Foreign Portfolio Investments (FPI): India

m (Pdewan moved page Foreign Portfolio Investors (FPI): India to Foreign Portfolio Investments (FPI): India) |

(→Private equity investors) |

||

| Line 57: | Line 57: | ||

There has been a nearly 50 per cent upswing in average deal value as private equity investors write larger cheques in chasing unprecedented buyout opportunities in the country. A Bloomberg report said Indian M&A deals have already crossed $100 billion in the current calendar as private equity, along with sovereign wealth and global pension funds, join a slug fest with strategic buyers to snap up assets in the world’s fastest growing major economy. | There has been a nearly 50 per cent upswing in average deal value as private equity investors write larger cheques in chasing unprecedented buyout opportunities in the country. A Bloomberg report said Indian M&A deals have already crossed $100 billion in the current calendar as private equity, along with sovereign wealth and global pension funds, join a slug fest with strategic buyers to snap up assets in the world’s fastest growing major economy. | ||

| + | |||

| + | =India vis-à-vis the world= | ||

| + | ==2021, till Aug: India vis-à-vis China== | ||

| + | [[File: Foreign Portfolio Investments in India vis-à-vis China, in 2021, till Aug.jpg| Foreign Portfolio Investments in India vis-à-vis China, in 2021, till Aug <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/08/31&entity=Ar01502&sk=C68C7051&mode=image August 31, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Foreign Portfolio Investments in India vis-à-vis China, in 2021, till August '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|F FOREIGN PORTFOLIO INVESTORS (FPI): INDIA | ||

| + | FOREIGN PORTFOLIO INVESTMENTS (FPI): INDIA]] | ||

| + | [[Category:India|F FOREIGN PORTFOLIO INVESTORS (FPI): INDIA | ||

| + | FOREIGN PORTFOLIO INVESTMENTS (FPI): INDIA]] | ||

=Year-wise developments= | =Year-wise developments= | ||

Revision as of 21:44, 6 September 2021

This is a collection of articles archived for the excellence of their content. |

Contents |

Rules, norms

Revised KYC norms/ 2018

Sebi issues revised KYC norms for FPIs, September 22, 2018: The Times of India

Markets regulator Sebi issued revised KYC norms for foreign portfolio investors (FPIs), wherein resident as well as non-resident Indians (NRIs) have been permitted to hold non-controlling stake in such entities.

Two circulars pertaining to KYC requirements and eligibility conditions for FPIs have been issued. These norms have been put in place weeks after a panel suggested various changes to the guidelines proposed earlier, amid concerns in certain quarters that overseas funds might face difficulties in ensuring compliance.

NRIs, overseas citizens of India (OCIs) and resident Indians (RIs) have been permitted to hold non-controlling stake in FPIs. There would also be no restriction on them to manage non-investing FPIs Sebi-registered offshore funds as well as registered investment managers, according to the regulator.

These entities would be allowed to be constituents of FPIs subject to certain conditions. If single and aggregate NRI/OCI/ RI holding is below 25% and 50%, respectively, of the assets under management (AUM) in the FPI, then such entities would be permitted to be constituents of the FPI.

According to Sebi, FPIs can be controlled by investment managers (IMs) — which are controlled and/or owned by NRIs, OCIs, or RIs. In this regard, the conditions include that the investment manager is appropriately regulated in its home jurisdiction and registers itself with Sebi as non-investing FPI.

Among others, a non-investing FPI can be directly or indirectly owned or controlled by an NRI, OCI or RI.

Private equity investors

2010-17

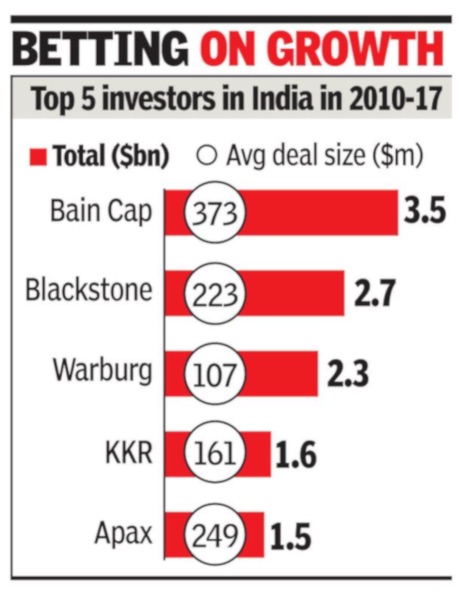

From: Boby Kurian, Bain tops global peers with $3.5 billion in 7 years, September 25, 2018: The Times of India

Bain Capital has made the biggest deployment of funds among private equity investors in India since 2010, signalling its commitment to Asia’s third-largest economy, said John Connaughton, co-managing partner of the firm controlling $95 billion in assets globally.

