Fast Moving Consumer Goods (FMCG): India

This is a collection of articles archived for the excellence of their content. |

Contents |

Indian arms of FM CG companies vis-a-vis global parents

C.2016-21

Rupali Mukherjee , Oct 31, 2022: The Times of India

From: Rupali Mukherjee , Oct 31, 2022: The Times of India

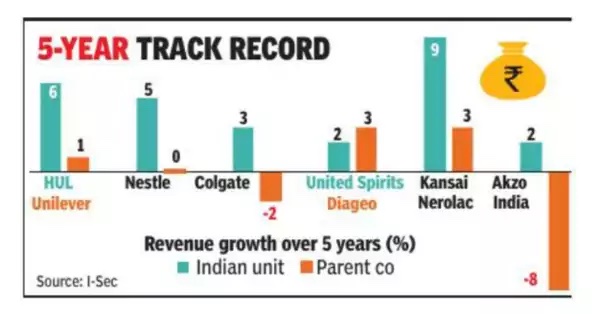

MUMBAI: Indian subsidiaries of global FMCG giants including Unilever, Nestle and Reckitt are outshining their listed foreign parents in revenue and profit growth over the last 10 years.

That’s not all. In certain cases, their Indian business could become the largest in value terms over a period of time, among all geographies they operate in. For instance, Hindustan Unilever (HUL) and Maruti are driving extensive value in terms of valuation support to the parent company stock, according to an I-Sec Research report (see graphic). HUL’s CEO & MD Sanjiv Mehta said in a recent interview to Financial Times that India, the consumer group’s biggest market by volume, will overtake the US to become the largest by value, without specifying a timeframe.

At present, HUL’s market valuation at $72 billion is about 62% of its parent’s market cap of $115 billion, while its revenue is over 10% of Unilever group sales.

A strong presence in a ‘high-growth’ emerging market like India is a strong narrative for MNCs, in the pursuit of growing their brand and widening their base to reach the untapped and burgeoning middle class. The analysis by I-Sec Research is in line with a Bain WEF Report released in 2019, which revealed that consumer demand in India will continue to grow at a healthy clip, adding about 140 million middle-income and 21 million high-income households by 2030. While Covid might have set this back by a few quarters, the India consumption story is still intact. FMCG companies have bounced back to double-digit revenue growth over the last one year.

Bain & Co partner Karthik Ganesan said that MNCs that have been successful in India have scaled profitably by understanding the India consumer and retail landscape better. “They understand what the Indian consumer needs and develop a ‘good enough’ product, which is key as many MNCs launch their global portfolio as-is at unsustainable margins and struggle to scale up,” he said.

Other factors include localising the marketing mix based on granular insights, participate in both mainstream and premium parts across categories as having the right price points to win with multiple consumer cohorts is key to scale and profitability. Besides, it also includes building and empowering a local team to have deep distribution at a low-cost.

Interestingly, many investors believe that owning the ‘cheap’ parent company stock is a better effective play to have the India exposure (Unilever, Suzuki, Kansai), the report said.

Further, India has proven to be a case study for FMCG majors in pioneering frugal innovation, particularly to tap the rural consumer. Several tech-driven low-cost interventions are being replicated in other developing countries.

A Nestle India spokesperson said, “India has a huge consumer base both in urban and rural centres. The consumer household isgoing to expand further in the coming years. Moreover, over the last few years we have also witnessed the emergence of aspirational India. This combined with the potential of penetration-led volume growth, makes India a promising market for any company. ”

Meanwhile, the growth momentum seems to have continued in the July-September quarter for the India businesses of Unilever, and Coco-Cola, among others.

“The current growth is driven strongly by pricing, but we expect volume and mix (premiumisation) growth contribution to increase in the coming quarters,’’ analysts said.

Multiple MNC affiliates listed in India have created tremendous value for the parent — they have outperformed the parent entity on growth and shareholder returns. Keeping this trend in mind, MNCs that can orient themselves to winning in India might definitely consider listing their Indian subsidiary, Ganesan added.

