Air India

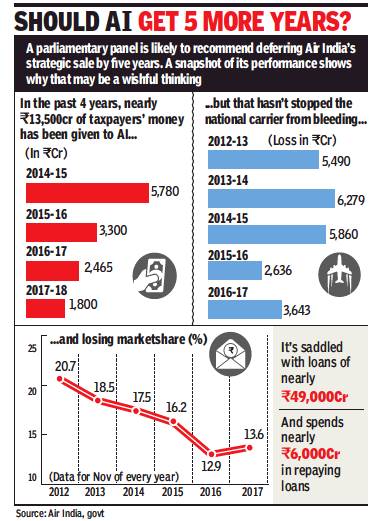

(→Losses and marketshare, 2012-17; Taxpayers’ money given to Air India, 2014-18) |

(→2012-2017: Declining strength) |

||

| (12 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | {| | + | [[File: Air India Boccaccio 70a.png| GLORY DAYS: <br/> '''Air India’s office in Rome '''was showcased, albeit briefly, in '' Boccaccio '70 '' (1962/ Italy-France; this part directed by Mario Monicelli), a major feature film that was commercially successful as well as well-regarded artistically|frame|500px]] |

| + | |||

| + | {| class="wikitable" | ||

|- | |- | ||

|colspan="0"|<div style="font-size:100%"> | |colspan="0"|<div style="font-size:100%"> | ||

This is a collection of articles archived for the excellence of their content.<br/> | This is a collection of articles archived for the excellence of their content.<br/> | ||

| + | Additional information may please be sent as messages to the Facebook <br/>community, [http://www.facebook.com/Indpaedia Indpaedia.com]. All information used will be gratefully <br/>acknowledged in your name. | ||

</div> | </div> | ||

|} | |} | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

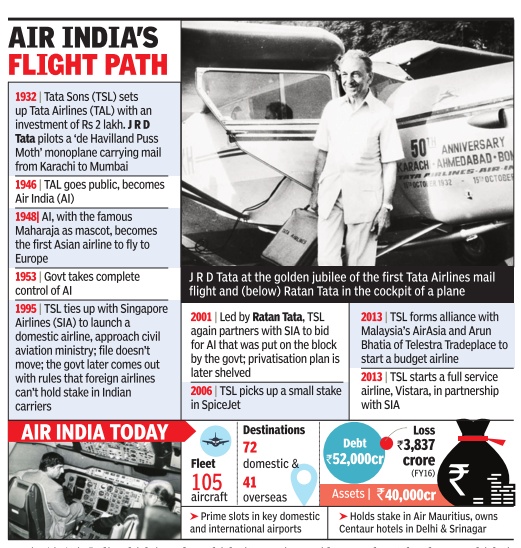

=History= | =History= | ||

==1932-2018== | ==1932-2018== | ||

| + | [[File: Air India, 1932-2017, a brief history.jpg|Air India: 1932-2017, a brief history; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=22_06_2017_020_001_008&type=P&artUrl=AI-will-go-back-to-original-owner-if-22062017020001&eid=31808 The Times of India], June 22, 2017|frame|500px]] | ||

| + | [[File: Air India.jpg| Air India in 2017 [https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 India Today]|frame|500px]] | ||

| + | |||

[https://timesofindia.indiatimes.com/business/india-business/air-india-legacy-of-an-86-yr-old-maharajah/articleshow/63529011.cms Abhik Deb, March 29, 2018: ''The Times of India''] | [https://timesofindia.indiatimes.com/business/india-business/air-india-legacy-of-an-86-yr-old-maharajah/articleshow/63529011.cms Abhik Deb, March 29, 2018: ''The Times of India''] | ||

| Line 36: | Line 35: | ||

As for potential bidders, the Air India saga might come a full circle with Tata Sons-Singapore Airlines having expressing interest earlier. If that deal comes through it would be a homecoming for the Maharajah. IndiGo and an unidentified foreign player are also in the fray. Jet Airways is also reportedly waiting for the bid documents to decide on its next move while Qatar Airways too, wants to start an airline in India. | As for potential bidders, the Air India saga might come a full circle with Tata Sons-Singapore Airlines having expressing interest earlier. If that deal comes through it would be a homecoming for the Maharajah. IndiGo and an unidentified foreign player are also in the fray. Jet Airways is also reportedly waiting for the bid documents to decide on its next move while Qatar Airways too, wants to start an airline in India. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

==1950s-1970s: glory days== | ==1950s-1970s: glory days== | ||

| Line 63: | Line 69: | ||

Meanwhile, on his return journey from America, Gustasp Irani had about as much luck as on his outward trip. “The Air India flight had stopped in Delhi. My co-passenger, being a domestic traveller, wasn't allowed to buy a whiskey . He requested me to buy two for him, which I did, thinking he'd let me have one. What he did, though, was down the first in one gulp, and then nurse the second.“ | Meanwhile, on his return journey from America, Gustasp Irani had about as much luck as on his outward trip. “The Air India flight had stopped in Delhi. My co-passenger, being a domestic traveller, wasn't allowed to buy a whiskey . He requested me to buy two for him, which I did, thinking he'd let me have one. What he did, though, was down the first in one gulp, and then nurse the second.“ | ||

| + | |||

| + | |||

| + | =Aircraft, purchase of= | ||

| + | ==2023: largest order in world aviation history== | ||

| + | [[File: In 2023, Air India placed the largest aircraft order in world aviation history.jpg|In 2023, Air India placed the largest aircraft order in world aviation history <br/> From: [https://epaper.timesgroup.com/article-share?article=15_02_2023_018_008_cap_TOI February 15, 2023: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' In 2023, Air India placed the largest aircraft order in world aviation history '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

=Air India Express= | =Air India Express= | ||

| Line 85: | Line 107: | ||

The year also saw Air India Express expanding its wings to markets out of Madurai, Coimbatore and Vijayawada. With a fleet size comprising 24 Boeing 737–800NG aircraft, the airline flies to 13 international and 18 Indian destinations, offering valuefor-money services to customers in tier II and III Indian cities. | The year also saw Air India Express expanding its wings to markets out of Madurai, Coimbatore and Vijayawada. With a fleet size comprising 24 Boeing 737–800NG aircraft, the airline flies to 13 international and 18 Indian destinations, offering valuefor-money services to customers in tier II and III Indian cities. | ||

| + | |||

| + | =Art collection= | ||

| + | ==As in 2021== | ||

| + | [https://indianexpress.com/article/explained/air-india-maharajah-art-collection-7574108/?utm_source=newzmate&utm_medium=email&utm_campaign=explained&utm_content=6386461&pnespid=VuV081Fc6ikLz1eMu4DbS0NUokoz2eYrrV0UH.xZYorKOia4Z8rYQK0cIwW4NOyPOdIbEyS. Divya A, Oct 16, 2021: ''The Indian Express''] | ||

| + | |||

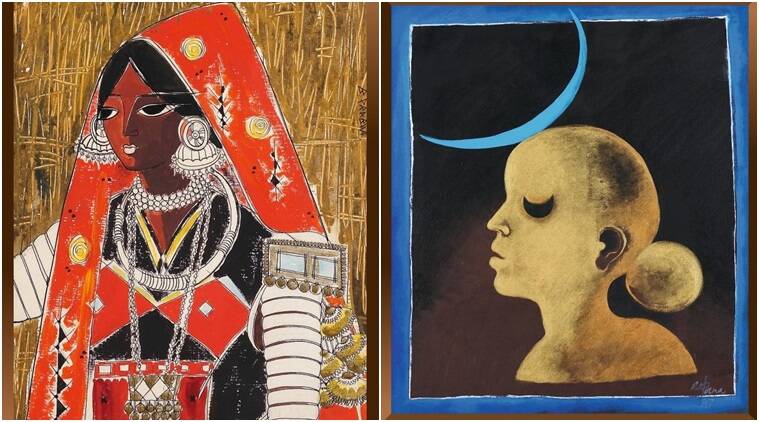

| + | [[File: B Prabha, Banjara Woman; Arpana Caur, Night.jpg|B Prabha, Banjara Woman; Arpana Caur, Night (Twitter/@airindiain) <br/> From: [https://indianexpress.com/article/explained/air-india-maharajah-art-collection-7574108/?utm_source=newzmate&utm_medium=email&utm_campaign=explained&utm_content=6386461&pnespid=VuV081Fc6ikLz1eMu4DbS0NUokoz2eYrrV0UH.xZYorKOia4Z8rYQK0cIwW4NOyPOdIbEyS. Divya A, Oct 16, 2021: ''The Indian Express'']|frame|500px]] | ||

| + | |||

| + | The ‘Maharajah collection’, as it is called, has over 4,000 works, including by Jatin Das, Anjolie Ela Menon, M F Husain and V S Gaitonde. | ||

| + | |||

| + | The Tata group has reclaimed Air India, but the priceless Air India art collection is not part of the deal and is likely to stay with the government. A look at what is in the collection, and why it is important: | ||

| + | |||

| + | ''' The collection ''' | ||

| + | |||

| + | The ‘Maharajah collection’, as it is called, has over 4,000 works, including by Jatin Das, Anjolie Ela Menon, M F Husain and V S Gaitonde. These were on display across Air India offices, and on its calendars, posters and menu cards. There are posters by cartoonist Mario Miranda as well as ads designed by The New Yorker cartoonist Peter Arno, besides paintings, textiles, sculptures, and traditional wooden and bronze artwork. No official estimate exists of the worth of the entire collection. As the airline expanded, so did the collection. But as computerised booking came in, some of the international booking offices were shut/streamlined, and the artworks were either sent back to Mumbai or stored elsewhere. Mumbai-based art historian and conservation architect Meera Dass, who is working on a book about the archive, said, “The airline always had the culture of being representative of the nation… The collection served that purpose — to present India as an ancient civilisation, but with a modern outlook.” | ||

| + | |||

| + | ''' The collector ''' | ||

| + | |||

| + | Air India bought its first set of six paintings for Rs 87.50 in 1956, from a novice art school graduate, B Prabha. The collection was built over more than six decades after Independence, driven by JRD Tata’s philosophy of “putting a little bit of India” in the booking offices of the erstwhile Tata Airlines. | ||

