Banking, India: Loans

(Created page with "{| class="wikitable" |- |colspan="0"|<div style="font-size:100%"> This is a collection of articles archived for the excellence of their content.<br/> Additional information ma...") |

|||

| Line 7: | Line 7: | ||

|} | |} | ||

| − | + | ||

| − | + | ||

| + | |||

=Credit, sector-wise= | =Credit, sector-wise= | ||

| Line 19: | Line 20: | ||

'' Bank credit to the telecommunication sector, 2015-20, bank-wise '' | '' Bank credit to the telecommunication sector, 2015-20, bank-wise '' | ||

| + | |||

| + | =Loans= | ||

| + | ==Prompt Corrective Action (PCA) == | ||

| + | ===Impact on advances: 2017-20=== | ||

| + | [[File: The Impact of Prompt Corrective Action on advances, 2017-20.jpg| The Impact of Prompt Corrective Action on advances: 2017-20 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F04%2F14&entity=Ar01302&sk=0E725B19&mode=image April 14, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' The Impact of Prompt Corrective Action on advances: 2017-20 '' | ||

| + | |||

| + | ==The top borrowers== | ||

| + | ===Cities, 2018=== | ||

| + | [https://timesofindia.indiatimes.com/city/bengaluru/bengalureans-take-most-personal-car-loans/articleshow/67649775.cms Rachel Chitra, Bengalureans take most personal, car loans, January 23, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Cities that were the biggest borrowers in 2018.jpg|Cities that were the biggest borrowers in 2018 <br/> From: [https://timesofindia.indiatimes.com/city/bengaluru/bengalureans-take-most-personal-car-loans/articleshow/67649775.cms Rachel Chitra, Bengalureans take most personal, car loans, January 23, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | The highest personal loan ticket sizes are in Bengaluru, at Rs 47 lakh, followed by Mumbai (Rs 40 lakh), Delhi (Rs 26 lakh) and Kolkata (Rs 30 lakh), as per data from 1.6 million loan applications in 2018 with BankBazaar, one of India’s biggest online financial services aggregators. | ||

| + | |||

| + | In the average ticket size of personal loans taken, Mumbai (Rs 2.79 lakh) was ahead of Bengaluru (Rs 2.66 lakh) and Chennai, Delhi and Kolkata. | ||

| + | |||

| + | BankBazaar CEO Adhil Shetty said the high number of large loans in Bengaluru is, perhaps, a reflection of larger disposable income and high growth opportunities. He said the city has more first-time salaried borrowers than other metros. | ||

| + | |||

| + | The data is of those who use the online mode. It’s possible that in some of the other cities, a higher proportion of people choose offline modes. | ||

| + | |||

| + | In car loans too, the top segment of Bengalureans takes higher loans than their counterparts elsewhere, suggesting they go for more flashy cars. The highest loan ticket sizes came from Bengaluru, at Rs 49.9 lakh, followed by Chennai at Rs 46.8 lakh, and Delhi at Rs 21.8 lakh. | ||

| + | |||

| + | Highest car purchase by women borrower in 2018 was at Rs 12.9L | ||

| + | |||

| + | Compared to their urban counterparts, borrowers from tier-2 and tier-3 cities restrict themselves to not spending above Rs 20 lakh for a car. Even when it came to average car loan size, rural and semi-urban borrowers were more conservative and borrowed only up to Rs 5.2 lakh, compared to their urban counterparts, who were willing to shell out Rs 5.7 lakh. | ||

| + | |||

| + | The highest car purchase by a woman borrower in 2018 was at Rs 12.9 lakh. In personal loans, Bankbazaar data shows the average ticket size in metros was at Rs 2.6 lakh, lower when compared to Rs 2.8 lakh in non-metros. | ||

| + | |||

| + | “It’s possible urban users have more choices such as credit card, and EMI options for consumer purchases on debit cards, and may not choose a personal loan as their first option,” said Shetty. | ||

| + | |||

| + | In home loans, Delhiites took the highest ticket sizes (Rs 5 crore), followed by Chennai (Rs 2.2 crore), Bengaluru (Rs 1.5 crore) and Mumbai (Rs 1.8 crore). | ||

| + | |||

| + | But this trend could only be an indicator of the buying pattern of younger, tech-savvy individuals. An SBI official said, “We get biggest home loan and car loan requests from Mumbai. It’s possible Mumbaikars prefer directly contacting their banker than going through a third-party aggregator.” | ||

| + | |||

| + | ==The top lenders== | ||

| + | ===2008-18=== | ||

| + | [[File: 2008-12, PSB banks’ share in lending.jpg|2008-12: PSB banks’ share in lending <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F13&entity=Ar02905&sk=AAE82DCD&mode=image October 13, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: 2013-18, PSB banks’ share in lending.jpg|2013-18: PSB banks’ share in lending <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F13&entity=Ar02905&sk=AAE82DCD&mode=image October 13, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

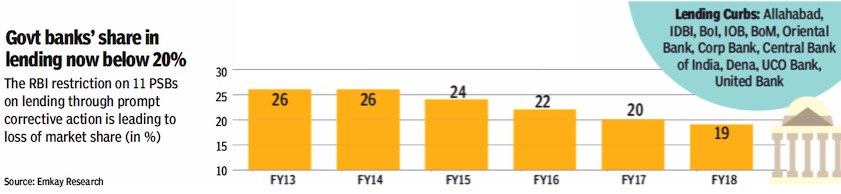

| + | '''See graphics''': | ||

| + | |||

| + | ''2008-12: PSB banks’ share in lending'' | ||

| + | |||

| + | ''2013-18: PSB banks’ share in lending'' | ||

| + | |||

| + | ===2017=== | ||

| + | SBI, ICICI Bank Are The First Two Lenders | ||

| + | |||

| + | The RBI added HDFC Bank to the list of systemically important banks, or banks that are considered too big to fail.The other banks on the list are the two largest lenders -SBI and ICICI Bank. Since 2015, the central bank has been identifying banks whose failure would impact the whole financial system.These banks are subject to more rigorous regulation and capital requirement.([http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=TOO-BIG-TO-FAIL-HDFC-Bank-Indias-third-05092017023032 The Times of India Sept 2017]) | ||

| + | |||

| + | ===States, 2019=== | ||

| + | [https://timesofindia.indiatimes.com/business/private-lenders-gain-market-share/articleshow/69095675.cms April 29, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Disbursement of loans by private lenders, state-wise, as in early 2019.jpg|Disbursement of loans by private lenders, state-wise, as in early 2019 <br/> From: [https://timesofindia.indiatimes.com/business/private-lenders-gain-market-share/articleshow/69095675.cms April 29, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Private lenders gain market share | ||

| + | |||

| + | Private lenders have expanded their retail lending market share by 10 percentage points across top states in four years. The 15 states listed here account for nearly 90% of the loans. Private banks also disbursed 40% of all advances in FY19 as against 30% in FY15. Nearly 75% of the incremental gains have come from western and southern states. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | ==Loans to gems & jewellery cos== | ||

| + | [[File: Outstanding bank loans to gems and jewellery, 2014-17.jpg|Outstanding bank loans to gems and jewellery, 2014-17 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F19&entity=Ar02106&sk=851520DD&mode=text Sidhartha, February 19, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Outstanding bank loans to gems and jewellery, 2014-17'' | ||

| + | |||

| + | ==Gender-wise size of loans, 2018== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F01%2F23&entity=Ar02815&sk=0FC28BB8&mode=text Rachel Chitra, Loan sizes higher when women borrow, January 23, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Home loans, city-wise and gender-wise, presumably as in 2018.jpg|Home loans, city-wise and gender-wise, presumably as in 2018 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F01%2F23&entity=Ar02815&sk=0FC28BB8&mode=text Rachel Chitra, Loan sizes higher when women borrow, January 23, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | The average ticket size of a home loan when women borrow is significantly higher (Rs 27 lakh) than when a man borrows (just under Rs 23 lakh), according to data from 1.6 million loan applications in 2018 on BankBazaar, one of India’s biggest online financial services aggregators. | ||

| + | |||

| + | BankBazaar CEO Adhil Shetty said the higher loan amount when a woman applies could indicate it’s a household with two incomes, unlike when a male applies, where he could be the only breadwinner. Banks also have special loan offers for women, with interest rates many basis points (100bps = 1 percentage point) lower than for men. | ||

| + | |||

| + | When it came to car-buying patterns, the data shows that when a woman is the primary loan applicant, they tend to steer away from big-ticket car purchases. Male borrowers borrowed up to Rs 49.9 lakh for a car, whereas the highest female car loan ticket size was Rs 12.9 lakh. | ||

| + | |||

| + | But in terms of the average car loan size taken by women, it’s significantly higher (Rs 5.5 lakh) than when men are the sole applicants (Rs 5.3 lakh). “Again, I think when women apply, they are an indicator of a double-income household,” said Shetty. | ||

| + | |||

| + | This trend of women boosting the household’s purchasing capacity could be seen across metros. The average ticket size of home loans in Delhi for women borrowers was Rs 28 lakh, compared to male borrowers at Rs 24.5 lakh. In Bengaluru, women borrowed Rs 37.9 lakh — higher than men at Rs 36.9 lakh, and in Chennai women borrowed Rs 34.8 lakh compared to men at Rs 30.1 lakh. However, the situation was the opposite in Mumbai, where men borrowed more in home loans at an average of Rs 32.8 lakh compared to women at Rs 29.7 lakh. | ||

| + | |||

| + | For personal loans, women seem to borrow less than men. The average ticket size for female applicants was Rs 2.7 lakh, compared to men who borrowed Rs 2.8 lakh. | ||

