Black money: India

(→Black money in real estate transactions) |

(→2010: Indian deposits in European banks) |

||

| (45 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

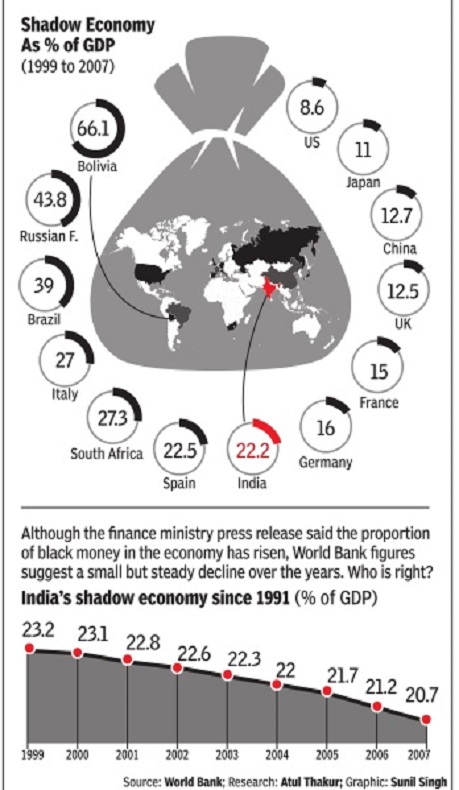

| + | [[File: The proportion of the black shadow economy in India and other countries, 1999-2007; the proportion of the black shadow economy in India, 1999-2007.jpg| i) The proportion of the black shadow economy in India and other countries, 1999-2007; <br/> ii) the proportion of the black shadow economy in India, 1999-2007 <br/> [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-Indias-Black-Economy-Relatively-Small-And-Shrinking-15112016009014 ''The Times of India'']|frame|500px]] | ||

| + | |||

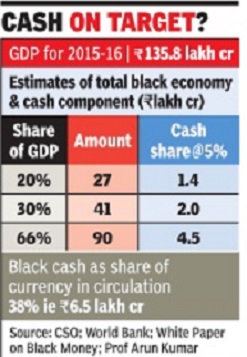

| + | [[File: Black money in India in 2015-16.jpg|Black money in India in 2015-16: estimates <br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=21_11_2016_001_070_008&type=P&artUrl=Queues-of-pain-for-tiny-gain-on-black-21112016001070&eid=31808 ''The Times of India''] |frame|500px]] | ||

{| Class="wikitable" | {| Class="wikitable" | ||

|- | |- | ||

| Line 10: | Line 13: | ||

[[Category:Crime |B ]] | [[Category:Crime |B ]] | ||

| − | =India is 3rd on black money list= | + | =The size of the problem, India's global position = |

| + | ==2003-12: Size of problem, India's global position== | ||

| + | [http://indiatoday.intoday.in/story/black-money-narendra-modi-government-global-financial-integrity-gdp-tax-evasion/1/436124.html ''India Today''] | ||

| + | |||

| + | May 18, 2015 | ||

| + | |||

| + | Vivek Kaul | ||

| + | |||

| + | “There is no clear estimate of the total amount of black money in India. As per a confidential report submitted to the government by the National Institute of Public Finance and Policy (NIPFP) in December 2013, the black money economy could be three-fourths the size of the Indian economy. This report was accessed by The Hindu in August 2014.”- Vivek Kaul | ||

| + | |||

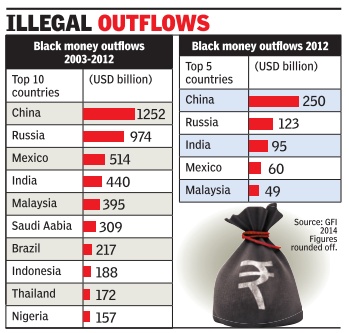

| + | Bringing back black money from abroad has been one of the pet issues of the Narendra Modi government. Black money is essentially money on which taxes have not been paid. An estimate by Washington-based research and advocacy group Global Financial Integrity in its report Illicit Financial Flows from Developing Countries: 2003-2012, suggests that around $439.6 billion of black money left Indian shores, between 2003 and 2012. | ||

| + | |||

| + | India is ranked fourth (behind China, Russia and Mexico) when it comes to the total amount of black money leaving a developing country. The interesting thing nonetheless is that the quantum of money leaving India increased dramatically during the Congress-led UPA regime. | ||

| + | In 2003, around $10.18 billion left the country. By 2012, it had jumped by more than nine times to $94.8 billion. Interestingly, the number in 2009 was at $29 billion. This clearly tells us that the second term of the UPA, which started in May 2009, was fairly corrupt. | ||

| + | Also the amount of money leaving China grew by less than four times between 2003 and 2012. In case of Russia, the increase was three times. For Mexico, the increase was less than two times. Hence the jump in India's case was clearly the highest. | ||

| + | |||

| + | The $439.6 billion that left the country was equal to around 23 per cent of India's GDP of $1.88 trillion in 2013. It is a large amount of money and hence the Modi government's interest in bringing this money back seems justified. | ||

| + | |||

| + | While things may always be possible, what we need to look at is whether they are probable. And the answer in this case is no. Conventional wisdom has it that all this money is lying in Swiss banks. But that is an incorrect assumption to make. | ||

| + | |||

| + | |||

| + | There are around 70 tax havens across the world. Given this, the money that has left Indian shores could be anywhere. These tax havens are unlikely to cooperate with the Indian government to help it bring back the black money stashed abroad. The economies of many tax havens run on black money. | ||

| + | |||

| + | So does that mean the government should give up on its pursuit of black money? Of course not. But it should concentrate on the black money stashed in India itself. | ||

| + | |||

| + | There are other figures that are not so big. Nevertheless, what we know for sure is that only around 2.9 per cent of Indians pay income tax (I-T). In fact, previous finance minister P. Chidambaram in his February 2013 Budget speech had said India had only 42,800 people with a taxable income of Rs 1 crore or more. | ||

| + | |||

| + | Now compare this with the fact that around 30,000 luxury cars are sold in India every year. Both Audi and Mercedes sold more than 10,000 cars in India in 2014. A February 2015 report by business lobby FICCI makes a similar point. | ||

| + | |||

| + | The report estimates that the number of dollar millionaires (i.e. with assets of Rs 6 crore or more) in India in 2014 stood at 2.27 lakh, up from 2.14 lakh in 2013. But the number of taxpayers with a taxable income of more than a crore is less than 50,000. | ||

| + | |||

| + | What this tells us clearly is that there is widespread tax evasion in the country. This tax evasion continues to generate a lot of black money, some of which escapes the shores of this country. This is the black money that the government should be going after. | ||

| + | |||

| + | Information technology can play a big role in this. In fact, it already is. As the FICCI report cited earlier points out: "The Integrated Taxpayer Data Management System is a data mining tool implemented by the I-T department that is used for detection of potential cases of tax evasion. The tool assists in generating a 360-degree profile of the high net worth assesses." The government should work towards making this tool even more robust by building more data into it in the days to come. | ||

| + | |||

| + | Further, it has to get cracking on the real estate sector where the maximum amount of black money is invested. This black money generates more black money. Going after the biggest property dealers of the National Capital Region, where most black money changes hands, might be a good starting point. | ||

| + | |||

| + | The question is will this government (or for that matter any other government) go after domestic black money, given that it finances almost every political party in the country? Now that is something worth thinking about. | ||

| + | ==2004-2013: India 4th in black money outflows== | ||

| + | [http://timesofindia.indiatimes.com/india/India-ranks-4th-in-black-money-outflows-per-annum-Report/articleshow/50102244.cms ''The Times of India''], December 9, 2015 | ||

| + | |||

| + | India ranks fourth in black money outflows with a whopping $51 billion siphoned out of the country per annum between 2004-2013, a US-based think-tank's report said. | ||

| + | Notably India's defence budget is less than $50 billion. China tops the list with $139 billion average outflow of illicit finances per annum, followed by Russia ($104 billion per annum) and Mexico ($52.8 billion per annum), according to the annual report released by Global Financial Integrity (GFI), a Washington-based research and advisory organisation. | ||

| + | The illegal capital outflows stem from tax evasion, crime, corruption and other illicit activity, the report said, according to which a record $1.1 trillion flowed illicitly out of developing and emerging economies in 2013, the latest year for which data is available. | ||

| + | In all, during this decade-long period of 2004-2014, GFI estimates that more than half a trillion ($510 billion) went out of India and in the case of China the figure was $1.39 trillion and Russia $1 trillion. | ||

| + | Titled 'Illicit Financial Flows from Developing Countries: 2004-2013', the study shows that illicit financial flows first surpassed $1 trillion in 2011 and have grown to $1.1 trillion in 2013, marking a dramatic increase from 2004, when illicit outflows totalled just $465.3 billion. | ||

