Goods and services tax (GST)

This is a collection of articles archived for the excellence of their content. |

What is GST?

As on the launch date, 1 July 2017

Prasad Sanyal | TIMESOFINDIA.COM | Jun 29, 2017

HIGHLIGHTS

GST is a multi-stage, destination-based tax that will be levied on every value addition

Final consumer will bear only the GST charged by the last dealer in the supply chain

Many VATs and levies currently in vogue will be subsumed by the new system come July 1

In what makes it significantly different from the existing system, GST is a destination-based taxIn what makes it significantly different from the existing system, GST is a destination-based tax

GST or Goods & Services Tax, set to launch on July 1, is a multi-stage, destination-based tax that will be levied on every value addition.

Set to revolutionise the way India does its taxes, GST will be levied on value additions at each stage of the production cycle - buying raw materials, processing, manufacturing, warehousing and sale to customers - the monetary worth added at each stage to achieve the final sale to the end customer will be taxed. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

In what makes it significantly different from the existing system, GST is a destination-based tax. Currently, the central government levies excise duty on the manufacture, and then the state adds VAT (Value Added tax) when the item is sold to the next stage in the cycle — i.e. from processed raw material like rubber to be manufactured into tyres. Then there would be a VAT at the next point of sale - i.e. when the tyre is sold to the dealership and then to the consumer and so on.

If the tyres are made in Tamil Nadu and used in Delhi, under the GST regime, Delhi will earn the revenue on the final sale, because it is a destination-based tax and this revenue will be collected at the final point of sale/destination. Tamil Nadu will however get the benefits of GST levied at the earliest stages of manufacturing since the tyre was made there.

One Nation, One Tax? Not Quite, Not Yet

GST would apply to all goods other than crude petroleum, motor spirit, diesel, aviation turbine fuel and natural gas. It would apply to all services barring a few to be specified. With the increase of international trade in services, GST has become a global standard. GST will ensure that indirect tax rates and structures are common across India and increase the ease of doing business. This would make doing business in the country tax neutral, irrespective of the choice of place of doing business.

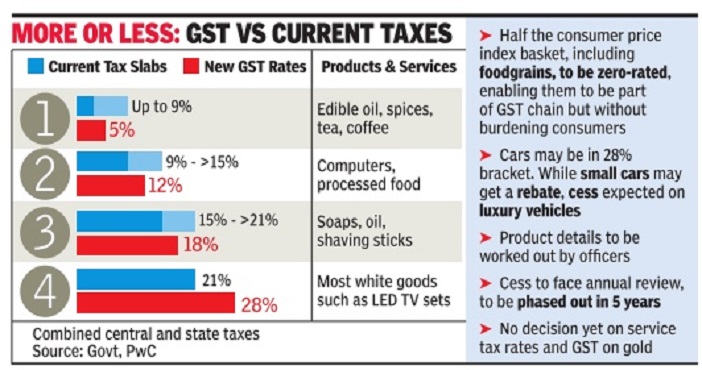

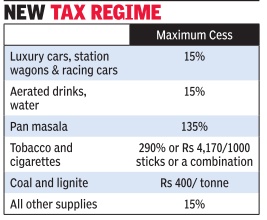

The government has opted for four slabs for both goods and services — 5%, 12%, 18% and 28%. In addition, several items face zero levy, while bullion will attract 3% GST and luxury and sin goods that are in the top bracket will also attract a cess that will be used to compensate states for revenue loss.

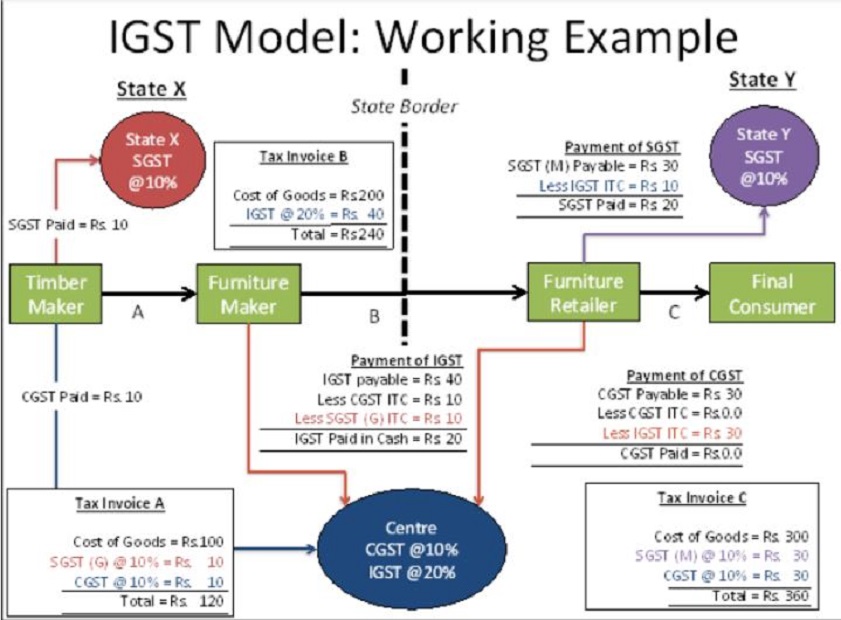

The proposed tax system will take the form of "dual GST" which is concurrently levied by central and state government. This will comprise of:

Central GST (CGST) which will be levied by Centre

State GST (SGST) Which will be levied by State

Integrated GST (IGST) - which will be levied by Central Government on inter-State supply of goods and services.

Revenue secretary Hasmukh Adhia has said that the ultimate goal of the government should be to move to a single- or dual-rate goods and services tax regime.

"Ideally like all other advanced countries, we should have got one GST which is levied by one government only, and not a dual GST and also a GST in which there is a uniform rate. In our country, where there are different stratas of society to be looked after, it's not possible to have an ideal GST. We are in a good direction. We will prefer to have a single GST rate but after sometime. That should be the ultimate goal — instead of having too many complicated rates, at least one or two rates should be there," Adhia said

But pending that here's a graphic example of how the system as implemented from July 1 will work:

Many VATs and levies currently in vogue will be subsumed by the new system come July 1.

At the Central level, the following taxes are being subsumed:

1. Central Excise Duty,

2. Additional Excise Duty,

3. Service Tax,

4. Additional Customs Duty commonly known as Countervailing Duty, and

5. Special Additional Duty of Customs.

At the State level, the following taxes are being subsumed:

1. Subsuming of State Value Added Tax/Sales Tax,

2. Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States),

3. Octroi and Entry tax,

4. Purchase Tax,

5. Luxury tax, and

6. Taxes on lottery, betting and gambling.

GST Rates list, as on 1 July 2017

GST Rates list: Here's your complete guide | TIMESOFINDIA.COM | Jun 28, 2017

From The Times of India

The Goods and Services Tax (GST) has been finalised for almost all items by the GST Council led by Finance Minister Arun Jaitley. The council concluded its 16th meeting on June 11 where rates for 66 items were revised.+

Most of the goods and services have been listed under the four broad tax slabs- 5 per cent, 12 per cent, 18 per cent and 28 per cent. However, some items like gold and rough diamonds have exclusive tax rates. Also, some items have been exempted from taxation.

The new GST regime might well affect your personal budget with quite a few goods and services getting cheaper or dearer+ .

So, here is a list of all the goods and services and their respective tax slabs:

Tax exempted

Goods

A number of food items have been exempted from any of the tax slabs. Fresh meat, fish, chicken, eggs, milk, butter milk, curd, natural honey, fresh fruits and vegetables, flour, besan, bread, all kinds of salt, jaggery and hulled cereal grains have been kept out of the taxation system.

Bindi, sindoor, kajal, palmyra, human hair and bangles also do not attract any tax under GST.

Drawing or colouring books alongside stamps, judicial papers, printed books, newspapers also fall under this category.

Other items in the exempted list include jute and handloom, Bones and horn cores, hoof meal, horn meal, bone grist, bone meal, etc.

Services

Grandfathering service has been exempted under GST.

A low budget holiday may get cheaper as hotels and lodges with tariff below Rs 1,000 are in this category.

Rough precious and semi-precious stones will attract GST rate of 0.25 per cent.

5% tax

Goods

An array of food items such as fish fillet, packaged food items, cream, skimmed milk powder, branded paneer, frozen vegetables, coffee, tea, spices, pizza bread, rusk, sabudana, cashew nut, cashew nut in shell, raisin, ice and snow will be priced at 5 per cent tax.

Apparel below Rs 1000 and footwear below Rs 500 are also in this category.

Some items in the fuel category like bio gas, kerosene and coal are in this slab.

Items from the health industry in this category include medicine, insulin and stent.

Other items in this slab are agarbatti (incense sticks), kites, postage or revenue stamps, stamp-post marks, first-day covers and lifeboats.

Services

Transport services like railways and air travel fall under this category.

Small restaurants will also be under the 5% category

Gold has been taxed under a separate slab of 3 per cent.