| + | |||

| + | Women seem to now have the firepower for globe-trotting just as much as men — women’s applications for travel credit cards grew 73%, slightly higher than male applications that increased 71.5%. In lifestyle credit cards too, applications from women grew at a 10.5% rate, compared to men at 8%. | ||

| + | |||

| + | ==Women borrowers== | ||

| + | ===2014-20=== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F03%2F09&entity=Ar01709&sk=EF551508&mode=text March 9, 2021: ''The Times of India''] | ||

| + | |||

| + | [[File: Women borrowers, 2014-20.jpg|Women borrowers, 2014-20 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F03%2F09&entity=Ar01709&sk=EF551508&mode=text March 9, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Credit-wary women up home loan share… | ||

| + | |||

| + | Reduce Personal Loans, Plastic Money’s Use, Have Higher Credit Score Than Men: Study | ||

| + | |||

| + | Mumbai: | ||

| + | |||

| + | Women have sharply increased their share of home loans, but have turned averse to personal loans and credit cards in the wake of the pandemic. Women are also more closely monitoring their credit scores, according to a study by TransUnion Cibil. | ||

| + | |||

| + | A report released by the credit bureau on Women’s Day shows that in 2019, women accounted for 23% of consumer loans. This dipped by 400 basis points (100bps = 1 percentage point) to 19% in 2020. Similarly, credit card enquiries by women dipped from 13% to 12% during the same period. However, when it comes to home loans, women have increased their share to 11% from 9% in 2019. | ||

| + | According to TU Cibil chief operating officer Harshala Chandorkar, this is because of factors like reduced stamp duty for women consumers on a home purchase in some states along with lenders offering better terms & conditions and a lower rate of interest for women borrowers. “Also, the fact that women have a higher average Cibil score than that of men indicates that women have a better credit history and therefore lesser probability of default, which makes them better customers for banks and credit institutions. Improved and easier access to economic opportunities have catalysed the financial inclusion of women in India,” she added. | ||

| + | |||

| + | TU Cibil VP and head (DTC interactive) Sujata Ahlawat said, “With improved levels of education and employment of women across our country, their credit consciousness has also grown. This is corroborated by the fact that we have seen a significant surge in the number of women borrowers who monitor their Cibil score and report. This is a promising indicator of increased awareness and financial literacy among women.” This increased credit consciousness is also evident from data that shows women now constitute 12% of self-monitoring consumers — an increase from10% in 2018. | ||

| + | |||

| + | Women consumers also show better credit history as compared to men, with the average Cibil score of an Indian woman consumer being 719 — higher than that of an average male consumer at | ||

| + | 709. Additionally, 61% of the women consumers in TU Cibil’s consumer credit bureau have a score greater than 720, whereas only 56% of male consumers have greater than or equal to that figure. “Increased credit consciousness leads to a positive credit behaviour as consumers understand the impact of their credit activity on their Cibil score and access to finance,” said Ahlawat. | ||

| + | |||

| + | As women turn credit conscious, their overall share in retail loans is increasing too with 4.7 crore active women borrowers. Over the last six years, the share of women borrowers grew to around 28% in September 2020 — up from around 23% in September 2014, which is a compounded annual growth rate (CAGR) of around 16%. In terms of the sanctioned loan amount, women borrowers account for Rs 15.1 lakh crore of retail loans, which has grown at a 12% CAGR over the last six years. | ||

| + | |||

| + | =Loans: Bad loans= | ||

| + | ==5 business houses alone owe PSU banks Rs. 1.4 lakh crore== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Just-5-business-houses-owe-PSU-banks-Rs-06052016013032 ''The Times of India''], May 06 2016 | ||

| + | |||

| + | ''' Adani Group Has Debt Of Rs. 72,000 Crore' ''' | ||

| + | |||

| + | Raising the issue of corporate loans in Rajya Sabha, JD(U) member Pavan Verma said the Adani group had a debt of Rs 72,000 crore -an amount equal to the total debt of farmers in the country. Verma said corporate houses owed about Rs 5 lakh crore to PSU banks and particularly referred to the Adani group, alleging that the company got “unimaginable“ favours. Raising the issue during zero hour, he contended that PSU banks were influenced to give loans to people who were not able to repay them. | ||

| + | |||

| + | “PSU banks are owed abo ut Rs 5 lakh crore by corporate houses and of this, roughly Rs 1.4 lakh crore are owed by just five companies, which include Lanco, GVK, Suzlon Energy , Hindustan Construction Company and a certain company called the Adani group and Adani Power,“ he said. | ||

| + | |||

| + | “I want a reply from the government, are they aware of this or are they not. And if they are aware, what are they doing in this matter. One company owes as much as all the farmers of India,“ he further said. | ||

| + | |||

| + | The amount owed by this group both in terms of its long-term and short-term debt was around Rs 72,000 crore, Verma said, claiming to be quoting from reports. He added that on Wednesday , it was mentioned that the entire amount owed by farmers as crop loans was Rs 72,000 crore. | ||

| + | |||

| + | “I don't know what is the relationship of this government with this business house. I don't even know if they know them, but the owner of this group (Gautam) Adani is seen everywhere the prime minister has gone, every country , China, the UK, the US, Europe, Japan,“ Verma said. | ||

| + | |||

| + | “This company has been given favours which are unimaginable. In Gujarat, their SEZ was approved in spite of the high court's strictures,“ he added. | ||

| + | |||

| + | When deputy chairman P J Kurien warned Verma against making allegations, the JD(U) member said, “I am giving you factual account. It is a high court judgment. It was left to the state government.The UPA government had not approved it and when this government came to power, it was approved.“ | ||

| + | |||

| + | Verma said it did not matter if Adani group had the ability to pay this amount, but in the last 2-3 years, the company's net worth had gone up by 85%. | ||

| + | == 25% of Rs 8 lakh crore bad debt is from just 12 accounts == | ||

| + | [http://timesofindia.indiatimes.com/business/india-business/rbi-just-12-accounts-responsible-for-25-of-rs-8-lakh-crore-bad-debt-with-banks/articleshow/59130795.cms RBI: Just 12 accounts responsible for 25% of Rs 8 lakh crore bad debt with banks, Jun 13, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | '''HIGHLIGHTS''' | ||

| + | |||

| + | Just 12 accounts responsible for 25% of all NPAs with banks | ||

| + | |||

| + | Lenders will be asked to initiate insolvency proceedings to recover the dues | ||

| + | |||

| + | The RBI today identified 12 accounts each having more than Rs 5,000 crore of outstanding loans and accounting for 25 per cent of total NPAs of banks for immediate referral for resolution under the bankruptcy law. | ||

| + | |||

| + | Without naming the defaulters, the Reserve Bank said the lenders will be asked to initiate insolvency proceedings to recover the dues. | ||

| + | The banking sector is saddled with non-performing assets (NPAs) worth over Rs 8 lakh crore, of which Rs 6 lakh crore is with public sector banks (PSBs). | ||

| + | The Internal Advisory Committee (IAC), the central bank said, has arrived at an objective, non-discretionary criterion for referring accounts for resolution under the Insolvency and Bankruptcy Code (IBC). | ||

| + | |||

| + | "In particular, the IAC recommended for IBC reference of all accounts with fund and non-fund based outstanding amount greater than Rs 5,000 crore, with 60 per cent or more classified as non-performing by banks as of March 31, 2016," the RBI said in a statement. | ||

| + | The IAC noted that under the recommended criterion, 12 accounts with about 25 per cent of the current gross NPAs of the banking system would qualify for immediate reference under IBC, it said. | ||

| + | |||

| + | The apex bank, based on the recommendations of the IAC, will accordingly be issuing directions to banks to file for insolvency proceedings under the IBC in the identified accounts. | ||

| + | |||

| + | Such cases will be accorded priority by the National Company Law Tribunal (NCLT). | ||

| + | |||

| + | ==2012-18== | ||

| + | |||

| + | [[File: Share of stressed loans, 2012-18.jpg|Share of stressed loans, 2012-18 <br/> From: [https://epaper.timesgroup.com/olive/apa/timesofindia/SharedView.Article.aspx?href=TOIDEL%2F2019%2F05%2F22&id=Ar02506&sk=900EB13A&viewMode=text May 22, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Share of stressed loans, 2012-18 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | |||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | ==2014: loans to coal sector…== | ||

| + | [[File: banks NPA.jpg| NPAs (non-performing assets) as in 2013, especially bad loans to power sector. Source: [http://epaperbeta.timesofindia.com//Gallery.aspx?id=25_09_2014_025_017_010&type=P&artUrl=Power-sector-bad-loans-may-rise-25092014025017&eid=31808 The Times of India ]|frame|500px]] | ||

| + | '''… and scrapping of coal block allotments ''' | ||

| + | |||

| + | ''' Power sector bad loans may rise ''' | ||

| + | |||

| + | Mumbai: | ||

| + | |||

| + | TIMES NEWS NETWORK | ||

| + | |||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Power-sector-bad-loans-may-rise-25092014025017 The Times of India ] Sep 25 2014 | ||

| + | |||

| + | |||

| + | The Supreme Court verdict scrapping all but four coal block allotments has added to the bad loan headache of the banking industry . | ||

| + | |||

| + | Although bank exposure to coal mining sector is estimated to be below Rs 20,000 crore, the biggest fear is that coalfuelled power plants may stop producing power and default on loans. Bank exposure to power companies is around Rs 5.16 lakh crore and accounts for 9% of their loans. A large chunk of these depend on coal. | ||