| + | China also had the largest illicit outflows of any country in 2013, amounting to a staggering $258.64 billion in just that one year, the report said. | ||

| + | |||

| + | "This study clearly demonstrates that illicit financial flows are the most damaging economic problem faced by the world's developing and emerging economies," said GFI President Raymond Baker, a longtime authority on financial crime. | ||

| + | |||

| + | "This year at the UN the mantra of 'trillions not billions' was continuously used to indicate the amount of funds needed to reach the Sustainable Development Goals. Significantly curtailing illicit flows is central to that effort," he said. | ||

| + | Noting that Sustainable Development Goals (SDGs) calls on countries to significantly reduce illicit financial flows by 2030, the report said the international community has not yet agreed on goal indicators, the technical measurements to provide baselines and track progress made on underlying In its report, GFI recommends that world leaders should focus on curbing opacity in the global financial system, which facilitates these outflows. | ||

| + | ==2010: Indian deposits in European banks== | ||

| + | |||

| + | The Times of India, July 17, 2011 | ||

| + | |||

| + | The Swiss National Bank, the central bank of Switzerland, has estimated that Indian clients had deposits of about $2.5 billion in banks in the European nation in 2010. This is just a fraction of the $1.5-trillion figure that had been projected by political parties and non-governmental organizations, who have attacked the UPA government with their anti-corruption movement over the last few months. | ||

| + | “The Swiss National Bank can only say that liabilities of Swiss banks towards Indian holders according to our annual statistics... were Swiss francs 1.9 billion ($2.5 billion) in 2010,” Walter Meier, spokesperson for the Swiss National Bank’s president, said. | ||

| + | |||

| + | According to him, the liabilities of Swiss banks towards Indian holders were Swiss francs 1.965 billion ($2.7 billion) in 2009 and Swiss francs 2.4 billion (about $3 billion) in 2008. In the aftermath of the financial crisis that engulfed the West after the collapse of the Lehman Bank in the US in 2008, Swiss private banks, particularly their largest bank UBS, had suffered huge losses. Subsequently, there were substantial withdrawals of funds from Swiss banks. | ||

| + | |||

| + | Unconfirmed reports suggested that several Indian companies and private holders had also moved funds from Switzerland to Singapore following the financial crisis in 2008. Moreover, several legal cases were filed against Swiss banks, especially UBS, for parking funds by wealthy US citizens through tax evasion. | ||

| + | |||

| + | In addition, the banks came under growing international pressure from the Paris-based Organisation for Economic Cooperation and Development and faced tougher G-20 financial regulations. | ||

| + | All these forced the Swiss government to considerably relax its confidentiality provisions of numbered accounts that provided the extreme forms of client confidentiality until two years ago. After the OECD reported a list of such “uncooperative” countries as Switzerland, Luxembourg, Austria and Liechtenstein, among others, to the G-20, there was a panic reaction. AGENCIES | ||

| + | |||

| + | ==2010: $490bn stashed abroad== | ||

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F06%2F25&entity=Ar01210&sk=4B6840A4&mode=text June 25, 2019: ''The Times of India''] | ||

| + | |||

| + | ‘$490bn in black money stashed abroad till 2010’ | ||

| + | |||

| + | New Delhi: | ||

| + | |||

| + | Studies conducted by three premier institutes — NIPFP, NCAER and NIFM — have concluded that unaccounted wealth held by Indians outside the country till 2010 could be as high as $490 billion, besides black money parked within the country as ‘investments’ in sectors like real estate, mining, tobacco/gutka, bullion, films and education. | ||

| + | |||

| + | This was part of a report of the standing committee on finance tabled in Lok Sabha on Monday. This is the first official acknowledgement of the three government-sponsored studies initiated in 2011 to estimate black money held by Indians in the country and abroad. | ||

| + | |||

| + | On a reference from the then UPA government, the three think tanks came out with their own estimates of black money. The reports have not been made public yet, though they were submitted to the government during the UPA regime. | ||

| + | |||

| + | The National Institute of Public Policy and Finance (NIPFP) has estimated illicit financial flow out of the country during 1997-2009 in the range of 0.2% to 7.4% of GDP. The National Council of Applied Economic Research (NCAER), however, estimated unaccounted wealth accumulated outside the country by Indians between $384 billion and $490 billion during 1980-2010. | ||

| + | |||

| + | The National Institute of Financial Management (NIFM) found the total illicit outflow from India (1990-2008) at Rs 9,41,837 crore ($216.48 billion). Illicit outflows from India was on average 10% of the unaccounted income, it said. | ||

| + | |||

| + | “There are no reliable estimates of black money generation or accumulation, neither is there an accurate wellaccepted methodology for making such estimation,” the standing committee on finance said in its report. It said these estimates were made merely on “assumptions” as there was no uniformity or consensus on the best methodology or approach to be used for this purpose. | ||

| + | |||

| + | The standing committee report, tabled on Monday, was first submitted by the panel headed by M Veerappa Moily to the Lok Sabha Speaker on March 28 before the lower House was dissolved ahead of parliamentary elections. | ||

| + | |||

| + | The panel noted that the findings were preliminary in nature owing to paucity of time. Only a limited number of stakeholders could be examined by the committee, it said, and recommended examination of more witnesses, including non-official witnesses and experts. | ||

| + | |||

| + | [[Category:Crime|B | ||

| + | BLACK MONEY: INDIA]] | ||

| + | [[Category:Economy-Industry-Resources|B | ||

| + | BLACK MONEY: INDIA]] | ||

| + | [[Category:India|B | ||

| + | BLACK MONEY: INDIA]] | ||

| + | |||

| + | ==2012: India is 3rd on black money list== | ||

''' $440billion flows out in 10 years ''' | ''' $440billion flows out in 10 years ''' | ||

| Line 34: | Line 133: | ||

Besides, the SIT has also disclosed tracing unaccounted wealth worth Rs 14,958 crore within India, which are now being investigated by the Enforcement Directorate and the Income Tax Department. | Besides, the SIT has also disclosed tracing unaccounted wealth worth Rs 14,958 crore within India, which are now being investigated by the Enforcement Directorate and the Income Tax Department. | ||

| − | = | + | ==Black money outflow in 2012== |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | =Black money outflow in 2012= | + | |

''' Rs 6000000000000 - THE AMOUNT OF BLACK MONEY THAT WENT OUT OF INDIA IN 2012 ''' | ''' Rs 6000000000000 - THE AMOUNT OF BLACK MONEY THAT WENT OUT OF INDIA IN 2012 ''' | ||

| Line 72: | Line 152: | ||

India ranked third after China and Russia in the quantum of illicit outflows in 2012.For the whole decade of 2003 to 2012, India ranks fourth. A total of 151 countries were studied by Kar and his colleague Joseph Spanjers at the GFI. “As this report demonstrates, illicit financial flows are the most damaging economic problem plaguing the world's developing and emerging economies,“ said GFI President Raymond Baker , a longtime authority on financial crime. The $991.2 billion that flowed illicitly out of developing countries in 2012 was greater than the combined total of FDI ($789.4 billion) and net official development assistance ($89.7 billion), which these economies received that year. Some of the poorest regions of the planet -south Asia and subSaharan Africa -have very high rates of foreign outflows, depriving them of much needed capital for basic amenities and services. | India ranked third after China and Russia in the quantum of illicit outflows in 2012.For the whole decade of 2003 to 2012, India ranks fourth. A total of 151 countries were studied by Kar and his colleague Joseph Spanjers at the GFI. “As this report demonstrates, illicit financial flows are the most damaging economic problem plaguing the world's developing and emerging economies,“ said GFI President Raymond Baker , a longtime authority on financial crime. The $991.2 billion that flowed illicitly out of developing countries in 2012 was greater than the combined total of FDI ($789.4 billion) and net official development assistance ($89.7 billion), which these economies received that year. Some of the poorest regions of the planet -south Asia and subSaharan Africa -have very high rates of foreign outflows, depriving them of much needed capital for basic amenities and services. | ||

| − | = | + | ==2014: Global Financial Integrity report== |

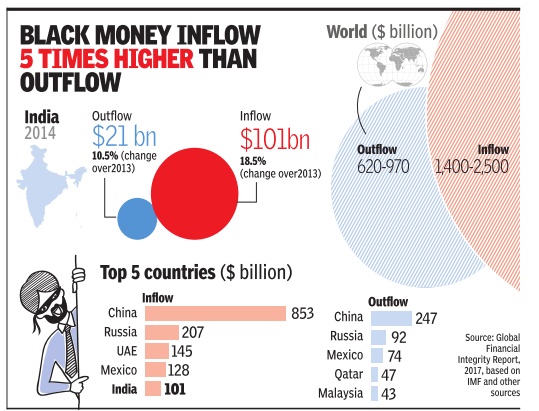

| − | [http:// | + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=21b-in-black-money-went-out-of-India-03052017013038 Subodh Varma, `$21b in black money went out of India in 2014’, May 3, 2017: The Times of India] |