| + | “He (JRD Tata) was a great nationalist and he used the airline’s booking offices outside India to expose the country’s art and artists to the world,” Dass said. | ||

| + | |||

| + | While some of the works were commissioned by the airline and some were bought for as low as Rs 50-500, others were bartered for air tickets to artists travelling abroad. In an interview, M F Husain had said: “They (Air India) would take the paintings and give free air tickets in return. As a result, the artists could travel to Czechoslovakia, Hong Kong, Paris. I did about four or five trips.” | ||

| + | |||

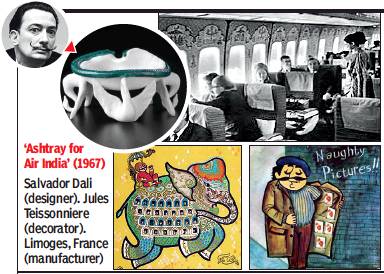

| + | There were other interesting ways of remunerating the artists. An ashtray — a porcelain shell surrounded by a serpent and supported by an elephant and swan — was commissioned to Salvador Dali, to be presented as a gift to first-class passengers. In return, Dali asked for a baby elephant, which was duly procured from the Bangalore zoo and sent to him. | ||

| + | |||

| + | ''' State of the art ''' | ||

| + | |||

| + | The works haven’t been opened for decades, and it is believed some of them have been lost, stolen or damaged. In June 2017, Jatin Das learned that his 1991 oil painting Flying Apsara, acquired by Air India, was for sale on the open market for Rs 25 lakh. Following investigations, a complaint was filed against a former Air India executive for stealing government property. Subsequently, it was reported that the airline was “examining how many more former or serving Air India officials could be in possession of such paintings”. | ||

| + | |||

| + | Last year, just before the pandemic hit, Air India organised a four-day exhibition of 7,000 artefacts and memorabilia in Mumbai. | ||

| + | |||

| + | Dass said that since 2016, there have been serious efforts to create a detailed inventory of all art pieces owned by Air India. While a bulk of the collection is in Mumbai, some works are also in erstwhile Air India offices in New York, Washington, Perth, Rome, Tokyo, Paris, and London. The effort is now to get them back, a tedious process given that they were sent out 30 to 40 years ago. | ||

| + | |||

| + | There are, however, no plans to use the artworks to raise funds. The ministries of Civil Aviation and Culture are working out an agreement to transfer the collection to Delhi and display it at a prominent museum. | ||

| + | |||

| + | “Even though the nation couldn’t afford the airline, we can surely create a dedicated museum to display this landmark collection, which unravels the India story, slice by slice,” Dass said. | ||

| + | |||

| + | == Salvador Dali== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F09&entity=Ar01114&sk=E982BF2C&mode=text Manju V, February 9, 2020: ''The Times of India''] | ||

| + | [[File: ‘Ashtray for Air India’ (1967) Salvador Dali (designer). Jules Teissonniere (decorator). Limoges, France (manufacturer).jpg|‘Ashtray for Air India’ (1967) Salvador Dali (designer). Jules Teissonniere (decorator). Limoges, France (manufacturer) <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F09&entity=Ar01114&sk=E982BF2C&mode=text Manju V, February 9, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: AERIAL HERITAGE- A six-day exhibition celebrating the national carrier’s golden era begins at Nehru Centre, Worli, on February 12.jpg|AERIAL HERITAGE- A six-day exhibition celebrating the national carrier’s golden era begins at Nehru Centre, Worli, on February 12 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F09&entity=Ar01114&sk=E982BF2C&mode=text Manju V, February 9, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Way back in 1967, Spanish surrealist Salvador Dali designed an ashtray for Air India and asked for a baby elephant in remuneration. Uttara Parikh, the then Air India deputy commercial director, went shopping to Byculla zoo for a baby elephant, only to be told that they didn’t have one to spare. She finally bought one from Bangalore zoo and Air India flew it to Spain, where a two-day national holiday was declared to welcome the calf. Dali had plans for the elephant. He wanted to cross the Alps, Hannibalstyle, on an Indian elephant; but was eventually dissuaded by his wife. Meanwhile, the elephant grew up in Spain. It died two years ago, in a Spanish zoo. | ||

| + | |||

| + | Photographs of archival material showcasing this and other such anecdotes, events, aircraft fleet inductions, vintage advertising posters, promotion material, calendars, sales letters, etc, plucked from Air India’s golden era will be open for the first time for public viewing in an exhibition titled ‘Itihaas ke panno se’ (from the pages of history). The six day exhibition, organised by the Society for Culture and Environment (SCE), begins on February 12 at Nehru Centre, Worli (more details are on the SCE’s website). It would narrate the story of Air India in ten different categories using 125 panels, films and talks by former Air India officials on subjects, including engineering, advertising, promotion, and inflight service. | ||

| + | |||

| + | The exhibition would also tell of the story of marketing genius: how the national airline, which only had a small fleet, carved out a distinctly Indian identity to gain global recognition alongside bigwigs such as TWA, PanAm, and AirFrance. Given that India has no museum dedicated to air travel, the exhibition would be a chance to look back at those glamorous days of air travel when airfares were identical across carriers and so passengers chose an airline for its punctuality and service. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

= Fleet = | = Fleet = | ||

| + | ==2017== | ||

[https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 Raj Chengappa , The endgame “India Today” 19/6/2017] | [https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 Raj Chengappa , The endgame “India Today” 19/6/2017] | ||

''' See graphic ''' | ''' See graphic ''' | ||

| − | [[File: Ageing fleet .jpg| Ageing fleet [https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 India Today]|frame|500px]] | + | [[File: Ageing fleet .jpg| Ageing fleet, 2017 [https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 India Today]|frame|500px]] |

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

=Irregularities= | =Irregularities= | ||

| Line 266: | Line 350: | ||

=Personnel issues= | =Personnel issues= | ||

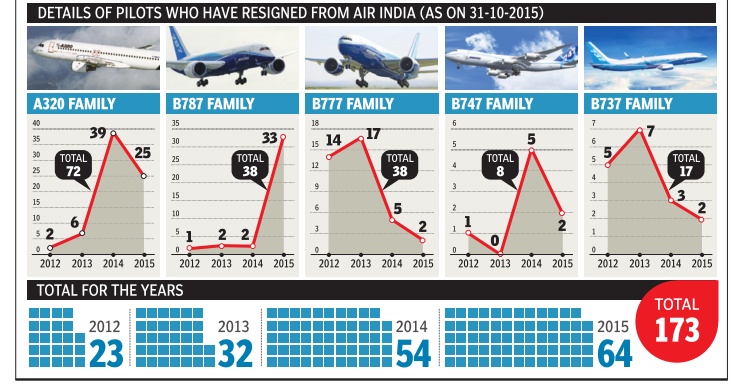

==Resignation of pilots, 2012-15== | ==Resignation of pilots, 2012-15== | ||

| + | [[File: Details of pilots who have resigned from Air India as on October 31, 2015.jpg|Details of pilots who have resigned from Air India as on October 31, 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=13_01_2016_009_039_005&type=P&artUrl=STATOISTICS-ON-AUTO-PILOT-THE-FLIGHT-OF-PILOTS-13012016009039&eid=31808 ''The Times of India''], January 23, 2016|frame|500px]] | ||

| + | |||

'''See graphic''': | '''See graphic''': | ||

''Details of pilots who have resigned from Air India as on October 31, 2015'' | ''Details of pilots who have resigned from Air India as on October 31, 2015'' | ||

| − | + | ||

| + | ==2019: 120 A320 first officers quit in 3-4 months== | ||

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2019/10/11&entity=Ar01502&sk=6944378A&mode=text Manju V, Oct 11, 2019: ''The Times of India''] | ||

| + | |||

| + | Air India has been witnessing an exodus of A320 first officers, with about 120 resignations submitted in the past 3-4 months alone, according to airline sources. These youngsters, who occupy the right-hand seat in a cockpit, have been serving their sixmonth notice period. | ||

| + | |||

| + | The reason for quitting ranges from low pay, no career progression and ready availability of jobs in other airlines. The exit hasn’t hit flight operations though as the airline has a surplus of first officers. | ||

| + | |||

| + | “These first officers were taken on a five-year fixed term contract. Most of them joined with only about 250 hours of flying experience, but they quit with 3,000 hours or so. The cost to AI is that of experienced crew leaving as the airline took so much effort to bring them up to a certain level,” said a source. | ||

| + | “These pilots were hired at a very low salary. The difference in their current salary structure and market rate would be more than Rs 1 lakh. Then again, the salary isn’t paid on time,” the source added. | ||

| + | |||

| + | An Air India spokesperson confir med that first officers have been resigning, but couldn’t give a number. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A | ||

