required for their effective functioning,“ said the committee headed by former Supreme Court judge, Justice Arijit Pasayat.

Among the deficiencies that hurt speedy redressal of consumers' complaints are -inadequate infrastructure at consumer forum, appointment of nonjudicial members through political and bureaucratic influence, serious lack of punctuality by members of consumer forums so much so that many sit only for two hours once or twice a week, files kept in open either getting lost or eaten by termites, and nonjudicial members ganging up against judicial members.

The committee found very few approaching consumer forums because of abysmally low level of awareness. “The level of awareness of consumer rights is very poor in rural, tribal and far-flung areas due to economic inequality, low level of literacy and ignorance of law,“ it said.

“The awareness campaigns run by the central government like `Jago Grahak Ja go' through the electronic and print media appear to have a limited impact. It is imperative that an all-out effort is made to spread awareness of consumer rights and grievance redressal mechanism under the act,“ it recommended.

Looking into grievances against consumer forums as highlighted by a PIL pending for 14 years, a bench headed by Chief Justice T S Thakur had taken views of additional solicitor general Maninder Singh before appointing the committee. The panel, which also comprises former Delhi high court judge Rekha Sharma and member P V Rama Sastri, was asked to visit states and give a factual ground report on the state of consumer forums in the country .

The report shocked the CJI-headed bench which said it would soon pass appropriate orders. TOI has a copy of the report. In a disturbing disclosure, the committee said: “The consumer forums were not found maintaining punctuality anywhere. Most start working around 11.30am or 12 noon and finish work by 1.30pm or 2pm. Either one or more nonjudicial members were found missing from the dais. Nonjudicial members are not at all competent but have somehow managed to get selected.“

“Remuneration paid to nonjudicial members of the consumer fora varies from state to state and in some states, it is too meagre to attract any qualified competent person. The members hardly display any interest in discharging their functions.“

“Most of the nonjudicial members are not capable of writing or dictating even small orders. At some places, such nonjudicial members act in unison against president (of the consumer forum) and pass orders contrary to law, thereby bringing bad name to the president,“ it said.

“This has also caused fear in the minds of presidents and they allow them (the nonjudicial members) to abstain from sitting in the court. Nonjudicial members make one or two appearances in a week and come late. As a result, the consumer forums are not able to keep the disposal up to the desired level as per the norms fixed by National Consumer Disputes Redressal Commission,“ the committee said.

District consumer forums: Selection Process Lacks Transparency

`Selection Process Lacks Transparency'

District consumer forums in many states have become the backyard for politicians and bureaucrats to fill the posts of nonjudicial members with their men, a Supreme Court-appointed committee has said.

“Such nonjudicial members manage to get selected and then misuse their position as members as they call themselves `judges',“ the committee said.

A bench headed by Chief Justice T S Thakur had set up a committee under former SC judge, Justice Arijit Pasayat, to know the state of consumer forums in the country . The committee's report gave startling facts about Uttar Pradesh and Haryana.

In its 15-page report submitted to the apex court after visiting district forums in different states, the committee said: “There has been considerable bureaucratic and political influence or interfe rence in the `selection process' and functioning of the consumer forums.“

“Just to cite a few instances, the committee found that relatives of politicians, bureaucrats and judicial fraternity have been selected,“ the report said.

Giving examples in UP and Haryana, it said: “These instances make it crystal clear that there is definite political influence and interference and in such a scenario, the work of district consumer forum is affected as it results in lowering the morale of the president of the forum.“

The committee gave a few examples: “A nonjudicial member Jamal Akhtar post ed at Meerut District consumer forum has been absenting without permission since May 11, 2015. The state government has failed to take any action against him. Pleas of president (of the forum) and state commission have gone unheeded. His post has not been declared vacant, yet another non-judicial member posted elsewhere has been attached in his place.“

“One nonjudicial member, who had her first term at Lucknow, has now been enjoying her second term being appointed to Barabanki district consumer forum. She has been attached to Greater Noida consumer forum and as per reports attends work in Greater Noida once or twice a week.“

“Another woman nonjudicial member who happens to be wife of a bureaucrat was appointed for district forum Baghpat but was posted at Greater Noida, “ the Justice Pasayat committee said.

“In Haryana, a non-judicial woman member does not attend the district forum regularly , as she has to travel around 160km everyday . The president of one district forum who happens to be former president of the Bar association has been serving the second term as president of the forum,“ it added.

The committee said the selection process of nonjudicial members in district forums lacks transparency .

“The candidates applying for various posts should be required to undergo written tests, particularly in respect of consumer protection-related aspects. Desirability of posting selected candidates at places other than their own district needs to be given serious consideration,“ it said.

“But to attract best talent, the remuneration and emoluments have to be reasonable,“ the committee said and promised to give furtherreport on this issue to the Supreme Court.

Delhi, 2016: 20% of cases on insurance

Dipak Dash, 20% of consumer court cases on insurance, Jan 29 2017: The Times of India

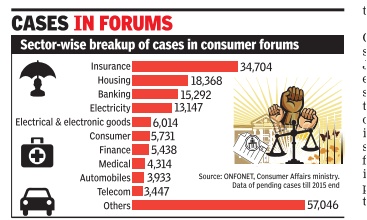

One in almost every five cases in consumer forums is related to the insurance sector, followed by complaints relating to the housing and banking sectors, according to a sample analysis done by the consumer affairs ministry .

The latest data shared by the ministry with the state governments recently show that at present about 4.15 lakh cases are pending before different consumer forums, nearly three-fourth of them at the district level.

The analysis of data of pending cases till 2015, available on internet-based case monitoring system Confonet, show that there were 34,704 pending cases relating to the insurance sector out of the total 1.67 lakh cases.

Experts said consumer forums receive more insurance-related cases for two reasons. First, consumers prefer approaching these forums to civil courts where one has to pay court fee. Second, consumers, who largely buy insurance products in good faith without even going through the contract conditions properly, are confronted with tricky conditions to deny compensation by insurance companies.

“Usually, insurance products are marketed and sold by agents whom consumers know for years. They sign documents in good faith even without going through the terms and conditions. Agents even take the responsibility to collect the premium from the consumers,“ said Suresh Misra, professor of consumer affairs in Indian Institute of Public Affairs.

He said the consumers come to know about the terms and conditions only when they apply for compensation.

President of National Consumer Disputes Redressal Commission Justice D K Jain had last month observed: “Insurance companies should have a heart. I feel they lack it.“ He had pointed out how surveyors often look into clauses written in the smallest fonts with a magnifying glass to prove that the insured person had failed to provide the most minute details while buying a policy.

Former member of NCDRC Justice J M Malik said while consumer forums at three levels --district, state and Centre-were set up for speedy justice, the large number of pending cases points to the need to fix the system.“Governments are not not filling vacant posts of presidents and members in district and state forums. The number of judges deployed does not match with the number of cases.“ he said.

Unregistered bodies cannot file cases

Dipak Dash, Unregistered bodies can't file cases: Consumer court, May 7, 2017: The Times of India

The country's apex consumer forum, NCDRC, has ruled that trusts, unregistered consumer organisations, residents' welfare associations (RWAs), cooperative societies or associations of flat or plot buyers cannot file a case for one or more consumers or on behalf of a group.

The order passed ends ambiguity on who can approach the consumer forum under the category of “Voluntary Consumer Association (VCA)“.

“A trust cannot be said to be a VCA within the meaning of section 12 of the Consumer Protection Act,“ the order by a three-member bench said while hearing more than a dozen cases filed by different or ganisations, RWAs in Delhi Noida, Gurgaon, Kolkata and Chennai.

