Amul (Anand Milk Federation Union Limited)

m (Pdewan moved page Amul to Amul (Anand Milk Federation Union Limited) without leaving a redirect) |

|||

| Line 1: | Line 1: | ||

[[Category:India|A]] | [[Category:India|A]] | ||

[[Category: Economy-Industry-Resources |A]] | [[Category: Economy-Industry-Resources |A]] | ||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | |colspan="0"|<div style="font-size:100%"> | ||

| + | This is a collection of articles archived for the excellence of their content.</div> | ||

| + | |} | ||

[[File:Amul.jpg| |frame| 500px]] | [[File:Amul.jpg| |frame| 500px]] | ||

| + | ==Amul in the 21st century== | ||

| + | ''' Amul 2.0: What the ongoing change means for the Rs 18,143 crore cooperative ''' | ||

| + | [http://economictimes.indiatimes.com/industry/cons-products/food/amul-2-0-what-the-ongoing-change-means-for-the-rs-18143-crore-cooperative/articleshow/39327959.cms?curpg=5] By Naren Karunakaran, ET Bureau | 31 Jul, 2014 | ||

| + | [[File:Amul.jpg| |frame| 500px]] | ||

| + | |||

| + | In 2014 around 85% of Amul’s membership still comprises small and marginal farmers. For the new emerging lot dairying is a hard-nosed business. Around 85% of Amul’s membership still comprises small and marginal farmers. For the new emerging lot dairying is a hard-nosed business. | ||

| + | |||

| + | Several decades after Amul was established that movement, better known to the world as Amul, is facing yet another churn, a slow and silent one. Its farmer membership of 3.3 million -- the very composition of its bulwark, its raison d'etre - is undergoing a makeover. The upstream of the Amul value chain is changing like never before. | ||

| + | |||

| + | In the 21st century there has been a steady, methodical infusion of large, affluent farmers into the supply ecosystem. They seek to establish dairying units on a commercial level, with a big herd size of 30-50 animals and all the trappings of a modern dairy, complete with automated systems and Swedish milking machines. | ||

| + | |||

| + | They rub shoulders with the typical Gujarati village dairywoman engaged in subsistence or supplementary-income sort of dairying. They rub shoulders even with the likes of the landless such as Shantaben of Jalotra village in Banaskantha who secures green fodder for her cows in lieu of her labour in the fields. | ||

| + | |||

| + | ''' Amul 2.0: What the ongoing change means for the Rs 18,143 crore cooperative: ''' Around 85% of Amul's membership still comprises small and marginal farmers. For the new emerging lot, imbued with the keen Gujarati ken for profits, dairying is not a livelihood plank. It is hard-nosed business. | ||

| + | |||

| + | Those at the Gujarat Cooperative Milk Marketing Federation (GCMMF) --owner of the Amul brand and the apex body of the milk unions -- are encouraging the ''' transition. ''' "We already have over 5,000 such ''' large commercial farms," ''' reveals RS Sodhi, managing director of GCMMF. "And they will only grow in numbers." These large farms, quite under the radar for the casual observer, suddenly seem critical for the future growth of GCMMF, even as it reorients itself, and begins to address and design specific programmes for these relatively new entities. | ||

| + | |||

| + | Compulsion To Grow This lot is expected to play a singular role in fuelling milk supplies as GCMMF begins to cope with a growing population, higher incomes, increasing health consciousness, and the consequent explosion in demand for pouch milk and value-added products across the country. | ||

| + | |||

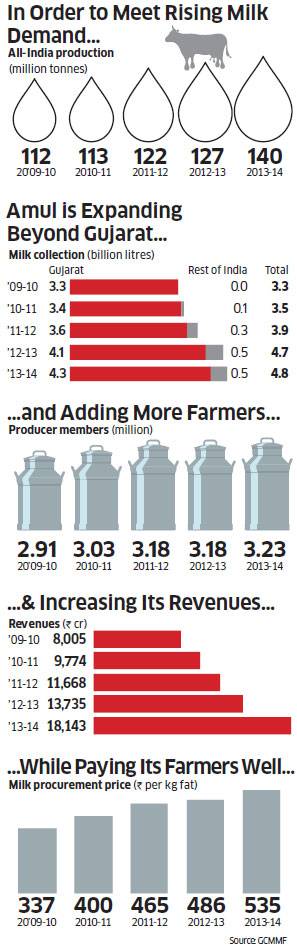

| + | Estimates by the National Dairy Development Board (NDDB) indicate milk demand is expected to rise to 180 million tonnes by 2022 (around 140 million tonnes in 2014). In order to meet this demand, an average annual increase exceeding 5 million tonnes over the coming years is required. | ||