| + | AIR INDIA]] | ||

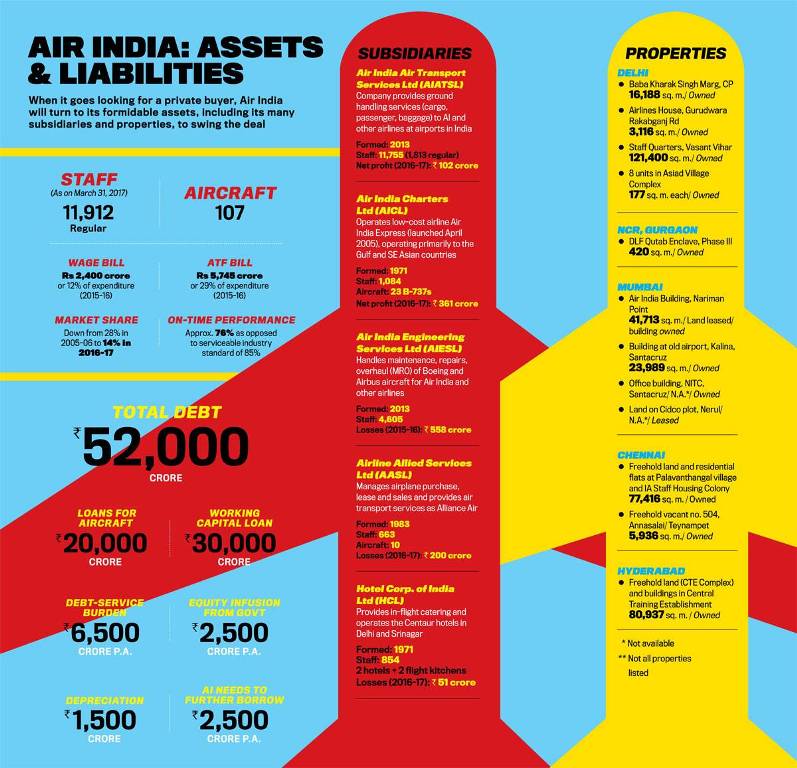

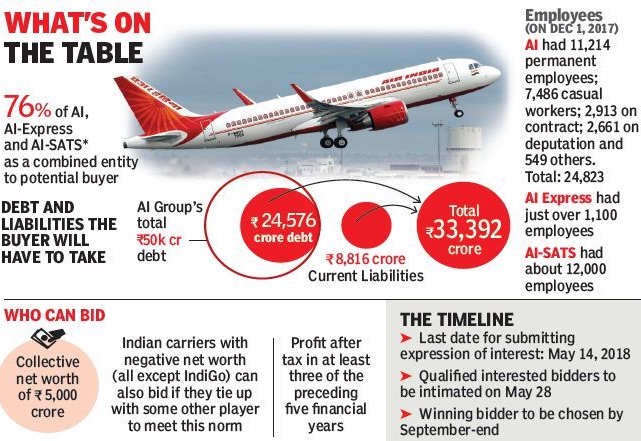

=Privatisation (attempts at)= | =Privatisation (attempts at)= | ||

| Line 362: | Line 464: | ||

The fate of the fat loans that banks have given to Air India remains unclear. In a situation where the majority of the revenues earned by the airline goes in paying the interest of these loans, it is unlikely that a new owner would be keen on carrying the burden of legacy. This leads to a possible situation where banks might have to take a haircut at a time when they are already saddled by growing bad loans. | The fate of the fat loans that banks have given to Air India remains unclear. In a situation where the majority of the revenues earned by the airline goes in paying the interest of these loans, it is unlikely that a new owner would be keen on carrying the burden of legacy. This leads to a possible situation where banks might have to take a haircut at a time when they are already saddled by growing bad loans. | ||

| + | |||

| + | |||

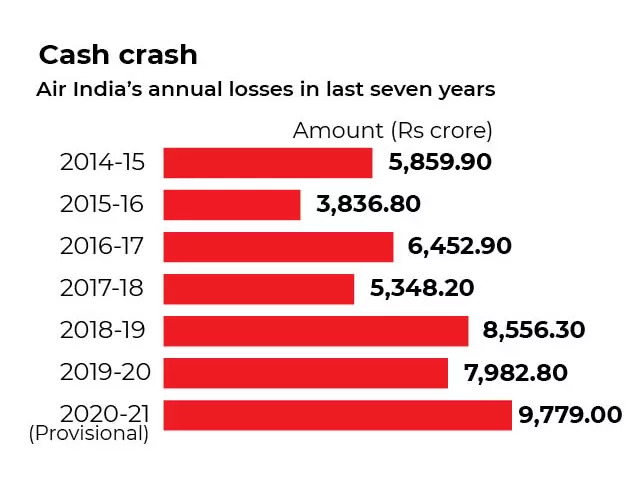

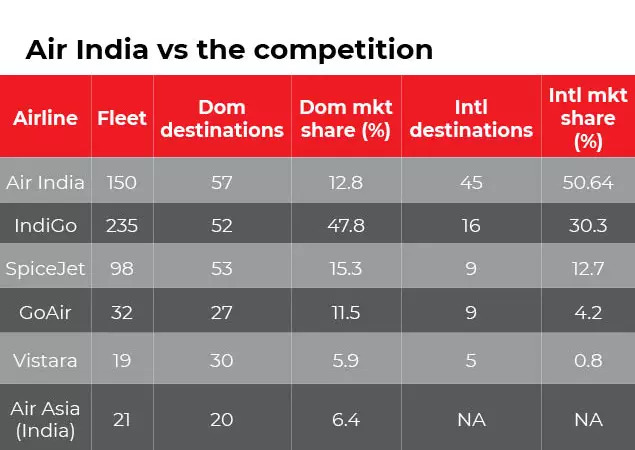

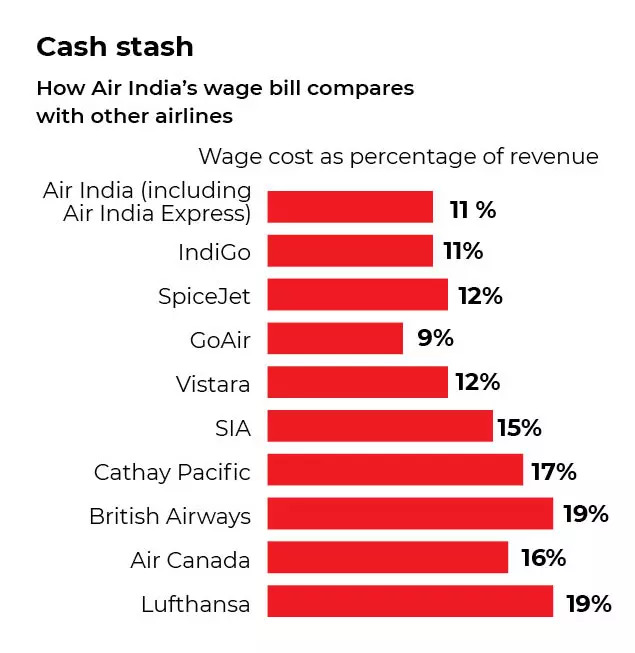

| + | ==Why Air India has very few takers: as in 2021 Sept== | ||

| + | [https://timesofindia.indiatimes.com/india/is-this-the-toughest-company-in-the-world-to-sell/articleshow/86342544.cms Sep 23, 2021: ''The Times of India''] | ||

| + | |||

| + | [[File: Air India's annual losses, 2014- 21, year-wise.jpg|Air India's annual losses, 2014- 21, year-wise <br/> From: [https://timesofindia.indiatimes.com/india/is-this-the-toughest-company-in-the-world-to-sell/articleshow/86342544.cms Sep 23, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: Air India vs the competition.jpg|Air India vs the competition <br/> From: [https://timesofindia.indiatimes.com/india/is-this-the-toughest-company-in-the-world-to-sell/articleshow/86342544.cms Sep 23, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: Wage cost as % of revenue.jpg|Wage cost as % of revenue <br/> From: [https://timesofindia.indiatimes.com/india/is-this-the-toughest-company-in-the-world-to-sell/articleshow/86342544.cms Sep 23, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: Employee per aircraft.jpg|Employee per aircraft <br/> From: [https://timesofindia.indiatimes.com/india/is-this-the-toughest-company-in-the-world-to-sell/articleshow/86342544.cms Sep 23, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: Employee costs at AISATS, 2014- 19.jpg|Employee costs at AISATS, 2014- 19 <br/> From: [https://timesofindia.indiatimes.com/india/is-this-the-toughest-company-in-the-world-to-sell/articleshow/86342544.cms Sep 23, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | From an airline that was the first in Asia to acquire a jet aircraft (a Boeing 707) in its fleet and which inspired the birth of Singapore Airlines (SIA), Air India today is struggling for resuscitation. The fact that the beleaguered airline company has become the unwanted poster child of neglect would surprise even Lee Kuan Yew (widely considered Singapore’s founding father and its former prime minister), who had conceptualised SIA along the lines of Air India, which was at the time considered the epitome of luxurious airline hospitality. | ||

| + | |||

| + | That only two entities — Tata Sons and SpiceJet — put in their bids for acquiring Air India, India’s flag carrier by the deadline of mid-September, is probably indicative that what was once India’s international pride is now an unwanted, debt-ridden liability. | ||

| + | |||

| + | ''' What ails Air India ''' | ||

| + | |||

| + | The airline had an accumulated loss of over Rs 80,000 crore, till March FY21 — which includes a confirmed loss of Rs 70,820 till FY20 and a provisional loss of Rs 9,779 crore for the year ending March 31, 2021. | ||

| + | |||

| + | Then there’s a total debt and liabilities amounting to Rs 90,000 crore, which includes a debt component of Rs 38,366 crore — that too after Rs 22,064 crore of debt was transferred to Air India Assets Holding Limited (AIAHL), a Special Purpose Vehicle (SPV). | ||

| + | However, more than the financial stress, it’s the culture that’s been fostered on the airline from outside — read, the government and politicians — as well as the one that’s bred from within which is the real albatross around the Maharaja’s apocryphal neck. A reflection of just how low the airline has fallen, is the disappearance of a painting by noted artist Jatin Das, titled ‘Flying Apsara’, which he made specially for Air India and which has somehow found its way to the open market. | ||

| + | |||

| + | An enquiry conducted to determine how the painting ended up in the open market revealed that the airline had managed to ‘lose’ Rs 750 crore worth of paintings — with the most likely reason being retiring executives and officials helping themselves to the precious artwork and artefacts, some of which date back to the ninth century, as ‘retirement gifts’. | ||

| + | |||

| + | Then of course there are the freebies — including complementary air tickets and upgrades — doled out to government officials and ministers, not to mention politicians and MPs of all hues, along with their family members, that have eroded the culture of profitability. | ||

| + | |||

| + | ''' Sputtering engines ''' | ||

| + | |||

| + | This is the third serious attempt made by the Centre to get rid of Air India, almost seven decades after it was nationalised — a move that many feel was the start of the airline’s decay and ruin. | ||

| + | |||

| + | The first serious bid was in 2001, when 40% of Air India’s and 26% of Indian Airlines’ equity was offered to the private sector. This came a cropper after the government of the day, headed by PM Atal Bihari Vajpayee, threw a last minute spanner in the works by ‘clarifying’ that any foreign airline desirous of bidding for Air India will need an Indian equity partner. That led to the likes of British Airways, Qantas, Delta and Air France — all of which had been shortlisted as potential suitors for Air India — to back off. | ||