There have been several cases in the past when trusts and unregistered entities had filed cases in the National Consumer Diputes Redressal Commission (NCDRC) see king relief for consumers.Section 12 of the Consumer Protection Act mentions that besides individual consumers only “recognised consumer organisation“ can file a case in the consumer forums.It further explains recognised consumer association as those VCAs that are registered under any law.

Both the NCDRC and the Supreme Court have already ruled that a group of consumers with the same interest can come together without forming any association to file a case in NCDRC and qualify under the threshold of Rs 1 crore or more claim. The apex consumer forum can take up cases directly where the claim is Rs 1crore or more. If the claim is less, then consumers need to file cases in the district forum or state commission.

Welcoming the order, national convenor of Fight for Real Estate Regulation Act (RERA) Abhay Upadhyay said, “It has cleared the ambiguity and will not only help the ongoing cases by recognised VCAs but will also encourage other suffering home buyers to seek justice through collective effort against the builders by forming such associationsMore and more suffering consumers can take this route, which is not only more cost effective but also more forceful.“

Consumer Forums’ performance

2017: adjournments, cases pending, types of cases

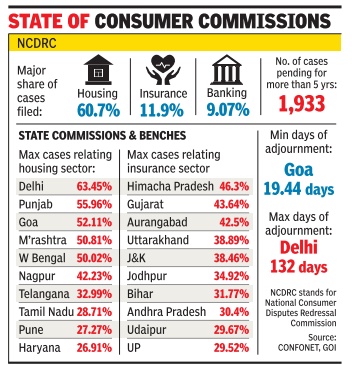

In Most States, Average Adjournment Period Is A Month

If the trends of adjournments and their duration are any indication to go by, consumers are in for a long haul while fighting cases in state consumer commissions.

According to details accessed from the government's computer networking of consumer foras (CONFONET), the period of adjournment in Delhi is the maximum at an average of more than four months. Barring a few states UTs including Goa, Puducherry and Chandigarh, the average adjournment period in almost all other state consumer commissions is more than a month. Even the average adjournment period in the country's apex consumer commissionNational Consumer Disputes Redressal Commission (NCDRC)-it is over three months.

“In certain cases, the next date of hearing is put after six months. There are at least 5-6 hearings for each case and go ing by this trend of long adjournments, you can imagine how the process of justice is getting delayed,“ said Gaurav Prakash, a consumer activist, who has started an online petition to push for quicker processing of cases and urgent filling of vacancies in these commissions. Delay due to long adjo urnments defeats the whole purpose of consumer fora, which were created specially under the Consumer Protection Act, said Anil Sood, another consumer activist.

“These have become like normal courts. The procedures are complicated and lengthy, processes are cumber some. These commissions have become parking place for retired persons. Most of the members don't want to work and the condition of these commissions is worse while posts of members are lying vacant for months,“ Sood alleged.

Even a former member of a state commission admitted that many of the members are “simply spending time while occupying posts“.NCDRC has three vacant posts of members for more than a year.

Former NCDRC member Justice J M Malik said the governments need to give members a tenure of 10 years.

2018: 3 lakh cases pending since 2016

Dipak Dash, 3 lakh consumer cases pending for over 2 yrs, October 28, 2018: The Times of India

From: Dipak Dash, 3 lakh consumer cases pending for over 2 yrs, October 28, 2018: The Times of India

‘Vacancies, Pleas Against Petty Fines Cause Pile-Up’

Concerned over the huge pile-up of complaints before consumer forums, country’s apex consumer commission chief, Justice R K Agrawal, on Saturday suggested that government entities, PSUs like railways and insurance companies should decide not to appeal against “petty” compensation awarded by district forums. He said these entities should fix the “ceiling” as is being followed by income tax department.

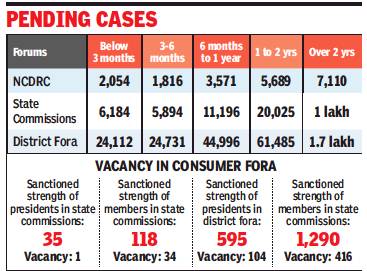

National Consumer Disputes Redressal Commission (NCDRC) president Justice Agrawal’s observation came in the light of nearly three lakh complaints (about 60% of all yet to be disposed off cases) pending before the consumer forums in districts, states and at the Centre for more than two years. This is despite the Consumer Protection Act specifying cases should be decided within “three months” or a maximum of “five months”. The cap of five months is for cases which requires analysis or testing of commodities.

Consumer affairs ministry officials said there are multiple reasons for this situation, which include vacant posts of presidents and members at all three levels of consumer forums, frequent adjournments and government entities and insurance companies challenging petty compensations awarded by district forums in favour of consumers.

“There are a large number of consumer cases pending against the railways and insurance companies involving petty amounts. Not only the cost of litigation in such cases may be far more than the stakes involved , the pendency of these cases cause more unending harassments to small consumers. It would be better if an inhouse mechanism could take care of such petty matters,” Justice Agrawal said at a conference on functioning of consumer foras.

While citing that increased consumer awareness has resulted in more people filing complaints, a NCDRC functionary said the judicial procedures and systems introduced by the legal professionals in this system have overtaken the spirit of quick justice as prescribed in the law. “The intent of the legislation was to have summary disposal of cases,” the functionary added.

While Agrawal said the NCDRC has been working with 8-9 members for the last one-and-a-half years against the sanctioned strength of 12, including its president, data show 25% posts of members are lying vacant in the state commissions and in district forums it is more than one-third of sanctioned posts. The share of vacant posts of presidents in district forums is about 20%.

Minister of state for consumer affairs C R Chaudhary also appealed to the representatives of district forums to avoid the “practice of adjourning case in the first hearing without going into the details of the complaints”.

Delhi

2017-2020 Aug

Aamir Khan2, September 14, 2020: The Times of India

From: Aamir Khan2, September 14, 2020: The Times of India

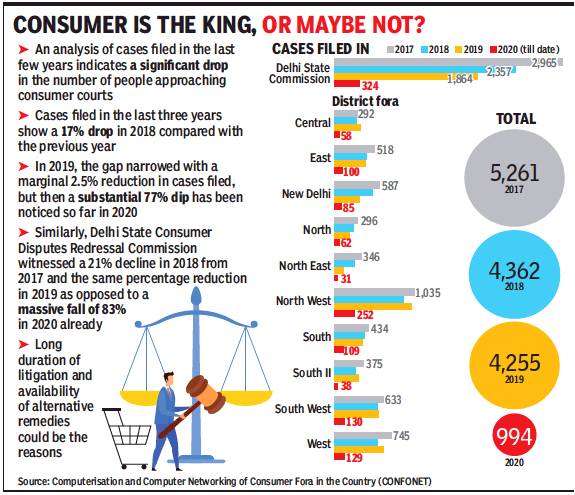

In an indication of the quagmire hapless consumers find themselves in, CM Arvind Kejriwal recently touched upon the subject during the launch of an online filing system for such complaints.

Kejriwal said about 15,000 cases were pending in the state and district consumer commissions in Delhi. An analysis indicated a significant drop in the number of cases filed in consumer courts in the last few years. The long duration of litigation and availability of alternative remedies were the primary reasons behind this, experts said. Talking about the gradual decline in the number of cases, advocate Shashi Shankar, who specialises in consumer dispute cases, said, “It is not like people are not aware of consumer rights. But when someone approaches a consumer commission, it’s not certain when the final outcome will come.” He usually advises clients to cut a deal with the manufacturer or dealer instead of litigating.