| + | [[File: Black money inflow in and outflow from India and the world, 2014.jpg|Black money inflow in and outflow from India and the world, 2014; [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=21b-in-black-money-went-out-of-India-03052017013038 Subodh Varma, `$21b in black money went out of India in 2014’, May 3, 2017: The Times of India]|frame|500px]] | ||

| − | + | ''' At Same Time, $101b Illicitly Flowed In: Global Watchdog ''' | |

| − | + | Over $21 billion worth of black money was illegally taken out of India in 2014, according to the latest report by the international watchdog Global Financial Integrity (GFI), released. | |

| − | + | This illicit outflow was nearly 19% more than 2013. | |

| + | GFI has, for the first time, given information on the equally damaging inflow of illegal funds in this report, with India being the destination of a staggering $101 billion in 2014, up nearly 11% over the previous year. | ||

| − | + | Globally, the report estimates that between $620 and $970 billion was drained out of the developing world, primarily through trade fraud. Illicit inflows are estimated at $1.4-2.5 trillion. Combined, illicit outflows and inflows accounted for 14-24% of total developing country trade over 2005-2014. This year's GFI report stands out from its previous reports for adopting a much more rigorous method of collecting and analysing information on international trade and balance of payments. Besides using IMF global data on direction of trade, the report has included information from other sources to plug gaps. | |

| − | + | Inclusion of Swiss data on gold exports, that was earlier omitted, has led to a drastic revision of India's outflow and inflow figures. | |

| − | + | ||

| − | + | ||

| − | + | “Due to India's large imports of gold from Switzerland, rectifying this data issue significantly closed observed bilateral trade gaps between the two countries,“ economist Joseph Spanjers, one of the report's authors, told TOI. He thanked India's Directorate of Revenue Intelligence and the Swiss Directorate General of Customs for cooperating in the process. For India too, like all other countries, a range of estimates has been presented for inflows and outflows. Although both the lower and higher ends are described by the economists as “conservative“ because it is difficult to trace all illicit transactions, the higher-end estimates are closer to previous years' estimates while the lower ones take into account only trade gaps with advanced economies, according to Spanjers. | |

| − | + | About 87% of the global illicit financial flows are happening through trade misinvoicing. This is how it works: if you want to send money out of the country , you order something from abroad and get an inflated invoice or bill made for it. After paying the inflated bill to your foreign accomplice, the extra money is put away in your name. By reversing this process -by under-invoicing or getting a less-than-actual bill made -you can illicitly allow money to flow into the country . This can be profitably used for a variety of illegal purposes, with no tax to pay . | |

| + | ''' How can these shenanigans be checked? ''' | ||

| − | + | Recommending a slew of measures, the report primarily suggests a much better trained and equipped customs staff and stricter scrutiny of trade deals, along with global cooperation in exchanging information on bank accounts, especially in tax havens. | |

| − | + | ==2015: Survey by Global Financial Integrity (GFI)== | |

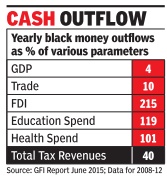

| + | [[File: cash outflow 2008-12.jpg|Cash outflow: 2008-12; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Black-money-mkt-larger-than-Indias-edu-spend-05062015009021 ''The Times of India''], Jun 05 2015|frame|500px]] | ||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Black-money-mkt-larger-than-Indias-edu-spend-05062015009021 ''The Times of India''], Jun 05 2015 | ||

| − | + | Subodh Varma | |

| − | + | ''' Black money mkt larger than India's edu spend ''' | |

| − | + | Wealth earned from crime, corruption and tax evasion and illegally taken out of the country tops India's total spending on education or health, according to a new study by financial watchdog Global Financial Integrity (GFI).Average yearly flows of such illicit finances, popularly called black money , were nearly 120% more than the government's yearly education spend and about 100% more than health expenditure. | |

| − | + | The report correlated outflows of black money from 82 developing countries around the world and discovered that the poorer the country , the more money is illegally taken out, presumably to be stashed away in tax havens. | |

| − | + | Earlier GFI studies have found that nearly $1 trillion worth of illicit financial flows take place every year from developing countries. India was estimated to lose about $44 billion annually between 2003 and 2012, the total working out to a mind boggling $440 billion over the decade. Source: GFI Report June 2015; Data for 2008-12 Notably , GFI investigations have shown that globally, 80% of the illicit financial flows take place through trade misinvoicing done by international corporate entities. For India, this component is even more predominant, accounting for over 98% of illicit financial outflows. | |

| − | + | For India, the average yearly illicit outflow for the years 2008-12 was 4% of GDP , 10% of trade, 215% of foreign direct investment (FDI), 40% of total tax revenue and 0.7% of capital stock, the report said. | |

| + | |||

| + | The report also found a disturbing correlation between illicit financial flows and higher levels of poverty , higher levels of economic inequality , and lower levels of human development, as measured by the United Nations' annual Human Development Index. | ||

| + | |||

| + | “Higher illicit outflows aggravate poverty , exacerbate income inequality , and erode human development in the world's poorest countries,“ said Joseph Spanjers, co-author of the report. | ||

| + | |||

| + | Correlations are also found between higher relative levels of illicit financial flows and trade openness, tariff rates, and the efficiency of customs. But no correlation was found between indicators of quality of public institutions or rule of law like the Fragile State Index, Corruption Perception Index or Public Sector Management rankings, and illegal black money outflows.No correlation was found with broad fiscal or macroeconomic indicators either. | ||

| + | |||

| + | Surprisingly , no correlation was found even between the extent of the shadow economy within the country and illicit financial outflows.Earlier GFI studies on India, Mexico, Russia and the Philippines had shown a link between the two phenomena. | ||

| + | |||

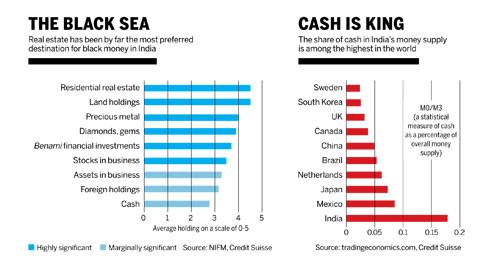

| + | ==2016: Destinations for black money, India and the world== | ||

| + | '''See graphic''': | ||

| + | |||

| + | ''Destinations for black money in India; share of cash in the money supply, India and the world'' | ||

| + | |||

| + | [[File: Destinations for black money in India; share of cash in the money supply, India and the world.jpg|Destinations for black money in India; share of cash in the money supply, India and the world <br/> From: [http://indiatoday.intoday.in/story/demonetisation-indian-economy-markets-impact-narendra-modi/1/818422.html M.G.Arun and Shweta Punj , Down and Ouch “India Today” 24/11/2016]|frame|500px]] | ||

| + | |||

| + | = Efforts against black money= | ||

| + | ==Lohia: On black money== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Lohia-would-have-approved-of-note-ban-29112016010047 `Lohia would have approved of note ban,' Nov 29 2016 : The Times of India] | ||

| + | |||

| + | |||

| + | Veteran BJP member Hukumdeo Narayan Yadav, a veteran Lohiaite and a former Union minister who joined BJP in the 1990s, said legendary socialist leader Ram Manohar Lohia “had said the government should not seek to find out the source of black money if it is declared within a deadline.However, he also said the go vernment should keep the declared amount with it for 20 years after paying interest. The money thus generated should be used for improving agriculture and the agro-rural infrastructure,“ | ||

| + | |||

| + | Yadav said the Modi- government's move to use the unaccounted money for Prime Minister's Garib Kalyan Yojana is similar to what Lohia proposed. | ||

| + | |||

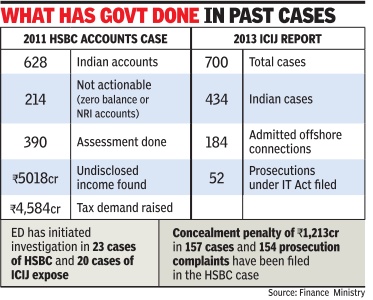

| + | ==2008-2014: Efforts against black money== | ||

| + | '''See graphic''': | ||

| + | |||

| + | ''Enforcement Directorate's investigations, 2011 HSBC Accounts case and 2013 ICIJ report'' | ||

