Company directors: India

This is a collection of articles archived for the excellence of their content. the Facebook community, Indpaedia.com. All information used will be acknowledged in your name. |

Contents |

Age

If above 70...

Incumbent directors above 70 need 75% shareholders' nod to stay: HC The Times of India, Feb 19 2016

Reeba Zachariah & Boby Kurian India Inc's septuage narian leaders have to clear another hurdle to continue in corporate boardrooms. The Bombay high court, in a recent order, has ruled that incumben directors who are 70 years old and above will face automatic disqualification if they are no elected by a special resolution and supported by three-fourths of the shareholders. The order, by justices V M Kanade and Shalini Phansal kar-Joshi, with regard to Srid har Sundarajan vs Ultramari ne & Pigments, stated that a person who was appointed MD before April 1, 2014, when he was below 70, can continue to be on the board after turning 70 only if the company passes a special resolution to that effect. The ruling has created a flutter in corporate boardrooms with companies examining its implications.

About 100 directors, aged 70 to 73, will now be forced to seek reappointment through a special resolution. Moreover, in an era of growing shareholder activism, it may not be easy to secure an approval for directors of companies where promoter holdings are low .

The court order follows the new Companies Act that prescribes that board members, including chairman and directors, who have attained 70 years, will have to be elected by a special resolution and with 75% shareholder approval. The rule, which came into force on April 1, 2014, lacked clarity whether it impacted the tenures of those already elected.

“The order makes it clear that the rule is applicable prospectively ,“ said Viral Shukla, lawyer at Shukla & Associates.

Some of the well-known senior executives who will be im pacted include N Srinivasan (71), VC & MD, India Cements; Pracheta Majumdar (71), director, Birla Corp; Jawahar Lal Oswal (72), CMD, Monte Carlo; and Suneel Advani, CMD, Blue Star Infotech.

“We are examining the or der. We are in the process of obtaining legal opinion,“ said an India Cements spokesperson.

The rationale behind the approval through special resolutions is to have younger board members, but at the same time have experienced heads provided a majority of the shareholders feel that such people can add value to the company .

“The regulators -MCA and Sebi -should immediately put out a clarification on the Companies Act, and hold companies responsible for noncompliance. Companies have chosen to ignore this nuance of directors' age limit. Minority shareholders' interest and rights cannot be taken for granted,“ said Shriram Subramanian, MD, InGovern Research, a proxy advisory firm.

Director Identification Number (DIN)

Surrendering DIN is almost impossible/ 2018

Lubna Kably, Tough for directors to give up ID no.s, September 22, 2018: The Times of India

From: Lubna Kably, Tough for directors to give up ID no.s, September 22, 2018: The Times of India

‘DIN’ Deactivation Only Way Out, Experts Seek Govt Nod For Voluntary Surrender

Once you have obtained a director identification number (DIN), it sticks to you like a shadow and — barring limited circumstances — you cannot voluntarily surrender it. Several corporate law experts hold that former directors, who have no wish to continue on other boards, should be allowed to surrender their DIN. Ongoing compliance is especially challenging for erstwhile foreign directors.

A recent news item that the government has decided to deactivate the DINs of as many as 21 lakh directors was followed by a frenzy of messages on social media groups. The reason? After September 15, which was initially set as the last day for the KYC compliance, several top political leaders and a few Bollywood superstars had their DIN deactivated. TOI verified this and also noted that these individuals were no longer directors on the board of any company, including those once promoted by them.

A few days later, the government gave defaulting directors another chance — KYC details can now be filed by October 5, with a fee of Rs 500 (reduced from Rs 5,000). According to industry watchers, this extension may get a lukewarm response.

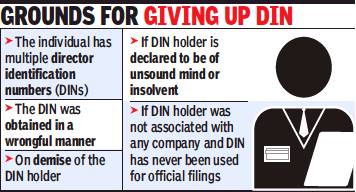

Rule 11 of the Companies (Appointment and Qualification of Directors) Rules, 2014, is restrictive when it comes to surrender of a DIN (see graphic). J Sundharesan, founder of a firm of practising company secretaries, points out, “As regards voluntary surrender, a DIN holder can do so only if he/she has never been associated as a director in any company and the said DIN has never been used for filing of any document with any authority.” But such instances are rare, and holding a DIN comes with its annual KYC filing obligations and intimation of any change in particulars such as address.