Shankar’s approach could be crucial in understanding the situation. First, it takes longer for a case to reach its conclusion than, perhaps, out of court mediation or settlement. Secondly, there is a good chance of a client receiving an honest opinion from lawyers on how their case might not be concluded in the desired time frame. There was a 17% drop in cases in 2018 compared with the previous year. In 2019, the gap narrowed with a marginal 2.5% reduction in cases filed. However, a substantial 77% dip has been noticed so far in 2020. Similarly, Delhi State Consumer Disputes Redressal Commission witnessed a 21% decline in 2018 from 2017 and the same number in 2019 as opposed to a massive fall of 83% in 2020 till date.

Although the big fall in 2020 could be attributed to the pandemic, the options of return or replacement available with online purchasers nowadays could be of relevance, though marginally. Online purchases were included in Consumer Protection Act, 2019, which came into effect on July 20 this year.

Advocate Amresh Anand pointed to a situation where a consumer lost the motivation to pursue dispute resolution realising its cumbersomeness. “Even if we talk about luxury goods, the maximum price is somewhere between Rs 50,000-70,000. But dispute resolution from start to finish at a consumer commission can become more strenuous owing to several factors,” he said.

“These cases are supposed to be decided within six months, but consumers have moved from filing complaints to negotiating with service providers as they can’t afford to litigate for two-three years,” Shankar said.

A case filed by the lawyer against a city hospital in 2003 is yet to get a final decision. Though a district commission passed its judgment, the complainant preferred an appeal. The case came full circle after the Delhi state commission remanded it back to the district commission for rehearing and reassessment of evidence.

The need for an alternative coupled with a situation where a certain category of cases are increasing might have prompted the consumer to change tactics, said Anand. “Ever since Real Estate Regulation Act came into being, a majority of homebuyers have been taking that recourse,” he added. In one of his cases, only five hearings have taken place since the case was filed in 2018 in the state commission.

“Filing a case under RERA is easier compared with a consumer commission. The filing has been online since its inception and has a nominal fee. In RERA, there is a pre-litigation procedure of conciliation too, allowing parties to settle before getting into a legal battle,” Anand said.

A person can appear in his case, but legal nitty-gritty or lack of technical know-how could derail the process. “At times, people are compelled to withdraw cases and file again with the correct details. It’s not that easy. This can make litigation in consumer commissions seem a colossal task,” said Anand.

So, what is the way forward? Experts said the government should continue with online filing or basic paperwork for filing complaints, replies and rejoinders and questionnaires to parties. Besides, evidence could be taken separately by filing in appropriate and dedicated departments without the commission’s indulgence at every stage. The commission would, thus, be able to save time for hearing arguments.

2021

Oct 7, 2022: The Times of India

From: Oct 7, 2022: The Times of India

New Delhi : For the first time, the National Lok Adalat scheduled to be on November 12 across the country will take up and dispose of pending consumers cases through settlement, the consumer affairs ministry said on Thursday. It said groundwork for this exercise has been initiated and all the consumer commissions have been intimated to identify and prepare a list of cases where there are chances of settlement and that can be referred to Lok Adalat.

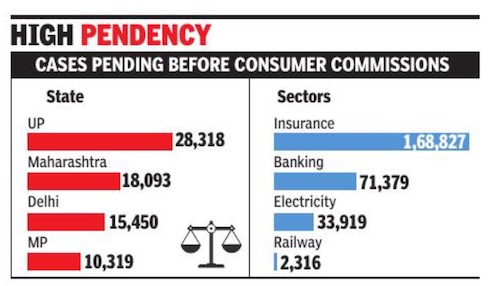

“To have maximum outreach and benefit consumers, the department is reaching out to consumers, companies, and organisations through SMS and emails. The department has the phone numbers and emails of three lakh partieswhose cases are pending before the commissions. It has done a video conferencing with the Consumer Commissions which has more than 200 pending cases,” the ministry said. It is creating a separate link and circulating it amongst all stakeholders wherein they can enter their pending case number andcommission where the case is pending and easily refer the matter to Lok Adalat. According to official data, amaximum of nearly 1. 7 lakh cases are related to insurance companies and 71,379 complaints are pending against banks. The total number of complaints related to the electricity sector is around 34,000.

Consumer Protection Act

Coverage

Legal services not under Consumer Protection Act

March 15, 2020: The Times of India

Service of lawyers won’t come under the Consumer Protection Act, Union consumer affairs minister Ram Vilas Paswan said amid speculations from lawyers that the provision of “all services” could include legal services as well and thereby giving a handle to their clients to drag them to consumer commissions.

“I would like to clarify that there is no proposal to include legal services in the rules being framed under the Act. Further, at present, there is no proposal to amend the definition of ‘services’ in the Consumer Protection Act, 2019,” said Paswan. Paswan’s comment came soon after Bar Council of India (BCI) and Bar Council of Delhi (BCD) wrote to him. In a statement, the Supreme Court Bar Association (SCBA) had said, “The government is called upon not to go ahead with proposed move and not to do anything directly or indirectly to treat lawyers as service providers under the said Act.”

The Act says that “service” means service of any description which is made available to potential users and includes, but not limited to, the provision of facilities in connection with banking, financing, insurance, transport, supply of electrical or other energy, telecom, or the purveying of news or other information.

Deficiency of service

Theft on train is not deficient service: SC

Dhananjay Mahapatra, June 16, 2023: The Times of India

NEW DELHI: The Supreme Court ruled that money stolen from a passenger during train journey cannot be termed deficiency of service on the part of the Railways and set aside concurrent findings of district, state and national consumer forum asking the Railways to pay Rs 1 lakh with interest as compensation to a cloth merchant who suffered theft of the same amount during his journey in April 2005.

Allowing an appeal filed by the Railways challenging the unanimous decisions of the consumer fora, a vacation bench of Justices Vikram Nath and Ahsanuddin Amanullah agreed with the central government counsel Rajan K Chourasia and said, “We fail to understand as to how the theft could be said to be deficiency of service by the Railways when the passenger was not able to safekeep his belongings.”

Cloth merchant Surender Bhola was travelling to Delhi on April 27, 2005, on a reserved berth in Kashi Vishwanath Express for purchasing stock of clothes with Rs 1 lakh kept in the belt of cloth tied to his waist. On waking up at 3.30am on April 28, he found that the belt of cloth and a part of the right side of his trousers were cut and Rs 1 lakh was stolen. On getting down at Delhi station on April 28, he lodged an FIR with Government Railway Police (GRP).

Days later, he filed a complaint in the District Consumer Disputes Redressal Forum, Shahjahanpur, seeking a direction to the Railways to make good his stolen money with 18% interest and Rs 400 towards his damaged trousers while claiming that the theft happened due to negligence of Railways.

Railways said it was responsible only for the luggage booked with it and not the belongings of passengers. It had told the district forum that notices have been put up at every station warning passengers to be watchful and responsible towards safekeep of their belongings. It had said that security of the passengers and their luggages come under the jurisdiction of the GRP operating under state governments.

The district forum on in 2006 partly allowed the complaint and directed the Railways to pay Rs 1 lakh to Bhola while rejecting claims of interest and compensations for damaged trousers. Appeal by the Railways was dismissed by the Uttar Pradesh state consumer disputes redressal commission in December 31, 2014. Railways appeal was also dismissed by the National consumer disputes redressal Commission on June 12, 2015.

Medical negligence

Examinations (academic)

₹75,000 for admission card delay

Aamir Khan2, June 5, 2019: The Times of India

10 yrs on, student to get ₹75,000 for admit card delay

New Delhi:

The national consumer disputes redressal commission (NCDRC) has held that the future of students cannot be risked and they cannot be put under mental agony due to delay in issuance of admit cards for exams. The consumer watchdog was dealing with a 10-year case of a student from a Delhi school who suffered mental agony and scored less after his school delayed issuing him admit card for Class XII board exam. Presiding member C Vishwanath upheld the state commission judgment granting Rs 75,000 compensation to the student, as he could not secure admission in a good college. The apex body, however, set aside the commission’s direction to the Directorate of Education to de-recognise the school.