| + | |||

| + | Planning, not only for the near, but the distant future, is key to sustenance, estimates the Kaira District Cooperative Milk Producers Union, popularly known as Amul Dairy, and the oldest of the 17 district unions. "All along our focus has been on products, and processing infrastructure." The downstream of the value chain prevailed. | ||

| + | |||

| + | For a long time, Amul was faced with a situation where its milk procurement was increasing at a much faster pace than it could dispose in the form of value-added products. It was therefore forced into a milk powder play, which it didn't relish. | ||

| + | ==2010-14: new markets and sourcing milk locally== | ||

| + | It was only when GCMMF started entering ''' new markets ''' for liquid milk – ''' Uttar Pradesh and West Bengal,''' around 2010 -- the realisation dawned that hauling milk all over the country from Gujarat wasn't a prudent idea. In any case, milk from Gujarat wasn't enough for its expansion. Even today, two special milk trains leave Banaskantha for Kanpur every alternate day. From an era of milk plenitude, the tide turned, forcing GCMMF to seriously explore sourcing milk locally in UP and elsewhere. "We were falling short by 10% or so then," says Sodhi. The Amul pattern of coop structure is now being transplanted in UP. | ||

| + | |||

| + | The supply situation has eased, but the strain to keep pace with spiralling demand, and the windfall accruing from the changed circumstances, are showing. GCMMF posted a turnover of Rs 18,143 crore in 2013-14, along with its highest-ever growth of 32.1%. Over the last six years, GCMMF has recorded a compounded annual growth of 23% and hopes to touch Rs 30,000 crore by 2020. | ||

| + | |||

| + | The induction of a force multiplier in milk supplies -- like the professionally run commercial farms, or 'tabelas', as villagers in Anand, the home of Amul Dairy, describe them -- was in a way inevitable. Nowhere is this scorching growth more apparent than at the Banaskantha District Coop Milk Producers Union, or Banas Dairy as it is called. | ||

| + | |||

| + | With a daily milk collection of over 3.5 million litres, it is the largest dairy in Asia. Banas Dairy relies a great deal on large farms. They already account for 20%, or 700,000 litres, of milk procured every day. Abdul Rashid of Semodra village and Punmabhai Desai from Bevata village are exemplars of the new tribe (See box: The New Amul Farmer) | ||

| + | == Why is commercial dairying attractive in Banas/ Gujarat?== | ||

| + | ''' Lure Of The Dairy ''' | ||

| + | |||

| + | Why is commercial dairying attractive in Gujarat? Selling any quantity of milk is not an issue with the Amul ecosystem in place. The price on offer is good. Banas Dairy offers Rs 590 per kg fat, perhaps the best price for milk anywhere in the country. GCMMF officials insist it may be the ''' best in the world ''' if subsidies for milk in foreign countries are pared out. | ||

| + | |||

| + | In addition to a good price, access to cheap cattle-feed, vet services and support for buying milking machines, members of the cooperative are also eligible for a share of the 'price difference', or profits, which can be substantial. For 2013-14, Banas Dairy announced a rate of 14%: a farmer receives Rs 14 for every Rs 100 worth of milk supplied during the year. On July 16, the Banas Dairy disbursed Rs 430 crore. That's not all. The village coop societies also disbursed -- another Rs 200 crore -- to its member farmers. Last year, Rashid earned Rs 3.5 lakh as price difference alone. | ||

| + | |||

| + | While the pickings seem good, these commercial dairies, as all other farmers, also retain a degree of freedom to do whatever they like with their milk as long as the mandatory minimum is poured at the village society. This is around 400 litres per cow per year to retain voting rights; and 750 litres to be a managing committee member. The situation is pregnant with possibilities | ||

| + | == Farmer-consumer balance== | ||

| + | The sheet-anchor of the Amul pattern has always been maximising of benefit to farmers and providing low-cost, value-for-money products to consumers. The tradition continues. "If you pay a good price, milk will come," says Sodhi. Subsistence farmers never bothered about costs, inputs, outputs or efficiency. "We are now fostering a business model," he says, and insists that the future of Indian dairying lies in encouraging "self-managed, farmer-managed units of 40 animals or so", and not the promotion of large private dairying behemoths of 5,000-plus animals. | ||