| + | |||

| + | Shares of leading public sector banks dipped sharply on Monday over fears that their bad loans would rise following the Supreme Court order. | ||

| + | |||

| + | Bank of India and Canara Bank, which have large exposures to the power segment (relative to their loan book) fell 5.6% and 5%, respectively , to Rs 263 and Rs 358. Punjab National Bank, which is estimated to have the largest exposure to coal mining, fell 4.3% to Rs 927. The State Bank of India, one of the largest lenders to power in absolute terms, saw its share price fall 2.7% to Rs 2,487. Even without the coal block cancellation, several power projects and steel companies are under stress and are undergoing restructuring. Stoppage of fuel to these projects could tip them into the non-performing assets category , considering that imported coal is four times as expensive as domestic coal. Reacting to the SC order, SBI chairman Arundhati Bhattacharya said, “We believe that uncertainty is possibly the worst enemy of growth. We are glad that this is over with the SC verdict on coal blocks allocation. We now look forward for a quick plan of action for ensuring that coal supplies are not disrupted and, thereafter, a swift and transparent bidding process for reallocation.“ | ||

| + | |||

| + | According to IDBI Bank chairman MS Raghavan, the bank has an exposure of close to Rs 2,000 core to the companies affected by the Supreme Court order. The bank is still assessing the impact of the verdict. | ||

| + | |||

| + | In the private sector, ICICI Bank has loans to power and steel companies that are dependent on coal supply . Earlier in an interview to TOI, Chanda Kochhar, MD & CEO of ICICI Bank, had said it was important to ensure that back-end projects that depend on coal keep producing. “The government has been talking about finding ways of reallocating coal. As long as coal is produced and power and steel plants get it, that ensures the viability of the power project; where it is allocated, who owns it and who mines it is not the primary thing. Banks had mainly extended assistance to either power or iron and steel projects,“ Kochhar had said. While deciding to cancel all but four coal blocks allotted since 1993, The Supreme Court brushed aside Coal Producers Association's (CPA) estimate that Rs 9 lakh crore linked to them would come to naught. | ||

| + | |||

| + | The CPA, through senior advocate K K Venugopal, had said that loans worth Rs 2.5 lakh advanced by banks and financial institutions would become non-performing assets. It had said that SBI has an exposure of up to Rs 78,263 crore. | ||

| + | |||

| + | Venugopal had said that apart from huge losses to other PSU banks like PNB and Union Bank, public sector entities like Rural Electricity Corporation and PFC would experi ence an even higher exposure than banks. The financial implication narrated by CPA covered many other aspects.“Huge investments up to about Rs 2.9 lakh crore have been made in 157 coal blocks as on December 2012, investments in the end-use plants have been made to the extent of about Rs 4 lakh crore, which employ 10 lakh people,“ CPA had said. | ||

| + | |||

| + | The CPA had warned of many other adverse effects -the country's dependence on coal as a primary source of fuel for up to 60% for power generation might result in inflationary trends; 28,000 mw of power capacity would be affected due to de-allocation; closure of coal mines would result in an estimated loss of Rs 4.4 lakh crore in terms of loss of royalty , cess, direct and indirect taxes; coal imports would go up even more in financial year 2016-17 to the extent of Rs 1.4 lakh crore. | ||

| + | |||

| + | A bench of Chief Justice R MLodha and Justices Madan B Lokur and Kurian Joseph cited arguments of attorney general Mukul Rohatgi to counter adverse economic fallout predicted by CPA. “It was submitted by the AG that all aspects, including the economic implications or fallout of the cancellation of coal block allotments and the possible adverse impact that it may have on other socio-economic factors, have been taken into consideration and it is only after that the affidavit has been filed by the Union of India,“ the bench said. | ||

| + | |||

| + | |||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | ==2018/ Loans to the power sector== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/rbi-capital-identified-by-jalan-panel-may-back-power-loans/articleshow/68713764.cms ‘RBI excess capital identified by panel may back power loans’, April 4, 2019: ''The Times of India''] | ||

| + | |||

| + | |||

| + | The Bimal Jalan committee has to submit its report on the appropriate level of reserves to be maintained by the RBI. According to a report by Bank of America Merrill Lynch, the panel will identify excess capital of $14 billion to $42 billion, which can be used to address stressed loans in power sector. | ||

| + | |||

| + | The Supreme Court quashed a circular from the RBI forcing banks to initiate insolvency proceedings against defaulting companies. This order has paved the way for restructuring of loans to the power sector. While this is a relief to both lenders and borrowers it does not address the issue. Lenders did not want to start insolvency proceedings as projects were under implementation and would not find takers. | ||

| + | |||

| + | According to BoAML, the finance ministry should be able to form a much-needed public sector asset reconstruction or asset management company that manages banks’ nonperforming assets (NPAs) in power with the Supreme Court ruling against the February 12 RBI circular, which had adopted a one-size-fits-all approach. This had also been proposed by RBI deputy governor Viral Acharya earlier. | ||

| + | |||

| + | “Our power analyst estimates that auctioning these power NPLs will need a haircut of 75%, that is $9 billion (Rs 63,000 crore) more. Banks can then transfer the $9 billion of cleaned-up power NPLs to the ARC/AMC. This can be done by either the government recapitalizing banks by an additional Rs 7,000 crore or it can deploy excess RBI economic capital set to be identified by the Jalan committee next week,” said Indranil Sen Gupta, India Economist with Bo-AML. | ||

| + | |||

| + | ==Priority sector more creditworthy than corporates/ 2016== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Loans-to-priority-sector-turn-out-more-creditworthy-04092017015049 Satyanarayan Iyer, Loans to priority sector turn out more creditworthy than corporates, September 4, 2017: The Times of India] | ||

| + | |||

| + | [[File: NPA reduction due to write-offs, 2011-17.jpg|NPA reduction due to write-offs, 2011-17; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Loans-to-priority-sector-turn-out-more-creditworthy-04092017015049 Satyanarayan Iyer, Loans to priority sector turn out more creditworthy than corporates, September 4, 2017: The Times of India]|frame|500px]] | ||

| + | |||

| + | Priority sector loans, long seen as a socialist burden on banks, have turned out to be more credit worthy than advances to large corporates. During April-December 2016, banks had written off loans worth Rs 35,587 crore to large industries as against write-offs of Rs 32,445 crore of advances in the priority sector. | ||

| + | |||

| + | Also, banks could recover only Rs 16,717 crore from large industries who are in default as against Rs 25,070 crore from the priority sector. | ||

| + | |||

| + | An RBI response to a Right to Information (RTI) filing shows that inability to make timely recoveries from large businesses is forcing banks to take a huge hit on their earnings. Banks had written off Rs 68,032 crore of bad loans in the first nine months of FY17 -close to 97% of total write-offs in the whole of FY16. Given that the fourth quarter writeoffs in FY17 had been significant, the total write-offs in the last three years have crossed Rs 2 lakh crore. | ||

| + | |||

| + | CARE Ratings chief economist Madan Sabnavis said, “After the asset quality review norms were put in place by the RBI, bad loans and provisioning have risen steeply . As banks started realising a part of these bad lo ans cannot be recovered, they also started writing off more to clean their balance sheets.“ He added the situation is a result of bad lending decisions and governance issues among banks, which was supported by the “system“. | ||

| + | |||

| + | In the first nine months of FY2017, scheduled commercial banks (SCBs) wrote off Rs 35,587 core worth of loans to large industries, compared to Rs 6,628 crore written off by lenders to farm loans, Rs 8,106 crore toward MSME loans and Rs 17,711 crore wrote off to the other priority sectors. | ||

| + | |||

| + | A loan write-off does not mean that the borrower goes scot free as all recovery proceedings continue. A balance sheet write-off indicates that even if the borrower does not repay , the bank has set aside own funds to repay depositors. Similarly , the farm loan waiver announcement by state governments is not included in `write-offs' by banks. “The loan is always there in the books. They are just moved from sub-standard to standard when the government waives and makes good the loan outstanding. Only that amount of the agriculture loan is written off which is not made good by the government,“ said a senior public sector banker in charge of priority sector banking. | ||

| + | |||

| + | ==2017: Bad loans at record Rs 9.53 lakh crore== | ||

| + | [https://timesofindia.indiatimes.com/business/international-business/exclusive-no-respite-for-indian-banks-as-bad-loans-hit-record-146-bln/articleshow/61030217.cms Bad loans hit record Rs 9.53 lakh crore, up 5.8% in last six months, Oct 11, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | '''HIGHLIGHTS''' | ||

| + | |||

| + | Unpublished data show that bad loans in banks have reached a record Rs 9.53 lakh crore by end-June | ||

| + | |||

| + | The stressed loans have risen 5.8 per cent in last six months | ||

| + | |||

| + | Stressed loans as a percentage of total loans reached 12.6 per cent at end-June, the highest level in at least 15 years | ||

| + | |||

| + | The bad loans of banks hit a record Rs 9.53 lakh crore at the end of June, unpublished data shows, suggesting Asia's third-largest economy is no nearer to bringing its bad debt problems under control. | ||

| + | |||

| + | A review of Reserve Bank of India (RBI) data obtained through Right To Information (RTI) applications show banks' total stressed loans - including non-performing and restructured or rolled over loans - rose 4.5 per cent in the six months to end-June. In the previous six months they had risen 5.8 per cent. | ||

| + | |||

| + | While banks remain the main source of funding for companies in India, the stubborn bad debt problem has eaten into bank profits and choked off new lending, especially to smaller firms, at a time when an economy that depends on them is stalling. | ||

| + | |||

| + | The GDP grew at its slowest pace in three years in April-June quarter - a concern for the government which faces elections in 2019 and has pledged to create millions of new jobs before then. | ||

