Remittances: South Asia

| Line 45: | Line 45: | ||

“With the RBI now doubling the remittance figure, and overseas property proving to be attractive, investors are hoping for a tax break. The forthcoming Budget should consider this issue and re-introduce tax breaks on reinvestment in a house property overseas,“ says Naushad Panjwani, senior executive director, Knight Frank India. | “With the RBI now doubling the remittance figure, and overseas property proving to be attractive, investors are hoping for a tax break. The forthcoming Budget should consider this issue and re-introduce tax breaks on reinvestment in a house property overseas,“ says Naushad Panjwani, senior executive director, Knight Frank India. | ||

| + | |||

| + | =Outward remittances= | ||

| + | |||

| + | ==The remittance limit: 2015== | ||

| + | |||

| + | ''' Buying a house overseas easier now ''' | ||

| + | |||

| + | Mumbai | ||

| + | TIMES NEWS NETWORK [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Buying-a-house-overseas-easier-now-04022015027025 ''The Times of India''] Feb 04 2015 | ||

| + | |||

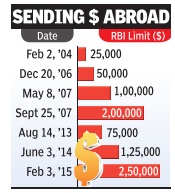

| + | '' RBI Increases Forex Remittance Limit To $250,000Year As Reserves Swell '' | ||

| + | |||

| + | [[File: remitances .jpg|2004-2015: changes in the outward remittance limit |frame|500px]] | ||

| + | Buying a house overseas, which used to be the preserve of the super rich, has now become a lot easier for wealthy Indians with the Reserve Bank of India doubling the foreign exchange remittance limit to $250,000 per individual per year. In other words, a family of four can remit $1 million (equivalent of Rs 6.2 crore) every year to purchase assets overseas. | ||

| + | With this move, the rupee has become almost fully convertible for most Indians. The funds remitted overseas can be used for almost any activity barring a few such as speculation in exchanges, funding terror groups or for remittances to Bhutan, Nepal, Mauritius and Pakistan. | ||

| + | |||

| + | According to Bank of India chairperson V R Iyer, the increase in the liberalized remittance scheme to $2.5 lakh reflects the confidence of the regulator in consistency in foreign inflows. | ||

| + | |||

| + | RBI governor Raghuram Rajan said on Tuesday the foreign currency remittance limit was relaxed following a review of the external sector outlook and as a further exer cise in macro prudential management. The central bank also said that it will ask the government to subsume under this limit various remit tances that an individual is allowed under the Foreign Exchange Management Act, which include donations, gift remittances and exchange facilities for those seeking employment overseas and for maintenance of close relatives abroad. Until now, this facility was in addition to remittance limits already available for private travel, business travel, studies, medical treatment, etc as described in Schedule III of Foreign Exchange Management (Current Account Transactions) Rules, 2000. | ||

| + | |||

| + | An improvement in the country’s foreign exchange re serves has emboldened the RBI to increase the limit. Announcing his policy , Rajan said the following the drop in oil prices the current account deficit has been comfortably financed by net capital inflows, mainly in the form of buoyant portfolio flows and supported by foreign direct investment inflows and external commercial borrowings. | ||

| + | |||

| + | “Accordingly, there was accretion to India’s foreign exchange reserves to the tune of $6.8 billion in Q3,” said Rajan. The sensex fell 122 points on Tuesday to close at 29,000 because of RBI’s decision to maintain status quo on rates and a sell-off in PSu banks due to worsening asset quality. FII selling added to the slide, dealers said. | ||

| + | |||

| + | The day’s session started on a better note with the index opening about 100 points higher. After the RBI said that it was keeping the key policy rates unchanged due to lack of data since its last rate cut, the index started giving up gains and at one point was down over 200 points. | ||

| + | |||

| + | In volatile trades, finally the index closed 0.4% lower with banking and financial services sector stocks among the top laggards. | ||

| + | |||

| + | While FIIs were net sellers in the stock market, in the debt segment they got more freedom to invest in the government securities market. In its policy, RBI allowed foreign investors to plough back their interest earnings from gilts into the same instrument, in effect increasing their exposure limit in government securities. | ||

| + | |||

| + | With the current FII gilt limit at $30 billion, at the current gilt yield, foreign investors can invest an additional $2.5 billion in gilts next year, bond dealers pointed out. This will also help in government’s debt auction by channelizing more funds into the gilt market, they said. | ||