12% tax

Goods

Yet another category of edibles like frozen meat products, butter, cheese, ghee, dry fruits in packaged form, animal fat, sausage, fruit juices, namkeen and ketchup & sauces will attract 12 per cent tax.

Cellphones will also be priced in this category.

Cutlery items like Spoons, forks, ladles, skimmers, cake servers, fish knives, tongs fall in this slab.

Ayurvedic medicines and all diagnostic kits and reagents are taxed at 12 per cent.

Utility items like tooth powder, umbrella, sewing machine and spectacles and indoor game items like playing cards, chess board, carom board and other board games like ludo are in this slab

Apparel above Rs 1000 will attract 12 per cent tax.

Services

Non-AC hotels, business class air ticket, state-run lottery, fertilisers, work contracts will fall under 12 per cent GST tax slab

18% tax

Goods

Another set of consumables are listed under the 18 per cent category- biscuits, flavoured refined sugar, pasta, cornflakes, pastries and cakes, preserved vegetables, jams, sauces, soups, ice cream, instant food mixes, curry paste, mayonnaise and salad dressings, mixed condiments and mixed seasonings and mineral water.

Footwear costing more than Rs 500 are in this category.

Items like Printed circuits, camera, speakers and monitors, printers (other than multi function printers), electrical transformer, CCTV, optical fiber are priced at 18 per cent tax under GST.

Other items in this slab include bidi leaves, tissues, envelopes, sanitary napkins, note books, steel products, kajal pencil sticks, headgear and its parts, aluminium foil, weighing machinery (other than electric or electronic weighing machinery), bamboo furniture, swimming pools and padding pools.

Services

AC hotels that serve liquor, telecom services, IT services, branded garments and financial services will attract 18 per cent tax under GST.

28% tax

Goods

The residuary set of edibles which include chewing gum, molasses, chocolate not containing cocoa, waffles and wafers coated with choclate, pan masala and aerated water fall in this category.

Bidi attracts 28 per cent tax.

An array of personal care items like deodorants, shaving creams, after shave, hair shampoo, dye and sunscreen are in the highest tax slab as well.

Paint, wallpaper and ceramic tiles are priced at 28 per cent.

Water heater, dishwasher, weighing machine, washing machine, ATM, vending machines, vacuum cleaner, shavers and hair clippers have been clubbed together in this slab.

Automobiles, motorcycles and aircraft for personal use will attract 28 % tax - the highest under GST system.

Services

5-star hotels, race club betting, private lottery and movie tickets above Rs 100 are under the 28 per cent category.

As on 6 Oct 2017: reduced rates

GST gets simpler for small businesses and exporters, Oct 07 2017: The Times of India

Rates Cut On 27 Goods With Eye On Gujarat Polls

The GST Council tweaked rules to make life simpler for small businesses and exporters and also cut rates on 27 products, including man-made yarn, which was a key demand of the textiles sector, in a bid to mollify those complaining about the new tax regime. While the main focus was on reducing the compliance burden for a majority of taxpayers who contribute a minuscule part of the revenue, the move to reduce the rate on man-made fibre was meant to comfort businessmen in states such as Gujarat, where assembly elections are due later this year.

Similarly, the tax rate on rotis and khakra was cut along with savouries and ayurvedic and homoeopathic medicines. Prime Minister Narendra Modi, who had promised on Wednes day to remove all impediments, was quick to comment that the council's decisions would immensely help small and medium businesses, which have been complaining the most. “Good and simple tax becomes even simpler. Today's recommendations will immensely help small and medium business... GST is in line with our constant endeavour to ensure interests of our citizens are safeguarded and India's economy grows,“ he tweeted hours after finance minister Arun Jaitley announced the changes at a press conference. After day-long deliberations, the Centre and the states agreed to put in place a new mechanism that will allow those with a turnover of up to Rs 1.5 crore -which make up for over 90% of the base but only 5% of the tax collections -to file returns every quarter. At the same time, Jaitley promised that none of the large businesses, which will have to file monthly returns, will be denied credit for the taxes paid by their smaller vendors. In addition, the government has allowed traders, manufacturers and restaurants with turnover of up to Rs 1 crore, instead of the Rs 75-lakh cap earlier, to opt for the composition scheme that will reduce their com pliance burden by paying a flat rate of tax ranging between 1% and 5%. In addition, the deadline for the reverse charge mechanism was also extended.

“If you look at the GST pattern, the large players provide substantial taxation. SMEs pay nil or nominal tax but have high compli ance pressures,“ Jaitley said. There was also a major relief package for exporters, who have been complaining of funds getting locked up due to the absence of refunds and tax credits. Jaitley acknowledged that funds were blocked, impacting the cash liquidity of exporters.

As a result, the GST Council has decided to exempt those covered by the advance authorisation scheme, export promotion capital goods or 100% export-oriented units from paying taxes on inputs till March. Merchant exporters will pay 0.1% GST for purchases from domestic players.

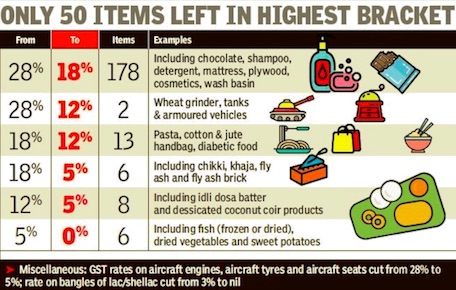

As on 10 Nov 2017: GST cut on over 210 items, 180 of them in top 28% slab

November 11, 2017: The Times of India

HIGHLIGHTS

GST Council moved 80 per cent of items in the top 28 per cent tax bracket to lower rates.

Only 50 products like tobacco products, aerated drinks and automobiles, will be in the top GST rate bracket of 28 per cent.

When GST was rolled out on July 1, more than 250 items were in the highest tax bracket.

Making the biggest change in the four-month-old goods and services tax regime, the GST Council on November 10, 2017 moved 80 per cent of items in the top 28 per cent tax bracket to lower rates. Starting November 15, eating out could cost up to 13 per cent less than before (GST rate cut from 18 per cent to 5 per cent) and a whole host of consumer products like shampoo, deodorant, chocolates, fans, furniture and sanitary fittings should get cheaper by up to 10 per cent or more.

Only 50 products, classified as sin or luxury items like tobacco products, aerated drinks and automobiles, will be in the top GST rate bracket of 28 per cent. When GST was rolled out on July 1, more than 250 items were in the highest tax bracket. That's a reduction of 80 per cent in the number of items in just 132 days. The total tax on several products still in the highest slab will be higher than 28 per cent since they also attract a cess.

The government also reduced the levy under composition scheme for traders and industry to 1 per cent of turnover, with further easing for those selling exempted goods

Finance minister Arun Jaitley said the rate adjustment was part of the rationalisation exercise undertaken over the last few months. "Optically, some of them should not have been there (in 28 per cent slab). There are some items in which small players were exempted from excise (duty payment before GST was rolled out)," he told reporters after a seven-hour meeting of the panel that has representation from all states and two union territories. A lower tax rate will translate into a reduction in prices of over 200 products.

The council went beyond the recommendations of the fitment committee comprising officers. The committee had suggested keeping 62 items in the highest bracket. The ministers, however, ignored demands for duty reduction from the construction sector and left cement and paints in the 28 per cent slab.

The latest round of changes will leave a Rs 20,000-crore hole in the pockets of the states and the Centre. It is the Union government that will have to bear the burden of any shortfall in collections since it has committed to make good any revenue loss for five years. Jaitley, however, said the revenue loss was notional.

"Rate reduction for 200-plus goods and services may suggest that there is buoyancy in tax collections," said Divyesh Lapsiwala, tax partner at consulting firm EY India, suggesting that the revenue loss will be compensated.

More than the revenue considerations, the move is aimed at cheering consumers and placating traders and small businesses who have been complaining of higher compliance burden. With consumers on its side, the Centre is hoping that the protests from traders will wane. The rate cuts should reduce leakages as there is lower incentive to evade taxes. Assam finance minister Himanta Biswa Sarma, who headed the group of ministers for reviewing the tax structure for restaurants said, "Today we have addressed every small issue raised by industry, traders and consumers."

In May, when rates were finalised by the GST Council, the Centre and the states had agreed to rework rates to ensure that they would be close to the combined incidence of Union excise duty and state value added tax. That principle has been given a go-by, at least in the highest bracket.

Detailed list of GST rates, as on 10 Nov 2017

See graphics:

Items in GST tax brackets (28%, 18%, 12%, 5%, 0%), as on November 10, 2017

Goods on which GST rates have been cut from 28% to 8% and from 18% to 12%

Goods in which GST rates have been cut from 18% to 5%, 12% to 5%, 5% to NIL.jpg|Goods in which rates have been cut from 18% to 5%, 12% to 5%, 5% to NIL

From: November 11, 2017: The Times of India

From: November 11, 2017: The Times of India

From: November 11, 2017: The Times of India

As on 18 Jan 2017: Rates cut on 29 goods, 53 services

More GST relief: Rates cut on 29 goods & 53 services, January 19, 2018: The Times of India

Govt Signals Move Towards 1-Stage Filing

The Centre and states decided to reduce goods and services tax rates on over 80 items, while deciding to start the move towards a single-stage filing instead of the current threestage form, in what is seen as the biggest process overhaul

since the new regime kicked in last July. TOI had reported on January 16 that such a move was likely.

