Burma, Commerce and Trade 1908

This article has been extracted from THE IMPERIAL GAZETTEER OF INDIA , 1908. OXFORD, AT THE CLARENDON PRESS. |

Note: National, provincial and district boundaries have changed considerably since 1908. Typically, old states, ‘divisions’ and districts have been broken into smaller units, and many tahsils upgraded to districts. Some units have since been renamed. Therefore, this article is being posted mainly for its historical value.

Contents |

Commerce and trade

For centuries the seaboard of Burma has been visited by ships from many countries. Bassein was a flourishing port in the twelfth century, and at a later period we find Arabs and other Asiatic Commerce and constant communication with Arakan, Pegu, and Tenasserim. Towards the beginning of the second half of the fourteenth century, Muhammadan merchants car- ried on a brisk trade between Pegu and the countries east and west.

The Arabs brought to Burma goods of European manufacture as well as the produce of their own country ; and large sea-going boats from Arakan visited the ports of Bengal. The principal exports from Bassein and Pegu were gold, silver, rubies, sapphires, long-pepper, lead, tin, lac, and some sugar. The imports from Arabia and the Persian Gulf to Syriam, an ancient emporium of Burma, close to the mouth of the Pegu river, were woollen cloths, scarlet velvet, and opium ; and from Madras and Bengal piece-goods of various kinds. The trade of Malacca and places to the eastward was with Mergui and Martaban, then flourishing ports of Tenasserim, the imports being porcelain from China, camphor from Borneo, and pepper from Achin. From Arakan, rice was the principal export, the imports being muslins, woollens, cutlery, {)iece-goods, and glass and crockery ware. Tenasserim ex- ported tin largely. After the cession of Arakan to the British, Akyab rapidly rose in importance. The trade of Tenasserim, when the British came into possession, was at a very low ebb. The country, however, had large teak forests, which led to the foundation of the town of Moulmein, where ship-building could be extensively carried on. Later on, after the second Burmese War, Rangoon came into pro- minence and has now far out-distanced the older ports.

The chief items of the export trade of Burma are rice, timber, cutch, hides, petroleum, india-rubber, cotton, and precious stones. It is the rice produce and the rice exports that have made, and maintain, the prosperity of the Province. Paddy and rice now form more than three- quarters of the total exports. The only other item of export which can approach rice in importance is teak timber. The chief imports are piece-goods, silk, salted fish, wool, cotton twist, gunny-bags, betel- nuts, lic]uors, tobacco, iron, mill machinery, and sugar. The chief centres of trade in the Province are the seaports of Ran- goon, MouLMEiN, Akyab, Bassein, Tavoy, Mergui, Kyaukpyu, Sandoway, and Victoria Point ; and, in the interior, Mandalay, Bhamo, Pakokku, Prome, Henzada, and Myingyan. The bulk of the trade at the ports is sea-borne. Mandalay and Bhamo are the two main emporia for the trade with South-Western China and the northern portion of the Shan States, which is wholly by land. The trade of Pakokku, Prome, Henzada, and Myingyan is partly river- and partly land-borne. Rangoon exports rice, timber, cutch, hides, india-rubber, tobacco, and cotton. Akyab and Bassein export little else than rice, but Moulmein sends timber, also rice and a little tobacco.

The chief exports of Mergui are fish and shrimp paste {tigapi), dried prawns, salted fish, mother-of-pearl and its substitutes, and tin. The produce that leaves Tavoy by sea is miscellaneous in nature, but rice preponderates ; and it may be laid down in general terms that the amount of merchandise other than rice and timber which passes out through the smaller ports of the Province is practically a negligible quantity. Rangoon's chief imports are hardware, piece-goods, kero- sene, salted fish, liquors, and sugar ; and the smaller ports follow suit on a less extended scale, the only noticeable feature being Moulmein's large importation of betel-nuts and sugar. Mandalay is the head- quarters of the tea and jade trade of Upper Burma, and Myingyan is largely concerned with the cotton grown in the dry areas of the Upper Province. Rangoon possesses a Chamber of Commerce, formed in 1877 with a view to the furtherance of commercial interests in the Province, and a Trades Association. The port of Rangoon is adminis- tered by a Port Trust constituted under the Rangoon Port Act of 1905.

There are thirteen commissioners, of whom four are elected by the Rangoon Chamber of Commerce and one by the Rangoon Trades Association, the others being appointed by the Local Government. The chief executive authority is vested in a full-time chairman, who is also the Chief Engineer of the port. The receipts of the Port Fund in 1881 amounted to nearly 5^ lakhs, and its expenditure to over 6-| lakhs. In 1902-3 the corresponding figures were i5-| and 14^ lakhs respectively, and in 1903-4 the income had risen to 17I lakhs.

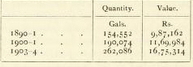

The simplest method of classifying the trade of the Province is that which distinguishes between the internal and the external trade. External trade may be with countries beyond the limits of British India (trans-frontier) or with other Provinces of the Indian Empire. The trans-frontier sea-borne trade is registered by the Customs depart- ment, the trans-frontier land trade with China, Siam, and other Asiatic countries by a Trade Registration department under the Director of Land Records and Agriculture. External trade with the rest of British India may similarly be maritime or land trade. In the former case it is generally known as coasting trade and is registered by the Customs department, in the latter it is not registered. Table V (p. 238) gives statistics of the sea trade of the Province with other Provinces and with foreign countries, and of its foreign land trade, for the years 1890-1, 1900-1, and 1903-4.