When Akash Aggarwal was in Class XII, he failed to attend classes as he was unwell. On February 25, 2009 all students of Bal Mandir Senior Secondary School were asked to collect their admit cards from the school. However, admit cards of 12 students were withheld due to inadequate attendance and were asked to come back on February 27. Aggarwal said he fell unconscious on hearing that his admit card was being withheld. Later, Aggarwal approached a civil court, which issued a notice to the Central Board of Secondary Education (CBSE). Aggarwal claimed that due to the delay in getting his admit card, he scored less and missed out on securing a seat in a reputed college. He blamed the school management and it’s principal for his “suffering”.

The school and CBSE, on the contrary, denied the student’s claims saying he was irregular and also failed to submit a medical certificate to prove that he was suffering from dengue. The school said his attendance was 232 out of 338, and as per the CBSE rules, a student was required to have a minimum of 75% attendance. The school submitted that on February 26, CBSE was sent a list of students who had shortage of attendance. The school further said that Aggarwal’s admit card was withheld as the board had not replied on condonation of the attendance shortage.

Aggarwal first moved a district forum, which on November 11, 2011 denied any relief to him observing that he was handed over the admit card immediately after a clearance was given by CBSE.

Later, Aggarwal approached the state commission, which observed that CBSE had asked the school about shortage of attendance on February 11, 2009, but the school sent the list of such students only at 4pm on February 26, 2009. “This shows sheer negligence and deficiency on the part of the school in withholding the admit card of those whose life was at stake,” the state commission held.

Homebuyer, builder should pay same interest for default

Amit Anand Choudhary, June 13, 2019: The Times of India

Builder charging exorbitant interest from homebuyers on delayed payment is unfair: NCDRC

NEW DELHI: Forcing homebuyers to pay interest in the range of 18 per cent per annum for delay in payment of installment while the builders themselves pay a paltry 1.5-2 per cent for delay in project amounts to unfair trade practice by real estate companies which cannot be enforced, the apex consumer commission has ruled, bringing relief to homebuyers.

A bench of National Consumer Disputes Redressal Commission’s president Justice R K Agrawal and member M Shreesha said that such provisions in builder-buyer agreement are unfair and unreasonable and real estate company could not be allowed to bind home-buyers with one-sided contractual terms which protect the interests of the company at the cost of the buyers.

It said that there should be parity in the rate of interest to be paid by builders and homebuyers for not complying with the terms of agreement and suggested that the builders should be compelled to pay the same rate of interest as compensation for delay in project which they demand from buyers in case of delay in payment.

The court passed the order on a plea of a homebuyer who had booked a flat in 2012 in ‘Winter Hills 77’ residential housing project in Gurugram which was being developed by a real estate company Umang Realtech Pvt Ltd. The buyer was promised possession of the flat by December 2015 and had paid around Rs 83 lakh to the builder in different instalments. As the builder failed to deliver the project even four years after the promised dateline, the buyer sought refund of the money with 18 per cent interest per annum, at a rate at which he had paid penalty to builder for delay in payment on his part.

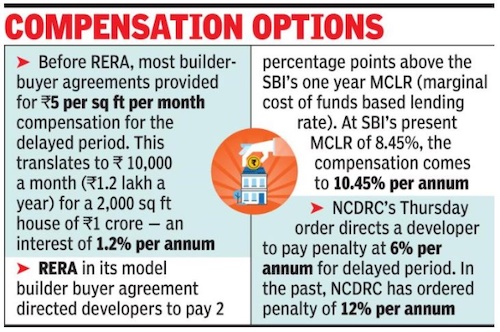

The company, however, said that it was liable to pay compensation at the rate of Rs 5 per square feet for delay as per the agreement. Rejecting its contention, the commission said, “It is also an admitted fact that the opposite party (the company) charged interest at the rate 18 per cent per annum for any delayed payments made by the purchasers and there is no justification in offering a meager Rs 5- per square feet, which comes to approximately 1.4 per cent per annum which is only a paltry percentage of what the company was charging for any delayed payments”.

“In any case, such a clause, where the seller, in case of default on the part of the buyer seeks to recover interest a 18 per cent per annum but offers only Rs 5 per square feet for any delay in delivery of possession, amounts to unfair trade practice since it gives an unfair advantage to seller over the buyer. We are of the view that such terms in clauses are extremely unfair and one-sided and fall within the definition of unfair trade practice,” the commission said.

Although the commission said if the seller is charging interest of 18 per cent per annum from buyer then logically buyer should also be paid at the same rate, it, however, directed the company to refund the money with 12 per cent interest taking into account that banks have lowered the interest rate in recent years. It also directed the company to pay compensation of Rs 1 lakh to the buyer.

Homebuyers get refund if possession is delayed beyond one year

Amit Anand Choudhary, May 16, 2019: The Times of India

From: Amit Anand Choudhary, May 16, 2019: The Times of India

Homebuyers can seek refund if flat delayed beyond 1 year: NCDRC

NEW DELHI: In a relief to lakhs of aggrieved homebuyers who are forced to wait for possession of their flats for years, the apex consumer commission has quantified a time period of one year for delayed projects beyond which investors can claim refund from builders.

Judicial forums, including Supreme Court and consumer courts, have repeatedly held that homebuyers cannot be made to wait indefinitely, but it was not clarified when refund can be claimed in case of delay. Now, the National Consumer Disputes Redressal Commission has held that buyers can seek refund if possession is delayed by one year beyond the date promised by the builder. “It is now established that allottees have the right to ask for refund if possession is inordinately delayed, particularly beyond one year,” a bench of Prem Narain said.

The court passed the order on a plea by Delhi resident Shalabh Nigam, who in 2012 bought a flat in the luxury housing project, Greenopolis, in Gurgaon being developed by Orris Infrastructure and 3C company.

Nigam had made a payment of around Rs 90 lakh against the total cost of around Rs 1 crore. As per the agreement, the flat was to be handed over within 36 months, with a grace period of six months, from the date of allotment. When the builders failed to complete the project, Nigam approached the commission through advocate Aditya Parolia, seeking its direction for either refund or time-bound possession of the flat.

As the buyer preferred to take possession of the flat, the commission directed the builder to complete the construction and hand over the flat, complete in all respects as per the agreement, by end of September 2019 after obtaining occupancy certificate.

The commission directed the builder to pay compensation at the rate of 6% per year on the total deposit for the delayed period even after handing over possession. In case of non-delivery of flat within the deadline prescribed by commission, NCDRC said the builder will have to refund the entire amount with 10% interest.

The builder had contended that the buyer had discontinued paying instalments and if refund is ordered, then there will be a forfeit of 10% of the amount as earnest money, as per the agreed clause. But the commission rejected the contention, saying instalments were paid up to the 7th stage and the payment was stopped later as there was no progress in the construction.

Though in cases of delayed projects, builders often pay compensation as per the clause in agreement which ranges from Rs 5-10 per sq feet per month, the sum is meagre in view of the large investments by buyers.

‘Refund buyers with interest equal to home loan rate’

AmitAnand Choudhary, July 8, 2019: The Times of India

In order to ensure that homebuyers recover their money, including interest paid on home loans, the National Consumer Disputes Redressal Commission (NCDRC) has said builders should refund money for delayed projects with interest at the rate at which a nationalised bank like SBI gave home loan during the corresponding period.

The apex consumer commission has said builders have to pay compensation and litigation cost to homebuyers who seek refund. In the absence of uniformity in decisions by consumer forums on interest rate, the NCDRC has said linking it with rate of interest of home loan is “appropriate and logical”.