It may be noted that the revenue and profit contribution of most Indian consumer MNCs to their parent has increased significantly over the past couple of years, but it still remains around low-to-mid-single digit (barring HUL and Kansai Nerolac).

Urban vis-à-vis rural markets

2022-23

Namrata Singh, March 17, 2023: The Times of India

From: Namrata Singh, March 17, 2023: The Times of India

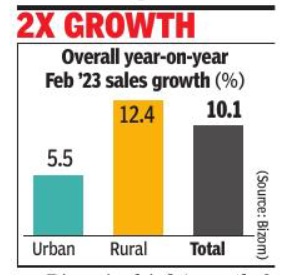

Mumbai : FMCG (fast-moving consumer goods) categories such as home care, packaged foods, branded commodities and personal care have driven the rural sales turnaround in February this year, as the hinterland outpaced urban growth. This, according to data from Bizom, a platform that automates retail execution at 7. 5 million kirana stores, underscores rural India seeing real growth for the first time since August 2022. In February 2023, while urban sales grew 5. 5% as compared to the year-ago period, rural sales expanded 12. 4%. Bizom’s chief (growth & insights) Akshay D’Souza said, “We’ve seen a doubledigit growth in FMCG sales on the back of a strong performance in villages. In five of the six categories, we’ve seen rural sales outperform urban in February 2023. ”

YEAR WISE DEVELOPMENTS

2014

John Sarkar & Shubham Mukherjee

Dec 27 2014

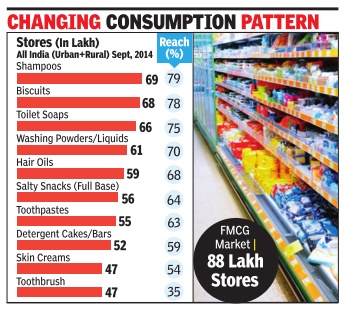

Personal care drives FMCG biz on rural push. Biscuits only food item among top 5 categories

For decades, food items have been the most widely distributed FMCG products in the country. But that rule of thumb is changing. Indians are more likely to find more personal care products than food in a shop these days—a result of consumer goods players pushing the distribution of an entire range of their products in the face of wary consumer spending.

Latest data from market research firm Nielsen reveals that on the list of the top five FMCG product categories, only one food product—biscuits— finds place. The category with the maximum reach, or penetration as it’s called in market parlance, is shampoos at 79%, followed closely by biscuits at 78%.

Distribution of categories has undergone a dramatic transformation in the last 15 years. FMCG is available in 8.8 million outlets and shampoo is available in 80% of those outlets, says D Shivakumar, chairman and CEO, PepsiCo India.

“Skin creams have got into the top 10 distributed list and packaged tea, which was the most distributed category a few decades ago, is now out of the top 10. Daily-use, lowunit price, easy-to-sell via wholesale are the key lessons for categories in the last 10 years.” Data suggests that most of this evolution is due to a lot of un-branded consumption shifting to branded consumption. For instance, in utensil cleaners and edible oils penetration has increased to 36% from 33% and 21% to 17% from 2012 to 2014, respectively. “Earlier, people would turn up at shops with bottles to buy loose mustard oil. That’s changing with rising affluence levels and lower packaging costs. In future, we will see more un-branded-tobranded consumption in nonmature categories such as, hair oils and hair conditioners,” says Vijay Udasi, executive director, Nielsen India.

The findings also reveal a drop in penetration levels of detergents cakes and bars from 60% in 2012 to 59% in 2014 as more consumers shift to washing machines to do their laundry . Similarly, skin creams have also seen a drop of 2% due to changes in consumer behaviour. “The segments within the skin creams category have also changed.More people are buying emerging products like face washes, anti-ageing and under-eye creams,“ says Udasi.

For HUL, next step now is to make its brands accessible using pack sizes and price points tailored to win across the country . “We have been able to maintain our leadership position in a growing market by following a market development approach. One of the most successful attempts on this front has been the Dove `twin sachet', which offers a shampoo and conditioner together at a Rs 5 price point to induce trials,“ says Srirup Mitra, category head – Hair Care, HUL.

But the dominance of nonfood categories on the top could change. There are ominous signs. Take the salty snacks category for instance.