The internal trade of Burma is still mainly in the hands of the Burmans ; but they hold their own with difficulty when pitted against the natives of India and of China, whose shrewdness and business capacity have enabled them to take a large proportion of the petty business away from the people of the country. The rail- and water- ways are the main commercial highways of the country in Burma proper. Up to 1892 practically the only statistics of internal trade were those furnished by the Irrawaddy Flotilla Company and the railway administration. In 1892 steps were taken to register the trade carried on by the country boats plying on the rivers of Burma, but it was found that the value of the information furnished was not commensurate with the cost incurred in collecting the required data, and in 1897 the arrangements were discontinued. The boat trade is still largely carried on by the indigenous population, and the float- ing pedlars it supports are able to reach a portion of the community untouched by bazars and the ordinary traffic of the market-place.

Though its precise extent has not been gauged of recent years, the internal trade of Burma is comprehensive and far-reaching. Here statistical details, which must of necessity be defective, are of no great value. Advantage may, however, be taken of what has been collected in the past to place on record that in 1896-7, the last year of registra- tion, the value of the internal trade of Burma was given as about 937 lakhs. Between Burma proper and the Shan States, and within the limits of the latter, there is a fairly extensive caravan traffic ; bullocks and mules are the main means of transport, but a considerable portion of the merchandise is conveyed in baskets slung on bamboos upon the shoulders of carriers. This section of inland trade has been in the past, and is still, registered by the Trade Registration department. The value of the inland trade between Burma and the Shan States amounted in 1903-4 to over 78 lakhs under exports and 104 lakhs under imports. In return for the cotton twist, cotton goods, salted fish, and betel-nuts, which form the bulk of what they take from Burma, the Shan States send into the Burmese markets tea (pickled and dry), timber, fruit, vegetables, and cattle. The Northern Shan States supply the greater part of the pickled tea (letpef) consumed in the Province. The value of this commodity imported from the Northern Shan States in 1903-4 was about 22 lakhs. Barter is occasionally resorted to liy the inland traders, especially in the case of dealings with the hill tribes, but the practice is not widespread.

There is a little land trade between Burma and the rest of India. Goods pass between Akyab and Chittagong and Assam and the Upper Chindwin District ; but the business done over these inland trade routes is insignificant, is not registered, and for general statistical purposes may be left out of consideration. Burma's commercial inter- course with the rest of the Indian Empire may be said to be almost wholly maritime. It is carried on to a small extent by native craft ; but the great bulk of what is known as the coasting trade of the Pro- vince is in the hands of the British India Steam Navigation Com- pany, which unites the Province with all the chief commercial ports of the seaboard of the Indian Empire, besides furnishing steamer services which ply the whole length of the coast from Akyab to Mergui.

The Asiatic Steam Navigation Company is also concerned in the coasting trade of the Province. It connects Rangoon with the Andamans and several ports of India. Of the imports from other Provinces the most notable are coal, tobacco, gunny-bags, cotton yarn, vegetable oil, and betel-nuts, while rice, mineral oil, and teak timber form the bulk of the exports. The coasting trade of the Province passes through the larger ports, namely, Rangoon, Akyab, Moulmein, Tavoy, and Mergui, and to some extent through Kyaukpyu, Sandoway, and Victoria Point. In the smaller ports the imports by coasting trade ordinarily exceed the exports. In Rangoon the case is reversed, and, taking the Province as a whole, the export business exceeds the import. Bassein is not visited by any of the regular coasting lines of steamers, and thus, though its foreign trade is far from inconsiderable, it does very little coasting business.

Table V appended to this article (p. 238) shows that, excluding Government treasure, the total value of the maritime trade of Burma with other Provinces in the year 1903-4 was nearly 7 crores under imports and more than 4| crores under exports, the corresponding figures for 1 900-1 being, in round figures, 6 and 10 crores. In the latter year the exports were raised by the abnormal demand for rice from the Provinces suffering from famine, especially from Bombay ; and it may be said in general terms that the existence or non-existence of calls of this nature decides whether the coasting trade of the Province in any one year shall exceed or fall below its foreign trade. A noticeable feature of the coasting trade returns is the fact that famine in India, while affecting the destination of shipments from the rice- exporting ports of Rangoon and Akyab, has in the past failed to divert the rice supply of Bassein from its ordinary foreign channel.

The foreign sea-borne trade of Burma is carried by the boats of the Bibby, the Patrick Henderson, and other lines, and passes for the most part only through the larger ports of the Province : namely, Rangoon, Akyab, Moulmein, Bassein, Tavoy, and Mergui. Except at Rangoon, there is no comparison between the imports and the exports under foreign trade, the proportion the latter bear to the former in the lesser ports being roughly 20 to i. An instance of this disparity may be cited. At Bassein the value of foreign exports in the year 1 900-1 was over 103 lakhs, that of foreign imports was Rs. 354. Rice and timber are the main articles of export, and the imports are generally those indicated on p. 178. Details will be found in Table VI on p. 239, which shows that in 1903-4 the total foreign import trade was valued at 8i crores, and the export trade at nearly 16 crores.

The increase in exports and imports under foreign trade during the past twenty years has on the whole been steady. The trade of the first half of the decade 1 891 -1900 was disastrously affected by a com- bination entered into by the rice-millers in 1893 to keep down the price of rice. Since then, however, there have been no very marked fluctuations, though the effect of the scarcity of 1896-7 in Upper Burma is visible in the yearly trade returns.

