Capital gains: India

(→Tax: longterm capital gains (LTCG) tax) |

|||

| (17 intermediate revisions by 2 users not shown) | |||

| Line 6: | Line 6: | ||

|} | |} | ||

| − | [ | + | |

| − | [[ | + | |

| − | [ | + | |

| − | [[ | + | |

| + | =An overview= | ||

| + | ==As in 2020 == | ||

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F02&entity=Ar00704&sk=4F6FE2E6&mode=text February 2, 2020: ''The Times of India''] | ||

| + | |||

| + | [[File: Capital gains, An overview, As in 2020.jpg|Capital gains, An overview, As in 2020 <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F02&entity=Ar00704&sk=4F6FE2E6&mode=text February 2, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''' LONG-TERM CAPITAL GAINS (LTCG) ''' | ||

| + | |||

| + | Capital gain on sale of listed securities (other than a unit), or a unit of UTI/ equity-oriented fund, or a zero-coupon bond held for more than 12 months is treated as LTCG. Unlisted share of a company and immovable property (land/ building) have to be held for more than 24 months to qualify for LTCG. In all other types of capital assets, sale after 36 months will qualify as LTCG | ||

| + | |||

| + | ''' SHORT-TERM CAPITAL GAINS (STCG) ''' | ||

| + | |||

| + | Gains made on securities (listed other than units/equity-oriented MF/units of UTI/zero coupon bonds) held for up to a year, or capital assets held for 24/36 months qualify as STCG | ||

| + | |||

| + | ''' SET-OFF PROVISIONS FOR CAPITAL LOSSES ARE RATHER RESTRICTIVE ''' | ||

| + | |||

| + | Loss from transfer of a long-term capital asset can be set off against gain from transfer of any other long-term capital asset in the same year. But, long-term capital loss cannot be set off against short-term capital gains | ||

| + | |||

| + | Loss from transfer of a short-term capital asset can be set off against gain from transfer of any other capital asset in the same year | ||

| + | |||

| + | Any unutilised capital loss after absorption in the same year can be further carried forward to next eight years and be utilised under the same conditions as above | ||

| + | |||

| + | You should file your I-T return with the tax authorities before July 31 to carry forward any losses | ||

| + | |||

| + | There are certain restrictions on set-off of carry-forward loss under the new ‘simplified’ personal income tax regime | ||

| + | |||

| + | |||

| + | =Avoiding/ minimising/ reducing LTCG= | ||

| + | ==As in 2018== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F03%2F12&entity=Ar02202&sk=5FA1C8EE&mode=text BABAR ZAIDI, How to avoid LTCG tax, March 12, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: How to avoid LTCG tax- Preeti and Uday Salunke with son Aditya; Ajay and Supriya Bajaj.jpg|How to avoid LTCG tax- Preeti and Uday Salunke with son Aditya; Ajay and Supriya Bajaj <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F03%2F12&entity=Ar02202&sk=5FA1C8EE&mode=text BABAR ZAIDI, How to avoid LTCG tax, March 12, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''Equity investors are realising the implications of the proposed LTCG tax. Here are a few ways to avoid it'' | ||

| + | |||

| + | Ranjan Saxena is surprised by the criticism for the proposed LTCG tax. “Why should anybody mind paying 10% of his gains in tax?” asks the Delhibased retiree. Saxena’s portfolio is not very big. His total investments in equity funds is only ₹2 lakh, and his gains are unlikely to cross the tax-free limit of ₹1 lakh for several years. | ||

| + | |||

| + | But Mumbai-based Preeti and Uday Salunke (see picture) are in a different boat. With an equity fund portfolio of roughly ₹15 lakh and SIPs of ₹25,000 a month, their investments are growing and could attract tax when they withdraw in a few years. Their best bet is to start investing in the name of their son Aditya. Gifting money to a child above 18 and then investing it is perfectly legal. “You can gift any amount to your child without any tax liability,” says Sudhir Kaushik, Co-founder of Taxspanner. | ||

| + | |||

| + | '''Take the help of an adult child''' | ||

| + | |||

| + | Tax rules say that after a person turns 18, he is a separate individual and his earnings will not get clubbed with his parent’s income. If the Salunkes invest in Aditya’s name, he will not only be eligible for the ₹1 lakh exemption for capital gains but also the ₹2.5 lakh basic exemption and the ₹1.5 lakh deduction under Sec 80C. Effectively, he is not getting into the tax net for several years. | ||

| + | |||

| + | In another part of Mumbai, PSU manager Ajay Bajaj and his wife Supriya are sizing up their equity portfolio. With almost ₹32 lakh in stocks and mutual funds, they are likely to cross the ₹1 lakh threshold very soon. However, they are not too worked up by the LTCG tax. “Even after 10% tax, equity remains my preferred investment because it gives better returns than other asset classes,” says Ajay. | ||

| + | |||

| + | '''Harvest gains regularly''' | ||

| + | |||

| + | Investors like the Bajajs should get into the habit of harvesting their gains on a regular basis. Even if they intend to hold a stock for the long term, it makes sense to churn the portfolio. Sell your stocks to book long-term capital gains, and then buy back the same scrips. This way you reset the acquisition date and can book short-term or long-term losses if the stock prices recede from these levels. Suppose you bought 1,000 shares of a company at ₹150 apiece in February 2018 and the stock rose to ₹220 by March 2019. You would have made long-term gains of ₹70,000. If you sell all the shares in March 2019, and buy them back, your acquisition price will be reset to ₹220 and the date of acquisition will become March 2019. Now if the stock rose to ₹300 in another 12 months, your gains will only be ₹80,000 and still tax free. | ||

| + | |||

| + | On the other hand, if you had not sold off at ₹220, your acquisition price would have been ₹150 and your total capital gain would have been ₹1.5 lakh. Of this, ₹50,000 would have been subject to tax. | ||

| + | |||

| + | '''How to calculate capital gains''' | ||

| + | |||

| + | After the LTCG tax, a lot of investors are worried about how to calculate their gains and the tax payable. This is where a portfolio tracker can be very useful. The online portfolio tracker of Value Research calculates the taxable longterm capital gains made on stocks and equity funds. It uses the grandfathering cut-off date of 31 January 2018 to calculate the LTCG. It will be especially useful for investors with a large fund portfolio. | ||

=Bitcoin sale= | =Bitcoin sale= | ||

| Line 57: | Line 111: | ||

To plug tax leaks, the government has now made it mandatory for buyers to deduct TDS when they buy a house worth over `50 lakh. TDS of 1% of the value of the property has to be deducted before making the payment to the seller.Till last month, this amount was required to be deposited within seven days from the end of the month in which the sale transaction was carried out, but from 1 June, the period has been extended to 30 days. Since this payment is made on behalf of the seller and linked to his PAN, it is reflected on the seller's Form 26AS. The seller must also obtain a TDS certificate in Form 16B from the buyer. The seller can claim a refund of TDS if he is incurring a loss on the sale of the house or if he is claiming exemption from long-term capital gains. To claim the refund, he should provide details of investment of the capital gains in his tax return. Alternatively, he can obtain a certificate from the assessing officer specifying that no TDS must be deducted on payments made to him, and present this certificate to the buyer. | To plug tax leaks, the government has now made it mandatory for buyers to deduct TDS when they buy a house worth over `50 lakh. TDS of 1% of the value of the property has to be deducted before making the payment to the seller.Till last month, this amount was required to be deposited within seven days from the end of the month in which the sale transaction was carried out, but from 1 June, the period has been extended to 30 days. Since this payment is made on behalf of the seller and linked to his PAN, it is reflected on the seller's Form 26AS. The seller must also obtain a TDS certificate in Form 16B from the buyer. The seller can claim a refund of TDS if he is incurring a loss on the sale of the house or if he is claiming exemption from long-term capital gains. To claim the refund, he should provide details of investment of the capital gains in his tax return. Alternatively, he can obtain a certificate from the assessing officer specifying that no TDS must be deducted on payments made to him, and present this certificate to the buyer. | ||