Penetration has risen from 58% to 64%. Even a category like noodles, which has still not broken into the top-ten list, has seen an increase in penetration from 38% to 42%.

“The next level of growth lies within branded foods,” says Udasi. “There is an emergence of new food categories in bread spreads, including peanut butter and branded spices. As affluence levels rise, rural consumers will spend more on grocery items and food.” Although FMCG growth has been slowing for some time now, sliding by 8.1% from 2010 to 2013, Nielsen predicts that India’s FMCG industry will grow from $37 billion in 2013 to $49 billion in 2016. Distribution growth and innovations around sachet offerings will play major roles in fuelling growth, which had slowed down in the last few years. While the rise of e-commerce is being keenly watched, several new models may evolve over the next few years.

2018> 2019: The slowdown

July 24, 2019: The Times of India

From: July 24, 2019: The Times of India

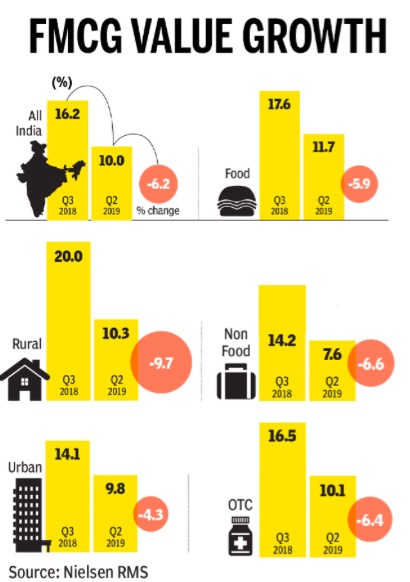

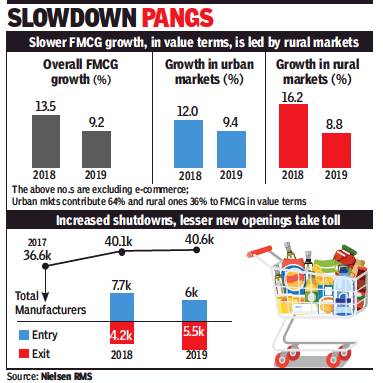

See graphic:

2018> 2019: FMCGs and the slowdown

From the highs of Q3 of 2018, the FMCG sector is staring at a slowdown with the value growth dropping to 10%. In this quarter, demand has dropped across segments with salty snacks, biscuits, spices and packaged tea leading slowdown.

2018> 19

January 22, 2020: The Times of India

From: January 22, 2020: The Times of India

NEW DELHI: Around half of the slowdown in growth in the FMCG segment was led by small players, with more than 5,000 businesses shutting shop in 2019, a report showed.

While these small businesses (turnover less than Rs 100 crore) accounted for 20% of the FMCG business in India, their contribution to the slowdown in consumption was pegged at 45%, followed by 32% for large companies (turnover greater than Rs 600 crore) and 24% for medium-sized companies (turnover between Rs 100 crore and Rs 600 crore), according to the latest study by market research company Nielsen.

The slowdown was driven by fewer new manufacturers entering the FMCG space and declining distribution. While the total number of FMCG manufacturers increased from 36,600 in 2017 to 40,100 in 2018, the number remained stagnant at 40,600 in 2019, due to more exits by the smaller companies. Growth in distribution, too, plunged into the negative for smaller players from 7.8% in 2018 to -4.2% in 2019.

This led to companies spending less on innovations, which resulted in a steep 25% dip in new launches in 2019 over the previous year. “2019 has been a tough year for the FMCG industry with over four-point decline, but we do see it stabilising in the last quarter of the year,” said Prasun Basu, South Asia Zone president at Nielsen Global Connect.

“A mix of macro-economic factors, and channel and zone factors driven by manufacturers, coupled with consolidation of smaller players have been instrumental in the slowdown. However, 2020 offers a stable outlook for the industry arresting the 2019 decline,” he said.

The last quarter of 2019 saw the FMCG industry grow at 6.6% (7.3% with e-commerce), compared to 15.7% in Q4 2018, indicating an arrest as against the sharp slowdown witnessed in the previous quarters. After two years of double-digit growth, FMCG witnessed 9.2% growth (excluding e-commerce) in the calendar year 2019, down from 13.5% in the previous calendar year.