The list included 29 goods and 53 services, finance minister Arun Jaitley told reporters after a meeting of the GST Council, which has all state finance ministers as members. There was relief for those selling second-hand vehicles or buying diamonds and precious stones in addition to tickets for theme parks, ballets and dance performances as well as contributions to services provided by RWAs to their members.

Theatre performance in Indian language and entry to planetariums that cost less than Rs 500 will be exempted from GST, against Rs 250 now. There is also a move to reduce tax on small housekeeing service providers hired through e-commerce platforms from 18% to 5%. The new rates will kick in from January 25.

In addition, rates will be reviewed for 42 handicrafts, including products such as hand-made paper.

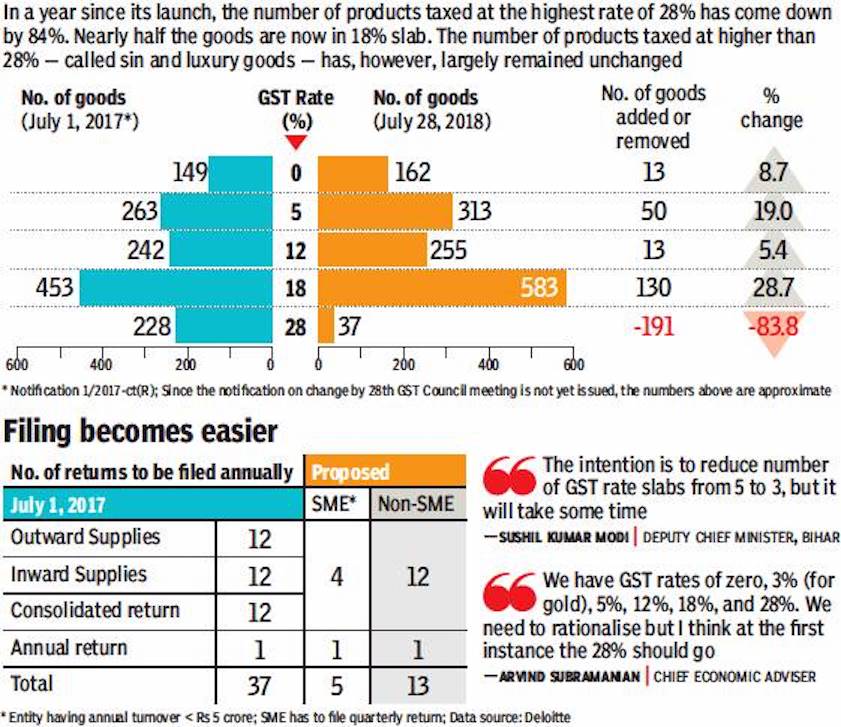

2017 May -2019 Nov

From: Dec 4, 2019: The Times of India

See graphic:

Effective GST rate, 2017 May -2019 Nov

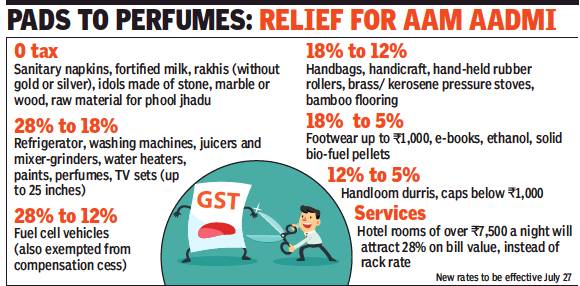

As in July 2018

Rate cuts come on back of improvement in tax collections, July 22, 2018: The Times of India

From: Rate cuts come on back of improvement in tax collections, July 22, 2018: The Times of India

From: July 24, 2018: The Times of India

The GST council delivered a fresh round of rate cut on Saturday to benefit consumers, slashing the levy on nearly 100 items, including white goods, sanitary napkins, handicrafts, perfumes and paints, in what was seen as a pre-election bonanza. It also eased the burden for hotels, the textiles sector and small businesses at a marathon nine-hour meeting.

A large number of the items, which faced 28% levy, such as refrigerators and washing machines, were moved to the 18% slab as part of a strategy to keep only sin and luxury goods such as tobacco, soft drinks and cars in the top bracket. Of the 49 items in the top slab, rates on 17 have been reduced to 18%.

“This is a major step towards rationalising the 28% tax slab which has been narrowed to only a few commodities in the past 13 months,” Union minister Arun Jaitley tweeted. The rate reduction along with several clarifications will leave the Centre and states poorer by Rs 8,000-10,000 crore on an annual basis. The rate cuts come on the back of an improvement in collections in recent months.

Piyush Goyal, who chaired his maiden GST council meeting, told reporters better compliance and higher consumption, apart from boosting economic growth and employment, will more than make up for the revenue loss.

Although there was a proposal to also pare the levy on cement, for the second time, the council opted to retain it in the top bracket as it would have left a Rs 20,000-crore hole.

“Every state wanted that every citizen should feel the benefit of GST for the support that consumers and businessmen have provided... Every state wanted to do things to benefit SMEs and promote what was in the interest of consumers,” Goyal said at a press conference. Tax experts too saw Saturday’s rationalisation, the biggest since last November, as a relief for the common man. “Summary of GST proposal for a common man: You can celebrate Rakhi in a clean and newly painted house while having an icecream and watching a movie on a small TV... with multiple gift options ranging from footwear to washing machine,” said Pratik Jain, who heads the indirect tax practice at consulting firm PwC. The rate cuts come on the back of an improvement in collections in recent months with Goyal being optimistic about the GST kitty swelling to Rs 13 lakh crore during the current fiscal year compared to the target of Rs 12 lakh crore. Since its launch last July, the GST Council had reduced rates on over 320 items and with Saturday’s reduction, the number will swell by almost a third.

“The broad-level reductions in rates may lead to lower tax collections for the next few months, but it will lead to volume expansion, which could more than make up for the reduction. The exemptions indicate that the government is confident that revenues will stabilise on account of growth in volumes,” said M S Mani, partner at consulting firm Deloitte India.

The government has repeatedly said it will reduce rates if tax collections improved. The plan is to merge the 12% and 18% slabs while keeping the items in the 28% bracket limited.

›GST Council OKs quarterly filings, P 7 ›Mantris opt for GST cuts despite alert, P 7 Better compliance and higher consumption will make up for the revenue loss, said Union minister Piyush Goyal

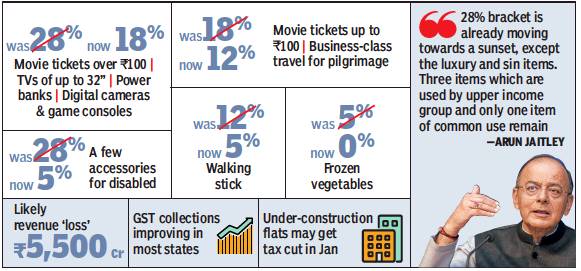

2018, Dec: rates slashed on 23 items

December 23, 2018: The Times of India

From: December 23, 2018: The Times of India

Only Cement, 27 Other Products Left In 28% Slab

Movie tickets, third party motor insurance, smaller TV sets, power banks, flights for Haj and Mansarovar yatra and branded frozen vegetables will get cheaper with the GST council

slashing rates on 23 items on Saturday. There are indications that rates will be pared for more items — including under-construction flats when the panel comprising Union and state finance ministers meets in January.

With the latest round of cuts, effective January 1, the government has reduced rates on nearly 360 items since GST was introduced almost 18 months ago.

There are indications that in the next meeting a simpler set of rules will be put in place for small-scale and medium-scale industries and small service providers.

Parota/ parantha: 2020

Lubna Kably, June 13, 2020: The Times of India

From: Lubna Kably, June 13, 2020: The Times of India

The hashtag #HandsoffPorotta has nearly 15,000 tweets, and counting. Memes are rolling in thick and fast. The reason for the outrage is a recent decision of the GST Authority for Advance Rulings (AAR) that distinguished between “rotis” and “parotas”, holding that the latter is subject to a higher GST rate of 18%. Kerala Tourism tweeted: “The loyal fans of the Malabar cuisine simply cannot keep their @handsoffporotta, lockdown or not. Share your favourite porotta recipes with us.”

The root cause of litigation boils down to complexities in classification. Pratik Jain, partner and leader indirect tax at PwC India, says, “The AAR has not appreciated that the term roti is a generic term and can cover different types of Indian breads.”