| − | == Capital gains can be invested more than once in new house== | + | |

| + | == Amenities can cut capital gains on sale== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F12%2F02&entity=Ar00204&sk=A38E8CEF&mode=text December 2, 2020: ''The Times of India''] | ||

| + | |||

| + | Flat amenities can cut capital gains on sale | ||

| + | |||

| + | Price Can Be Added To Total Cost: ITAT | ||

| + | |||

| + | Mumbai: | ||

| + | |||

| + | In a litigation over capital gains arising on a flat sale, Income-Tax Appellate Tribunal (ITAT)’s Mumbai bench has held that the taxpayer can add the price paid for amenities to a builder’s group company to arrive at the total cost of acquisition of the property. | ||

| + | |||

| + | The sale consideration minus the cost of acquisition (adjusted by applying the cost inflation index) determines capital gains. Higher the cost of acquisition, lower the taxable capital gains component. If the sale consideration is lower than the cost of acquisition, it results in a capital loss. | ||

| + | |||

| + | On sale of a flat held for more than two years, the capital gains that arises is treated as long term and is subject to a tax at 20%. Thus, it is important for sellers to know what can be included as the cost of acquisition—typically it constitutes the purchase price, stamp duty, registration cost and broker fees. | ||

| + | |||

| + | In the case of Rashmi Dhanani, which ITAT heard, the taxpayer had shown a long-term capital loss on sale of her flat. In the total cost of acquisition reflected in her tax computation, she had included Rs 9.4 lakh, which was paid to an affiliated company of the builder, under a separate amenities’ agreement. | ||

| + | |||

| + | The amenities for which the additional charges were paid included special water proofing in the toilets and the kitchen and special wood for doors and windows. | ||

| + | |||

| + | In this case, ITAT had remanded the matter to the I-T officer to ascertain whether other flat owners had entered into similar amenities agreements. | ||

| + | |||

| + | ITAT observed 33 of the 128 flat owners had entered into a similar agreement. Further, the taxpayer’s financial statement consistently included this sum of Rs 9.4 lakh in the total property cost. Based on the above facts, ITAT decided in the taxpayer’s favour. | ||

| + | |||

| + | Tax experts say determining what can be added to arrive at the total cost of acquisition is a fact-based exercise. Puneet Gupta, director, People Advisory Services, EY India, says, “A distinction should be made between capital costs that become an integral part of the house versus the cost of movable items such as furniture and fittings, which will be treated as personal effects. The taxpayer must be able to substantiate the expenditure with documentary evidence.” | ||

| + | |||

| + | An I-T official said builders are increasingly offering various amenities to buyers, typically at an additional cost. These vary from special bathroom fittings, marble floorings, modular kitchens, and so on. Taxpayers need to obtain a proper breakup to avoid litigation at a later stage, when they sell this flat. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | |||

| + | ==Holding period== | ||

| + | ===Starts from date of allotment, not registration=== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F04%2F08&entity=Ar00900&sk=65C18A4D&mode=text Lubna Kably, ‘Holding period of house starts from date of allotment, not registration’, April 8, 2019: ''The Times of India''] | ||

| + | |||

| + | |||

| + | In a decision that will benefit many taxpayers, the Mumbai bench of Income Tax Appellate Tribunal (ITAT) recently held that the date of allotment of a house shall be treated as the date of acquisition. The holding period will be counted from this date and not from the date of registration. | ||

| + | |||

| + | Gains arising from the sale of a long-term capital asset are treated as long-term capital gain (LTCG). For an asset to be regarded as longterm, the holding period of a house property is 24 months. Prior to 2017-18 financial year, it was 36 months. | ||

| + | |||

| + | The tribunal’s decision is important as a taxpayer (under Section 54-F) is entitled to a deduction from LTCG arising on sale of a house if investments are made in another house within a stipulated period. This deduction reduces the taxable component of the capital gains and results in a lower tax outgo. On the other hand, if the gains arising on sale of a house are treated as shortterm, purchase of a new house will not entitle a taxpayer to any such benefit. | ||

| + | |||

| + | With the ITAT saying that the holding period should be computed from the date of allotment, it will help many taxpayers as typically the registration happens much later. | ||

| + | |||

| + | In the matter before the ITAT, Keyur Shah had sold a duplex apartment on April 4, 2012 for Rs 12 crore. His share in the property was 50% and the corresponding capital gains worked out to Rs 2.9 crore. In his income tax (I-T) return for the financial year 2012-13, he claimed a deduction under Section 54-F of Rs 1.09 crore (for investment in a new house) and offered the balance Rs 1.8 crore as taxable. | ||

| + | |||

| + | However, the I-T officer contested that the duplex apartment was purchased via a registered agreement only on March 25, 2010. Counting from this date to the date of sale, the holding period was less than 36 months. Thus, the capital gains should be treated as short-term and the Section 54F benefit could not be allowed, the official held. | ||

| + | |||

| + | The I-T department submitted to the ITAT that “the allotment letter is only an offer and the right or interest in property accrues only on signing and stamping of the agreement.” On the other hand, Shah argued that the duplex flat was purchased via an allotment letter dating back to February 26, 2008 and a substantial payment of Rs 1.86 crore was already made by July that year. Thus, the holding period when counting from the date of the allotment letter was more than 36 months. | ||

| + | |||

| + | “The ITAT rightly held that the date of allotment should be treated as the date of acquisition, since there were no material changes in the terms and conditions as compared to those in the final registered agreement,” said Gautam Nayak, tax partner at CNK & Associates. | ||

| + | |||

| + | Taxpayers will benefit from ITAT’s recent ruling as cost of new house can be claimed as deduction only from long-term capital gains | ||

| + | |||

| + | ==Investment: Capital gains can be invested more than once in new house== | ||

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Capital-gains-can-be-invested-more-than-once-17082017001022 Lubna Kably, Capital gains can be invested more than once for new house, August 17, 2017: The Times of India] | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Capital-gains-can-be-invested-more-than-once-17082017001022 Lubna Kably, Capital gains can be invested more than once for new house, August 17, 2017: The Times of India] | ||

| Line 74: | Line 188: | ||

The I-T official disputed this claim and said a deduction of Rs 47.84 lakh had been claimed earlier by Jain under section 54F for construction of the same house at Mehendi Farm. This claim had been allowed by the I-T authorities for 2008-09. The I-T official contended that on the date of sale of these five properties, Jain owned more than one residential house (at Vasant Vihar and the property under construction). Thus, he denied the I-T benefit that was sought by the taxpayer. When the dispute reached ITAT, it decided in favour of the taxpayer. | The I-T official disputed this claim and said a deduction of Rs 47.84 lakh had been claimed earlier by Jain under section 54F for construction of the same house at Mehendi Farm. This claim had been allowed by the I-T authorities for 2008-09. The I-T official contended that on the date of sale of these five properties, Jain owned more than one residential house (at Vasant Vihar and the property under construction). Thus, he denied the I-T benefit that was sought by the taxpayer. When the dispute reached ITAT, it decided in favour of the taxpayer. | ||

| + | |||

| + | ==Multiple flats’ sale can still fetch tax benefit== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F12&entity=Ar00722&sk=D61E26CA&mode=text Lubna Kably, February 12, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Multiple flats’ sale- Investment within time period is a must..jpg|Multiple flats’ sale- Investment within time period is a must. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F12&entity=Ar00722&sk=D61E26CA&mode=text Lubna Kably, February 12, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | In a landmark decision, the Income Tax Appellate Tribunal (ITAT) has held that a taxpayer can avail of tax benefits where long-term capital gains (LTCGs) arising on sale of more than one flat are invested or will be invested in one residential house in India, within the stipulated time. | ||