| + | |||

| + | Even the Tatas, which had tied up with SIA to bid for the airline, walked away after SIA said it “was surprised by the intensity of opposition to the privatisation of Air India” and that “in such an adverse climate”, it wasn’t “confident that it can play a useful and effective role”. However, political opposition wasn’t the only headache SIA was suffering from — it had also suffered massive financial losses due to damage caused to its aircraft at the Colombo international airport when LTTE terrorists bombed it in 2001. | ||

| + | |||

| + | The plan to divest government control from Air India then went into cold storage during the UPA-1 regime as the Manmohan Singh-led government was crucially dependent on support from the Left parties, for whom privatisation is an unwelcome step. | ||

| + | |||

| + | The biggest snub to the airline’s privatisation however, came during the first tenure of the Narendra Modi government in 2018, when it issued an Expression of Interest (EoI) to sell 76% stake in Air India, along with low-cost airline Air India Express and a 50% stake in AISATS, a ground handling joint venture with Singapore Airport Terminal Services (SATS). | ||

| + | |||

| + | To its utter surprise and humiliation, it didn’t receive a single bid for what it thought would sell like hot-cakes. The reasons touted were many, chief among them being the government’s insistence that any new prospective owner of the airline would have to assume responsibility for its (till then) Rs 33,392 crore debt. There were other riders too, which made the divestment unappetising, such as the real estate component of Air India, which is worth several thousand crore (the last estimate, in 2012, pegged the total value of its real estate assets at Rs 5,000 crore), not being part of the sale, a condition that’s been persisted with for the latest bids received too. | ||

| + | |||

| + | Moreover, even though the government would have owned a minority 24% stake post-divestment, having it as an equity partner probably wasn’t appealing enough for any prospective bidder as it would have prevented it from merging Air India with any of its existing businesses. Additionally, the winning bidder not only had to stay invested for a minimum of three years but also had to give an undertaking that it will list the airline. | ||

| + | |||

| + | Added to that was what may have seemed like a rush job — the EoI was issued in March 2018, with the Centre setting a deadline of mid-May 2018 for putting in the bids — just a year ahead of the 2019 Lok Sabha polls, which tend to create their own nebula of political uncertainty. | ||

| + | |||

| + | ''' Final countdown? '''

| ||

| + | This is the third attempt by the government to sell Air India and the deal has been sweetened substantially for the potential winner. For one, the government is divesting complete ownership control of the airline by offering 100% of Air India and Air India Express’s equity, along with 50% equity in AISATS. Secondly, the new owner will only have to shoulder Rs 23,286.5 crore of the total debt, with the rest being transferred to the SPV, AIAHL. | ||

| + | |||

| + | Considering however that the entire process, which commenced in January 2020 when the EoI was issued, has taken more than 18 months with just two parties expressing interest, shows that this ‘groom’ doesn’t quite attract attention — even if it comes with a ‘dowry’ of 4,400 domestic and 1,800 international landing and parking slots at domestic airports, as well as 900 slots at airports overseas. | ||

| + | |||

| + | Whoever wins the bid will also have to contend with a haemorrhaging market share, with Air India’s domestic market share down from 20% in 2010 to 12.8% now and which, over the next three to four years, could dip even below 10% as 500 aircraft are scheduled for delivery to India’s private sector airlines. | ||

| + | |||

| + | ''' How the rot set in '''

| ||

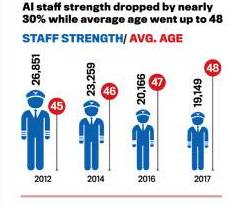

| + | While political interference and bureaucracy ate away the foundations of the airline over the years since its nationalisation, the merger with Indian Airlines was probably the last straw that broke the proverbial camel’s back. According to former Air India’s managing director Ashwani Lohani, the merger not only led to a bloated workforce but also a clash of work culture due to difference in pay structure and different aircraft inventory that led to an increase in costs. | ||

| + | |||

| + | Added to that was overspending on not just staff — many of whom were entitled to perks unheard of in other airlines, such as subsidised housing in posh metro localities and holiday homes at subsidised rates for both serving and retired employees — but also on aircraft. | ||

| + | |||

| + | The most notable instance of overspending came in 2004, when then Civil Aviation Minister Praful Patel upped the purchase order from 28 aircraft to 68, which were finally ordered in December 2005. Alongside, Indian Airlines placed a purchase order for 43 Airbus airplanes in February 2006, which led to the Comptroller and Auditor General (CAG) to term them a “recipe for disaster.” | ||

| + | |||

| + | The CAG in fact has come down heavily on both the airline and the Ministry of Civil Aviation, which considers the airline its personal fiefdom, for several financial irregularities. In its 2016 report, the CAG faulted both for a poor job in implementing the turnaround plan sanctioned by the UPA-2 government in 2012. The plan had also involved an equity infusion of Rs 42,182 crore in the beleaguered airline over a 20-year period from 2011-12 to 2031-32. | ||

| + | In its 2017 report, the auditor slammed Air India for selling five Boeing 777-200 long-range aircraft to Etihad below cost price and in the process, incurring a loss of Rs 671 crore. | ||

| + | |||

| + | ''' Tackling the workforce '''

| ||

| + | Perhaps the biggest fear for any bidder for Air India will be dealing with its heavily unionised, 14,000-plus workforce, with a total wage bill in excess of Rs 3,000 crore, constituting 11% of its revenue. This, however, compares favourably with the wage cost as a percentage of revenues of other airlines, both foreign and domestic. | ||

| + | |||

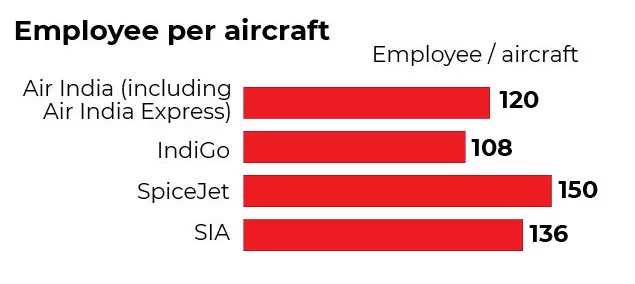

| + | In terms of employee per aircraft, Air India’s figure of 120 is higher than that of domestic market leader IndiGo, though it’s lower than that of SpiceJet and SIA. | ||

| + | |||

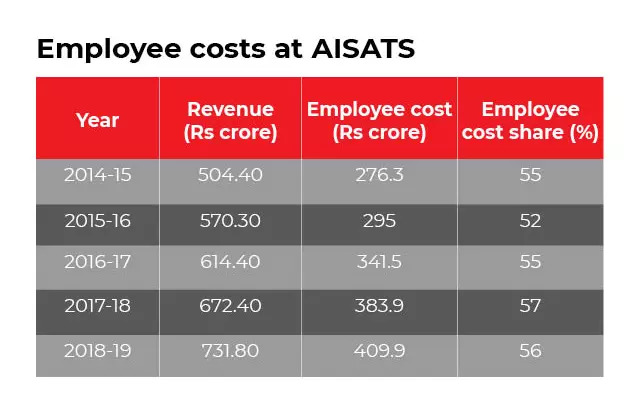

| + | Added to that are the 11,958 employees of AISATS where the new owner will be a 50% partner — the other 50% being with SATS — and where the wage bill is a whopping 56% of the total revenues. In 2018-19 for instance, nearly Rs 410 crore was the wage bill component of the unit’s nearly Rs 732 crore revenue. | ||

| + | |||

| + | |||

| + | |||

| + | '' Timeline of Air India’s disinvestment efforts '' | ||

| + | |||

| + | ''' 2000 ''' | ||

| + | |||

| + | * The Ministry of Disinvestment offered 40% stake in AI and 26% stake in Indian Airlines to a strategic investor, to be later followed by offering 20% stake in AI and 25% in Indian Airlines to employees, public and financial institutions | ||

| + | |||

| + | * Bids were received from Tata Sons with SIA, Ashok Leyland-Hinduja Group with Lufthansa, LN Mittal-Kotak Mahindra with British Airways and Qantas, SkyTeam Alliance that included Delta and Air France, the Indian Pilots’ Guild led by S P Verma and Videocon International which bid for Indian Airlines only in a consortium with two Asian airlines | ||

| + | |||

| + | * Centre insisted on foreign airlines partnering with Indian companies, following which most airlines withdrew | ||

| + | |||

| + | ''' 2001 ''' | ||

| + | |||

| + | * Tata-SIA also pulled out of the bid, citing political opposition and SIA suffering financial losses due to aircraft damaged in the LTTE Colombo airport bomb attack | ||

| + | |||

| + | ''' 2003 ''' | ||

| + | |||

| + | * Naresh Chandra committee report bats for privatising Air India and Indian Airlines but faces strong opposition | ||

| + | |||

| + | ''' 2004 ''' | ||

| + | |||

| + | * Privatisation plan shelved as Left parties are opposed and UPA-1 government depends on them for support | ||

| + | |||

| + | ''' 2007 ''' | ||

| + | |||

| + | * Air India merged with Indian Airlines to form National Aviation Company of India Ltd, later renamed Air India in 2010 | ||

| + | |||

| + | ''' 2017 ''' | ||

| + | |||

| + | * Air India privatisation approved by Centre | ||

| + | |||

| + | ''' 2018 ''' | ||

| + | |||

| + | * Expression of Interest (EoI) in selling 76% stake in Air India, along with low-cost airline Air India Express and 50% stake in AISATS, a ground handling joint venture with Singapore Airport Terminal Services (SATS) issued in March | ||

| + | |||

| + | * Conditions include absorbing Rs 33,392 crore (US$ 4.7 billion) debt with bids to be submitted by mid-May. No bid received | ||

| + | |||

| + | ''' 2020 ''' | ||

| + | |||

| + | * Government again lists Air India for divestment, in January, offering 100% stake in both Air India and Air India Express plus 50% in AISATS. However, as before, real estate assets to be excluded from divestment | ||