Firm fined ₹5L, told to deposit sum in 4 weeks

The commission passed the order on a plea of 20 homebuyers who had invested around Rs 10 crore in Wave Garden housing project in Mohali in 2012. The builder — Country Colonisers Pvt Ltd — had promised to hand over possession of flats within three years but failed to complete construction in the last seven years.

“In so far as refund of the amount deposited by the complainant with the builder is concerned, there can be no two opinions. The refund in full has necessarily to be made by the builder to the complainant. In respect of the interest on the amount deposited, it is always desirable and preferable, to the extent feasible and appropriate in the facts and specificities of a case,” a bench of S M Kantikar and Dinesh Singh said.

“The rate of interest cannot be arbitrary or whimsical, some reasonable and acceptable rationale has to be evident, subjectivity has to be minimised. In our considered view, bearing in mind that the subject unit in question is a residential dwelling unit, in a residential housing project, the rate of interest for house building loan for the corresponding period in a scheduled nationalised bank would be appropriate and logical, and, if floating/varying/different rates of interest were/are prescribed, the higher rate of interest should be taken for this instant computation,” it added.

It also directed the builder to pay Rs 1 lakh as compensation and Rs 1 lakh as cost of litigation to each homebuyer. The commission slapped a fine of Rs 5 lakh on the company for indulging in unfair trade practices and directed it to deposit all the money within four weeks.

No forfeiture for cancelling delayed house

AmitAnand Choudhary, June 4, 2019: The Times of India

No forfeit for cancelling delayed house, says panel

Supertech Told To Return ₹1Cr To Buyer For 2-Year Delay

New Delhi:

The apex consumer commission has held that a homebuyer cannot be forced to forfeit any amount deposited with a builder in case he seeks cancellation of allotment of flat to delay in construction and directed real estate major Supertech to refund the entire amount of over Rs one crore to a buyer for delay of two years in delivering the house.

In order to discourage homebuyers from cancelling allotment, builders always put stringent clauses in the agreement on forfeiture of a substantial amount deposited by buyers. But the National Consumer Disputes Redressal Commission (NCDRC) held that real estate companies cannot invoke such harsh clauses in cases where the buyers are forced to seek cancellation due to inordinate delay in completion of any project.

A bench of Justice V K Jain restrained Supertech from forfeiting 15% of the cost of the unit as cancellation charges after a buyer sought refund of money as the company failed to deliver the house in its Noida housing project by December 2016 as per the agreement.

The Commission passed the order in favour of complainant Chandan Gupta who had booked a residential flat with Supertech’s project ‘ORB Towers’ in Sector 74 of Noida for a consideration of Rs 2.36 crore. As per the agreement, the flat was to be delivered to him by June 2016 or latest by December 2016 after including the grace period of six months.

As the developer failed to hand over possession within the stipulated period, the homebuyer sought cancellation of allotment and approached the Commission after the developer refused to refund Rs 1.08 cr which he had deposited so far. As the Commission directed that the amount be refunded to the buyer, the developer contended that it was entitled to forfeit 15% of the cost of the unit as cancellation charges as per clause 37 of the agreement between the parties.

The Commission, however, rejected its claim saying there was no merit in the contention. “In my opinion, the aforesaid clause would apply to a case where the allottee, for his own reasons, seeks cancellation of the allotment and does not apply to a case where he is forced to seek cancellation of the allotment and refund of the amount paid by him to the developer on account of failure of the developer to deliver possession of the house within the time period committed. Had the complainant sought cancellation of the allotment before December 2016, by which the possession was to be delivered to him even after giving benefit of the grace period to the builder, there could have been some merit in the contention. But, he having filed the complaint after expiry of the aforesaid time-line, clause 37 of the agreement would have no application,” it said.

It directed Supertech Ltd to refund the buyer within three months the entire principal amount of Rs 1.08 crore along with compensation in the form of simple interest at 10% per annum from the date of each payment till the date of refund.

Insensitivity: SC makes Shimla hospital, docs pay /2019

The Supreme Court on Thursday granted an additional Rs 10 lakh in compensation to a poor woman from the hills in a medical negligence case on finding that when she was writhing in pain, doctors at a Shimla hospital insensitively chided her by saying “people from hilly areas make unnecessary noise”.

Due to medical negligence at Ripon Hospital, Shimla, the woman’s right arm had to be amputated. The National Consumer Disputes Redressal Commission awarded her Rs 2 lakh compensation in addition to Rs 2.93 lakh ex gratia granted by the state consumer forum. She appealed in the SC and sought more compensation.

A bench of Justices A M Sapre and Dinesh Maheshwari acceded to her request and said the approach in awarding compensation should not be restrictive when the victim comes from a poor and rural background, rather in a case like this, it should be reasonably higher.

Writing the judgment, Justice Maheshwari said, “Grant of reasonably higher amount of compensation in the present case appears necessary to serve dual purposes: one, to provide some succour and support to the appellant against the hardship and disadvantage due to amputation of right arm; and second, to send the message to professionals that their responsiveness and diligence has to be equi-balanced for all their consumers and all human beings deserve to be treated with equal respect and sensitivity.

“We are impelled to make these observations in the context of an uncomfortable fact indicated on record that when the appellant was writhing in pain, she was not immediately attended to and was snubbed with the retort that ‘people from hilly areas make unnecessary noise’. Such remarks, obviously, added insult to injury and were least expected of professionals on public duty.

“When the appellant is shown to be a poor lady from rural background, her contribution in ensuring the family making both ends meet also deserves due consideration... the amount of compensation ought to be of such level as to provide relief in reasonable monetary terms to the appellant...”

Justice Maheshwari said, “We are of the view that the appellant deserves to be allowed further an amount of Rs 10 lakh towards compensation, over and above the amount awarded by the state commission and the national commission.... it is also considered proper to grant three months’ time to the respondents (hospital and doctors) to make the requisite payment and else, to bear the burden of interest.”

Ruling in a case of medical negligence, the SC granted Rs 10 lakh in compensation, over and above what consumer forums had awarded, to a poor woman from the hills on finding that when she was writhing in pain, doctors at a Shimla hospital insensitively chided her by saying ‘people from hilly areas make unnecessary noise’

National Consumer Disputes Redressal Commission (administrative issues)

2014-17: declining disposal rate

From: Dipak Dash, Consumer plaint disposal drops as case flow surges, December 27, 2017: The Times of India

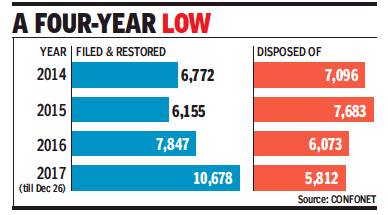

The disposal of cases filed in the National Consumer Disputes Redressal Commission (NCDRC), the country’s apex consumer commission, is at its lowest in four years while the number of cases has hit an all-time high.

According to details available on the central online database of consumer forums (CONFONET), the number of cases disposed of by the NCDRC was 5,812 till Tuesday, against 10,678 cases filed and restored during the year. The share of restored cases, the ones not inititally pursued by complainants but which they later sought to resolve, is low, at nearly 300.

Raising concerns over the dwindling number of cases disposed of in comparison to the number of complaints filed, NCDRC president Justice D K Jain had recently said he was disheartened that people were not getting the relief they expected when approaching the commission. “The increase in cases filed indicates that the consumers have become more aware... But we are not meeting their expectation. This disheartens me,” Justice Jain said on national consumer day.

Ideally, every case filed in the forums must be disposed of in three to six months. But in 2017 the average period between two hearings in the NCDRC has been more than three months. “The consumer forums were created for quicker redressal of consumer disputes. But these have become like normal courts and the purpose gets defeated if people have to wait for years to get relief,” said consumer rights activist Bejon Mishra.