| + | |||

| + | This recent ITAT decision will benefit taxpayers in Mumbai and in the absence of any contrary jurisdictional order will strengthen the case of other taxpayers. | ||

| + | |||

| + | It is not uncommon for a taxpayer to sell more than one house in order to buy a larger accommodation or shift to a tonier locality. | ||

| + | |||

| + | |||

| + | '''Dispute revolved around Section 54 of Income Tax Act''' | ||

| + | |||

| + | There have been instances where tax benefit claims made by taxpayers have been denied as sale proceeds of more than one flat were invested in a new residential property. | ||

| + | |||

| + | If the taxpayer makes a profit on sale of a residential house that has been held for at least two years, then such profit is treated as a LTCG. This gain is taxable at 20% with an adjustment for inflation referred to as indexation benefit. Section 54 of the Income Tax Act, which was the subject matter of the dispute, provides that if the investment is made in one house in India, in the stipulated period , then to the extent of this investment, the taxable component of the LTCG is reduced, which results in a lower tax outgo. | ||

| + | |||

| + | The ITAT agreed with the contention of the taxpayer that Section 54 of the I-T Act has an inbuilt restriction that the capital gain arising from sale of a residential house cannot be invested in more than ‘one’ residential house, in India. However, there is no restriction that the capital gains arising from the sale of more than one residential houses can be so invested. | ||

| + | |||

| + | ITAT held: “The provision of Section 54 is applied to the transfer of any number of residential houses provided the capital gains arising therefrom are invested in a proper manner within the prescribed time period.” | ||

| + | |||

| + | Incidentally, the Interim Budget has provided for an additional relaxation. It proposes to allow investments to be made in two house properties in India, but this option can be exercised only once in a lifetime. ITAT is the final fact-finding authority. The I-T department can appeal only if it involves a question of law. At this stage, it is not known whether the I-T department will file an appeal in the HC. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Pages with broken file links|CAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

== Possession date counts for CG relief== | == Possession date counts for CG relief== | ||

| Line 92: | Line 241: | ||

Relying on previous orders of high courts, including the Bombay HC, the tribunal held that the date of final occupation should be considered for calculating the period of eligibility for deduction under section 54. In this case, it would enable the taxpayer to satisfy the requirement that the new house must be purchased within one year prior to transfer of the existing house. | Relying on previous orders of high courts, including the Bombay HC, the tribunal held that the date of final occupation should be considered for calculating the period of eligibility for deduction under section 54. In this case, it would enable the taxpayer to satisfy the requirement that the new house must be purchased within one year prior to transfer of the existing house. | ||

| + | |||

| + | ==Exemption valid even if housing loan used for new house== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F04%2F12&entity=Ar01706&sk=646F5125&mode=text Lubna Kably, Capital gains exemption valid even if housing loan used for new house: ITAT, April 12, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | The Kolkata bench of the Income-tax Appellate Tribunal (ITAT) has held that investment-linked capital gains tax exemption, which is available on purchase of a new house, cannot be denied merely because the taxpayer has taken a housing loan. | ||

| + | |||

| + | Capital gains are taxable under the Income-tax (I-T) Act. If on sale of a residential house (held for at least two years), the taxpayer makes a profit, then such profit is treated as a long term capital gain (LTCG). This gain is taxable at 20% with an adjustment for inflation, referred to as indexation benefit. | ||

| + | |||

| + | Section 54 of the I-T Act provides for investment-linked capital gains tax exemption. If an investment is made in another house in India, within the stipulated period of time, then the ‘cost of the new house’ is deducted and only the balance component of the LTCGs is taxable. | ||

| + | |||

| + | Such deduction results in a lower I-T outgo. Thus, if the amount of the capital gain is equal to or less than the cost of the new house, the entire sum of LTCG is not taxable. | ||

| + | |||

| + | The new house needs to be purchased either within one year prior to or two years from the date of sale of the old house. This tax benefit is also available if the taxpayer, within three years after the date of sale of the old house, constructs a new residential house. | ||

| + | |||

| + | In the case decided by the ITAT on April 4, Amit Parekh, the taxpayer, had claimed capital gains tax exemption of Rs 59 lakh under provisions of section 54. During tax assessment, the I-T officer noted that Parekh had obtained a housing loan of Rs 82 lakh from ICICI Bank and invested only Rs 9.37 lakh in the new house out of the capital gains. | ||

| + | |||

| + | The I-T officer held that the taxpayer had not adhered to the spirit of the section and he allowed the claim only to the extent of Rs 9.37 lakh. The I-T officer added back a sum of Rs 49.7 lakh (Rs 59 lakh minus Rs 9.37 lakh) to the taxpayer’s income, which would increase Parekh’s I-T liability. | ||

| + | |||

| + | The I-T litigation finally reached the doorsteps of the ITAT, which adjudicates I-T disputes. | ||

| + | |||

| + | The tax tribunal noted that the I-T authorities had not disputed the fact that cost of the new residential house was more than the capital gains. Further, post the sale of the old house, the new residential house was purchased within the time stipulated in the I-T Act. Thus, merely because the taxpayer had availed of a housing loan from the bank, his claim for exemption under section 54 could not be denied, held the ITAT. In reaching its decision, the ITAT also relied on past orders of a few high courts. | ||

| + | |||

| + | Gautam Nayak, tax partner at CNK & Associates, a firm of chartered accountants said: “There is no identity of funds required for claim of exemption. Section 54 recognises the fungibility of funds. In fact, it even permits purchase of a new residential house up to one year prior to sale of the old residential house, where obviously the same funds from the sale could not have been used.” | ||

| + | |||

| + | However, taxpayers need to ensure they adhere to the timelines for purchase or construction of new houses. | ||

| + | |||

| + | ===Exemption even if investment not from capital gain proceeds=== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F15&entity=Ar01117&sk=C7116CF1&mode=text Lubna Kably, ITAT shields tax sops on 2nd house, March 15, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: ITAT’s ruling on capital gain Exemption on investment in 2nd house from funds other than capital gain proceeds.jpg|ITAT’s ruling on capital gain Exemption on investment in 2nd house from funds other than capital gain proceeds <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F15&entity=Ar01117&sk=C7116CF1&mode=text Lubna Kably, ITAT shields tax sops on 2nd house, March 15, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '' ‘Valid Even If Cap Gains Not Used For Buy’ '' | ||

| + | |||

| + | The Mumbai bench of the Income-tax Appellate Tribunal (ITAT) has held that the investment-linked capital gains tax exemption, which is available on purchase of a new house, cannot be denied to a taxpayer merely because she has not invested from out of the capital gain proceeds itself. | ||

| + | |||

| + | The I-T officer had denied the tax benefit as the investment made towards purchase of the new house “was not out of the taxpayer’s own funds”. The Commission (Appeals) agreed with this stand. This led to the taxpayer approaching ITAT, which ruled in her favour. | ||

| + | |||

| + | Ishita Sengupta, tax partner, PwC-India, says, “This beneficial order will help taxpayers as practically there could be time gaps between sale and purchase of a new house property and other funds could be deployed for the new investment. However, it is vital that the new house is purchased within the prescribed time limits.” | ||

| + | |||

| + | Similarly, in April last year, the ITAT’s Kolkata bench had ruled that the tax benefit cannot be denied merely because the taxpayer had used the proceeds of a housing loan and not the capital gain proceeds itself. | ||

| + | |||

| + | Capital gains are taxable under the I-T Act. If on sale of a residential house ( held for at least two years), the taxpayer makes a profit, then such profit is treated as a long-term capital gain. This is taxable at 20% with an adjustment for inflation, called indexation benefit. | ||

| + | |||

| + | The new house needs to be bought either within a period of one year prior to or two years from the date of sale of the old one. This benefit is also valid if the taxpayer, within three years after the sale of the old house, constructs a new residential house. | ||