In the matter of foreign imports the United Kingdom heads the list of supplying countries. In 1900-1 it supplied 4 crores' worth of goods, or 58 per cent, of the total, and in 1903-4 4| crores, about the same proportion. The Straits Settlements, important as a distributing rather than as a producing centre, are the second largest supplier. Japan follows next in the list of importing countries, and the rapid growth of its business with Burma is not the least significant feature of the trade statistics of the past decade. The Straits Settlements were Burma's largest customer in 1903-4, the exports exceeding in value those to the United Kingdom (349 lakhs against 254 lakhs); but it should be mentioned that information as to the ultimate destination of a good deal of the produce exported from the country by sea is defective, in consequence of the practice of shipping in vessels whose ultimate destination is unknown. A considerable portion of the exports to the Straits is intended for Java, Sumatra, Borneo, and Eastern Asia generally.

The trans-frontier land trade of Burma is carried on with China, Siam, Karenni \ and French Indo-China, and is registered at a number of frontier stations. The trade with Western China passes for the most part over a route terminating at Bhamo on the Irrawaddy, though there is some traffic through Myitkyina District and the Northern Shan States. A small portion of the Western China trade also passes through the registration stations established south of Mayniyo along the Shan States border. Karenni sends its merchandise for the most part down the Salween to Kawludo and Kyaukhnyat. Dagwin, Tadan- ku, and Kwanbi, stations along the eastern frontier of the Tenasserim

' Karenni, tliouj^h controlled by the British Government, is not part of British India, and, for trade purposes, has been treated as a foreign country.

Division, secure the bulk of the trade between Burma and Chiengmai that does not pass through the Shan States, while commerce with the rest of Siam, besides traversing the Tadanku route, crosses the fron- tier hills near Kyeikdon in Amherst and Myitta in Tavoy District. The merchandise that enters and leaves the country by land is carried mostly by pack-bullocks and mules, though cooly-carriage is not uncommon. The traders seldom travel singly ; and caravans mark, with jangling bells and clouds of dust, their progress up and down the main frontier highways during the whole of the dry season. The Burman himself takes very little active part in the trans-frontier land trade of his country. The carriers are Shans, Maingthas, Panthays, Chinese, and Siamese. The registration stations are placed on the roadside at suitable points where traffic converges, and the record of statistics may be said on the whole to be fairly accurate. In 1 89 1 the total number of registration stations was 13, in 1904 it was 33.

The figures in the foreign land trade table appended to this article (p. 241) show that trade of this class increased very largely during the ten years ending 1901. In the case of imports the total for 1901 is almost exactly double what it was in 1891, and the exports have more than doubled; the figures for 1903-4 show a further increase. The present trans- frontier land trade is in value and extent still far below the trade that passed before 1885 between British and Independent Burma, but its development during the past few years augurs well for the future. The distribution of the total of 1903-4 between the different foreign countries concerned is as follows, the figures being given in thousands of rupees :—

Western China is mainly responsible for the growth in this class of

trade. In 1891 its imports and exports were smaller than those of the

other countries shown above, while it now heads the list. The main

imports are teak timber, cattle, ponies, hides, tea, and silk. Cotton,

cotton yarn, piece-goods, and dried fish make up the bulk of the

exports.

Finance

The main sources of revenue in Lower Burma under Burmese rule were a tax based more or less on the land cultivated, taxes on ploughs, transit dues, judicial fees and fines, and a few other . miposts. In Upper Burma prior to the annexation the kings looked for their revenue in the first place to the thathameda or income tax, but also to the rent of state land, to receipts from forests and minerals (rubies, jade, and earth-cnl), and to other items of receipt, such as water rate, fisheries, transit dues, monopolies, ferries, and bazars. In Lower and Upper Burma the revenues were farmed out to unsalaried native administrators {jiiyozas, literally ' eaters of districts '), who paid a fixed sum on account of their myos into the royal exchequer, and retained the larger amount they had succeeded in extracting from the long-suffering taxpayers. With the abolition of this system in Lower Burma, after annexation, the finances of the country began to show an upward tendency. The revenue of Arakan expanded between 1826 and 1855 from 2-3 to 12-8 lakhs, while that of Tenasserim rose from Rs. 27,000 in 1829 (three years after its annexation) to 8-3 lakhs in 1855. Between 1855 and 1882 the revenue of Lower Burma increased from about i to 3 crores of rupees. This total includes all receipts, whether eventually credited to Provincial revenues or not, as well as the incomes of municipalities and ' Excluded ' Local funds.

All items of the revenue of Burma, other than those derived from municipal and purely local sources, fall into one or other of two classes. They may be treated as Provincial, in which case they are at the dis- posal of the Local Government, or as Imperial, in which case a portion returns into the country in the form of payments, the balance being absorbed into the Imperial exchequer (see chapter on Finance, Volume IV, chapter vi). The financial relations of the Local and Supreme Governments have for the last quarter of a century been regulated by periodical settlements. The first of these was made in 1878, and further settlements took place in 1882, 1892, 1897, and 1902. Till 1897 the finances of Upper Burma were excluded from this arrangement, but in that year the Upper Burma accounts were also provincialized and included in the terms of the 1897-1902 settlement.