| + | |||

| + | Only now, Sodhi is a trifle worried about the ''' farmer-consumer balance. ''' With a cost-conscious, profit-seeking professional flock under his wings, he will now have to be more mindful about inflationary trends, input costs in dairying, and perhaps calibrate milk prices at the consumer end in a more nuanced and acceptable manner. | ||

| + | |||

| + | The Punjab milk crisis of just two years ago is still on everyone's mind. Commercial dairy farmers took to the streets as rising input costs made their units unviable. Many downed shutters. | ||

| + | |||

| + | The farmer-consumer conflict, therefore, is only going to get more complex for GCMMF in the future. Sodhi wonders why urban consumers raise hell with an increase of a couple of rupees in liquid milk prices when they don't mind splurging on fast food, fancy electronic gadgetry or mobile air time. However, for now, things aren't choppy. | ||

| + | == Influx of large Farmers== | ||

| + | ''' Advantage, Large Farmers ''' | ||

| + | |||

| + | "Big farmers will bring in 50% of Banas Dairy's milk in 10 years," proclaims Parthibhai Bhatol, chairman of Banas Dairy, who was elected chairman of GCMMF after the visionary Verghese Kurien demitted office. Bhatol, the dairy veteran who has steered Banas Dairy to its prima donna position today, is certain that a business approach to dairying is the only way to go if the Amul coops have to attract and retain the interest of Gujarat's rural households and the restive youth in dairying. | ||

| + | |||

| + | He has little choice. Many dairying families are dropping out of the system for varied reasons. Membership has reached saturation. "No one has been left behind, even the landless who tie their animals on the roadside are members in Banaskantha," he says. | ||

| + | |||

| + | Will this influx of affluence unsettle the cooperative spirit and dilute Amul values? GCMMF officials don't see that happening and underscore the cooperative dictum of 'one member, one vote', hinting that a tilt in balance, in favour or against a section of farmers, is not possible. "With commercial farms, efficiencies will only increase; productivity will rise," says Kishore Jhala, chief general manager of GCMMF. India's productivity per animal is abysmally low; about 987 kg per lactation as against the global average of 2,038 kg per lactation. | ||

| + | |||

| + | Moreover, they fit into the federation's future plans. In situations where a controlled environment is necessary -- for instance, innovating with neutraceuticals (food products that provide both health and medical benefits -- these modern, high-tech farms would be ideal locations. | ||

| + | ==Stigma on cattle breeding== | ||

| + | Bhatol believes that it was imperative for them to move along this path as the present generation in dairying families is showing signs of restlessness. Girls also do not prefer marrying into families that keep animals. Even the boys, better educated and more aware than their forebears, are gravitating towards jobs in cities. Even call-centre jobs are enticing. | ||

| + | |||

| + | "There is no life in dairying," says Haresh Chaudhury, 30. "All our waking hours, which starts at 4 am, is spent feeding, milking, caring and tending to animals." He kept a herd of 10 for several years, but slowly became embittered by the sheer drudgery of it all. | ||

| + | |||

| + | One day, he sold all his animals for a song and breathed freedom. "Now, we have many career options, unlike our parents," he says. Growing cash crops doesn't call for the same labour intensity as dairying. Chaudhury has tried his hand at growing papayas. That continues. He is now examining options in real estate and retailing. Bhatol says a churn -- arising from a mix of rising aspirations, and dairying economics at the grassroots -- is inevitable and that farmers will enter and leave the system. It's evolutionary. Abdul Rashid is more direct. "All these three to five animal types will eventually wither away," he says, with a sage-like shake of his head. | ||

| + | ==Beyond Gujarat== | ||

| + | What do all these structural churns, heightened political activity and acrimonious interference, within and outside cooperative boardrooms, as witnessed in recent years, and the absence of a charismatic leader like Verghese Kurien who held the family together, mean for the future of Amul? | ||

| + | |||

| + | As the first GCMMF chairman post the Kurien era, Bhatol has been in the thick of the messy and disquieting transition. He says Amul values revolve around providing maximum benefit to farmers. If this is adhered to in all earnest, he adds, the rest can be handled. | ||