Revision as of 07:03, 28 February 2015

This is a collection of articles archived for the excellence of their content. |

BRIDGING THE GULF The Times of India Dec 01 2014

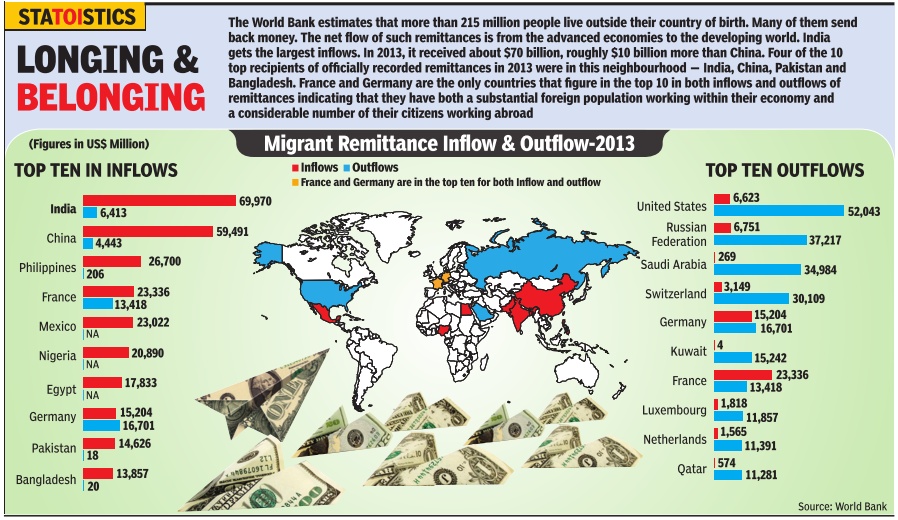

India gets the highest amount of remittances in the world at roughly $70 billion, almost three times the amount of FDI that comes into the country. Where does all this money come from? Data shows that the bulk of remittances come from three different categories of countries: Middle Eastern monarchies such as Qatar, Western developed nations such as the US or Australia, and next door neighbors such as Bangladesh and Nepal. By far the largest amount comes from the Gulf countries -Qatar, Bahrain, Oman, Saudi Arabia, and Kuwait -which sent a combined $32.7 billion, almost half of all remittances received.

Contents |

Migrant remittances: 2013

Outward remittance norms,2015:Overseas house purchases

Feb 05 2015

RBI's new remittance norm: No tax breaks may hit overseas home buys

Lubna Kably

The Reserve Bank of India's (RBI's) recent move, which doubled overseas remittances for individuals up to $2,50,000 (Rs 1.5 crore) per individual per year, may tempt many to buy property overseas. Today , property prices in Dubai and some areas in the United States are attractive for Indian investors.A cursory glance at a few international property portals shows that a one-bedroom house in Dubai costs upwards of 9,50,000 UAE dirhams, or Rs 1.5 crore approximately . In Boston, USA, a similar-sized flat is available for $1,50,000 (upwards of Rs 90 lakh). These prices fall well within the now enhanced permissible remittance figures. However, tax professionals caution that buyers who wish to sell their house property or other assets in India (for instance, a shop or even jewellery) and reinvest the long-term capital gains in a residential property overseas should note that tax exemptions are no longer available for such reinvestments.

Sections 54 and 54F, which earlier permitted investors to claim a capital gains tax exemption even if the reinvestment was in a house property overseas, was amended by last year's Budget -effective from April 1, 2014.

Prior to this amendment, section 54 provided that, where capital gains arise from the transfer of a residential house (held for three years or more) and the tax payer reinvests the capital gains in a new residential house whether by way of purchase or construction within a certain period, the capital gains to the extent re-invested would be exempt.

Section 54F provided for similar exemptions for long term capital gains arising on sale of assets other than a residential property .

