Black money: India

(→2010: Indian deposits in European banks) |

|||

| Line 12: | Line 12: | ||

The Times of India, July 17, 2011 | The Times of India, July 17, 2011 | ||

| − | |||

| − | |||

The Swiss National Bank, the central bank of Switzerland, has estimated that Indian clients had deposits of about $2.5 billion in banks in the European nation in 2010. This is just a fraction of the $1.5-trillion figure that had been projected by political parties and non-governmental organizations, who have attacked the UPA government with their anti-corruption movement over the last few months. | The Swiss National Bank, the central bank of Switzerland, has estimated that Indian clients had deposits of about $2.5 billion in banks in the European nation in 2010. This is just a fraction of the $1.5-trillion figure that had been projected by political parties and non-governmental organizations, who have attacked the UPA government with their anti-corruption movement over the last few months. | ||

Revision as of 22:07, 29 June 2015

This is a collection of articles archived for the excellence of their content. |

Contents |

2010: Indian deposits in European banks

The Times of India, July 17, 2011

The Swiss National Bank, the central bank of Switzerland, has estimated that Indian clients had deposits of about $2.5 billion in banks in the European nation in 2010. This is just a fraction of the $1.5-trillion figure that had been projected by political parties and non-governmental organizations, who have attacked the UPA government with their anti-corruption movement over the last few months. “The Swiss National Bank can only say that liabilities of Swiss banks towards Indian holders according to our annual statistics... were Swiss francs 1.9 billion ($2.5 billion) in 2010,” Walter Meier, spokesperson for the Swiss National Bank’s president, said.

According to him, the liabilities of Swiss banks towards Indian holders were Swiss francs 1.965 billion ($2.7 billion) in 2009 and Swiss francs 2.4 billion (about $3 billion) in 2008. In the aftermath of the financial crisis that engulfed the West after the collapse of the Lehman Bank in the US in 2008, Swiss private banks, particularly their largest bank UBS, had suffered huge losses. Subsequently, there were substantial withdrawals of funds from Swiss banks.

Unconfirmed reports suggested that several Indian companies and private holders had also moved funds from Switzerland to Singapore following the financial crisis in 2008. Moreover, several legal cases were filed against Swiss banks, especially UBS, for parking funds by wealthy US citizens through tax evasion.

In addition, the banks came under growing international pressure from the Paris-based Organisation for Economic Cooperation and Development and faced tougher G-20 financial regulations. All these forced the Swiss government to considerably relax its confidentiality provisions of numbered accounts that provided the extreme forms of client confidentiality until two years ago. After the OECD reported a list of such “uncooperative” countries as Switzerland, Luxembourg, Austria and Liechtenstein, among others, to the G-20, there was a panic reaction. AGENCIES

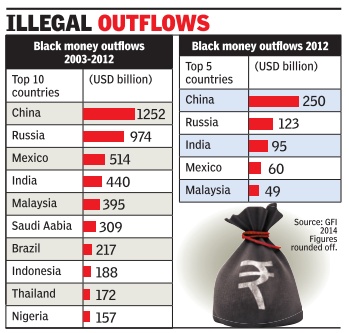

India is 3rd on black money list

$440billion flows out in 10 years

WASHINGTON, December 16, 2014

As India continues its pursuit of suspected black money stashed abroad, an international think-tank has ranked the country third globally with an estimated $94.76 billion (nearly Rs 6 lakh crore) illicit wealth outflows in 2012.

As a result, the cumulative illicit money moving out of the country over a ten-year period from 2003 to 2012 has risen to $439.59 billion (Rs 28 lakh crore), as per the latest estimates released by the Global Financial Integrity (GFI).

Russia is on the top with $122.86 billion, followed by China at the second position ($249.57 billion) in terms of the quantum of black money moving out of a country for 2012- the latest year for which these estimates have been made.

The Washington-based research and advocacy group further said that the illicit fund outflows from India accounts for nearly 10 per cent of a record $991.2 billion worth illegal capital that moved out of all developing and emerging nations in 2012 to facilitate "crime, corruption, and tax evasion".

As per GFI's 2014 Annual Global Update on Illicit Financial Flows report, that the cumulative illicit outflows from developing economies for ten years between 2003 and 2012 stands at $6.6 trillion.