| + | |||

| + | [[File: Enforcement Directorate's investigations, 2011 HSBC Accounts case and 2013 ICIJ report.jpg|Enforcement Directorate's investigations, 2011 HSBC Accounts case and 2013 ICIJ report; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=05_04_2016_016_035_006&type=P&artUrl=Cong-questions-probe-BJP-says-it-has-done-05042016016035&eid=31808 ''The Times of India''], April 5, 2016|frame|500px]] | ||

| + | |||

| + | =A decline in the magnitude= | ||

| − | |||

| − | = | + | ==2015: 10% decline in Swiss deposits== |

| − | + | ||

| − | = | + | |

[http://timesofindia.indiatimes.com/india/Money-held-by-Indians-in-Swiss-banks-falls-by-over-10-to-Rs-12615-crore/articleshow/47720068.cms ''The Times of India''], Jun 18, 2015 | [http://timesofindia.indiatimes.com/india/Money-held-by-Indians-in-Swiss-banks-falls-by-over-10-to-Rs-12615-crore/articleshow/47720068.cms ''The Times of India''], Jun 18, 2015 | ||

| Line 130: | Line 243: | ||

However, "amounts due to customers' savings and deposit accounts" was only CHF 52 million (down from CHF 63 million a year ago), while over CHF 100 million was due through other banks and the remaining amount of well over one billion Swiss francs have been classified as "other amounts due to the customers" from India. | However, "amounts due to customers' savings and deposit accounts" was only CHF 52 million (down from CHF 63 million a year ago), while over CHF 100 million was due through other banks and the remaining amount of well over one billion Swiss francs have been classified as "other amounts due to the customers" from India. | ||

| + | ==2016: Black economy shrinking, but still 20%== | ||

| + | [http://timesofindia.indiatimes.com/business/india-business/Indias-black-economy-shrinking-still-exceeds-Thailand-and-Argentinas-GDP/articleshow/52602507.cms ''The Times of India''], Jun 5, 2016 | ||

| − | =Black money in real estate transactions= | + | '''India's black economy shrinking, still exceeds Thailand and Argentina's GDP''' |

| + | |||

| + | |||

| + | Pegging India's 'black economy' at over Rs 30 lakh crore or about 20% of total GDP, a new study says it has been contracting gradually over the years but still remains bigger than the overall economic size of countries like Thailand and Argentina. | ||

| + | |||

| + | Besides, a crackdown on black money has made the cost of capital costlier in the black economy with the lending rates having risen to as high as 34%, from about 24% a year ago, as per the study by Ambit Capital Research. | ||

| + | |||

| + | The study said that the crackdown has had some "unintended consequences" in form of an increase in preference for cash in its physical form and a notable decline in the usage of formal banking channels with record low deposit growth — which may keep the GDP growth rate flat this year. | ||

| + | It said the size of the India's black economy expanded rapidly over the 1970s and 1980s, but since then had been contracting at a gradual pace and is now estimated at around 20% of the country's GDP. | ||

| + | |||

| + | The term 'black economy' typically refers to the economic activities outside formal banking channels and include cash transactions in high-value assets like gold and real estate. | ||

| + | "Given that India's GDP in calender year 2016 is expected to be $2.3 trillion, the size of India's black economy is about $460 billion (over Rs 30 lakh crore), which is larger than the stated GDP of emerging markets like Thailand and Argentina," Ambit Capital Research said in a research note. | ||

| + | Majority of this black money is locked up in physical assets such as real estate and gold, it added. | ||

| + | |||

| + | Physical savings instruments have been historically preferred to financial savings instruments in India because purchase of physical assets can be funded using black money, while the purchase of financial assets can not be funded in such a manner due to a strong paper trail. | ||

| + | While official figures regarding the quantum of black money flowing into real estate sector are not available, experts suggest that more than 30% of India's real estate sector is funded by black money. | ||

| + | |||

| + | The report said that since the Modi government assumed power there has been a clear step-up in checks around gold transactions and it has become increasingly difficult to park unaccounted cash in the form of jewellery or bullion. | ||

| + | Due to various measures taken by the government to tighten the noose around black money, there has been a clear drop in the prices of land and real estate and a decline in the appetite in gold, it said. | ||

| + | |||

| + | The crackdown has, however, also resulted in increase in the preference for cash in physical form and notable decline in the usage of formal banking channels as evinced by the decline in bank deposits as well as usage of debit cards. | ||

| + | |||

| + | "The combination of heightened interest rates in the black economy as well as the lack of liquidity in the banking system has led to the weighted average cost of debt capital in India rising by 30 bps over the last 12 months even as policy rates were cut by 100 bps," the report noted. | ||

| + | |||

| + | "As banks are unwilling to lend to sub-investment grade creditors owing to their own NPA troubles, this credit demand has shifted entirely to informal channels of lending. This, in turn, has driven increase in lending rates in the black economy to as high as about 34 per cent per annum as per our primary data sources (against about 24 per cent a year ago)," it added. | ||

| + | |||

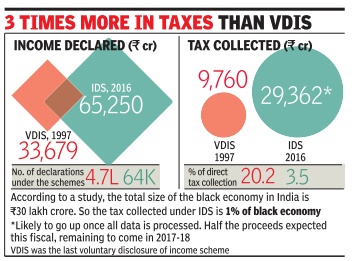

| + | ==2016/ Income Declaration Scheme: Rs 65,250 crore declared== | ||

| + | [[File: Income Declaration Scheme 2016 vs. VDIS 1997.jpg| Income Declaration Scheme 2016 vs. VDIS 1997: income declared, tax collected |frame|500px]] | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Rs-65000cr-revealed-in-black-money-disclosure-scheme-02102016001035 Rs 65,000cr revealed in black money disclosure scheme Oct 02 2016 : The Times of India] | ||

| + | |||

| + | May Yield Rs 30,000cr In Taxes | ||

| + | |||

| + | Surpassing expectations, the Centre's move to unearth black money received a robust response with the total amount declared under the Income Declaration Scheme totalling Rs 65,250 crore. | ||

| + | |||

| + | Finance minister Arun Jaitley announced that 64,275 declarations had been made under the scheme, which was open for four months and closed on September 30. | ||

| + | |||

| + | He said the number is ex pected to go up once all the declarations are verified. Based on the current declarations, the Centre is likely to get tax revenues of Rs 29,362 crore, of which Rs 14,700 crore will flow into its coffers by March and the rest in the next fiscal year. Those who have availed of the Income Disclosure Scheme can pay the amount in two instalments up to September 30, 2017. “It is an important step towards more and more becoming tax compliant,“ Jaitley said. | ||

| + | |||

| + | The declarations are seen as a major success for the government which had faced criticism from opponents who cited the muted response to a scheme for those with undisclosed wealth overseas last year, to claim that IDS is not going to fare better. “I compliment all those who chose to be tax compliant in IDS-2016. This is a great contribution towards transparency and growth of the economy ,“ Modi tweeted. He complimented Jaitley , revenue secretary Hasmukh Adhia and CBDT chairperson Rani Singh Nair for putting in a tremendous effort. | ||

| + | |||

| + | The IDS came into effect from June 1, 2016. The total levy is 45% with tax, penalty and surcharge. Jaitley said IDS cannot be compared with the Voluntary Disclosure of Income Scheme of 1997, which yielded tax worth Rs 9,760 crore. He said the effective tax rate for the scheme was in single digit as valuation was based on 1987 prices.Jaitley said the average declaration under IDS worked out to Rs 1 crore per declarant, suggesting that the scheme fared better despite a stiffer rate of 45%. | ||

| + | |||

| + | Jaitely said 164 prosecution complaints had been filed and assessment worth Rs 8,000 crore done in the 175 HSBC cases, while authorities had detected Rs 5,000 crore of undisclosed deposits in foreign accounts made out of cases revelaed by the Inter national Consortium of Investigative Journalists. Jaitley said 55 prosecution cases had been filed. | ||

| + | |||

| + | “The quantum jump in the searches has resulted in seizure of Rs 1986 crore as well as undisclosed income of Rs 56, 378 crore in the last two and a half years,“ Jaitley said. The finance minister said upgradation of IT capabilities of the tax department had led to non-intrusive methods of detection of evasion. He said Rs 16, 000 crore had been received as tax out of from the Non-filers of Monitoring System. | ||

| + | |||

| + | =Court judgements= | ||

| + | ==Supreme Court on Black money== | ||

| + | |||

| + | December 3, 2014, PTI | ||

| + | |||

| + | [http://timesofindia.indiatimes.com/india/Black-money-case-SC-asks-Centre-to-complete-probe-by-March/articleshow/45362752.cms''The Times of India''] | ||