= Refunds (e.g. from builders)= | = Refunds (e.g. from builders)= | ||

| Line 133: | Line 328: | ||

Various provisions of the I-T Act grant a tax benefit when LTCGs arising on sale of certain assets (eg: house, land, commercial property) are invested in acquiring a new house. To the extent of investment in the new house, the LTGCs are reduced and only the balance amount is taxable. Tax tribunals have taken alenient view and tax benefits have not been denied in case of a delay in possession of the new house beyond the stipulated period of two years from sale of the original asset.“However, as things currently stand, when there is a closure of a project and refund of the advances paid, the buyer may also lose the capital gains exemption that he has claimed under sections 54 or 54F of the I-T Act for investment in a new house,“ says Nayak. | Various provisions of the I-T Act grant a tax benefit when LTCGs arising on sale of certain assets (eg: house, land, commercial property) are invested in acquiring a new house. To the extent of investment in the new house, the LTGCs are reduced and only the balance amount is taxable. Tax tribunals have taken alenient view and tax benefits have not been denied in case of a delay in possession of the new house beyond the stipulated period of two years from sale of the original asset.“However, as things currently stand, when there is a closure of a project and refund of the advances paid, the buyer may also lose the capital gains exemption that he has claimed under sections 54 or 54F of the I-T Act for investment in a new house,“ says Nayak. | ||

| + | |||

| + | ==Excess sum on flat cancellation is capital gain== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F09%2F09&entity=Ar01023&sk=9528D5D7&mode=text September 9, 2020: ''The Times of India''] | ||

| + | |||

| + | ''' ‘Excess sum from builder on flat cancellation is cap gains’ ''' | ||

| + | |||

| + | '' Can’t Be Treated As ‘Income From Other Sources’: ITAT Mumbai '' | ||

| + | |||

| + | |||

| + | If a Mumbaikar books a flat and then cancels the deal with the builder, and benefits by receiving a sum higher than the earnest amount paid, the excess will not be treated as a tax-free income. In tax parlance, it will not constitute a capital receipt. | ||

| + | |||

| + | The next issue which arises is whether it will be treated as ‘income from other sources’ or ‘capital gains’. In its recent order, Income-Tax Appellate Tribunal (ITAT)’s Mumbai bench has held the excess consideration received is in the nature of ‘capital gains’. | ||

| + | |||

| + | This is a more favourable scenario than that drawn by the income-tax officer, who in the course of assessment had treated the excess amount or that received minus the booking and earnest money as ‘income from other sources’. | ||

| + | |||

| + | In the absence of any contrary jurisdictional decisions, this ITAT order will also play a significant role in assessment of cases outside Mumbai. | ||

| + | Under Section 54 of the Income-Tax Act, if the long-term capital gains arising on a house sale are invested in another residence in India within a stipulated period of time, then to the extent of such investment, the taxable component of capital gains is reduced. This results in a lower tax outgo. Thus, if the entire amount of long-term capital gains is invested, no tax is payable. | ||

| + | |||

| + | Anil Harish, an advocate specialising in real estate told TOI: “I agree with the ITAT view and it is a good decision. Years ago, in 1979, Bombay HC had held that when a part-payment was made and a right was acquired, this amounted to a capital asset, even though the transaction had not been completed. On the sale of the asset, the surplus was to be treated as a capital gain. This HC order has been the foundation for several other decisions referred to in the recent ITAT order.” | ||

| + | |||

| + | In this case heard by ITAT, Mukesh Sohanraj Vardhan, the taxpayer, had treated the benefit of Rs 18.75 lakh received from the builder on cancellation of his deal—flat booked in Vardhaman Heights, Byculla—as a longterm capital gain. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

=Tax: longterm capital gains (LTCG) tax= | =Tax: longterm capital gains (LTCG) tax= | ||

| Line 191: | Line 425: | ||

LTCG will be calculated by deducting the cost of acquisition from the full value of consideration on transfer of the long-term capital asset. The cost of acquisition for the long-term capital asset acquired on or before January 31, 2018 will be the actual cost. In case of a listed equity share or unit, the fair market value means the highest price of such share or unit quoted on a recognised stock exchange on January 31, 2018. If there was no trading on that day, the highest price quoted on a date immediately preceding that on which it has been traded should be considered. | LTCG will be calculated by deducting the cost of acquisition from the full value of consideration on transfer of the long-term capital asset. The cost of acquisition for the long-term capital asset acquired on or before January 31, 2018 will be the actual cost. In case of a listed equity share or unit, the fair market value means the highest price of such share or unit quoted on a recognised stock exchange on January 31, 2018. If there was no trading on that day, the highest price quoted on a date immediately preceding that on which it has been traded should be considered. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Pages with broken file links|CAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Pages with broken file links|CAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Government|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:India|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

| + | [[Category:Law,Constitution,Judiciary|C CAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIACAPITAL GAINS: INDIA | ||

| + | CAPITAL GAINS: INDIA]] | ||

Revision as of 12:16, 3 December 2020

This is a collection of articles archived for the excellence of their content. |

An overview

As in 2020

February 2, 2020: The Times of India

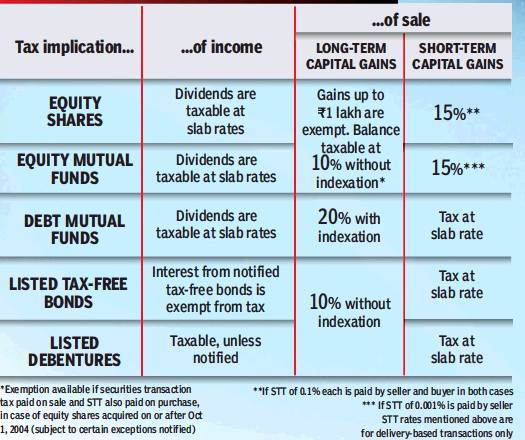

From: February 2, 2020: The Times of India

LONG-TERM CAPITAL GAINS (LTCG)

Capital gain on sale of listed securities (other than a unit), or a unit of UTI/ equity-oriented fund, or a zero-coupon bond held for more than 12 months is treated as LTCG. Unlisted share of a company and immovable property (land/ building) have to be held for more than 24 months to qualify for LTCG. In all other types of capital assets, sale after 36 months will qualify as LTCG

SHORT-TERM CAPITAL GAINS (STCG)

Gains made on securities (listed other than units/equity-oriented MF/units of UTI/zero coupon bonds) held for up to a year, or capital assets held for 24/36 months qualify as STCG

SET-OFF PROVISIONS FOR CAPITAL LOSSES ARE RATHER RESTRICTIVE

Loss from transfer of a long-term capital asset can be set off against gain from transfer of any other long-term capital asset in the same year. But, long-term capital loss cannot be set off against short-term capital gains

Loss from transfer of a short-term capital asset can be set off against gain from transfer of any other capital asset in the same year

Any unutilised capital loss after absorption in the same year can be further carried forward to next eight years and be utilised under the same conditions as above

You should file your I-T return with the tax authorities before July 31 to carry forward any losses

There are certain restrictions on set-off of carry-forward loss under the new ‘simplified’ personal income tax regime

Avoiding/ minimising/ reducing LTCG

As in 2018

BABAR ZAIDI, How to avoid LTCG tax, March 12, 2018: The Times of India

From: BABAR ZAIDI, How to avoid LTCG tax, March 12, 2018: The Times of India

Equity investors are realising the implications of the proposed LTCG tax. Here are a few ways to avoid it

Ranjan Saxena is surprised by the criticism for the proposed LTCG tax. “Why should anybody mind paying 10% of his gains in tax?” asks the Delhibased retiree. Saxena’s portfolio is not very big. His total investments in equity funds is only ₹2 lakh, and his gains are unlikely to cross the tax-free limit of ₹1 lakh for several years.