Bain invested about $3.5 billion in select large deals — including its $1-billion deals in private lender Axis Bank and BPO major Genpact — ahead of its more prolific global peers Blackstone and Warburg Pincus.

“We are not momentum investors flying in and out. We have built one of the largest teams in India with four managing directors, which has stayed on with the firm since joining. India (along with Japan & China) comprise a core market as part of our Asia-Pacific investment strategy,” Connaughton said in an interview last week.

“We work with the managements of the top-three leading companies in any sector to help them achieve their full potential. We follow a certain discipline and rely on insights to offer fundamental value-added strategies to the managements,” he added, while in Mumbai to mark the Boston-headquartered firm’s 10th anniversary of Indian operations. Connaughton said Bain was bullish about its biggest bet — $1.06 billion made in Axis Bank last year — as it “demonstrates our conviction” on prospects of private sector lenders in a high-growth economy. “We have provided them with capital to help them with provisioning in line with RBI guidelines, and grow in order to ultimately improve ROE (return on equity).”

He added, “It’s still early days, especially since the bank is in the midst of top-level changes, but we are hopeful about it delivering to our expectations.” Earlier this month, Axis Bank announced Amitabh Chaudhary, who spearheaded HDFC Standard Life previously, as the new CEO to succeed Shikha Sharma. Connaughton said the firm’s playbook of discipline, relying on insights beyond the obvious and large cheques meant there could be long periods of no deal activity. Bain Capital India MD Amit Chandra said, “This helps us to cut out the noise and lean in or lean back. You may see us doing a deal once in 12 or 18 months, and not do a deal every six months or so.”

Bain’s average Indian deal size was $373 million compared to $249 million of Apax Partners and $223 billion by Blackstone. The data is based on pure-play private equity deals in the last seven years and excludes investments in infrastructure and real estate. Bain’s other Indian deals were in two-wheeler giant Hero MotoCorp, engineering services company Quest Global and Emcure Pharma. Limited Partners or LPs — an industry parlance for sovereign wealth, global pension plans and university endowments providing firepower to private equity funds — co-invested with Bain in some of its bigger deals.

Bain Capital launched its credit unit through a joint venture with Ajay Piramal Group last year as India Inc and lenders grapple with more than $200 billion of non-performing loans. It invests in a full spectrum of credit strategies such as leveraged loans, distressed debt, special situations and structured products. Bain Capital Credit and the Piramals were in the midst of raising a fund currently.

Connaughton said Bain was following the market dislocations caused by the distressed debt pile-up in the country. “We look out to fix balance sheet issues in fundamentally good assets that are under-performing and help them become productive again,” he added. In context, he said India’s Insolvency and Bankruptcy Code offered a workable and practical framework that didn’t exist previously.

“But like everywhere, enacting laws and practising them are entirely different things,” he said, while adding that frameworks, implementation and setting of precedents were all equally important in making the bankruptcy code a success.

Private equity investments in India touched a record high of $25 billion across 639 deals in 2017, up from $16.5 billion from 829 deals in the previous calendar, according to PwC data.

There has been a nearly 50 per cent upswing in average deal value as private equity investors write larger cheques in chasing unprecedented buyout opportunities in the country. A Bloomberg report said Indian M&A deals have already crossed $100 billion in the current calendar as private equity, along with sovereign wealth and global pension funds, join a slug fest with strategic buyers to snap up assets in the world’s fastest growing major economy.

India vis-à-vis the world

2021, till Aug: India vis-à-vis China

From: August 31, 2021: The Times of India

See graphic:

Foreign Portfolio Investments in India vis-à-vis China, in 2021, till August

Year-wise developments

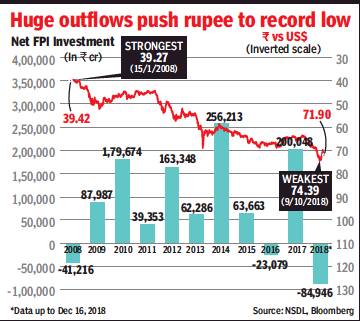

2008-18: net FPI investment

From: December 17, 2018: The Times of India

See graphic:

2008-2018- net FPI investment

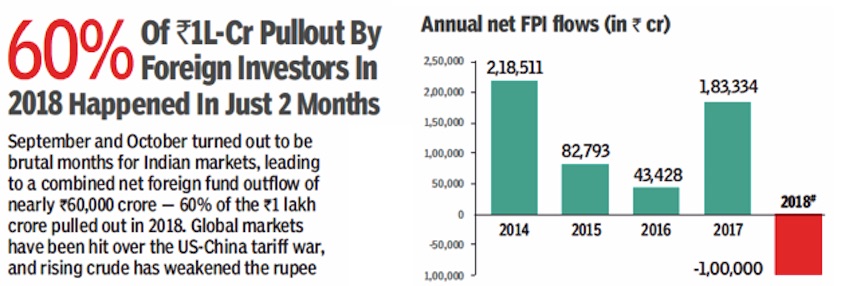

2014-17, inflows; 2018: outflow

From: November 4, 2018: The Times of India

From: November 4, 2018: The Times of India

See graphics:

2014-18, inflows and outflows of Foreign Portfolio Investment in India- Part I

2014-18, inflows and outflows of Foreign Portfolio Investment in India- Part II

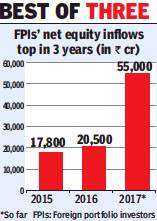

2015-17: inflows

Indian mkts get $30bn foreign inflows in 2017, December 18, 2017: The Times of India

From: Indian mkts get $30bn foreign inflows in 2017, December 18, 2017: The Times of India

Foreign investors are flocking to the Indian capital markets in a big way with a net inflow of over $30 billion (nearly Rs 2 lakh crore) of so-called ‘hot money’ in 2017, with equities alone getting over $8 billion (over Rs 50,000 crore) — an amount bigger than the cumulative investment of the previous two years.

The Indian stock market seems to have regained its status as one of the most favoured destinations for foreign portfolio investors (FPIs), as they have taken their net investment position in equities so far in 2017 to Rs 55,000 crore — the highest in three years after Rs 20,500 crore in 2016 and Rs 17,800 crore in 2015.

But this remains a far cry from the heady levels seen earlier — Rs 97,000 crore in 2014, Rs 1.13lakh crore in 2013 and Rs 1.28 lakh crore in 2012. However, a sharper turnaround was seen in 2017 in terms of FPI inflows into debt markets where the net investments soared to a staggering Rs 1.5 lakh crore ($23 billion) after a net outflow of about Rs 43,600 crore in 2016.

Although marketmen believe that this kind of FPI flows may not continue in 2018 as the withdrawal of liquidity and rate hikes in developed economies pick up. Also, the inflation cycle is likely to turn following increase in commodity prices and recovery in consumption demand. The capital poured in by FPIs is often called ‘hot money’ because of its unpredictability, but these overseas entities have still been among the most important drivers of Indian stock markets. In terms of sectors, banking, housing finance and auto have seen consistent FPI inflows.

2018: 5 stocks favoured by FIs

From: July 27, 2018: The Times of India

See graphic :

2018: 5 Indian stocks favoured by Foreign investors

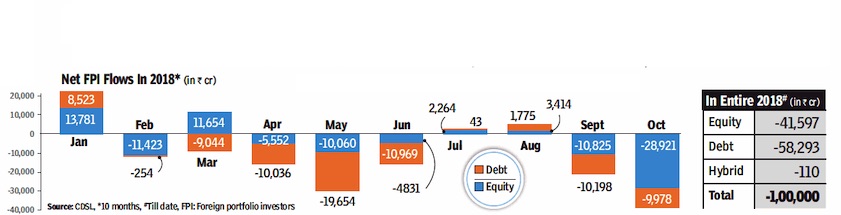

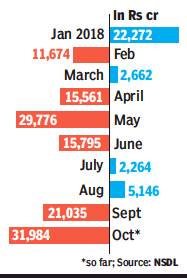

Jan-Oct: FPIs mainly sell

October 22, 2018: The Times of India

From: October 22, 2018: The Times of India

Higher interest rates in the US, rising oil prices and the trade war have prompted Foreign Portfolio Investors (FPIs) to sell in emerging markets, such as India. So far in 2018, outflows from Indian capital markets are estimated at close to Rs 93,500 crore against net inflows of over Rs 2 lakh crore in entire 2017

Outflows almost ₹1 lakh crore

December 17, 2018: The Times of India

Foreign portfolio investors’ (FPIs’) fundings have long been known as ‘hot money’ that comes in fast but can go out even faster. And it is the outward journey that seems to be the underlying theme for Indian capital markets as 2018 draws to a close, with net outflows nearing the Rs 1-lakh-crore mark. This could make 2018 the worst year for FPI investments in the Indian capital markets and follows a record net inflow of about Rs 2 lakh crore into equities and debt securities in 2017, according to data available with the depositories and exchanges.