This includes $439.59 billion worth illicit money that has moved out of India in these ten years, putting the country at fourth position in overall ranking for a decade, after China ($1.25 trillion), Russia (973.86 billion) and Mexico ($514.26 billion). In these ten years, an average of $43.96 billion of black money is being sent out of India every year, GFI said.

The estimate of this huge illegal money flow follows a Supreme Court-constituted Special Investigation Team (SIT) tracing Rs 4,479 crore in the accounts of Indians figuring in a list of account holders of HSBC's Geneva branch.

Besides, the SIT has also disclosed tracing unaccounted wealth worth Rs 14,958 crore within India, which are now being investigated by the Enforcement Directorate and the Income Tax Department.

Supreme Court on Black money

December 3, 2014, PTI

In the black money case, the Supreme Court has asked Centre to complete the probe by 31st March, 2015. A Bench headed by chief justice H L Dattu also asked the apex court-appointed Special Investigation Team (SIT) to probe the cases of black money to consider the plea for furnishing certain information and correspondences received by it to the petitioners without "blackening" the contents.

Eminent jurist Ram Jethmalani, who is one of the petitioners in the matter, submitted that the then Solicitor General in the previous UPA government Mohan Parasaran, had supplied some letters and documents after masking certain portions.

The bench, also comprising Justices M B Lokur and A K Sikri, accepted another plea of Jethmalani's counsel Anil Divan that the SIT headed by Justice M B Shah, should consider the plea for providing him the copies of the reports of its probe into the black money cases.

Attorney General Mukul Rohatgi responded to the pleas saying that he would not say "no" for supplying the copies of the reports submitted by the SIT and also assured that the issue of time bar would not arise in the tax probe for suspected black money.

"We are aware of it and there would not be any problem as now the prosecution for tax evasion can be initiated upto 16 years of commission of the offence," he said.

The issue of black money has been matter of a serious political debate in India, including during the last general elections. While the new government has said it is committed to tackle this menace, there are no official figures for the overall size of illicit wealth stashed by Indians within the country or abroad.

Black money outflow in 2012

Rs 6000000000000 - THE AMOUNT OF BLACK MONEY THAT WENT OUT OF INDIA IN 2012

Subodh Varma, December 17, 2014

Nearly $95 billion (Rs 6 lakh crore) were illegally taken out of India in 2012, bringing the total illicit outflow of capital from the country to $440 billion (about Rs 28 lakh crore) in the preceding decade, according to the latest study released on Tuesday by Global Financial Integrity (GFI), a Washington DC-based research and advisory organization. Not only have taxes not been paid for these enormous sums, they may have been put to use for various corrupt or criminal activities once parked in foreign safe havens. Overall, just in 2012, nearly a trillion dollars ($991 billion) in illicit capital flowed out of developing and emerging economies, the study noted. This is an all-time high. Between 2003 and 2012, the illicit outflows add up to a monstrous $6.6 trillion, averaging nearly 4% of the developing world's GDP .

Black money has been a major issue roiling India in the recent past. The new Modi government had promised it would bring back black money stashed away in foreign banks in 100 days. While investigations are inching forward, opposi tion parties have been pressing for more decisive action.

Despite much political noise over “black money“, the outflow of national wealth seems to be continuing unchecked and growing each year. The GFI study says illicit outflows are growing at an inflation-adjusted 9.4% per year -roughly double the global GDP growth over the same period. As if these numbers are not mind-boggling enough, GFI chief economist Dev Kar stresses that these estimates are “conservative” since several types of illegal transactions are not reflected in these figures.

“This means that many forms of abusive transfer pricing by multinational corporations as well as much of the proceeds of drug trafficking, human smuggling, and other criminal activities, which are often settled in cash, are not included in these estimates,“ explained Kar, who served as a senior economist at the International Monetary Fund before joining GFI in January 2008.

India ranked third after China and Russia in the quantum of illicit outflows in 2012.For the whole decade of 2003 to 2012, India ranks fourth. A total of 151 countries were studied by Kar and his colleague Joseph Spanjers at the GFI. “As this report demonstrates, illicit financial flows are the most damaging economic problem plaguing the world's developing and emerging economies,“ said GFI President Raymond Baker , a longtime authority on financial crime. The $991.2 billion that flowed illicitly out of developing countries in 2012 was greater than the combined total of FDI ($789.4 billion) and net official development assistance ($89.7 billion), which these economies received that year. Some of the poorest regions of the planet -south Asia and subSaharan Africa -have very high rates of foreign outflows, depriving them of much needed capital for basic amenities and services.