For 2019, the slow growth was led by the rural market, which accounts for 75% of India’s population and contributes 36% to overall FMCG spends. Traditionally, rural India has grown around 3-5% points faster than urban. But in the last quarter, its growth dropped below that of urban India for the first time in seven years. Nielsen expects Q1 (Jan-Mar 2020) FMCG growth to be in the range of 8-9%, marginally higher than Q4 2019. The full year 2020 forecast, however, is expected to be stable at 9-10%.

2021-2023: local, national, unbranded

Namrata Singh, July 28, 2023: The Times of India

From: Namrata Singh, July 28, 2023: The Times of India

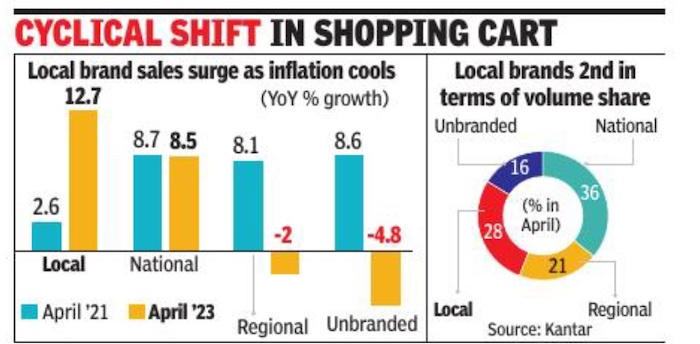

Local FMCG brands have mushroomed amid cooling inflation and are growing faster than national brands in categories ranging from noodles to dishwash bars.

Local dishwash brands Supremo 51 (Madhya Pradesh) and Reflect (Maharashtra) have seen over 100% growth in households over one year, while Balaji Gippi noodles in Gujarat has grown 58%, a report by Kantar showed.

“The mix of purchases that are made by a household keeps shifting depending upon inflation or uncertainties. During Covid, we had a very poor presence of local brands for two reasons. One, in a situation of uncertainty consumers tend to gravitate towards familiar or known brands. Local brands suffered on account of that. Second, they faced logistical issues because of the lockdown,” K Ramakrishnan, MD, south Asia, world panel division at Kantar, told TOI.

The advantage for national brands is that they become the preferred choice for consumers during a crisis like the pandemic, and they continue to grow even during inflationary times. On the flip side, local brands are unable to cope with the pricing pressures during inflation.

“Local brands as they couldn’t take price increases when raw materials became expensive. After two years of suffering, local brands have grown more than the national brands. It’s cyclical and this is the year in which we are seeing a resurgence of the local brands,” Ramakrishnan said. Teju masala in Karnataka, which has a 37% penetration, is growing at 65%, and Challenge detergent bar, which has a 20% penetration, is seeing 42% growth, the data showed. ‘1to3 Noodle’ in Karnataka, with a 35% penetration, is growing at 113%.

Local brands have surpassed the growth of national brands by a significant margin. Their volume share has been rising over the last few years to reach 28% in MAT (moving annual total) April 2023, the data showed.

When compared to the year-ago period, volume growth in local brands is 12. 7%, which is ahead of the 8. 5% growth clocked by national brands, while regional and unbranded players de-grew. Volume growth among local brands was 2. 6% in MAT April 2021. Although local brands are said to be gaining from regional and unbranded players, national brands are conversant with the prevailing trend.

Hindustan Unilever’s CFO Ritesh Tiwari recently noted that local players gaining ground. “When high inflation happens, we know there are players who vacate the market. We also know when commodity deflation happens, more players participate in the market at the local, regional level. That’s the reality of the industry and we have to live with it. Small players are growing ahead of the large players as we look at the data for the latest quarter,” said Tiwari.

While national brands would benefit by straddling the pyramid on packs and prices as also launching region-specific strategies, the challenge for local brands is to drive innovation at a faster pace and explore cross category entries.

See also

Fast Moving Consumer Goods (FMCG): India