| + | Banks are having to take higher provisions to account for more defaulters being pushed into bankruptcy and margins are likely to be squeezed further by proposed new rules to encourage commercial banks to pass on central bank interest rate cuts. | ||

| + | |||

| + | To be sure, the bulk of India's bad loans are in the state banks and stem from lending to large conglomerates, especially in steel and infrastructure. But analysts say the rise in bad loans among small firms, and even retail borrowing, is worrying and will do little to encourage new loans to help fuel growth. | ||

| + | |||

| + | "On the corporate side, we think it's a recognition cycle which is nearing an end," said Alka Anbarasu, senior analyst at Moody's Investor Service, referring to more bad loans being recognised as such, as banks come under pressure from the RBI and other regulators. "But it's really those data points beyond corporate that are causing some worry." | ||

| + | |||

| + | Anbarasu forecast weak quarters ahead for banks before profitability picks up, and several senior bankers from public sector lenders - which account for more than two-thirds of Indian banking assets - agreed the months ahead would be strained. | ||

| + | |||

| + | Stressed loans as a percentage of total loans reached 12.6 per cent at end-June, according to the RBI data, the highest level in at least 15 years. | ||

| + | |||

| + | '''Higher provisions, weaker loans''' | ||

| + | |||

| + | Part of the issue for banks and the government is a strict provisioning regime: the RBI wants banks to provide for at least 50 per cent of the secured loans to companies taken to bankruptcy proceedings, and 100 per cent for the unsecured part. | ||

| + | |||

| + | A dozen of the biggest such cases account for nearly Rs 1.78 lakh crore, or a quarter of total non-performing assets. | ||

| + | |||

| + | For those companies, banks will need to provide Rs 18,000 crore on top of existing provisions, according to July estimates from India Ratings and Research, the local affiliate of Fitch Ratings. | ||

| + | More than 20 other sizeable companies are at risk of being taken to bankruptcy court. | ||

| + | |||

| + | Bankers say these and other pressures - including rising government bond yields that forced banks to post mark-to-market losses - have added to the squeeze, and hit new loans. | ||

| + | |||

| + | According to RBI data, new loans grew at just about 5 percent in the year to March, the lowest growth rate in more than six decades. Several banks have already cut back their loan books to conserve capital. | ||

| + | |||

| + | "What are they (RBI) thinking while they're taking these steps all at the same time?" said a treasurer at a state-run bank, who didn't want to be named due to the sensitivity of the issue. "Do they want banks to wind up their businesses, or do they want to save the banks?" | ||

| + | |||

| + | Treasury income accounted for 22.7 per cent of banks' operating profits in the last financial year, doubling its share from a year earlier, India Ratings estimates. | ||

| + | |||

| + | "The almost zero treasury income will hit provisioning ability and, in turn, make it more difficult for weaker banks to give loans as capital becomes more scarce," said Soumyajit Niyogi, an associate director at the rating agency. | ||

| + | |||

| + | A senior policymaker, who requested anonymity as the discussions are not public, said the government would have to help to sufficiently capitalise the banks. | ||

| + | |||

| + | Fitch Ratings estimates Indian banks will need Rs 4.24 lakh crore of additional capital by March 2019 to meet Basel III global banking rules. Moody's expects the top 11 state lenders alone will need nearly Rs 98,000 crore. The government has just Rs 19,500 crore left in its budget for bank recapitalisation. | ||

| + | |||

| + | "We think capitalisation is the biggest challenge for the banks at the moment, given that earnings will remain subdued and will not support any capital generation," said Moody's Anbarasu. | ||

| + | |||

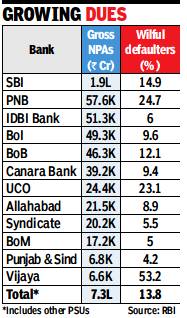

| + | ==2017-18: Wilful defaulters form 14% of PSB bad loans== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F01%2F08&entity=Ar01911&sk=69B35F59&mode=text Mayur Shetty, Wilful defaulters form 14% of PSB bad loans, January 8, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: Gross Non-Performing Assets and wilful defaulters, as in January 2018.jpg|Gross Non-Performing Assets and wilful defaulters, as in January 2018 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F01%2F08&entity=Ar01911&sk=69B35F59&mode=text Mayur Shetty, Wilful defaulters form 14% of PSB bad loans, January 8, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''With 53%, Vijaya Bank On Top Of RBI List'' | ||

| + | |||

| + | Around 14% of the bad loans in public sector banks (PSBs) are due to wilful defaulters. The total gross non-performing assets (NPAs) of 21 PSBs stood at Rs 7.33 lakh crore as on September 30, 2017. Of this, Rs 1.01 lakh crore of loans were termed as those in wilful default. | ||

| + | |||

| + | Wilful defaults have an element of malfeasance as it broadly means that the borrower has reneged on the agreement on usage of funds or has not paid despite having resources. | ||

| + | |||

| + | Recovery from such accounts are difficult because in many cases the money is siphoned off from the books of the defaulting company and most of them are being fought in courts. Some of the largest cases of wilful default are Kingfisher Airlines, Zoom Developers, Winsome Diamonds and Varun Industries. | ||

| + | |||

| + | Of the 9,025 cases of wilful defaults in PSU banks, lenders have filed cases against 8,423 for recovery of Rs 95,384 crore of NPAs. They have also filed 1,968 police complaints in cases of loan amounts totalling 31,807 crore. In 6,937 accounts, representing an outstanding of Rs 87,458 crore, banks have also initiated proceedings to attach and sell assets under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act. | ||

| + | |||

| + | Data released by the RBI in response to a Parliament query shows that Vijaya Bank has the highest share of wilful defaulters in its books. The Bengaluru-based banks had NPAs worth Rs 6,649 crore as on September 30, 2017. Of this loans amounting to Rs 3,537 crore were on account of wilful defaults. Punjab National Bank has the highest share of wilful defaults in its books among the larger banks. Of its bad loans worth Rs 57,630 crore, 25% are on account of borrowers who have deliberately defaulted. | ||

| + | |||

| + | The implication for a business or promoter being declared a wilful defaulter is that they will never be able to get bank loans as long as they have the tag. For a lender, declaring a borrower as a wilful defaulter is a complicated process with senior bankers having to give a hearing to the borrower. In several cases, courts have ruled against the labelling of the borrower due to shortcomings in the process. | ||

| + | |||

| + | Among banks with small percentage of wilful defaulters among NPA accounts are Punjab & Sind Bank (4%), Bank of Maharashtra (5%) and Syndicate Bank (5.4%). | ||

| + | |||

| + | As on September 30, 2017, leading corporate houses accounted for approximately 77% of the total gross NPA from domestic operations for banks in India. | ||

| + | |||

| + | ==2017-18/ Bad loan write-offs by PSBs surge 140% over their losses== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/bad-loan-write-offs-by-psbs-surge-140-over-their-losses-in-2017-18/articleshow/64602195.cms June 15, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | '''HIGHLIGHTS''' | ||

| + | |||

| + | This is a double whammy for the struggling PSBs as they had massive write-offs as well as huge losses in the last financial year | ||

| + | |||

| + | Till 2016-17, 21 state-owned banks made combined profit while in 2017-18, they posted a staggering loss of Rs 85,370 crore, as per the data | ||

| + | |||

| + | |||

| + | Public sector banks have written off bad loans worth a whopping Rs 1.20 lakh crore, an amount that is nearly one-and-a-half times more than their total losses posted in 2017-18, according to official data. | ||

| + | |||

| + | This is a double whammy for the struggling PSBs as they had massive write-offs as well as huge losses in the last financial year. This is for the first time in a decade that banks have made huge write-offs of bad loans along with booking of hefty losses. Till 2016-17, 21 state-owned banks made combined profit while in 2017-18, they posted a staggering loss of Rs 85,370 crore, as per the data. | ||

| + | |||

| + | During 2016-17, PSU banks wrote off non-performing assets (NPAs) worth Rs 81,683 crore as against combined net profit of Rs 473.72 crore. | ||

| + | |||

| + | SBI alone has written off bad loans of Rs 40,196 crore, nearly 25 per cent of the total write-offs during 2017-18. This was followed by Canara Bank (Rs 8,310 crore), Punjab National Bank (Rs 7,407 crore) and Bank of Baroda (Rs 4,948 crore). | ||

| + | |||

| + | As per the data provided by rating agency Icra, Indian Overseas Bank has written of NPAs worth Rs 10,307 crore, followed by Bank of India (Rs 9,093 crore), IDBI Bank (Rs 6,632 crore) and Allahabad Bank (Rs 3,648 crore). These banks along with 7 others come under Prompt Corrective Action framework of RBI. | ||

| + | |||

| + | As per the government data, banks' write-offs stood at Rs 34,409 crore in 2013-14. The figure has jumped nearly four-fold in five years. In 2014-15, the banks wrote off Rs 49,018 crore ; Rs 57,585 crore in 2015-16, Rs 81,683 crore in 2016-17 and hitting a record high of Rs 1.20 lakh crore (provisional) in 2017-18. | ||

| + | |||

| + | Write-off in banking parlance means that the bank has made 100 per cent provision from its earning against that account. Following this, NPA is no longer part of its balance sheet. | ||

| + | |||

| + | However, a write-off puts pressure on balance sheet of banks as it erodes operating profit. | ||

| + | |||

| + | Indian banking sector is grappling with mounting NPAs and host of scams and frauds. NPA in the banking sector stood at Rs 8.31 lakh crore as of December 2017. | ||