Under the first settlement with the Government of India, that of 1878-9, the Imperial exchequer received five-sixths, and the Provincial one-sixth, of the revenue of the Province. Under the scheme which came into operation in 1882, fixed percentages of land revenue, export duties, and salt revenue, and the whole of the receipts and charges of certain departments, were assigned to the Province. At the same time, half of the receipts and expenditure under the heads Forest, Excise, Stamps, and Registration became Provincial. The 1882 settle- ment was not favourable to Burma ; only in the first and last years of its currency was there a Provincial surplus. In each of the other three years there was a deficit, which had to be met from Imperial revenues. The average annual receipts and expenditure during the currency of this settlement were — Imperial and Provincial combined, receipts 2-73 crores, charges i-6o crores ; Provincial alone, receipts 1-29 crores, charges 1-35 crores. In 1887-8, in lieu of a fresh quin- quennial settlement, a provisional arrangement was entered into by which the terms of the previous settlement were continued with cer- tain modifications, the chief of which -fixed the shares of land revenue at two-thirds Imperial and one-third Provincial, and a special assignment of 4| lakhs was granted to Provincial to cover the probable excess of expenditure over revenue. This arrangement was continued up to 1889-90, when the Imperial share of excise receipts and charges was increased to three-fourths, and the receipts and charges in con- nexion with income-tax were equally divided, the loss thus caused to Provincial being adjusted by a contribution from Imperial. During the five-year period covered by these arrangements, the combined Imperial and Provincial receipts and charges averaged 3-33 crores and 1-70 crores yearly, and the Provincial alone i-5i crores and 1-45 crores. The quinquennium was one of economic progress and closed in conditions of material prosperity. Under the settlement of 1892 the Provincial shares of land and fishery revenue were re- duced to one-fourth, while that of stamp revenue was raised from one-half to three-fourths. These and other changes caused a loss to the Provincial government, which was met in part by an increase in the lump grant from Imperial to Provincial, fixed at 41^ lakhs per annum. The average annual receipts and charges during the currency of the 1892 settlement were : under Imperial and Provincial combined, 4-26 and 2-19 crores respectively, and for Provincial alone, 2-01 and 2-03 crores. The settlement was, on the whole, a favourable one from the Provincial point of view, though the credit balance at its close was lower than at its commencement.

Upper Burma finance may be said practically to date from the year 1887-8. At the outset the revenue was small ; but it increased steadily and at the end of the decade ending 1897 was double what it had been at the commencement, and this despite the fact that the last year of the decade (1896-7) was a season of scarcity marked by a substantial diminution in land revenue. With the settling down of the country after annexation cultivation was largely extended, and the progress of settlements raised the revenue total. Forests and Railways also showed very large increases. The average annual receipts and ex- penditure during the ten years in question were i crore and i| crores respectively.

The year 1897—8 saw the commencement of a fresh quinquennial settlement. It was the first which comprised the finances of the Pro- vince as a whole. Under its terms the Provincial share of land revenue and excise was raised to two-thirds and a half respectively, and the lump sum grant from Imperial to Provincial was reduced from 41^ lakhs to 39 lakhs. During the currency of this settlement the total receipts and expenditure of the Province averaged 6-93 and 4-20 crores annually, and the Provincial share averaged 3-47 and 3-26 crores respectively. On the whole the period covered by the settlement was one of material prosperity. The harvests were good ; there were large extensions of cultivation, and land revenue settlement operations resulted in a rise in the rate of assessments over a large area. In each year of the quinquennium both revenue and expenditure exceeded the standard figure very considerably, and the period closed with a Provincial credit balance of 120 lakhs, a sum nearly four times as great as the balance in hand at its commencement.

By the settlement of 1902 the Provincial share of land revenue receipts was reduced from two-thirds to one-half, £jnd that of excise revenue and expenditure from one-half to one-third.

Table VIII at the end of this article (p. 242) shows the average receipts under the main heads of revenue during the decades 1881-90 and 1891-1900, side by side with the actual receipts for 1900-1 and 1903-4. The figures are illustrative of the steady growth of revenue during the past twenty years. Table IX (p. 243) indicates the fluctuations in Provincial expenditure during the same period.

Land Revenue

The principles that underlie the land tenures of the Province have been indicated in an earlier paragraph. In Lower Burma a permanent right of use and occupancy in land may be acquired Land revenue.

by prescription or by virtue of a specific grant from the state. In early days a theory seems to have sprung up that the people of the country had, of their own motion, surrendered a portion of their produce to the monarch, as a return, so to speak, for his assumption of the arduous and responsible duties of ruler. The theory is based, no doubt, on a democratic fiction ; and, whatever its merits may be, the principle that the permanent right of use and occupancy aforesaid does not free land in Lower Burma from its liability to pay revenue has never, been seriously disputed. In Upper Burma the crown's ownership in the soil was unmistakably affirmed for all future time by the Upper Burma Land and Revenue Regulation (III of 1889), which declares the proprietary ownership of the state in all waste land and in all islands and alluvial formations, as well as in land known under the Burmese regime as royal or service land. At the same time it was recognized that there was land in Upper Burma in which the full proprietary title of the crown had been extinguished, much as in Lower Burma, by the prescriptive rights of private indi- viduals in the past. In the case of this land the ownership appeared, moreover, at first sight, to have passed more fully away from the state than in Lower Burma, since for some time prior to the annexation the sovereigns of Upper Burma had abstained from levying land revenue on it, although rent was paid on state land. It is more than probable, however, that this abstention was due, not to the idea that the Burmese government had relinquished all rights in private land, but to the fact that the primary source of revenue in pre-annexation days was the tha- thameda. This tax — which appears in the first instance to have been a proportion of the produce of the fields, and at one time to have been actually taken from the grain-heap and paid in kind by all classes of landholders — gradually assumed a form which caused its intimate connexion with the land and its fruits to be lost sight of, and, by the time the British came into occupation, had developed into something that may be described as approximating more closely to an income-tax than to any other form of impost. However that may be, the Upper Burma Land and Revenue Regulation established the right of Govern- ment to demand land revenue from the holders of non-state, no less than from the holders of state land ; and this right, even when not actually enforced since then, has been held to be only temporarily in abeyance. Where both classes of land are assessed to land revenue, the private landholder has the advantage in a lower assessment and in full rights of transfer. In the case of all but non-state land there are certain restrictions on the right of alienation. Thus in Lower Burma transfers of land granted or leased by Government are forbidden within five years of the execution of the grant or lease (or within a longer period if exemption from land revenue has been allowed), with- out the previous sanction of the Deputy-Commissioner ; while in Upper Burma no transfer of state land held on lease can be made to a non- agriculturist, or to a person who is not a native of Burma, without the previous sanction of the township officer.