One of the reasons for the drastic fall in disposal of cases has been the four vacancies for members that the government is struggling to fill. Considering this serious situation, the Supreme Court recently extended the retirement of members and its chairman by three months to give more time for the government to find replacements.

The biggest impact of low disposal has been on flat buyers. According to CONFONET data, 60% of the cases filed are from the housing sector, followed by insurance, banking and medical sectors. “People moved the NCDRC hoping to get quick justice. But long adjournments have dashed our hopes,” said Gaurav Prakash, who is involved in an online campaign to strengthen the apex consumer commission.

National Consumer Disputes Redressal Commission (decisions)

Aeroplane accidents

SC enhances NCDRC award

Stanly Pinto, May 21, 2020: The Times of India

The Supreme Court has enhanced the compensation awarded to the next of kin of a man who was killed when an Air India Express flight from Dubai crashed on landing in Mangaluru on May 22, 2010 from Rs 7.35 crore to Rs 7.64 crore.

Mahendra Kodkany’s wife and children will now get Rs 7.64 crore plus 9% interest per annum (on the amount yet to be paid). The compensation awarded by the National Consumer Disputes Redressal Commission was Rs 7.35 crore with 9% interest.

The family’s advocate, Yeshwanth Shenoy, said this is the highest amount awarded to any of the victims.

‘Assess income on the basis of entitlements’

The accident, in which the aircraft overshot the runway, went down a hillside and burst into flames, killed 158 of the 166 passengers on board. While enhancing the compensation, an apex court bench of Justices DY Chandrachud and Ajay Rastogi said it was unable to accept the reasons cited by NCDRC in making a deduction from the salary of the victim while calculating compensation. Kodkany was the regional director for the Middle East for a UAE-based company.

“The bifurcation of salary into diverse heads may be made by the employer for a variety of reasons. However, in a claim for compensation arising out of the death of the employee, the income has to be assessed on the basis of the entitlement of the employee,” the order said. The court also held that Kodkany had been a confirmed employee entitled to adequate weightage in terms of determination of compensation in the event of untimely demise.

Haj pilgrims are not consumers

Setting a precedent, the National Consumer Disputes Redressal Commission has held that Haj pilgrims are not consumers as the Haj Committee of India is operating without any motive of profit. The ruling came on a complaint of a father-and-son duo and the Haj Committee of India where the duo claimed that they had been overcharged and provided with an accommodation facility inferior than what they desired for in Saudi Arabia.

Hotels are liable for car thefts

Dipak Dash, At owner’s risk? Hotel liable for car theft: Panel, February 6, 2018: The Times of India

The mere mention of ‘at owner’s risk’ on the parking tag does not absolve a hotel of liability if a vehicles goes missing from its parking space and it will be construed as ‘negligence’, the country’s apex consumer commission ordered.

The order was passed by single-member bench of M Shreesha while hearing the case of a Maruti Zen being stolen from the parking lot of Taj Mansingh Hotel in Delhi in August 1998 after the car owner left it at the valet parking. Holding the hotel responsible, the National Consumer Disputes Redressal Commission (NCDRC) ordered it to pay Rs 2.8 lakh to United India Insurance Company, which had insured the car, and pay interest at 9% from January 28, 1999.

One Sapan Dhawan had gone to the hotel on August 1, 1998 to have dinner at 11 pm and had given the keys to the parking man. He had received a parking slip. When he retuned after dinner two hours later and asked for the key, he was informed that his car was driven away by some unknown person.

The hotel had denied any negligence on its part when Dhawan sought Rs 5.3 lakh as compensation. He approached the Delhi state commission, which ordered Rs 2.8 lakh compensation to the insurance company and Rs 1 lakh to Dhawan. Though the hotel paid Dhawan, it challenged the order in NCDRC.

The hotel argued there was no negligence on its part and the parking slip clearly mentioned the vehicle was being parked at the request of the guest at his own risk.

But the NCDRC observed that as per the doctrine of ‘infra hospitium’, the hotel’s ‘duty of care’ towards guests’ vehicle does not stop with mere parking of the vehicles.

“...When the parking tag is issued in the name of the hotel, it can be reasonably inferred by the ‘car owner’ that the car would be in the ‘duty of care’ and custody of the hotel, which in this case, it failed to exercise and is held liable to pay damages,” NCDRC member Shreesha said.

Patients treated free can sue for negligence

Patients treated free of charge at government hospitals fall under the definition of ‘consumers’ and cases can be filed in consumer forums against hospitals for negligence, country’s apex consumer forum NCDRC has said.

Holding the district medical officer and in-charge of Government Bangar Hospital in Rajasthan’s Pali district guilty of negligence, resulting in the death of a road accident victim in 2001, the National Consumer Disputes Redressal Commission (NCDRC) ordered Rs 10 lakh penalty on the hospital. The order was passed by a bench comprising president Justice D K Jain and member M Shreesha on Tuesday.

Ramesh Chand Vyas, a former commissioner of Pali municipal council had succumbed to injuries four days after he was admitted to the hospital in June 2001.

The counsel of the respondents had argued that the complaint does not fall within the definition of consumer under the Consumer Protection Act as the patient was in a government hospital and he was treated free of cost. The NCDRC bench referred to a 1995 judgment of the Supreme Court which had observed that “free service would also be ‘service’ and the recipient a ‘consumer’ under the Act.”

The petitioner had alleged that Vyas was admitted in the trauma ward of hospital. It was pleaded that despite repeated requests from the relatives and attendants, ultra sonography and other necessary pre-investigative tests were not performed and the diagnosis was not even explained to the patient.

Power for agriculture: MSEDCL to pay/ 2009, 2018

₹12L Awarded In 2014 With ₹1,000/Day Fine & Interest Forms Payout

A farmer from Latur, Prakash Kerba Raut, will get a payout from the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) for its delay in providing him a power connection for an agriculture pump in 2009.

The National Consumer Disputes Redressal Commission on Friday dismissed MSEDCL’s appeal against the state commission’s verdict that had in 2016 upheld the Latur forum’s order asking the power distribution firm to pay Raut Rs 12 lakh and a Rs 1,000 per day fine for the delay of over a year.

However, while the fine was to be paid for the period between August 31, 2010 and November 30, 2011 under sections of the Electricity Act, Raut has quoted provisions of the same Act to claim a payout of Rs 90 lakh.

A senior MSEDCL official said the firm was unaware of the National Commission’s order and Raut’s Rs 90 lakh claim. “Once we receive the order, we will study it and respond to the claim,” the official said.

Raut had on February 17, 2009 applied for an electric connection and on March 3 paid Rs 7,170 in response to a quotation supplied by MSEDCL. As MSEDCL assured Raut that he would be provided the connection within 30 days as per the Electricity Act, 2003, the farmer said he kept his 10 acres of land ready for sugarcane plantation. When there was no response from the power firm even after a series of reminders had been issued, Raut moved the Latur district consumer forum, which passed an order in his favour on July 17, 2014.

The MSEDCL then filed an appeal before the Aurangabad bench of the Maharashtra State Consumer Disputes Redressal Commission. The state commission on February 15, 2016 upheld the order passed by the Latur forum and asked MSEDCL to pay the fine and compensation to Raut as per provisions of the Electricity Act.

“The Latur District Consumer Forum has rightly held that after completion of formalities by Raut, the MSEDCL failed to release the electric connection and thereby committed breach of the provision of Section 43(1) of the Electricity Act and asked MSEDCL to pay penalty charges in accordance with the law. We find no infirmity or illegality in the Latur Forum order; hence no interference is warranted,” judicial member S M Shembole observed in his order. After this the MSEDCL moved the National Consumer Disputes Redressal Commission.