2003-2012

May 18, 2015

Vivek Kaul

“There is no clear estimate of the total amount of black money in India. As per a confidential report submitted to the government by the National Institute of Public Finance and Policy (NIPFP) in December 2013, the black money economy could be three-fourths the size of the Indian economy. This report was accessed by The Hindu in August 2014.”- Vivek Kaul

Bringing back black money from abroad has been one of the pet issues of the Narendra Modi government. Black money is essentially money on which taxes have not been paid. An estimate by Washington-based research and advocacy group Global Financial Integrity in its report Illicit Financial Flows from Developing Countries: 2003-2012, suggests that around $439.6 billion of black money left Indian shores, between 2003 and 2012.

India is ranked fourth (behind China, Russia and Mexico) when it comes to the total amount of black money leaving a developing country. The interesting thing nonetheless is that the quantum of money leaving India increased dramatically during the Congress-led UPA regime. In 2003, around $10.18 billion left the country. By 2012, it had jumped by more than nine times to $94.8 billion. Interestingly, the number in 2009 was at $29 billion. This clearly tells us that the second term of the UPA, which started in May 2009, was fairly corrupt. Also the amount of money leaving China grew by less than four times between 2003 and 2012. In case of Russia, the increase was three times. For Mexico, the increase was less than two times. Hence the jump in India's case was clearly the highest.

The $439.6 billion that left the country was equal to around 23 per cent of India's GDP of $1.88 trillion in 2013. It is a large amount of money and hence the Modi government's interest in bringing this money back seems justified.

While things may always be possible, what we need to look at is whether they are probable. And the answer in this case is no. Conventional wisdom has it that all this money is lying in Swiss banks. But that is an incorrect assumption to make.

There are around 70 tax havens across the world. Given this, the money that has left Indian shores could be anywhere. These tax havens are unlikely to cooperate with the Indian government to help it bring back the black money stashed abroad. The economies of many tax havens run on black money.

So does that mean the government should give up on its pursuit of black money? Of course not. But it should concentrate on the black money stashed in India itself.

There are other figures that are not so big. Nevertheless, what we know for sure is that only around 2.9 per cent of Indians pay income tax (I-T). In fact, previous finance minister P. Chidambaram in his February 2013 Budget speech had said India had only 42,800 people with a taxable income of Rs 1 crore or more.

Now compare this with the fact that around 30,000 luxury cars are sold in India every year. Both Audi and Mercedes sold more than 10,000 cars in India in 2014. A February 2015 report by business lobby FICCI makes a similar point.

The report estimates that the number of dollar millionaires (i.e. with assets of Rs 6 crore or more) in India in 2014 stood at 2.27 lakh, up from 2.14 lakh in 2013. But the number of taxpayers with a taxable income of more than a crore is less than 50,000.

What this tells us clearly is that there is widespread tax evasion in the country. This tax evasion continues to generate a lot of black money, some of which escapes the shores of this country. This is the black money that the government should be going after.

Information technology can play a big role in this. In fact, it already is. As the FICCI report cited earlier points out: "The Integrated Taxpayer Data Management System is a data mining tool implemented by the I-T department that is used for detection of potential cases of tax evasion. The tool assists in generating a 360-degree profile of the high net worth assesses." The government should work towards making this tool even more robust by building more data into it in the days to come.

Further, it has to get cracking on the real estate sector where the maximum amount of black money is invested. This black money generates more black money. Going after the biggest property dealers of the National Capital Region, where most black money changes hands, might be a good starting point.

The question is will this government (or for that matter any other government) go after domestic black money, given that it finances almost every political party in the country? Now that is something worth thinking about.

