ABG Shipyard Ltd

This is a collection of articles archived for the excellence of their content. |

A backgrounder

As in 2022

Abhishek Sharan, March 21, 2022: The Times of India

From: Abhishek Sharan, March 21, 2022: The Times of India

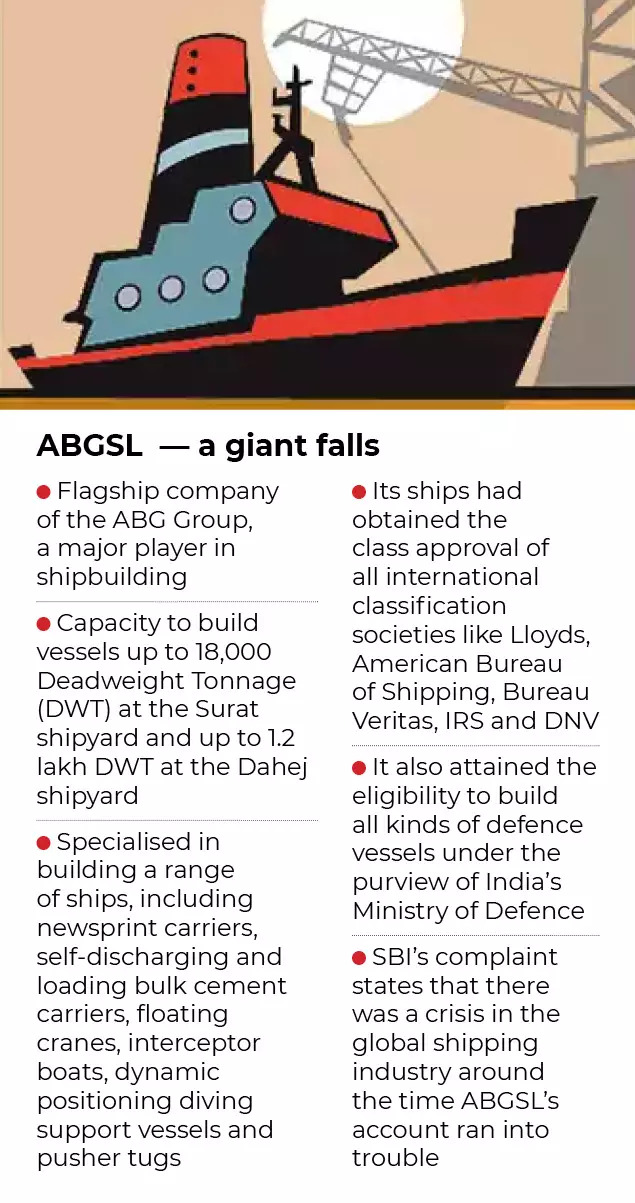

About a decade ago, Gujarat’s ABG Shipyard Ltd (ABGSL), which specialised in building a wide range of vessels, was the toast of the domestic marine industry. After a modest debut on March 15, 1985 and with the acquisition of Surat’s Magdalla Shipyard, ABGSL made rapid strides over the next two decades to become India's largest private-sector shipbuilding yard and service provider.

In 2012, it bagged the ‘Ship Building Company of the Year’ award instituted by Dun & Bradstreet, an American company that provides commercial data, analytics and insights for businesses. It also won the ‘All India Trophy for Highest Exporter’ from the government for five consecutive years. There were a slew of other recognitions.

How then did this company, which attained the distinction of building over 165 vessels, including 46 for export in the last 16 years, and saw a net profit of over ₹107 crore, come to be investigated for allegedly defrauding 28 banks to the tune of around ₹22,842 crore?

ABGSL — along with a group firm and five of its former top functionaries — are now being investigated by two central investigative agencies, the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED), for having allegedly cheating a 28-member bank consortium, including the largest public sector lender, the State Bank of India (SBI).

It is also the ‘biggest’ such probe in terms of money involved being handled by the CBI, way bigger than the ₹12,500-crore Punjab National Bank case against fugitive diamond merchant Nirav Modi and his uncle Mehul Choksi; and the ₹9,000-crore willful default case against former liquor baron Vijay Mallya and his defunct Kingfisher Airlines.