But Mumbai-based Preeti and Uday Salunke (see picture) are in a different boat. With an equity fund portfolio of roughly ₹15 lakh and SIPs of ₹25,000 a month, their investments are growing and could attract tax when they withdraw in a few years. Their best bet is to start investing in the name of their son Aditya. Gifting money to a child above 18 and then investing it is perfectly legal. “You can gift any amount to your child without any tax liability,” says Sudhir Kaushik, Co-founder of Taxspanner.

Take the help of an adult child

Tax rules say that after a person turns 18, he is a separate individual and his earnings will not get clubbed with his parent’s income. If the Salunkes invest in Aditya’s name, he will not only be eligible for the ₹1 lakh exemption for capital gains but also the ₹2.5 lakh basic exemption and the ₹1.5 lakh deduction under Sec 80C. Effectively, he is not getting into the tax net for several years.

In another part of Mumbai, PSU manager Ajay Bajaj and his wife Supriya are sizing up their equity portfolio. With almost ₹32 lakh in stocks and mutual funds, they are likely to cross the ₹1 lakh threshold very soon. However, they are not too worked up by the LTCG tax. “Even after 10% tax, equity remains my preferred investment because it gives better returns than other asset classes,” says Ajay.

Harvest gains regularly

Investors like the Bajajs should get into the habit of harvesting their gains on a regular basis. Even if they intend to hold a stock for the long term, it makes sense to churn the portfolio. Sell your stocks to book long-term capital gains, and then buy back the same scrips. This way you reset the acquisition date and can book short-term or long-term losses if the stock prices recede from these levels. Suppose you bought 1,000 shares of a company at ₹150 apiece in February 2018 and the stock rose to ₹220 by March 2019. You would have made long-term gains of ₹70,000. If you sell all the shares in March 2019, and buy them back, your acquisition price will be reset to ₹220 and the date of acquisition will become March 2019. Now if the stock rose to ₹300 in another 12 months, your gains will only be ₹80,000 and still tax free.

On the other hand, if you had not sold off at ₹220, your acquisition price would have been ₹150 and your total capital gain would have been ₹1.5 lakh. Of this, ₹50,000 would have been subject to tax.

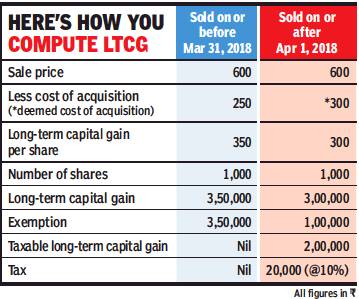

How to calculate capital gains

After the LTCG tax, a lot of investors are worried about how to calculate their gains and the tax payable. This is where a portfolio tracker can be very useful. The online portfolio tracker of Value Research calculates the taxable longterm capital gains made on stocks and equity funds. It uses the grandfathering cut-off date of 31 January 2018 to calculate the LTCG. It will be especially useful for investors with a large fund portfolio.

Bitcoin sale

Profit is taxable

Need To Declare Earned Income & Pay Tax, Say Experts

India is not isolated from the rising popularity of bitcoins, which got a boost post-demonetisation. According to industry sources, nearly 300-plus enthusiasts of the cryptocurrency trade daily on Indian bitcoin exchange platforms. Most of these platforms boast of user registrations of more than a lakh.Thus, many taxpayers in India need to understand the I-T nuances of their bitcoin transactions.

Curiosity prompted Rakesh M, a Bengaluru-based techie (identity changed), to make his first investment in bitcoins. He sold his investment during the financial year 2016-17 (year ending March 31, 2017) and earned a profit.The perplexing issue for him is: How should he treat the income on sale of the bitcoin for I-T purposes? As a salaried employee, he has to file his I-T return by July 31. The Central Board of Direct Taxes (CBDT) has not yet issued any guidance. Tax authorities in many countries, such as the US, treat bitcoins a capital asset in hands of investors, with the sale resulting in a capital gain.

The I-T department can catch up if you try to evade tax on sale of bitcoins. Benson Samuel, co-founder, Coinsecure, a trading platform for bitcoins in India, points out, “When you sell your bitcoins over an exchange such as Coinsecure, the money flows directly into your bank account.The transaction is completely transparent. Even though not obliged to do so, most bitcoin exchanges also adopt KYC norms for their customers.“

Bitcoins in India are unregulated but are not yet illegal. However, the RBI has on occasion cautioned investors of inherent risks. An inter-disciplinary committee set up by the government is examining the framework of virtual currencies. “That said, even if bitcoins were illegal, income earned needs to be declared and tax paid,“ says an I-T official.

Harshal Kamdar, tax partner, PwC India, says, “Taxability of bitcoins is a nuanced is sue and will depend on facts of each case. In the absence of CBDT guidelines, the logical conclusion is to treat profits on sale of bitcoins as `capital gains', unless the person is in the business of trading bitcoins, in which case it would likely be `business income'. However, we have seen instances, where to be on the safe side, individuals have preferred to treat it as `income from other sources' where the relevant slab rate of I-T applies, as opposed to a 20% tax with indexation (if applicable), on long-term capital gains“.

Capital gains for a bitcoin investor

Nishith Desai, founder of an international law firm which is working closely with the bitcoin industry , says, “Given the wide nature of definition of capital assets under Section 2(14) of the I-T Act, the purchase of bitcoins, if it has been made for the purpose of investment, should be treated as a capital asset. Thus, any gains arising on transfer (ie: sale) should be characterised as capi tal gains.“ (See illustration of I-T computation.) Caution point: Short-term capital gains are taxed at the applicable I-T slab rate, which for those with a taxable income of more than Rs 10 lakh is 30% plus applicable surcharge and cess. On the other hand, long-term capital gains (LTCGs) attract a tax rate of only 20%. The time period for which an asset is held before its sale determines whether it is a longterm asset that is eligible for a lower rate of tax on sale. For equity , the holding period prescribed is just 12 months.“The period of holding of bitcoins should be like any other property . If they are held for three years or more, it should be considered longterm and if less than shortterm,“ says Desai.Hot tip: Indexation benefit (which is an adjustment to account for inflation for the period between purchase and sale of a capital asset) can be availed of. This would reduce the total tax outgo on capital gains. A cost inflation index (CII) figure is issued by the CBDT each year and the prescribed formula is to be followed.

Business income for a bitcoin trader

It may be a bit perplexing to understand whether one would be regarded as an investor or trader. Desai points out, “The CBDT has in the past issued a circular (4 2007) which, after taking into consideration various judicial precedents, has set out various tests to determine whether shares are held as investment or stock in trade.The same parameters can also be applied to bitcoins.“

For instance, if the transactions in bitcoins are substantial and frequent, it could be said that the individual is trading in bitcoins. In this case, income on sale of bitcoins would be a business income, to which the applicable slab rate of income tax would apply . Thus, for those having a taxable income of more than Rs 10 lakh (including on bitcoin sales) the applicable tax slab rate of 30% plus surcharge and cess is higher than the tax rate of 20% on LTCGs.

There is also an additional catch. If you haven't paid any advance tax on income from your bitcoin transactions, it's likely that penal interest will be levied.