| + | |||

| + | In the black money case, the Supreme Court has asked Centre to complete the probe by 31st March, 2015. | ||

| + | A Bench headed by chief justice H L Dattu also asked the apex court-appointed Special Investigation Team (SIT) to probe the cases of black money to consider the plea for furnishing certain information and correspondences received by it to the petitioners without "blackening" the contents. | ||

| + | |||

| + | Eminent jurist Ram Jethmalani, who is one of the petitioners in the matter, submitted that the then Solicitor General in the previous UPA government Mohan Parasaran, had supplied some letters and documents after masking certain portions. | ||

| + | |||

| + | The bench, also comprising Justices M B Lokur and A K Sikri, accepted another plea of Jethmalani's counsel Anil Divan that the SIT headed by Justice M B Shah, should consider the plea for providing him the copies of the reports of its probe into the black money cases. | ||

| + | |||

| + | Attorney General Mukul Rohatgi responded to the pleas saying that he would not say "no" for supplying the copies of the reports submitted by the SIT and also assured that the issue of time bar would not arise in the tax probe for suspected black money. | ||

| + | |||

| + | "We are aware of it and there would not be any problem as now the prosecution for tax evasion can be initiated upto 16 years of commission of the offence," he said. | ||

| + | |||

| + | The issue of black money has been matter of a serious political debate in India, including during the last general elections. While the new government has said it is committed to tackle this menace, there are no official figures for the overall size of illicit wealth stashed by Indians within the country or abroad. | ||

| + | |||

| + | ==Undisclosed funds in someone else's account can be seized: HC== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Undisclosed-funds-in-someone-elses-account-can-be-30052017007007 Abhinav Garg, Undisclosed funds in someone else's account can be seized: HC , May 30, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | The Delhi high court upheld the validity of one of the first post-demonetisation raids and seizures carried out by Income Tax authorities in the capital this year. | ||

| + | |||

| + | A bench of Justices S Muralidhar and Chander Shekhar also said the department had powers to seize unexplained funds lying in bank accounts not owned by the person who has been raided if the money trail leads there. | ||

| + | |||

| + | The I-T department had raided the premises of a city businessman and after following the money trail, seized unexplained funds lying in different bank accounts of eight companies and an associate of the man. | ||

| + | |||

| + | Money parked in a bank account is “certainly a valuable thing,“ the bench observed, referring to the I-T Act and noted that “a sum in a bank account is not outside the ambit of Section 132(1) of the Act and can be subject to search and seizure“ as a “person could be in possession of undisclosed income not only in his or her own account but in someone else's account.“ | ||

| + | |||

| + | In January , intensifying its drive against black money post demonetisation, the I-T wing had raided the premises of Mohnish Mohan Mukkar, accusing him of controlling a number of paper entities. | ||

| + | |||

| + | The department told HC that most of these companies did no substantial operations but merely lent funds to each other to mask the real source of funds and evade taxes. After examining bank records and detailed cash trail, the I-T department traced Rs 24 crore lying in eight bank accounts of several companies and one account of a woman employee. | ||

| + | |||

| + | Against this seizure, the affected people approached HC challenging the action of the department. Senior advocate P Chidambaram defended the eight companies whose bank accounts had been frozen. But HC imposed costs of Rs 1 lakh each on the companies and one individual petitioner for trying to mislead it.The bench also ordered their prosecution for filing false affidavits where they tried to hide that forged documents were presented before the department during post-search enquiries. | ||

| + | |||

| + | “It is sought to be suggested by Chidambaram that the writ petitions were drafted in a hurry . However, if that were true then in the rejoinder affidavits filed by both sets of petitioners some attempt ought to have been made to justify their missing out the material facts in the main petition. On the contrary , both rejoinders only serve to confirm the deliberate suppression of material facts by both sets of petitioners,“ the bench noted, asking the registrar to start prosecution. | ||

| + | |||

| + | =Money laundering through banks: A brief history= | ||

| + | ==Legal hawala/ money laundering through banks== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Bank-of-Baroda-OBC-cases-bring-spotlight-back-23102015017044 ''The Times of India''], Oct 23 2015 | ||

| + | |||

| + | Pradeep Thakur | ||

| + | |||

| + | ''' Bank of Baroda, OBC cases bring spotlight back on `legal hawala' ''' | ||

| + | |||

| + | In 2011, a team of the Enforcement Directorate raided a private vault service, similar to bank lockers, in the Connaught Place, B Block, in New Delhi and recovered Rs 10 crore, all in Rs 1,000 denominations. No one owned the money but fading trails led to a top UP politician. | ||

| + | |||

| + | Investigations revealed that the CP vault's owner had deposited at least Rs 1,000 crore in cash in the central Delhi branches of three leading private banks in the space of nine months and remitted the same to Dubai by producing fake customs invoices of diamond imports. Diamonds were, however, never actually imported or sold in Surat and Mumbai, as the trader had claimed. | ||

| + | The vault owner's only job was to provide safe locker services to big industrialists and politicians who had lots of cash, launder them to Dubai in the garb of diamond imports and thereafter the beneficiaries invested the money in properties in a third country or even brought it back to India as legal currency by way of FDIs. | ||

| + | |||

| + | All this was done through the banking channel. The leading private banks allowed huge cash deposits without alerting financial intelligence agencies. Even when the racket was unearthed, authorities ensured no action was taken against any bank. | ||

| + | |||

| + | As per rules, any bank branch caught aiding money laundering can face punitive action that may include closure of the branch in question, besides heavy monetary penalty. None of these conditions were, however, imposed on banks who allegedly broke these rules even four years after the incident. Such cases have been put in cold storage, or probably closed. | ||

| + | Many in the investigative agencies call this legal hawala -money laundering using the banking channel. The recent case of Bank of Baroda in Ashok Vihar and the Oriental Bank of Commerce in Ghaziabad where fake customs invoices were generated and remittances to the tune of over Rs 6,000 crore made to Hong Kong and from there to Dubai fall in this category. | ||

| + | This has been going on for decades despite the fact that agencies such as the DRI, the ED, the I-T and the financial intelligence unit have generated several alerts by way of concrete probe reports and suspicious transaction details. The investigation into Jharkhand's former CM MadhuKoda's case in 2010 revealed a bigger scam at the Noida SEZ, where sleuths detected fictitious trade in gold and diamonds. | ||

| + | Agencies had then found that the SEZ had a turnover of around Rs 16,000 crore of which nearly Rs 10,000 crore was trade in gold, platinum and diamonds, most of which had allegedly been imported from Dubai and re-exported to Dubai. | ||

| + | |||

| + | In another 2012 case, DRI had found that a rice mill owner at the Noida SEZ had in a three-month period traded gold worth Rs 1,700 crore. DRI had then suspected that the annual turnover of the rice mill owner from the yellow metal was anywhere around Rs 4,000 crore. | ||

| + | |||

| + | These were suspect cases of black money being sent out using the banking channel. There are many such instances where the money is being round-tripped to India through the banking channel as FDIs. | ||

| + | A classic case is that of a leading realty firm which had no background in the business and yet managed to raise nearly Rs 7,500 crore from Mauritius and Cyprus. The case was busted by the I-T department in 2010 which suspected the money to have come out of political kickbacks, allegedly linked to one politician, salted away through illegal hawala channels but brought back as FDIs in the real estate sector. Taxmen had established that all the investments through the Mauritius route came from one address in Port Louis. The recipient 26 firms were all registered at two common addresses in NitiBagh and Karampura in Delhi. On October 19, 2010, the I-T depart ment raided all the 26 firms and many accused were questioned, but even after five years not a single beneficiary has been identified or prosecuted. | ||

| + | |||

| + | Investigating another similar political kickback, I-T officials had traced transactions to the Savage Island -a new discovery for them. It found front entities of Indian beneficiaries had opened two banks on this tiny isle costing them as low as Rs 4.5 lakh for each bank. The purpose was to use these banks to enter into legitimate transactions with other financial institutions across the world. | ||

| + | |||

| + | The trail in another political kickback revealed that more than Rs 7,500 crore came to one of these banks through some entities in other tax havens, and then the money was moved to another bank on the same island and later both the banks were shut down so that no further trail would be available. Before the banks were closed, the money was safely moved out to financial institutions in the US and elsewhere. The extent of unaccounted cash deposits in India where the government is not aware of the colour of the money is huge.In February 2006, an I-T investigation in Delhi had unearthed Rs 1,540 crore of black money transacted at the Fatehpuri branch of the Federal Bank. The disclosure came while I-T officials were trailing certain hawala dealings. Probe later revealed three individuals who had no business antecedents had conducted the entire transaction. | ||