CBI spokesperson R C Joshi said that all five persons named as accused in its FIR are in India and there are Look Out Circulars (LOCs) issued against them at all exit points. Following the initiation of the probe by the CBI, the ED too has launched its money-laundering investigation to look into the suspected siphoning of loan proceeds.

What is CBI’s case? On February 7, the CBI registered an FIR, acting on a complaint from SBI’s Stressed Assets Management Branch, Mumbai, against ABGSL, its then CMD and ‘guarantor’ Rishi Kamlesh Agarwal. Besides Agarwal, the CBI also named ABGSL’s ex-executive director Santhanam Muthuswamy, ex-directors Ashwini Kumar, Sushil Kumar Agarwal and Ravi Vimal Nevetia and another ABG Group firm, ABG International. ABG International finds mention in the FIR as ‘corporate guarantor’. The FIR was registered in Delhi and Rishi Agarwal, a first-generation entrepreneur and founder-chairman of ABG Group, has already been questioned. Rishi Agarwal's lawyer, Vijay Aggarwal, who is based in Delhi, told TOI+: “My client Rishi Agarwal has given a detailed representation to CBI. My client has fully cooperated in the investigation and responded to CBI’s summons. He had resigned in 2008, when the loans outstanding were only ₹400 crores and those were repaid subsequently. It was a professionally-managed company, having nominees of the banks and independent directors on board, so everything was extremely transparent. So, my client has nothing to hide and moreover all documents are in the possession of the official liquidator. And my client shall continue to cooperate, as he believes in the law of the land and expects investigating agencies to be fair.” Apart from the ICICI Bank and SBI, the bank consortium included the erstwhile State Bank of Patiala and State Bank of Travancore (both merged with SBI in 2017). ABGSL had been in banking arrangements with SBI since 2001. SBI’s exposure with ABGSL is Rs 2,468.51 crore. How the money was diverted

While the FIR refers to “collusion” between the accused, and “diversion of funds” , the findings of a January 18, 2019 forensic report by Ernst & Young LLP are more revealing:

1) Alleged “payouts to related/linked parties”

This is the typical modus operandi adopted by companies to siphon of money borrowed from a bank. Create shell companies overseas, give them bogus contracts and make payments.

2) “Investment through overseas subsidiaries”

This essentially means that the money the shell companies received was invested in other businesses. So, what has happened is that the money borrowed from banks for funding a specific business has been diverted to make other investments.

3) "Property purchases made by related / linked entities (‘parties’) from funds provided by ABG Shipyard Limited.”

This is an old-fashioned way of diverting funds from a loan before beginning to default on repayments.

4) “Potential violation of CDR” (Corporate Debt Restructuring) arrangement and alleged “circular” transactions.

“Huge amounts were allegedly transferred by the said private company to its related parties and subsequently adjustment entries were made,” Joshi said, adding that “bank loans to the said company were diverted and huge investments were found to have been made in an overseas subsidiary. Also, that the funds from banks were diverted to purchase huge assets in the name of its related parties.”

How loans turned into NPA

ABGSL, which began accessing bank credits in 2001, saw its account turn into a Non Performing Asset (NPA) on November 30, 2013, due to poor performance.

The account was restructured on March 27, 2014, but that did not help. This was after the CBI began its probe.

At the meeting of the joint lenders held on April 10, 2018, a decision was taken to appoint Ernst & Young LLP as the forensic auditor.

According to the FIR, the audit report also suggested examination of possible role of public servants, even though “the banks do not suspect the role of their staffers in the alleged fraud by ABGSL.” Between April 2019 and March 2020, various other banks of the consortium also declared the account of ABGSL as “fraud” based upon the forensic audit report of January 2019.

After ABGSL found itself in a list of companies identified for insolvency proceedings, liquidation was initiated in 2019. ABGSL was then referred to the Ahmedabad bench of the National Company Law Tribunal (NCLT) for the corporate insolvency resolution process.

What next?

The CBI had conducted searches at 13 locations belonging to the accused, including offices and residential premises in Surat, Bharuch, Mumbai and Pune.

The agency has claimed the raids led to the recovery of “incriminating” documents, including books of accounts belonging borrower companies, purchase/sales details, minutes of meetings, share registers and contract files.

The agency is looking at financial records pertaining to the loan accounts and ABGSL’s transactions with group firms.

The CBI is in touch with the consortium banks to seek details, including documents, connected with sanctioning of loans and their disbursal.