“Some individuals may have obtained a DIN in specific circumstances which no longer apply, such as acting as a first director to facilitate company incorporation. Or by a foreign national on secondment as an MD to India for a limited duration, who may now have moved on, or by a director of a company which has been liquidated. Even if these individuals have no intention to act as directors in other Indian companies, under current law they all still need to make filings and maintain their DINs,” explains Bharat Varadachari, partner and national leader (global compliance) at EY India.

While the annual form is to be e-filed, both Varadachari and Sundharesan say that erstwhile foreign directors face greater compliance challenges, such as notarisation of identification documents.

“If an individual chooses not to be a director, he/ she should have the ability to surrender DIN and all formalities that go alongside. Perhaps here a distinction should be made in regards to executive and non-executive directors. Of course, DIN records would exist to take care of past activities,” says Simone Reis, leader (M&A) at law firm Nishith Desai Associations.

But there are practical issues. “Once DIN is surrendered, the corporate affairs ministry’s database may show no past association with any companies and stakeholders like creditors, shareholders, foreign investors, various authorities will face challenges in identifying directors in companies where noncompliance or frauds have occurred. An option like keeping the DIN dormant or inactive for filing can be considered,” suggests Vedashri Bhilare, partner at GHV & Co, a firm of practising company secretaries.

On the flip side, Shankar Jaganathan, CEO at Cimply-Five Secretarial Services, does not view the inability to surrender as a material issue. Holding a DIN does not prevent anyone from undertaking other roles, is his take.

Directors’ liabilities

Directors can’t be booked because firm violated law: SC

Dhananjay Mahapatra, Nov 6, 2021: The Times of India

The Supreme Court has asked investigating and prosecuting agencies not to proceed mechanically against directors of errant companies merely because of the post held and said such avoidable prosecution leads to humiliation and loss of reputation in society.

Quashing prosecution and summons issued to a director of a company, which allegedly failed to pay minimum wages to some workmen, a bench of Justices R S Reddy and Sanjiv Khanna said, “A person cannot be prosecuted and punished merely because of their status or position as a director, manager, secretary or any other officer, in a company unless the offence in question was committed with their consent or connivance or is attributable to any neglect on their part.”

The important clarification will offer relief to persons holding these positions.

Liability only when offence done with consent, rules SC

Section 22C of the Minimum Wages Act provided that “if the person committing any offence under this Act is a company, every person who at the time the offence was committed, was in charge of, and was responsible to, the company for the conduct of the business of the company as well as the company shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly”.

It said the exact role of the officer proceeded against must be delineated by the prosecution. The SC said vicarious liability would be attracted only when the offence was committed with the consent, connivance, or is attributable to the neglect on the part of a director, manager, secretary, or other officer of the company and not merely because the person holds a responsible post in the company.

Justices Reddy and Khanna said that arresting directors and officers of a company, without them having even any remote role in the perpetration of the alleged violation of law by the company, is fraught with serious consequences and must be avoided at all costs.

“Initiation of prosecution and summoning of an accused to stand trial has serious consequences. They extend from monetary loss to humiliation and disrepute in society, sacrifice of time and effort to prepare defence and anxiety of uncertain times. Criminal law should not be set into motion as a matter of course or without adequate and necessary investigation of facts on mere suspicion, or when the violation of law is doubtful,” the bench said.

“It is the duty and responsibility of the public officer to proceed responsibly and ascertain the true and correct facts. Execution of law without appropriate acquaintance with legal provisions and comprehensive sense of their application may result in an innocent being prosecuted,” it said.