Raut claimed on Saturday that since MSEDCL has lost the case at all forums, he is entitled for compensation of Rs 90 lakh for inordinate delay in providing him a power connection. Quoting the Act, he claimed that MSEDCL will have to pay him the fine of Rs 12 lakh along with nine per cent interest and in addition to this, compensation of Rs 1,000 per day. Further, he has claimed if MSEDCL fails to implement an order passed by a commission, then besides a fine of Rs1 lakh (for failure to implement order), it would have to pay compensation of Rs 6,000 per day. “I demand that the entire amount be recovered from the salary of assistant engineer and executive engineer,” Raut said.

Salon to pay ₹2cr for ruining model’s haircut

Saurabh Sinha, Sep 24, 2021: The Times of India

If it wasn’t for the sum involved, one could perhaps joke that the salon operator was having a bad hair day. But Rs 2 crore is not a trifling sum and that is what the salon has to pay a model as punitive award for a haircut that allegedly wasn’t what she had hoped for.

National Consumer Disputes Redressal Commission (NCDRC) awarded this sum to the model on Tuesday for allegedly deficient services at a salon in a five-star hotel in Delhi in April 2018.

Justifying the award, NCRDC president RK Agrawal and member S M Kantikar held in their order that “…women are very cautious and careful with their hair. They spend a handsome amount on keeping hair in good condition. They are also emotionally attached with their hair. The complainant was a model for hair products because of her long hair... But due to hair cutting against her instructions, she lost her expected assignments and suffered a huge loss which completely changed her lifestyle and shattered her dream to be a top model.”

The model visited the salon on April 12, 2018, a week before she was to appear for an interview. Her regular hairdresser was unavailable that day and some other stylist apparently took over. The order noted, “According to the complainant, she specifically instructed the hairdresser for long flicks/layers covering her face in the front and at the back and four-inch straight hair trim from the bottom. It is alleged in the complaint that the complainant was wearing high-powered spectacles and was requested by the hairdresser to keep her head constantly down.”

While the model wanted a “simple haircut”, the hairdresser allegedly took over an hour on the task. Told she was getting a “London” haircut. The complainant was left in “utter shock and surprise”, when the hairdresser allegedly “chopped off her entire hair, leaving only four inches from the top”.

The haircare model complained to the salon management and was offered hair extension treatment for the interview or treatment of hair “free of cost.” On May 3, the model returned to the salon, but alleged later that “during treatment, her hair and scalp got completely damaged with excess ammonia and there was lot of irritation in the scalp”.

The NCRDRC order noted that the model “underwent severe mental breakdown and trauma due to negligence in cutting her hair and… finally lost her job”, and directed the hotel to pay her Rs 2 crore within eight weeks of the order.

Rights of consumers

2019: five new rights

Dipak Kumar Dash, August 22, 2019: The Times of India

With the passage of the Consumer Protection Bill in Rajya Sabha on Tuesday, consumer rights are set to receive a massive boost. The new regulations put more responsibility on companies for misleading advertising and faulty products. In a global first, it also lays out penalties for celebrities endorsing or promoting false advertising and adulterated goods. TOI explains how consumers stand to benefit from the new legislation...

1. RIGHT TO FILE A COMPLAINT FROM ANYWHERE

The new law empowers you to file a complaint with the District Consumer Commission or State Consumer Commission from your place of residence or work instead of the present practice of consumer filing case at place of purchase or where the seller has its registered office. This will reduce harassment of consumers. A complaint can also be filed at the district commission by a recognised consumer body or by multiple consumers with the same interest. Consumer affairs ministry will frame rules for filing of complaints electronically and will also specify norms for paying the required fee digitally.

2. RIGHT TO SEEK COMPENSATION UNDER PRODUCT LIABILITY

A complainant can file a case against a product manufacturer or seller for any loss caused to him or her on account of a defective product. This applies to all services as well. The manufacturer shall be held liable if there is a manufacturing defect or if there is deviation from the manufacturing specifications or the product does not conform to the express warranty The new law recognises “sharing personal information of consumers” as an unfair trade practice. The provision brings e-commerce under its ambit.

3. RIGHT TO PROTECT CONSUMERS AS A CLASS

A complaint relating to violation of consumer rights or unfair trade practices or misleading advertisements, which are prejudicial to the interests of consumers as a class, may be forwarded either in writing or in electronic mode, to any one of these authorities — the district collector or the commissioner of regional office or the Central Consumer Protection Authority (CCPA) for class action.

4. RIGHT TO SEEK A HEARING THROUGH VIDEO CONFERENCING

The law says every complaint shall be heard by district commission on the basis of an affidavit and documentary evidence placed before it. If an application is made for hearing or for examination of parties through video conference, the commission can allow this.

5. RIGHT TO KNOW WHY A COMPLAINT WAS REJECTED

The commission cannot reject a complaint without hearing the complainant. The commission has to decide about admitting or rejecting a complaint within 21 days. If the commission doesn’t decide within the time limit, it shall be deemed to have been admitted. If the consumer commission finds that a settlement is possible, it can direct both the parties to give their consent to have the dispute settled through mediation.

- Endorser exercised due diligence to verify the veracity of the claims made in the advertisement regarding the product or service being endorsed by him/ her

- Publisher/advertiser published or arranged for the publication of such advertisement in the ordinary course of his business

WHAT'S STILL GREY

Who will address healthcare

The government removed healthcare as one of the services to make the bill 'non-controversial'

Too many regulators

While the CCPA will be a central regulator for consumer issues, there are other regulators for various sectors (like telecom, insurance), which leaves the scope for overlapping jurisdictions and confusion. Some activists have said that the multiplicity of options to complain — consumer courts, councils, sector regulators — will also end up confusing consumers.

Commissions need to be manned

The law proposes a 21-day deadline for hearing complaints, but 118 posts of president of consumer commissions and 362 posts of commission members are lying vacant in 596 districts.

ADULTERATION

No injury to consumer - Up to 6 months jail with up to Rs 1 lakh fine

Causes injury - Up to 1 year in jail & fine up to Rs 3 lakh Grievous injury - Up to 7 years in jail & fine up to Rs 5 lakh

NON COMPLIANCE

Failure to comply with order of CCPA - Up to 6 months in jail / jail with fine up to Rs 20 lakh or both

Failure to comply with orders of district, state or national commission - Jail from 1 month - to 3 years / jail with fine from Rs 25,000 up to Rs 1 lakh or both

Maximum retail price (MRP)

Applies to multiplex, airport shops, too

Dipak Dash, Dec 1, 2016: The Times of India

`Multiplex, airport shops must follow normal MRP'

There cannot be two maximum retail prices (MRPs) for the same packaged item within a state, the consumer affairs department has said in its advisory to state governments. This means that not just bottled water, but all packaged items, including beverages, cannot be sold at two different MRPs in shops, multiplexes or airports.

“There is no dual MRP provision in the packaged commodity rules and hence state governments must ensure that no one sells packaged items at different prices within a region. In case of different MRPs, the lowest one will be treated as the actual price,“ a senior department official said. He said while there were orders from the National Consumer Disputes Redressal Commission (NCDRC) that no one could sell bottled water at different MRPs, including at malls, cinema halls and airports, it actually applied to all packaged items.

The department is also writing to state governments to carry out verification of net content of bread at manufacturing units. The step is being taken after the department received complaints of how the actual weight of bread was less in many cases against what the manufacturers declared.

“As per our norms, the net weight difference can be 4.5 grams. But there were complaints that bread makers were not complying with the norms. The states are empowered to inspect, verify and take action. We expect the manufacturers to comply with the specified rules and ensure consumers get products of the right weight for which they are paying,“ the official said.

SC: restaurants can charge more for packaged water

The government will file a review petition before the Supreme Court after its order allowed hotels and restaurants to charge more than the maximum retail price (MRP) for mineral and packaged water bottles.