| + | |||

| + | Weak financials due to mounting bad loans have already pushed 11 banks, out of 21 , under the Prompt Corrective Action (PCA) framework of RBI. | ||

| + | |||

| + | The recent tight prudential norms released by RBI on February 12 have added to the NPA woes. | ||

| + | |||

| + | Interim Finance Minister Piyush Goyal has announced setting up of a committee to give recommendations in two weeks on formation of an Asset Reconstruction Company (ARC) for faster resolution of stressed accounts. | ||

| + | |||

| + | The committee under Sunil Mehta, non-executive chairman of PNB, will make recommendations for the same. | ||

| + | |||

| + | The finance minister said the committee will consider whether such an arrangement will be good for the banking system and, if any such suggestion is advisable, it will also consider the modalities by which such an ARC should be set up. | ||

| + | |||

| + | ==How ‘haircuts’ help in dealing with bad loans== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F09&entity=Ar01200&sk=F6E1546C&mode=text July 9, 2018: ''The Times of India''] | ||

| + | |||

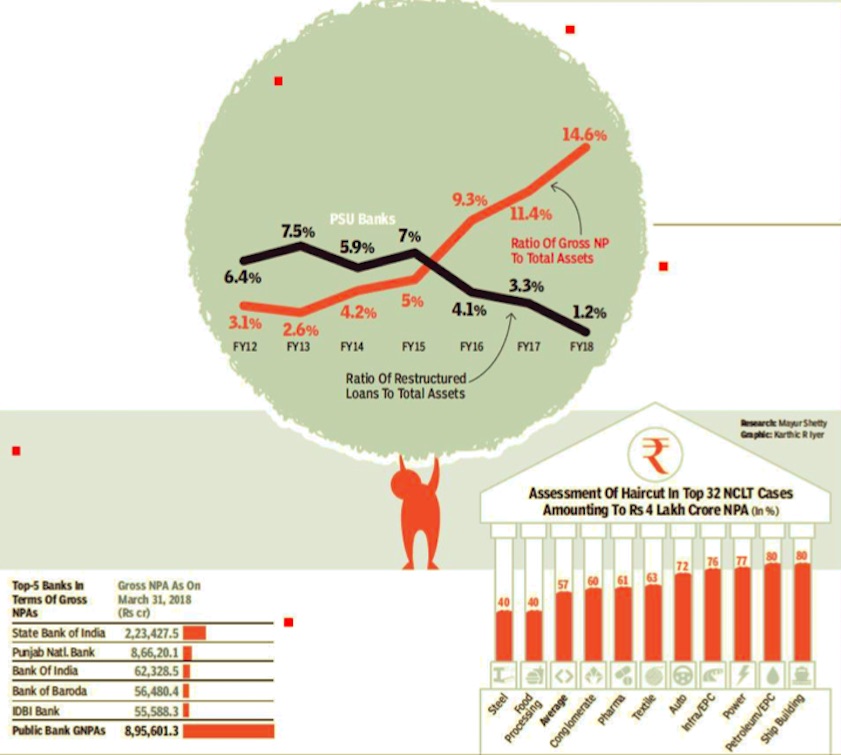

| + | [[File: The banks with the highest NPAs, 2017-18; 2012-18- The ratio of restructured loans to total assets; and; 2012-18- The ratio of gross.jpg|The banks with the highest NPAs, 2017-18; 2012-18- The ratio of restructured loans to total assets; and; 2012-18- The ratio of gross <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F09&entity=Ar01200&sk=F6E1546C&mode=text July 9, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | As the government looks to reel in the likes of Nirav Modi and Vijay Mallya, who have sought shelter on foreign shores after leaving behind huge outstanding loans in India, a panel has come up with recommendations to help state-run banks achieve faster resolution of their non-performing assets. A look at these bad loans and how deep the problem is... | ||

| + | |||

| + | |||

| + | '''How are haircuts a solution to the NPA crisis?''' | ||

| + | |||

| + | One reason private and foreign banks have a lower level of NPAs is they have the flexibility to cut their losses by selling off assets in a bad loan for whatever it is worth. In the case of public sector banks, selling a loan or a company for less than the outstanding loan was not feasible as it would trigger action by Central Vigilance Commission, Central Bureau of Investigation and Comptroller and Auditor General. It is only now that the bankruptcy code provides a framework for selling assets at a discount to the loan amount (taking a haircut). | ||

| + | |||

| + | '''What caused this pile-up?''' | ||

| + | |||

| + | Post global financial crisis, RBI and the gover nment relaxed lending nor ms to stimulate the economy and allowed banks to lend more to projects as part of a countercyclical measure. The government also allowed banks to ‘restructure’ project loans that were going into default by giving borrowers more time and more money. Loans of these troubled borrowers were classified as ‘restructured’ and not NPAs. | ||

| + | |||

| + | '''How much money would banks lose if they took haircuts on NPAs?''' | ||

| + | |||

| + | Losses reported by banks so far include the part-provisions made on existing NPAs. According to CLSA, the top-32 NPAs facing action under the bankruptcy code account for Rs 4 lakh crore or 45% of total NPAs. CLSA estimates the haircut on these loans are less than 60%. Banks must make provisions for at least half the loan amount in case of bankruptcy. | ||

| + | |||

| + | '''What is the NPA crisis?''' | ||

| + | |||

| + | NPAs or non-performing assets are loans for which borrowers are unable to meet repayment obligations. Ideally, these should be within 2% of total assets (loans) for banks. Bad loans beyond this level are difficult to manage as banks work with narrow margins and the interest spread they earn is not enough to make up for the losses from defaults. For public sector banks it has reached crisis level with gross NPAs at 14.6% — almost three times the level of 4.9% for private banks. | ||

| + | |||

| + | '''Why did NPAs blow out in FY18?''' | ||

| + | |||

| + | In 2017, the new insolvency law came into effect. It provided a resolution mechanism for bad loans, enabling companies to be sold. Earlier under Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002, lenders could sell assets but not businesses as a whole. With a mechanism in place, RBI removed restructuring schemes, asking banks to come clean on bad loans. As a result, provisions rose to Rs 3.2 lakh crore in FY18 from Rs 2 lakh crore in FY17, surpassing operating profits of banks. | ||

| + | |||

| + | '''What are the haircuts that are talked about?''' | ||

| + | |||

| + | Under the Bankruptcy Code, borrowers unable to repay their dues face insolvency proceedings in the National Company Law Tribunal. Under the insolvency process, a resolution professional is appointed to invite bids for the bankrupt business. The difference between the best bid and the borrower’s total outstanding dues is the haircut. | ||

| + | |||

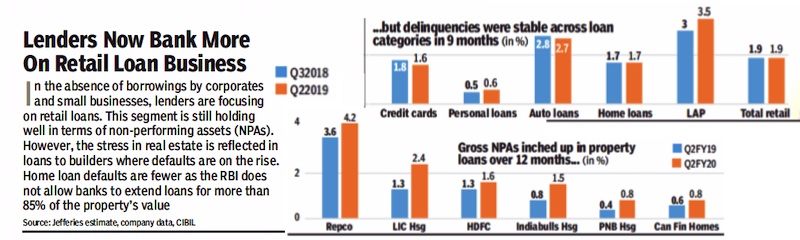

| + | ==NPAs in 2018-19== | ||

| + | [[File: 2018-19, NPAs grew in the housing sector, but remained stable in other sectors..jpg|2018-19: NPAs grew in the housing sector, but remained stable in other sectors. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F12%2F03&entity=Ar02102&sk=D090F356&mode=image Dec 3, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' 2018-19: NPAs grew in the housing sector, but remained stable in other sectors. '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

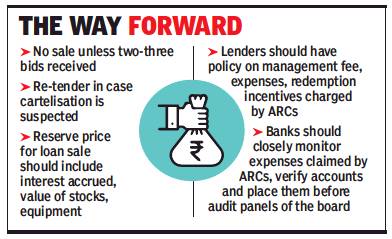

| + | ==CVC finds many flaws in sale of bad debt/ 2019== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F18&entity=Ar01705&sk=87B6E5D1&mode=text Sidhartha, March 18, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: The Central Vigilance Commission (CVC) has pointed to several irregularities in transactions involving non-performing loan accounts. Some guidelines which should be followed are mentioned above.jpg|The Central Vigilance Commission (CVC) has pointed to several irregularities in transactions involving non-performing loan accounts. Some guidelines which should be followed are mentioned above <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F18&entity=Ar01705&sk=87B6E5D1&mode=text Sidhartha, March 18, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | ''Review Points To Several Lapses In Deals, Govt Orders Scrutiny'' | ||

| + | |||

| + | In high season for sale of bad loans to asset reconstruction companies (ARCs), the Central Vigilance Commission (CVC) has pointed to several irregularities in transactions involving non-performing loan accounts, prompting the government to initiate action against errant executives. | ||

| + | |||

| + | “Instances have come to the notice of the commission, wherein prudence has not been observed, while taking decision on sale of stressed asset to ARCs. Irregularities have been noticed in estimating the value of underlying securities (which) is much higher that the value at which the assets were sold to ARCs, post-sale realisation from assets, management fees and expenses charged by ARCs, etc,” the CVC said after an analysis of 302 cases of over Rs 50 crore from 2014-15 to 2017-18. | ||

| + | |||

| + | In at least 48 cases, assets were sold to ARCs below the realisable value of securities that the borrower had given as security at the time of availing of the loan. In several cases, banks were found to be fixing the reserve price without factoring in the accrued interest, resulting in banks having to take a deeper haircut, the CVC said in its report to the government. It also said that in case of companies that are sold as a “going concern”, the primary value of stocks and equipment were not factored in, while fixing the reserve price. | ||