In unpacked form, rotis, parotas face same levy

As reported by TOI in some of its editions on June 12, the AAR differed from the view submitted by the applicant company — iD Fresh Food — that parotas should be classified under the product description of “Khakhara, plain chapatti or roti” (or, to be more technical, under heading 1905). Owing to Entry 99A of Schedule 1 to GST notifications, rotis are subject to a lower rate of 5%. The benefit of Entry 99A was denied to the company, by the Karnataka AAR bench. In unpacked form, including from restaurants and takeaway joints, rotis and parotas face the same levy of 5%. But all is not lost for those opting for packed and frozen parotas, as the company intends to file an appeal. “ We have decided to appeal against the recent ruling by the AAR Karnataka,” said P C Musthafa, CEO and co-founder of iD Fresh Food.

Tax practitioners point out that contrary decisions of the AAR are quite common and troublesome. Sure enough, even in the case of parotas (or call it parathas) a contrary ruling (favourable to parota lovers) is available. Musthafa said that in 2018, the Maharashtra bench of the AAR had observed that “the unleavened flatbread products such as plain chapatti, tortilla, tortilla wraps, roti, roti rolls, wraps, paratha and paratha wraps are covered under Entry No. 99 A of Schedule I and they would be liable to tax @ 5%.” TOI has seen a copy of this order, which runs into 54 pages.

Flour products, instant: 2021

January 13, 2021: The Times of India

From: January 13, 2021: The Times of India

A ruling ‘unites’ foodies with single GST rate

5% Tax, Whether It Is Dhokla Or Rava-Idli Flour-Mix

Mumbai:

Be it a school kid in Ahmedabad whose favourite tea-time snack is a plate of Dhoklas or a senior citizen in Bengaluru who can’t do without his staple breakfast of piping hot Rava-Idlis, an advance ruling, issued by the Gujarat bench, has ‘united’ foodies across India with a single goods and services tax (GST) rate.

Despite various products of instant flour mixes falling in different sub-headings, fortunately the GST rate was the same at 5%.

On the flip side, the Authority for Advance Ruling did not agree with the submission of the applicant that a nil rate should apply as his instant flour products were nothing but grain and pulse flour mixed with spices, condiments and flavours.

In this case, a businessman who manufactured and sold varied types of instant mixed flour under the ‘Talod’ brand name sought an advance ruling to determine the GST rates on his products and also on chutney powder, which was provided free with a few products — such as the Bhajiya mix.

The instant mixed flour sold by him was used by customers to prepare a range of Indian dishes such as Khaman, Gota, Handwa, Dhokla, Rice Idlis, Rava Idlis, Dahiwada, Bhajiya, Upma and so on. The ingredients differed from product to product. To illustrate the Dhokla mix, flour consisted of Udad dal, Chana dal, Sugar, Salt, Sodium Bicarbonate, Citric acid and Asafoedtida. The ingredients of the Rava-Idli mix were Gram dal, Udad dal, Rava, Citric acid, Salt, Green Chilli, Curry leaves, and Mustard seeds.

The advance ruling bench has to delve deeply into the classification and sub-headings. While products such as the Dhokla mix, Dahi wada mix, Bhajiya mix and Idli mix fell under one sub-heading; Rava-Idli mix, Upma mix and Muthiya mix fell under another subheading. This despite the fact that all products were essentially flour and spices. The saving grace, there was no difference in the GST rate, which was the same at 5%. As regards Chutney powder, which was supplied free with a few flour mix categories, the AAR held it to be a ‘mixed supply of goods’ — this too had a GST rate of 5%.

Turmeric not agri produce, but taxable spice/ 2021

Lubna Kably, Dec 28, 2021: The Times of India

MUMBAI: The Maharashtra bench of the GST-Authority for Advance Rulings (AAR) has held that turmeric is a ‘spice’ that would be taxable at 5%. Recently, the bench was approached to determine whether turmeric would be exempt as an ‘agriculture produce’. However, the GST-AAR bench gave its ruling as the whole turmeric had been cleaned by boiling and later dried and polished by farmers prior to its sale.

This is contrary to a ruling given by the Gujarat bench. Further, on the flip side, the Karnataka bench had recently held eggs (in their raw form) to be an agriculture produce and, hence, exempt from GST.

In the latest case, the applicant Nitin Bapusaheb Patil was a commission agent, recognised under the state’s Agricultural Produce Market Committee (APMC) rules. His role was to conduct an auction under the supervision of an APMC officer and in the presence of farmers and traders. If the price obtained at the auction was accepted by the farmer, he continued to act as the intermediary and facilitated delivery of the dried and polished whole turmeric. For such services, he got a fixed commission of 3% from the traders, according to the APMC rules. Further, in his application to the AAR, he sought to know whether his ancillary services would also be exempt from GST.

According to a notification No. 12/2017 dated June 28, 2017, agricultural produce means any produce out of cultivation of plants and rearing of all life forms (except horses) for food, fibre, fuel, raw material or other similar products. The notification also requires that no further processing should be done on such items, or processing which is done by the cultivator or producer should be such that it does not alter the essential characteristics of the produce but makes it more marketable for the primary market.

The applicant relied on various judicial and quasi-judicial precedents. He quoted the Supreme Court which, in two cases, had held that in case of certain agricultural products, some cutting or processing is required to make it marketable. If it is minimal and does not result in transformation of the product, it would remain an agriculture produce.

However, the GST-AAR bench held that the applicant had failed to prove that the specialised process of boiling, drying and polishing that required use of machines was carried out by the farmers on their own land. It was not ‘fresh’ turmeric and would be taxed at 5%. Consequently, the services provided by the commission agent would also be taxable.

Learning kits for children, unbound: 5% GST/ 2021

Lubna Kably, Dec 9, 2021: The Times of India

MUMBAI: Do not judge a book by its cover — this adage has obtained a whole new meaning. Given the Covid pandemic, home learning is the norm and picture books have become very popular in households with young kids. The Madhya Pradesh bench of the GST-Authority for Advance Rulings (AAR) had to decide whether a home-learning kit box’s books — largely meant for pre-schoolers to develop their linguistic, logical, sensory, cognitive, creativity and other skills — would attract a nil rate of GST. Children’s picture books under tariff heading 4903 are subject to a nil rate of GST. The kit box, called the ‘Class Monitor Home Learning Kit’ and manufactured & marketed by private company Riseom Solutions, consisted of cards, pamphlets and sheets containing images and pictures.

After going through the learning kit, the AAR observed that it is not in a book or bound form. Thus, the learning kit would be classified under tariff heading 4901, which covers ‘pamphlets, booklets, brochures, leaflets and similar printed matter’. This would attract a GST rate of 5%.

The manufacturing company explained that the contents of the kit box are in the form of separate sheets that are grouped together according to the sub-topic, say animals, vegetables, etc. All the sheets are part of a kit box book, which is suitable for binding. “However, if we bind all the sheets together, it would be heavy for a kid to use it easily,” the company submitted. It added that an activity-based methodology is adopted with instructions on the back of the sheets and various supporting materials like craft-paper, ribbon, Fevicol tube, etc, “to keep a child happily engrossed in the learning process”.

However, it all boiled down to the fact that the sheets were unbound and thus the kit box’s books were not eligible for a nil GST rate. It should be noted that GST rulings do not set a judicial precedent. However, they have a persuasive impact during assessment of similar cases.

Benefits

How almost everybody gains

The Times of India, Aug 4, 2016

After decades of tying itself up in political knots debating a transparent, simple, efficient, one-nation system, India will soon be on a clutter-free tax highway. Around 6 million entities are expected to be covered under GST+ and more than 10 tax rates are likely to fall. Here's a quick look at how GST will impact the economy, businesses and the consumer.

ECONOMY

- Dual monitoring by the Centre & states to reduce tax evasion

- Better compliance through real time matching of supplier & purchaser

- Reduction in approximately Rs 1.8 lakh crore annual loss due to excise duty exemptions

- Cut in Rs 1.5 lakh crore estimated loss to states due to tax exemptions

COMPANIES

- Tax credits to lower tax burden, improve profit margin for some

- No distinction between product and service for tax

- Uniform tax across the country to ease business

- Smooth movement of products across states

- One-time increase in compliance cost likely

CONSUMER

- No tax rates have yet been decided though a suggestion of 3 rates-12%,

- 17-18% and 40% has been made

- Most products are likely to be less expensive over time

- Most services (eg. restaurants, travel, mobile bills, insurance premium) likely to cost more

- Mobiles, jewellery, some readymade wear in some states may cost more

Analysis and definitions: In the view of economists

The Times of India, Dec 05 2015

GST a win-win for all in long run: Economists

What is the goods and services tax (GST)?

The proposed levy will be a single tax that will cover all indirect taxes at the Centre and state level, including entry tax. It is a value-added tax, which means a levy at each stage of production, sale or consumption will be set off against taxes paid in the previous stage.

Through a system of tax credits, those who are in the intermediate stages of a chain of production will get credits or refunds for whatever levies they have paid.This avoids cascading of taxes for the end-consumer. Unlike the existing VAT, which is levied only on manufactured goods, GST will also include services. Most economists agree that a GST is a win-win situation with the consumer, industry , government and economy all gaining in the long run.

When was GST conceived and when will it be implemented?

