Pensions and retirement: India

(→Global Pension Index 2015) |

(→Transfer from provident, superannuation funds) |

||

| Line 36: | Line 36: | ||

The return on NPS for central government employees for one year works out to 15.9% while for five years it stands at 11%. | The return on NPS for central government employees for one year works out to 15.9% while for five years it stands at 11%. | ||

| + | |||

| + | ==2017: Age limit relaxed== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/age-limit-relaxed-for-national-pension-system-nps/articleshow/61409676.cms Age limit relaxed for National Pension System, Nov 1, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | '''HIGHLIGHTS''' | ||

| + | |||

| + | Subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years | ||

| + | |||

| + | The choice of pension fund and investment option to remain same for subscribers | ||

| + | |||

| + | At a time when bank fixed deposits rates are falling, the government on Wednesday increased the age limit for joining the National Pension System (NPS). This small savings scheme is open for Indian citizens as well as for the non-resident Indians (NRIs). | ||

| + | |||

| + | The maximum age of joining the savings scheme under NPS-Private Sector (All Citizen and Corporate Model) is now increased to 65 years from the existing 60, a release from the Ministry of Finance stated. Any subscriber "between the age of 60-65 years can also join NPS and continue up to the age of 70 years," it added. | ||

| + | |||

| + | "With this increase of joining age, subscribers who are willing to join NPS at later stage of life will be able to avail the benefits of the scheme," it further said. | ||

| + | |||

| + | The choice of pension fund and investment option to remain same for subscribers joining after or before the age of 60 years. | ||

| + | |||

| + | To opt out from the scheme, the subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years. In this case, they are required to utilise at least 40 per cent of the corpus for purchase of annuity and the remaining amount can be withdrawn in lump-sum. | ||

| + | |||

| + | Pension fund regulator PFRDA said that the subscribers of NPS increased by 27 per cent to 1.78 crore at September-end. | ||

=Global Pension Index 2015= | =Global Pension Index 2015= | ||

Revision as of 09:10, 3 November 2017

This is a collection of articles archived for the excellence of their content. |

Contents |

National Pension System (NPS)

Transfer from provident, superannuation funds

`Fund transferred from PF to NPS not taxable', March 8, 2017: The Times of India

PFRDA Now Unveils Rules On Transfers

The pension regulator unveiled rules for transfer from recognised provident and superannuation funds to the National Pension System (NPS).

In the 2016-17 budget, the government had announced that subscribers from provident and superannuation funds would be able to transfer their corpus from these funds to NPS without any tax complications.

The Pension Fund and Regulatory Development Authority said any subscriber interested in such a transfer should have an active NPS Tier I account which can be opened either through the employer (where NPS is implemented) or through the points-of-presence (POPs) or online through eNPS on the NPS Trust website.

The regulator also made it clear that as per the provisions of the Income Tax Act, 1961, the amount transferred from recognised provident or superannuation fund to NPS was not treated as income for the current year and hence not taxable.

“Further, the transferred recognised provident fund superannuation fund will not be treated as contribution of the current year by employeeemployer and accordingly the subscriber would not make income tax claim of contribution for this transferred amount,“ the regulator said in a statement.

The subscriber presently under government, private sector employment should approach the recognised provident or superannuation fund trust through the current employer requesting transfer to the NPS account.

“The recognised provident fundsuperannuation fund trust may initiate transfer of the fund as per the provisions of the trust deed read with the provisions of the Income Tax Act,“ the pension regulator said.

In case of a government or private sector employee, the employee should request the recognised provident or superannuation fund to issue a letter to his present employer mentioning that the amount was being transferred from the recognised fund to the NPS Tier I account of the employee. This should be recorded by the present employer or POP as the case may be, while uploading the amount.

The return on NPS for central government employees for one year works out to 15.9% while for five years it stands at 11%.

2017: Age limit relaxed

Age limit relaxed for National Pension System, Nov 1, 2017: The Times of India

HIGHLIGHTS

Subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years

The choice of pension fund and investment option to remain same for subscribers

At a time when bank fixed deposits rates are falling, the government on Wednesday increased the age limit for joining the National Pension System (NPS). This small savings scheme is open for Indian citizens as well as for the non-resident Indians (NRIs).

The maximum age of joining the savings scheme under NPS-Private Sector (All Citizen and Corporate Model) is now increased to 65 years from the existing 60, a release from the Ministry of Finance stated. Any subscriber "between the age of 60-65 years can also join NPS and continue up to the age of 70 years," it added.

"With this increase of joining age, subscribers who are willing to join NPS at later stage of life will be able to avail the benefits of the scheme," it further said.

The choice of pension fund and investment option to remain same for subscribers joining after or before the age of 60 years.

To opt out from the scheme, the subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years. In this case, they are required to utilise at least 40 per cent of the corpus for purchase of annuity and the remaining amount can be withdrawn in lump-sum.

Pension fund regulator PFRDA said that the subscribers of NPS increased by 27 per cent to 1.78 crore at September-end.

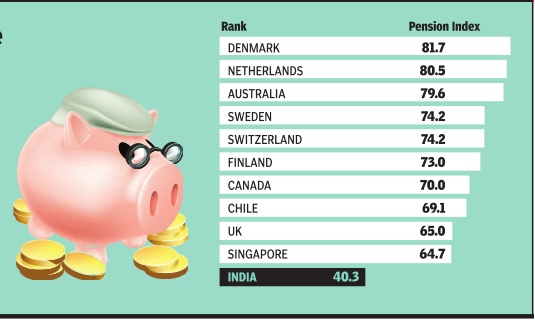

Global Pension Index 2015

The Times of India, Dec 13 2015

No country to retire

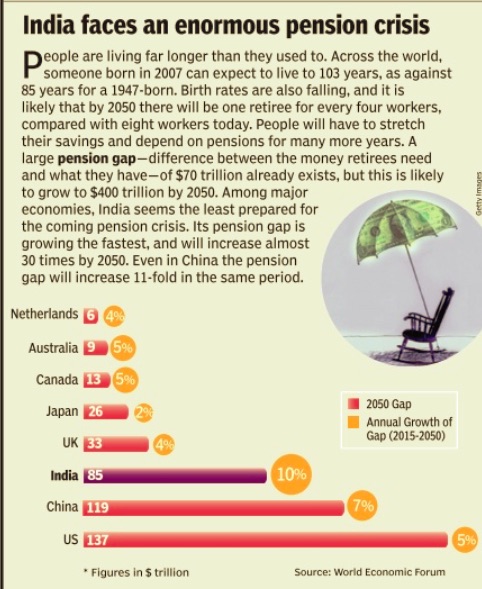

The Indian retirement system was ranked last worldwide, while Denmark topped the list of countries in the Melbourne Mercer Global Pension Index 2015. The MMGPI's seventh edition measured 25 retirement income systems against more than 40 indicators, under the sub-indices of adequacy, sustainability and integrity. In the process, it covered nearly 60% of the global population

Pension gap: 2015-2050 (expected)