| + | |||

| + | * Original deadline for submitting bids, March 17, 2020, extended several times, with final deadline of September 15, 2021 | ||

| + | |||

| + | ==2021-22: Tata group now owns Air India== | ||

| + | Air India back to Tatas: Who gets what - Business News [https://www.indiatoday.in 28-Jan-2022] | ||

| + | |||

| + | |||

| + | |||

| + | Tata group now owns Air India through its subsidiary Talace. Control of the airline was officially handed over to the Tata group [in Jan 2022] by the Department of Investment and Public Asset Management (DIPAM). The conglomerate had made a successful bid of Rs 18,000 crore to buy Air India in October 2021. | ||

| + | |||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIA | ||

| + | AIR INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

= Staff = | = Staff = | ||

| Line 367: | Line 604: | ||

[https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 Raj Chengappa , The endgame “India Today” 19/6/2017] | [https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 Raj Chengappa , The endgame “India Today” 19/6/2017] | ||

| − | + | [[File:Staff woes .jpg| Staff woes [https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 ''India Today'']|frame|500px]] | |

| − | [[File:Staff woes .jpg| Staff woes [https://www.indiatoday.in/magazine/from-india-today-magazine/story/20170619-air-india-indian-airlines-merger-pm-modi-government-986551-2017-06-09 India Today]|frame|500px]] | + | |

| + | |||

| + | ''' See graphic ''': | ||

| + | |||

| + | '''Air India- Staff woes'' | ||

| + | =See also= | ||

| + | [[JRD Tata]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIA | ||

| + | AIR INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:India|A AIR INDIAAIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

| + | [[Category:Pages with broken file links|AIR INDIAAIR INDIAAIR INDIAAIR INDIA | ||

| + | AIR INDIA]] | ||

Latest revision as of 10:48, 30 July 2023

This is a collection of articles archived for the excellence of their content. |

Contents |

[edit] History

[edit] 1932-2018

Abhik Deb, March 29, 2018: The Times of India

From: Abhik Deb, March 29, 2018: The Times of India

It was June 28, 2017 -- when the Union Cabinet gave the 'in-principle nod' to divest the government's stake in the India's national carrier Air India. A gestation period of exactly nine months later, the plan attained fruition when the government offered to sell 76 per cent stake in AI to private bidders.

THE BIRTH OF A 'MAHARAJAH'

Air India's roots trace back to the year 1932- the year when India played its first test match even as the national hockey team grabbed yet another Olympic gold at Los Angeles. The year also witnessed Mahatma Gandhi giving a clarion call to relaunch the Civil Disobedience movement and amid the turmoil, Tata Sons patriarch, JRD Tata founded the country's first scheduled airline- Tata Airlines. JRD, who in 1929 became the first Indian licensed pilot, himself flew the first flight between Karachi and Mumbai (then Bombay). In 1946, Tata Airlines became a public limited company under the name of Air India. The same year, the iconic Maharajah mascot made its first appearance when when Bobby Kooka, Air India's Commercial Director and Umesh Rao, an artist with advertising agency J.Walter Thompson, together created the Maharajah. A few years later in 1953, under the Air Corporation Act, the government nationalised all existing airline assets.

FROM A KING TO 'A BEGGAR'

In an exclusive interview to TOI, Union minister of state for civil aviation Jayant Sinha said that the previous Congress-led UPA government had "reduced Maharajah to a beggar", making a reference to the carrier's debt burden of Rs 50,000 crore. While Sinha's comment makes for fine articulation, it would be a stretch to lay the blame squarely on the UPA government. The story of burgeoning debt and the bid to privatise Air India dates back to almost two decades ago. The idea was first conceived in 2000 when the Atal Behari Vajpayee-led NDA government decided to sell 51 per cent of equity of the erstwhile domestic airline Indian Airlines, with 26 per cent stake to a strategic partner. It also decided to allow disinvestment of 60 per cent of Air India, which was running international operations, with 26 per cent foreign entity stake. The move however was stalled by the then civil aviation minister Sharad Yadav of coalition partner Janata Dal (United). On his part, Jayant Sinha might put up the rebuttal that in 2012, the UPA government, in its second stint at the centre, ruled out privatisation of Air India and approved the infusion of Rs 30,000 crore in Air India till 2021.

In a deja vu of sorts, the latest bid to sell Air India too has run into criticism from the opposition and trade union bodies. But a government keen on economic reforms and free of coalition pulls and pressures means that the deal is likely to sail through this time-- provided it finds buyers. The successful bidder is expected to emerge by September-end.

THE MAHARAJAH'S LEGACY

Bobby Kooka, on conceiving the Maharajah mascot said, "He may look like royalty, but he isn't royal." The line quite aptly captures Air India's genesis- an infant independent India's idea aimed at literally touching heights, despite staying rooted to a socialist agenda of state-owned entities. On what the government will do to retain Air India's identity, Jayant Sinha said, "The brand name Air India will have to be retained...We have ensured AI has an independent existence for at least three years and that it remains a domestic airline with the substantial ownership and control with Indians". He further said that the government will create AI Asset Holding company, which will have non-core real estate and art collection of AI, among other things. The art and artefacts, which the airline has collected over the years will be handed over to the ministry of culture which will, in turn, give them to museums.

As for potential bidders, the Air India saga might come a full circle with Tata Sons-Singapore Airlines having expressing interest earlier. If that deal comes through it would be a homecoming for the Maharajah. IndiGo and an unidentified foreign player are also in the fray. Jet Airways is also reportedly waiting for the bid documents to decide on its next move while Qatar Airways too, wants to start an airline in India.

[edit] 1950s-1970s: glory days

Joeanna Rebello Fernandes|WHEN THE MAHARAJA WAS GLAM|Jul 16 2017: The Times of India (Delhi)

Now reduced to scrimping on meals, Air India was once the pinnacle of luxury travel. A look back at the days when Indians clicked photos with the Maharaja and washed down caviar with champagne The 1950s streets of Bombay glow phosphorescently in the dark as Mitter Bedi bikes from his Colaba studio to the airport in Santa Cruz. He goes into the terminal and sets to work. First in is a clan saying their goodbyes to a Londonbound son. Bedi shepherds them to an Air India logo, encourages them to relax and smile, and shoots. The airline's official photographer, Bedi spends his nights capturing that exotic species -the flying Indian. Air India, which has now been put on the block by the government, stood for something entirely different back then. The brand and product collaborated to give travellers the `magic carpet service', in the words of Bobby Kooka, Air India's commercial director and creator of its `Maharaja'.

Passengers arrived in style, in Chantilly lace saris, sky-high bouffants, doublebreasted suits and Bond Street brogues.First-timers came with families, with garlands and auspicious coconuts for a safe crossing. “People were photographed at the airport because flying at the time was so rare,“ says Sarla Bedi, Mitter's wife, “The photographs would later appear in newspaper supplements and families who desired a copy would have to get it from the newspaper.“

In the early `70s, travel writer Gustasp Irani made his first trip to the US on Air India. “My sister moved to the States, and I was sent a free Economy ticket. Even there people dressed up, and I remember wondering how the scruffy guy next to me managed to get in!' First-time fliers were initiated into AI etiquette with an illustrated booklet called `Better Acquainted', which dwelled on topics like dress-code, ticket cancellation, bathroom manners, and baggage allowance. Sample this: `When you fly with us, it is not necessary to dress like Trader Horn or Theodore Roosevelt on the eve of a visit to the Dark Continent. A safari has its points but mountains of bedding, snack-bite (sic) ointment and Man Friday at your elbow are not required.“

Irani travelled light, with no more than $8 in foreign exchange. So when a trolley selling miniature bottles of alcohol rolled past, Irani had to glumly watch it pass. “I only managed a drink when we were given a voucher, after stopping to refuel in Frankfurt,“ he says.

Naturally, the red carpet was laid thicker in First Class where the water for scotch cascaded from silver carafes. A 1960s First Class menu on the Boeing 707 was a roll-call of the finest: for hors d'oeuvres, caviar Malossol sur glace (Malossol caviar on ice) and pate de foie gras Strasbourg (Strasbourg goose liver paste); entrees included filet mignon. There was a generous cheese platter, and vermouth, sherry and champagne to wash it down.Today , their equivalents are shahi paneer, babycorn korma and palak kofta. Prawn, lamb and chicken are now available only on long-haul flights. Domestic passengers travelling short distances in Economy have been force-fed vegetarianism to ostensibly help Air India economise.

“Food was an important element of our service,“ says Firdausi Jussawalla, former deputy commercial director with the airline. “We had chefs from Centaur hotels (owned by AI's subsidiary Hotel Corporation of India) and the Taj Hotel help plan the menu,“ he says.

The now-much-travelled Gustasp Irani recalls how people lit up their cigarettes as soon as the No Smoking sign went off, which was even before the seatbelt sign went off! If you ran out of sticks, you could buy a carton on board. His sister was an air hostess till she got married (as was the rule until the late `70s), and he remembers the time JRD Tata was on the flight. The chairman (and founder) of the airline called his sister and told her to convey a message to the pilot: `You were six minutes too long on the runway'.

From the '50s to the '70s you travelled Air India in equal parts for the flight and the destination, unlike today, when most airlines are a purgatorial means to an end. “As a passenger you felt so welcome and wanted,“ says Bobby Sista, who helmed Sista Advertising until the '90s. Air India's fleet was growing; having distinguished itself as the world's first all-jet airline in June 1962, a decade later in 1971 it acquired its first Jumbo Jet, the Boeing 747. Sara Kapoor (name changed) joined Air India that year. It was the movie life for young people at the time, a chance to travel the world and live in posh hotels, and shop abroad.

These air hostesses were a glamorous set, some even featured in consumer product ads. A promotional film from 1962 called them `shimmering shepherdesses' and showed them gliding down the aisle in their silks, offering passengers hot towels and boiled candy . “Most of the passengers flying Air India in the '60s and '70s were businessmen, film stars, or people travelling to meet relatives,“ says Kapoor.