Although the plan has been discussed for years, a formal announcement was made in the 2006 Budget by P Chidambaram, the then finance minister. Since then, it has missed several deadlines. The last target date set for a nationwide roll-out of GST was April 2016, but even that is now extremely unlikely .

Why was it held up?

When the system was first discussed, there was great enthusiasm. But, gradually sta tes started raising objections.One reason is that finance ministers would lose control over the taxation system and be unable to give discretionary concessions. The other area of concern is potential loss of revenue from cash cows such as petroleum, which makes up for almost half the revenue for some states. There was also an element of bargaining in the states' objections.

What's the current status?

The Lok Sabha has approved a Bill to amend the Constitu tion so that the Centre can levy the tax. It has to be approved by the Rajya Sabha and then by state legislatures.

The NDA 's lack of maS jority in the Upper ho use means that it has to get the opposition on board.The Centre has assured states that it will compensate them for revenue loss due to GST roll-out, besides providing flexibility on entry tax and taxing oil products. Once Parliament passes the constitution amendment Bill, at least half the state legislatures will also have to do so for the Constitution to be amended. After this process is over, several other gaps need to be filled, including the rate of tax. A panel headed by chief economic adviser Arvind Subramanian has recommended standard GST rates of 17-18% and a revenue neutral rate in the 15-15.5% range.

What are the sticking points now?

The Congress says it sup ports the idea of a GST but wants several changes to the Constitution Amendment Bill introduced by the Modi government. In particular, it is focusing on three issues. The first is a demand to specify the GST rate in the Constitution Amendment Bill. The government argues that this will reduce flexibility as any change in the rate, say to deal with a natural calamity in a state, will require an amendment to the Constitution. One option is to specify a cap on the GST rate, another is to incorporate the rate in the other legislations to be enacted by the states and Centre. A second sticking point is the proposed additional levy of up to 1% by manufacturing states such as Gujarat, Maharashtra, Tamil Nadu and Karnataka to compensate them for losing out because the tax will be levied at the point of consumption instead of the point of production. The Subramanian panel has recommend that this levy be done away with.

This issued might be resolved by the Centre agreeing to compensate these states. The third point is the Congress also wants a panel of judges to deal with disputes instead of the proposal to let the GST Council decide. It is arguing that the complainant can't be the arbitrator too. Finance minister Arun Jaitley counters that by saying this will result in the legislature surrendering its powers to the judiciary.Some of the regional parties too are not in favour of letting a panel of retired judges to decide on the issue.

Eligibility

Companies in co-working spaces can get GST

Lubna Kably, August 28, 2019: The Times of India

The Authority for Advance Rulings (AAR-GST), Kerala, has taken cognisance of the shift towards a shared office space culture in its recent order. In response to an application sought by a company that was providing coworking space in Kochi, it held that a GST registration cannot be denied to those working from shared office spaces. However, each co-working space should be demarcated with a different desk number.

In some instances, startups have been denied GST registration if they were operating from a co-working space. The main ground for such denial by the registration authorities was that another company has already been registered with the same address.

Advance rulings are binding only on the applicant and the tax officer in respect of that particular transaction for which the ruling was sought. However, it has a persuasive value. Thus, the ruling will strengthen the case of those operating from shared offices. “The advance ruling lays down the correct principles. This ruling will be most helpful if followed consistently by all officials across India,” says Sunil Gabhawalla, chartered accountant and indirect tax expert.

Typically, startups, in their initial stages, prefer to work from a co-working space. Not only does this mean lower rentals as opposed to hiring an independent office, but co-working spaces also provide various other facilities.

In this case, Spacelance Office Solutions sub-leased coworking spaces to its clients. It provided them the needed infrastructure facilities. Each client was provided a distinct identifiable space, such as tables and chairs. The clients were engaged in the services sector and did not need to maintain any ‘stock’. However, financial records were maintained by them in electronic form.

The company sought an advance ruling on whether GST registration can be allowed for multiple firms (which were in the services sector) and were operating from the same address, provided they follow all GST rules relating to the principal place of business. The GST number assigned to each co-working space must be displayed at a prominent location, it added.

Institutions

GST Council

The Hindu, November 4, 2016

Puja Mehra

GST Council pegs the GST rate structure at 5, 12, 18 and 28 per cent.

The Goods and Services Tax (GST) will be levied at multiple rates ranging from 0 per cent to 28 per cent. Ultra luxuries, demerit and sin goods, will attract a cess for a period of five years on top of the 28 per cent GST.

Overcoming opposition from some States, the GST Council finalised on Thursday a multiple-slab rate structure, including the cess, for the new indirect tax. The quantum of cess on each of these will depend on the current incidence of tax.

On nearly half of the consumer inflation basket, including food grains, the GST will be at 0 per cent, Council Chairman and Union Finance Minister Arun Jaitley told a media conference after the meeting.

The approved slabs vary slightly from the proposal the Centre had moved at the Council’s last meeting.

The lowest slab of 5 per cent will be for items of common consumption, Mr. Jaitley said.

There would be two standard rates of 12 per cent and 18 per cent, which would fall on the bulk of the goods and services. This includes fast-moving consumer goods.

Most services are expected to become costlier as the ones being taxed currently at the rate of 15 per cent are likely to be put in the 18-per cent slab, said Revenue Secretary Hasmukh Adhia. The services being taxed at lower rates, owing to the provision of abatement, such as train tickets, will fall in the lower slabs, Mr. Adhia added.

The highest slab of 28 per cent will include white goods and all those items on which the current rate of incidence varies from 30-31 per cent.

The principle for determining the rate on each item will be to levy and collect the GST at the rate slab closest to the current tax incidence on it.

Mr. Jaitley said the Council will review annually the tax revenue raised from the cess that will fund compensations from the Centre to States for losses arising out of the transition to the GST.

The Centre gave a constitutional guarantee to States for making good these losses for a period of five years.

“If the revenue raised from the cess is found to be in excess of the sums needed to finance the compensations to States, the Council will decide to what use the surpluses will be put,” Mr. Jaitley said.

The GST will subsume the multitude of cesses currently in place, including the Swachh Bharat Cess, the Krishi Kalyan Cess and the Education Cess. Only the Clean Environment Cess is being retained, revenues from which will also fund the compensations.

Though on the expiry of the five-year period the cess will no longer be collected, the Council will, Mr. Jaitley said, revisit the GST rates on ultra luxury and demerit goods.

The Council did not take a call on the GST rate on gold. “GST rate on gold will be finalised after the fitting to the approved rates structure of all items is completed and there is some idea of revenue projections,” Mr. Jaitley said.

National Anti-Profiteering Authority

November 16, 2017: Press Information Bureau

Aim: to reassure consumers that Government is fully committed to take all possible steps to ensure the benefits of implementation of GST in terms of lower prices of the goods and services reach them. Affected consumers who feel the benefit of commensurate reduction in prices is not being passed on when they purchase any goods or services may apply for relief to the Screening Committee in the particular state.

Composition: to be headed by a senior officer of the level of Secretary to the Government of India with four Technical Members from the centre and /or the states.

Institutional framework: NAA, a Standing Committee, Screening Committee in every State and the Directorate General of Safeguards in the Central Board of Excise & Customs (CBEC).

In case the incident of profiteering relates to an item of mass impact with 'All India' ramification, the application may be directly made to the Standing Committee. After forming a prima facie view that there is an element of profiteering, the Standing Committee shall refer the matter for detailed investigation to the Director General of Safeguards, CBEC, which shall report its findings to the NAA.

In the event the NAA confirms there is a necessity to apply anti-profiteering measures, it has the authority to order the supplier / business concerned to reduce its prices or return the undue benefit availed by it along with interest to the recipient of the goods or services. If the undue benefit cannot be passed on to the recipient, it can be ordered to be deposited in the Consumer Welfare Fund. In extreme cases, the NAA can impose a penalty on the defaulting business entity and even order the cancellation of its registration under GST.

The (likely) impact, as assessed on its launch day

Summary/ highlights

GST's red-carpet entry: Impact on consumers, traders, government| Jun 29, 2017 | IANS

From The Times of India, 1 July 2017

HIGHLIGHTS

The GST will irreversibly impact consumers, traders, businesses

The real impact of reform can be assessed only after a full year of its implementation

The Goods and Services Tax will irreversibly impact consumers, traders, businesses as well as the revenue collection machines of the states and the centre.

Though the real impact of the government's big-bang reform can be assessed only after a full year of its implementation, let us gauge its effect on the various aspects of trade, consumer prices and government revenue.

(What gets more expensive )

In many cases it may weigh heavily on your pockets while in others it may soothe the traders' frayed nerves with input tax credit. In terms of GST's effect on the government's revenue kitty, it seems to be on the wait and watch mode.

- Services, including banking and telecom, will get more expensive, as will flats, ready-made garments, monthly mobile bills and tuition fees.

- From July 1, when you visit an air-conditioned restaurant, be ready to shell out 18 per cent as taxes. In case you prefer a non-air-conditioned food joint, then you will save six per cent as such restaurants will attract 12 per cent GST.