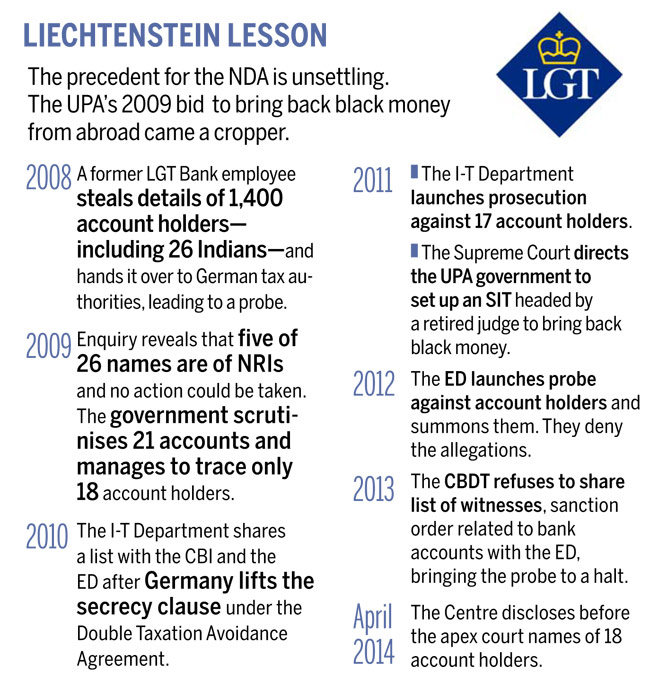

2008-2014

2015

The Times of India, Jun 18, 2015

Money held by Indians in Swiss banks falls by over 10% to Rs 12,615 crore

The Swiss bank holdings of foreign clients from across the world rose to CHF 1.6 trillion or Rs 103 lakh crore at the end of 2014, the SNB said.

Money held by Indians in Swiss banks fell by over 10 per cent last year to 1.8 billion Swiss franc (about Rs 12,615 crore), amid an enhanced clampdown against the famed secrecy wall of Switzerland's banking system by Indian and other governments.

This is the second lowest amount of funds held by Indians in the Swiss banks.

In contrast, the money held in Swiss banks by their foreign clients from across the world surprisingly rose during 2014 to 1.5 trillion Swiss franc (USD 1.6 trillion or Rs 103 lakh crore), from about Rs 90 lakh crore at the end of 2013 — the record low level so far.

During 2012, the Indians' money in Swiss banks had fallen by over one-third to its lowest ever level of 1.42 billion Swiss franc (Rs 8,530 crore).

As per the latest data, the total Indian money held in Swiss banks at the end of 2014 included 1,776 million Swiss franc or Rs 12,350 crore held directly by Indian individuals and entities (down from 1,952 million a year ago), and another 38 million Swiss franc (down from 77.3 million Swiss francs at 2013-end) through 'fiduciaries' or wealth managers.

However, "amounts due to customers' savings and deposit accounts" was only CHF 52 million (down from CHF 63 million a year ago), while over CHF 100 million was due through other banks and the remaining amount of well over one billion Swiss francs have been classified as "other amounts due to the customers" from India.

Black money in real estate transactions

Ashok V. Desai

October 30, 2014

Bulk of black money in India likely to be in real estate transactions

Ashok V. DesaiAshok V. DesaiThere are few facts on black money but everyone has a view on it, the commonest being that there is a lot- too much-of it. Those who work in the media have white money. So, they are the most likely to take this view. How well founded is it?

The conventional definition of black money is income on which tax has not been paid. If it were spent on consumables, it would vanish in thin air forever. It can be traced and identified only if it financed a durable asset. Very few people who have made money are idiots; most of them would have paid partly in white so that they would have a legal title to the asset. So, most black money would involve undervaluation. Cash deals were common on stock exchanges before they went electronic. Nowadays, a cash transaction in financial assets would be too much of a trouble. Hence, the bulk of black money in India is likely to be in real estate transactions. Corporates and rich taxpayers generally prefer to pay in white even for real estate; and builders are quite ready to take payment by cheque for new property because of the expenses they have to incur in white. Most of the black money is likely to be involved in subsequent sale of property. Indian governments get half a per cent of GDP from property taxes. That is pretty low- the average is 1.2 per cent for the BRICS and 1.9 per cent for the G20. This is not because Indian property prices are low, or because Indian property taxes are high. And Indians do much trade in property-it is their favourite durable asset. Hence, undervaluation is likely to be common. In fact, we can say that property undervaluation is the commonest form of black money in India. It is so common that no one gets worked up about it.