| + | |||

| + | A similar drive in Maharashtra and Gujarat that year unearthed over Rs 1,000 crore for which no source could be identified. The modus operandi of these hawala dealers was identical: in all domestic deals, they raised bogus bills and discounted bank drafts on behalf of actual traders dealing in cash. Or, simply issued loans to industrialists by receiving cash from them at a commission of 1% of the total transaction. In offshore deals, money was delivered to contacts named by the beneficiary at any location across the world for commission ranging up to 2%. | ||

| + | |||

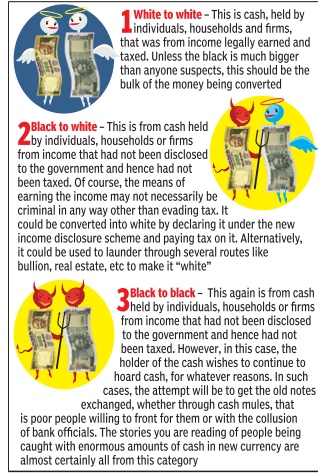

| + | =How black money is used= | ||

| + | '''See graphic''': | ||

| + | |||

| + | ''3 kinds of conversions of cash, from accounted to accounted, unaccounted to accounted and unaccounted to accounted money'' | ||

| + | |||

| + | |||

| + | [[File: 3 kinds of conversions of cash, from accounted to accounted, unaccounted to accounted and unaccounted to accounted money.jpg|3 kinds of conversions of cash, from accounted to accounted, unaccounted to accounted and unaccounted to accounted money; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=13_12_2016_009_010_002&type=P&artUrl=3-WAYS-OLD-CASH-IS-GETTING-CONVERTED-INTO-13122016009010&eid=31808 ''The Times of India''], December 13, 2016|frame|500px]] | ||

| + | |||

| + | ==Black money in real estate transactions== | ||

[http://indiatoday.intoday.in/story/black-money-income-tax-real-estate-stock-exchanges/1/398330.html ''India Today''] | [http://indiatoday.intoday.in/story/black-money-income-tax-real-estate-stock-exchanges/1/398330.html ''India Today''] | ||

| Line 140: | Line 380: | ||

''' Bulk of black money in India likely to be in real estate transactions ''' | ''' Bulk of black money in India likely to be in real estate transactions ''' | ||

| − | + | There are few facts on black money but everyone has a view on it, the commonest being that there is a lot- too much-of it. Those who work in the media have white money. So, they are the most likely to take this view. How well founded is it? | |

The conventional definition of black money is income on which tax has not been paid. If it were spent on consumables, it would vanish in thin air forever. It can be traced and identified only if it financed a durable asset. Very few people who have made money are idiots; most of them would have paid partly in white so that they would have a legal title to the asset. So, most black money would involve undervaluation. Cash deals were common on stock exchanges before they went electronic. Nowadays, a cash transaction in financial assets would be too much of a trouble. Hence, the bulk of black money in India is likely to be in real estate transactions. Corporates and rich taxpayers generally prefer to pay in white even for real estate; and builders are quite ready to take payment by cheque for new property because of the expenses they have to incur in white. Most of the black money is likely to be involved in subsequent sale of property. Indian governments get half a per cent of GDP from property taxes. That is pretty low- the average is 1.2 per cent for the BRICS and 1.9 per cent for the G20. This is not because Indian property prices are low, or because Indian property taxes are high. And Indians do much trade in property-it is their favourite durable asset. Hence, undervaluation is likely to be common. In fact, we can say that property undervaluation is the commonest form of black money in India. It is so common that no one gets worked up about it. | The conventional definition of black money is income on which tax has not been paid. If it were spent on consumables, it would vanish in thin air forever. It can be traced and identified only if it financed a durable asset. Very few people who have made money are idiots; most of them would have paid partly in white so that they would have a legal title to the asset. So, most black money would involve undervaluation. Cash deals were common on stock exchanges before they went electronic. Nowadays, a cash transaction in financial assets would be too much of a trouble. Hence, the bulk of black money in India is likely to be in real estate transactions. Corporates and rich taxpayers generally prefer to pay in white even for real estate; and builders are quite ready to take payment by cheque for new property because of the expenses they have to incur in white. Most of the black money is likely to be involved in subsequent sale of property. Indian governments get half a per cent of GDP from property taxes. That is pretty low- the average is 1.2 per cent for the BRICS and 1.9 per cent for the G20. This is not because Indian property prices are low, or because Indian property taxes are high. And Indians do much trade in property-it is their favourite durable asset. Hence, undervaluation is likely to be common. In fact, we can say that property undervaluation is the commonest form of black money in India. It is so common that no one gets worked up about it. | ||

| + | |||

What they do get worked up about is black money parked abroad, because it is supposed to be the privilege of the tiny minority of filthy rich. Many estimates of it have been made. The first attempt was made in the World Bank's World Development Report of 1985. Every country has a currency. So, there are as many possibilities of conversion between currencies as there are pairs of currencies. For many decades, all governments used to worry about the balance of payments, which is a summary of such transactions, and used to keep reserves of gold or foreign currencies to be able to influence it. Some industrial countries no longer do so, but they all still compile balance of payments statistics. | What they do get worked up about is black money parked abroad, because it is supposed to be the privilege of the tiny minority of filthy rich. Many estimates of it have been made. The first attempt was made in the World Bank's World Development Report of 1985. Every country has a currency. So, there are as many possibilities of conversion between currencies as there are pairs of currencies. For many decades, all governments used to worry about the balance of payments, which is a summary of such transactions, and used to keep reserves of gold or foreign currencies to be able to influence it. Some industrial countries no longer do so, but they all still compile balance of payments statistics. | ||

| + | |||

However, these statistics never balance. All balance of payments statistics have a residual entry called errors and omissions. The first black money enthusiasts assumed that the errors and omissions were flows of black money. The statistics are never the same for pairs of countries. For example, India's exports to Baltistan are different from Baltistan's imports from India. The second set of enthusiasts assumed that the difference (after adjusting for intercountry costs such as freight and insurance) was due to misinvoicing and hence black money. And economists are a competitive and innovative lot. Others invented new techniques of estimation. For instance, if the ratio of interest inflows into a country to its investment outflows looked too low, it was assumed that someone must be salting away interest abroad. | However, these statistics never balance. All balance of payments statistics have a residual entry called errors and omissions. The first black money enthusiasts assumed that the errors and omissions were flows of black money. The statistics are never the same for pairs of countries. For example, India's exports to Baltistan are different from Baltistan's imports from India. The second set of enthusiasts assumed that the difference (after adjusting for intercountry costs such as freight and insurance) was due to misinvoicing and hence black money. And economists are a competitive and innovative lot. Others invented new techniques of estimation. For instance, if the ratio of interest inflows into a country to its investment outflows looked too low, it was assumed that someone must be salting away interest abroad. | ||

| + | |||

It would be silly of me to say that no one sends money abroad clandestinely. As long as the government charges an import duty on gold, it must be highly profitable to smuggle it in. The smuggling channels developed by Dawood Ibrahim and company in the 1980s remain available to all entrepreneurs. | It would be silly of me to say that no one sends money abroad clandestinely. As long as the government charges an import duty on gold, it must be highly profitable to smuggle it in. The smuggling channels developed by Dawood Ibrahim and company in the 1980s remain available to all entrepreneurs. | ||

| + | |||

But gold smuggling apart, I do not think rich Indians have any reason to resort to hawala. A rich man can avoid all taxes by keeping his wealth in unrealised capital gains, and has to pay only 10 per cent even if he realises them. There are simple, legitimate ways to take money abroad. The Reserve Bank of India allows all of us to transfer $125,000 a year abroad without any questions. It lets us invest abroad; all we have to do is tell our bank. If that is not enough, one can do whatever one likes abroad, as long as one does not spend more than 182 days in a financial year in India. If one does not like to be not ordinarily resident, any number of countries abroad would give a rich Indian residence or nationality. So, there is no need to resort to black money. But faith is free. If anyone wants to believe trillions are stashed abroad, let him choose his figure. | But gold smuggling apart, I do not think rich Indians have any reason to resort to hawala. A rich man can avoid all taxes by keeping his wealth in unrealised capital gains, and has to pay only 10 per cent even if he realises them. There are simple, legitimate ways to take money abroad. The Reserve Bank of India allows all of us to transfer $125,000 a year abroad without any questions. It lets us invest abroad; all we have to do is tell our bank. If that is not enough, one can do whatever one likes abroad, as long as one does not spend more than 182 days in a financial year in India. If one does not like to be not ordinarily resident, any number of countries abroad would give a rich Indian residence or nationality. So, there is no need to resort to black money. But faith is free. If anyone wants to believe trillions are stashed abroad, let him choose his figure. | ||