- Mobile bills, tuition fees and salon visits will also get costlier by three per cent, as GST at the rate of 18 per cent will be applicable on all services from July 1 as compared to the current service tax rate of 15 per cent.

- Apparels above Rs 1,000 will attract 12 per cent tax as compared to the current six per cent state VAT. It may be noted that apparels below 1,000 will attract GST at the rate of five per cent.

- In GST regime, buying a flat or shop, will attract GST of 12 per cent as compared to current six per cent approximately.

"Though the developers are expected to pass on the benefits of input-credit available to them, with the government also issuing an advisory in this regard, practically how it will work is doubtful," GST expert Pritam Mahure told IANS.

So what gets cheaper under GST?

- With 81 per cent of items falling under below 18 per cent tax rate, certain goods that will become cheaper are salad dressings, mayonnaise, weighing machinery, static converters (UPS), electric transformers, winding wires, transformers industrial electronics and two-way radio (walkie talkie) used by defence, police and paramilitary forces, which will attract 18 per cent tax rate.

- Postage or revenue stamps will also become cheaper as GST on these has been reduced to five per cent.

- Tax rate on cutlery, ketchup, sauces and pickle under GST will likely become cheaper as they will be taxed at 12 per cent.

- Salt, children's picture, drawing or colouring books and cereal grains have been exempted under GST. Playing cards, chess board, carrom board and other board games have been reduced to 12 per cent GST rate. Rough precious and semi-precious stones have been kept at a special rate of 0.25 per cent under GST.

How the traders will be affected?

- Traders below Rs 20 lakh annual turnover are exempt under GST as compared to the current threshold of Rs 10 lakh in indirect taxes.

- Traders, manufacturers and restaurants with up to Rs 75 lakh turnover can go for the Composition Scheme and pay 1, 2 and 5 per cent tax respectively. Such businesses though will not get input tax credit but will have to file only one quarterly return.

- Rest of the traders will have to file three returns every month, out of which two will be auto-populated.

The input tax credit under Cenvat credit will be carried forward into the new regime.

Integrated GST (IGST) and GST Compensation Cess would be levied on cargo arriving on July 1. Cargo arrived up to June 30 would not attract IGST and compensation cess even though the clearance may happen after July 1.

However, additional duty of customs would continue to be levied for imports of petroleum and tobacco products.

It is mandatory for all importers/ exporters to declare GST Registration Number (GSTIN) along with Import Export Code (IEC) in the bills of entry, shipping bills and courier forms. Provisional IDs issued by Goods and Services Tax Network (GSTN) also be declared during the transition period. Input tax credit of IGST would be available based on GSTIN declared in the bill of entry.

Exports are zero-rated under GST. Exporter would be entitled to refund of IGST paid on exports or refund of accumulated tax credit on inputs used towards exports. Refund of IGST for exports would be based on GSTIN declared in the shipping bill.

So how much money will the government raise trough GST?

The revenue growth in the remaining nine months of the fiscal are expected to fall to eight per cent as compared to 22 per cent from indirect taxes in 2016-17. However, no prediction has been made by the government for the full year of indirect tax collection growth for the next fiscal.

Indirect tax collections (central excise, service tax and customs) in 2016-17 stood at Rs 8.63 lakh crore.

The government is yet to gauge the impact on revenue collection under GST as it had said that they are predicting a neutral growth as they do not know whether the tax growth will go up or down.

"In the first year (2017-18), because of implementation issues, there might be a little lag in income. We have kept a target of 8-9-10 per cent growth target (in indirect tax collections) this year as compared to 22 per cent indirect tax growth that we saw in 2016-17. We have kept it as neutral this year, as we don't know whether it will go up or down," Revenue Secretary Hasmukh Adhia had said earlier.

"Revenue in first year is uncertain, I am not sure, so can't project it. It will go up overall but central government's revenue will be same or not we will have to see. Because we are surrendering the cesses for the GST compensation," he had said. Cesses imposed on taxpayers so far went to the centre without any share to the states.

The Centre will compensate the states for any revenue losses in the GST regime for the first five years, with 14 per cent growth rate in taxes with a base year of 2014-15.

What gets cheaper, what does not

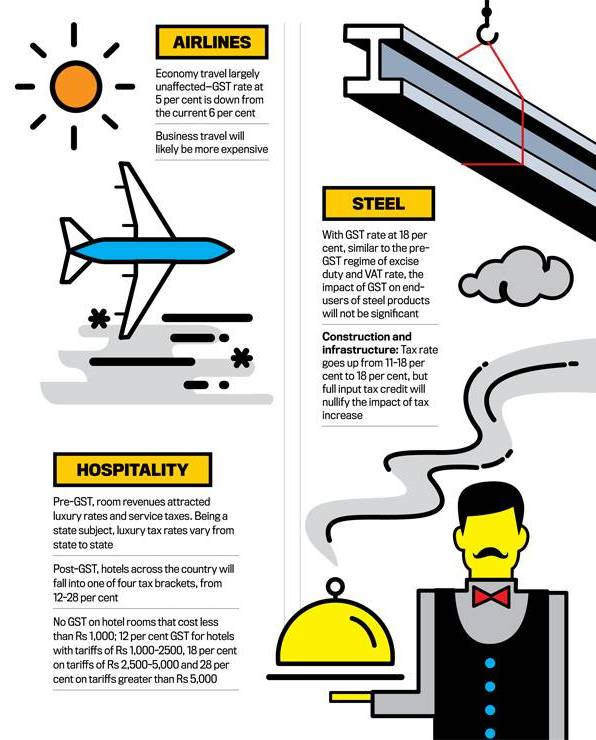

See the following four graphics, some or most of which might appear above this item on your device:

1 After GST is introduced on July 1, 2017, most products will get cheaper

2 After GST is introduced on July 1, 2017, most services will remain unaffected

3 After GST is introduced on July 1, 2017, some things will become more expensive, many won't change

4 After GST is introduced on July 1, 2017, the impact on restaurants will depend on their category

The impact on households

HIGHLIGHTS

For middle class families, impact on monthly budget will not be more than a few hundred rupees.

Individual preferences might hold more weight as to which way the household budget might swing.

With service tax increasing to 18% from 15% all services will become dearer.

GST may not burn a hole in your pocket, but you will have to tighten purse strings

From The Times of India

What we buy, how we buy and why we buy are questions that have for long fascinated anthropologists. But GST is expected to add a new twist to the tale of Indian consumerism+ .

Under the new taxation regime fruits, vegetables, pulses, wheat, bread and rice are exempted from taxation even as chips, biscuits, butter, tea and coffee are attracting higher taxes. So, would that make families to make healthier choices at the supermarket?

Cited as the "single largest taxation reform" in independent India, GST is set to change taxation for every sector+ — from real estate to vehicles+ to consumer durables to branded goods to luxury items.

From The Times of India

For a middle class family that earns between Rs 50,000-Rs 80,000 a month, the impact on the monthly budget will not be more than a few hundred rupees. For those earning in the Rs 1.75 lakh bracket, the purchase of luxury items and SUVs or sedans will not necessarily result in an increase of more than 2-4%.

While this is a rough estimate, individual likes and preferences might hold more weight as to which way the household budget might swing.

"For instance, ghee and tea are taxed higher. Now, if your budget includes substantial quantities of ghee, then you are likely to feel the pinch. It is still early though — it has not been made law. And many items have seen exemptions," says M R Venkatesh, a Chennai-based chartered accountant.

Among the list of items getting cheaper are chicken, oil, butter and bhujia (snack), while purchase of tea, coffee, masala powders, curd, cheese, biscuits, chewing gum, chocolate and ice-cream will be 1-5% more expensive.

At the top of the chart with the highest taxation increase are items like paneer, sweets and cornflakes. Tobacco, alcohol+ and petroleum continue to be exempted, allowing the state government to dictate rates.

"Instead of increasing the cost of alcohol, they have increased the cost of side-dishes," says B Kannan, a tax consultant.

With service tax increasing to 18% from 15% all services will become dearer. Loans will get more expensive. Purchase of health, life and motor insurance+ will also get more expensive.

"Service tax rates were increased earlier too, but we didn't see any change in consumer buying pattern over more than a decade. Impact on policies for the common man will be at a minimum. For instance in the Pradhan Mantri Fasal Bima Yojana, a 3% increase in taxation will hardly result in a few paise increase," says Tapan Singhel, CEO, Bajaj Allianz

Higher educational institutes, impact on

Impact of GST on higher educational institutes decoded, June 3, 2017: The Times of India

Though Kept Out Of The Ambit, Outsourced Services To Bear Levy

Let's make `Study in India' happen! To achieve this, the government needs to think progressively like a business partner. TOI spoke to experts to decode the GST impact on higher educational institutions The importance of education cannot be undermined in a country like India -where nearly half of its billion plus population is below the age of 25. In the years to come, the country will need to cater to a huge demand for jobs -a challenging prospect in an environment which could be dominated by robotics and artificial intelligence.

Jobs will call for creative problem solving, analytics and critical thinking. Hence, helping higher educational institutions which can impart cutting edge knowledge, at times in collaboration with foreign institutions, is the need of the hour.