A person cannot be prosecuted and punished merely because of their status or position as a director, manager, secretary or any other officer, in a company unless the offence in question was committed with their consent or connivance or is attributable to any neglect on their part —SC Bench

Educational qualifications

2017

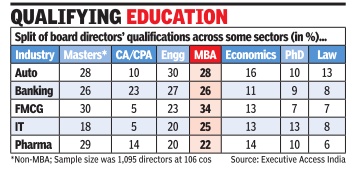

Namrata Singh, Over 25% of India Inc's directors have an MBA, June 26, 2017: The Times of India

Given the popularity of an MBA degree in India, an MBAMBA-equivalent is the most commonly held qualification among directors on boards of companies. A study by executive search firm Executive Access India -done exclusively for TOI -says more than a quarter (26%) of directors, on an average, hold an MBAMBAequivalent degree, followed by a non-MBA master's degree (22%). An engineering degree comes in third with only a fifth of board members holding such an educational qualification.

In terms of subjects of specialisation, economics stood out with around 10% having either a graduate or higher degree in the subject. In what reflects poorly on diversity on boards, nearly half the directors (47%) across industries were specialists in their respective fields. Retail and financial services have close to 67% of directors with significant experience within their respective industries.

While most corporate boards are seen to be taking measures to move the needle with respect to gender diversity , the Executive Access study covering 1,095 directors across 106 companies from across industries reveals a lack of general diversity on boards with respect to education, age and region. Auto industry had the highest composition of engineering graduates (30%) as directors, while in FMCG, 34% directors had MBA degrees. In banking, chartered accountants (CAs) held almost 30% of board positions.

Retail saw the lowest percentage (11%) in master's degree (not including the MBA), while it was the highest for the MBAMBA-equivalent (38%), indicating a strong preference for MBAs on the boards of these companies. Hotels, on the other hand, saw the lowest MBA degree holders (14%), engineering degree holders (6%) and PhD holders (2%).

Ronesh Puri, MD, Executive Access India, said, “Moving towards diverse boards is the next stage of evolution for organisations as they face bigger challenges of disruptions going for ward. Boards need to help the management to innovate more and faster as shelf life of any product or service is reducing fast. For ensuring this, boards will get better outcomes when they have more diversity of backgrounds and mindsets.“

Among companies with greater board diversity , Dr Reddy's Laboratories (DRL) had the highest representation of people from different industry backgrounds. As against the industry average of 35% of board directors with non-pharma background, DRL has 60%. Bajaj Finserv has a mix of 80% directors from the non-finance space while the industry average is at 35%. ICICI Prudential's board is composed of 42% engineers while the industry average is only 15%.

As against the FMCG industry average of 5% CA directors, Nestle has almost 30% of CAs on its board. A Nestle In dia spokesperson said the company's policy is to have broad experience and diversity on the board of directors, which embraces knowledge and understanding of relevant diverse geographies, people and their background, diverse culture, personality and work-style.

Rajeev Dubey , group president (HR & corporate services), Mahindra Group, said, “There are many dimensions of board diversity and education mix is just one of them. The other dimensions could be business experience, functional expertise, age, gender and nationality .“

Independent directors

2019: e-registration, training proposed

Sidhartha, May 8, 2019: The Times of India

From: Sidhartha, May 8, 2019: The Times of India

Independent directors face mandatory e-registration

Corp Affairs Ministry Plans Voluntary Training Modules

New Delhi:

All independent directors may have to register as part of a new initiative by the ministry of corporate affairs (MCA), which also plans to introduce online training modules on various issues that these board members deal with. While registration is proposed to be made mandatory through an online facility, the training through electronic modules, that are being prepared by Indian Institute of Corporate Affairs, will be purely voluntary.

The registration process will be in addition to the Directors Identification Number, where a KYC process was recently undertaken. Sources told TOI that a corporate boss or a promoter, who may be an executive director on the board, will also have to register if he or she is an independent director on the board of another company.