As has been already stated, Burma is a ryottvCxri Province : that is to say, the cultivator, as a general rule, pays his land revenue to the state direct and not through the medium of a landlord. In the early days of the British occupation of the Lower province, an attempt was made in Arakan by the revenue officials, fresh from a zamlndari Province, to erect the village headman, on whom the collection of the revenue devolved, into a species of zam'inddr; but this policy does not appear to have been a success and was not persisted in. The assessments of revenue are fixed, subject to revision, at periodical settlements for which no uniform period of duration has yet been prescribed.

The term seldom exceeds fifteen years in Lower Burma ; and in Upper Burma, where a regular settlement policy is still in process of development, fifteen years has been the maximum up to now. The whole of the Province has not yet been brought under regular settlement, but only a com- paratively small portion of the cultivated area of Lower Burma remains unsettled. In Upper Burma the settlement of the greater part of the dry zone Districts is either complete or approaching completion, and a commencement has been made on the remoter wet areas ; but the land revenue system in the Upper province is still in a state of transition. Settlement operations are more elaborate in Upper than in Lower Burma : the crops are more varied than in the Lower province : the field season is longer, and additional labour is thrown on the .settle- ment officer by the investigations entailed in preparing a record of rights and occupation, and in adjusting the thathameda on the classes who do not depend solely on agriculture for their livelihood. In Upper Burma the District is settled as a whole, in Lower Burma in tracts of varying size. In the unsettled Districts of Upper Burma non- state land is ordinarily not assessed to land revenue, and state land pays at rates based on local custom and varying from locality to locality.

In the second edition of the Imperial Gazetteer it was stated that the basis of the land revenue settlement in Burma had been ' 20 per cent. of the gross produce after many deductions, payable to Government in money at the rates of the price of grain in the circle within which the land is situated.' It is now a generally accepted principle throughout India that land revenue rates should be calculated on the net and not on the gross produce ; and, speaking generally, it may be said that 50 per cent, of the net produce is what is looked upon in Burma as the theoretical maximum. The actual rates are, however, as a rule far below this. In Lower Burma the provisional maximum is one-fourth of the net produce, and rates varying from one-tenth to one-sixth are the most common. To arrive at the rates the land is first classified accord- ing to its fertility, the approximate productiveness of each class is ascertained by crop measurements, and the money value of the gross produce is arrived at after a consideration of average prices extending over a considerable period of years. From this is deducted the cost of cultivation, computed on a liberal scale, and on the net remainder the rates are based. In the settled Upper Burma Districts non-state land is ordinarily assessed at rates 25 per cent, lower than those at which state land is assessed, while in a few Districts all ya land (see page 150), whether state or non-state, is assessed at a single rate. A fallow rate of two annas per acre is levied in Lower Burma on land which has been left uncultivated in order to allow it to recover from exhaustion, or as a result of causes over which its occupier had no control ; otherwise a rate ranging between two annas an acre and the normal cultivation rate is ordinarily levied. In Upper Burma the assessment is levied on matured crops only, and rates are not assessed on either failures or fallows.

It is practically impossible now to form anything but the roughest estimate of the amount of land revenue assessed and collected by the Burmese kings in the days that preceded the annexation of the Lower Province. In addition to a form of income-tax, the amount of which was gauged by the area of land cultivated by each assessee, a tax was paid in Arakan and Tenasserim, prior to 1826, on every plough used; and it was not till 1831 that any attempt was made by the British to assess the cultivated land by area instead of by the plough. Before the second Burmese ^\'ar added Pegu to the Indian Empire, the tax upon the land cultivated in that province was according to the }okes of cattle employed, the onlj- exception to the general rule being Prome, where half the produce (apparently the gross produce) was taken from some lands and no other demand was made on the occupiers. The revenue of Pegu prior to annexation was nominally nearly 15 lakhs, and to this total private exactions on the part of the minor officials are computed to have added 10 lakhs more ; but this figure represents only the revenue that was not paid in service or in kind, and there are no means now of separating the purely land revenue from the other items, such as transit dues, timber revenue, and the like, which went to make up the aggre- gate. In Upper Burma in 1884, i.e. immediately before annexation, the amount collected from the rent-paying royal rice-fields, cultivated grounds, and gardens was rather more than 3^- lakhs in money pay- ments, and a little over a million and a half baskets of paddy. These rents, however, formed only a small portion of the total revenue of the kingdom ; the greater part was furnished by the ihathameda, which in 1884-5 brought a total of 36 lakhs into the royal coffers. In the first two years of the reign of Mindon, the immediate predecessor of Thibaw, a land tax of 12 to 15 annas per acre was levied on rice land, and from 10 to 12 annas per acre on land producing island crops in Sagaing Dis- trict, but on the introduction of thathameda this tax was abolished. In Minbu District under Mindon's predecessor, Pagan Min, the land tax appears to have been heavier in incidence, nearly Rs. 3 per acre in certain cases. King Mindon himself would seem in this District to have introduced a land tax on one-tenth of the produce on all classes of land. In Meiktila the government share of the produce of state land was taken at one-fourth, and the assessment was fixed at Rs. 15 per pc (1-75 acres); but there are no signs of any permanency in the revenue system of the Burmese monarchs.