House sale

Tax implications

The Times of India, Jun 20 2016

Also, if a house is sold within 5 years of the end of the financial year in which it was purchased, tax benefits claimed go out of the window. The tax deduction claimed for the principal repayment, stamp duty and registration under Section 80C are reversed and the amount becomes taxable in the year of sale. Only the deduction of the interest payment under Section 24B is left untouched.

This is why it is advisable to hold a property for at least three years. If you sell after three years, the profit is treated as long-term capital gains and taxed at 20% after indexation. Indexation takes into account the inflation during the holding period and adjusts the purchase price accordingly, thereby slashing the tax burden for the seller (see graphic). There are other benefits too.The owner can claim exemptions in the case of long-term capital gains, but no such benefit is provided for short-term gains. “Expenses incurred on repairs and renovation can be added to the cost of acquisition while computing longterm capital gains. The interest paid during the pre-construction period can also be added to the cost, if not already claimed as a deduction earlier,“ says Vaibhav Sankla, Director, H&R Block India.

How to avoid tax

There are several ways to avoid paying tax when you sell a house. There is no tax to be paid if you use the entire gain from the transaction to buy another house within two years or construct one within three years. The twoand three year period applies even if you bought another house a year before selling the first one. But the property should have been bought in the name of the seller.In case the entire capital gains are not invested, the balance amount is charged to long-term capital gains tax. However, the entire tax exemption will be reversed if the new property is sold within three years of purchase or construc tion. In such a case, the entire capital gains from the sale of the previous house will be considered as short-term gains and taxed at the normal slab rates.

If you are not keen to lock-in your gains from the sale of a house in another property , there is another way out.You can claim exemption under Section 54 (EC) by investing the long-term capital gains for 3 years in bonds of NHAI and Rural Electrification Corporation Limited within six months of selling the house. However, one can invest only up to `50 lakh in these bonds in a fiscal.From the current financial year, sellers also have the option of investing the entire long-term capital gain in a technology driven start-up (certified by the Inter-Ministerial Board of Certification) to get relief from tax. The investment in computers and software for your startup will be eligible for exemption from tax on the sale of house held for at least three years. Apart from this, sellers also have the option set off long-term capital gains from sale of the house against any long-term loss from sale of other assets.These can be losses carried forward over the past 8 years or even those incurred in the same year. However, the only way to avoid tax on short-term capital gains is to set it off against any short-term loss from the sale of other assets.

Dealing with TDS

To plug tax leaks, the government has now made it mandatory for buyers to deduct TDS when they buy a house worth over `50 lakh. TDS of 1% of the value of the property has to be deducted before making the payment to the seller.Till last month, this amount was required to be deposited within seven days from the end of the month in which the sale transaction was carried out, but from 1 June, the period has been extended to 30 days. Since this payment is made on behalf of the seller and linked to his PAN, it is reflected on the seller's Form 26AS. The seller must also obtain a TDS certificate in Form 16B from the buyer. The seller can claim a refund of TDS if he is incurring a loss on the sale of the house or if he is claiming exemption from long-term capital gains. To claim the refund, he should provide details of investment of the capital gains in his tax return. Alternatively, he can obtain a certificate from the assessing officer specifying that no TDS must be deducted on payments made to him, and present this certificate to the buyer.

Amenities can cut capital gains on sale

December 2, 2020: The Times of India

Flat amenities can cut capital gains on sale

Price Can Be Added To Total Cost: ITAT

Mumbai:

In a litigation over capital gains arising on a flat sale, Income-Tax Appellate Tribunal (ITAT)’s Mumbai bench has held that the taxpayer can add the price paid for amenities to a builder’s group company to arrive at the total cost of acquisition of the property.

The sale consideration minus the cost of acquisition (adjusted by applying the cost inflation index) determines capital gains. Higher the cost of acquisition, lower the taxable capital gains component. If the sale consideration is lower than the cost of acquisition, it results in a capital loss.

On sale of a flat held for more than two years, the capital gains that arises is treated as long term and is subject to a tax at 20%. Thus, it is important for sellers to know what can be included as the cost of acquisition—typically it constitutes the purchase price, stamp duty, registration cost and broker fees.

In the case of Rashmi Dhanani, which ITAT heard, the taxpayer had shown a long-term capital loss on sale of her flat. In the total cost of acquisition reflected in her tax computation, she had included Rs 9.4 lakh, which was paid to an affiliated company of the builder, under a separate amenities’ agreement.

The amenities for which the additional charges were paid included special water proofing in the toilets and the kitchen and special wood for doors and windows.

In this case, ITAT had remanded the matter to the I-T officer to ascertain whether other flat owners had entered into similar amenities agreements.

ITAT observed 33 of the 128 flat owners had entered into a similar agreement. Further, the taxpayer’s financial statement consistently included this sum of Rs 9.4 lakh in the total property cost. Based on the above facts, ITAT decided in the taxpayer’s favour.

Tax experts say determining what can be added to arrive at the total cost of acquisition is a fact-based exercise. Puneet Gupta, director, People Advisory Services, EY India, says, “A distinction should be made between capital costs that become an integral part of the house versus the cost of movable items such as furniture and fittings, which will be treated as personal effects. The taxpayer must be able to substantiate the expenditure with documentary evidence.”

An I-T official said builders are increasingly offering various amenities to buyers, typically at an additional cost. These vary from special bathroom fittings, marble floorings, modular kitchens, and so on. Taxpayers need to obtain a proper breakup to avoid litigation at a later stage, when they sell this flat.

Holding period

Starts from date of allotment, not registration

In a decision that will benefit many taxpayers, the Mumbai bench of Income Tax Appellate Tribunal (ITAT) recently held that the date of allotment of a house shall be treated as the date of acquisition. The holding period will be counted from this date and not from the date of registration.

Gains arising from the sale of a long-term capital asset are treated as long-term capital gain (LTCG). For an asset to be regarded as longterm, the holding period of a house property is 24 months. Prior to 2017-18 financial year, it was 36 months.

The tribunal’s decision is important as a taxpayer (under Section 54-F) is entitled to a deduction from LTCG arising on sale of a house if investments are made in another house within a stipulated period. This deduction reduces the taxable component of the capital gains and results in a lower tax outgo. On the other hand, if the gains arising on sale of a house are treated as shortterm, purchase of a new house will not entitle a taxpayer to any such benefit.

With the ITAT saying that the holding period should be computed from the date of allotment, it will help many taxpayers as typically the registration happens much later.

In the matter before the ITAT, Keyur Shah had sold a duplex apartment on April 4, 2012 for Rs 12 crore. His share in the property was 50% and the corresponding capital gains worked out to Rs 2.9 crore. In his income tax (I-T) return for the financial year 2012-13, he claimed a deduction under Section 54-F of Rs 1.09 crore (for investment in a new house) and offered the balance Rs 1.8 crore as taxable.

However, the I-T officer contested that the duplex apartment was purchased via a registered agreement only on March 25, 2010. Counting from this date to the date of sale, the holding period was less than 36 months. Thus, the capital gains should be treated as short-term and the Section 54F benefit could not be allowed, the official held.

The I-T department submitted to the ITAT that “the allotment letter is only an offer and the right or interest in property accrues only on signing and stamping of the agreement.” On the other hand, Shah argued that the duplex flat was purchased via an allotment letter dating back to February 26, 2008 and a substantial payment of Rs 1.86 crore was already made by July that year. Thus, the holding period when counting from the date of the allotment letter was more than 36 months.

“The ITAT rightly held that the date of allotment should be treated as the date of acquisition, since there were no material changes in the terms and conditions as compared to those in the final registered agreement,” said Gautam Nayak, tax partner at CNK & Associates.

Taxpayers will benefit from ITAT’s recent ruling as cost of new house can be claimed as deduction only from long-term capital gains

Investment: Capital gains can be invested more than once in new house

The Income-Tax Appellate Tribunal (ITAT) has held that a taxpayer can invest capital gains for the second or third time towards the same “new“ house property. Tax benefits cannot be denied on this ground, provided the cost of the new house is within capital gains that have arisen to the taxpayer.