The consumer affairs department will cite the latest change in rules, done specifically to bring such ‘institutional consumers’ under the ambit of the law. The law had specified that items procured in bulk for their own use could

not be sold as retail items. The modified rule was notified on June 23 and will come into effect from January 1.

In its order, the SC had said that provisions of legal metrology rules for retail sale of packaged commodities would not apply to institutional consumers such as hotels. It had ruled that neither the Standards of Weights and Measures Act or the Legal Metrology Act would apply so as to prohibit the sale of mineral water in hotels and restaurants at prices which were above the MRP.

The court had observed that a client would order nothing beyond a bottle of water or a beverage, but his direct purpose in doing so would clearly travel to enjoying the ambience available therein and incidentally to the ordering of any article for consumption.

Procedure for filing appeals

SC: 50% of award to be deposited for filing appeal

Amit Anand Choudhary, Dec 8, 2021: The Times of India

NEW DELHI: The Supreme Court on Tuesday held that pre-deposit of 50% of the award granted by a state consumer commission is mandatory for filing an appeal in the National Commission which can also direct a party to deposit the entire amount before staying the order of the state forum.

A bench of M R Shah and B V Nagarathna held that the pre-deposit condition has no link with the grant of stay by the National Commission which can direct the party to deposit any amount higher than 50% or the entire amount of as a condition to stay the operation of the state commission order.

The court passed the order on a plea by a batch of real estate companies challenging the orders of the National Commission directing them to deposit the entire amount which they were directed to refund to aggrieved homebuyers before staying the orders. They contended that as per Section 51 of the Consumer Protection Act, the parties cannot be directed to deposit more than 50% of the decretal amount before the National Commission.

“It is the pre-condition to deposit 50% of the amount as ordered by the state commission before the appeal is entertained by the National Commission. Therefore, it is a condition precedent to deposit 50% of the amount before his appeal is entertained by the National Commission. However, that does not take away the jurisdiction of the National Commission to order to deposit the entire amount and or any amount higher than 50% of the amount while considering the application to stay the order passed by the state commission,” the bench said. “Pre-deposit of 50% of amount as ordered by the state commission under second proviso to Section 51 ofthe Consumer Protection Act...,” it said.

Relief under consumer law

It is in addition to court cases: SC

The Supreme Court has said nursing homes without an intensive care unit facility cannot carry out surgeries because ab sence of an ICU poses danger to the patient's life.

A bench of Justices Adarsh Kumar Goel and U U Lalit gave the ruling on a petition filed by Bijoy Kumar Sinha, who lost his wife due to the alleged medical negli gence of Dr Biswanath Das who conducted a hysterectomy surgery at Ashutosh Nursing Home in Kolkata.The nursing home did not have an ICU facility. The Supreme Court's ruling in a case, based on a plea filed by a man who lost his wife due to alleged medical negligence of a doctor who had conducted a surgery on her at a Kolkata nursing home which didn't have an ICU, has implications for beleaguered homebuyers of Jaypee Infratech projects.

The petitioner, Bijoy Kumar Sinha, died while fighting a lengthy 23-year-long litigation over his wife's death, in consumer forums before his son Soumik pursued the case to get justice for his mother in the Supreme Court.

The SC said that the Consumer Protection Act was an additional remedy , thereby indicating that proceedings against a realtor under the Insolvency and Bankruptcy Code 2016 wouldn't bar recourse to parallel action in consumer forums. This will boost hopes of all homebuyers facing harassment at the hands of truant realtors.

A bench of Justices Adarsh Kumar Goel and U U Lalit said, “Provisions of the Consumer Protection Act, 1986, are in addition to and not in derogation of any other law. Thus, the Act provides for additional remedies. The authorities under the Act exercise quasi-judicial powers.The award of damages (in the case filed by Sinha) is aimed at bringing about qualitative change in the attitude of service providers.“

While absolving Dr Biswanath Das of medical negligence for deciding to perform surgery on Sinha's wife, the court awarded a compensation of Rs 5 lakh to Soumik.

This ruling means that even if a realtor has been proceeded against under the Insolvency and Bankruptcy Code, people won't be barred from taking recourse to consumer forums to claim relief for deficient services.

The apex court said though an alternative dispute redressal mechanism for settlement of disputes outside courts was applicable only to civil cases, “there is no reason to exclude its applicability to consumer fora“.

“It will be open to the national commission and the state commissions to coordinate with the national legal services authority and state legal services authorities for settlement of disputes by resorting to alternative dispute redressal mechanism,“ the Supreme Court said.

RTI: Information under, sought by applicants

Jan 12 2015

Applicant seeking info under RTI Act is not a consumer

Jehangir B Gai

There were conflicting judge ments of the National Commission as to whether an applicant seeking information under the RTI Act would be a consumer or not. Certain two member benches had held that an RTI applicant who pays fees for the information would be a consumer, while other benches held a consumer complaint would not be maintainable since the RTI Act provides its own channel of appeals. Hence, a three member bench was constituted to settle the law.

The National Commission addressed itself two issues. Firstly , whether a person seeking information under RTI Act can be addressed as a consumer. If it is held that he is a consumer, can a complaint be filed under the Consumer Protection Act, or would this remedy be barred by the provisions of the RTI Act.

The Commission observed that an applicant under the RTI Act is required to pay fees along with the application seeking information. Thereafter, at the time of being provided the information, the applicant is charged further fees towards the cost of providing the information.Hence the information is provided on payment of consideration.

However, the legislative intent is equally important. Citizens have a right to know every public act, everything that is done in a public way by their public functionaries, which right is derived from the concept of freedom of speech. The RTI Act has been passed with this objective, so that citizens can access public information. The RTI Act is a complete code in itself, which provides an adequate and effective remedy to the person aggrieved by any decision, inaction, act, omission or misconduct of a Public Information Officer. Not only does the RTI Act provide for two ap peals, but it also provides for a complaint to the Central or State Information Commission, as applicable, in case the information sought is not furnished within the prescribed time. The Central or State Information Commissioner can impose penalty upon the errant Information Officer, and also recommend disciplinary action against him. He can also award suitable compensation to the applicant. If a person is still aggrieved, he can approach the concerned high court by way of a writ petition. In fact, several writ petitions are pending in the high courts against the orders passed by the Information Commissions.

The National Commission observed that it is a settled legal proposition that when a right is created by a statute which also provides for an adequate and satisfactory remedy to enforce that right, a person must avail of the mechanism available under the relevant Act. The Public Information Officer is actually discharging a statutory function and not rendering any services. Besides, section 23 of the RTI Act bars the jurisdiction of courts.

By its order of 8.1.2015, the National Commission concluded that it is not permissible to have two parallel machineries for enforcement of the same rights created by the RTI Act which a special statute. If a consumer complaint is permitted, it would defeat the purpose of providing a special mechanism under the RTI Act.

An RTI applicant is not entitled to file a consumer complaint for deficiency in service. He must follow the appeal procedure prescribed under the RTI Act.

'Sales’ at discounted prices

VAT/ other duties on the discounted price

No VAT on items sold at a discount: Consumer body, Feb 3, 2017: The Times of India

The National Consumer Disputes Redressal Commission has held that shops selling goods at 40% discount cannot charge VAT or any other duty on the discounted price. It said that the rebate was on the MRP, which includes all taxes and cess as per Section 2(d) of Consumer Goods Act.

The NCDRC order came last month after state forums had rejected the plea of Woodland franchises in Chandigarh and Delhi that had refused to refund VAT charged to customers on jackets sold at `flat 40% discount'. The amount in dispute was Rs 119.85, which was the VAT charged on a jacket bought at 40% discount on an MRP of Rs 3,995.