| − | = | + | =State-wise trends= |

| − | [ | + | ==2018: Gujaratis disclosed ₹18,000 cr in 4 months== |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F02&entity=Ar01705&sk=A6211F54&mode=text Ashish Chauhan, October 2, 2018: ''The Times of India''] | ||

| − | |||

| − | + | Gujaratis declared a whopping Rs 18,000 crore in four months flat under the Income Declaration Scheme (IDS), about 29% of the total unaccounted money disclosed across the country. | |

| − | + | This happened between June and September 2016, before black money hogged the spotlight courtesy demonetisation and even ahead of property dealer Mahesh Shah’s disclosure of illegal income of Rs 13,860 crore. | |

| − | + | ||

| − | + | In a reply to an RTI query, the Income-Tax (I-T) department stated that over Rs 18,000 crore was declared in Gujarat under IDS from June 2016 to September 2016 — 29% of the total declaration of Rs 65,250 crore under the scheme. | |

| − | + | It took I-T department nearly two years to provide the information that RTI applicant Bharatsinh Jhala had sought in his application of December 21, 2016, after Ahmedabad-based property dealer Shah’s Rs 13,860 crore declaration. His IDS was, however, cancelled after he defaulted on payment on the first instalment. | |

| − | The | + | The department has remained silent over income declared by netas, police officials and bureaucrats. Jhala says it was nearly two years of struggle to get the information. “First, the application was misplaced. Then the department declined as the application was in Gujarati language. On September 5 this year, Chief Information Commissioner in Delhi directed I-T department to provide the information,” said Jhala. |

| − | + | The Union government announced the IDS in 2016 under which the declaration could be made between June 2016 and September 2016. After declaration, the first instalment of 25% amount was to be paid by November 2016 and the second, of 25%, by March 2017. The remaining amount had to be paid till November 2017. | |

| − | + | The Rs 18,000 crore declared by Gujaratis made up 29% of the total unaccounted amount of Rs 62,250 crores. It took the I-T department 2 years to respond to the RTI regarding the Income Declaration Scheme introduced in 2016 | |

| − | + | =See also= | |

| + | [[Black money: India ]] | ||

| + | |||

| + | [[Indian money in foreign banks]] | ||

| + | |||

| + | [[Indian money in offshore entities: The Panama Papers]] | ||

| + | |||

| + | [[Indian money in offshore entities: The ‘Paradise Papers’]] | ||

| + | |||

| + | [[Indian money in HSBC, Switzerland]] | ||

| + | |||

| + | [[Indian money in Liechtenstein banks]] | ||

| + | |||

| + | [[India’s offshore economy]] | ||

| + | |||

| + | [[Pakistani money in offshore entities: The ‘Paradise Papers’]] | ||

| + | |||

| + | [[Sri Lankan money in Swiss banks]] | ||

| + | |||

| + | =And also= | ||

| + | [[India’s offshore economy]] | ||

| + | |||

| + | [[Sri Lankan money in Swiss banks]] | ||

Latest revision as of 19:08, 8 December 2020

ii) the proportion of the black shadow economy in India, 1999-2007

The Times of India

The Times of India

This is a collection of articles archived for the excellence of their content. |

[edit] The size of the problem, India's global position

[edit] 2003-12: Size of problem, India's global position

May 18, 2015

Vivek Kaul

“There is no clear estimate of the total amount of black money in India. As per a confidential report submitted to the government by the National Institute of Public Finance and Policy (NIPFP) in December 2013, the black money economy could be three-fourths the size of the Indian economy. This report was accessed by The Hindu in August 2014.”- Vivek Kaul

Bringing back black money from abroad has been one of the pet issues of the Narendra Modi government. Black money is essentially money on which taxes have not been paid. An estimate by Washington-based research and advocacy group Global Financial Integrity in its report Illicit Financial Flows from Developing Countries: 2003-2012, suggests that around $439.6 billion of black money left Indian shores, between 2003 and 2012.

India is ranked fourth (behind China, Russia and Mexico) when it comes to the total amount of black money leaving a developing country. The interesting thing nonetheless is that the quantum of money leaving India increased dramatically during the Congress-led UPA regime. In 2003, around $10.18 billion left the country. By 2012, it had jumped by more than nine times to $94.8 billion. Interestingly, the number in 2009 was at $29 billion. This clearly tells us that the second term of the UPA, which started in May 2009, was fairly corrupt. Also the amount of money leaving China grew by less than four times between 2003 and 2012. In case of Russia, the increase was three times. For Mexico, the increase was less than two times. Hence the jump in India's case was clearly the highest.

The $439.6 billion that left the country was equal to around 23 per cent of India's GDP of $1.88 trillion in 2013. It is a large amount of money and hence the Modi government's interest in bringing this money back seems justified.

While things may always be possible, what we need to look at is whether they are probable. And the answer in this case is no. Conventional wisdom has it that all this money is lying in Swiss banks. But that is an incorrect assumption to make.

There are around 70 tax havens across the world. Given this, the money that has left Indian shores could be anywhere. These tax havens are unlikely to cooperate with the Indian government to help it bring back the black money stashed abroad. The economies of many tax havens run on black money.

So does that mean the government should give up on its pursuit of black money? Of course not. But it should concentrate on the black money stashed in India itself.

There are other figures that are not so big. Nevertheless, what we know for sure is that only around 2.9 per cent of Indians pay income tax (I-T). In fact, previous finance minister P. Chidambaram in his February 2013 Budget speech had said India had only 42,800 people with a taxable income of Rs 1 crore or more.

Now compare this with the fact that around 30,000 luxury cars are sold in India every year. Both Audi and Mercedes sold more than 10,000 cars in India in 2014. A February 2015 report by business lobby FICCI makes a similar point.

The report estimates that the number of dollar millionaires (i.e. with assets of Rs 6 crore or more) in India in 2014 stood at 2.27 lakh, up from 2.14 lakh in 2013. But the number of taxpayers with a taxable income of more than a crore is less than 50,000.

What this tells us clearly is that there is widespread tax evasion in the country. This tax evasion continues to generate a lot of black money, some of which escapes the shores of this country. This is the black money that the government should be going after.

Information technology can play a big role in this. In fact, it already is. As the FICCI report cited earlier points out: "The Integrated Taxpayer Data Management System is a data mining tool implemented by the I-T department that is used for detection of potential cases of tax evasion. The tool assists in generating a 360-degree profile of the high net worth assesses." The government should work towards making this tool even more robust by building more data into it in the days to come.

Further, it has to get cracking on the real estate sector where the maximum amount of black money is invested. This black money generates more black money. Going after the biggest property dealers of the National Capital Region, where most black money changes hands, might be a good starting point.

The question is will this government (or for that matter any other government) go after domestic black money, given that it finances almost every political party in the country? Now that is something worth thinking about.

[edit] 2004-2013: India 4th in black money outflows

The Times of India, December 9, 2015

India ranks fourth in black money outflows with a whopping $51 billion siphoned out of the country per annum between 2004-2013, a US-based think-tank's report said. Notably India's defence budget is less than $50 billion. China tops the list with $139 billion average outflow of illicit finances per annum, followed by Russia ($104 billion per annum) and Mexico ($52.8 billion per annum), according to the annual report released by Global Financial Integrity (GFI), a Washington-based research and advisory organisation. The illegal capital outflows stem from tax evasion, crime, corruption and other illicit activity, the report said, according to which a record $1.1 trillion flowed illicitly out of developing and emerging economies in 2013, the latest year for which data is available. In all, during this decade-long period of 2004-2014, GFI estimates that more than half a trillion ($510 billion) went out of India and in the case of China the figure was $1.39 trillion and Russia $1 trillion. Titled 'Illicit Financial Flows from Developing Countries: 2004-2013', the study shows that illicit financial flows first surpassed $1 trillion in 2011 and have grown to $1.1 trillion in 2013, marking a dramatic increase from 2004, when illicit outflows totalled just $465.3 billion. China also had the largest illicit outflows of any country in 2013, amounting to a staggering $258.64 billion in just that one year, the report said.

"This study clearly demonstrates that illicit financial flows are the most damaging economic problem faced by the world's developing and emerging economies," said GFI President Raymond Baker, a longtime authority on financial crime.

"This year at the UN the mantra of 'trillions not billions' was continuously used to indicate the amount of funds needed to reach the Sustainable Development Goals. Significantly curtailing illicit flows is central to that effort," he said. Noting that Sustainable Development Goals (SDGs) calls on countries to significantly reduce illicit financial flows by 2030, the report said the international community has not yet agreed on goal indicators, the technical measurements to provide baselines and track progress made on underlying In its report, GFI recommends that world leaders should focus on curbing opacity in the global financial system, which facilitates these outflows.