ITAT also held that as the new property was under construction, it cannot be counted towards the number of houses already owned by the taxpayer.

Various provisions of the Income-Tax (I-T) Act grant a tax benefit, where long-term capital gains (LTCGs) arising out of the sale of certain assets are invested in acquiring a new house property . To the extent of investment in the new property , the taxable component of LTCGs is reduced, which results in lower I-T outgo. But if the taxpayer owns more than one house, other than the “new“ residential property , on the date of transfer of the original assets, the I-T benefit is not available.

It is not uncommon for taxpayers to sell more than one asset to buy a larger accommodation or purchase a more expensive one. The Delhi bench's decision early this month will support I-T deduc tion claims of taxpayers.

“ITAT has rightly held that the new house was not complete, so it could not be regarded as a house already `owned' by the taxpayer. Also, there is no bar on claim on exemption of more than one capital gain in respect of investment in one house, which ITAT upheld. The only aspect taxpayers need to keep in mind is meeting timelines for acquisition of the new house,“ said Gautam Nayak, tax partner at CNK & Associates. This case decided by ITAT relates to section 54F, which provides for I-T deduction where LTCGs arising from sale of non-residential property are invested to acquire a new house property .Tax experts said the same tenet will apply to section 54 too, which covers investment of LTCGs arising from sale of a residential property in another house property . LTCGs arise where property held for more than three years is sold for a profit.

Mohinder Kumar Jain, whose case was heard by ITAT, had sold five properties and invested the LTCGs, for construction of a house at Mehendi Farm. He claimed a deduction of Rs 1.59 crore under section 54F in his I-T returns for 2010-11.

The I-T official disputed this claim and said a deduction of Rs 47.84 lakh had been claimed earlier by Jain under section 54F for construction of the same house at Mehendi Farm. This claim had been allowed by the I-T authorities for 2008-09. The I-T official contended that on the date of sale of these five properties, Jain owned more than one residential house (at Vasant Vihar and the property under construction). Thus, he denied the I-T benefit that was sought by the taxpayer. When the dispute reached ITAT, it decided in favour of the taxpayer.

Multiple flats’ sale can still fetch tax benefit

Lubna Kably, February 12, 2019: The Times of India

From: Lubna Kably, February 12, 2019: The Times of India

In a landmark decision, the Income Tax Appellate Tribunal (ITAT) has held that a taxpayer can avail of tax benefits where long-term capital gains (LTCGs) arising on sale of more than one flat are invested or will be invested in one residential house in India, within the stipulated time.

This recent ITAT decision will benefit taxpayers in Mumbai and in the absence of any contrary jurisdictional order will strengthen the case of other taxpayers.

It is not uncommon for a taxpayer to sell more than one house in order to buy a larger accommodation or shift to a tonier locality.

Dispute revolved around Section 54 of Income Tax Act

There have been instances where tax benefit claims made by taxpayers have been denied as sale proceeds of more than one flat were invested in a new residential property.

If the taxpayer makes a profit on sale of a residential house that has been held for at least two years, then such profit is treated as a LTCG. This gain is taxable at 20% with an adjustment for inflation referred to as indexation benefit. Section 54 of the Income Tax Act, which was the subject matter of the dispute, provides that if the investment is made in one house in India, in the stipulated period , then to the extent of this investment, the taxable component of the LTCG is reduced, which results in a lower tax outgo.

The ITAT agreed with the contention of the taxpayer that Section 54 of the I-T Act has an inbuilt restriction that the capital gain arising from sale of a residential house cannot be invested in more than ‘one’ residential house, in India. However, there is no restriction that the capital gains arising from the sale of more than one residential houses can be so invested.

ITAT held: “The provision of Section 54 is applied to the transfer of any number of residential houses provided the capital gains arising therefrom are invested in a proper manner within the prescribed time period.”

Incidentally, the Interim Budget has provided for an additional relaxation. It proposes to allow investments to be made in two house properties in India, but this option can be exercised only once in a lifetime. ITAT is the final fact-finding authority. The I-T department can appeal only if it involves a question of law. At this stage, it is not known whether the I-T department will file an appeal in the HC.

Possession date counts for CG relief

The date of possession of a new house, and not that of the purchasesale agreement, will be considered for calculating the eligibility period for claiming I-T exemption available on reinvestment of long term capital gains (LTCGs) in residential property , the Income-tax Appellate Tribunal (Mumbai bench) has held recently .

If a taxpayer makes a profit on sale of certain assets (house, land, commercial property), she has held for two years (2017-18 budget reduced the holding period from the earlier three years), it is treated as an LTCG, taxable at 20% with an adjustment for inflation.

If a component of LTCG is reinvested in another house in India within a stipulated period -one year prior or two years from the date of sale of the first house -the taxpayer can claim a tax ex emption under section 54 of the I-T Act. The reinvestment must be made within that period, failing which the tax benefits are not available.

In this case before the tribunal, the taxpayer, Ramita Mahendra Mehta, claimed I-T deduction as she had sold her house on September 11, 2009 and purchased a new house by entering into an agreement dated August 18, 2007. The I-T officer said she did not comply with the requirement that the new house must be purchased within one year prior to transfer of the existing property .However, Mehta contended that though the purchase agreement was entered into on August 18, 2007, the final possession of the new house was received only in March 2009.

The date of possession must be considered for determining the `period of eligibility'. Thus, she would meet the criteria of having invested within one year prior to the transfer of the existing property (which was sold on Sep tember 11, the same year). The tribunal bench recognised the issues that buyers of house properties face, especially in metropolitan cities, which could include project delays and thus delay in possession of the new house.

In its order, the ITAT said: “The buyers even after having the agreement for purchase of the new flat cannot exercise any right of ownership or their right cannot be traced to any part of the construction till such time the builder actually gives the possession of a particular flat to the buyer...“

Relying on previous orders of high courts, including the Bombay HC, the tribunal held that the date of final occupation should be considered for calculating the period of eligibility for deduction under section 54. In this case, it would enable the taxpayer to satisfy the requirement that the new house must be purchased within one year prior to transfer of the existing house.

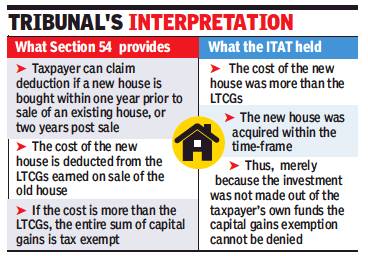

Exemption valid even if housing loan used for new house

The Kolkata bench of the Income-tax Appellate Tribunal (ITAT) has held that investment-linked capital gains tax exemption, which is available on purchase of a new house, cannot be denied merely because the taxpayer has taken a housing loan.

Capital gains are taxable under the Income-tax (I-T) Act. If on sale of a residential house (held for at least two years), the taxpayer makes a profit, then such profit is treated as a long term capital gain (LTCG). This gain is taxable at 20% with an adjustment for inflation, referred to as indexation benefit.

Section 54 of the I-T Act provides for investment-linked capital gains tax exemption. If an investment is made in another house in India, within the stipulated period of time, then the ‘cost of the new house’ is deducted and only the balance component of the LTCGs is taxable.

Such deduction results in a lower I-T outgo. Thus, if the amount of the capital gain is equal to or less than the cost of the new house, the entire sum of LTCG is not taxable.

The new house needs to be purchased either within one year prior to or two years from the date of sale of the old house. This tax benefit is also available if the taxpayer, within three years after the date of sale of the old house, constructs a new residential house.