Turning now to the actual outcome of the British settlements, we find that the rate now levied on rice land very seldom exceeds Rs. 7, or falls below Rs. 1-4 per acre. Ow ya land the rates are lower and do not as a rule rise much above Rs. i -8, at times being as low as 3 annas per acre. Kaing\eL\\'dL rates (page 150) vary from Rs. 7 to Rs. 1-4 per acre. Garden land is, as a rule, assessed at lower rates than rice land. Remissions of revenue are granted when erop.s have been wholly or partially destroyed by flood or drought. These remissions may be either entire or partial, according to the extent of the loss sustained, but are not ordinarily granted unless the loss exceeds one-third of the estimated ordinary full crop of the holding concerned. Temporary exemptions from land revenue are allowed under certain conditions in the case of uncleared land granted or leased by Government for purposes of culti- vation. The maximum period of exemption is fifteen years.

In 1 88 1 the average incidence of land revenue in its narrowest sense was Rs. i'7 per head of the population of the Lower province. By the end of the succeeding decade. Upper Burma had been added to the Indian Empire ; and the peculiar revenue conditions obtaining there had reduced the average incidence of land revenue proper for i8gi to Rs. 1-2 per head for the whole Province. Since then successive settlements in Upper Burma, coupled with an extension of cultivation that has out- stripped the growth of population, have added to the land revenue to an extent that in 1901 raised the incidence to Rs. 1-9 per head, or above the average for 188 r. As thathameda is gradually replaced by land revenue in Upper Burma, this figure will tend to rise still farther.

The net demand of land revenue proper was 66 lakhs in 1880-1, 94 lakhs in 1890-1, 180 lakhs in 1900-1, and 218 lakhs in 1903-4. The ywathugyi^ or village headman, is the revenue collector in Burma. He is remunerated by commission varying from 3 to ro per cent, on his collections.

Capitation tax has been a source of revenue in Lower Burma from the earliest days of British dominion. It does not appear to have been levied by the native rulers, but was introduced soon after the cession of Arakan and Tenasserim in 1826. In 1831 it was fixed at Rs. 5 on married men, Rs. 3 on widowers, and Rs. 2 on bachelors. In 1876 this was altered to a rate not exceeding Rs. 5 for married men, and Rs. 2-8 for widowers of between eighteen and sixty years of age ; and it has remained at this figure ever since. In several of the larger towns of Lower Burma a land rate not exceeding one pie and a half per square foot on land covered with buildings and Rs. 3 per acre on land not so utilized is levied in lieu of capitation tax. The capitation tax produced 29 lakhs in 1880-1, 36 lakhs in 1890-1, and 45 lakhs in 1900-1. In 1903-4 the demand was 49 lakhs. Exemptions from the tax are granted to certain classes, such as Government servants and pensioners, village headmen, priests, persons who pay income-tax, and the like.

The original connexion between thathameda and land revenue has been referred to in an earlier paragraph. Thathameda was introduced into Upper Burma during the reign of Mindon Min. The origin of the word is doubtful. Various derivations, Sanskrit and other, have been suggested, but none has obtained popular acceptance. In the earliest years of its imposition the incidence of the tax was light ; but about 1866, when its origin as a fixed proportion of the cultivator's grain-heap had dropped out of sight and it had become a kind of income-tax, it was raised to the level at which it was found when the British took over the administration of the country, namely, at about Rs. 8 to Rs. 12 per household. It was continued by the British Government, and the principle on which it has since been assessed is that a tract enjoying ordinary prosperity should pay a sum not exceeding Rs. 10 per annum for each household that it contains. Rates are not, however, now fixed annually. In settled Districts the rates sanctioned in the Local Govern- ment's orders on the Settlement Report are levied. In unsettled tracts the normal rate, generally Rs. 10 per household, is assessed. The unit for which rates are fixed is generally the village ; and the exact share to be paid by each individual household is determined by village assessors or thamadis, who fix the demand above or below the average according to the assessee's means. The average incidence of the tax in 1901 was Rs. 8-8 per household. No maximum or minimum limit has been fixed for individual payments, but in practice these range ordinarily between Rs. 30 and 8 annas. Exemption from thathameda is granted to Govern- ment servants, the old and infirm, religious mendicants, and a few other classes. Immediately before the annexation of Upper Burma the thathameda produced 36 lakhs. The collections of 1 890-1 amounted to 44 lakhs, those of 1900-1 to 58 lakhs, and those of 1903-4 to 46 lakhs. It is generally acknowledged that thathameda presses somewhat heavily on the agricultural classes of Upper Burma ; and one of the most important features of the existing revenue policy is a scheme the object of which is to retain the total present amount of taxation on non-agri- cultural incomes unchanged, but so far as possible to ensure that a greater share than heretofore of that taxation should be borne by the richer non-agriculturists, and to substitute assessment in the form of acre rates on land for that part of the thathameda which represents tax- ation on income derived from land. This principle is applied at each fresh settlement, and as it is introduced thathameda will tend to diminish. It is still, however, and will continue for some time to be, the main source of revenue in the Upper province.