| + | |||

| + | Similarly, in 55 cases, assets were sold within a year of the date of the account turning into a non-performing asset (NPA), without banks initiating recovery action under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act. | ||

| + | |||

| + | In all, 22 irregularities and gaps in regulations have been pointed out by the vigilance body, prompting the government to swing into action. | ||

| + | |||

| + | The department of financial services has written to all staterun banks, asking them to analyse all accounts of over Rs 50 crore and initiate action after examining accountability of executives and lodge complaints with law enforcement agencies. | ||

| + | |||

| + | While bankers acknowledged that there may be instances of improper transactions, they said the latest advisory is prompting many lenders to go slow on asset sales — which typically peak at the year-end. Some of the bankers said this may result in several loans, which would have been sold, remaining on their balance sheets. | ||

| + | |||

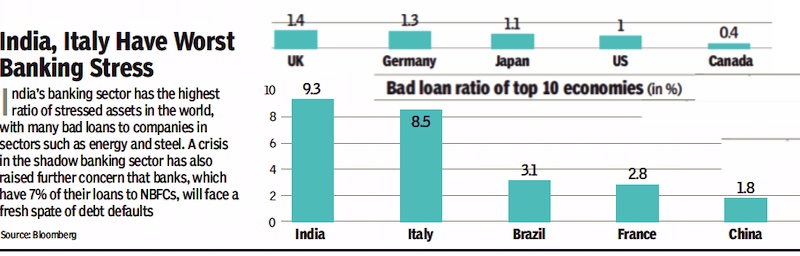

| + | ==2019: Stressed assets in India, major economies== | ||

| + | [[File: 2019, Bad loan ratio in India, Brazil, Canada, China, Germany, Italy, Japan, the UK and the USA.jpg|2019: Bad loan ratio in India, Brazil, Canada, China, Germany, Italy, Japan, the UK and the USA. <br/> From: [https://epaper.timesgroup.com/olive/apa/timesofindia/SharedView.Article.aspx?href=TOIDEL%2F2019%2F12%2F09&id=Ar01910&sk=E14ABA42&viewMode=image Dec 8, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''2019: Bad loan ratio in India, Brazil, Canada, China, Germany, Italy, Japan, the UK and the USA. '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|B | ||

| + | BANKING, INDIA: LOANS]] | ||

| + | [[Category:India|B | ||

| + | BANKING, INDIA: LOANS]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: LOANS]] | ||

Revision as of 19:11, 15 August 2021

This is a collection of articles archived for the excellence of their content. |

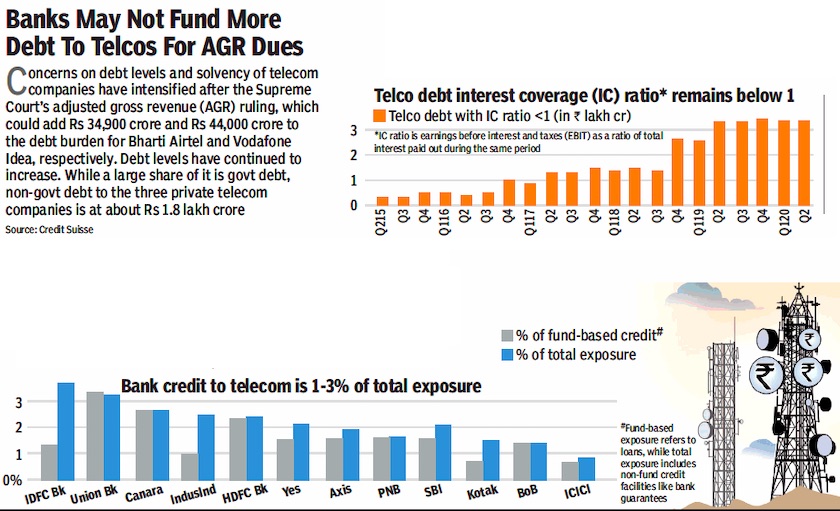

Credit, sector-wise

Telecommunication sector

2015-20, Bank-wise

From: Dec 12, 2019: The Times of India

See graphic:

Bank credit to the telecommunication sector, 2015-20, bank-wise

Loans

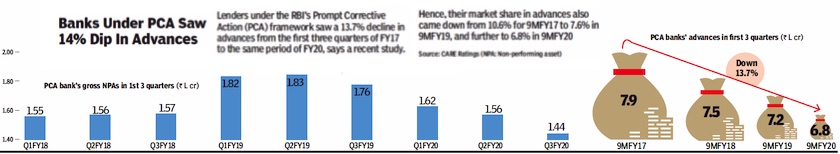

Prompt Corrective Action (PCA)

Impact on advances: 2017-20

From: April 14, 2020: The Times of India

See graphic:

The Impact of Prompt Corrective Action on advances: 2017-20

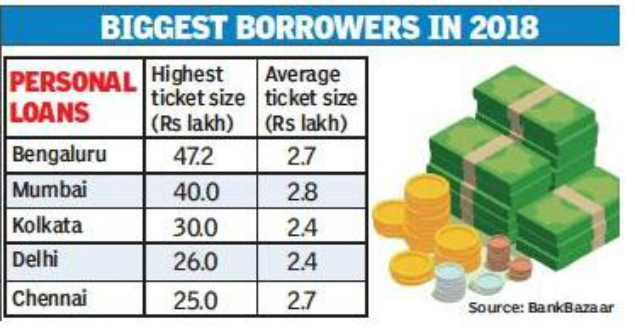

The top borrowers

Cities, 2018

Rachel Chitra, Bengalureans take most personal, car loans, January 23, 2019: The Times of India

From: Rachel Chitra, Bengalureans take most personal, car loans, January 23, 2019: The Times of India

The highest personal loan ticket sizes are in Bengaluru, at Rs 47 lakh, followed by Mumbai (Rs 40 lakh), Delhi (Rs 26 lakh) and Kolkata (Rs 30 lakh), as per data from 1.6 million loan applications in 2018 with BankBazaar, one of India’s biggest online financial services aggregators.

In the average ticket size of personal loans taken, Mumbai (Rs 2.79 lakh) was ahead of Bengaluru (Rs 2.66 lakh) and Chennai, Delhi and Kolkata.

BankBazaar CEO Adhil Shetty said the high number of large loans in Bengaluru is, perhaps, a reflection of larger disposable income and high growth opportunities. He said the city has more first-time salaried borrowers than other metros.

The data is of those who use the online mode. It’s possible that in some of the other cities, a higher proportion of people choose offline modes.

In car loans too, the top segment of Bengalureans takes higher loans than their counterparts elsewhere, suggesting they go for more flashy cars. The highest loan ticket sizes came from Bengaluru, at Rs 49.9 lakh, followed by Chennai at Rs 46.8 lakh, and Delhi at Rs 21.8 lakh.

Highest car purchase by women borrower in 2018 was at Rs 12.9L

Compared to their urban counterparts, borrowers from tier-2 and tier-3 cities restrict themselves to not spending above Rs 20 lakh for a car. Even when it came to average car loan size, rural and semi-urban borrowers were more conservative and borrowed only up to Rs 5.2 lakh, compared to their urban counterparts, who were willing to shell out Rs 5.7 lakh.

The highest car purchase by a woman borrower in 2018 was at Rs 12.9 lakh. In personal loans, Bankbazaar data shows the average ticket size in metros was at Rs 2.6 lakh, lower when compared to Rs 2.8 lakh in non-metros.

“It’s possible urban users have more choices such as credit card, and EMI options for consumer purchases on debit cards, and may not choose a personal loan as their first option,” said Shetty.

In home loans, Delhiites took the highest ticket sizes (Rs 5 crore), followed by Chennai (Rs 2.2 crore), Bengaluru (Rs 1.5 crore) and Mumbai (Rs 1.8 crore).

But this trend could only be an indicator of the buying pattern of younger, tech-savvy individuals. An SBI official said, “We get biggest home loan and car loan requests from Mumbai. It’s possible Mumbaikars prefer directly contacting their banker than going through a third-party aggregator.”

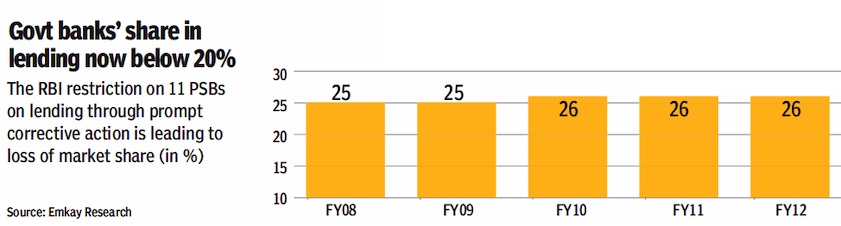

The top lenders

2008-18

From: October 13, 2018: The Times of India

From: October 13, 2018: The Times of India

See graphics:

2008-12: PSB banks’ share in lending

2013-18: PSB banks’ share in lending

2017

SBI, ICICI Bank Are The First Two Lenders

The RBI added HDFC Bank to the list of systemically important banks, or banks that are considered too big to fail.The other banks on the list are the two largest lenders -SBI and ICICI Bank. Since 2015, the central bank has been identifying banks whose failure would impact the whole financial system.These banks are subject to more rigorous regulation and capital requirement.(The Times of India Sept 2017)