[edit] 2010: Indian deposits in European banks

The Times of India, July 17, 2011

The Swiss National Bank, the central bank of Switzerland, has estimated that Indian clients had deposits of about $2.5 billion in banks in the European nation in 2010. This is just a fraction of the $1.5-trillion figure that had been projected by political parties and non-governmental organizations, who have attacked the UPA government with their anti-corruption movement over the last few months. “The Swiss National Bank can only say that liabilities of Swiss banks towards Indian holders according to our annual statistics... were Swiss francs 1.9 billion ($2.5 billion) in 2010,” Walter Meier, spokesperson for the Swiss National Bank’s president, said.

According to him, the liabilities of Swiss banks towards Indian holders were Swiss francs 1.965 billion ($2.7 billion) in 2009 and Swiss francs 2.4 billion (about $3 billion) in 2008. In the aftermath of the financial crisis that engulfed the West after the collapse of the Lehman Bank in the US in 2008, Swiss private banks, particularly their largest bank UBS, had suffered huge losses. Subsequently, there were substantial withdrawals of funds from Swiss banks.

Unconfirmed reports suggested that several Indian companies and private holders had also moved funds from Switzerland to Singapore following the financial crisis in 2008. Moreover, several legal cases were filed against Swiss banks, especially UBS, for parking funds by wealthy US citizens through tax evasion.

In addition, the banks came under growing international pressure from the Paris-based Organisation for Economic Cooperation and Development and faced tougher G-20 financial regulations. All these forced the Swiss government to considerably relax its confidentiality provisions of numbered accounts that provided the extreme forms of client confidentiality until two years ago. After the OECD reported a list of such “uncooperative” countries as Switzerland, Luxembourg, Austria and Liechtenstein, among others, to the G-20, there was a panic reaction. AGENCIES

[edit] 2010: $490bn stashed abroad

June 25, 2019: The Times of India

‘$490bn in black money stashed abroad till 2010’

New Delhi:

Studies conducted by three premier institutes — NIPFP, NCAER and NIFM — have concluded that unaccounted wealth held by Indians outside the country till 2010 could be as high as $490 billion, besides black money parked within the country as ‘investments’ in sectors like real estate, mining, tobacco/gutka, bullion, films and education.

This was part of a report of the standing committee on finance tabled in Lok Sabha on Monday. This is the first official acknowledgement of the three government-sponsored studies initiated in 2011 to estimate black money held by Indians in the country and abroad.

On a reference from the then UPA government, the three think tanks came out with their own estimates of black money. The reports have not been made public yet, though they were submitted to the government during the UPA regime.

The National Institute of Public Policy and Finance (NIPFP) has estimated illicit financial flow out of the country during 1997-2009 in the range of 0.2% to 7.4% of GDP. The National Council of Applied Economic Research (NCAER), however, estimated unaccounted wealth accumulated outside the country by Indians between $384 billion and $490 billion during 1980-2010.

The National Institute of Financial Management (NIFM) found the total illicit outflow from India (1990-2008) at Rs 9,41,837 crore ($216.48 billion). Illicit outflows from India was on average 10% of the unaccounted income, it said.

“There are no reliable estimates of black money generation or accumulation, neither is there an accurate wellaccepted methodology for making such estimation,” the standing committee on finance said in its report. It said these estimates were made merely on “assumptions” as there was no uniformity or consensus on the best methodology or approach to be used for this purpose.

The standing committee report, tabled on Monday, was first submitted by the panel headed by M Veerappa Moily to the Lok Sabha Speaker on March 28 before the lower House was dissolved ahead of parliamentary elections.

The panel noted that the findings were preliminary in nature owing to paucity of time. Only a limited number of stakeholders could be examined by the committee, it said, and recommended examination of more witnesses, including non-official witnesses and experts.

[edit] 2012: India is 3rd on black money list

$440billion flows out in 10 years

WASHINGTON, December 16, 2014

As India continues its pursuit of suspected black money stashed abroad, an international think-tank has ranked the country third globally with an estimated $94.76 billion (nearly Rs 6 lakh crore) illicit wealth outflows in 2012.

As a result, the cumulative illicit money moving out of the country over a ten-year period from 2003 to 2012 has risen to $439.59 billion (Rs 28 lakh crore), as per the latest estimates released by the Global Financial Integrity (GFI).

Russia is on the top with $122.86 billion, followed by China at the second position ($249.57 billion) in terms of the quantum of black money moving out of a country for 2012- the latest year for which these estimates have been made.

The Washington-based research and advocacy group further said that the illicit fund outflows from India accounts for nearly 10 per cent of a record $991.2 billion worth illegal capital that moved out of all developing and emerging nations in 2012 to facilitate "crime, corruption, and tax evasion".

As per GFI's 2014 Annual Global Update on Illicit Financial Flows report, that the cumulative illicit outflows from developing economies for ten years between 2003 and 2012 stands at $6.6 trillion.

This includes $439.59 billion worth illicit money that has moved out of India in these ten years, putting the country at fourth position in overall ranking for a decade, after China ($1.25 trillion), Russia (973.86 billion) and Mexico ($514.26 billion). In these ten years, an average of $43.96 billion of black money is being sent out of India every year, GFI said.

The estimate of this huge illegal money flow follows a Supreme Court-constituted Special Investigation Team (SIT) tracing Rs 4,479 crore in the accounts of Indians figuring in a list of account holders of HSBC's Geneva branch.

Besides, the SIT has also disclosed tracing unaccounted wealth worth Rs 14,958 crore within India, which are now being investigated by the Enforcement Directorate and the Income Tax Department.

[edit] Black money outflow in 2012

Rs 6000000000000 - THE AMOUNT OF BLACK MONEY THAT WENT OUT OF INDIA IN 2012

Subodh Varma, December 17, 2014

Nearly $95 billion (Rs 6 lakh crore) were illegally taken out of India in 2012, bringing the total illicit outflow of capital from the country to $440 billion (about Rs 28 lakh crore) in the preceding decade, according to the latest study released on Tuesday by Global Financial Integrity (GFI), a Washington DC-based research and advisory organization. Not only have taxes not been paid for these enormous sums, they may have been put to use for various corrupt or criminal activities once parked in foreign safe havens. Overall, just in 2012, nearly a trillion dollars ($991 billion) in illicit capital flowed out of developing and emerging economies, the study noted. This is an all-time high. Between 2003 and 2012, the illicit outflows add up to a monstrous $6.6 trillion, averaging nearly 4% of the developing world's GDP .

Black money has been a major issue roiling India in the recent past. The new Modi government had promised it would bring back black money stashed away in foreign banks in 100 days. While investigations are inching forward, opposi tion parties have been pressing for more decisive action.

Despite much political noise over “black money“, the outflow of national wealth seems to be continuing unchecked and growing each year. The GFI study says illicit outflows are growing at an inflation-adjusted 9.4% per year -roughly double the global GDP growth over the same period. As if these numbers are not mind-boggling enough, GFI chief economist Dev Kar stresses that these estimates are “conservative” since several types of illegal transactions are not reflected in these figures.

“This means that many forms of abusive transfer pricing by multinational corporations as well as much of the proceeds of drug trafficking, human smuggling, and other criminal activities, which are often settled in cash, are not included in these estimates,“ explained Kar, who served as a senior economist at the International Monetary Fund before joining GFI in January 2008.

India ranked third after China and Russia in the quantum of illicit outflows in 2012.For the whole decade of 2003 to 2012, India ranks fourth. A total of 151 countries were studied by Kar and his colleague Joseph Spanjers at the GFI. “As this report demonstrates, illicit financial flows are the most damaging economic problem plaguing the world's developing and emerging economies,“ said GFI President Raymond Baker , a longtime authority on financial crime. The $991.2 billion that flowed illicitly out of developing countries in 2012 was greater than the combined total of FDI ($789.4 billion) and net official development assistance ($89.7 billion), which these economies received that year. Some of the poorest regions of the planet -south Asia and subSaharan Africa -have very high rates of foreign outflows, depriving them of much needed capital for basic amenities and services.

[edit] 2014: Global Financial Integrity report

Subodh Varma, `$21b in black money went out of India in 2014’, May 3, 2017: The Times of India

At Same Time, $101b Illicitly Flowed In: Global Watchdog

Over $21 billion worth of black money was illegally taken out of India in 2014, according to the latest report by the international watchdog Global Financial Integrity (GFI), released.

This illicit outflow was nearly 19% more than 2013. GFI has, for the first time, given information on the equally damaging inflow of illegal funds in this report, with India being the destination of a staggering $101 billion in 2014, up nearly 11% over the previous year.