Fisheries

Fisheries both in Upper and Lower Burma contributed towards the revenue of the country before the days of British occupation, and are still one of the most profitable of the assets of the Province. There are two main classes of fishery revenue, the proceeds of leases of fisheries and net licence fees, the greater part of the realizations being of the former class. The fishery area of the Province is not susceptible of any appreciable extension. In spite of this, however, the fishery revenue has increased sensibly during the past two decades. In 1 880-1 the total collections amounted to 14 lakhs. By 1S90-1 the annexation of the Upper province had raised the figure to 19 lakhs. In 1900-1 the receipts amounted to 23 lakhs, and in 1903-4 to 29 lakhs. The more important of the leased fisheries are in the delta Districts ; and the subdivision of large fisheries, with other improvements in methods of control (largely the outcome of investiga- tions recently conducted by Major Maxwell in the delta areas), have been weighty factors in the increase of late years.

Other considerable items classed under Land Revenue in the larger sense of the term are receipts from water rates, from the duty on oil extracted from the oil-fields, and the rent paid by the Burma Ruby Mines Company. Under this head come also the receipts from bird's- nest and jade-stone revenue. The incidence of Land Revenue in its broader meaning, which includes thathameda, capitation tax, and the other forms of revenue indicated above, was in 1901 Rs. 2-12 per head for Lower and Rs. 2-8-6 for Upper Burma. Comparing this with similar figures for other Provinces, it will be found that the Lower Burma figure is exceeded only by Sind and the Upper Burma figure only by Sind and Berar.

Miscellaneous revenue

The existing opium policy of Burma was introduced in 1894, It is the same in the two portions of the Province, but is at two different stages of application. It has as its basis the view that the drug is exceptionally deleterious in the case Miscellaneous revenue,of Burmans. In Lower Burma the possession of

opium in small quantities up to a certain limit (3 tolas or rather less than i^ oz.) is allowed in the case of non-Burmans and such Burmans as are registered as having been opium consumers prior to 1894. In the case of non-registered Burmans possession is allowed only in a few special cases, e. g. to tattooers. In Upper Burma, where the object has been to preserve as far as possible the law in force at the time of annexation, registration of Burmans as consumers is not permitted, and, with a few minor exceptions, no Burman is allowed to possess opium. Non- Burmans may possess the drug, as in Lower Burma, up to an individual limit of 3 tolas.

For all practical purposes it may be said that opium is imported and held in bulk solely by Government. Licensed vendors obtain their supplies from Government treasuries and retail it to the actual consumers. The number of licences for the retail vend of opium is strictly limited, and till recently they were sold by auction ; but this system has now been discarded in favour of selection by Government on payment of fixed fees, as it was found that the auction system tended to encourage smuggling by the vendors. The taxation of opium, which is derived from a fixed duty per seer (2 lb.) plus vend fees, is very high. The price at which the drug was supplied to the licensees in Lower Burma was Rs. 2>Z P^*" •Cer in 190 1-2 and Rs. 60 per seer in 1902-3. As already mentioned, only those Burmans are registered in Lower Burma who can show that they became habituated to the drug prior to the intro- duction of the policy of 1894. The experience of a few years showed, however, that the first list of registered consumers did not contain the names of all persons who might have claimed the privilege of registration; and in 1900 the registers of consumers were reopened, to be finally closed on March 31, 1903. As no person who has acquired the opium habit since 1894 can be registered, the number of registered Burman consumers will in process of time diminish and must eventually altogether disappear. Owing to these restrictions, and to the high tax- ation of the drug, opium smuggling is rife, and special excise establish- ments have recently been sanctioned to cope with it. The receipts from opium revenue, which are credited to excise, amounted in 1890-1 to 21 lakhs, in 1 900-1 to 27 lakhs, and in 1903-4 to 45^ lakhs.

Opium is not grown in Burma proper, though in portions of the Shan States it is cultivated for local consumption. The Province is mainly supplied from India with Bengal opium. Malwa opium has been tried, but did not find favour among the opium consumers.

The possession oi gdnja, except in special cases, has been prohibited ; the large seizures of the drug that have been made recently show, however, that it continues to be smuggled into the country.

Locally made salt, produced along the sea-coast, used, in the years succeeding the second Burmese War, to form a substantial portion of the salt supply of the Province, but has since then yielded to a large extent to the imported article. Indian or foreign salt has long paid duty at the rate of R. i per maund (82^ lb.), to which it was reduced in India proper in 1907. Salt made in the country was formerly taxed by levy of fees on the pans, cauldrons, or other vessels used in boiling it. In 1902, however, a tax of 8 annas per maund on the output was introduced as an experimental measure in two Lower Burma Districts, and this system of taxation has since been extended. In inland Dis- tricts the production of local salt is insignificant, and is carried on, under licence, in sterile tracts and in the face of considerable difficulties by the most indigent section of the community. In parts of Upper Burma the industry has approached the border-line of extinction. There are no reliable statistics of the total amount of salt consumed in the Province. In 1900 it was calculated that 794,000 cwt. of foreign salt passed out of bond, and for the same year the estimated local output was returned at 415,000 cwt. ; but a comparison of these totals with the figures of the previous year shows that a portion of the require- ments of the year must have been met from stocks held over from the preceding twelve months. The gross salt revenue was 15^ lakhs in 1890-1, 13^ lakhs in 1900-T, and 15^ lakhs in 1903-4.

The imported salt comes for the most part from Germany and England, the former country being the largest supplier, but Aden and Madras salt are beginning to find a market. Salt is exported by land to China and Siam, the amount in 1903-4 aggregating 24,500 cwt. The consumption of salt per head of population in Burma seems to be about 12 lb. per annum, but the matter is obscured by the system of assessment on local salt, and the estimate can at best be only approximate.