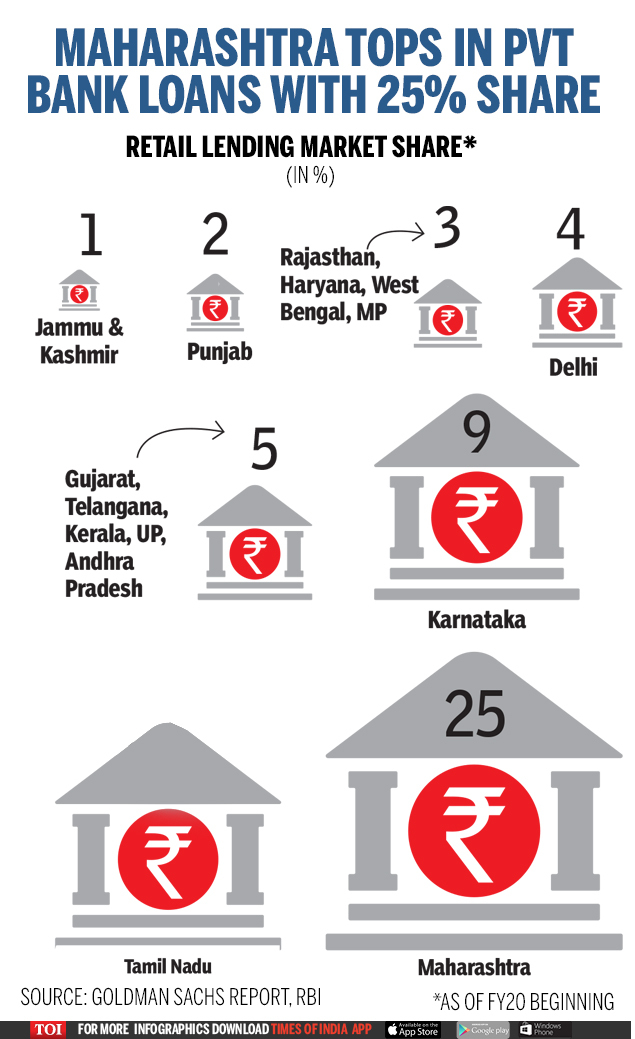

States, 2019

April 29, 2019: The Times of India

From: April 29, 2019: The Times of India

Private lenders gain market share

Private lenders have expanded their retail lending market share by 10 percentage points across top states in four years. The 15 states listed here account for nearly 90% of the loans. Private banks also disbursed 40% of all advances in FY19 as against 30% in FY15. Nearly 75% of the incremental gains have come from western and southern states.

Loans to gems & jewellery cos

From: Sidhartha, February 19, 2018: The Times of India

See graphic:

Outstanding bank loans to gems and jewellery, 2014-17

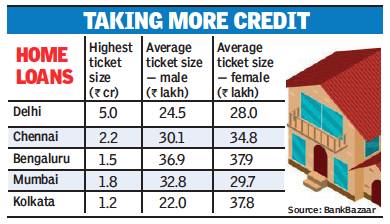

Gender-wise size of loans, 2018

Rachel Chitra, Loan sizes higher when women borrow, January 23, 2019: The Times of India

From: Rachel Chitra, Loan sizes higher when women borrow, January 23, 2019: The Times of India

The average ticket size of a home loan when women borrow is significantly higher (Rs 27 lakh) than when a man borrows (just under Rs 23 lakh), according to data from 1.6 million loan applications in 2018 on BankBazaar, one of India’s biggest online financial services aggregators.

BankBazaar CEO Adhil Shetty said the higher loan amount when a woman applies could indicate it’s a household with two incomes, unlike when a male applies, where he could be the only breadwinner. Banks also have special loan offers for women, with interest rates many basis points (100bps = 1 percentage point) lower than for men.

When it came to car-buying patterns, the data shows that when a woman is the primary loan applicant, they tend to steer away from big-ticket car purchases. Male borrowers borrowed up to Rs 49.9 lakh for a car, whereas the highest female car loan ticket size was Rs 12.9 lakh.

But in terms of the average car loan size taken by women, it’s significantly higher (Rs 5.5 lakh) than when men are the sole applicants (Rs 5.3 lakh). “Again, I think when women apply, they are an indicator of a double-income household,” said Shetty.

This trend of women boosting the household’s purchasing capacity could be seen across metros. The average ticket size of home loans in Delhi for women borrowers was Rs 28 lakh, compared to male borrowers at Rs 24.5 lakh. In Bengaluru, women borrowed Rs 37.9 lakh — higher than men at Rs 36.9 lakh, and in Chennai women borrowed Rs 34.8 lakh compared to men at Rs 30.1 lakh. However, the situation was the opposite in Mumbai, where men borrowed more in home loans at an average of Rs 32.8 lakh compared to women at Rs 29.7 lakh.

For personal loans, women seem to borrow less than men. The average ticket size for female applicants was Rs 2.7 lakh, compared to men who borrowed Rs 2.8 lakh.

Women seem to now have the firepower for globe-trotting just as much as men — women’s applications for travel credit cards grew 73%, slightly higher than male applications that increased 71.5%. In lifestyle credit cards too, applications from women grew at a 10.5% rate, compared to men at 8%.

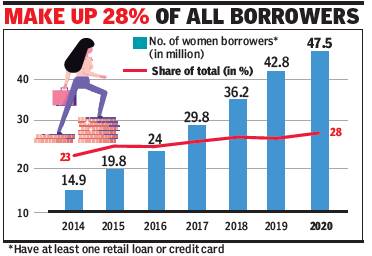

Women borrowers

2014-20

March 9, 2021: The Times of India

From: March 9, 2021: The Times of India

Credit-wary women up home loan share…

Reduce Personal Loans, Plastic Money’s Use, Have Higher Credit Score Than Men: Study

Mumbai:

Women have sharply increased their share of home loans, but have turned averse to personal loans and credit cards in the wake of the pandemic. Women are also more closely monitoring their credit scores, according to a study by TransUnion Cibil.

A report released by the credit bureau on Women’s Day shows that in 2019, women accounted for 23% of consumer loans. This dipped by 400 basis points (100bps = 1 percentage point) to 19% in 2020. Similarly, credit card enquiries by women dipped from 13% to 12% during the same period. However, when it comes to home loans, women have increased their share to 11% from 9% in 2019. According to TU Cibil chief operating officer Harshala Chandorkar, this is because of factors like reduced stamp duty for women consumers on a home purchase in some states along with lenders offering better terms & conditions and a lower rate of interest for women borrowers. “Also, the fact that women have a higher average Cibil score than that of men indicates that women have a better credit history and therefore lesser probability of default, which makes them better customers for banks and credit institutions. Improved and easier access to economic opportunities have catalysed the financial inclusion of women in India,” she added.

TU Cibil VP and head (DTC interactive) Sujata Ahlawat said, “With improved levels of education and employment of women across our country, their credit consciousness has also grown. This is corroborated by the fact that we have seen a significant surge in the number of women borrowers who monitor their Cibil score and report. This is a promising indicator of increased awareness and financial literacy among women.” This increased credit consciousness is also evident from data that shows women now constitute 12% of self-monitoring consumers — an increase from10% in 2018.

Women consumers also show better credit history as compared to men, with the average Cibil score of an Indian woman consumer being 719 — higher than that of an average male consumer at 709. Additionally, 61% of the women consumers in TU Cibil’s consumer credit bureau have a score greater than 720, whereas only 56% of male consumers have greater than or equal to that figure. “Increased credit consciousness leads to a positive credit behaviour as consumers understand the impact of their credit activity on their Cibil score and access to finance,” said Ahlawat.

As women turn credit conscious, their overall share in retail loans is increasing too with 4.7 crore active women borrowers. Over the last six years, the share of women borrowers grew to around 28% in September 2020 — up from around 23% in September 2014, which is a compounded annual growth rate (CAGR) of around 16%. In terms of the sanctioned loan amount, women borrowers account for Rs 15.1 lakh crore of retail loans, which has grown at a 12% CAGR over the last six years.

Loans: Bad loans

5 business houses alone owe PSU banks Rs. 1.4 lakh crore

The Times of India, May 06 2016

Adani Group Has Debt Of Rs. 72,000 Crore'

Raising the issue of corporate loans in Rajya Sabha, JD(U) member Pavan Verma said the Adani group had a debt of Rs 72,000 crore -an amount equal to the total debt of farmers in the country. Verma said corporate houses owed about Rs 5 lakh crore to PSU banks and particularly referred to the Adani group, alleging that the company got “unimaginable“ favours. Raising the issue during zero hour, he contended that PSU banks were influenced to give loans to people who were not able to repay them.

“PSU banks are owed abo ut Rs 5 lakh crore by corporate houses and of this, roughly Rs 1.4 lakh crore are owed by just five companies, which include Lanco, GVK, Suzlon Energy , Hindustan Construction Company and a certain company called the Adani group and Adani Power,“ he said.

“I want a reply from the government, are they aware of this or are they not. And if they are aware, what are they doing in this matter. One company owes as much as all the farmers of India,“ he further said.

The amount owed by this group both in terms of its long-term and short-term debt was around Rs 72,000 crore, Verma said, claiming to be quoting from reports. He added that on Wednesday , it was mentioned that the entire amount owed by farmers as crop loans was Rs 72,000 crore.

“I don't know what is the relationship of this government with this business house. I don't even know if they know them, but the owner of this group (Gautam) Adani is seen everywhere the prime minister has gone, every country , China, the UK, the US, Europe, Japan,“ Verma said.

“This company has been given favours which are unimaginable. In Gujarat, their SEZ was approved in spite of the high court's strictures,“ he added.