In the case decided by the ITAT on April 4, Amit Parekh, the taxpayer, had claimed capital gains tax exemption of Rs 59 lakh under provisions of section 54. During tax assessment, the I-T officer noted that Parekh had obtained a housing loan of Rs 82 lakh from ICICI Bank and invested only Rs 9.37 lakh in the new house out of the capital gains.

The I-T officer held that the taxpayer had not adhered to the spirit of the section and he allowed the claim only to the extent of Rs 9.37 lakh. The I-T officer added back a sum of Rs 49.7 lakh (Rs 59 lakh minus Rs 9.37 lakh) to the taxpayer’s income, which would increase Parekh’s I-T liability.

The I-T litigation finally reached the doorsteps of the ITAT, which adjudicates I-T disputes.

The tax tribunal noted that the I-T authorities had not disputed the fact that cost of the new residential house was more than the capital gains. Further, post the sale of the old house, the new residential house was purchased within the time stipulated in the I-T Act. Thus, merely because the taxpayer had availed of a housing loan from the bank, his claim for exemption under section 54 could not be denied, held the ITAT. In reaching its decision, the ITAT also relied on past orders of a few high courts.

Gautam Nayak, tax partner at CNK & Associates, a firm of chartered accountants said: “There is no identity of funds required for claim of exemption. Section 54 recognises the fungibility of funds. In fact, it even permits purchase of a new residential house up to one year prior to sale of the old residential house, where obviously the same funds from the sale could not have been used.”

However, taxpayers need to ensure they adhere to the timelines for purchase or construction of new houses.

Exemption even if investment not from capital gain proceeds

Lubna Kably, ITAT shields tax sops on 2nd house, March 15, 2019: The Times of India

From: Lubna Kably, ITAT shields tax sops on 2nd house, March 15, 2019: The Times of India

‘Valid Even If Cap Gains Not Used For Buy’

The Mumbai bench of the Income-tax Appellate Tribunal (ITAT) has held that the investment-linked capital gains tax exemption, which is available on purchase of a new house, cannot be denied to a taxpayer merely because she has not invested from out of the capital gain proceeds itself.

The I-T officer had denied the tax benefit as the investment made towards purchase of the new house “was not out of the taxpayer’s own funds”. The Commission (Appeals) agreed with this stand. This led to the taxpayer approaching ITAT, which ruled in her favour.

Ishita Sengupta, tax partner, PwC-India, says, “This beneficial order will help taxpayers as practically there could be time gaps between sale and purchase of a new house property and other funds could be deployed for the new investment. However, it is vital that the new house is purchased within the prescribed time limits.”

Similarly, in April last year, the ITAT’s Kolkata bench had ruled that the tax benefit cannot be denied merely because the taxpayer had used the proceeds of a housing loan and not the capital gain proceeds itself.

Capital gains are taxable under the I-T Act. If on sale of a residential house ( held for at least two years), the taxpayer makes a profit, then such profit is treated as a long-term capital gain. This is taxable at 20% with an adjustment for inflation, called indexation benefit.

The new house needs to be bought either within a period of one year prior to or two years from the date of sale of the old one. This benefit is also valid if the taxpayer, within three years after the sale of the old house, constructs a new residential house.

Refunds (e.g. from builders)

Interest is taxable

Getting Refunds Classed As Capital Gain Can Cut Tax Outgo: Experts

The Supreme Court and several high courts have come to the rescue of investors who have booked flats in projects that were delayed for years, with no sign of completion in sight. Additionally , several errant builders, prior to coming into force of The Real Estate Regulatory Authority Act (RERA), have refunded the downpayments plus interest to the buyers.

These buyers may have got back their initial investment and also interest as a compensation but they aren't uncorking the bubbly .“A few friends and I had booked flats in a prominent project in Mumbai.After a delay of nearly six years, the builder recently refunded my deposit aggregating to Rs 1 crore and paid simple interest at 12%. The interest payout is not in tandem with the capital appreciation the flat we would have obtained. Lastly, the I-T liability in my hands on the interest component at 30% is an added sting. To add insult to injury , the errant builder will be able to claim this interest payout as a business deduction and reduce his taxable profits,“ says a buyer.

“Under a negotiated settlement with the builder, it may be possible to characterise the sums received as a `capital gain' with a lower tax rate of 20% and other benefits,“ says Anil Harish, an advocate specialising in real estate.

Those hoping to avail of I-T deductions under sections 54 or 54F on investments in a new house, now find themselves at a complete loss. If they don't get possession of the new house, these claims will be denied.

The tax consequences under various scenarios are analysed below.

Negotiated settlement with builder:

If the document is properly worded, the sums received from the builder could be classified as a capital gain, which would result in a lower tax outgo for the buyer.

“A `transfer' of a capital asset results in a capital gain.The definition of `transfer' in section 2(47) of the I-T Act is wide. It also includes `the extinguishment of any rights in a capital asset'. At the time of booking, the buyer acquires a right in the ownership of the flat. When he settles with the builder he is extinguishing this right. Thus, the amount paid to him is characterised as sale proceeds of the capital asset,“ explains Harish.

“The sale proceeds so received, less the indexed cost, in the case of a long term capital asset, would be a longterm capital gain (LTCG), which attracts a lower I-T rate of 20% plus surcharge and cess,“ he adds.

In our illustration (see table), the buyer gave a deposit of Rs 5 lakh and in addition to a refund of this amount, the builder paid interest at 12% for eight years (or Rs 4.80 lakh). After indexation, which is an inflation adjustment to the deposit amount by applying the relevant cost inflation index (CII), the I-T on LTCG works out to Rs 12,216.

On the other hand if the settlement agreement is not properly drafted, while refund of the deposit of Rs 5 lakh would be treated as non-taxable (it is return of one's own money and in technical parlance it is a capital receipt), there would be an I-T levy on the entire interest component of Rs 4.80 lakh. At a rate of 30% this works out to a steep Rs 1.44 lakh.

In the past, the assessee had to hold an immovable property for three years in order for it to result in longterm capital gains. This holding period is now reduced to two years. In case of refunds by the builder, the holding period will be considered from the date of booking and initial payment by the buyer up to the date of the settlement agreement with the builder.

Harish adds, “This longterm capital gain can then be invested in eligible bonds under section 54EC or the sale proceeds can be invested in another new house, under section 54F to further reduce the I-T outgo.“

Interest paid in cases of dispute:

To safeguard buyers, RERA requires the builder to pay interest at 2% above SBI's marginal lending rate, which currently works out to 10.15%.“Such interest will be part of taxable income and I-T at the applicable slab rate, say 30% plus applicable cess and surcharge, will have to be paid,“ says Ameet Patel, tax partner at Manohar Chowdhry & Associates “It could be provided that such interest would be on a net of tax basis (i.e: tax would have to be borne by the builder, by grossing up of the sum payable),“ explains Gautam Nayak, tax partner at CNK & Associates. “Or to mitigate this burden, the government could consider an amendment that instead of an interest component, a premium based on a stipulated rate of return would be paid to the buyer.This premium will be treated as capital gain,“ adds Nayak.

Loss of I-T benefit on investments in a new house:

Various provisions of the I-T Act grant a tax benefit when LTCGs arising on sale of certain assets (eg: house, land, commercial property) are invested in acquiring a new house. To the extent of investment in the new house, the LTGCs are reduced and only the balance amount is taxable. Tax tribunals have taken alenient view and tax benefits have not been denied in case of a delay in possession of the new house beyond the stipulated period of two years from sale of the original asset.“However, as things currently stand, when there is a closure of a project and refund of the advances paid, the buyer may also lose the capital gains exemption that he has claimed under sections 54 or 54F of the I-T Act for investment in a new house,“ says Nayak.

Excess sum on flat cancellation is capital gain