The main principles underlying the liquor excise policy of Upper Burma are practically the same as those which have been shown to form the basis of the Provincial opium policy. One of the chief objects aimed at is to keep intoxicating liquor as much as possible out of the reach of the pure Burman, whose inability to refrain from alcoholic excess is notorious. In Lower Burma special restrictive measures for the indigenous population were not introduced when the Province first came under British dominion, and the Lower Burman has thus acquired a certain title to be absolved from exceptional treatment.

In Upper Burma, on the other hand, the British have perpetuated the excise policy in force at the time of annexation ; and although the Upper Burman cannot be punished for the possession of liquor if it is in quantities below the maximum fixed by the Excise Act, the sale to him of any intoxicant except tari is prohibited, under penalty, by special conditions attached to the licences issued to liquor vendors. The manufacture and sale of spirits and fermented liquor may be carried on only under licences granted by Government, and the prohibition of the sale to Upper Burmans is thus susceptible of enforce- ment. Persons other than Upper Burmans may possess liquor in small quantities. Tdri, the fermented juice of the toddy-palm, stands on a different footing from other intoxicating liquors in Burma. It is generally looked upon as less harmful than other forms of drink, its consumption was more or less countenanced under native rule in Upper Burma, and over a considerable portion of the rural areas of the Upper province there is practically no restriction on its production and consumption. Spirit is manufactured at four private distilleries organ- ized on the English pattern, where it pays duty at Rs. 6 per gallon, and in parts of the Province in native out-stills. Tdrl and hlatvzaye are the principal country fermented liquors produced in Burma ; but there are other kinds, and in respect of their manufacture the members of some of the backward hill communities have been exempted from the provisions of the Excise law. The Excise Act (XII of 1896) has been extended to a few stations in the Shan States and the Chin Hills. The revenue from liquor in Burma falls under the following heads : (<?) Customs duty on imported foreign liquor and spirits ; (^) excise duty on local distillery liquor and spirits ; (c) licence fees for the sale of local distillery and foreign liquor and spirits ; {d) licence fees for the manu- facture and sale of country spirits ; and ie) licence fees for the sale of country fermented liquor. Licences to sell are disposed of annually by auction. The net revenue under all heads during the decade 1891- 1900 averaged 21 lakhs. In the year 1900-1 the collections were 26^ lakhs, and in 1903-4 Ty2t\ lakhs. The average incidence of the liquor excise revenue per head of the population was in i88r, 9-3 annas; in 1891, 8-6 annas; and in 1901, 9-2 annas. There is nothing to show that the indigenous liquor-drinker is at all fastidious in his tastes. He is usually content with the form of alcohol that is most readily procurable ; but if figures speak aright, he appears of late to be showing a preference for country fermented liquor over country spirits — a tendency which there is no need to deplore. On the whole, local liquor is fairly well able to hold its own against the imported article. The trade returns show that the quantity and value of foreign spirits imported from foreign countries into Burma in 1 890-1, 1900-T, and 1903-4 were as follows : —

Such efforts as have been made by Government to restrict consumption are indicated above. Falling in as it does with the precepts of their religion and immemorial custom, the policy of prohibition meets with universal approval but no active co-operation from the people of the country.

The stamp revenue of the Province is made up of receipts from ici) judicial and {h) non-judicial stamps, the former levied under the Indian Court-fees Act and the latter under the Stamp Act. The stamp revenue during the ten years 1891-1900 averaged 16 lakhs. The gross receipts in 1 900-1 amounted to nearly 21 lakhs, and in 1903-4 to 29^ lakhs.

The demand for both judicial and non-judicial stamps is affected generally by the prosperity or otherwise of the people of the country, but commercial activity has not always the same effect in the case of both classes of stamps. Thus it was said of the decrease under non- judicial and the increase under judicial stamps in 1893-4 that the ' variations were due to the same causes : namely, depression of trade and tightness of the money market, which impeded the transfer of money and led to litigation for the recovery of the advances made.'

The Indian Income Tax Act, 1886, was extended to Lower Burma in 1888-9, &"d with effect from April i, 1905, was brought into operation through the whole of the Lower province : but in L^pper Burma it applies only to Government and railway servants, and to the city of Mandalay, where it was brought into force in 1897-8. The tax produced 8 lakhs on an average during the decade ending 1900, and II lakhs in 1 900-1. Notwithstanding the raising of the maximum income excluded from Rs. 500 to Rs. 1,000 in 1903, the income-tax receipts of 1903-4 amounted to 11 1 lakhs.

Customs duties are levied, under the Indian Tariff Act (VIII of 1894), on goods brought by sea from foreign countries into the ports of the Province ; and there is also a duty on exports of paddy, rice, and rice flour (see Volume IV, chapter viii). This export duty, which brings in a larger revenue than all the varied items of import, is 3 annas per maund of 82f lb. Nearly the whole of the customs revenue is credited to Imperial, Provincial receiving only a few minor items, such as warehouse and wharf rents and miscellaneous receipts. Customs expenditure is a wholly Provincial charge. For the ten years ending 1890 the annual receipts from customs averaged %(i\ lakhs, and during the following decade nearly 77 lakhs. The actual collections in 1900-1 amounted to 92 lakhs (of which 56 lakhs represented export duty on paddy and rice), and in 1903-4 to nearly i^ crores.

See also

For a large number of articles about Burma, extracted from the Gazetteer of 1908 (as well as other articles on Burma) please either click the 'Myanmar' link (below, left) and go to Burma(under B) or enter 'Burma' in the 'Search' box (top, right).

Burma, Commerce and Trade 1908