As of now, the FPIs have made a net withdrawal of about Rs 87,000 crore from Indian markets with about a fortnight of trading remaining.

Analysts warn the trend may continue in the wake of negative sentiments about possible changes in the regulatory framework after the sudden exit of the RBI governor and the emerging political scenario. Marketmen feel FPIs have stamped their influence very strongly this year after their stiff resistance to proposed changes in norms for recording beneficiary ownership of their funds forced regulators to have a re-think and eventually change the rules.

FPIs are among the largest shareholders in several listed blue-chips, especially in the banking and financial services sectors, while their overall average holding is estimated at around 25%. This is one of the biggest holdings after promoters, who typically own an average of about 60% stake in listed Indian firms. The rest is divided among various domestic institutional investors such as MFS, insurers, pension funds and corporates, as also HNIs and small retail investors.

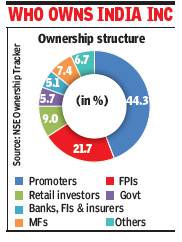

2020, Q3

March 26, 2021: The Times of India

From: March 26, 2021: The Times of India

India Inc’s foreign holding at record high: NSE report

Mumbai:

The aggregate shareholding by foreign portfolio investors (FPIs) in India had touched an all-time high during the quarter ended December 2020 as foreign fund managers went overweight on financial stocks. Domestic mutual funds (MFs), on the other hand, had slightly reduced their stakes in India Inc, along with promoters and retail investors, according to a shareholding analysis by NSE. Official data showed that FPIs together owned 21.7% of NSE-listed companies, while MFs owned 7.4%. Investments by foreign funds were also concentrated in the Nifty 50 stocks. As much as 73% of their total funds in India were invested in these companies, the report noted.

FPI ownership in the December quarter rose to 27.6% from 25.9% from the September quarter in the Nifty 50 companies. “This was the steepest sequential increase seen in last 46 quarters for the Nifty 50 universe, supported by record high FPI inflows of $20 billion into Indian equities during the December quarter,” the report noted. “The increase in FPI ownership was entirely led by financials”, excluding which it declined during the quarter, it said.

The NSE report also noted that the number of stocks in the FPI portfolio has remained unchanged over the last decade, with inflows of $145 billion since 2010 merely leading to a larger share in existing stocks. FIIs have at least 5% ownership in 70% of the Nifty 500 companies and have nearly 74% and 93% of their investments made towards Nifty 50 and top 10% companies respectively, it said.

The report also noted a decline in private promoter ownership following a steady rise over the previous three quarters, drop in ownership by domestic MFs for the third quarter in a row, partly attributed to continued moderation in SIP inflows, and redemption pressures and a marginal decline in direct retail ownership, reflecting some amount of profit-booking amid a huge market rally.

The share of banks, financial institutions and insurance companies fell further to 5.1% — a fresh two-decadal low in the December quarter, the report noted.

2020-21

March 22, 2021: The Times of India

Foreign portfolio investors have pumped in a record $36 billion into equities so far this fiscal up to March 10, which is the highest since FY13, shows the latest data from the RBI.

On the other hand, net foreign direct investment inflows jumped to $44 billion, till end January, up from $36.3 billion a year ago, driven by the massive inflows in November and December, with the last month of the year getting a record $6.3 billion. But the inflows moderated in January due to lower inflows into equities, shows the latest data from the March issue of RBI Bulletin released over the weekend.

“Foreign portfolio investors (FPIs) made net purchases in the equity segment so far this fiscal, while they have been net sellers in the debt market during the period,” says the report.

It notes that the quality of FPI inflows improved during the period as category-1 foreign investors, comprising central banks, sovereign wealth funds, pension funds, regulated entities and multilateral organisations, increased their stake to a high 95% of total equity assets at end-February compared with 87% at end-December 2019. According to depositories data, FPIs were net buyers of equities so far in March at Rs 8,642 crore. FPIs poured in Rs 14,202 crore into equities but pulled out Rs 5,560 crore from debt segment between March 1 and 19, leaving net investment to Rs 8,642 crore. Prior to this, overseas investors had invested Rs 23,663 crore in February and Rs 14,649 crore in January, on a net basis. According to analysts, domestic equities are attractive for foreign investors due to the higher returns. Also a rejig in some of the global indices has led to net inflows into domestic equities. PTI

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together