“This will also help create a database that can be used to get the best talent available in the industry,” said an official. Sources said that registration is already provided for in the Companies Act. The move follows earlier efforts by the ministry to put in place a screening mechanism for independent directors after several Indian companies led by IL&FS were hit by a series of irregularities and the role of several individual had come under the scanner. In fact, provisions related to disqualification of directors was also discussed.

MCA had proposed an overhaul of the process to appoint independent directors, with many agencies also suggesting a review mechanism, but the proposals failed to get the green light from an informal group of ministers that discussed ways to improve corporate governance in Indian companies. In 2013, the government had mandated independent directors for all companies and many believe that the rush to find members resulted in the appointment of several individuals, who were not fully conversant with accounting techniques and basic rules.

The 2021 norms

June 30, 2021: The Times of India

In an attempt to give more power to non-promoting shareholders in a company, markets regulator Sebi said that two-thirds of the members of the nomination & remuneration committee (NRC) and the audit committee (AC) of the board of a listed company should be independent directors. Currently, rules say that a majority of the members of these two important committees of the board should be independent directors.

In its Tuesday’s board meeting, Sebi also said that an appointment of an independent director should be approved by shareholders within three months or through an AGM, whichever is earlier. The appointment should be through a special resolution, one that would need the nod of at least 75% of the shareholders.

Sebi further said that if an independent director resigns from the board, the company should disclose to the exchanges the full content of the letter of resignation of that director. It said that all related-party transactions should be cleared only by the independent directors on the audit committee.

According to Sebi, among other qualifications, an independent director is a person who is not a promoter or a relative of the promoter of the company, its holding, subsidiary or an associate company. The person should also be qualified to add some value to the company. The person, other than receiving director’s remuneration, should have no other pecuniary relationship with the company during the two immediately preceding financial years.

Sebi also introduced a cooling off period of one year for an independent director becoming a whole-time director in the same company, holding, subsidiary, associate company or any group company. It also said that if key managerial personnel, their relative, or an employee of the promoter group companies wants to be an independent director, there should be a cooling off period of three years.

A Sebi release noted that the board has agreed to make a reference to the corporate affairs ministry of the government for “giving greater flexibility to companies while deciding the remuneration for all directors (including independent directors), which may include profit-linked commissions, sitting fees, ESOPs, etc, within the overall prescribed limit specified under Companies Act, 2013”.

These changes to the rules will be effective from January 1, 2022.

Sebi has also tried to make the appointment of an independent director more transparent. It said that the NRC, while appointing an independent director, should make enhanced disclosures that should include the skills required for appointment as an independent director and specify how the proposed candidate fits into that skillset.

According to Anand Lakra, partner at corporate law firm J Sagar Associates, by increasing voting threshold for appointment of independent directors from 51% to 75%, public shareholders would play an important part in companies with low promoter stake.

However, “a more public shareholder-friendly approach would have been to introduce the requirement of seeking majority of public shareholder vote for appointment of independent directors which was articulated in the discussion paper”, Lakra said.

Non-executive directors

Sitting fee, average: 2017-18

Nifty 50 non-exec dirs got avg ₹60L sitting fees, March 2, 2019: The Times of India

From: Nifty 50 non-exec dirs got avg ₹60L sitting fees, March 2, 2019: The Times of India

Profit-Linked Payout Crossed ₹5Cr: Study

Non-executive directors, including independent ones, have been paid on an average a sitting fee of Rs 60 lakh (ranging from a cumulative payout of Rs 11 lakh to Rs 195 lakh) during fiscal 2017-18 by the Nifty 50 group of companies. Profit-linked commission, paid to non-executive directors, was much higher. It averaged Rs 505 lakh (ranging between Rs 31 lakh and Rs 21 crore).

Among companies falling in the Nifty 50 basket, Axis Bank topped with the highest sitting fee payout of Rs 195 lakh during FY18. The Companies Act permits a maximum remuneration of Rs 1 lakh per meeting to each director as sitting fee.