| + | |||

| + | Bhatol describes how his recent intervention in UP is benefiting a whole new lot of farmers. Exploitative private players wouldn't pay more than Rs 18-20 a litre. As expected, there was resistance to Amul's entry in the state. He ratcheted up the game and started offering Rs 28. Over 1,100 village societies have been formed. Milk collection has reached 200,000 litres a day. "This winter we will reach 500,000 litres," he says. | ||

| + | |||

| + | Amul is present across much of Gujarat. Saurashtra and Kutch, untouched all these years, is also now under the umbrella. Now, it's the turn of farmers in other regions to benefit from Amul's direct play, although in the past the Amul/Anand pattern has been replicated in many states. | ||

| + | |||

| + | NDDB, which had been created to proliferate the Anand pattern, has now begun promoting milk-producer companies, a blend of a cooperative and a private limited company, under the Companies Act. "A producer company insulates us from undue government and political interference, and is more transparent in its operations," says SK Bhalla, CEO, Maahi Milk Producer Company Limited, based in Rajkot. With 76,000 members, a collection of 600,000 litres a day, it has been fairly successful, and hopes to reach a turnover of Rs 1,000 crore in 2014-15. | ||

| + | |||

| + | == Politics and politicians== | ||

| + | The deep suspicion of politics and politicians will remain. However, they cannot be wished away. It's how a situation or a set of circumstances are managed. Bhatol reveals how the present UP chief minister, despite stiff opposition, is helping him build a chain of Amul milk-processing plants in Faridabad, Lucknow and Kanpur | ||

| + | |||

| + | Political patronage, or interference, is not new to Amul. "In fact, we are born out of politics," explains Kishore Jhala, alluding to its formative years. Only then, the politicians were more statesmen-like. And Kurien was a buffer between the political establishment and the cooperative. Today, Amul, for good or bad, is directly exposed to politics and politicians. | ||

| + | The churn continues | ||

| + | ='' Manthan '' (1976)= | ||

| + | '' Manthan '' (The Churning), the 1976 Shyam Benegal film, financed by marginal farmers [i.e. by Amul], and set against the backdrop of Operation Flood, captures the agrarian tumult and the promises held out by the dairy cooperative movement in Gujarat. [The film is a hagiography of Amul founder Mr Kurien.] | ||

| + | ==The New Amul Farmer== | ||

| + | Banas Dairy likes to describe farmers like Abdul Rashid as progressive milk producers (PMPs) and is grooming another 7,100 farmers to join the fold. His is an example worth emulating. | ||

| + | |||

| + | Rashid, with a herd of 48 cows (25 milking cows), supplies 240 litres of milk a day to the dairy. His last year's supply was worth `18 lakh and he made a neat profit of `5 lakh. "I spend `2.4 lakh on labour alone in a year," he says, mischievously hinting he could have saved this money if his family members involved themselves in tending to the herd. | ||

| + | |||

| + | Over the years, Rashid has spent over `10 lakh on infrastructure: a warehouse to store a year's stock of feed, an animal housing with fans and foggers to manage heat stress of his herd, sprinklers over six bighas of land to grow green fodder, water-recycling and composting systems. He also rears his own stock. He was the first to buy a `45,000 DeLaval milking system in the entire district in 2011. | ||

| + | |||

| + | Unlike Rashid, with years of experience, 31-year-old Punmabhai Desai from Bevata village, a commodity trader, is a newcomer to dairying. He earns around `5 lakh a year from his trading activities and another `4 lakh comes as agriculture income. | ||

| + | |||

| + | "Dairying is a safe bet," says Desai. That's why he didn't think twice before mortgaging 40% of his five-hectare land for a `45 lakh loan from ICICI Bank to set up one of the most modern dairies in his region. He own 25 milking animals. His farm is already a "must visit" for hordes of farmers from Ghodsar and adjoining areas. "Within two years I will install bulk chillers and target 1,000 litres of milk supply a day," he says | ||

Revision as of 19:35, 31 July 2014

This is a collection of articles archived for the excellence of their content.

|

Contents |

Amul in the 21st century

Amul 2.0: What the ongoing change means for the Rs 18,143 crore cooperative [1] By Naren Karunakaran, ET Bureau | 31 Jul, 2014

In 2014 around 85% of Amul’s membership still comprises small and marginal farmers. For the new emerging lot dairying is a hard-nosed business. Around 85% of Amul’s membership still comprises small and marginal farmers. For the new emerging lot dairying is a hard-nosed business.