Even as private higher educational institutions are emerging, these are forced to continue to operate under the umbrella of `not-for-profit'.

The GST Council's decision to continue to exempt services provided by educational institutions to its students is a step in the right direction. To this extent, the apple cart has not been rocked. However, services to higher educational institutions are not GST free.Higher educational institutions will have to pay GST when availing of a wide range of services. This dilutes the objective of keeping education outside the GST ambit.

Earlier, a vast majority of services provided to educational institutions were classified as `business auxiliary services' and procurement of such services did not attract service tax. Then, the category of services supplied to educational institutions which would not attract service tax were restricted to four.

Bipin Sapra, indirect tax partner at EY India, explains: “The first step to distinguish between services provided to educational institutions vs higher educational institutions, was taken in March, much before the GST bills were passed in the Parliament“. Services in the nature of transportation, catering, housekeeping, admissions or examination conduct if provided to higher educational institutions were subject to service tax.“Unfortunately , the GST Council, has continued with this. Given the importance of higher education, in a country like ours, there is an urgent need to revisit this,“ says Sapra.

Services provided to higher educational institutions are taxable. While services provided by an educational institution are out of the GST ambit, unfortunately the same is not the case with services provided to an educational institution.

The GST exemption on procurements is available only to schools (from preschool up to higher secondary school or its equivalent).Thus, the `input'or supply of services such as transportation, catering, housekeeping, services relating to admission or conduct of examination to higher educational institutions will bear a GST levy. This will have to be borne by the higher educational institution.

As the `output' (service of providing education to students) is tax free, no input credit would be available. This partly defeats the purpose of exempting educational services from GST.

In fact, sprawling campus of higher educational institutions, especially if these have boarders are likely to incur heavy expenditure on some of the above items -such as security , housekeeping or catering, as compared to schools. For instance, maintenance of laptops provided to students, or maintenance of a swimming pool or basketball court. Since all educational institutions op erate as non-profits, so why this dichotomy? There is an additional issue. “The impact of non-eligibility of input tax credit, is even more pinching due to the mandatory reverse charge mechanism if the goods or services are procured from unregistered dealers. Educational institutions typically obtain services from freelancers such as supervisors, research assistants, paper setters et all. Payments to such individuals would attract GST under reverse charge it is the educational institution which would pay this tax and also comply with formalities of uploading documents on the GSTN portal,“ explains Sunil Gabhawalla, chartered account and indirect tax specialist.

Australia has the most comprehensive GST regime in the world it covers almost all goods and services and provides for very few exemptions. However, education largely remains GST free.Supply of services to educational institutions are `zero rated'. In other words, these institutions (as they are GST exempt) can claim a refund against the taxes paid by them on inputs. Other countries such as South Africa also adopt a similar norm.

Higher costs would be an added deterrent for foreign students, who wish to study in India. Statistics drawn from the All India Survey on Higher Education conducted by the Union ministry of human resource development show that 45,424 students enrolled in India in 2015-16.While these students came from 165 countries, bulk of the students were from our neighbouring countries Nepal (21%), followed by Afghanistan (10%) and Bhutan (6%). Compared with the outflow of students from India, overseas largely to USA, this seems an insignificant figure. However, it denotes a rise of 31% as compared with numbers two years earlier.

Nearly 3.6 lakh students from India are studying overseas according to the Indian students mobility report (2016) by M.M. Advisory services. Even as media reports indicate that the Chinese students are twice this number, this report points out an increasing flow of Indian students to foreign countries.Higher educational institutions in India, especially through foreign collaborations are emerging as a more viable option for providing the same high quality , globally recognised education.

Many institutes have tied up with foreign counterparts for various courses, such as Bennett University's tie up with Georgia Tech or with Johnson Cornell. BML Munjal has a tie up with Imperial College London. SPJIMR partners with ESB Business School of Reutlingen University, Germany .

“Lower tax costs would enable the educational institutions, who as non-profits earn small margins, to upgrade their infrastructure and also reduce costs for students,“ explains Sapra. Higher educational institutions in India have the potential to attract more foreign students and also fulfil the educational aspirations of our own students. But for this to happen, the government needs to think like a business partner.

Automobiles

Shweta Punj MG Arun , GST gets rolling “India Today” June 29, 2017

The overall impact

First 100 days’ impact on eight key sectors

October 10, 2017: The Times of India

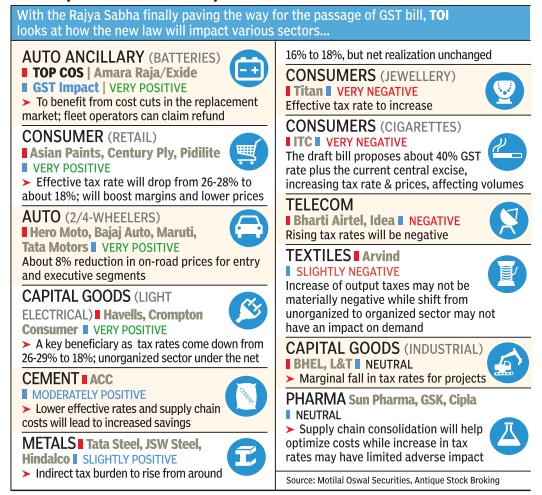

See graphic: What 100 days of GST meant for key sectors, positive and negative implications, as on October 10, 2017

From October 10, 2017: The Times of India

HIGHLIGHTS

October 10 marks 100 days of GST roll out

The government has claimed that roll out of the new tax regime has been smooth however industry experts have detected disruption in the market due to GST

It has been 100 days since the government introduced Goods and Services Tax (GST) on the midnight of June 30 and July 1. The government has claimed that GST roll out has been fairly smooth, various analysts have opined that it has caused disruptions in the market. Here is a round up of hits ans misses of the new tax regime across eight sectors. The evaluation has been done by a PricewaterhouseCoopers team of Gautam Khattar (Partner, Indirect Tax), Kishore Kumar (Director) and Vidushi Gupta (Assistant Manager)

What worked

1) The litigation on E-commerce operators being liable to register under State VAT laws as 'agents of supplier of goods is put to rest

2) GST has brought down trade barriers

3) Increased pool of credits under GST is expected to bring down the overall cost of service in the long run

What didn't work

1) The threshold for registration is not applicable to e-commerce operators and persons supplying goods via e-commerce operators. The small players, ordinarily outside tax net, find it difficult to manage mammoth compliances

2) GST gives small tax payers an option to pay taxes under the composition scheme which entails lesser compliances. However, this option is not available to e-commerce operators and persons supplying goods through these e-commerce operators

3) GST envisages that e-commerce operator should collect a certain percentage of taxable supplies made through it by other suppliers, as tax at source. Though this mandate is applicable only in cases where the payment is collected by such operators, it adds to compliance burden and cash blockage. Considering the challenges, government has deferred it to April 2018.

What worked

1) The hospitality industry was previously subject to multiple tax levies on account of luxury tax, VAT and service tax. Restaurants were also charging both VAT and service tax. These issues have been eliminated by the single levy of GST

2) The state specific rates, classification and valuation challenges have been a bane for the industry which is now streamlined, providing a big respite in addition to the reduction in the effective tax incidence

What didn't work

1) Under the GST regime, the tax rate slabs applicable to hotels have been allocated on the basis of the published room tariffs, which has forced the industry to reevaluate their promotional and marketing schemes

2) State-wise registration under the GST regime has substantially increased the compliance burden

3) The exclusion of alcohol for human consumption from the purview of GST has also resulted in additional tax cost and documentational challenges

What worked

1) The effective rate of tax on most products has not seen much change from previous regime, while some products like toothpaste, soaps, hair oil etc has seen a overall reduction

2) Like most other sectors, the FMCG sector has been benefitted on account of seamless flow of credit resulting in reduction in procurement/production cost.

What didn't work

1) A lot of FMCG companies have set up warehouses in states like HP/ Uttaranchal as they enjoy benefits/exemptions under earlier regime. Govt has clarified intention to converge these tax holidays to refund schemes.

2) Most companies have consolidated their warehouses due to increased compliance burden. This has given rise to the requirement to re-evaluate supply chain mechanism so as to maximize gains under GST.