What they do get worked up about is black money parked abroad, because it is supposed to be the privilege of the tiny minority of filthy rich. Many estimates of it have been made. The first attempt was made in the World Bank's World Development Report of 1985. Every country has a currency. So, there are as many possibilities of conversion between currencies as there are pairs of currencies. For many decades, all governments used to worry about the balance of payments, which is a summary of such transactions, and used to keep reserves of gold or foreign currencies to be able to influence it. Some industrial countries no longer do so, but they all still compile balance of payments statistics.

However, these statistics never balance. All balance of payments statistics have a residual entry called errors and omissions. The first black money enthusiasts assumed that the errors and omissions were flows of black money. The statistics are never the same for pairs of countries. For example, India's exports to Baltistan are different from Baltistan's imports from India. The second set of enthusiasts assumed that the difference (after adjusting for intercountry costs such as freight and insurance) was due to misinvoicing and hence black money. And economists are a competitive and innovative lot. Others invented new techniques of estimation. For instance, if the ratio of interest inflows into a country to its investment outflows looked too low, it was assumed that someone must be salting away interest abroad.

It would be silly of me to say that no one sends money abroad clandestinely. As long as the government charges an import duty on gold, it must be highly profitable to smuggle it in. The smuggling channels developed by Dawood Ibrahim and company in the 1980s remain available to all entrepreneurs.

But gold smuggling apart, I do not think rich Indians have any reason to resort to hawala. A rich man can avoid all taxes by keeping his wealth in unrealised capital gains, and has to pay only 10 per cent even if he realises them. There are simple, legitimate ways to take money abroad. The Reserve Bank of India allows all of us to transfer $125,000 a year abroad without any questions. It lets us invest abroad; all we have to do is tell our bank. If that is not enough, one can do whatever one likes abroad, as long as one does not spend more than 182 days in a financial year in India. If one does not like to be not ordinarily resident, any number of countries abroad would give a rich Indian residence or nationality. So, there is no need to resort to black money. But faith is free. If anyone wants to believe trillions are stashed abroad, let him choose his figure.

2015: Survey by Global Financial Integrity (GFI)

The Times of India, Jun 05 2015

Subodh Varma

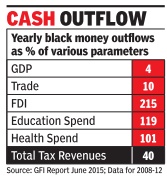

Black money mkt larger than India's edu spend

Wealth earned from crime, corruption and tax evasion and illegally taken out of the country tops India's total spending on education or health, according to a new study by financial watchdog Global Financial Integrity (GFI).Average yearly flows of such illicit finances, popularly called black money , were nearly 120% more than the government's yearly education spend and about 100% more than health expenditure. The report correlated outflows of black money from 82 developing countries around the world and discovered that the poorer the country , the more money is illegally taken out, presumably to be stashed away in tax havens.

Earlier GFI studies have found that nearly $1 trillion worth of illicit financial flows take place every year from developing countries. India was estimated to lose about $44 billion annually between 2003 and 2012, the total working out to a mind boggling $440 billion over the decade. Source: GFI Report June 2015; Data for 2008-12 Notably , GFI investigations have shown that globally, 80% of the illicit financial flows take place through trade misinvoicing done by international corporate entities. For India, this component is even more predominant, accounting for over 98% of illicit financial outflows.

For India, the average yearly illicit outflow for the years 2008-12 was 4% of GDP , 10% of trade, 215% of foreign direct investment (FDI), 40% of total tax revenue and 0.7% of capital stock, the report said.

The report also found a disturbing correlation between illicit financial flows and higher levels of poverty , higher levels of economic inequality , and lower levels of human development, as measured by the United Nations' annual Human Development Index.

“Higher illicit outflows aggravate poverty , exacerbate income inequality , and erode human development in the world's poorest countries,“ said Joseph Spanjers, co-author of the report.

Correlations are also found between higher relative levels of illicit financial flows and trade openness, tariff rates, and the efficiency of customs. But no correlation was found between indicators of quality of public institutions or rule of law like the Fragile State Index, Corruption Perception Index or Public Sector Management rankings, and illegal black money outflows.No correlation was found with broad fiscal or macroeconomic indicators either.

Surprisingly , no correlation was found even between the extent of the shadow economy within the country and illicit financial outflows.Earlier GFI studies on India, Mexico, Russia and the Philippines had shown a link between the two phenomena.