Central excise duties: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Medicine or cosmetic? SC uses ‘cure or care’ formula

Dhananjay Mahapatra TNN

New Delhi: The Supreme Court has used ‘cure or care’ differentiation to separate medicinal products from cosmetics for levy of central excise duties. It is of seminal importance to producers of cosmetics to classify their products as medicaments, which attract a central excise duty of 15% as against cosmetics, which face 15% levy.

How to classify a product as medicament or cosmetic? This question was raised before a bench of Justices S J Mukhopadhaya and Kurian Joseph by Central Excise, Mumbai, which wanted to tax the product “Moisturex” as cosmetic, even as the producer claimed it to be a medicament.

Referring to the Central Excise Act, the bench found that preparations for the care of skin, beauty or make-up were the ones to be classified as cosmetics, but it had clarified that cosmetics with medicinal preparations used to treat certain skin complaints could be categorized as medicaments, or products containing pharmaceutical substances used for medical, surgical, dental or veterinary purposes.

Writing the judgment for the bench, Justice Joseph said: “If a product comprises of two or more constituents mixed or compounded together for therapeutic or prophylactic use, the same is to be covered under medicament.”

Applying the law to the dispute, the bench said, “Care or cure’, is the clue for the resolution of the lis (dispute) arising in these cases.”

The bench said prior to adjudicating upon whether a product was a medicament, courts have to see what consumers understand the product to be. “If a product’s primary function is “care” and not “cure”, it is not a medicament,” it said.

Justices Mukhopadhaya and Joseph said: “Cosmetic products are used in enhancing or improving a person’s appearance or beauty, whereas medicinal products are used to treat or cure some medical condition. A product used mainly in curing or treating ailments or diseases and contains curative ingredients even in small quantities is to be branded as a medicament.”

The bench said, “The use of the cream is not for the care of the skin. ‘Moisturex’ is also not primarily intended to protect the skin from sun, tan or dryness, etc. On the other hand, it is intended for treating or curing the dry skin conditions of the human skin and for a few other skin complaints...”

The excise department said if it was a medicament, it should have been sold under doctor’s prescription and not over the counter. Rejecting this argument, the bench said: “If a product is sold without a prescription of a medical practitioner, it does not lead to the immediate conclusion that all products that are sold over/across the counter are cosmetics. There are several products that are sold over-the-counter and are yet, medicaments.”

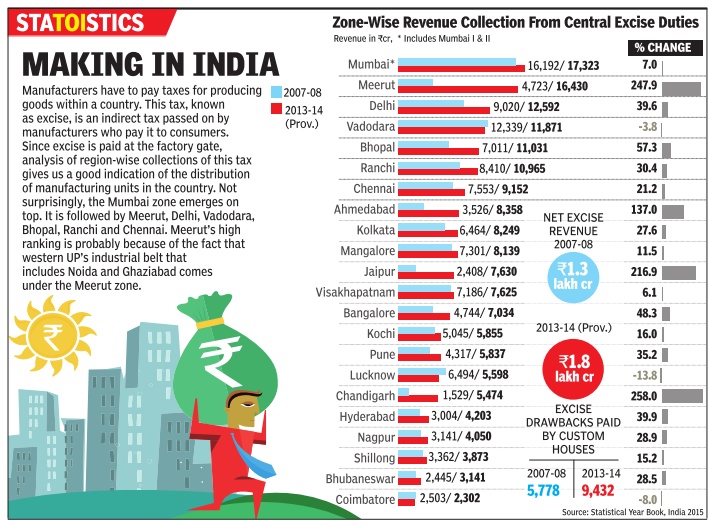

Central excise collection: 2007-14

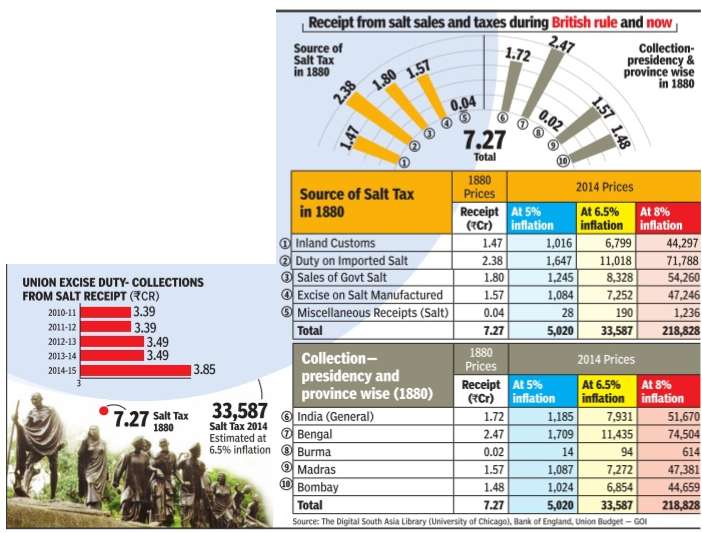

Salt tax: 1880-2015

Feb 19 2015

During the British era, the salt tax was extremely unpopular in India. In his book `Hind Swaraj and Other Writings', Mahatma Gandhi mentions the collection of 7 million pounds of salt revenue in 1880. How high was it when compared to the excise revenue from salt that the government gets today? According to data from the Digital South Asia Library, University of Chicago, in 1880, the British government's total revenue from various taxes on salt was 7.3cr.Adjusted for inflation at an average 6.5% annually -the actual rate between 1947 and 2014-7.3cr in 1880 would be equivalent to just under 33,600cr in 2014.That's almost 10,000 times the 3.85cr the estimated excise collection on salt in 2014-15.