Meanwhile, on his return journey from America, Gustasp Irani had about as much luck as on his outward trip. “The Air India flight had stopped in Delhi. My co-passenger, being a domestic traveller, wasn't allowed to buy a whiskey . He requested me to buy two for him, which I did, thinking he'd let me have one. What he did, though, was down the first in one gulp, and then nurse the second.“

[edit] Aircraft, purchase of

[edit] 2023: largest order in world aviation history

From: February 15, 2023: The Times of India

See graphic:

In 2023, Air India placed the largest aircraft order in world aviation history

[edit] Air India Express

[edit] 2015-16: profits

AI Express reports ₹262cr profit for FY18, November 10, 2018: The Times of India

From: AI Express reports ₹262cr profit for FY18, November 10, 2018: The Times of India

Air India Arm In Green For 3rd Yr Amid Industry Turbulence

At a time when Indian carriers have been reporting losses, Air India Express — the lowcost arm of Air India — has reported a net profit of Rs 262 crore for the financial year 2017-18, down 11% from the previous fiscal’s Rs 297.

It’s the third consecutive year that AI Express has reported a profit. With the rupee depreciation and high fuel prices, what remains to be seen is whether the airline will manage to stay profitable this fiscal year too.

The airline’s statement added that it has been registering an operating profit for the last five years, and earned a net profit for the first time in 2015-16.

“The net profit earned in 2017-18 is particularly significant as the aviation sector had to face many challenges, including high input costs. Added to that was the sluggishness of Gulf economies where 90% of our capacities are deployed,” said K Shyam Sundar, CEO, Air India Express. “Unit costs have increased over the past 12 months due to a steady increase in global fuel rates. The average cost of fuel in March 2018 was about 20% more compared to what it was in March 2017,” he added.

However, prudent commercial and management interventions, including better utilisation of assets, contributed to the positive financial outcome, he added.

Air India Express increased its revenues by 8.7% to Rs 3,648 crore. “Average daily aircraft utilisation rose to 12.7 hours from 12.2 hours in the previous year,” the airline said. The number of passengers carried by the airline increased by 13.7% to 3.89 million from 3.42 million in 2016-17.

The year also saw Air India Express expanding its wings to markets out of Madurai, Coimbatore and Vijayawada. With a fleet size comprising 24 Boeing 737–800NG aircraft, the airline flies to 13 international and 18 Indian destinations, offering valuefor-money services to customers in tier II and III Indian cities.

[edit] Art collection

[edit] As in 2021

Divya A, Oct 16, 2021: The Indian Express

From: Divya A, Oct 16, 2021: The Indian Express

The ‘Maharajah collection’, as it is called, has over 4,000 works, including by Jatin Das, Anjolie Ela Menon, M F Husain and V S Gaitonde.

The Tata group has reclaimed Air India, but the priceless Air India art collection is not part of the deal and is likely to stay with the government. A look at what is in the collection, and why it is important:

The collection

The ‘Maharajah collection’, as it is called, has over 4,000 works, including by Jatin Das, Anjolie Ela Menon, M F Husain and V S Gaitonde. These were on display across Air India offices, and on its calendars, posters and menu cards. There are posters by cartoonist Mario Miranda as well as ads designed by The New Yorker cartoonist Peter Arno, besides paintings, textiles, sculptures, and traditional wooden and bronze artwork. No official estimate exists of the worth of the entire collection. As the airline expanded, so did the collection. But as computerised booking came in, some of the international booking offices were shut/streamlined, and the artworks were either sent back to Mumbai or stored elsewhere. Mumbai-based art historian and conservation architect Meera Dass, who is working on a book about the archive, said, “The airline always had the culture of being representative of the nation… The collection served that purpose — to present India as an ancient civilisation, but with a modern outlook.”

The collector

Air India bought its first set of six paintings for Rs 87.50 in 1956, from a novice art school graduate, B Prabha. The collection was built over more than six decades after Independence, driven by JRD Tata’s philosophy of “putting a little bit of India” in the booking offices of the erstwhile Tata Airlines. “He (JRD Tata) was a great nationalist and he used the airline’s booking offices outside India to expose the country’s art and artists to the world,” Dass said.

While some of the works were commissioned by the airline and some were bought for as low as Rs 50-500, others were bartered for air tickets to artists travelling abroad. In an interview, M F Husain had said: “They (Air India) would take the paintings and give free air tickets in return. As a result, the artists could travel to Czechoslovakia, Hong Kong, Paris. I did about four or five trips.”

There were other interesting ways of remunerating the artists. An ashtray — a porcelain shell surrounded by a serpent and supported by an elephant and swan — was commissioned to Salvador Dali, to be presented as a gift to first-class passengers. In return, Dali asked for a baby elephant, which was duly procured from the Bangalore zoo and sent to him.

State of the art

The works haven’t been opened for decades, and it is believed some of them have been lost, stolen or damaged. In June 2017, Jatin Das learned that his 1991 oil painting Flying Apsara, acquired by Air India, was for sale on the open market for Rs 25 lakh. Following investigations, a complaint was filed against a former Air India executive for stealing government property. Subsequently, it was reported that the airline was “examining how many more former or serving Air India officials could be in possession of such paintings”.

Last year, just before the pandemic hit, Air India organised a four-day exhibition of 7,000 artefacts and memorabilia in Mumbai.

Dass said that since 2016, there have been serious efforts to create a detailed inventory of all art pieces owned by Air India. While a bulk of the collection is in Mumbai, some works are also in erstwhile Air India offices in New York, Washington, Perth, Rome, Tokyo, Paris, and London. The effort is now to get them back, a tedious process given that they were sent out 30 to 40 years ago.

There are, however, no plans to use the artworks to raise funds. The ministries of Civil Aviation and Culture are working out an agreement to transfer the collection to Delhi and display it at a prominent museum.

“Even though the nation couldn’t afford the airline, we can surely create a dedicated museum to display this landmark collection, which unravels the India story, slice by slice,” Dass said.

[edit] Salvador Dali

Manju V, February 9, 2020: The Times of India

From: Manju V, February 9, 2020: The Times of India

From: Manju V, February 9, 2020: The Times of India

Way back in 1967, Spanish surrealist Salvador Dali designed an ashtray for Air India and asked for a baby elephant in remuneration. Uttara Parikh, the then Air India deputy commercial director, went shopping to Byculla zoo for a baby elephant, only to be told that they didn’t have one to spare. She finally bought one from Bangalore zoo and Air India flew it to Spain, where a two-day national holiday was declared to welcome the calf. Dali had plans for the elephant. He wanted to cross the Alps, Hannibalstyle, on an Indian elephant; but was eventually dissuaded by his wife. Meanwhile, the elephant grew up in Spain. It died two years ago, in a Spanish zoo.

Photographs of archival material showcasing this and other such anecdotes, events, aircraft fleet inductions, vintage advertising posters, promotion material, calendars, sales letters, etc, plucked from Air India’s golden era will be open for the first time for public viewing in an exhibition titled ‘Itihaas ke panno se’ (from the pages of history). The six day exhibition, organised by the Society for Culture and Environment (SCE), begins on February 12 at Nehru Centre, Worli (more details are on the SCE’s website). It would narrate the story of Air India in ten different categories using 125 panels, films and talks by former Air India officials on subjects, including engineering, advertising, promotion, and inflight service.

The exhibition would also tell of the story of marketing genius: how the national airline, which only had a small fleet, carved out a distinctly Indian identity to gain global recognition alongside bigwigs such as TWA, PanAm, and AirFrance. Given that India has no museum dedicated to air travel, the exhibition would be a chance to look back at those glamorous days of air travel when airfares were identical across carriers and so passengers chose an airline for its punctuality and service.

[edit] Fleet

[edit] 2017

Raj Chengappa , The endgame “India Today” 19/6/2017

See graphic

[edit] Irregularities

[edit] 2004-14: Purchase of aircraft

Neeraj Chauhan, `Blatant irregularities crashed Air India', May 31, 2017: The Times of India

Airline Bought 111 Planes For Rs 70,000Cr When Its Profit Was Just Rs 100Cr, Reveal CBI FIRs

The Central Bureau of Investigation's three FIRs in the `Air India scam', which took place during the UPA regime, have alleged blatant irregularities that hastened the downfall of the national carrier.

The FIRs, accessed by TOI, said the civil aviation ministry decided to purchase 111aircraft for Air India costing about Rs 70,000 crore at a time when the airline was showing a profit of about Rs 100 crore and didn't have the capacity to purchase even a few aircraft. Due to this particular decision, the airline immediately went into huge losses, which increased every year to reach tens of thousands of crores, the CBI said, quoting from the allegation levelled by activist-lawyer Prashant Bhushan in his PIL before the Supreme Court.

The FIRs mentioned an internal Air India report of 2000-01 which said the airline should only lease aircraft and not go for purchase.The view was overruled by the aviation ministry , the FIR said, quoting from Bhushan's allegations which led the SC to direct a CBI probe.

It was decided in 2004-05 that Air India will buy 68 aircraft instead of 28, as originally planned, a decision which quadrupled the expenditure from Rs 10,000 crore, as originally estimated, to Rs 44,000 crore. This apart, the government also decided to buy 43 planes for Indian Airlines at a cost of Rs 8,399 crore.

“Concerns regarding potential difficulties of Indian Airlines in successfully funding the acquisition process with a positive NPV (net present value) was raised within civil aviation ministry , but were ignored,“ the CBI FIR said, referring to one of the main allegations which led the court to direct the CBI to probe the alleged scam.

Interestingly , the CBI said the acquisition programme had been under consideration since 1996 but never got traction, until 2004 when it suddenly picked up speed. “Between August 2004 and December 2005, the proposals were formulated by Air India, approved by its board, examined and approved by ministry , Planning Commission, department of expenditure, group of ministers and the cabinet,“ the FIR said.

Not just that, Air India signed the contract with Boeing to buy 68 aircraft on the same day , December 30, 2005, that the government cleared the purchase order.

The CBI said NACIL (National Aviation Company of India Ltd), incorporated to merge Indian Airlines and Air India, had an equity base of only Rs 145 crore, yet it made a commitment to pay Rs 44,000 crore for procuring 111new aircraft. It said loans for the purchase were taken from US and Indian banks, pushing the airline into debt and huge losses.

