Baby wipes: India

This is a collection of articles archived for the excellence of their content. |

Market size

2014> 2018

Namrata Singh, January 23, 2020: The Times of India

From: Namrata Singh, January 23, 2020: The Times of India

MUMBAI: Driven by new-age ‘supermoms’ who are financially independent, educated and internet-savvy, baby wipes has emerged as a big category. This segment was practically non-existent 10 years ago.

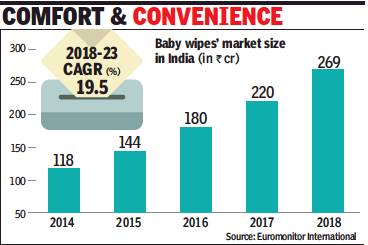

Though still nascent, the category has been growing fast over the last couple of years. Data by Euromonitor International reveals that baby wipes doubled in size over five years. According to the market research provider, the size of the baby wipes category increased from a little over Rs 100 crore in 2014 to around Rs 270 crore in 2018. However, it is small compared to the around Rs 5,000-crore baby diapers market.

Kimberly-Clark India marketing director Chella Pandyan said, “The wipes category in India has been growing fast over the last couple of years, but remains in a nascent stage of development as far as household penetration is concerned. While hygiene and convenience are the key consumer needs driving adoption, it is the growing availability and access — enabled by more affordable price-points and e-commerce — that is helping expand penetration.” For ‘Huggies’ baby wipes made by Kimberly-Clark, according to Pandyan, the primary driver has been the fact that it is made from natural fibres.

A study by JL Morison found that financially independent mothers don’t shy away from spending money to buy products for their babies, which provides time as well as convenience for themselves. In the qualitative part of the study, a lot of mothers indicated that they do strive to get some ‘me-time’ for themselves, which is difficult during motherhood phases, especially if they are working. Whenever they get this time, they spend it on socialising, catching up on their sleep, catching up on their hobbies and interests, surfing the net, or spending time with their spouses.

JL Morison India group brand manager Nitin Bhandari said, “From a marketer’s point of view, this indicates that mothers are now willing to spend on products that provide them quality, convenience, comfort and safety for their babies.” These ‘supermoms’ are aware about the products and they also have a plethora of choices at their disposal. “While this provides an opportunity to marketers, the challenge is to provide the best quality and benefits at value-for-money prices. One of the biggest examples is the emergence of baby wipes, which did not exist around 10 years ago. Today, it is among the fastest growing categories,” said Bhandari.

The research by JL Morison was conducted on a sample size of more than 400 mothers across five cities to understand their usage and attitudes regarding motherhood, babies and the product usage related to the same. The key trends that are driving growth in the baby care category are increasing birth rates, urbanisation, more working mothers, enhanced purchasing power and increased concern for child care.