When deputy chairman P J Kurien warned Verma against making allegations, the JD(U) member said, “I am giving you factual account. It is a high court judgment. It was left to the state government.The UPA government had not approved it and when this government came to power, it was approved.“

Verma said it did not matter if Adani group had the ability to pay this amount, but in the last 2-3 years, the company's net worth had gone up by 85%.

25% of Rs 8 lakh crore bad debt is from just 12 accounts

HIGHLIGHTS

Just 12 accounts responsible for 25% of all NPAs with banks

Lenders will be asked to initiate insolvency proceedings to recover the dues

The RBI today identified 12 accounts each having more than Rs 5,000 crore of outstanding loans and accounting for 25 per cent of total NPAs of banks for immediate referral for resolution under the bankruptcy law.

Without naming the defaulters, the Reserve Bank said the lenders will be asked to initiate insolvency proceedings to recover the dues. The banking sector is saddled with non-performing assets (NPAs) worth over Rs 8 lakh crore, of which Rs 6 lakh crore is with public sector banks (PSBs). The Internal Advisory Committee (IAC), the central bank said, has arrived at an objective, non-discretionary criterion for referring accounts for resolution under the Insolvency and Bankruptcy Code (IBC).

"In particular, the IAC recommended for IBC reference of all accounts with fund and non-fund based outstanding amount greater than Rs 5,000 crore, with 60 per cent or more classified as non-performing by banks as of March 31, 2016," the RBI said in a statement. The IAC noted that under the recommended criterion, 12 accounts with about 25 per cent of the current gross NPAs of the banking system would qualify for immediate reference under IBC, it said.

The apex bank, based on the recommendations of the IAC, will accordingly be issuing directions to banks to file for insolvency proceedings under the IBC in the identified accounts.

Such cases will be accorded priority by the National Company Law Tribunal (NCLT).

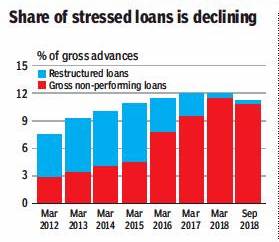

2012-18

From: May 22, 2019: The Times of India

See graphic:

Share of stressed loans, 2012-18

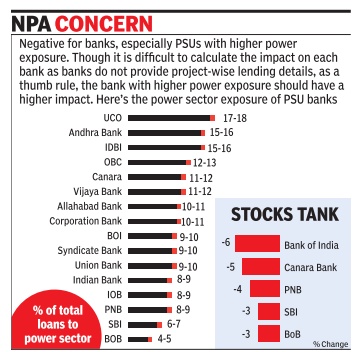

2014: loans to coal sector…

… and scrapping of coal block allotments

Power sector bad loans may rise

Mumbai:

TIMES NEWS NETWORK

The Times of India Sep 25 2014

The Supreme Court verdict scrapping all but four coal block allotments has added to the bad loan headache of the banking industry .

Although bank exposure to coal mining sector is estimated to be below Rs 20,000 crore, the biggest fear is that coalfuelled power plants may stop producing power and default on loans. Bank exposure to power companies is around Rs 5.16 lakh crore and accounts for 9% of their loans. A large chunk of these depend on coal.

Shares of leading public sector banks dipped sharply on Monday over fears that their bad loans would rise following the Supreme Court order.

Bank of India and Canara Bank, which have large exposures to the power segment (relative to their loan book) fell 5.6% and 5%, respectively , to Rs 263 and Rs 358. Punjab National Bank, which is estimated to have the largest exposure to coal mining, fell 4.3% to Rs 927. The State Bank of India, one of the largest lenders to power in absolute terms, saw its share price fall 2.7% to Rs 2,487. Even without the coal block cancellation, several power projects and steel companies are under stress and are undergoing restructuring. Stoppage of fuel to these projects could tip them into the non-performing assets category , considering that imported coal is four times as expensive as domestic coal. Reacting to the SC order, SBI chairman Arundhati Bhattacharya said, “We believe that uncertainty is possibly the worst enemy of growth. We are glad that this is over with the SC verdict on coal blocks allocation. We now look forward for a quick plan of action for ensuring that coal supplies are not disrupted and, thereafter, a swift and transparent bidding process for reallocation.“

According to IDBI Bank chairman MS Raghavan, the bank has an exposure of close to Rs 2,000 core to the companies affected by the Supreme Court order. The bank is still assessing the impact of the verdict.

In the private sector, ICICI Bank has loans to power and steel companies that are dependent on coal supply . Earlier in an interview to TOI, Chanda Kochhar, MD & CEO of ICICI Bank, had said it was important to ensure that back-end projects that depend on coal keep producing. “The government has been talking about finding ways of reallocating coal. As long as coal is produced and power and steel plants get it, that ensures the viability of the power project; where it is allocated, who owns it and who mines it is not the primary thing. Banks had mainly extended assistance to either power or iron and steel projects,“ Kochhar had said. While deciding to cancel all but four coal blocks allotted since 1993, The Supreme Court brushed aside Coal Producers Association's (CPA) estimate that Rs 9 lakh crore linked to them would come to naught.

The CPA, through senior advocate K K Venugopal, had said that loans worth Rs 2.5 lakh advanced by banks and financial institutions would become non-performing assets. It had said that SBI has an exposure of up to Rs 78,263 crore.

Venugopal had said that apart from huge losses to other PSU banks like PNB and Union Bank, public sector entities like Rural Electricity Corporation and PFC would experi ence an even higher exposure than banks. The financial implication narrated by CPA covered many other aspects.“Huge investments up to about Rs 2.9 lakh crore have been made in 157 coal blocks as on December 2012, investments in the end-use plants have been made to the extent of about Rs 4 lakh crore, which employ 10 lakh people,“ CPA had said.

The CPA had warned of many other adverse effects -the country's dependence on coal as a primary source of fuel for up to 60% for power generation might result in inflationary trends; 28,000 mw of power capacity would be affected due to de-allocation; closure of coal mines would result in an estimated loss of Rs 4.4 lakh crore in terms of loss of royalty , cess, direct and indirect taxes; coal imports would go up even more in financial year 2016-17 to the extent of Rs 1.4 lakh crore.

A bench of Chief Justice R MLodha and Justices Madan B Lokur and Kurian Joseph cited arguments of attorney general Mukul Rohatgi to counter adverse economic fallout predicted by CPA. “It was submitted by the AG that all aspects, including the economic implications or fallout of the cancellation of coal block allotments and the possible adverse impact that it may have on other socio-economic factors, have been taken into consideration and it is only after that the affidavit has been filed by the Union of India,“ the bench said.

2018/ Loans to the power sector

‘RBI excess capital identified by panel may back power loans’, April 4, 2019: The Times of India

The Bimal Jalan committee has to submit its report on the appropriate level of reserves to be maintained by the RBI. According to a report by Bank of America Merrill Lynch, the panel will identify excess capital of $14 billion to $42 billion, which can be used to address stressed loans in power sector.

The Supreme Court quashed a circular from the RBI forcing banks to initiate insolvency proceedings against defaulting companies. This order has paved the way for restructuring of loans to the power sector. While this is a relief to both lenders and borrowers it does not address the issue. Lenders did not want to start insolvency proceedings as projects were under implementation and would not find takers.

According to BoAML, the finance ministry should be able to form a much-needed public sector asset reconstruction or asset management company that manages banks’ nonperforming assets (NPAs) in power with the Supreme Court ruling against the February 12 RBI circular, which had adopted a one-size-fits-all approach. This had also been proposed by RBI deputy governor Viral Acharya earlier.

“Our power analyst estimates that auctioning these power NPLs will need a haircut of 75%, that is $9 billion (Rs 63,000 crore) more. Banks can then transfer the $9 billion of cleaned-up power NPLs to the ARC/AMC. This can be done by either the government recapitalizing banks by an additional Rs 7,000 crore or it can deploy excess RBI economic capital set to be identified by the Jalan committee next week,” said Indranil Sen Gupta, India Economist with Bo-AML.

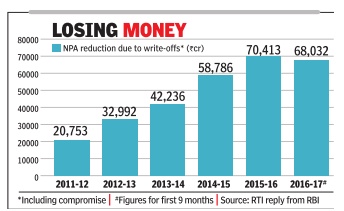

Priority sector more creditworthy than corporates/ 2016

Priority sector loans, long seen as a socialist burden on banks, have turned out to be more credit worthy than advances to large corporates. During April-December 2016, banks had written off loans worth Rs 35,587 crore to large industries as against write-offs of Rs 32,445 crore of advances in the priority sector.

Also, banks could recover only Rs 16,717 crore from large industries who are in default as against Rs 25,070 crore from the priority sector.

An RBI response to a Right to Information (RTI) filing shows that inability to make timely recoveries from large businesses is forcing banks to take a huge hit on their earnings. Banks had written off Rs 68,032 crore of bad loans in the first nine months of FY17 -close to 97% of total write-offs in the whole of FY16. Given that the fourth quarter writeoffs in FY17 had been significant, the total write-offs in the last three years have crossed Rs 2 lakh crore.

CARE Ratings chief economist Madan Sabnavis said, “After the asset quality review norms were put in place by the RBI, bad loans and provisioning have risen steeply . As banks started realising a part of these bad lo ans cannot be recovered, they also started writing off more to clean their balance sheets.“ He added the situation is a result of bad lending decisions and governance issues among banks, which was supported by the “system“.

In the first nine months of FY2017, scheduled commercial banks (SCBs) wrote off Rs 35,587 core worth of loans to large industries, compared to Rs 6,628 crore written off by lenders to farm loans, Rs 8,106 crore toward MSME loans and Rs 17,711 crore wrote off to the other priority sectors.