Similarly, the CBI FIR into the leasing of planes said the ministry and officials of Air IndiaIndian Airlines decided to lease planes “dishonestly without due considerations regarding proper route study and marketing or price strategy“.

“The leasing was done despite airline running with very low load because of largescale aircraft acquisition and several flights, especially overseas flights running almost empty at a huge loss,“ the CBI said.

For example, Air India leased 15 expensive planes when it did not have pilots to fly the aircraft, the FIR said, emphasising that this was “known to everyone“.

In another instance of alleged irregularity , Air India dry leased four Boeing 777s for a period of five years in 2006 even when new planes for the airline were set to arrive in July 2007.

This “resulted in five Boeing 777s and five Boeing 737s standing idle, leading to an estimated loss of Rs 840 crore during 2007-2009“, the CBI said.

The third FIR to probe Air India giving up profitable routes and schedules for private airlines alleged that “foreign airlines were given unrestricted entry into India and major routes were given to them without taking any reciprocal benefits“.

Air India gave up Kolkata-Bangkok, Kolkata-Dhaka, Doha-Kochi, Kochi-Kuwait and domestic routes like Ahmedbad-Jaipur, MumbaiVadodara, Pune-Goa and MumbaiPatna and others.

“On all these routes, private airlines like Jet Airways, Kingfisher, Go Air, Indigo, Spicejet, Paramount Airways etc started operating and made profits,“ the FIR said.

On lucrative routes like Mumbai-Dubai and Mumbai-Doha, Air India reduced its flights and gave private airlines major market share, it added.

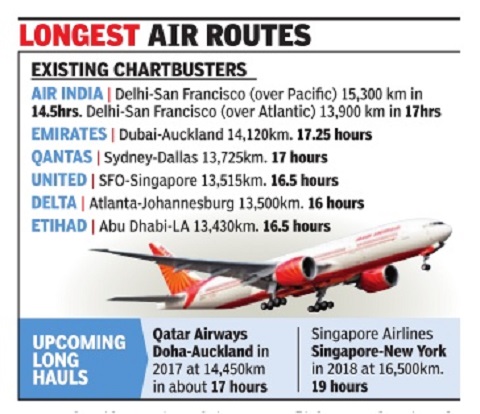

[edit] Longest flights

[edit] Delhi- San Francisco: 15,300 kilometres in 14.5 hours

Junks Atlantic Route, Covers Longer Distance Than Any Other Flight

Flying Delhi to San Francisco (SFO) over the Pacific Ocean instead of the Atlantic, as it had done till last week, has earned Air India the record of operating the world's longest nonstop flight.

The Pacific route is almost 1,400km longer than the Atlantic one, and the flight covered 15,300 kilometres in 14.5 hours.Despite the route being longer, the flight took almost two hours less thanks to tailwinds -winds that blow in the same direction as an aircraft and thus make it go faster.

“The Earth rotates from west to east, and winds flow in that direction too. Flying west means facing strong headwinds (that decreases an aircraft's actual ground speed), and flying east means getting strong tailwinds, which does the opposite,“ said a senior AI official. “While taking the (western) Atlantic route to SFO, we usually face headwinds of 24kmph. This means that if our aircraft is doing 800kmph, its actual ground speed is 776kmph. Taking the (eastern) Pacific route will mean getting tailwinds of 138kmph, which make the aircraft have an actual ground speed of 938kmph,“ the official added.

At 13,900km, the Atlantic route of AI's Delhi-SFO nons top flight made it the world's second-longest after Emirates' Dubai-Auckland (14,120km). Now, AI's Pacific route will remain the world's longest nonstop for two years, till Singapore Airlines launches the mother of all direct flights -Singapore-New York -that will cover 16,500km in 19 hours (see box). The four pilots, captains Rajneesh Sharma, Gautam Verma, MA Khan and SM Palekar, and the 10 cabin crew members who operated the first Delhi-SFO flight over the Pacific are ecstatic at setting this record.

“The aircraft took off from Delhi at 4am on Sunday (October 16) morning. We were in that date till Japan. After that, we crossed the international date line and were in October 15. By the time we landed in San Francisco, it was 6.30am on October 16 (local time in SFO),“ said one of the pilots.

The AI Delhi-SFO-Delhi flight now does a round trip of the world as it flies back to India over the Atlantic to get tailwinds on both the outbound and inbound flights.

The Boeing-777 200 long range used by AI on this route, on an average, burns 9,600 litres of fuel for each hour of flying. A shorter flying time on the Delhi-SFO route -by an hour in summer to three hours in winter -would mean huge fuel savings for the airline.

[edit]

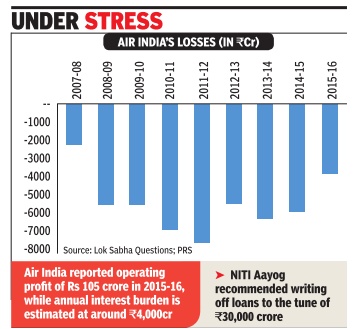

[edit] 2007-16

See graphic:

Air India’s losses, 2007-16

[edit]

ii) Air India’s losses, 2012-17; and

ii) Air India’s marketshare, 2012-17

From: January 9, 2018: The Times of India

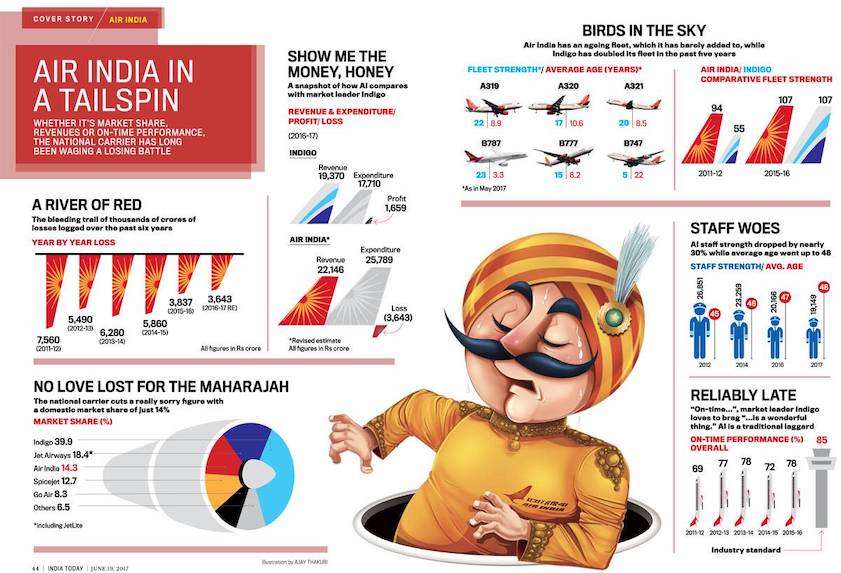

ii) Revenue/Expenditure: 2016-17; iii) Fleet strength/ average age (years), as in May 2017;

iv) Air India/Indigo- comparative fleet strength: 2011-16;

v) Domestic market share, Air India vis-a-vis other major airlines;

vi) Staff strength/ average age;

vii) On-time performance, overall: 2011-16, year-wise

From: Raj Chengappa, June 19, 2017: India Today

See graphics:

1. i) Taxpayers’ money given to Air India, 2014-18;

ii) Air India’s losses, 2012-17; and

ii) Air India’s marketshare, 2012-17

2. Air India: i) Losses: 2011-17;

ii) Revenue/Expenditure: 2016-17; iii) Fleet strength/ average age (years), as in May 2017;

iv) Air India/Indigo- comparative fleet strength: 2011-16;

v) Domestic market share, Air India vis-a-vis other major airlines;

vi) Staff strength/ average age;

vii) On-time performance, overall: 2011-16, year-wise

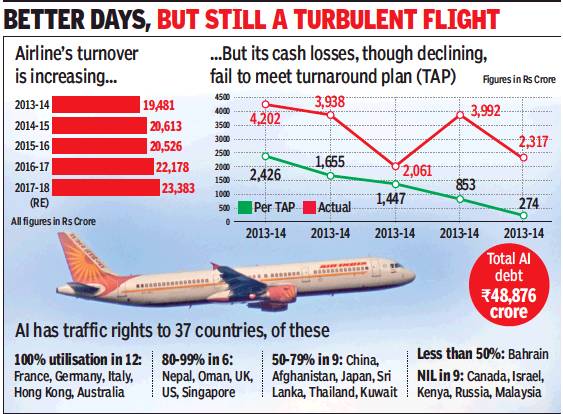

[edit] Turnover, 2013-18; Cash losses, 2013-14

Rajeev Deshpande, ‘AI facing cash deficit of ₹250cr every mth’, April 23, 2018: The Times of India

ii) Cash losses, 2013-14; and

iii) Total debt, , presumably as in March 2018

From: Rajeev Deshpande, ‘AI facing cash deficit of ₹250cr every mth’, April 23, 2018: The Times of India

No Fund For Spares Leaves Planes Idling

Air India is unable to purchase all the spares it needs, resulting in idling aircraft, due to a monthly cash deficit of Rs 200-250 crore that affects availability of funds for maintenance, the civil aviation ministry has candidly admitted.

The ministry has told Parliament’s Public Accounts Committee that a restricted cash flow was responsible for inoperational aircraft despite a turnaround plan (TAP) being in force since 2011 while fleet expansion had been hit by viability issues and an ongoing CBI probe into previous acquisitions.

“There is a cash deficit of Rs 200 crore to Rs 250 crore every month which affects availability of funds for procurement of spares,” the ministry told the PAC even as it said that “every attempt” was being made to devote maximum financial resources to availability of spares to improve utilisation of aircraft.

It needed $300 million accessed through external commercial borrowings to liquidate outstanding dues of foreign suppliers in 2015 to improve the situation as maintenance expenditure soaked up Rs 2,500 crore or 12% of the debt-laden airline’s operating expenditure.

An examination of AI’s functioning by the PAC is significant in the light of the government’s decision to disinvest 76% stake in the carrier. A parliamentary committee on transport, tourism and culture headed by Trinamool MP Derek O’Brien had opposed the plan but the draft report was “rejected” by NDA MPs on the panel.