Several decades after Amul was established that movement, better known to the world as Amul, is facing yet another churn, a slow and silent one. Its farmer membership of 3.3 million -- the very composition of its bulwark, its raison d'etre - is undergoing a makeover. The upstream of the Amul value chain is changing like never before.

In the 21st century there has been a steady, methodical infusion of large, affluent farmers into the supply ecosystem. They seek to establish dairying units on a commercial level, with a big herd size of 30-50 animals and all the trappings of a modern dairy, complete with automated systems and Swedish milking machines.

They rub shoulders with the typical Gujarati village dairywoman engaged in subsistence or supplementary-income sort of dairying. They rub shoulders even with the likes of the landless such as Shantaben of Jalotra village in Banaskantha who secures green fodder for her cows in lieu of her labour in the fields.

Amul 2.0: What the ongoing change means for the Rs 18,143 crore cooperative: Around 85% of Amul's membership still comprises small and marginal farmers. For the new emerging lot, imbued with the keen Gujarati ken for profits, dairying is not a livelihood plank. It is hard-nosed business.

Those at the Gujarat Cooperative Milk Marketing Federation (GCMMF) --owner of the Amul brand and the apex body of the milk unions -- are encouraging the transition. "We already have over 5,000 such large commercial farms," reveals RS Sodhi, managing director of GCMMF. "And they will only grow in numbers." These large farms, quite under the radar for the casual observer, suddenly seem critical for the future growth of GCMMF, even as it reorients itself, and begins to address and design specific programmes for these relatively new entities.

Compulsion To Grow This lot is expected to play a singular role in fuelling milk supplies as GCMMF begins to cope with a growing population, higher incomes, increasing health consciousness, and the consequent explosion in demand for pouch milk and value-added products across the country.

Estimates by the National Dairy Development Board (NDDB) indicate milk demand is expected to rise to 180 million tonnes by 2022 (around 140 million tonnes in 2014). In order to meet this demand, an average annual increase exceeding 5 million tonnes over the coming years is required.

Planning, not only for the near, but the distant future, is key to sustenance, estimates the Kaira District Cooperative Milk Producers Union, popularly known as Amul Dairy, and the oldest of the 17 district unions. "All along our focus has been on products, and processing infrastructure." The downstream of the value chain prevailed.

For a long time, Amul was faced with a situation where its milk procurement was increasing at a much faster pace than it could dispose in the form of value-added products. It was therefore forced into a milk powder play, which it didn't relish.

2010-14: new markets and sourcing milk locally

It was only when GCMMF started entering new markets for liquid milk – Uttar Pradesh and West Bengal, around 2010 -- the realisation dawned that hauling milk all over the country from Gujarat wasn't a prudent idea. In any case, milk from Gujarat wasn't enough for its expansion. Even today, two special milk trains leave Banaskantha for Kanpur every alternate day. From an era of milk plenitude, the tide turned, forcing GCMMF to seriously explore sourcing milk locally in UP and elsewhere. "We were falling short by 10% or so then," says Sodhi. The Amul pattern of coop structure is now being transplanted in UP.

The supply situation has eased, but the strain to keep pace with spiralling demand, and the windfall accruing from the changed circumstances, are showing. GCMMF posted a turnover of Rs 18,143 crore in 2013-14, along with its highest-ever growth of 32.1%. Over the last six years, GCMMF has recorded a compounded annual growth of 23% and hopes to touch Rs 30,000 crore by 2020.

The induction of a force multiplier in milk supplies -- like the professionally run commercial farms, or 'tabelas', as villagers in Anand, the home of Amul Dairy, describe them -- was in a way inevitable. Nowhere is this scorching growth more apparent than at the Banaskantha District Coop Milk Producers Union, or Banas Dairy as it is called.

With a daily milk collection of over 3.5 million litres, it is the largest dairy in Asia. Banas Dairy relies a great deal on large farms. They already account for 20%, or 700,000 litres, of milk procured every day. Abdul Rashid of Semodra village and Punmabhai Desai from Bevata village are exemplars of the new tribe (See box: The New Amul Farmer)

Why is commercial dairying attractive in Banas/ Gujarat?