Thus, earlier, there was no explicit bar on capital gains being denied if the capital gains were re-invested in a residential house overseas. “Even tax tribunals had upheld the tax benefits in cases where re-investments were made in a house overseas. For instance, in the case of Vinay Mishra, a tax payer who had reinvested in a house property in Singapore, the Bangalore tax tribunal had held that the claim under section 54 could not be rejected. It had also added that the tax payer had not violated the law by purchasing the new house in Singapore utilizing the consideration on sale of his residential house in India. Subsequently, the Chennai tax tribunal also took a similar view. However, the amendment to the tax law by the Finance Act, 2014, has overturned these decisions,“ explains Sonu Iyer, tax partner at EY.

The Finance Bill, 2014 (providing for tax provisions applicable for the financial year April 1, 2014 to March 31, 2015) was tabled in the Parliament on July 10, 2014. As of this date, RBI's liberalized remittance scheme prohibited individuals from remitting money overseas for purchase of property .Thus, the amendment in the Income Tax Act of prohibiting capital gains exemption on reinvestment in a house property overseas had little or no adverse impact.

“With the RBI now doubling the remittance figure, and overseas property proving to be attractive, investors are hoping for a tax break. The forthcoming Budget should consider this issue and re-introduce tax breaks on reinvestment in a house property overseas,“ says Naushad Panjwani, senior executive director, Knight Frank India.

Outward remittances

The remittance limit: 2015

Buying a house overseas easier now

Mumbai TIMES NEWS NETWORK The Times of India Feb 04 2015

RBI Increases Forex Remittance Limit To $250,000Year As Reserves Swell

Buying a house overseas, which used to be the preserve of the super rich, has now become a lot easier for wealthy Indians with the Reserve Bank of India doubling the foreign exchange remittance limit to $250,000 per individual per year. In other words, a family of four can remit $1 million (equivalent of Rs 6.2 crore) every year to purchase assets overseas. With this move, the rupee has become almost fully convertible for most Indians. The funds remitted overseas can be used for almost any activity barring a few such as speculation in exchanges, funding terror groups or for remittances to Bhutan, Nepal, Mauritius and Pakistan.

According to Bank of India chairperson V R Iyer, the increase in the liberalized remittance scheme to $2.5 lakh reflects the confidence of the regulator in consistency in foreign inflows.

RBI governor Raghuram Rajan said on Tuesday the foreign currency remittance limit was relaxed following a review of the external sector outlook and as a further exer cise in macro prudential management. The central bank also said that it will ask the government to subsume under this limit various remit tances that an individual is allowed under the Foreign Exchange Management Act, which include donations, gift remittances and exchange facilities for those seeking employment overseas and for maintenance of close relatives abroad. Until now, this facility was in addition to remittance limits already available for private travel, business travel, studies, medical treatment, etc as described in Schedule III of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

An improvement in the country’s foreign exchange re serves has emboldened the RBI to increase the limit. Announcing his policy , Rajan said the following the drop in oil prices the current account deficit has been comfortably financed by net capital inflows, mainly in the form of buoyant portfolio flows and supported by foreign direct investment inflows and external commercial borrowings.

“Accordingly, there was accretion to India’s foreign exchange reserves to the tune of $6.8 billion in Q3,” said Rajan. The sensex fell 122 points on Tuesday to close at 29,000 because of RBI’s decision to maintain status quo on rates and a sell-off in PSu banks due to worsening asset quality. FII selling added to the slide, dealers said.

The day’s session started on a better note with the index opening about 100 points higher. After the RBI said that it was keeping the key policy rates unchanged due to lack of data since its last rate cut, the index started giving up gains and at one point was down over 200 points.

In volatile trades, finally the index closed 0.4% lower with banking and financial services sector stocks among the top laggards.

While FIIs were net sellers in the stock market, in the debt segment they got more freedom to invest in the government securities market. In its policy, RBI allowed foreign investors to plough back their interest earnings from gilts into the same instrument, in effect increasing their exposure limit in government securities.

With the current FII gilt limit at $30 billion, at the current gilt yield, foreign investors can invest an additional $2.5 billion in gilts next year, bond dealers pointed out. This will also help in government’s debt auction by channelizing more funds into the gilt market, they said.