The ministry told the PAC that aircraft engines earlier sent abroad for overhaul and repair were being maintained domestically. “AI is also in constant dialogue with its suppliers to remove the credit hold in order to maintain a smooth supply of spares for sustained and uninterrupted operations,” it said.

The ministry also stated that aircraft acquired on lease were grounded for around two months at the time of redelivery as a number of conditions had to be satisfied.

With a total debt totalling Rs 48,876 crore (governmentguaranteed Rs 25,388 crore and non-GOI guaranteed Rs 23,488 crore) AI’s cash situation remains perilous despite improvements in operating profits.

AI’s debt remains high as a key assumption or objective of the TAP — accumulation of Rs 5,000 crore by way of monetisation of properties — has not happened. As against Rs 500 crore being monetised every year, AI has managed only Rs 725 crore till date and reason is “defective title deeds” and a bar by the ministry of urban development on sale of property given the airline on “perpetual lease”.

Though AI’s turnover has been increasing, and the TAP and financial reconstruction plan has helped improve on time performance, load factor, aircraft utilisation, hiving off non-core assets and gaining equity support, cash losses remain high despite a declining trend. Also, plans to offer a VRS (voluntary retirement scheme) to employees was dropped as it was found to be financially unviable.

[edit]

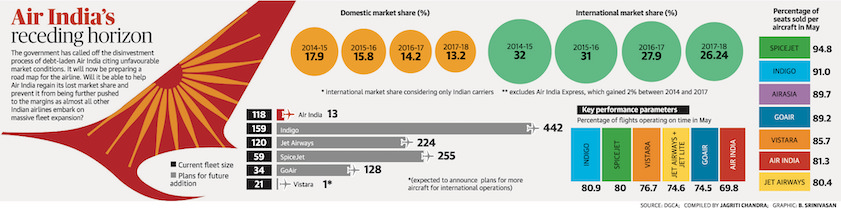

Percentage of seats sold per aircraft in May 2018

From: July 2, 2018: The Hindu

See graphic:

Air India- Domestic and International market share, 2014-17;

Percentage of seats sold per aircraft in May 2018

[edit] 2017: AI starts selling land in 13 cities

AI starts selling land in 13 cities, August 26, 2017: The Times of India

Air India has started to sell its land in 13 cities, including a prime land on Anna Salai here where it was once planning to build its city office. The land will be up for bidding soon.

The airline has decided to do an e-auction of properties at Chennai, Bengaluru, Mumbai, Kolkata, Ahmedabad, Goa, Lucknow, Bhuj, Nasik, Pune, Trivandrum, Gurugram and Gwalior. Most of the property are office blocks, land for residential blocks, flats and other assets.

The land and property are being auctioned as part of monetisation of assets plan which kicked in after the Cabinet cleared disinvestment of the airline. “Though the airline may be making money , the loan burden will pull down the value and will discourage investors,“ Aviation minister Ashok Gajapati Raju said.

[edit] 2017-18: 20% growth in revenue

Air India records 20% growth in revenue, May 13, 2018: The Times of India

HIGHLIGHTS

According to the DGCA, Air India had a market share of 13.4 per cent in March 2018.

With a fleet of over 150 aircraft, Air India currently boasts of over 2,500 international prime-time slots per week in 43 destinations and 3,800 domestic slots in 54 destinations

Air India has recorded a 20% growth in revenue in March-April 2018 and has embarked on a route analysis exercise, focussing on increasing flying hours of each of its aircraft, to add more trips, the airline's chairman-cum-managing director, Pradeep Singh Kharola, said.

The airline is focussing on improving the operational efficiency both in the domestic and international sectors even as it is buoyed over the load factor, on time performance and revenue growth, Kharola told PTI.

"During March-April, the revenue has increased by about 20 per cent as compared to the same period last year at roughly about Rs 3,000 crore, though expenses continue to remain high," he said, adding that the airline has benefitted from the overall growth in the aviation market.

He pinned high hopes on international routes, generating 70% of Air India's total revenue, stating that the new destinations such as Tel Aviv is giving good returns to the carrier.

The increase of frequency to the San Francisco route is expected to give the airline Rs 90 crore a month. "We are focussing on improving on the operational efficiency. We are doing our route analysis and all, finding out which are the more yielding routes and we are focussing on those routes.

"At the same time, we want to increase the flying hours of each aircraft, we are trying to push the number of hours so that with the same aircraft we can do more trips," Kharola said. According to the Directorate General of Civil Aviation, Air India had a market share of 13.4 per cent in March 2018.

With a fleet of over 150 aircraft, Air India currently boasts of over 2,500 international prime-time slots per week in 43 destinations and 3,800 domestic slots in 54 destinations.

Kharola, however, did not elaborate about the network analysis exercise or the new routes the airline is eyeing, especially in the international sector.

However, he hinted that the African continent promises to hold a better future for the airline.

In February, the civil aviation ministry said Air India has been "consistently improving" its overall performance and more than doubled its operating profit to Rs 298.03 crore in 2016-17.

During the same period, the airline's net loss widened to Rs 5,765.16 crore. In 2015-16, Air India had an operating profit of Rs 105 crore, while the net loss stood at Rs 3,836.77 crore.

The ailing airline has been put on the block with the government proposing to divest 76 per cent of its stake in the airline.

[edit] On-time performance

[edit] 2016: third worst in the world

AI ranked world's 3rd worst performer, co disagrees Jan 10 2017 : The Times of India

A report published by data services company FlightStats ranked the airline as the third worst global performer in terms of on-time performance (OTP) in 2016.

[edit] Personnel issues

[edit] Resignation of pilots, 2012-15

See graphic:

Details of pilots who have resigned from Air India as on October 31, 2015

[edit] 2019: 120 A320 first officers quit in 3-4 months

Manju V, Oct 11, 2019: The Times of India

Air India has been witnessing an exodus of A320 first officers, with about 120 resignations submitted in the past 3-4 months alone, according to airline sources. These youngsters, who occupy the right-hand seat in a cockpit, have been serving their sixmonth notice period.

The reason for quitting ranges from low pay, no career progression and ready availability of jobs in other airlines. The exit hasn’t hit flight operations though as the airline has a surplus of first officers.

“These first officers were taken on a five-year fixed term contract. Most of them joined with only about 250 hours of flying experience, but they quit with 3,000 hours or so. The cost to AI is that of experienced crew leaving as the airline took so much effort to bring them up to a certain level,” said a source. “These pilots were hired at a very low salary. The difference in their current salary structure and market rate would be more than Rs 1 lakh. Then again, the salary isn’t paid on time,” the source added.

An Air India spokesperson confir med that first officers have been resigning, but couldn’t give a number.

[edit] Privatisation (attempts at)

[edit] 2018, May: No takers for Air India

Saurabh Sinha, No takers for Air India as deadline expires, June 1, 2018: The Times of India

From: Saurabh Sinha, No takers for Air India as deadline expires, June 1, 2018: The Times of India

Expected Better Response, Says Aviation Secy

The government’s bid to sell off loss-ridden Air India has come a cropper with not a single entity showing interest in the national carrier till Thursday, the last day for doing so.

“As informed by the transaction adviser, no response has been received for the expression of interest (EoI) floated for the strategic disinvestment of AI. Further course of action will be decided appropriately,” the aviation ministry tweeted after 5 pm, the deadline for submissions.

Civil aviation minister Suresh Prabhu and his deputy Jayant Sinha opted to stay quiet on the failed attempt to sell the cash-guzzler even as they were busy tweeting about a pick-up in the economy.

Aviation secretary R N Choubey, who had on Wednesday expressed hope that bids would come even at the last hour, said on Thursday that the government had expected better response.

“It did not meet the expectations of participation that we had. Inputs will be taken from the transaction adviser on what went wrong and the plan is to reach the alternate mechanism (AI GoM) for solutions within a couple of weeks,” Choubey said, without commenting on whether AI privatisation will happen in the remaining tenure of this gover nment.

Terms of AI sale need to be tweaked: Govt officials

We would not want AI to lose market share and may discuss allowing the carrier to continue with their expansion plans in the interim (getting more planes and adding routes, which were put on hold due to the planned divestment),” Choubey said, indicating government will move swiftly in dealing with the problem child.

Airline executives, consultants and even government officials listed a number of issues that the government will need to resolve to ensure that the Maharaja gets a taker. Otherwise, no “bakra”— as former aviation minister A G Raju had said — will be found for the airline.

The key issues troubling investors are — fate of AI’s 27,000-strong workforce; Rs 50,000-crore debt-cum-losses; government offering 76% in the airline and retaining the balance. The bidder was expected to take on Rs 33,392 crore of this debt under the terms of sale that had no takers.

Now, with senior government officials admitting that the terms of sale will need to be tweaked if AI has to be privatised, there is little chance of that happening in the remaining term of this administration — which is being seen as a major setback to the most ambitious disinvestment taken up by PM Narendra Modi. A government official said that offering the entire equity would be a wiser option as private players want no government intervention.

“A big sell-off like Air India cannot happen in the last few months of a government’s tenure. Anyone expecting to put thousands of crores will be worried about how the deal will be viewed in case of a change in administration after the polls. As it is, taking on AI means acquiring huge issues and you do not want CBI, CVC and CAG running down your neck later on if the party selling AI does not return to power,” said a source.

A corporate entity, which had the first meeting with EY on AI sale, had raised the issue of elections being too close.

A group of ministers from finance, aviation and other ministries will prepare recommendation for FM -headed GoM, which will take the final call on what needs to be done for AI till the polls. EY will give its report to the government on the issues troubling potential investors, which need to be changed, if AI has to be sold.

The unions, which have been opposing the sale, are rejoicing. “No bids at the end of the day. Victory for Joint Forum in our endeavour of save AI,” a leader said.

The key issues troubling investors are — fate of AI’s 27,000-strong workforce; Rs 50,000-crore debt-cum-losses; government offering 76% and retaining the balance

[edit] Why AI could not be sold/ 2018