Lure Of The Dairy

Why is commercial dairying attractive in Gujarat? Selling any quantity of milk is not an issue with the Amul ecosystem in place. The price on offer is good. Banas Dairy offers Rs 590 per kg fat, perhaps the best price for milk anywhere in the country. GCMMF officials insist it may be the best in the world if subsidies for milk in foreign countries are pared out.

In addition to a good price, access to cheap cattle-feed, vet services and support for buying milking machines, members of the cooperative are also eligible for a share of the 'price difference', or profits, which can be substantial. For 2013-14, Banas Dairy announced a rate of 14%: a farmer receives Rs 14 for every Rs 100 worth of milk supplied during the year. On July 16, the Banas Dairy disbursed Rs 430 crore. That's not all. The village coop societies also disbursed -- another Rs 200 crore -- to its member farmers. Last year, Rashid earned Rs 3.5 lakh as price difference alone.

While the pickings seem good, these commercial dairies, as all other farmers, also retain a degree of freedom to do whatever they like with their milk as long as the mandatory minimum is poured at the village society. This is around 400 litres per cow per year to retain voting rights; and 750 litres to be a managing committee member. The situation is pregnant with possibilities

Farmer-consumer balance

The sheet-anchor of the Amul pattern has always been maximising of benefit to farmers and providing low-cost, value-for-money products to consumers. The tradition continues. "If you pay a good price, milk will come," says Sodhi. Subsistence farmers never bothered about costs, inputs, outputs or efficiency. "We are now fostering a business model," he says, and insists that the future of Indian dairying lies in encouraging "self-managed, farmer-managed units of 40 animals or so", and not the promotion of large private dairying behemoths of 5,000-plus animals.

Only now, Sodhi is a trifle worried about the farmer-consumer balance. With a cost-conscious, profit-seeking professional flock under his wings, he will now have to be more mindful about inflationary trends, input costs in dairying, and perhaps calibrate milk prices at the consumer end in a more nuanced and acceptable manner.

The Punjab milk crisis of just two years ago is still on everyone's mind. Commercial dairy farmers took to the streets as rising input costs made their units unviable. Many downed shutters.

The farmer-consumer conflict, therefore, is only going to get more complex for GCMMF in the future. Sodhi wonders why urban consumers raise hell with an increase of a couple of rupees in liquid milk prices when they don't mind splurging on fast food, fancy electronic gadgetry or mobile air time. However, for now, things aren't choppy.

Influx of large Farmers

Advantage, Large Farmers

"Big farmers will bring in 50% of Banas Dairy's milk in 10 years," proclaims Parthibhai Bhatol, chairman of Banas Dairy, who was elected chairman of GCMMF after the visionary Verghese Kurien demitted office. Bhatol, the dairy veteran who has steered Banas Dairy to its prima donna position today, is certain that a business approach to dairying is the only way to go if the Amul coops have to attract and retain the interest of Gujarat's rural households and the restive youth in dairying.

He has little choice. Many dairying families are dropping out of the system for varied reasons. Membership has reached saturation. "No one has been left behind, even the landless who tie their animals on the roadside are members in Banaskantha," he says.

Will this influx of affluence unsettle the cooperative spirit and dilute Amul values? GCMMF officials don't see that happening and underscore the cooperative dictum of 'one member, one vote', hinting that a tilt in balance, in favour or against a section of farmers, is not possible. "With commercial farms, efficiencies will only increase; productivity will rise," says Kishore Jhala, chief general manager of GCMMF. India's productivity per animal is abysmally low; about 987 kg per lactation as against the global average of 2,038 kg per lactation.

Moreover, they fit into the federation's future plans. In situations where a controlled environment is necessary -- for instance, innovating with neutraceuticals (food products that provide both health and medical benefits -- these modern, high-tech farms would be ideal locations.

Stigma on cattle breeding

Bhatol believes that it was imperative for them to move along this path as the present generation in dairying families is showing signs of restlessness. Girls also do not prefer marrying into families that keep animals. Even the boys, better educated and more aware than their forebears, are gravitating towards jobs in cities. Even call-centre jobs are enticing.

"There is no life in dairying," says Haresh Chaudhury, 30. "All our waking hours, which starts at 4 am, is spent feeding, milking, caring and tending to animals." He kept a herd of 10 for several years, but slowly became embittered by the sheer drudgery of it all.