What worked

1) The effective tax rate applicable on economy class tickets has seen a reduction

2) The aviation industry has also witnessed a reduction in cost due to seamless flow of credit

What didn't work

1) The effective tax rate applicable on business class tickets has seen a considerable increase

2) Jet fuel has been kept outside the GST net. This has led to increase in fare

3) Under GST, airlines have to seek multiple registrations and undertake mammoth compliances in comparison to the erstwhile tax regime

What worked

1) The classification of works contracts transactions as supply of service and charging a single tax has brought transparency and relief across the industry. Previously both VAT and service tax was charged and valuation of these transactions were highly litigated across the states

What didn't work

1) Stamp duty continues to be outside the GST net which has complicated the tax structure

2) The overall rate of tax applicable on most inputs like paint, cement etc. used by the industry has increased leading to overall increase in the property prices

3) The real estate sector typically works a lot with unregistered dealers. The GST has imposed an additional requirement to pay tax under reverse charge mechanism on procurement of goods and services from such un-registered dealers. While the reverse charge provisions have been deferred till March 31, 2018 the relief is only temporary in nature

What worked

1) The cost of local taxes such as octroi, entry tax has been subsumed under the GST regime, resulting in reduction in manufacturing cost

2) The spinning and powerloom sector benefited from reduction in tax rate on man-made fiber and yarn to 12% from 18% and the rate applicable to job work of zari (embroidery) has also been slashed to 5% from 12%

3) Decisions such as quarterly tax filings for SMEs with an annual turnover of up to Rs 1.5 crore, deferring reverse charge taxability on procurement from unregistered vendors, expeditious refunds to exporters has aided the industry

What didn't work

1) The GST requirement to pay tax under the reverse charge mechanism on purchase from unregistered dealers has come as a huge blow to the industry. While the reverse charge provisions have been deferred till March 31, 2018 giving some immediate relief, the issue is likely to pose a challenge in the long run

2) To address concerns of exporters regarding timeline of GST refund, the Council has introduced facilities such as e-wallet and award of notional refund, however the drawback rates applicable to the textile industry from October 1 are substantially lower than those applicable under the previous regime

What worked

1) GST has removed taxes such as automobile cess, infra cess, motor vehicle tax, leading overall effective tax rate cut

2) The procurement/production cost of the sector has been substantially reduced due to availability of additional credits.

3) Despite the levy of compensation cess, the overall tax incidence has come down, paving way for price cut

What didn't work

1) Under GST, tax liability of the supplier arises as advance payment is received, while credit of such tax is allowed after goods or services are received, leading to working capital blockage. GST on advances for small dealers and manufacturers with turnover up to Rs 1.5 crore removed

2) Promotional schemes such as free distribution of samples were not taxable earlier. These need to be evaluated in light of specific provisions

22 states remove check-posts

22 states scrap checkposts as GST gets smooth rollout|Jul 04 2017: The Times of India (Delhi)

New Delhi: TIMES NEWS NETWORK The rollout of the Goods & Services Tax across the country has been smooth with 22 states and UTs, including West Bengal and Delhi, abolishing checkposts, adding to the efforts to ensure that the changeover to the new tax regime is hassle-free and least disruptive for businesses and consumers. Eight states are on the verge of scrapping the checkposts, which is expected to ensure smooth flow of goods across the country . The removal of checkposts will come as a huge relief for trucks which queue up for hours to get their consignments and papers checked, causing delays and adding to costs.

A session of the assembly of J&K, which is yet to enact the law for the implementation of GST, has been convened on Tuesday to consider approving the legislation. Sources in the finance ministry said that there has been no inflationary impact of the new tax regime: an assertion which was significantly endorsed by the CPM-led government in Kerala. The LDF government issued a statement in Thiruvananthapuram saying prices of more than 100 products have been brought down under GST. State finance minister T M Thomas Isaac came out with the list of products to counter widespread complaints that there was no positive impact of GST in the state.

Keen to ensure that the momentum is maintained, authorities are also keeping a close watch to ensure that any roadblock is removed swiftly. Cabinet secretary P K Sinha reviewed the postGST implementation situa tion with the secretaries and senior officials of different ministries and departments.

The cabinet secretary urged every secretary to take up the responsibility of addressing GST-related issues of their respective stakeholders, trade and industry . He asked them to coordinate with state government officials to ensure smooth implementation of the tax measure. Sinha also asked all departments to ensure that there is no shortage of products and commodities especially consumer items in order to keep the prices under check.

The cabinet secretary also urged officials to ensure that retailers, dealers and shopkeepers display the post-GST prices of different items being sold by them. He said each department and ministry should make sure that benefits of GST are passed on to consumers which would help keep inflation under control. Sinha asked all departments to ensure that various machines used by dealers and retailers for computerised billing are calibrated at the earliest to reflect the GST rates. He said this exercise should be completed in a timebound manner without delay .

It was also decided that a weekly review meeting will be held to keep a close watch on the situation. The cabinet secretary also told the officials to launch campaign to make consumers fully aware about issues linked to GST.

The Centre also appealed to the people not to circulate wrong messages on social media as no distinction is made in the GST law on any provision based on religion.

Earlier versions of GST

What is GST? As in May, 2015

The constitutional amendment bill for rolling out the long-pending goods and services tax cleared the first hurdle with the legislation receiving LS approval.

What is GST?

It is a tax levied when a consumer buys goods or services. This is how what consumption is taxed in most developed countries.

What is article 246A and how will the power transfer to states take place?

The bill introduces a new article that says Parliament, and, subject to some conditions, the legislature of every state will have power to make laws with respect to goods and services tax imposed by the Union or the state.

Who will administer the levy?

The bill provides for a GST Council, a joint body of the states and the Centre.

There are fears that states may lose some revenue because of the introduction of GST. The bill allows for compensation for revenue loss to states for a period of 5 years.

GST will be levied on buyers of goods and services, or where the service is consumed. This means big consumer states such as Uttar Pradesh, West Bengal and Kerala will get a high share of the taxes. To compensate for this, manufacturing states such as Tamil Nadu, Maharashtra and Gujarat fear that they will lose out on revenues. The bill provides for 1 percentage point extra tax on goods for at least two years. This extra revenue will go to the state from which the goods originated, or where it was manufactured.

What is GST?/ 10 key points, as in Aug 2016

The Times of India, August 4, 2016

1. GST is a uniform indirect tax levied on goods and services across a country. Many developed nations tax manufacture, sale and consumption using a single, comprehensive tax.

2. Central Taxes GST would replace Central Excise Duty, Service Tax, Additional Duties of Excise & Customs, Special Additional Duty of Customs, and cesses and surcharges on supply of goods and services.

3. State Taxes GST would replace VAT, Central Sales Tax, Purchase Tax, Entry Tax, Entertainment Tax, taxes on advertisements, lotteries, betting and gambling, and state cesses and surcharges.

4. The main objectives of GST would be to eliminate excessive taxation. Central and state agencies often calculate taxes based not on the original cost of the product, but over and above the several layers of tax already levied on the product. This negatively affects the Gross Domestic Product of a nation.

GST is also expected to disincentivize tax evasion, lower tax rates, and make business operations easier.

5. The current NDA government and the Opposition disagree over the contents of the GST Bill

6. According to PRS Legislature Research, the 2011 Bill defined GST as any tax on the supply of goods or services, except taxes on the supply of petroleum crude, high speed diesel, motor spirit (petrol), natural gas, aviation turbine fuel and alcoholic liquor for human consumption.

7. The 2011 Bill provided for the creation of the Goods and Services Tax Dispute Settlement Authority to adjudicate disputes between the central government and state governments on the issues of GST resulting in any loss in revenue, and affecting the harmonized structure of the tax. The 2014 Bill deleted the provision of such an authority.

8. The 2014 Bill defined GST as any tax levied on the supply of goods, or services, except taxes on the supply of alcoholic liquor for human consumption.

9. In addition, the 2014 bill also deleted a provision of the 2011 bill that imposed restrictions on states on taxation of products deemed of special importance in inter-state trade or commerce.

10. It also removes a 2011 provision allowing states to tax the entry of goods into a local area that are for use or sale only to the extent levied by a Panchayat or a Municipality.

The GST’s rates

4-slab GST will spare common items in bid to curb inflation, Nov 04 2016 : The Times of India

Council Clears Cess On Coal, Sin & Luxury Goods

India's most ambitious tax reform since Independence took a giant leap forward in Nov 2016 with the Centre and states agreeing on the rates for the Goods and Services Tax (GST). To be implemented from April 1, 2017, the GST--which will subsume several taxes including excise duty and VAT--will have four rates. Currently, there are 15-20 tax slabs between the Centre and states. Coal, luxury and sin goods (eg cigarettes and alcohol) will attract cess in addition to the GST.

Finance minister Arun Jaitley said the GST Council had agreed to zero-rating for nearly half the items in the consumer price index (CPI) basket as well as major foodgrains, while goods of everyday use would attract 5% GST, as against 6% proposed earlier. In addition, there will be two standard rates of 12% and 18%, a move meant to blunt the Congress party's demand for a standard 18% levy .White goods and similar products will face 28% tax, instead of 26% suggested by the Centre earlier. The cess on luxury and sin goods, and the clean energy cess on coal, should help the Centre mop up around Rs 50,000 crore to compensate states for any revenue loss due to GST. There will be a sunset clause of five years, which will be reviewed on a year to year basis... Compensa tion through tax collec tions will have a cascading effect. There will not be any additional levy ,“ finance minister Arun Jaitley said, while explaining the rationale for the cess that has been questioned by many . While tobacco currently attracts 65% levy, the current rate on aerated drinks is around 40%.

The government suggested that the rate structure would be non-inflationary as rates on several items would come down. The finance minister said that the burden on the consumer would “hopefully“ be lower.