In addition to Axis Bank, others from the financial sector that paid the maximum permissible sitting fee of Rs 1 lakh were Yes Bank, IndusInd Bank, ICICI, HDFC and HDFC Bank. The financial sector was the most generous in terms of payment of sitting fees to non-executive directors. This is perhaps understandable as banks cannot pay commission to their non-executive directors. Sun Pharma, Mahindra & Mahindra, ITC, Hero MotorCorp, Bharti Airtel, Bajaj Auto and Vedanta were the other companies that paid the maximum sitting fee of Rs 1 lakh for each meeting.

Independent directors cannot be issued stock options (ESOPs). However, the Companies Act permits them to be paid a profit-linked commission, as approved by shareholders. As regards commission payout to non-executive directors, UltraTech Cements topped with a payout of Rs 21.25 crore. These statistics were collated by CimplyFive Corporate Secretarial Services, in its report ‘India Secretarial Practice, 2018’, which was released on Friday (see graphic).

The report points out that a few companies such as Dr Reddy’s, Bharti Infratel, Infosys and Tech Mahindra do not pay sitting fees to their directors for attending board and sub-committee meetings. However, they pay a commission based on the profits earned. For instance, Infosys and Tech Mahindra paid a commission of Rs 871 lakh and Rs 868 lakh, respectively, during FY18.

On the flip side, public sector entities that are part of the Nifty 50 — such as Bharat Petroleum, Coal India, GAIL, Indian Oil, NTPC, ONGC, Power Grid Corporation and SBI — did not pay any commission to its nonexecutive directors.

“Without casting any aspersions on the companies illustrated, if profit-linked commission is the only source of remuneration to independent directors, we need to see its influences on shortterm outlook that prioritises the quantum of profits over the quality of profits reported by the company,” Cimply-Five founder & CEO Shankar Jaganathan told.

Other requirements/ qualifications mandated by govt.

2018 norms

Directors need to give KYC details to remain on board, July 12, 2018: The Times of India

From: Directors need to give KYC details to remain on board, July 12, 2018: The Times of India

PAN-Linked E-Signatures, Certificate From CA/CS Required

The 30-35 lakh “active directors” on company boards will have to submit PANauthenticated digital signatures and a certificate from a chartered accountant or a company secretary to remain on boards as part of a massive KYC exercise undertaken by the government to ensure that only genuine individuals are responsible for running the affairs of companies.

The ministry of corporate affairs has ordered that it will be conducting the KYC exercise with all the 50 lakh individuals holding DINs, or director identification numbers, being asked to fill up an electronic form by August 31. Those who do not submit the form will see their DINs deactivated. The exercise covers all DINs issued up to March 31, 2018.

The details of KYC, such as digital signature and certification by a chartered accountant or a company secretary, will be specified shortly as the government is invoking a legal provision to ask two professional institutes — ICAI and ICSI — to help in the “national cause” to clean up businesses.

The plan for KYC is part of the government’s drive to rid the corporate sector of shell companies and bogus directors as it has seen that rogue businessmen often designate their household helps, drivers or gardeners as board members. Most of the times, these individuals do not even know that they are directors on boards of companies promoted by their employers and details come to light only when action is initiated against the company or its owners. “The exercise will help clean up the sector, at least from now on,” said an official.

While the original plan was to go for an Aadhaar-linked authentication, the move had to be shelved in the wake of the ongoing case in the Supreme Court. PAN-authenticated digital signatures will also serve the purpose, explained government officials. PAN in the digital signature will be matched with the income tax department’s database to ensure that bogus directors are weeded out. Besides, most of the PANs are linked to Aadhaar, providing further comfort.

In addition, requirement for a certificate from a CA or CS will also ensure that the director’s credentials are verified and the board member knows about his or her legal status.

The norms would be applicable to Indian as well as foreign directors on the boards of Indian companies.

Removal of independent directors

2018: second term directors’ removal

Tough norms for removing second term ind directors, February 23, 2018: The Times of India

Independent directors appointed for a second term at corporates can now be removed only by a special resolution passed by shareholders, with the government tightening the rules for the same. Before removal, such independent directors should also be given “reasonable opportunity of being heard”, according to the corporate affairs ministry.