One day, he sold all his animals for a song and breathed freedom. "Now, we have many career options, unlike our parents," he says. Growing cash crops doesn't call for the same labour intensity as dairying. Chaudhury has tried his hand at growing papayas. That continues. He is now examining options in real estate and retailing. Bhatol says a churn -- arising from a mix of rising aspirations, and dairying economics at the grassroots -- is inevitable and that farmers will enter and leave the system. It's evolutionary. Abdul Rashid is more direct. "All these three to five animal types will eventually wither away," he says, with a sage-like shake of his head.

Beyond Gujarat

What do all these structural churns, heightened political activity and acrimonious interference, within and outside cooperative boardrooms, as witnessed in recent years, and the absence of a charismatic leader like Verghese Kurien who held the family together, mean for the future of Amul?

As the first GCMMF chairman post the Kurien era, Bhatol has been in the thick of the messy and disquieting transition. He says Amul values revolve around providing maximum benefit to farmers. If this is adhered to in all earnest, he adds, the rest can be handled.

Bhatol describes how his recent intervention in UP is benefiting a whole new lot of farmers. Exploitative private players wouldn't pay more than Rs 18-20 a litre. As expected, there was resistance to Amul's entry in the state. He ratcheted up the game and started offering Rs 28. Over 1,100 village societies have been formed. Milk collection has reached 200,000 litres a day. "This winter we will reach 500,000 litres," he says.

Amul is present across much of Gujarat. Saurashtra and Kutch, untouched all these years, is also now under the umbrella. Now, it's the turn of farmers in other regions to benefit from Amul's direct play, although in the past the Amul/Anand pattern has been replicated in many states.

NDDB, which had been created to proliferate the Anand pattern, has now begun promoting milk-producer companies, a blend of a cooperative and a private limited company, under the Companies Act. "A producer company insulates us from undue government and political interference, and is more transparent in its operations," says SK Bhalla, CEO, Maahi Milk Producer Company Limited, based in Rajkot. With 76,000 members, a collection of 600,000 litres a day, it has been fairly successful, and hopes to reach a turnover of Rs 1,000 crore in 2014-15.

Politics and politicians

The deep suspicion of politics and politicians will remain. However, they cannot be wished away. It's how a situation or a set of circumstances are managed. Bhatol reveals how the present UP chief minister, despite stiff opposition, is helping him build a chain of Amul milk-processing plants in Faridabad, Lucknow and Kanpur

Political patronage, or interference, is not new to Amul. "In fact, we are born out of politics," explains Kishore Jhala, alluding to its formative years. Only then, the politicians were more statesmen-like. And Kurien was a buffer between the political establishment and the cooperative. Today, Amul, for good or bad, is directly exposed to politics and politicians. The churn continues

Manthan (1976)

Manthan (The Churning), the 1976 Shyam Benegal film, financed by marginal farmers [i.e. by Amul], and set against the backdrop of Operation Flood, captures the agrarian tumult and the promises held out by the dairy cooperative movement in Gujarat. [The film is a hagiography of Amul founder Mr Kurien.]

The New Amul Farmer

Banas Dairy likes to describe farmers like Abdul Rashid as progressive milk producers (PMPs) and is grooming another 7,100 farmers to join the fold. His is an example worth emulating.

Rashid, with a herd of 48 cows (25 milking cows), supplies 240 litres of milk a day to the dairy. His last year's supply was worth `18 lakh and he made a neat profit of `5 lakh. "I spend `2.4 lakh on labour alone in a year," he says, mischievously hinting he could have saved this money if his family members involved themselves in tending to the herd.

Over the years, Rashid has spent over `10 lakh on infrastructure: a warehouse to store a year's stock of feed, an animal housing with fans and foggers to manage heat stress of his herd, sprinklers over six bighas of land to grow green fodder, water-recycling and composting systems. He also rears his own stock. He was the first to buy a `45,000 DeLaval milking system in the entire district in 2011.

Unlike Rashid, with years of experience, 31-year-old Punmabhai Desai from Bevata village, a commodity trader, is a newcomer to dairying. He earns around `5 lakh a year from his trading activities and another `4 lakh comes as agriculture income.

"Dairying is a safe bet," says Desai. That's why he didn't think twice before mortgaging 40% of his five-hectare land for a `45 lakh loan from ICICI Bank to set up one of the most modern dairies in his region. He own 25 milking animals. His farm is already a "must visit" for hordes of farmers from Ghodsar and adjoining areas. "Within two years I will install bulk chillers and target 1,000 litres of milk supply a day," he says